Revival Gold Intersects 1.4 g/T Oxide Gold Over 44.2 Meters in Shallow Drilling and Extends Mineralization at Mercur

Revival Gold Inc. (TSX-V: RVG) (OTCQX: RVLGF) is pleased to provide further results from ongoing drilling at the Company’s Mercur Gold Project in Utah.

Highlights

- Received assay results from eleven drill holes with the following highlight intersections:

- 1.4 g/T gold over 44.2 meters width in RM25-117

- 1.0 g/T gold over 24.4 meters width in RM25-120

- 1.7 g/T gold over 12.9 meters width in RMC25-017

- 0.9 g/T gold over 24.4 meters width in RM25-113

- RMC25-120 intercept shows resource expansion potential down-dip from the 2025 Mercur Preliminary Economic Assessment (“PEA”) pit shell1.

- Continued confirmation of gold occurrence, grade and leachability with PEA estimates

- Average intercept depth starts at 45 meters downhole, highlighting the shallow nature of the Mercur gold deposit.

- Revival Gold has completed 100 holes and about 10,000 meters of the planned 13,000-meter drilling program.

- Drilling continues with three rigs at Mercur and one at Beartrack-Arnett in Idaho. Additional results are pending.Note: 1See “Preliminary Economic Assessment NI 43-101 Technical Report on the Mercur Gold Project, Tooele & Utah Counties, Utah, USA” prepared by Kappes, Cassidy & Associates, and RESPEC Company LLC dated May 2nd, 2025

“This year’s drilling at Mercur continues to align with the project’s PEA results and we are seeing strong indications of exploration upside beyond the current mine plan”, said Hugh Agro, President & CEO. “Mercur is a shallow oxide deposit, with a strike of about 4 kilometers in the Main Mercur area alone. Shallow depths and broad deposit extent translate into lower extraction costs and meaningful mine plan expansion potential.”

Mr. Agro continued, “With Mercur’s PEA economics estimated at $2,175 gold, and the current consensus long term gold price sitting at about $3,000 per ounce, projects like Mercur – which have the potential to move relatively quickly to production – offer investors significant upside exposure”.

Details

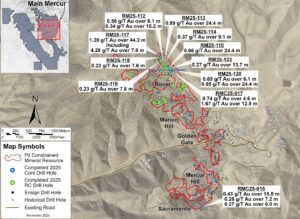

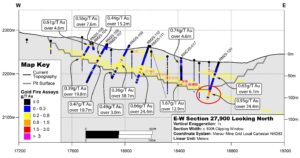

Revival Gold has completed 100 holes and about 10,000 meters of this year’s planned 13,000-meter drilling program. Figure 1 describes drill hole locations for the eleven holes released today. Figure 2 is a cross section through the Rover area at Main Mercur with drilling intercepts and resource blocks in the background. The figure shows broad alignment of this year’s drilling intercepts to the PEA block model. The figure further highlights the intercept of oxidized mineralization in RM25-120 showing resource expansion potential down-dip from the PEA pit shell.

Figure 1: Main Mercur Drill Plan Map and Current Results

Figure 2: Cross-Section 27900

Note: Figure reflects all drill results in the section as at November 17, 2025.

Full drilling results are presented in Table 1. In the program to date, the weighted average fire assay gold grade is 0.73 g/T and the AuCN/AuFA ratio, an indicator of gold leachability, is 83%. These results are generally consistent with the Inferred Mineral Resource and metallurgical models developed in the PEA.

Table 1: Detailed Drill Results

| Hole Number |

Area | Azimuth (deg.) |

Dip (deg.) |

From (m) |

To (m) |

Drilled Width (m)1 |

Fire Assay Gold Grade (g/T)2 |

AuCN/AuFA Ratio (%)3 |

| RMC25-015 | Sacramento | 320 | -60 | 110.2 | 126.0 | 15.9 | 0.43 | 85 |

| 54% Recovery4 | 126.0 | 133.2 | 7.2 | 0.26 | 66 | |||

| 133.2 | 139.2 | 6.0 | 0.27 | 84 | ||||

| RMC25-017 | Rover | 0 | -90 | 11.6 | 16.2 | 4.6 | 0.74 | 92 |

| 50.1 | 63.0 | 12.9 | 1.67 | 59 | ||||

| Including | 58.5 | 60.1 | 1.6 | 9.44 | 60 | |||

| RM25-110 | Rover | 240 | -70 | 47.2 | 71.6 | 24.4 | 0.66 | 78 |

| RM25-112 | Rover | 280 | -60 | 0.0 | 6.1 | 6.1 | 0.56 | 99 |

| 47.2 | 62.5 | 15.2 | 0.34 | 91 | ||||

| RM25-113 | Rover | 200 | -70 | 56.4 | 80.8 | 24.4 | 0.89 | 78 |

| RM25-114 | Rover | 280 | -60 | 50.3 | 59.4 | 9.1 | 0.37 | 92 |

| RM25-117 | Rover | 24 | -65 | 33.5 | 77.7 | 44.2 | 1.39 | 86 |

| Including | 45.7 | 53.3 | 7.6 | 4.28 | 95 | |||

| RM25-118 | Rover | 300 | -60 | 50.3 | 57.9 | 7.6 | 0.22 | 73 |

| RM25-119 | Rover | 205 | -60 | 54.9 | 62.5 | 7.6 | 0.23 | 52 |

| RM25-120 | Rover | 240 | -70 | 32.0 | 38.1 | 6.1 | 0.65 | 91 |

| 67.1 | 91.4 | 24.4 | 0.95 | 88 | ||||

| RM25-123 | Rover | 350 | -65 | 53.3 | 67.1 | 13.7 | 0.27 | 80 |

Notes:

1 True width for all holes is estimated to be 65-100% of drilled width. Numbers may not add up due to rounding.

2 Mineralized intercepts calculated based on a 0.17 g/T cutoff grade allowing up to two intervals of internal dilution.

3 AuCN/AuFA is the ratio of cyanide soluble gold assay to total gold in fire assay and provides an indication of potential heap leach recoverability for the material sampled.

4 2.9 meters of lost material in 126 to 133.2 meters was assigned zero grade for Fire Assay Gold Grade and not included in the AuCN/AuFa Ratio.

The Mercur property includes interests optioned from Barrick Resources (USA) Inc. and others as summarized in the PEA.

About Revival Gold Inc.

Revival Gold is one of the largest, pure gold mine developers in the United States. The Company is advancing development of the Mercur Gold Project in Utah and mine permitting preparations and ongoing exploration at the Beartrack-Arnett Gold Project located in Idaho. Revival Gold is listed on the TSX Venture Exchange under the ticker symbol “RVG” and trades on the OTCQX Market under the ticker symbol “RVLGF”. The Company is headquartered in Toronto, Canada, with its exploration and development office located in Salmon, Idaho.

For further information, please contact:

Scott Trebilcock, VP, Corporate Development & Investor Relations

Telephone: (416) 366-4100 or Email: info@revival-gold.com

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE