ARIS MINING REPORTS Q3 2025 RESULTS

Segovia Ramp-Up Driving Profitable Growth: Record Revenue, Cash Flow, and Adjusted Earnings

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its financial and operating results for the three and nine months ended September 30, 2025 (Q3 2025 and 9M 2025). All amounts are in U.S. dollars unless otherwise indicated.

Q3 2025 Financial Performance

- Revenue of $253.5 million, up 27% from Q2 2025 and 93% from Q3 2024, driven by higher gold prices and increased sales volumes.

- Adjusted EBITDA1 of $131.1 million, up 33% from Q2 2025 and triple Q3 2024. On a trailing 12-month basis, Adjusted EBITDA1 has reached $352.0 million.

- Adjusted net earnings1 of $71.8 million or $0.36/share, up from $0.27/share in Q2 2025 and $0.08/share in Q3 2024.

- Cash balance increased to $417.9 million as of September 30, 2025, up from $310.2 million at June 30, 2025. This increase primarily reflects:

- $90.8 million of cash flow after sustaining capital and income taxes;

- $60.5 million of proceeds from the exercise of ARIS.WT.A warrants (July 2025 expiry); and

- $13.2 million of proceeds from the sale of the Juby Gold Project; partially offset by

- $48.1 million invested in growth capital.

- Net debt reduced to $64 million, down from $241 million at year-end 2024.

Neil Woodyer, CEO, commented “The production ramp-up at Segovia is progressing well, leading to record financial results and a cash balance of $418 million. This year, we have also delivered two major technical studies – the Soto Norte Prefeasibility Study and the Toroparu Preliminary Economic Assessment. These projects reinforce the strength of our growth pipeline beyond Segovia and Marmato, where construction of the Bulk Mining Zone remains on schedule for first gold in the second half of 2026. With record revenue, cash flow, and earnings in Q3, Aris Mining is financially strong and strategically positioned for continued growth into 2026 and beyond.”

| Q3 2025 | Q2 2025 | Q1 2025 | Q3 2024 | |

| Gold production ounces (oz), total | 73,236 | 58,652 | 54,763 | 53,608 |

| Gold sold (oz), total | 73,001 | 61,024 | 54,281 | 53,769 |

| Segovia – AISC, Owner Mining ($/oz sold) | $1,452 | $1,520 | $1,482 | $1,451 |

| Segovia – CMP AISC Sales Margin* | 44 % | 42 % | 41 % | 34 % |

| EBITDA | $96.5M | $31.6M | $39.7M | $27.8M |

| Adjusted EBITDA1 | $131.1M | $98.7M | $66.6M | $43.0M |

| Adjusted EBITDA1, last 12 months | $352.0M | $264.0M | $201.3M | $145.7M |

| Net earnings (loss)2 | $42.0M3 or $0.21/share | $(16.9)M3 or $(0.09)/share | $2.4M or $0.01/share | $(2.1)M or $(0.01)/share |

| Adjusted earnings1 | $71.8M or $0.36/share | $47.8M or $0.27/share | $27.2M or $0.16/share | $13.1M or $0.08/share |

| Adjusted earnings1, last 12 months | $171.5M or $0.95/share | $112.7M or $0.65/share | $77.7M or $0.46/share | $41.5M or $0.28/share |

Q3 2025 Operational Performance

- Gold production totaled 73,236 oz, a 25% increase from 58,652 oz in Q2 2025. Production has progressively increased following the June 2025 commissioning of the second mill at Segovia on time and within budget.

- Marmato Narrow Vein Zone produced 7,687 oz, an 8% increase over Q2 2025 and 26% higher than Q3 2024, supported by stable throughput and higher average gold grades.

- Segovia Operations produced 65,549 oz, supported by gold grades of 9.9 g/t, gold recoveries of 96.1%, and a 31% increase in tonnes milled compared to Q2 2025.

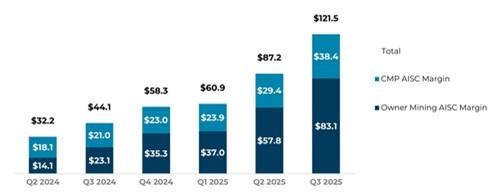

- AISC margin increased to $121.5 million, up 39% from Q2 2025. On a trailing 12-month basis, AISC margin has reached $327.9 million.

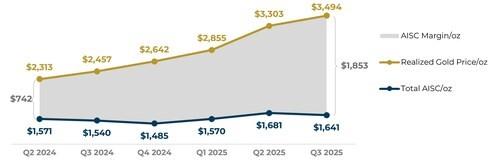

- Owner-operated Mining AISC was $1,452/oz compared to $1,520/oz in Q2 2025, bringing the 9M 2025 average to $1,482/oz, tracking toward the lower end of the full year 2025 guidance range of $1,450/oz to $1,600/oz.

- Contract Mining Partner (CMP) sourced gold delivered an AISC sales margin of 44%, contributing to a 43% margin for 9M 2025, which is above the full-year 2025 guidance range of 35% to 40%.

- Total AISC of $1,641/oz compared to $1,681/oz in Q2 2025, reflecting per ounce cost improvements primarily due to increased gold sales volumes.

| Total Segovia Operating Information | Q3 2025 | Q2 2025 | Q3 2024 |

| Average realized gold price ($/oz sold) | $3,494 | $3,303 | $2,457 |

| Tonnes milled (t) | 219,550 | 167,960 | 166,868 |

| Average tonnes milled per day (tpd) | 2,553 | 1,976 | 1,940 |

| Average gold grade processed (g/t) | 9.87 | 9.85 | 9.23 |

| Gold produced (oz) | 65,549 | 51,527 | 47,493 |

| Gold sold (oz) | 65,580 | 53,751 | 48,059 |

| AISC margin ($M) | 121.5 | 87.2 | 44.1 |

| Segovia Operating Information by Segment | Q3 2025 | Q2 2025 | Q3 2024 |

| Owner Mining | |||

| Gold sold (oz) | 40,984 | 32,685 | 22,952 |

| Cash costs – ($/oz sold) | $999 | $1,047 | $1,081 |

| AISC – ($/oz sold) | $1,452 | $1,520 | $1,451 |

| AISC margin ($M) | 83.1 | 57.8 | 23.1 |

| CMPs | |||

| Gold sold (oz) | 24,596 | 21,066 | 25,107 |

| Cash costs – ($/oz sold) | $1,653 | $1,622 | $1,417 |

| AISC – ($/oz sold) | $1,955 | $1,931 | $1,622 |

| AISC sales margin (%) | 44 % | 42 % | 34 % |

| AISC margin ($M) | 38.4 | 29.4 | 21.0 |

| * Aris Mining operates its own mines and contracts with community-based mining partners, referred to as Contract Mining Partners (CMPs), to increase total gold production. Some partners work within Aris Mining’s infrastructure, while others manage their own mining operations on Aris Mining’s titles using their own infrastructure. In addition, Aris Mining purchases high grade mill feed from third-party contractors operating off-title, which further optimizes production and increases operating margins. |

Corporate and Project Development Highlights

- Strong cash generation funding growth:

- Operations generated $90.8 million in cash flow after sustaining capital and income taxes in Q3 2025, fully funding all growth and expansion initiatives. After expansion capital, Aris Mining generated $42.6 million in net cash flow. See the Quarterly cash-flow summary in the following sections for additional cash flow analysis.

- Marmato Bulk Mining Zone construction advancing:

- Development of the main access decline has advanced 580 metres of the planned 1.7 kilometres. Current development rates average 72 metres per month and are expected to increase to approximately 150 metres per month once beyond the fault zone, with completion of the full decline length targeted for August 2026.

- The Los Indios crosscut is advancing toward its connection with the main decline, now approximately 320 metres away. This horizontal development will provide an additional access and ventilation pathway, enable ore and waste haulage between existing workings and new infrastructure. Importantly, completion of the crosscut will enhance operational flexibility and de-risk the project’s ramp-up phase by allowing multiple access points for early development and production sequencing.

- Surface construction activities continue to advance safely, with over 2.06 million workhours completed to date. Bulk earthworks for the process plant platform have reached 95% completion (294,000 m³ moved), and the retaining wall is over 75% complete. Final shaping of the carbon-in-pulp (CIP) plant platforms is expected during the first week of November 2025.

- Major equipment, including the primary crusher, SAG mill, ball mill, and filter press, has arrived in Cartagena. Approximately 95% of long-lead items have been ordered. The contract for the main civil, mechanical, and electrical works is in place, with the contractor mobilized and construction activities commenced in October.

- Preparations for the new powerline continue to advance. Land acquisition is complete, and the environmental impact study has been submitted for approval, enabling construction to commence in March 2026 following permit issuance. To ensure continuity of commissioning and early operations, back-up generators are included in the site power plan to mitigate any potential delays in the grid power connection.

- During Q2 and Q3 2025, we invested $20.1 million and $23.9 million, respectively, toward the construction budget.

- At the end of Q3, the estimate to complete the project was $250 million, reflecting approximately $40 million of progress made over the six-month period since the prior estimate of $290 million at the end of Q1, which had incorporated the scope increase from 4,000 to 5,000 tpd.

- Net of the remaining $82 million of stream financing payments to be received from Wheaton Precious Metals, the construction funding requirement is approximately $168 million.

- The project remains on schedule, with first gold in H2 2026, followed by a production ramp-up period to steady-state operations

- Soto Norte Project (51% owned, Colombia):

- Prefeasibility Study (PFS) completed in September 2025, demonstrating robust economics with, on a 100% basis, after-tax NPV5% of $2.7 billion, IRR of 35%, and 2.3-year payback at $2,600/oz gold.

- Strong leverage to higher gold prices, at $3,000/oz the NPV5% increases to $3.3 billion with IRR of 40.0%.

- The PFS highlights industry-leading environmental design features and integration of local community miners – 750 tpd (over 20% of 3,500 tpd capacity) has been dedicated to local contract mining partners.

- Aris Mining is advancing the required studies to apply for an environmental license in H1 2026 for the development of Soto Norte.

- Toroparu Project (100% owned, Guyana):

- Preliminary Economic Assessment (PEA) completed in October 2025, outlining another robust project with after-tax NPV5% of $1.8 billion, IRR of 25.2%, and 3.0-year payback at $3,000/oz gold.

- Aris Mining has initiated a PFS, targeted for completion in 2026, to advance Toroparu toward construction.

- Juby Gold Project Sale:

- Closed in September 2025 for a total consideration of $22 million, streamlining our portfolio to focus on our core operations and projects in South America.

Endnotes

| 1 All references to adjusted earnings, EBITDA, adjusted EBITDA, growth capital investment, cash flow after sustaining capital and income taxes, cash costs and AISC are non-GAAP financial measures in this document. These measures are intended to provide additional information to investors. They do not have any standardized meanings under IFRS, and therefore may not be comparable to other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Refer to the Non-GAAP Measures section in this document for a reconciliation of these measures to the most directly comparable financial measure disclosed in the Company’s financial statements. |

| 2 Net earnings represents net earnings attributable to owners of the company, as presented in the annual and interim financial statements for the relevant period. |

| 3 A $45.5 million non-cash loss was recognized in Q2 2025 from fair value adjustments to the Company’s warrant liability, valued at $40.8 million as of June 30, 2025. The fair value of the liability is directly correlated to the Company’s share price, which increased by 38% during Q2 2025 (year-to-date: 82% increase). In July 2025, the Company received an additional $60.5 million in cash proceeds from exercises of these warrants. With these exercises and the July 29, 2025 expiry of the remaining outstanding warrants, the liability has been fully extinguished, removing a source of non-cash earnings volatility from future results. |

Aris Mining’s Condensed Consolidated Interim Financial Statements for the three and nine months ended September 30, 2025 and 2024 and related MD&A are available on SEDAR+, in the Company’s filings with the U.S. Securities and Exchange Commission (the SEC) and in the Financials section of Aris Mining’s website here. Hard copies of the financial statements are available free of charge upon written request to info@aris-mining.com.

About Aris Mining

Founded in September 2022, Aris Mining was established with a vision to build a leading South America-focused gold mining company. Our strategy blends current production and cashflow generation with transformational growth driven by expansions of our operating assets, exploration and development projects. Aris Mining intends to unlock value through scale and diversification. The Company is listed on the TSX (ARIS) and the NYSE-A (ARMN) and is led by an experienced team with a track record of value creation, operational excellence, financial discipline and good corporate governance in the gold mining industry.

Aris Mining operates two underground gold mines in Colombia: the Segovia Operations and the Marmato Complex, which together produced 210,955 ounces of gold in 2024. With expansions underway, Aris Mining is targeting an annual production rate of more than 500,000 ounces of gold, following the commissioning of the second mill at Segovia, completed in June and ramping up during H2 2025, and the construction of the Bulk Mining Zone at the Marmato Complex, expected to start ramping up production in H2 2026. In addition, Aris Mining operates the 51% owned Soto Norte joint venture, where a PFS study is complete on a new, smaller scale development plan which confirms Soto Norte as a high-quality, long-life project with robust economics and industry-leading environmental and social design features. In Guyana, Aris Mining owns the Toroparu gold/copper project, where a new Preliminary Economic Assessment (PEA) is complete and a Prefeasibility Study is underway.

Colombia is rich in high-grade gold deposits and Aris Mining is actively pursuing partnerships with the Country’s dynamic small-scale mining sector. With these partnerships, we enable safe, legal, and environmentally responsible operations that benefit both local communities and the industry.

Figure 1: Strong AISC Margin Growth ($ million) – Segovia (CNW Group/Aris Mining Corporation)

Figure 2: Total AISC and Realized Gold Price Trends ($/oz) – Segovia (CNW Group/Aris Mining Corporation)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE