The Prospector News

Selkirk Copper Announces Initial Drill Results – Successfully Expands Minto North West Zone with a High-grade Intercept of 5.21% Cu, 0.47 g/t Au, 26.68 G/t Ag over 8.7 m Within a Broader Zone of 2.39% Cu, 0.32 g/t Au and 11.61 g/t Ag over 23.4 m in Drill Hole 25SCM001

You have opened a direct link to the current edition PDF

Open PDF CloseSelkirk Copper Announces Initial Drill Results – Successfully Expands Minto North West Zone with a High-grade Intercept of 5.21% Cu, 0.47 g/t Au, 26.68 G/t Ag over 8.7 m Within a Broader Zone of 2.39% Cu, 0.32 g/t Au and 11.61 g/t Ag over 23.4 m in Drill Hole 25SCM001

Selkirk Copper Mines Inc. (TSX-V: SCMI) (FSE: IO20) is pleased to announce assay results from the first four drill holes of the 50,000 m program, which strategically test the size and continuity of the high grade Minto North West Zone with highlights from drill hole 25SCM001 of 2.39% Cu, 0.32 g/t Au and 11.61 g/t Ag over 23.4 meters, including a higher grade core of 5.21% Cu, 0.47 g/t Au and 26.68 g/t Ag over 8.7 meters, and from drill hole 25SCM002 of 1.53% Cu, 0.93 g/t Au and 6.76 g/t Ag over 31.6 meters from hole 25SCM002, including a higher grade core of 3.73% Cu, 2.56g/t Au and 17.90g/t Ag over 9.5 meters.

Highlights

- Initial drill results at the Minto North West zone expands the previously identified high-grade mineralized zone

- Initial drill results from the ongoing program include the following high-grade intercepts:

- 5.21% Cu, 0.47 g/t Au, 26.68 g/t Ag over 8.7 m from 228.85 m, within a broader zone of 2.39% Cu, 0.32 g/t Au and 11.61 g/t Ag over 23.4 m in drill hole 25SCM001

- 3.73% Cu, 2.56 g/t Au, 17.90 g/t Ag over 9.5 m from 240.2 m, within a broader zone of 1.53% Cu, 0.93 g/t Au and 6.76 g/t Ag over 31.6 m in drill hole 25SCM002

- As of November 28, 2025, Selkirk Copper has completed ~26,000 m of drilling across 98 drill holes including a total of 7,632 m at the Minto North West zone

- A regional 1992 km2 Lidar survey has been completed as our first step in district scale exploration

Selkirk Copper’s inaugural 50,000 m diamond drill campaign is advancing on multiple fronts – testing high-potential exploration targets and increasing confidence within existing mineralized zones to support ongoing Trade-Off Studies. Drilling began on August 23rd with a single rig focused on the high-grade Minto North West zone (see Figure 1) and has since scaled up to four active rigs as of October 11th. Highlights from the ongoing program include:

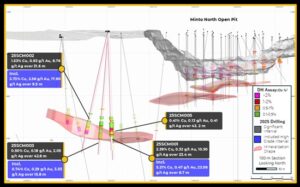

- Hole 25SCM001: a 100 m southeastern step out from the previous drilling at the Minto North West zone intersecting mineralized, strongly deformed migmatite host rock with foliaform and disseminated bornite and chalcopyrite over 23.4 m including a zone of massive bornite from 233.62-234.19 grading 28.50% Cu, 1.29 g/t Au and 147.00 g/t Ag over 0.57 m (Figure 2). These high-grade intercepts are consistent with high-grade copper-gold-silver mineralization encountered historically and elsewhere on the Minto property.

- 25SCM001 intersected 2.39% Cu, 0.32 g/t Au, 11.61 g/t Ag over 23.4 m including 5.21% Cu, 0.47 g/t Au, 23.58 g/t Ag over 8.7 m from 228.85 m to 237.5 m.

- Holes 25SCM002, 25SCM003 and 25SCM005: infilled a 135 m section between strong historic intercepts of 1.71% Cu over 20.14 m including 2.43% Cu over 11.14 m (22EXP0441) and 0.45% Cu over 49.38 m including 1.18% over 5.63 m (22EXP0471). While lower in grade, drillhole 25SCM003 and 25SCM005 show a similar continuity and thickness consistent with in previous drilling.

- 25SCM002 intersected a zone of 1.53% Cu, 0.93 g/t Au, 6.76 g/t Ag over 31.6 including 3.73% Cu, 2.56 g/t Au, 17.90 g/t Ag over 9.5 m

- 25SCM003 intersected a broad zone of 0.50% Cu, 0.18 g/t Au, 2.05 g/t Ag over 42.6 m

- 25SCM005 intersected a broad zone of 0.41% Cu, 0.13 g/t Au, 1.69 g/t Ag over 43.2 m also contiguous with mineralization in previous drilling.

- Drilling is targeting all major zones including expanding the open pit Ridgetop zone to the south, expansion of the Copper Keel zone, expansion of the Minto East zone, exploration around the 118 zone, infill drilling and expansion of the Minto North zone and testing greenfield targets north of the Minto Mine footprint

M. Colin Joudrie, President & CEO, commented: “Results from the first four drill holes of our inaugural drill campaign at the former Minto copper-gold-silver mine have met, and in several areas exceeded, our expectations, returning high grades of copper, as well as gold and silver, the value of which is now 100% attributable to Selkirk Copper following the extinguished legacy precious-metal stream. It’s exciting to see this initial drilling intersecting high-grade mineralization and expanding the footprint of the mineralized Minto North West zone by over 90%. We are eagerly anticipating additional results from the remainder of the drill program and are integrating these results into ongoing Trade-Off Studies in real-time.”

Minto North

The first four drill holes of the program focussed on the high-grade Minto North West zone, where the previous operator successfully identified a new zone of mineralization with discovery hole 21EXP003 which encountered 1.58% Cu over 28 m including 3.50% Cu over 5.0 m 2. The Minto North West zone represents an estimated total tonnage of ~1.1Mt3 and these early results have confirmed continuity within the zone as well as expanded the footprint of known mineralization to the south.

Driven by a geoscience-first approach, the following highlights several key geological observations from the Minto North West zone drill program. At the Minto North West zone drill holes typically collar in undeformed, megacrystic K-feldspar granodiorite with phenocrysts up to 5 cm. Toward the mineralized zones, foliation intensity increases, commonly accompanied by a halo of increasing magnetite and biotite (potassic) alteration. Sulphide mineralization textures, consisting primarily of chalcopyrite and bornite, show a progression in textures as sulphide mineral percentages increase, from disseminations to foliaform (foliation parallel blebs or stringers) and locally net-textured to semi-massive mineralization within more strongly deformed lithologic units. With increasing structural fabric and the onset of partial melting features, such as leucosome and melanosome development, this zone is classified as the “assimilation zone”. This contact can be abrupt and corresponds to a peak in magnetic susceptibility readings. Where partial melting, micro- and macro-folding is more pronounced, the host is referred to as migmatite (MIGM). All lithologies are locally cut by late andesite dykes and subordinate pegmatite or aplite dykelets.

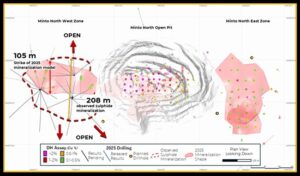

Drilling from the current program has returned grade and thicknesses comparable to historical 2021 and 2022 intersections, confirming continuity of the Minto North system. Higher-grade intervals correlate with increased visual sulphide abundance, particularly well-developed foliaform textures and localized zones of semi-massive and net-textured sulphides, often accompanied by a higher bornite-to-chalcopyrite ratio. Bornite has been visually logged in several step-out holes, indicating the system remains open along strike. Drilling to date has successfully identified chalcopyrite and bornite extending over 208 m in strike length, nearly doubling the 105-metre extent defined in the 2025 mineral resource estimate (MRE) model (Figure 1). For more information on 2025 MRE see Table 4.

Figure 1: Plan View of the Minto North West zone. Observed sulphide mineralization suggests the mineralized zone extends to over 208 m in the N-S strike direction, compared to the previously modelled 105 strike length (red shaded shape)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/276330_76f46d2514b77838_001full.jpg

Figure 2: Cross section (100 m section) looking north highlighting significant intervals outlined in Table 2.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/276330_76f46d2514b77838_002full.jpg

Table 1: Collar Locations and Header Information

| Hole ID | Easting | Northing | Azi | Dip | EOH |

| 25SCM001 | 6945817 | 384003 | 0 | -90 | 282m |

| 25SCM002 | 6945917 | 384003 | 314 | -73 | 297m |

| 25SCM003 | 6945917 | 384003 | 340 | -80 | 300m |

| 25SCM005 | 6945918 | 384003 | 7 | -77 | 312m |

Table 2: Significant Interval Table

| Hole ID | From | To | Length (m) | Cu % | Au g/t | Ag g/t | CuEq | Lith |

| 25SCM001 | 216.0 | 220.0 | 4.0 | 0.32 | 0.08 | 1.14 | 0.40% | ASMZ |

| 226.0 | 249.4 | 23.4 | 2.39 | 0.32 | 11.61 | 2.72% | ASMZ | |

| Incl. | 228.9 | 237.5 | 8.7 | 5.21 | 0.47 | 26.68 | 5.79% | ASMZ |

| 25SCM002 | 218.1 | 249.7 | 31.6 | 1.53 | 0.93 | 6.76 | 2.28% | ASMZ |

| Incl. | 240.2 | 249.7 | 9.5 | 3.73 | 2.56 | 17.90 | 5.78% | ASMZ |

| 25SCM003 | 220.2 | 262.8 | 42.6 | 0.50 | 0.18 | 2.05 | 0.65% | ASMZ |

| Incl. | 246.2 | 262.0 | 15.8 | 0.74 | 0.29 | 3.03 | 0.98% | ASMZ |

| 25SCM005 | 221.8 | 265.0 | 43.2 | 0.41 | 0.13 | 1.69 | 0.52% | MIGT |

| The flat laying to shallowly dipping nature of the mineralized zones suggest that true widths are typically >90% of the reported drill intersection length. | ||||||||

| ASMZ = Assimilation Zone; MIGT = Migmatite | ||||||||

| CuEq Calculation: CuEq = ((Cu% × CuP × RCu × 2204.62)+(Au g/t ÷ 31.1035 × AuP × RAu) + (Ag g/t ÷ 31.1035 × AgP × RAg ))/(CuP × RCu × 2204.62) Where: CuP/AuP/AgP = US$ commodity prices of $4.25/lb Cu, $2500/oz Au, $29/oz Ag; RCu = Cu Recovery = 98%; RAu = Au Recovery = 85%; RAg= Ag Recovery = 85% Recoveries as estimated from historical mineral processing results. |

||||||||

2025 Drill Program Progress

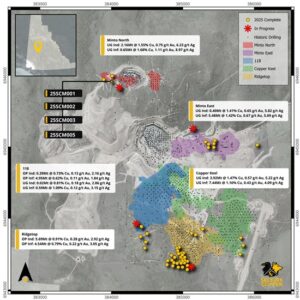

Approximately 26,000 m across 98 drill holes, out of a 50,000 m planned drill program, have been completed to date at the former Minto copper-gold-silver mine. The focus of this program is the expansion of the five primary zones of mineralization: Ridgetop, 118, Copper Keel, Minto East and Minto North (Figure 3), as well as exploration targets testing newly interpreted regional structures coincidental with geophysical targets.

Drilling production has been strong and is averaging ~85-90 m/day per rig. This program is on schedule to complete between 33,000 m to 34,000 m by Christmas break on December 20. The Company anticipates a mid-January restart to complete the remainder of the 50,000 m program. This schedule will coincide with the construction of the ice-bridge across the Yukon River which provides road access to site until spring breakup.

Table 3 summarizes meters and holes drilled by zone. To date, 5,877 samples have been prepared and shipped for analysis, with assays being returned on schedule. Results will be released once all appropriate QAQC reviews are completed.

Table 3: Drilling Progress by Zone

| Zone | Holes completed | Meters drilled | |||

| Minto North | 24 | 7,632 | |||

| Ridgetop | 47 | 9,851 | |||

| Minto East | 9 | 3,444 | |||

| Copper Keel | 7 | 1,990 | |||

| 118 | 11 | 3,080 | |||

| Total | 98 | 25,997 |

Figure 3: Plan view of the Minto Mine showing surface projections of mineralization zones (Ridgetop, Copper Keel, 118, Minto East and Minto North), relative to 2025 drill collars (yellow circles). Update 2025 Mineral Resources by zone are provided. See table 4 at end of release for full Mineral Resources details.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/276330_76f46d2514b77838_003full.jpg

District Scale LiDAR Survey

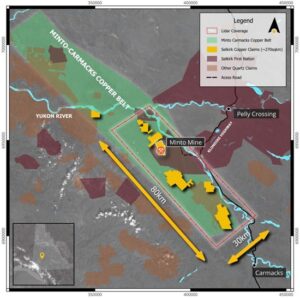

In October the exploration team completed a high-resolution LiDAR Survey that covers an 80 km by 30 km block of the Minto-Carmacks Copper Belt (Figure 4). This detailed dataset will provide the environmental, permitting, exploration, and engineering teams with high quality topographic information to guide ongoing and future work activities.

Next steps include a detailed review and integration of the LiDAR dataset to support the development of a regional structural model which will be combined with available soil & sediment geochemistry, induced polarization, surface and airborne magnetic, and radiometric data which will serve as an important field program planning and targeting tool for the 2026 exploration season.

Figure 4: Regional map of the Minto-Carmacks Copper Belt, showing the extent of the 2025 LiDAR survey (red rectangle).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/276330_selkirkfig4.jpg

Mineral Resource Details

The following table summarizes the current Minto Mineral Resource:

Table 4: Global Mineral Resource Estimate for the Minto Project (Effective Date: April 7, 2025)

| Type | Cut | Class | ROM | In Situ Grade | Metal | |||||||

| (CDN$) | Tonnage (000) | NSR (CDN$) | Cu (%) | Au (gpt) | Ag (gpt) | Ox Ratio | ASCu (%) | Cu (Mlbs) | Au (Koz) | Ag (Koz) | ||

| OP | $30 | Indicated | 6,085 | $89.11 | 0.897 | 0.274 | 2.9 | 0.15 | 0.163 | 120.3 | 53.7 | 560.4 |

| Inferred | 9,496 | $73.71 | 0.702 | 0.162 | 2.4 | 0.07 | 0.057 | 146.9 | 49.3 | 738.4 | ||

| UG | $80 | Indicated | 6,504 | $183.90 | 1.489 | 0.636 | 5.6 | 0.06 | 0.090 | 213.5 | 132.9 | 1,167.6 |

| Inferred | 14,162 | $156.85 | 1.281 | 0.539 | 4.9 | 0.06 | 0.075 | 399.9 | 245.4 | 2,229.6 | ||

| Total | Varies as Above | Indicated | 12,588 | $138.08 | 1.203 | 0.461 | 4.3 | 0.10 | 0.125 | 333.8 | 186.6 | 1,728.0 |

| Inferred | 23,658 | $123.48 | 1.048 | 0.387 | 3.9 | 0.07 | 0.068 | 546.8 | 294.7 | 2,968.1 | ||

| Notes |

NSR = CA$4.73*CuRec*Cu%*22.0462 + (CA$2400.60*AuRec*Augpt + CA$21.45*AgRec*Aggpt)/31.10348

|

|||||||||||

References

1 See 2023-02-02 News Release “Minto Metals Reports Multiple High-Grade Copper Intersections From Follow-up Drilling at Minto North Including 1.91% Copper Over 34.59 Metres” filed by Minto Metals Corp.

2 See 2022-03-15 News Release “Minto Metals Reports Multiple High-Grade Copper Intersections From 2021 Drilling” filed by Minto Metals Corp.

3 See 2025-08-06 Technical Report “NI 43-101 2025 Mineral Resource Estimate Update for the Minto Property, Yukon, Canada” effective date 2025-04-07 filed by Venerable Ventures Ltd., available on SEDAR+ (sedarplus.ca).

Technical aspects of this news release have been reviewed, verified and approved by Stacie Jones-Clark, P.Geo., Vice President Exploration of Selkirk Copper Mines Inc., who is a qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Marketing Services

Selkirk Copper announces it has engaged Triomphe Holdings Ltd., doing business as Capital Analytica, an arm’s-length service provider, to provide certain marketing and social media services to the company, in accordance with the policies of the TSX Venture Exchange and applicable securities laws. Based in Nanaimo, B.C., Capital Analytica specializes in marketing, social media and public awareness within the mining and metals sector. Capital Analytica will provide social media services, capital market consultation and social engagement reporting for an initial six-month term for a fee of $150,000 payable in two tranches, with an option to renew the agreement for an additional six months at a rate of $75,000 unless terminated earlier in accordance with the terms of the agreement. The engagement remains subject to the approval of TSX Venture Exchange. Capital Analytica has no direct or indirect interest in the company or its securities, and has no current intention or right to acquire any such interest during the engagement.

In addition, Selkirk Copper announces it has engaged the services of ICP Securities Inc. to provide automated market making services, including use of its proprietary algorithm, ICP Premium™, in compliance with the policies and guidelines of the TSX Venture Exchange and other applicable legislation. ICP will be paid a monthly fee of C$7,500, plus applicable taxes. The agreement between the Company and ICP was signed with a start date of December 1, 2025, and is for four (4) months and shall be automatically renewed for subsequent one (1) month terms unless either party provides at least thirty (30) days written notice prior to the end of the Initial Term or an Additional Term, as applicable. There are no performance factors contained in the agreement and no stock options or other compensation in connection with the engagement. ICP and its clients may acquire an interest in the securities of the Company in the future.

ICP is an arm’s length party to the Company. ICP’s market making activity will be primarily to correct temporary imbalances in the supply and demand of the Company’s shares. ICP will be responsible for the costs it incurs in buying and selling the Company’s shares, and no third party will be providing funds or securities for the market making activities. The engagement remains subject to the approval of the TSX Venture Exchange.

About Selkirk First Nation

Selkirk First Nation is centered in Pelly Crossing, a community in central Yukon, 280km north of Whitehorse. They are a self-governing First Nation, having signed its Final and Self-Government Agreements in 1997. Selkirk owns 4,740 square kilometers of Settlement Land, including 2,408 square kilometers where Selkirk owns both the surface and subsurface. Selkirk First Nation is one of three self-governing Northern Tutchone First Nations in the Yukon. The Selkirk First Nation, indirectly, holds a controlling equity stake in Selkirk Copper.

About Selkirk Copper

Selkirk Copper is a well-financed, newly formed company with a controlling interest held by the Selkirk First Nation through its wholly owned subsidiary, that, in partnership with the Selkirk First Nation, is completing a thorough exploration drilling campaign and a restart and redevelopment plan for the former Minto copper-gold-silver mine based on best-in-class environmentally sustainable mining, development and reclamation practice. Selkirk Copper controls 26,850 hectares of prospective mineral claims located in the Minto-Carmacks copper belt as well as significant open-pit and underground infrastructure, a 4,100 tonne per day processing plant, 400-person camp, water treatment facilities, numerous ancillary buildings, and mobile equipment centered on the former Minto copper-gold-silver mine. Selkirk Copper’s mineral tenure, operation infrastructure, access roads and powerline, is located on or adjacent to Lands of the Selkirk First Nation much of which is surrounded by prospective Selkirk First Nation Category A Lands.

Selkirk Copper Mines Inc. is listed on the TSX Venture Exchange under the symbol (TSXV: SCMI) and has a secondary listing on the Frankfurt Exchange under the symbol (FSE: IO20).

On behalf of the Board of Directors of Venerable Ventures Ltd.

M. Colin Joudrie

President and Chief Executive Officer

For more information, please contact:

M. Colin Joudrie, President & CEO

colin.joudrie@selkirkcopper.com

(604) 760-3157

Justin Stevens, Vice-President Corporate Development

justin.stevens@selkirkcopper.com

(604) 240-2959

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE