Guanajuato Silver Closes Acquisition of Bolanitos Gold-Silver Mine

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (OTCQX:GSVRF), a growing Mexico-based precious metals producer, is pleased to announce the closing of the previously announced acquisition of the Bolanitos gold-silver mine located in Guanajuato, Mexico, from Endeavour Silver Corp. TSX:EDR) (See GSilver news release dated November 24, 2025 – Guanajuato Silver to Acquire Bolanitos Gold-Silver Mine in Mexico).

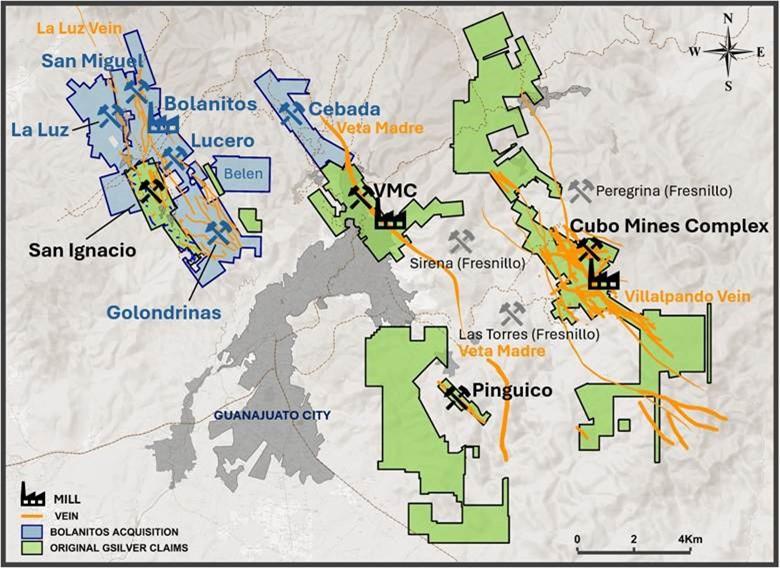

Bolanitos is the Company’s fifth producing precious metals mine in Mexico. Located adjacent to Guanajuato Silver’s San Ignacio mine, the 1,600 tonnes per day Bolanitos flotation plant is currently under-utilized and has significant capacity for increased throughput and production. Bolanitos is a gold mine and silver mine which will further enhance the Company’s position as a growing precious metals producer in Mexico.

James Anderson, Chairman & CEO, said, “With the prompt closing of the acquisition, Guanajuato Silver shareholders can now look forward to almost a full calendar year of precious metals production from the Bolanitos mine. We also look forward to working toward the full integration of Bolanitos into our growing portfolio of producing Mexican mining assets.”

Guanajuato Silver has acquired Bolanitos for total consideration of up to US$50 million consisting of (i) upfront consideration of US$40 million which was paid on closing and (ii) contingent consideration of US$10 million (See Transaction details below).

Rick Trotman, Senior Vice President: Mining Operations. added, “Bolanitos represents a significant opportunity to restructure our Guanajuato district hub-and-spoke processing model for peak economics. Material mined at San Ignacio during the first few days of January has already been stockpiled, ready to be transported the short distance to the Bolanitos plant in preparation for the blending of material designed to optimize both throughput and recoveries.”

Transaction Summary

Under the terms of the Agreement, Guanajuato Silver has acquired all the outstanding shares of Mina Bolanitos S.A. de C.V., a subsidiary of Endeavour, that holds all the mining assets located in the Guanajuato district currently held by Endeavour. Bolanitos has been acquired for total upfront consideration at closing of US$40 million, which is comprised of US$30 million in cash and US$10 million of Guanajuato Silver common shares at a deemed price of US$0.2709413 (Cdn$0.3815) per share resulting in the issuance of 36,908,363 shares. In addition to the Upfront Consideration, Guanajuato Silver will make two contingent payments to Endeavour, each being US$5 million, upon achieving production of two million ounces of silver-equivalent and four million ounces of silver-equivalent, respectively. Each Contingent Payment will be satisfied 50% in cash and 50% in Guanajuato Shares, subject to the Maximum Percentage (as defined below).

The number of Contingent Shares issuable to Endeavour is subject to a maximum ownership percentage of 9.9%. If the issuance of Contingent Shares would result in Endeavour holding more than the Maximum Percentage, the value of any excess contingent payment amount (after issuing shares up to 9.9%) shall be payable in cash.

Any Contingent Shares shall be issued at a price equal to the greater of (i) the volume weighted average trading price of the shares on the TSX Venture Exchange for the 10 consecutive trading days immediately preceding the applicable milestone payment date converted to United States dollars using the average exchange rate posted by the Bank of Canada on the day preceding the applicable milestone payment date, and (ii) the minimum price permitted by the TSXV (which is US$0.18909). The maximum number of Contingent Shares issuable for all Contingent Payments is 26,442,434 shares. Any additional Contingent Shares will be subject to the prior approval of the TSXV. If applicable, Guanajuato Silver will make a cash payment to Endeavour equal to any shortfall between the aggregate Contingent Share Issue Price and the Market Price, at the time of each Contingent Payment.

In connection with the Transaction, Endeavour and Guanajuato Silver entered into an investor rights agreement which includes, among other things, participation rights in favour of Endeavour. Pursuant to the Investor Rights Agreement, Endeavour has also agreed to vote its Guanajuato Shares in accordance with recommendations of the Company’s board of directors in respect of general matters for a period of 12 months and to certain restrictions on transfer on the Guanajuato Shares issued on closing. All Guanajuato Shares issued on closing are subject to voluntary restrictions on transfer for a period of 12 months, after which 50% of the Guanajuato Shares will be subject to restrictions for an additional two years. The Guanajuato Shares are also subject to a statutory hold period that expires on May 16, 2026.

The Transaction is arm’s length and no finder’s fees were paid in connection with the Transaction.

Figure 1: Map of the Guanajuato Mining District showing the main epithermal veins and other significant geological structures. Bolanitos is located along the La Luz Vein structure.

Except as otherwise specified herein, all scientific and technical information related to Bolanitos in this Press Release is based on a technical report entitled “NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Bolanitos Project, Guanajuato State, Mexico” with an effective date of November 9, 2022, filed on SEDAR+ by Endeavour on January 26, 2023 (the “Bolanitos Report“). To the best of the Company’s knowledge, information, and belief, the Bolanitos Report is considered current pursuant to National Instrument (“NI”) 43-101 and there is no new material scientific or technical information that would make the disclosure of the mineral resources, mineral reserves or results of the Bolanitos Report inaccurate or misleading. Furthermore, as required under applicable securities laws, the Company will file an updated technical report on Bolanitos, in accordance with NI 43-101, within 180 days of November 24, 2025. Bolanitos consists of 29 mining concessions and four of the concessions are subject to a 2% royalty which is further detailed in the Bolanitos Report.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed, approved and verified the technical data disclosed in this news release (including a review of the Bolanitos Technical Report on behalf of the Company) and has not detected any significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein. The verification of data underlying the disclosed information includes reviewing compiled assay data; QA-QC performance of blank samples, duplicates and certified reference materials; and grade calculation formulas.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio Mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE