Abitibi Metals Intersects 17.91% CuEq (13.48% Cu, 5.15g/t Au) over 6.3m Within 6.93% CuEq over 19.5m in Western Zone Expansion

Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) is pleased to report a new world-class high-grade copper-gold intercept from its ongoing Phase 3 drill program at the B26 Polymetallic Deposit in Québec. The Company’s resource improvement drilling campaign continues to outperform expectations, confirming exceptional grade continuity and delivering one of the strongest copper-gold intercepts ever recorded at B26 in hole 269W5. This world-class intercepts in hole 269W5 highlight areas of outstanding grade potential, paving the way for substantial resource growth and enhanced potential project economics.

Highlights:

- Exceptional High-Grade Intercept in Untested Gap:

- Hole 1274-17-269W5 returned 17.91% CuEq (13.48% Cu, 5.15 g/t Au) over 6.3 metres, within 6.93% CuEq over 19.5 metres, starting at 976.5 metres depth.

- Confirms world class grade continuity across an untested 80-metre gap, defining a newly identified high-grade zone within the Western Plunge.

- Strong gold credit significantly enhances the block model. Using spot CuEq⁴ pricing, the intercept equates to 23.83% CuEq over 6.3 metres, within 9.28% CuEq over 19.5 metres.

- Located ~100 metres east of Hole 1274-17-269W3 (4.46% CuEq over 21.1 metres), further upgrading the model in this area.

- Western Plunge Expansion

- Hole 1274-25-373W2 intersected the B26 Copper-Gold horizon, extending mineralization 150 metres down plunge.

- CEO Commentary – Potential Source Zone Emerging:

- “It has been our thesis that a more massive, higher-grade source exists for the copper-gold stringer zone. With this intercept, we believe we may be onto that source – and we will follow up to target the discovery of a 15 to 30-metre, 10%+ CuEq zone at depth.” – Jonathon Deluce, CEO, Abitibi Metals

A webinar will be held on Friday November 21st at 10:00am EST to present the results in more detail. Please Register Here

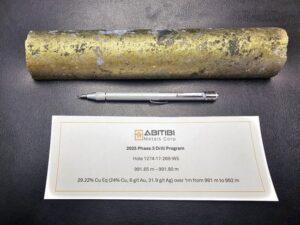

Figure 1. Massive copper-gold-rich mineralization from Hole 1274-17-269W5, highlighted by 29.22% CuEq over 1 metre (991-992 m depth).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11775/275226_710f4fbf34ef1a59_001full.jpg

Figure 2. Massive copper-gold-rich mineralization from Hole 1274-17-269W5, highlighted by 24.53% CuEq over 0.5 metre (993.0-993.5 m depth)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11775/275226_710f4fbf34ef1a59_002full.jpg

Jonathon Deluce, CEO of Abitibi Metals, commented: “This is an exceptional drill hole result, delivering world-class copper and gold grades within a previously untested 80-metre gap underscoring the true scale and quality of this system. With this intercept we see mineralization strengthening at depth, clearly demonstrating that B26 hosts high-value zones capable of materially enhancing the overall grade profile and supporting future resource growth within a deposit already ranked among the top 10% of the largest felsic VMS systems globally.

“It has been our thesis that a more massive, higher-grade source exists for the copper-gold stringer zone. With this intercept, we believe we may be onto that source – and we will follow up to target the discovery of a 15 to 30-metre, 10%+ CuEq zone at depth.”

Louis Gariépy, P.Geo., Vice President Exploration of Abitibi Metals, commented: “The grades encountered in hole 1274-17-269W5 are exceptional by any measure. Using current metal prices, the interval equates to a spot copper-equivalent grade of 23.83% CuEq over 6.3 metres, representing material valued at roughly C$3,500 per tonne – nearly ten times higher than nearby historic intercepts. The interval is dominated by a thick chalcopyrite-rich stringer similar to those observed in other high-grade portions of the system, indicating that these shoots are a recurring feature of the orebody. This consistency highlights the substantial internal upside that remains within the Western Zone and will meaningfully guide the continued growth of the B26 resource model.”

To date, 19,182 metres of the 20,000-metre Phase 3 program have been completed, with remaining drilling scheduled for completion by the end of November. Abitibi currently owns 50% of B26 and retains the option to earn an additional 30% from SOQUEM Inc., a subsidiary of Investissement Québec (see news release dated November 16, 2023.) The Company is fully funded through 2027, with a 20,000-metre Phase 4 program planned for 2026 to support continued resource growth at B26.

To recap, Phase 3 is a fully funded drilling program designed around three strategic objectives:

- Expansion of High-Grade Zone: Drilling continues to expand the higher-grade zones at B26, fueling resource growth within the block model. The latest results further strengthen this trend, with standout hole 1274-17-269W3 now confirmed by today’s strong results from hole 1274-17-269W5, located 100 metres to the east. These results underscore the exceptional strength and continuity of the B26 mineralization. Additional drilling is already planned to further expand this high-grade zone.

- Expansion of Mineralized Trends: Drilling continues to extend the open-ended mineralized trends beyond the current B26 resource block model, successfully confirming growth potential across multiple areas of the deposit. Today’s results from hole 1274-25-373W2 deliver a further 150-metre step-out on the B26 mineralized horizon, marking another significant expansion of the mineralized system.

- Unlocking Regional Potential: making new discoveries across Abitibi’s 3,328-hectare property is set to become the next focus in Q1 2026.

The results from these holes further validate the continuity of mineralization at depth along the down plunge of the western Cu-Au mineralized shoot within the current resource model of 11.3MT @ 2.13% Cu Eq (Indicated- 1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag) & 7.2MT @ 2.21% Cu Eq (Inferred – 1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag). The company anticipates these results to positively contribute to the expansion of its mineral resource base.

Table 1: Significant Intercepts from Phase 3

| Hole ID | From (m) | To (m) | Length (m) | CuEq (%)2 | Cu (%) | Au (g/t) | Ag (g/t) | Zn (%) | CuEq(%) Spot4 |

| 1274-17-269W5 | 976.5 | 996 | 19.5 | 6.93 | 5.05 | 2.19 | 8.55 | 0.03 | 9.28 |

| incl | 977.5 | 983 | 5.5 | 3.51 | 1.98 | 1.79 | 4.99 | 0.01 | 4.88 |

| incl | 989.7 | 996 | 6.3 | 17.91 | 13.48 | 5.15 | 20.18 | 0.06 | 23.83 |

| 1274-25-373W2 | 1370.5 | 1376.5 | 5.8 | 0.98 | 0.90 | 0.08 | 2.34 | 0.01 | 1.26 |

| and | 1411.5 | 1420 | 8.5 | 0.90 | 0.87 | 0.03 | 1.70 | 0.01 | 1.14 |

| incl | 1411.5 | 1414.1 | 2.6 | 2.35 | 2.30 | 0.04 | 3.08 | 0.01 | 2.97 |

Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates that the mineralized lens’ true width generally corresponds to 40% to 80% of the core length.

Note 2: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $2,500/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90.0% for gold, 96.1% for zinc, 72.1% for silver.

Note 3: Intervals are generally composited starting with a 0.1% CuEq cut-off and between 0.6% CuEq cut-off grade for the “including” intervals, allowing for up to 3 consecutive samples below cut-off grade.

Note 4: Spot copper equivalent values calculated using metal prices of $5.00/lb Cu, $1.35/lb Zn, $48.00/ounce Ag and $3,900/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90.0% for gold, 96.1% for zinc, 72.1% for silver.

Note 5: Results presented represent the rushed mineralized zones. Additional assays are still pending to complete these holes.

Discussion of Results:

The 23.83% CuEq over 6.3 m in hole 1274-17-269W5 represents a 3,500 CA$/t material at today’s metal prices and exchange rate. This is 10 times the grade of the nearby historic holes 1274-17-260 and 1274-17-269, which returned 2.4% CuEq over 10 metres and 2.7% CuEq over 12 metres, respectively. This remarkable grade is associated with a thick massive chalcopyrite stringer, similar in nature to the stringers present in the copper stringer zone. The local presence of such shoots is observed in other areas so it seems to be a characteristic of this ore body, which in return has the potential to generate a notable positive impact on the future production forecasts.

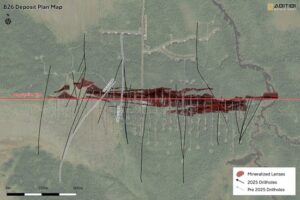

Figure 3: Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11775/275226_710f4fbf34ef1a59_003full.jpg

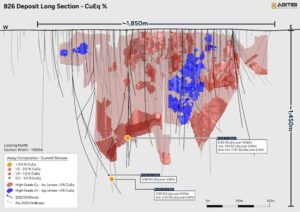

Figure 4: Longitudinal section looking north with Results from the current release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11775/275226_710f4fbf34ef1a59_004full.jpg

Figure 5: Core picture 17.91% CuEq (13.48% Cu, 5.15g/t Au) over 6.3 metres in hole 1274-17-269W5

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11775/275226_710f4fbf34ef1a59_005full.jpg

Table 2: Phase 3 Drill Hole Information

| Hole ID | UTM East | UTM North | Elevation | Azimuth | Dip | Start (m) | End (m) |

| 1274-25-269W5 | 652506 | 5513872 | 276 | 180 | -51 | 426 | 1258 |

| 1274-25-373W2 | 652070 | 5512815 | 277 | 18 | -65 | 751 | 1590 |

Note 1: Numbers have been rounded to the nearest whole number in the table above

About Abitibi Metals Corp:

Abitibi Metals Corp. is dedicated to acquiring and exploring mineral properties within Quebec, with a particular emphasis on high-quality base and precious metal assets that offer significant potential for growth and expansion.

The company’s flagship B26 Polymetallic project which has been optioned from SOQUEM, hosts a substantial and growing resource base.

- Indicated: 11.3Mt at 2.13% CuEq (1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag)

- Inferred: 7.2Mt at 2.21% CuEq (1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag) .

The B26 project is strategically located just 5 kilometres north of the formerly producing Selbaie mine. This proximity provides the project with ready access to all necessary infrastructure required for mine development

In addition to the B26 Deposit, Abitibi’s portfolio includes the Beschefer Gold project, historical drilling has identified four notable, historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres (BE13-038) and 13.07 g/t gold over 8.75 metres (BE12-014) amongst four modelled zones. These promising findings highlight the potential for further gold discoveries within the project area.

About SOQUEM:

SOQUEM, a mineral exploration company and subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

On Behalf of The Board

Jonathon Deluce, Chief Executive Officer

For more information, please call +1 226-271-5170, email info@abitibimetals.com, or visit https://www.abitibimetals.com.

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE