Rick Mills – “Graphite One identifies important magnet rare earths, plus scandium and yttrium at it’s Graphite Creek deposit in Alaska”

Graphite One (TSX-V:GPH) (OTCQX:GPHOF) has found rare earth elements at its Graphite Creek graphite deposit in Alaska, potentially making the mine, once it’s advanced to production, even more valuable than when graphite was the only mineral present.

Graphite forms from the metamorphism of organic-rich sedimentary rocks. The presence of garnet typically indicates medium to high-grade metamorphic conditions, specifically the amphibolite to granulite facies. These high temperatures and pressures are ideal for the growth of large, crystalline, and commercially valuable flake graphite.

A Feasibility Study was published in February 2025. It shows the proposed mine having 4.796 million tonnes of graphite (Cg) in the measured and indicated category, contained within 104.7Mt at 4.6% Cg, and 11.568Mt Cg inferred, contained within 268.1Mt @ 4.3% Cg. The resource estimate is based on a 2% Cg cut-off grade.

The FS pit and its anticipated 20-year lifespan comprises just 12% (1.9 km) of the 15.3 km-long graphite- and garnet-bearing mineralized zone.

Graphite Creek is now triple the size when the US Geological Survey reported 3.5 years ago that it was the largest flake graphite deposit in the US. Subject to securing project financing, construction could begin by 2027, and the mine could be producing by 2030.

US achieves security of graphite supply with G1’s Feasibility Study — Richard Mills

The news

Graphite One came out with some exciting news this week regarding the discovery of rare earth elements at Graphite Creek.

The company reports that Geochemical analyses completed by Activation Laboratories Ltd found rare earths in drill core samples of garnet-bearing ore rock within the anticipated pit outlined in G1’s Feasibility Study, completed in February 2025.

Garnet has a strong affinity for REEs and can concentrate them to levels exceeding those found in many existing REE ore sources, therefore garnet-bearing rocks are considered a potentially important source for rare earth elements (REEs), yttrium (Y) and Scandium (Sc), which makes them significant in the search for new REE deposits.

Scandium is often grouped with Rare Earth Elements (REEs) because it shares similar properties and is found in the same deposits. Garnet and scandium are closely linked, with garnet being the primary host for scandium in the deep lithospheric mantle, accounting for about 75% of the element’s budget there.

Yttrium (Y) and Scandium (Sc) are chemically similar to the lanthanides (REEs) and occur in the same ore deposits, so they are classified as rare earths for geological and commercial purposes.

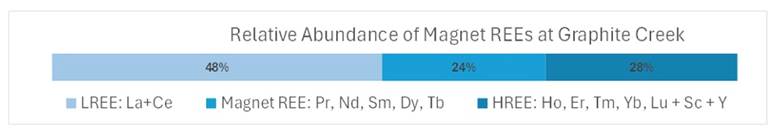

Initial test work identified all five of the principal permanent magnet REEs at Graphite Creek: neodymium, praseodymium, dysprosium, terbium and samarium.

A significant advantage of some REE-enriched garnet deposits are that they also have low concentrations of environmentally hazardous elements like uranium (U) and thorium (Th), in contrast to traditional REE ore minerals such as monazite and xenotime, which can have high levels of U and Th.

Read our Permanent magnets primer

G1’s rare earths recovery plan will include independent testing and process development with a Department of Energy national lab.

“The presence of two Defense Production Act Title III materials — graphite and REEs — in a single deposit further underscores Graphite Creek’s position as a truly generational deposit,” said Graphite One’s President Anthony Huston, in the Nov. 13 news release. “Given the robust economics of our planned complete graphite materials supply chain, the presence of Rare Earths at Graphite Creek suggests that recovery as a by-product to our graphite production will maximize the value.”

Test work on 21 representative samples from quartz-biotite-garnet- sillimanite schist units throughout the FS pit indicated elevated levels of the Heavy Rare Earths (HREE) and the presence of the five principle REE magnet elements – neodymium, praseodymium as well as the HREEs dysprosium and terbium — in addition to samarium, which is used in samarium-cobalt permanent magnets. Aside from the lanthanide REEs, the Graphite Creek garnet-bearing ore (Graphite Creek has a full feasibility study) contains scandium and elevated yttrium.

“Garnets are known for their ability to uptake Heavy Rare Earths and Yttrium into their mineral structure,” said Dr. Kirsten Fristad, Graphite One’s chief geologist.

Building on the initial bulk rock analyses, additional test work is being completed at the University of Alaska Fairbanks Advanced Instrumentation Laboratory and Activation Laboratories Ltd. to quantify the REE inventory within the host mineralogy. G1 is in discussions with a Department of Energy National Lab to develop extraction methods and separation pathways for the individual REEs in the Graphite Creek ore.

G1 is also talking to senior officials at all relevant federal departments and agencies about the company’s complete supply chain strategy for advanced graphite products. “We will now be adding updates on our rare earth by-product potential,” said Huston.

Critical minerals

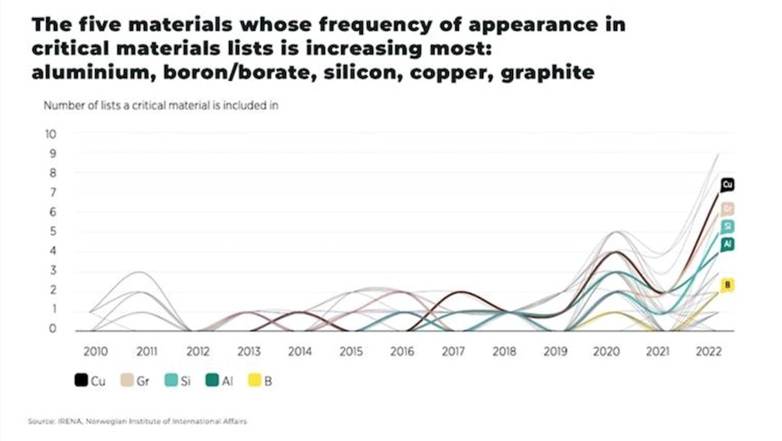

Electrification and decarbonization are driving demand for metals, especially critical metals like graphite and rare earths.

President Trump wants to expand production of critical minerals in America. On March 20 he set out the boldest measures the mining industry has seen in decades, with an executive order that aims to speed up permitting, prioritize land-use for mining and provide financial support.

According to the IEA, via Statista, global demand for minerals like lithium, cobalt, rare earths and graphite could double or triple, driven by the rise of electric vehicles, renewable energy infrastructure and advanced electronics used in artificial intelligence.

As shown in Statista’s (copyrighted, follow above link) chart, between 2024 and 2030, global lithium demand is projected to grow by 146 percent, while graphite and cobalt needs are expected to increase by 50-75 percent, according to the IEA’s baseline scenario, mainly driven by electric vehicles and energy storage. Furthermore, the demand for rare earths, essential for permanent magnets used in wind turbines and electric motors, is projected to increase by 45 percent.

The United States relies heavily on imports for dozens of critical minerals used in everything from clean energy to defense, states text to accompany a Visual Capitalist infographic that ranks US critical minerals by supply disruption risk in 2025.

Source: Visual Capitalist

Rhodium primarily from South Africa tops the list of 84 critical commodities, followed by niobium, sourced mainly from Brazil.

Rare earth elements also ranked high on the list, including samarium, terbium and dysprosium needed for permanent magnets, motors, EVs and wind turbines.

Lithium, cobalt and synthetic graphite — all crucial for battery production — appeared lower in dollar terms but are still vital to energy security, Visual Capitalist states.

Source: The Oregon Group

Graphite

Graphite is a highly critical mineral because of its essential role in electric vehicle batteries, energy storage and defense applications, with demand projected to rise dramatically.

Graphite is the ideal material for defense applications thanks to its unique properties, i.e., it is able to withstand very high temperatures with a high melting point; it is stable at these high temperatures; it is lightweight and easy to machine; and it is corrosion resistant.

A report from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications.

The report assessed the degree of criticality for each of 40 materials deemed critical or soon to be critical. Natural graphite was rated “very high-risk” for air applications, and “high-risk” for sea applications.

The United States does not currently produce any graphite; most of it (43%) is imported from China. Canada, Mexico and Mozambique each supplied 13% in 2024.

Deficits are expected to kick in this year, as new graphite mines fail to keep up with surging demand from automakers.

Graphite’s criticality equals or exceeds rare earths — Richard Mills

Rare earths

Rare earth elements are vital to 21st century technology, with neodymium, praseodymium, dysprosium, terbium and samarium forming essential building blocks of powerful permanent magnets used in wind turbines, electric vehicles and advanced defense systems such as precision-guided munitions and radar.

REEs further enable high-performance fiber optics, lasers, catalysts, and phosphors in displays and lighting. Their distinct magnetic, optical and catalytic properties make them indispensable across military applications and commercial electronics, renewable energy, and telecommunications – underscoring their strategic importance to US industry and national security.

Neodymium-iron-boron (NdFeB) magnets, or just neodymium magnets, are critical for electric vehicles, robots and wind turbines. They are also used in defense applications.

The BBC states that neodymium is used to make the powerful magnets used in loudspeakers, computer hard drives, EV motors and jet engines that enable them to be smaller and more efficient.

Yttrium and europium are used to manufacture television and computer screens…

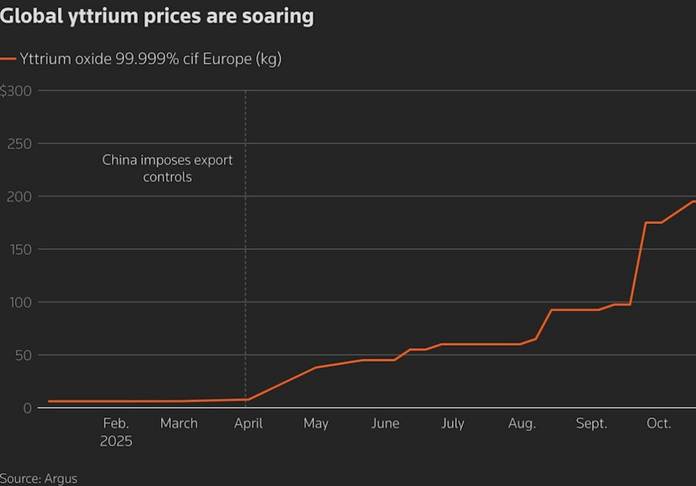

A shortage of yttrium is reportedly brewing as a result of Chinese export restrictions (see section below). There are fears that shortages and soaring costs could hit aerospace, energy and semiconductor production. China hasn’t shipped yttrium to the US since April.

According to Reuters, European prices for yttrium oxide, used to make heat-shield coatings, are up 4,400% since January at $270 a kilogram, Argus data showed.

Terbium and dysprosium are sometimes added to NdFeB magnets to allow them to tolerate even higher temperatures.

Samarium-cobalt (SmCo) magnets have the highest known resistance to demagnetization. This capability, meaning the magnet has higher coercivity, allows them to function in high-temperature environments without losing magnetic strength — an essential attribute for most military applications.

Precision-guided munitions depend on SmCo magnets as part of the motors that manipulate their flight control surfaces. The generators that produce power for aircraft electrical systems also rely on samarium-cobalt magnets, as does the stealth technology used to mask the sound of helicopter rotor blades by generating white-noise concealment.

Other permanent magnet applications include “jet engines and other aircraft components, electronic countermeasures, underwater mine detection, antimissile defense, range finding, and space-based satellite power and communications systems,” according to the USGS.

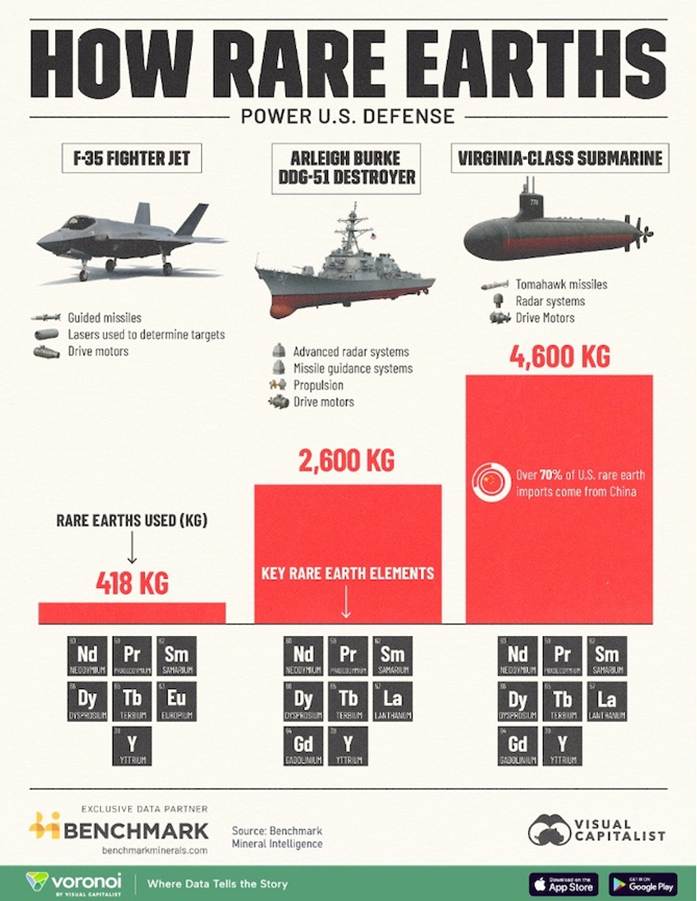

The Army relies on REE magnets for the navigation systems in its M1A2 Abrams battle tank, and the Navy is developing a similarly dependent electric drive to conserve fuel for its Arleigh Burke-class destroyers. The Air Force’s F-22 fighter uses miniaturized permanent magnet motors to run its tail fins and rudder.

Visualizing How Rare Earths Power U.S. Defense

The infographic below explores the quantities of REEs used in major US defense platforms and highlights their specific applications in modern warfare.

Source: Visual Capitalist

No scandium is currently mined in the United States. The US gets most of its scandium and scandium components from China. Scandium is mainly found in aluminum-scandium alloys and solid oxide fuel cells (SOFCs).

Aerospace is a key application for scandium, which is primarily used to create high-performance aluminum-scandium alloys. Even a small addition of scandium (typically 0.1% to 0.5%) significantly enhances the properties of aluminum, making it ideal for the demanding requirements of aircraft and spacecraft manufacturing.

Remember, Graphite One’s news indicates the presence of the five principle rare earths magnet elements at the Graphite Creek deposit — light rare earths neodymium, praseodymium and samarium, and heavy rare earths dysprosium and terbium. Also present is yttrium and scandium.

China and rare earths

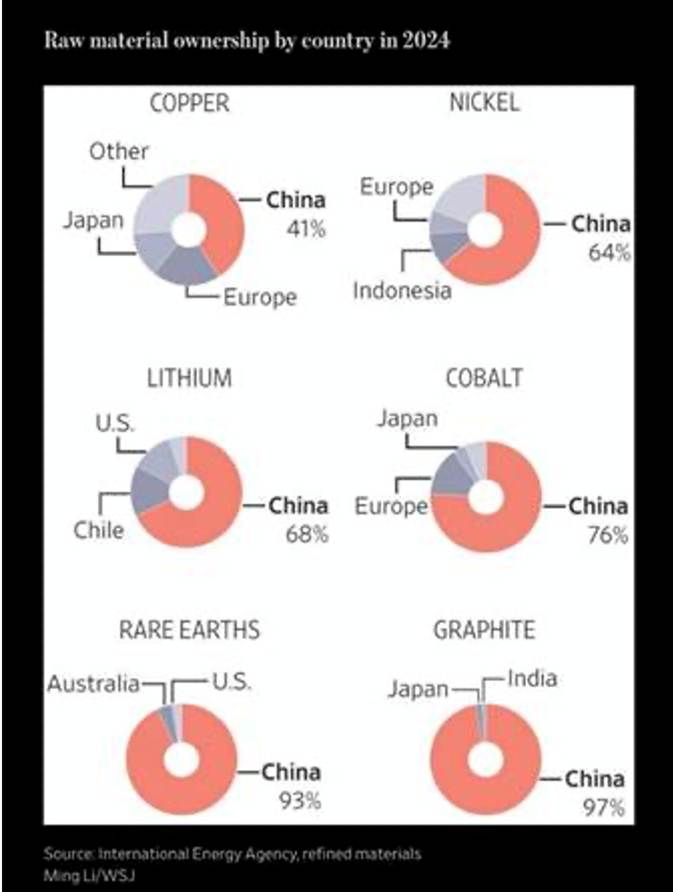

China, the world’s largest producer of REEs, imposed export limits on the magnet REEs in February 2024 and tightened graphite exports in December 2024, highlighting the importance of developing G1’s Graphite Creek mine. A recent UBS Evidence Labs report indicates that dependence on China for a select group of critical minerals is most severe for graphite (97%) and REEs (93%).

China is the leading source of 46 of the 84 critical minerals examined by the USGS.

The IEA estimates that China accounts for about 61% of rare earth production and 92% of their processing.

The United States is particularly vulnerable, given that there is only one rare earths mine, Mountain Pass in California. Only recently has the owner, MP Materials, begun processing its rare earths domestically; previously it sent the rare earth oxides to China for processing.

A US Geological report notes that from 2020-23, the US relied on China for 70% of its imports of all rare earth compounds and metals.

In early April 2025, China imposed export controls on seven rare earth elements (REEs) and related permanent magnets, citing national security concerns and in response to US tariffs. The targeted REEs were samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium.

Companies needed to get special export licenses to send rare earths and magnets out of the country.

On June 11, US and Chinese officials finalized a new trade framework following two days of negotiations in London. The agreement included a commitment from Beijing to resume exports of rare earth elements and magnets to the United States.

However, as we wrote at the time, Beijing had not committed to grant export clearance for some specialized rare-earth magnets that US military suppliers need for fighter jets and missile systems.

In October, China expanded its controls over the export of rare earths.

Foreign companies are now required to have the Chinese government’s approval to export even small amounts of rare earths and must explain their intended use.

Reuters reported on Oct. 9 that China planned to add five more rare earth elements and related materials to its export controls list, bringing the total to 12. The five additional REEs were holmium, erbium, thulium, europium and ytterbium.

Then, in late October, a tentative deal included a one-year suspension of Chinese export restrictions. US Treasury Secretary Scott Bessent said on Sunday the two countries hope to finalize the agreement by American Thanksgiving, which falls on Nov. 27.

Key implications of the continued REE export restrictions on the US mentioned by the BBC article:

- A CSIS report notes that defence technologies including F-35 jets, Tomahawk missiles and Predator unmanned aerial vehicles all depend on these minerals. It adds that this comes as China “expands its munitions production and acquires advanced weapons systems and equipment at a pace five to six times faster than the United States”.

- And it’s not only in the field of defence. US manufacturing, which Trump has said he hopes to revive through the imposition of his tariffs, stand to be severely impacted. “Manufacturers, particularly in defence and high-tech, face potential shortages and production delays due to halted shipments and limited inventories,” said Gavin Harper, a critical materials research fellow at the University of Birmingham.

- “Prices for critical rare earth materials are expected to surge, increasing the immediate costs of components used in a wide range of products, from smartphones to military hardware,” he says, adding that this could result in potential production slowdowns for affected US companies.

- Until the 1980s, the US was in fact the largest producer of rare earths. But these companies exited the market as China began to dominate in terms of scale and cost. This is largely believed to be part of why US president Donald Trump is so keen to sign a minerals deal with Ukraine — he wants to reduce dependency on China. Another place Trump has had his eye on is Greenland, which is endowed with the eighth largest reserves of rare earth elements.

Many are confused about the outcome of the most recent US/ China talks concerning the suspension of Chinese REE trade restrictions. China’s Ministry of Commerce announced a temporary suspension (November 9, 2025, to November 27, 2026) of some export controls on materials like gallium, germanium, and antimony.

The suspension specifically lifts a ban on exporting these materials to the U.S., which had been in place since December 2024. The clause prohibiting the export of any dual-use item to U.S. military users remains in place.

Dual-use items are materials that can be used for both civilian and military purposes.

Conclusion

Critical metals are the most important commodities to own going forward. We can see that in the angst they’re causing in global markets, particularly how China has weaponized, with export restrictions on certain critical minerals, including graphite and rare earths.

Commodities: the last safe haven standing — Richard Mills

But the US could soon have security of supply for a critical mineral that it is currently 100% reliant on China for.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska.

In 2024, the US imported 60,000 tonnes of natural graphite, of which 87.7% was flake and high purity.

The Feasibility Study anticipates a production rate of 155,439 tonnes, meaning Graphite One could have the capacity to not only meet 100% of the US’s annual natural graphite needs, but have extra to stockpile, in the neighborhood of 100,000 tonnes each year.

Now add the potential for five-by-product permanent magnet rare earth elements, plus yttrium and scandium, that G1 has identified at the Graphite Creek deposit, and the project looks even more attractive to investors.

At the close of trading on Tuesday, Nov 18, Graphite One’s stock was up 19% to $1.44 a share.

The US government has taken stakes in MP Materials, Lithium Americas, Trilogy Metals, and signed offtake agreements with MP Materials and the United States Antimony Corporation. The presence of rare earths at Graphite Creek will help the United States to break its dependence on China for rare earths and rare earth magnets, as it builds domestic refining capacity.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2025.11.18 Share Price: Cdn$1.44

Shares Outstanding: 146.2m

Market cap: Cdn$251.8m

GPH website

Subscribe to AOTH’s free newsletter

Richard does not own shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eldorado Announces Strong Exploration Results of Multiple New High-Grade Zones in Canada and Greece and Increases 2026 Exploration Investment, Reinforcing Confidence in Discovery Strategy

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) is pleased to announce the discovery of four new hi... READ MORE

First Atlantic Nickel Increases RPM Zone Strike Length 50% to Over 1.2 km and Width to Over 800 m from Phase 2x Drilling at Pipestone XL Magnetic Nickel-Cobalt Alloy Project

First Atlantic Nickel Corp. (TSX-V: FAN) (OTCQB: FANCF) (FSE: P21) is pleased to announce pos... READ MORE

McEwen Drilling Returns Significant Intersection at Gold Bar Mine Complex in Nevada: 5.55 gpt Gold over 44.2 Meters; Transformation into a Long-Life Mine Continues

McEwen Inc. (NYSE: MUX) (TSX: MUX) announces new drill results from the Gold Bar Mine Complex in th... READ MORE

Aya Gold & Silver Provides 2026 Outlook and Strategic Priorities

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased to provide its 2026 outlook and pres... READ MORE

Highlander Silver Announces US$40 Million Strategic Investment by Eric Sprott to Accelerate Growth

Highlander Silver Corp. (TSX: HSLV) is pleased to announce that Mr. Eric Sprott, an arm’s l... READ MORE