Abcourt Intersects 41.6 g/t Over 0.7 Metre in the 785N Zone at Depth of the Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) announces the results of the first holes of its drilling program to develop the deep mining potential of the Sleeping Giant mine.

In January 2025, Abcourt completed 2 underground drill holes totaling 928 metres from level 785. The highlights of the analysis results, included in this press release, are as follows:

- Holes 78-885 and 78-886 intersected the 785N Zone at targeted depths (41.6 g/t over 0.7m in hole 78-886).

- Holes 78-885 and 78-886 intersected other mineralized intervals outside the mineral resource estimation model (2022 MRE):

- 15.44 g/t Au over 3 metres including 54.7 g/t over 0.6m and in hole 78-885; and

- 29.13 g/t Au over 0.6 metres in hole 78-886.

Pascal Hamelin, President and CEO, comments: “We are very excited to see good drilling results in this intact area of the mine. This could open the door to a whole new and rich extraction zone with additional drilling. In addition, this sector is located above the lower level of mine. The shaft and mining infrastructure are well advanced in this sector to quickly convert mineral resources into a source of income within a few quarters.”

The main results are displayed in Table 1:

|

Table 1: Main Underground Drilling Results. |

|||||||

| DDH | From | To | Interval | Au | Vein | ||

| (m) | (m) | (m) | (g/t) | ||||

| 78-885 | 272.50 | 273.80 | 1.30 | 6.70 | 785N Vein | ||

| and | 379.00 | 380.00 | 1.00 | 35.20 | Intervals deeper than 785N Vein not included in MRE 2022. | ||

| and | 386.00 | 389.00 | 3.00 | 15.44 | |||

| Including | 386.00 | 386.60 | 0.60 | 54.7 | |||

| and | 398.20 | 399.70 | 1.50 | 12.26 | |||

| Including | 399.10 | 399.70 | 0.60 | 18.25 | |||

| 78-886 | 303.10 | 303.80 | 0.70 | 41.62 | 785N Vein | ||

| and | 364.00 | 364.50 | 0.50 | 13.05 | Intervals deeper than 785N Vein not included in MRE 2022. | ||

| and | 403.80 | 404.40 | 0.60 | 29.13 | |||

| and | 426.80 | 427.30 | 0.50 | 10.87 | |||

|

Notes: |

|||||||

| 1. The length represents the length measured along the drill core. | |||||||

| 2. Assay results are not capped, but higher-grade sub-intervals are highlighted. | |||||||

The objective of this drilling campaign is to increase the level of confidence in the mining potential in depth and to the East in an intact sector of the Sleeping Giant mine.

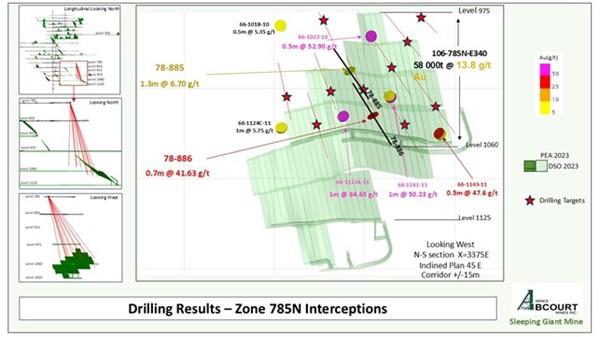

According to the preliminary economic study carried out by InnovExplo in June 2023, the tons and grades of the 106-785N-E340 site are estimated at 58,052t at 13.8 g/t Au. (See Technical Notes*)

Drilling data shows that:

- Hole 78-885 intersects the upper part of the 785N Zone 1.3 metres at 6.7 g/t Au.

- Hole 78-886 intersects the central part of the 785N Zone 0.7 metres at 41.6 g/t Au.

- The two holes (78-885 and 78-886) intercept the 785N Zone at the targeted depths in accordance with the modeling of the 785N Zone (Figure 1).

- Zone 785N, 1.6 to 3 metres wide, is made up of alternating veins of white and smoky quartz with the presence of sulphides: pyrrhotite, pyrite, chalcopyrite and sphalerite (Figure 2).

Figure 1: Main Drilling Results – Interception of 785N Zone.

Figure 2: Photo of Cores from 785N Zone (Hole 78-886).

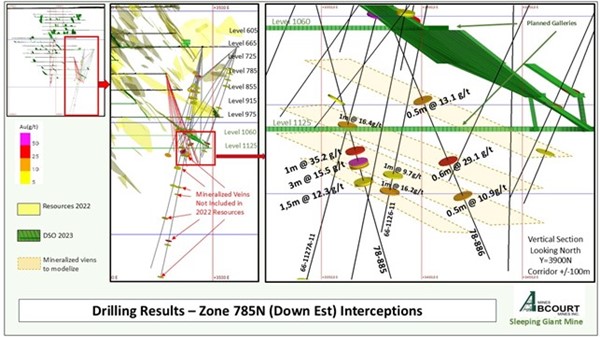

Drilling data also shows that:

- Several interesting, mineralized intervals at the bottom of the mine are not included in the 2022 Mineral Resources Estimate.

- The intervals intercepted by holes 78-885 and 78-886 are consistent with other nearby holes previously drilled: 66-1126-11 and 66-1127A-11.

- The mineralized intervals intercepted at the bottom of the 785N zone are subparallel to each other and to the 785N Zone. This is favorable to the existence of several mineralized veins subparallel to zone 785N, spaced one or more tens of meters apart (Figure 3). This pattern of subparallel veins is similar to several parallel veins observed in Sleeping Giant, notably those in Zone 20 and Zone 30.

Figure 3: Main Results – Interceptions at the bottom of Zone 785N (eastern part)

In parallel with the program to develop the deep mining potential of the Sleeping Giant mine, drilling continues in the upper part of the mine from the 295 level to:

- Convert the maximum of our inferred resources into indicated resources.

- Update the mineral resource estimate for the Sleeping Giant property.

- Support the engineering work required to prepare for the pre-feasibility study.

- Develop a geo structural model that supports the vein model to guide the exploration of the extensions of the Sleeping Giant mine.

Next Steps:

- Continuing the first phase of the campaign to develop the mining potential at depth and to the East of the Sleeping Giant mine.

- Adjust the drilling schedule considering the results by extending the planned holes to optimize knowledge of our mineral resources accessible by shaft 2.

- Study and interpret the veins at the bottom of the 785N Zone to properly identify and model them.

- Reassess the potential of the upper part of the 785N Zone (phase 2).

Quality Control Measures (QA/QC)

The drilling and core description work was carried out under the supervision of Mohamed Haithem Bennia, geo, Superintendent Geology, qualified person according to Regulation 43-101.

The alignment of the drill holes as well as the measurements of the deviations are done with high-precision instruments (Devialigner and Devigyro) using Gyroscopic technology to guarantee the quality of our data.

The orientation of the core as well as the measurements of the orientations of the geological elements are also done by high-precision digital tools (Reflex ACTIII and Reflex IQ-LOGGER) promoting a better understanding of the geological structure.

The quality assurance and control protocols for the analyses include the insertion of blank, standard and duplicate samples every 25 samples, in addition to the internal control of the laboratory samples.

The half-cores were prepared at the Sleeping Giant mine’s internal laboratory according to industry standards.

The samples used in the preparation of this press release were analyzed by the MSALABS laboratory in Val-d’Or, Quebec, using the Photon AssayTM method. MSA operates numerous laboratories worldwide and maintains ISO-17025 accreditation for many metal determination methods. MSA is an ISO-17025 accredited laboratory for the Photon AssayTM method.

* Technical Notes:

All technical information contained in this press release comes from the technical report of the of then mineral resources Estimation made by InnovExplo in December 2022 (MRE 2022) as well as the technical report of the Preliminary Economic Assessment also made by InnovExplo in June 2023 (PEA 2023).

Notes to the 2022 MRE

- The independent and qualified persons for the 2022 MRE, as defined by NI 43-101 are Olivier Vadnais-Leblanc, P. Geo. and Eric Lecomte, ing, all from InnovExplo Inc.

- These mineral resources are not mineral reserves because they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects of economic viability. The 2022 MRE follows the CIM Standards.

- The estimate encompasses 846 mineralized lenses that were modelled using a minimal geological width of 0.5m using Genesis software.

- A density value of 2.85 g/cm3 (based on measurements and mine and mill reconciliation) was assigned to all mineralized zones.

- High-grade capping supported by statistical analysis was done on composites data and established at 95 g/t Au for all mineralized zones. Composites (0.5 m) were calculated within the zones using the grade of the adjacent material when assayed or a value of zero when not assayed.

- The exigence of a Reasonable Prospect of Eventual Economical Extraction is fulfilled by the use of cut-off grades based on reasonable mining parameters and locally constrained within Deswik Stope Optimizer shapes using a minimal mining width of 1.7 m for both potential methods. It is reported at a rounded cut-off grade of 4.25 g/t Au using the long-holes (LH) method, and 5.0 g/t Au, using the Room and Pillars (R&P) method. The cut-off grades were calculated using the following parameters: mining cost = C$213.96/t (LH) to C$261.56/t (R&P); processing cost = C$35.10/t; G&A = C$22.09/t; gold price = US$1,650.00/oz and USD:CAD exchange rate = 1.30. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The estimate was completed using a sub-block model in Surpac 2022. A 4m x 4m x 4m parent block size was used (1m x 1m x 1m sub-blocked). Grade interpolation was obtained by Inverse Distance Squared (ID2) using hard boundaries.

- The mineral resource estimate is classified as Indicated and Inferred. The Inferred category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 75 m and shows reasonable geological and grade continuity. The Indicated mineral resource category is defined with a minimum of four (4) drill holes within the areas where the drill spacing is less than 30 m and shows reasonable geological and grade continuity.

- The number of metric tonnes was rounded to the nearest hundred, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) rounded to the nearest hundred.

- The independent and qualified persons for the 2022 MRE are not aware of any known environmental, permitting, legal, political, title-related, taxation, socio-political, or marketing issues that could materially affect the Mineral Resource Estimate.

Qualified Persons

Mohamed Haithem Bennia, geo, superintendent geology of the Sleeping Giant mine, wrote, collected, verified and approved the technical information contained in this press release.

Pascal Hamelin, Eng, President and Chief Executive Officer of the Corporation, has verified and approved the technical information contained in this press release.

Mr. Hamelin and Mr. Bennia are qualified persons under Regulation 43-101.

New Director

Abcourt welcomes Mr. Eric Gratton, as new director of the Corporation. Mr. Gratton is a chartered professional accountant with over 30 years of management experience and has spent the last 15 years working in the mining industry. Prior to his career in mining, he served as a logistics officer in the Canadian Army for 22 years, where he held numerous positions, including a six-month deployment to Afghanistan as Director of Resource Management for the Canadian contingent.

In the mining sector, he worked for Semafo, Glencore and Nordgold before joining Fortuna Mining as Commercial Manager in 2015. He was promoted to General Manager External Relations West Africa in 2017, a position he held until July 2023. He then founded Orionis Mining Consulting, a mining consulting firm based in Abidjan, Côte d’Ivoire. From 2017 to 2023, he headed the boards of directors of Roxgold SANU (Burkina Faso) and Roxgold SANGO (Côte d’Ivoire) on behalf of the Chairman.

About Abcourt Mines Inc.

Abcourt Mines Inc. is a Canadian exploration company with strategically located properties in northwestern Quebec, Canada. Abcourt owns the Sleeping Giant mine and mill and the Flordin property, where it focuses its exploration and development activities.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE