Rick Mills – “Harvest Gold now drilling Central Mosseau”

Northern Mosseau Drilling

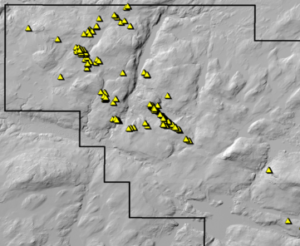

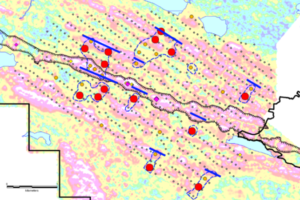

Below is a look at known gold mineralization in Mosseau North, the Morono and NW areas of Mosseau.

If another junior released the below results out of the blue, as a new discovery of two lenses, with those grades and potential strike and the fact they may be related to a moderate and relatively untested IP anomaly that can be traced for 600m along strike the share price rise imo would be spectacular.

But we get sold down because many think the results aren’t the mirror image of Windfall. Well, they are right, but this northern area was never described as such, that’s the description of the Central area by Quinton Hennigh of Crescat Capital which HVG is drilling now.

“Recent drilling in the Northern Area of the Mosseau property near Trench #1B, has returned encouraging results from an area previously known as prospective for gold. The best drill intercept was 1.90 g/t gold over 5.4 metres, including a higher-grade section of 8.67 g/t gold over 0.6 metres in hole MO-25-15. This zone also contains semi-massive sulphides, composed mainly of pyrite and lesser chalcopyrite, with notable silver and base metal values, including 203 g/t silver, 2.26% copper, 0.16 % zinc, and 0.05% lead.

The mineralized zone follows a relatively untested horizon, striking NNW-SSE, approximately 100 m east of the Trench #1B, where previous drilling tested it to a vertical depth of less than 50 m. It is interpreted that the semi-massive sulphides, associated with gold mineralization, may also be related to a moderate and relatively untested IP anomaly that can be traced for 600m along strike.”

And now it’s tax loss selling season and it’s Christmas and New Year’s.

We have results for 6 holes out of 23 being drilled in total for this program, we have none from Central Mousseau. We are still in the process of drilling there and will not see all results for at least 6-8 weeks.

We are NOT here for North Mosseau, we are here for the drilling of the Central part of the property, we have no results, no indication’s and yet HVG gets hammered by the partial north results, which, while not long intercepts are still high grade multi-metallic minerals in two distinct lenses that might be related to a moderate and relatively untested IP anomaly that can be traced for 600m along strike. Any junior would be ecstatic over these results as a Greenfields brand new discovery.

Sometimes the market does not make a lot of sense and stocks get sold for the wrong reasons.

Even at its simplest, Harvest Gold owns 50K of throughgoing structures on three properties in the Gold Fields dominated Urban Barry belt of Quebec, the company only announced announced 6 of 23 planned holes on one property, discovered a new lens in the known Northern Area of Mosseau and has not finished drilling in the most anticipated area, the Central Area of Mosseau. And those results will be out in January 2026.

Stock from the August 1st private placement is out as of December 1st adding additional pressure on the stock price, but HVG is clearly over sold, imo.

Unfortunately, as we all know, selling begets selling’ and we are obviously have been facing that over the past week or so. I do believe some shareholders might be leaving a little too early as the mystery at Mosseau has always been in the unexplored Central area.

Central Mosseau drilling

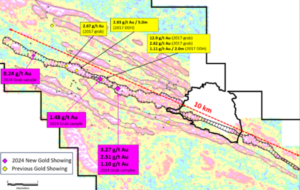

Below is where, and what, we are currently drilling.

This 3 km mineralized strike strongly correlates with the regional linear magnetic high that can be traced for over 10 kilometres. Much of this area remains underexplored, concealed beneath a thin layer of glacial till. The magnetic signature is associated with sulphide minerals, including pyrrhotite, located within or adjacent to a diorite/gabbro sill that has focused mineralizing fluids along the structure.

Several similar, parallel magnetic features have also been identified in the central part of the property, highlighting the area’s strong potential and warranting further exploration.

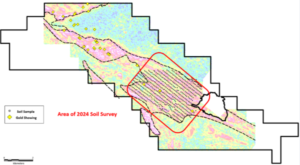

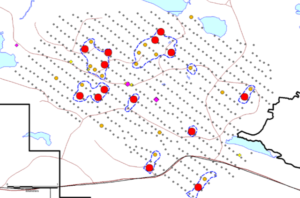

Results from the soil geochemical program highlight distinctive gold targets; the greater than 98th percentile Au Z-Score values define eight zones in and parallel to the Kiask River Mineralized Corridor (KRMC).

Three of the gold trains are immediately to the south and down-ice of the KRMC, confirming known mineralization from previous drilling and prospecting results. Another five (5) gold trains are parallel to the KRMC, to the North and the South of the KRMC.

These targets are also associated with magnetic highs and geologically by diorite and gabbro’s in the local stratigraphy (Figure 15, Figure 15). The soil sampling program included lines at a 200 m spacing, perpendicular to the known ice flow direction, and sample stations at every 25 m. The significance of the anomalies is not only determined by the gold grade and Z-score, but also by the contiguity of the anomalous samples.

Subscribe to AOTH’s free newsletter

Richard owns shares of Harvest Gold (TSX-V:HVG). HVG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of HVG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eldorado Announces Strong Exploration Results of Multiple New High-Grade Zones in Canada and Greece and Increases 2026 Exploration Investment, Reinforcing Confidence in Discovery Strategy

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) is pleased to announce the discovery of four new hi... READ MORE

First Atlantic Nickel Increases RPM Zone Strike Length 50% to Over 1.2 km and Width to Over 800 m from Phase 2x Drilling at Pipestone XL Magnetic Nickel-Cobalt Alloy Project

First Atlantic Nickel Corp. (TSX-V: FAN) (OTCQB: FANCF) (FSE: P21) is pleased to announce pos... READ MORE

McEwen Drilling Returns Significant Intersection at Gold Bar Mine Complex in Nevada: 5.55 gpt Gold over 44.2 Meters; Transformation into a Long-Life Mine Continues

McEwen Inc. (NYSE: MUX) (TSX: MUX) announces new drill results from the Gold Bar Mine Complex in th... READ MORE

Aya Gold & Silver Provides 2026 Outlook and Strategic Priorities

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased to provide its 2026 outlook and pres... READ MORE

Highlander Silver Announces US$40 Million Strategic Investment by Eric Sprott to Accelerate Growth

Highlander Silver Corp. (TSX: HSLV) is pleased to announce that Mr. Eric Sprott, an arm’s l... READ MORE