Collective Mining Intersects 467.35 Metres at 1.63 g/t AuEq from 170.10 Metres at Apollo and Expands the System to the Southeast

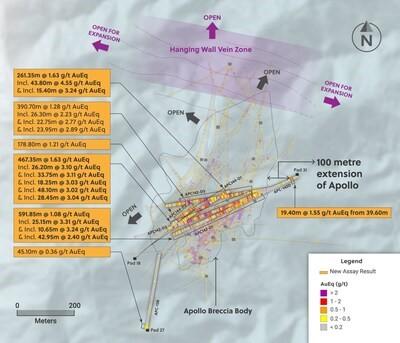

- Five diamond drill holes targeting various undrilled segments of the brecciated portion of Apollo from surface to 1,000 metres depth, intersected broad zones of mineralization with key highlights including:

- 261.35 metres @ 1.63 g/t gold equivalent from 432.90 metres including 43.80 metres @ 4.55 g/t gold equivalent (APC144-D1)

- 467.35 metres @ 1.63 g/t gold equivalent from 170.10 metres including 48.10 metres @ 3.02 g/t gold equivalent (APC142-D2)

- A directional mother hole drilled outside the main brecciated portion of the Apollo system intersected near surface mineralization in the Hanging Wall Vein Zone approximately 200 metres south of prior intercepts into this zone, returning:

- 19.40 metres @ 1.55 g/t gold equivalent from 39.60 metres (APC-142D)

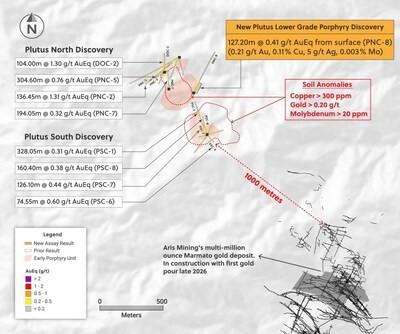

- At the Plutus target, located approximately one kilometre east of Apollo, a reconnaissance drill hole located in an area with no prior drilling has discovered a lower grade porphyry system beginning from surface, intersecting:

- 127.20 metres @ 0.41 g/t gold equivalent from surface consisting of 0.21 g/t Au, 0.11% Cu, 5 g/t Ag, 0.003% Mo (PNC-8)

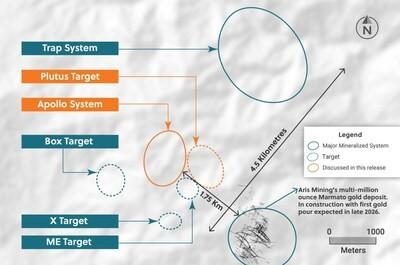

Collective Mining Ltd. (NYSE: CNL) (TSX: CNL) is pleased to announce assays results for ten diamond drill holes at the Guayabales project. Six holes were designed to test the Apollo system while the remaining four holes tested greenfield targets across the rest of the project area, which resulted in the discovery of outcropping lower grade porphyry mineralization at the Plutus target. The Company’s flagship discovery is the Apollo system and is classified geologically as a large, partially Reduced Intrusion Related System enriched in gold, silver, copper and tungsten. Drilling to date at Apollo has outlined continuous mineralization from surface to more than 1,400 vertical metres and is open along strike to the north and at depth. Apollo anchors the Company’s flagship Guayabales Project—a district-scale, multi-target and infrastructure-rich project in Caldas, Colombia.

To date, Collective has completed 155,500 metres of diamond drilling across the Guayabales and San Antonio projects, including 108,500 metres at Apollo. The Company intends to drill between 80,000-100,000 metres in 2026 with a maximum of 14 diamond drill rigs operating at any one time. Multiple high-priority holes remain in the lab, with additional assay results anticipated in the near term.

With US$135 million in cash (as of December 1, 2025), the Company is fully funded for its planned, aggressive 2026 program.

Ari Sussman, Executive Chairman, commented: “These latest results underscore the remarkable scale and continuity of the Apollo system, with strong infill drilling enhancing our internal block model and extending mineralization in key areas. The intersection of the Hanging Wall Vein Zone in a step-out hole and the new porphyry-style discovery at Plutus further highlights the district-scale potential of the Guayabales Project. With substantial cash on hand and an expanding fleet of drill rigs, we are well positioned to deliver significant value through continued aggressive exploration in 2026.”

Details (see Table 1 and Figures 1,2 and 4)

Five directional holes collared from mother holes APC-142D and APC-144D were drilled from the southwest and northeast respectively and targeted various gaps in the Company’s internal block model within the top 1,000 metres of the Apollo system. Results from this drilling have either improved the block model grades, extended the mineralized volume into areas with no prior drilling or upgraded confidence in the estimation.

Drill holes collared from mother hole APC-142D at Pad 31 directed to the southwest cut long continuous intervals of mineralization, including multiple higher-grade zones and added volume to the internal block model by infilling various gaps with results as follows:

- 591.85 metres @ 1.08 g/t gold equivalent from 59.15 metres (APC142-D1) including

- 13.05 metres @ 2.64 g/t gold equivalent from 59.15 metres

- 25.15 metres @ 3.31 g/t gold equivalent from 110.20 metres

- 10.65 metres @ 3.24 g/t gold equivalent from 184.75 metres

- 15.95 metres @ 2.25 g/t gold equivalent from 337.90 metres

- 42.95 metres @ 2.40 g/t gold equivalent from 520.00 metres

- 467.35 metres @ 1.63 g/t gold equivalent from 170.10 metres (APC142-D2) including

- 26.20 metres @ 3.10 g/t gold equivalent from 170.10 metres

- 33.75 metres @ 3.11 g/t gold equivalent from 251.95 metres

- 18.25 metres @ 3.03 g/t gold equivalent from 341.70 metres

- 48.10 metres @ 3.02 g/t gold equivalent from 419.00 metres

- 28.45 metres @ 3.04 g/t gold equivalent from 528.45 metres

- 390.70 metres @ 1.28 g/t gold equivalent from 135.75 metres (APC142-D3) including

- 26.30 metres @ 2.23 g/t gold equivalent from 186.00 metres

- 22.75 metres @ 2.77 g/t gold equivalent from 381.40 metres

- 23.95 metres @ 2.89 g/t gold equivalent from 475.60 metres

Holes collared from mother hole APC-144D at Pad 18 were drilled in a northeastern direction and have locally extended (horizontally) the volume of the mineralized Apollo breccia body within the southwest margin and also hosted multiple higher-grade subzones with the following results highlighted:

- 261.35 metres @ 1.63 g/t gold equivalent from 432.90 metres (APC144-D1) including

- 43.80 metres @ 4.55 g/t gold equivalent from 441.50 metres

- 8.05 metres @ 3.15 g/t gold equivalent from 514.75 metres

- 15.40 metres @ 3.24 g/t gold equivalent from 538.00 metres

- 178.80 metres @ 1.21 g/t gold equivalent from 314.60 metres (APC144-D2) including

- 6.70 metres @ 3.17 g/t gold equivalent from 314.60 metres

- 6.10 metres @ 3.39 g/t gold equivalent from 357.40 metres

APC-142D is a mother hole drilled southwestwards from Pad 31 and unexpectedly intersected the recently discovered Hanging Wall Vein Zone approximately 100 metres to the east and outside of the brecciated portion of Apollo. Additionally, this intercept also cut mineralization approximately 250 metres southwest of the previous Hanging Wall Vein Zone intercepts announced on December 9, 2025 as follows:

- 19.40 metres @ 1.55 g/t gold equivalent from 39.60 metres (APC-142D)

- and 3.60 metres @ 2.24 g/t gold equivalent from 129.10 metres

- and 3.00 metres @ 2.35 g/t gold equivalent from 137.40 metres

Table 1: Assays Results for Apollo Drill Holes APC-142D, APC142-D1, APC142-D2, APC142-D3, APC144-D1 and APC144-D2

| Hole # | From (m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Zn

% |

AuEq g/t* |

| APC-142D | 39.60 | 59.00 | 19.40 | 1.00 | 40 | 0.01 | 0.05 | 1.55 |

| and | 129.10 | 132.70 | 3.60 | 2.12 | 10 | 0.02 | 0.08 | 2.24 |

| and | 137.40 | 140.40 | 3.00 | 2.15 | 13 | 0.02 | 0.22 | 2.35 |

| APC142-D1 | 59.15 | 651.00 | 591.85 | 0.90 | 10 | 0.03 | 0.05 | 1.08 |

| Incl. | 59.15 | 72.20 | 13.05 | 2.27 | 26 | 0.02 | 0.20 | 2.64 |

| & Incl. | 110.20 | 135.35 | 25.15 | 3.19 | 13 | 0.02 | 0.05 | 3.31 |

| & Incl. | 184.75 | 195.40 | 10.65 | 2.97 | 20 | 0.07 | 0.03 | 3.24 |

| & Incl. | 337.90 | 353.85 | 15.95 | 1.99 | 15 | 0.03 | 0.24 | 2.25 |

| & Incl. | 520.00 | 562.95 | 42.95 | 2.27 | 9 | 0.03 | 0.13 | 2.40 |

| APC142-D2 | 170.10 | 637.45 | 467.35 | 1.40 | 14 | 0.04 | 0.11 | 1.63 |

| Incl. | 170.10 | 196.30 | 26.20 | 2.82 | 20 | 0.05 | 0.09 | 3.10 |

| & Incl. | 251.95 | 285.70 | 33.75 | 2.78 | 22 | 0.05 | 0.15 | 3.11 |

| & Incl. | 341.70 | 359.95 | 18.25 | 2.94 | 10 | 0.03 | 0.03 | 3.03 |

| & Incl. | 419.00 | 467.10 | 48.10 | 2.81 | 15 | 0.04 | 0.16 | 3.02 |

| & Incl. | 528.45 | 556.90 | 28.45 | 2.70 | 22 | 0.03 | 0.29 | 3.04 |

| APC142-D3 | 135.75 | 526.45 | 390.70 | 1.03 | 14 | 0.04 | 0.11 | 1.28 |

| Incl. | 186.00 | 212.30 | 26.30 | 2.03 | 14 | 0.04 | 0.05 | 2.23 |

| & Incl. | 381.40 | 404.15 | 22.75 | 2.43 | 21 | 0.05 | 0.21 | 2.77 |

| & Incl. | 475.60 | 499.55 | 23.95 | 2.40 | 27 | 0.08 | 0.35 | 2.89 |

| APC144-D1 | 432.90 | 694.25 | 261.35 | 1.40 | 16 | 0.04 | 0.06 | 1.63 |

| Incl. | 441.50 | 485.30 | 43.80 | 4.23 | 27 | 0.03 | 0.07 | 4.55 |

| & Incl. | 514.75 | 522.80 | 8.05 | 2.40 | 44 | 0.08 | 0.36 | 3.15 |

| & Incl. | 538.00 | 553.40 | 15.40 | 3.03 | 18 | 0.03 | 0.07 | 3.24 |

| APC144-D2 | 314.60 | 493.40 | 178.80 | 1.04 | 10 | 0.03 | 0.13 | 1.21 |

| Incl. | 314.60 | 321.30 | 6.70 | 3.00 | 12 | 0.02 | 0.21 | 3.17 |

| & Incl. | 357.40 | 363.50 | 6.10 | 2.90 | 26 | 0.05 | 0.55 | 3.39 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag (g/t) x 0.017 x 0.85) + (Cu (%) x 1.14 x 0.95) + (Zn (%) x 0.31 x 0.85) utilizing metal prices of Au – US$3,000/oz, Ag – US$50/oz, Cu – US$5.0/lb and Zn – US$1.35/lb and recovery rates of 97% for Au, 85% for Ag, 95% for Cu and 85% for Zn. Recovery rate assumptions for metals are based on metallurgical results announced on October 17, 2023, April 11, 2024 and October 3, 2024. The recovery rate assumption for zinc is speculative as limited metallurgical work has been completed to date. True widths are between 60%-100% of the total length and grades are uncut.

|

Greenfield Targets (See Table 2 and Figure 3 and 4)

Four holes were drilled into various targets at the Guayabales Project and all intersected lower grade mineralization beginning near surface with details below.

Plutus North Lower Grade Porphyry Discovery

Hole PNC-8 was drilled northeast from PPad 4 to test a gravity high anomaly and intersected porphyry-style mineralization consisting of chalcopyrite, chalcocite, molybdenite, pyrite and quartz veinlet stockwork associated with potassic alteration. The mineralization commenced from surface with assay results as follows:

- 127.20 metres @ 0.41 g/t gold equivalent from surface (0.21 g/t Au, 0.11% Cu, 5 g/t Ag, 0.003% Mo)

Follow up surface mapping designed to expand the newly discovered mineralization will be undertaken in early 2026 ahead of any potential follow up drilling.

Other Targets

Drilling at two other targets intersected near surface, low grade sheeted veinlets with details below.

APC-138 was drilled to the northeast from Pad 27 (south of the Apollo system) to test a coincidental geochemical and gravity high anomaly. The hole intercepted shallow and low-grade mineralization as follows:

- 45.10 metres @ 0.36 g/t gold equivalent from 9.75 metres downhole and

- 1.70 metres @ 10.80 g/t gold equivalent from 244.55 metres downhole

Drill holes APC-45 and APC-48 were drilled to the south from Pad 32 (located north of the Apollo system) and were designed to test coincidental geochemical and gravity anomalies. Both holes cut low grade mineralization from shallow depths with results below:

- 46.40 metres @ 0.30 g/t gold equivalent from 73.00 metres (APC-145) and

- 6.65 metres @ 1.46 g/t gold equivalent from 264.65 metres

- 55.65 metres @ 0.45 g/t gold equivalent from 17.50 metres (APC-148) including

- 6.40 metres @ 1.37 g/t gold equivalent from 117.60 metres

Table 2: Assays Results for Greenfield Targets Drilled at the Guayabales Project, Including PNC-8 into the Plutus Target

| Hole # | From (m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Mo

% |

AuEq g/t* |

| PNC-8 | 0.80 | 128.00 | 127.20 | 0.21 | 5 | 0.11 | 0.003 | 0.41 |

| APC-138 | 9.75 | 54.85 | 45.10 | 0.30 | 3 | 0.02 | – | 0.36 |

| and | 244.55 | 246.25 | 1.70 | 0.05 | 722 | 0.48 | – | 10.80 |

| APC-145 | 73.00 | 119.40 | 46.40 | 0.19 | 5 | 0.04 | 0.001 | 0.30 |

| and | 264.65 | 271.30 | 6.65 | 1.35 | 10 | 0.01 | – | 1.46 |

| APC-148 | 17.50 | 73.15 | 55.65 | 0.15 | 16 | 0.04 | 0.007 | 0.45 |

| Incl. | 117.60 | 124.00 | 6.40 | 1.28 | 8 | 0.01 | – | 1.37 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag (g/t) x 0.017 x 0.85) + (Cu (%) x 1.14 x 0.95) + (Mo (%) x 4.57 x 0.85) utilizing metal prices of Au – US$3,000/oz, Ag – US$50/oz, Cu – US$5.0/lb and Mo – US$20/lb and recovery rates of 97% for Au, 85% for Ag, 95% for Cu and 85% for Mo. Recovery rate assumptions for metals are based on metallurgical results announced on October 17, 2023, April 11, 2024 and October 3, 2024. The recovery rate assumption for molybdenum is speculative as limited metallurgical work has been completed to date. True widths are between 60%-100% of the total length and grades are uncut. |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com.

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective is a gold, silver, copper and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interest in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade gold-silver-copper-tungsten Apollo system. The Company’s objectives at the Guayabales Project are to expand the newly discovered high-grade Ramp Zone along strike and to depth and drill a series of greenfield generated targets on the property.

Additionally, the Company has launched its largest drilling campaign in history at the San Antonio Project as it hunts for new discoveries and looks to expand upon the newly discovered porphyry system at the Pound target. The San Antonio Project is located between two to five kilometers east-northeast of the Guayabales Project and could potentially share infrastructure given their proximity to each other.

Management, insiders, a strategic investor and close family and friends own 45.3% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on both the NYSE American and TSX under the trading symbol “CNL”.

Qualified Person and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE