ALPHAMIN PROVIDES Q3 2025 OPERATIONAL UPDATE

Alphamin Resources Corp. (TSX-V:AFM) (JSE AltX:APH) is pleased to provide an operational update as follows:

- Q3 2025 contained tin production of 5,190 tonnes, up 26% from the previous quarter (Q2 2025: 4,106 tonnes (period from phased restart on April 15 to June 30))

- FY2025 contained tin production guidance increased to between 18,000 and 18,500 tonnes (17,500 tonnes previously)

- Contained tin sales of 5,143 tonnes for the quarter, up 12% from the prior period

- Q3 2025 EBITDA2,3 guidance of US$96m, up 28% from Q2 2025 actual of US$75m

- Interim FY2025 dividend of CAD0.07 cents per share paid on 15 September 2025

- External laboratory assays received for drilling at Mpama North and Mpama South

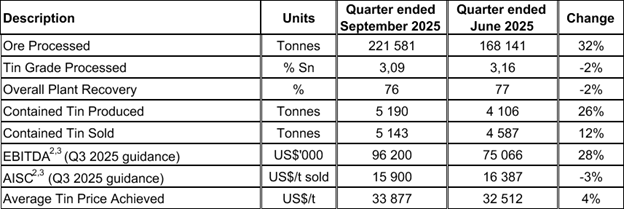

Operational and Financial Summary for the Quarter ended September 20251

1Information is disclosed on a 100% basis. Alphamin indirectly owns 84.14% of its operating subsidiary to which the information relates. 2Q3 2025 EBITDA and AISC represent management’s guidance. 3This is not a standardized financial measure and may not be comparable to similar financial measures of other issuers.See “Use of Non-IFRS Financial Measures” below for the composition and calculation of this financial measure.

Operational and Financial Performance

Contained tin production of 5,190 tonnes for the quarter ended September 2025 was substantially in line with the targeted quarterly production of 5,000 tonnes and 26% higher than the prior quarter. The comparative quarter ended June 2025 was impacted by the temporary cessation of operations related to security concerns and the phased restart from 15 April 2025. The processing facilities continue to perform well with overall plant recoveries averaging 76% during the quarter (Q2: 77%).

Q3 2025 contained tin sales of 5,143 tonnes was in line with the increased production. The average tin price achieved was 4% above the prior quarter at US$33,877/t – the tin price is currently trading at around US$37,000/t.

Q3 2025 AISC per tonne of tin sold is estimated at US$15,900 (Q2: US$16,387), 3% lower than Q2 due to a normalised production rate compared to the negative impact of the operational stop during the prior quarter. The mine took delivery of two replacement underground mine trucks during Q3 which increased sustaining capital expenditure included in AISC.

EBITDA guidance for Q3 2025 is US$96m, 28% higher than the previous quarter’s actual of US$75m. This increase is primarily due to additional tin production and sales and a slightly higher tin price.

The Company expects to produce approximately 5,000 tonnes of contained tin during the final quarter of the financial year which, together with its year-to-date production of 13,566 tonnes, increases tin production guidance for FY2025 to between 18,000 and 18,500 tonnes (17,500 tonnes previously).

The Company had US$57m in cash at 30 September 2025 (30 June 2025: US$110m) after Q3 outflows related to provisional FY2025 tax payments of US$25m, a reduction of its overdraft balance by US$15m to US$24m and payment of the interim FY2025 dividends and withholding taxes of US$89m.

Exploration update

Alphamin’s exploration strategy focuses on three key objectives:

- Increase the Mpama North and Mpama South Resource base and life of mine

- Discover the next tin deposit in close proximity to the Bisie mine

- Ongoing grassroots exploration in search of remote tin deposits on the large prospective land package

Exploration drilling at Mpama North and Mpama South re-commenced during Q4 2024. The Company received external laboratory assays from drilling at Mpama North and South (refer to Appendix 1 and 2), the highlights of which are:

Mpama South assay results received1, included:

- BGH192: 24.13 metres @ 2.43% Sn from 532.92 metres, including 5.08 metres @ 4.31% Sn from 539.92 metres, 1.81 metres @ 4.67% Sn from 546.6 metres, and 5.45 metres @ 4.18% Sn from 551.6 metres

- BGH194: 13.98 metres @ 1.62 % Sn from 489.26 metres, including 3.04 metres @ 4.26% Sn from 494.06 metres

Mpama North assay results1 received, included:

- MNUD008A: 29.34 metres @ 6.21% Sn, including 9.3 metres @ 13.63% Sn both from 247.7 metres

- MNUD009: 33.28 metres @ 16.83% Sn, including 10.1 metres @ 41.47% Sn, both from 236.3 metres

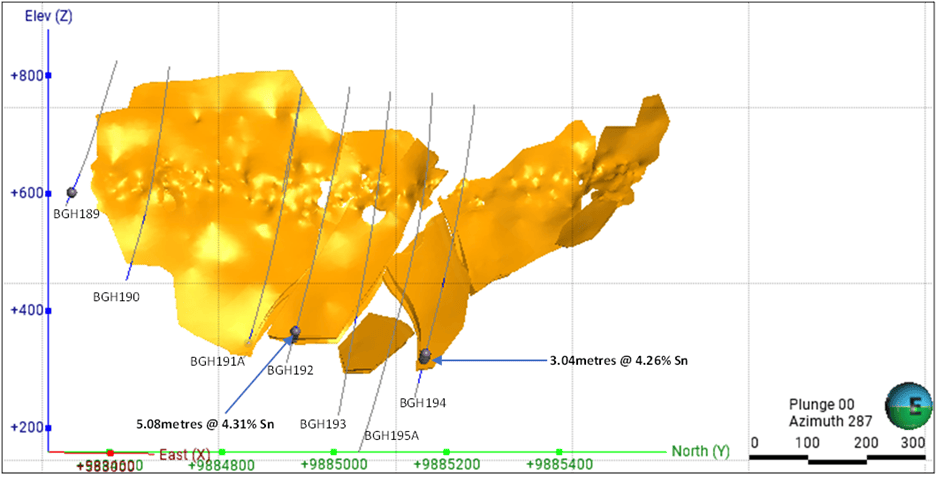

Mpama South Drilling Update

Figure 1: Mpama South drilling update with significant Sn intercepts (>0.5% shown as purple spheres).

The assayed drill hole intercepts for BGH 192 and BGH 194 are approximately 50m down dip of the current declared Mpama South Resource.

A second surface drill rig was mobilised at Mpama South targeting down-dip extensions. During the quarter, two holes were abandoned due to excessive hole deviations and drilling issues. Two drill holes are currently in progress and are approximately 1-2 weeks from the planned depth targets.

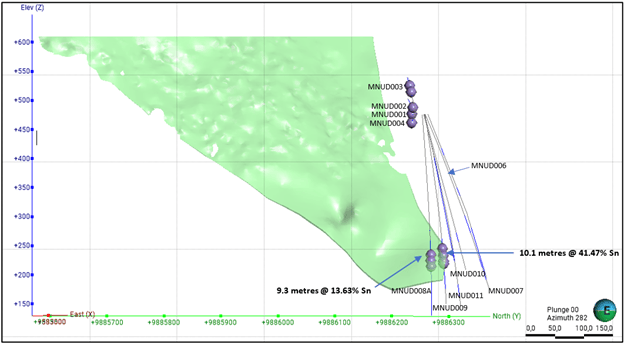

Mpama North Drilling Update

Figure 2: Mpama North drilling update with significant Sn intercepts (>0.5% shown as purple spheres).

The assayed drill hole intercepts for MNUD 008A and MNUD 009 are approximately 30m to 70m down plunge of the current declared Mpama North Resource.

Following a single rig exploration campaign of geological fan drilling from underground at Mpama North which resulted in the drilling update illustrated in Figure 2, the Company mobilised a dedicated surface drill rig during Q3 to test for extensions at depth below the currently defined mineralised area. After experiencing excessive deviation, the first surface drill hole was abandoned. The second hole was successfully completed probing for mineralisation 40 m south of the main trend and 100 m deeper than the recent underground drilling (MNUD008A) and did not intercept visual tin mineralisation. The next hole from surface is in progress. The Company is planning to introduce directional core drilling technology which will enable fan drilling at depth in order to expedite the identification of tin mineralisation extensions, structural faults and possible shifts in the deposit.

Security Update

The Company notes an increased number of security events on the border line between the Massisi and Walikale territories in the North Kivu province of the DRC. The Company’s mine is located in a remote area approximately 200 kilometers away from these events and at this time the Company continues to operate within guidance parameters. As a result of the ongoing security risks in the area, the operating risk profile remains elevated and a sustained advance closer to the mine location could result in mining operations being affected. The safety of the Company’s employees and contractors and compliance with the DRC and international laws remains our committed focus.

Qualified Persons

Mr. Clive Brown, Pr. Eng., B.Sc. Engineering (Mining), is a qualified person (QP) as defined in National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release other than in the section “Exploration update” and Appendix 1 and Appendix 2. He is a Principal Consultant and Director of Bara Consulting Pty Limited, an independent technical consultant to the Company.

Mr. Jeremy Witley, Pr. Sci. Nat., BSc. (Hons) Mining Geology, MSc (Eng), is a qualified person as defined in National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in the section “Exploration update”, Appendix 1 and Appendix 2. He is Head of Mineral Resources at the MSA Group (Pty) Ltd and is an independent technical consultant to the Company.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE