West Red Lake Gold Declares Commercial Production at Madsen Gold Mine

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQX: WRLGF) is pleased to declare commercial production at its 100% owned Madsen Gold Mine, located in the Red Lake Mining District of Northwestern Ontario, Canada.

The Madsen Mine achieved commercial production as of January 1, 2026. The mill averaged 689 tonnes per day in December 2025. This represents 86% of permitted throughput of 800 tpd and meets the Company’s internal commercial production requirement of 30 consecutive days of mill throughput at 65% or greater of permitted capacity. Operational stability, the other internal requirement, is also in place at Madsen. Consistent strong mill recoveries, which averaged 94.6% in December, enabled production of 3,215 ounces of gold.

“We are delighted to announce commercial production at the Madsen Mine, achieved only seven months after completion of the bulk sample,” said Shane Williams, President and CEO. “Achieving commercial production is a major milestone for any producer and it comes after a strong December that saw tonnage, grade, recoveries, and production all perform to plan. Credit and gratitude go to the site operations team, who delivered a responsible and methodical mine ramp up. I also want to thank our partners the Lac Seul and Wabauskang First Nations and the community of Red Lake for their longstanding support.”

“We will continue to ramp up from this strong base, and I anticipate Madsen will reach sustained permitted capacity by mid-2026.”

For the first quarter of 2026, mill feed will come predominantly from the 4447 area, the high-grade zone in South Austin that the Company defined in 2025. Mill feed is expected to average in excess of 6 grams per tonne gold in Q1.

In December the Madsen Mine produced 21,389 tonnes of ore, which is an average of 689 tonnes per day. The tonnes carried an average grade of 4.94 g/t Au. Mill recovery of 94.6% over the month produced 3,215 ounces of gold in December.

In the fourth quarter of 2025 the Madsen Mine produced 49,162 tonnes of ore, which is an average of 534 tonnes per day. The tonnes carried an average grade of 5.06 g/t Au. Mill recovery of 95% over the quarter recovered 7,379 ounces of gold in the quarter.

The operation poured 7,200 ounces of gold in Q4. (Note that recovered and poured ounces do no align exactly due to gold in circuit and timing of gold pours.) Those ounces were sold at an average price of US$4,150 per ounce for total gold sales revenue of US$30 million.

In 2025, the Madsen Mine poured 20,000 oz. gold. This gold was sold at an average price of US$3,650 per oz. for total gold sales revenues of US$73 million. The Company ended 2025 with CAD$46 million cash and gold receivables.

| Tonnes Milled | % Permitted Daily Mill Capacity | Gold Grade (g/t Au) | Ounces Produced | ||

| December 2025 | 21,389 | 86 | % | 4.94 | 3,215 |

| Q4 2025 | 49,162 | 67 | % | 5.06 | 7,379 |

| Ounces Poured | Average Sale Price (US$ per oz.) | Total Gold Sales Revenue | |||

| Q4 2025 | 7,200 | US$4,150 | US$30M | ||

| FY 2025 | 20,000 | US$3,650 | US$73M | ||

Table 1. Madsen Mine operational results for December and Q4 2025

“The potential to continue creating value at Madsen through multiple opportunities makes this achievement of commercial production especially exciting,” said Mr. Williams.

“We are drilling at Fork with a view to bring that deposit into the mine plan this year. The shaft is nearing operation and work to date has revealed a path to potentially increase shaft tonnage significantly in the medium term. We are starting to delineate a new high-grade area in Lower Austin called the 904 Complex that is similar to 4447, the high-grade area in South Austin that we advanced through definition drilling, mine design, and access development within 8 months so that today we are mining this high-margin mineralization. The immediate impact of mining these jewelry box-type areas was realized when material from 4447 lifted the gold grade through the Madsen Mill to levels reaching 8.9 g/t Au in December. We look forward to pulling a majority of our ore tonnes from the 4447 area through Q1.”

“It has taken immense work to get here and it is fantastic to see our methodical approach generate the results and opportunities we knew Madsen could deliver.”

The Company anticipates releasing 2026 guidance during Q1.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Hayley Halsall-Whitney, P.Eng., Vice President of Operations for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

ABOUT WEST RED LAKE GOLD MINES

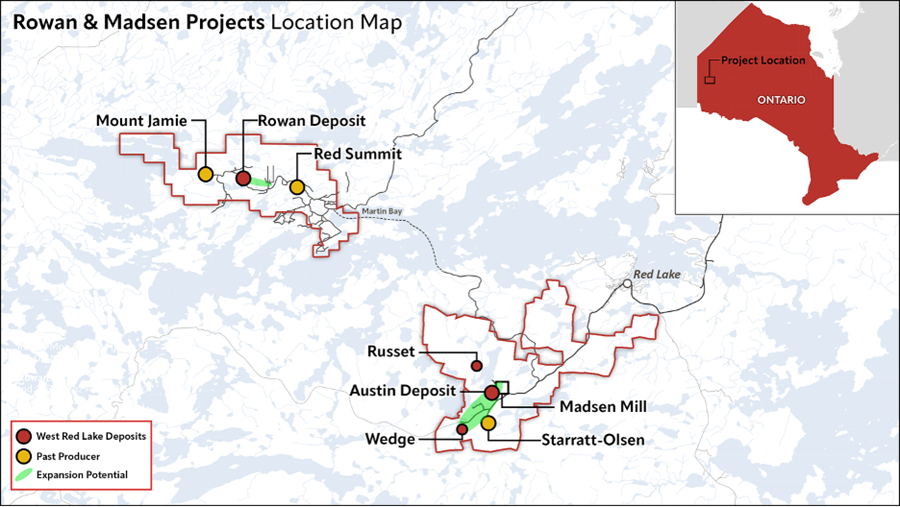

West Red Lake Gold Mines Ltd. is a gold mining company that is publicly traded and focused on its flagship high-grade Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also owns the Rowan Property in Red Lake, which hosts a small, high-grade deposit that West Red Lake Gold is looking to advance towards production.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE