Relevant Gold Secures $2.89M in Warrant Proceeds as Kinross, Bollinger, and Management Reaffirm Strategic Support

| Relevant Gold Corp. (TSX-V:RGC) (OTCQB:RGCCF) is pleased to announce a strategic capital infusion of $2.89 million through the exercise of 15.8 million previously outstanding common share purchase warrants. This includes increased investment from cornerstone shareholders Kinross Gold Corporation (TSX: K) (NYSE: KGC) and William Bollinger. The move signals strong conviction in the Company’s Wyoming-focused gold strategy and provides a healthy runway for advancing its district-scale exploration portfolio.

Management exercised 12,000,000 founder warrants at $0.13 per share which were issued on the formation of the Company, while Kinross and Bollinger exercised a combined 3,799,102 warrants at $0.35 per share. The warrant conversion reflects strong strategic alignment and long-term conviction in the Company’s vision, technical approach, and asset base.

“This funding is a clear endorsement from both our strategic investors and leadership team in the strength of Relevant Gold’s vision and our ability to execute,” said Relevant Gold CEO Rob Bergmann. “The continued support from Kinross and Mr. Bollinger not only validates the scale and potential of our Wyoming portfolio but also underscores the confidence in our team’s exploration model. With an aligned shareholder base, a clean capital structure, and a fortified balance sheet, we are well-positioned to accelerate exploration and unlock the next wave of discovery across our emerging gold districts.”

Proceeds from the warrant exercises will directly support:

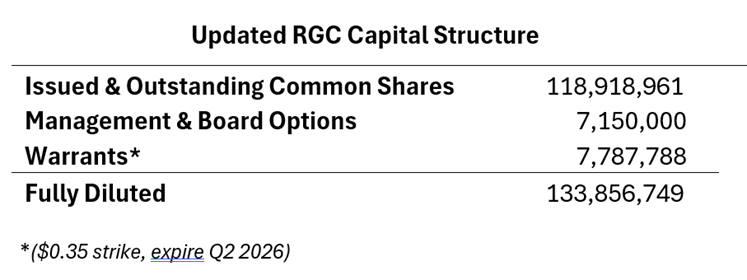

The financing also simplifies the Company’s capital structure, enhances financial flexibility, and significantly strengthens working capital as Relevant Gold enters a pivotal growth phase. As a result, only 7,787,788 warrants remain outstanding (at an exercise price of $0.35), substantially reducing the prior overhang. The Company’s updated capital structure is as follows:

|

|

|

|

About Relevant Gold Corp.

Relevant Gold Corp. is a North American gold exploration company focused on the acquisition, exploration, discovery, and development of district-scale gold projects in the state of Wyoming – one of the most mining-friendly jurisdictions in the United States and globally. Founded by experienced exploration geologists, Relevant Gold is operated by a highly respected team with a proven record of significant value creation for shareholders

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE