Rick Mills – “The S curve Meeting the J Curve Makes Copper the New Oil”

A major incident involving a landslide at the world’s second largest copper mine, Grasberg in Indonesia, has upended the copper market and sent the price of the base metal soaring.

As Reuters metals columnist Andy Home wrote, “The copper market is long accustomed to unexpected supply hits but the catastrophic events at Grasberg are unprecedented.”

Grasberg force majeure

On Sept. 8., 800,000 tons of mud slid into the Grasberg Block Cave mine — the underground portion of the former open pit — killing two workers and displacing five, who are still missing.

Mine operator Freeport McMoran (NYSE:FCX) immediately suspended operations, declaring “force majeure”, essentially an “act of God” or similar unforeseen circumstance that releases an operator from its contractual obligations to customers.

US-based Freeport advised that, while the incident only impacted one production block, it also damaged other infrastructure at the site.

The company therefore thinks its fourth-quarter sales of copper and gold will be “insignificant”, instead of its previous forecast to ship 445 million pounds of copper and 345,000 ounces of gold.

News of the force majeure saw the price of copper jump 3% to $5.15 a pound, compared to $4.45 at the start of the year. (The Register). Prices are up 17% this year after peaking at $5.50 in May 2024.

On the last day of September, Bloomberg reported copper recorded its biggest monthly advance since June.

The climb is all the more impressive given that copper was trading for just $2.00 in 2016, as the 10-year price chart below shows.

Source: Trading Economics

The supply implications from the halt at Grasberg is grave. In a note, analysts at Societe Generale SA wrote that the copper market could be on track for the widest annual supply deficit since 2004.

Freeport has slashed production guidance for this year and 2026.

Earlier we wrote that a 30% shortfall of supply versus demand could occur by 2035, but the raft of mine closures and other factors we’ll get into below, could bring that date up a lot closer.

Meanwhile demand for copper continues apace.

Electrification and decarbonization are driving demand for metals. EVs for example contain four times as much copper as gas-powered cars. Technology companies are investing hundreds of billions of dollars to build AI data centers requiring reams of copper wiring.

Demand for copper — the cornerstone for all electricity-related technologies — is set to grow by 53% to 39 million tonnes by 2040, according to BloombergNEF.

Precious metals and critical minerals feeling market love

Back to Grasberg, earlier this week Mining.com reported that Grasberg, a joint venture between the Indonesian government and Freeport, holds half of Freeport Indonesia’s reserves and is expected to supply about 70% of its copper and gold output through 2029.

However, the company this week issued an updated third-quarter guidance, lowering consolidated sales expectations by about 4% for copper and 6% for gold, compared to its July forecast.

BMO Capital Markets said Grasberg output is not expected to return to pre-incident levels until 2027.

Goldman Sachs lowered its global copper mine supply forecast for 2025 and 2026, estimating there will be a total loss of 525,000 metric tons of copper resulting from the Grasberg incident. The bank reduced its forecast for the second half of 2025 by 160,000 tons and its 2026 forecast by 200,000 tons.

Grasberg’s production is now expected to fall by 250,000 to 260,000 tons in 2025 and by 270,000 tons in 2026, Reuters said.

According to Freeport management, operations could restart sometime next year, but 2026 copper output could be 35% lower.

As for the effect on the global supply-demand balance, Goldman shifted from a projected surplus of 105,000 tons to a deficit of 55,000 tons.

Higher price expectations

The bank upped its December LME copper price forecast to $10,200-$10,500 a ton from its previous $9,700/t prediction.

Citi Bank now sees a market deficit of 400,000 tons in 2026 (400,000 tons of copper equates to approximately 15.04 days of global supply, using the 2023 refined copper production figure of 26.6 million tons as a basis for global supply.) and expects prices to rally to $12,000 a ton over the next six to 12 months. It revised its output assumptions at Grasberg to 500,000 tons for both 2025 and 2026, down from previous estimates of 680,000 and 774,000 tons, respectively.

Bank of America has also raised its copper price forecasts, flagging ongoing setbacks at some of the world’s largest mines, notably Grasberg in Indonesia, El Teniente in Chile, and Kamoa-Kakula in the Democratic Republic of Congo, as catalysts for rising copper prices.

Mining.com reports the bank now expects copper to average $11,313 per tonne in 2026, an 11% upgrade from its prior estimate, then rising to $13,501 in 2027, for a 12.5% increase. At its peak, copper could reach $15,000 per tonne, the bank’s strategists added, which equates to $6.80 per pound, a price never before reached.

Other closures

While Grasberg is the most dramatic, and newsworthy incident, hits to the copper industry have been coming for months.

Hudbay Minerals (TSX:HBM) said on Sept. 23 it was shutting the mill at its Constancia mine in Peru due to ongoing political protests.

Before that, seismic activity caused flooding at the Kakula mine in the DRC owned by Ivanhoe Mines (TSX:IVN). The company is still in the process of pumping water out of the most affected sections, Reuters said. Kakula and adjacent Kamoa produced about 437,000 tonnes of copper in 2024.

In June, port and mill disruptions hit two Teck Resources’ (TSX:TECK.B) operations in Chile. Also in Chile, a tunnel collapse at Codelco’s El Teniente mine, resulting in six fatalities, halted activities for over a week.

According to an AI Overview, El Teniente is the world’s largest underground copper mine, featuring extensive tunnels and a history of significant seismic activity. A 4.2 magnitude earthquake struck around 500 meters underground, causing a portion of the tunnel to collapse. The mine experienced a previous major incident in 1990, when a rock explosion killed six miners.

Chile has a history of mining accidents, including the famous 2010 Copiapó collapse, where 33 miners were trapped but later rescued.

Pollution and accidents

The latest accident involves a tailings dam collapse at a copper mine owned by Sino-Metals Leach Zambia, a subsidiary of Chinese state-owned China Nonferrous Metal Mining Group.

As reported by PBS, the spill happened in February when part of a dam that held mine waste collapsed, allowing the waste to flow into the Kafue River that runs through the heart of Zambia.

Source: Channel 4 News video screen shot

An environmental cleanup company contracted by Sino-Metals said its two-month investigation found that the disaster resulted in the release of 1.5 million tons of toxic material, at least 30 times more than Sino-Metals admitted at the time.

Indeed, the PBS story says the Chinese company is accused of covering the incident up.

The government ordered Sino-Metals to pay for an independent survey to assess the damage. That survey appears to have been buried by the government and the mine, but Channel 4 News obtained a copy. This 385-page report, compiled by South African environmental assessors, said the site would need at least 100 trucks a day, being filled for over a year, to begin clearing away the contamination.

According to a Channel 4 News video, the environmental assessors wrote that extremely hazardous substances were released, including arsenic, cyanide, uranium, and other heavy metals, which has created a toxic environment capable of causing irreversible harm to both the ecosystem and human health. Communities are at serious risk of developing birth defects, cancers, liver and lung disease, heart conditions, and other chronic illnesses. Without immediate intervention, the consequences for future generations of Zambians will be severe and long-lasting.

The government finally took action in June, after the US embassy issued a notice urging American nationals to evacuate the polluted region. A second warning in August stating the area in the polluted zone could be dangerous elicited a press conference.

Rather than ordering a cleanup, a government minister said lab results showed that pH levels had returned to normal and that concentrations of heavy metals were decreasing. His clear message: Nothing to see here. All serious implications on public health, water safety, agriculture, and the environment have been brought under control. There is, therefore, no cause for alarm.

Meanwhile, the mining company put out PR videos claiming the water is safe to drink. As Channel 4 News tells it, “Far from cleaning up for local people, they’re buying up local people.”

Sino-Metals Leach Zambia offered £800 (about USD$1,078) total compensation for affected families. Each recipient was required to sign a gag order preventing them from ever taking action against the mine.

Bloomberg reported the disaster appears to be the sixth worst in history.

Along with the dire consequences of the incident to the environment and human health, it has also thrown a wrench into Zambia’s plans to more than triple copper output to 3 million tons in the coming years.

Sino-Metals Leach Zambia produced 4,002 tonnes of copper cathode and tonnes of copper in concentrate in 2013 the latest year production figures were publicly available. Parent company China Nonferrous Mining Corp. in 2023 pledged to invest $1.3 billion to expand output in Zambia, the continent’s second-biggest producer of the metal.

Supply implications

All of these incidents point to the risk of supply interruptions if something goes wrong.

Reuters notes following the disaster at Grasberg that risk is becoming more concentrated as the world relies on a small group of mega mines to sustain production growth.

BMI estimates that the world’s 20 largest copper mines will account for 36% of global output this year and each of them faces its own unique combination of geological, operational and social challenges.

Their sheer size means that if something goes wrong, it is likely to go wrong at scale, meaning an outsize impact on the global supply chain – as the market has just found out.

AOTH is well aware of this fact and has been writing and warning about it for years.

Copper: the most important metals we’re running short of — Richard Mills

Exposing the copper surplus myth — Richard Mills

Remember, new copper supply is concentrated in just five mines — Chile’s Escondida, Spence and Quebrada Blanca, Cobre Panama and the Kamoa-Kakula project in the DRC. Our analysis shows that in four of the five mines where new copper supply is concentrated, there are offtake agreements either in place or implied, with non-Western buyers.

In the case of Kamoa-Kaukula, 100% of initial production is split between two Chinese companies, one of which owns 39.6% of the joint venture project. Nearly half of Cobre Panama’s annual production, if it hadn’t been closed by Panama, would have gone to a Korean smelter under a 2017 offtake agreement.

Escondida and Quebrada Blanca are both partially owned by Japanese companies — one can make the assumption that a corresponding percentage of production will be going there.

Analysts do not concern themselves with who owns the copper; their only concern is with the amount of global supply. Unfortunately, where it’s going – mostly China, South Korea and Japan – means its hardly global supply. Fact is, the West has almost no off-take agreements in place for 80% of the world’s future copper supply.

That supply is locked up. It’s been previously stated that we need to find a million tons per year of new copper production if we want to alleviate the supply deficit — the equivalent production of one Escondida mine each year — but only one of the five mines, Kamoa, has the capability of producing close to that much copper. But Kamoa’s production is going to China.

Not only that, but the mine also appears to have been constructed on top of a seismically active zone.

At AOTH we make a clear distinction between global copper supply and the global copper market. Mined copper that is locked up by offtake agreements should not rightly be lumped in with global supply, because it will never reach the United States, Canada or Europe. Instead, this copper will go straight to smelters in China for use in Chinese industry, to South Korean smelters for South Korean industry, and to Japanese smelters for Japanese industry.

We know that Chile, the world’s biggest copper producer, has problems with water and is having to desalinate seawater used for mining copper in the country’s arid north. Cochilco, the country’s copper commission, estimates the use of desalination by mining to increase 156% through 2030, with 90% of the desalinated seawater used for copper processing.

Reuters said that severe droughts are drying up rivers and reservoirs vital for production of zero-emission hydropower in several countries.

As global warming makes already scarce water and mineral resources more difficult and expensive to access, the protection of existing mines and the hunt for new deposits will intensify, resulting in potentially lower production, higher operating costs and conflicts between both water and land users.

With much of the world currently experiencing droughts, and the effects of warming occurring more frequently and powerfully, it seems to me that there’s a very real risk to future metals output.

The million extra tons a year needed to eliminate the copper supply deficit seems, with all the recent mine closures, to be a pipe dream.

(Codelco and Anglo American (LSE:AAL) just finalized an agreement to merge operations at their Los Bronces and Andina copper mines, with the goal of increasing copper production by 2.7 million tonnes over 21 years. But on an annual basis, the merger only amounts to an additional 120,000 tonnes, just over 10% of the 1 million tonnes needed every year, to nullify the expected massive coming copper supply deficit. BMO Capital Markets forecasts a deficit of 9 million tonnes by 2030, and the International Energy Agency predicts a 30% shortfall by 2035 despite major investments. Total mined copper production in 2024 was 23 million tonnes, as per the USGS.)

Looking back, Bloomberg noted that when First Quantum Minerals closed its Cobre Panama mine in 2023, it removed 1.5% of global copper supply. This year, however, conditions are much tighter.

“Back in late 2023, everyone was looking at the copper market as being quite well supplied heading into 2024, whereas today we’re obviously already in a deficit,” Bloomberg quoted Helen Amos, an analyst at BMO Capital Markets. She estimates the worldwide market for refined copper will likely see a deficit of around 300,000 tonnes this year.

Reuters posted a column on Thursday by metals expert Andy Home titled, ‘Grasberg disaster highlights fragility of copper supply chain’.

Home begins by stating that last year’s production at Grasberg was 815,000 tons, representing 4% of global copper output:

It’s a big hit to an already stretched supply chain, which is why the London Metal Exchange copper price jumped to a 15-month high of $10,485 per ton when Freeport declared force majeure last week.

Home then brings in stats from Benchmark Mineral Intelligence stating that the cumulative loss of units between Sept. 8 and the end of 2026 will be almost 600,000 tons of contained copper.

The output drop in the fourth quarter alone will be equivalent to next year’s forecast production at Collahuasi, the world’s third largest mine, BMI said.

Well, when you put it like that…

The Grasberg incident changes copper’s global supply landscape.

BMI has widened its expected 2026 market supply shortfall from a marginal 72,000 tons to 400,000 tons.

Citi has also revised its global market balance estimates and projects a similar-sized deficit in 2026 and a potential further 350,000-ton shortfall in 2027 unless prices rise significantly to incentivise more supply.

New super-cycle

In the AOTH article Precious metals and critical minerals feeling market love, we pointed to the dawn of a new commodities super-cycle, with The Globe and Mail stating there are structural factors on both the supply and demand side that could catalyze the next boom in commodities.

Ole Hansen, head of commodity strategy at Saxo Bank, agrees with this notion, with Kitco quoting him saying that for commodities in general, “we are still at the cusp of a super-cycle”.

Hansen says the force majeure at Grasberg, combined with the shutdown of Hudbay’s Constancia mine in Peru and ongoing struggles at a Codelco mine in Chile has “the two biggest mining operations in the in the world… temporarily… shutting production. And that is simply not what the market… can take, at this point in time.”

He goes on to say the demand for copper has fundamentally shifted in recent years, with consumption from renewable energy projects and global electrification “picking up the slack” from a weaker Chinese housing sector.

Bringing these two themes together, Hansen explained that we are on the cusp of an “energy transition super-cycle” driven by massive, inflationary investment required for electrification and the re-industrialization of the US. “That all points, in my book, to higher prices,” Hansen concluded.

“The Globe and Mail reports in its Friday edition that Bay Street is booming. The Globe’s Jameson Berkow writes that stock sales, corporate borrowing rates, and merger-and-acquisition activity all posted dramatic gains in the third quarter, according to data from LSEG Data & Analytics, as investors and executives shrug off rising geopolitical risks. M&A was especially strong, with deals involving Canadian companies between early July and late September totalling nearly $84 billion (U.S.), or more than 51 per cent above the same period in 2024. Companies appear to be getting used to doing deals in a volatile economic environment — and the deals are a lot larger. Teck Resources proposed $50-billion megamerger with Anglo American, Cenovus’s friendly $7-billion offer to buy MEG Energy…are just a few examples of the many multibillion-dollar deals that were announced during the quarter. Corporate stock sales also continued their steady climb out of multidecade lows. “We are not back to long-term averages, but it definitely feels like the activity has picked up,” said Jackie Nixon, head of Canadian equity capital markets at RBC.” https://www.stockwatch.com/News/Item/Z-C!TECK-3737958/C/TECK

Copper added as critical mineral

All of the supply constraints on copper we have outlined so far in this article will likely get worse due to copper being elevated to “critical mineral” status.

This past summer, the US Department of the Interior released a draft 2025 list of 54 minerals deemed critical to the US economy and national security. The update, developed by the US Geological Survey (USGS), includes six new additions: copper, silver, potash, silicon, rhenium and lead. (Mining Weekly)

The move primarily stems from analyses showing that copper’s supply chain is vulnerable to disruptions that could significantly impact the United States’ economy, defense and green-energy goals. Indeed, copper remains central to electrification, renewable infrastructure and high-tech manufacturing.

Including copper on the critical minerals list signals a recognition that demand is growing rapidly and that domestic supply and processing may not be sufficient or resilient enough to cope with trade shocks, regulatory delays or external dependencies.

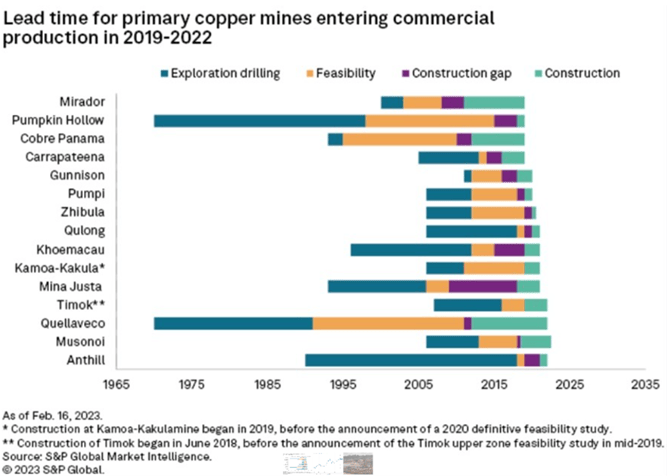

According to a blog post by copper wire manufacturer Kris-Tech, determining whether a site has enough copper ore to make the investment worthwhile can take two to eight years, and another four to 12 years before it can start operations. In North America, it can take up to 20 years for a mine to go from discovery to production.

“New primary copper mines starting up between 2019 and 2022 had an average lead time of 23 years from discovery to commercial production.”

At a recent conference on the Indonesian island of Bali, it was noted that the demand for key energy transition metals is expected to increase fourfold in the decade from now to 2035. Via Reuters:

Copper is also viewed as essential to the energy transition and Masson said the market would need 909,000 tons of additional capacity by 2035 to meet demand for electric vehicles and renewable technologies such as wind and solar.

Is copper the new oil?

Some are even calling copper the new oil.

In a recent Financial Post video, Mike Philbrick, chief executive at ReSolve Asset Management Global, talks about the bull market and what investors should be looking at in the AI boom.

Philbrick starts by noting that we are currently in an inflationary environment where inflation, volatility and interest rates are more volatile. That calls for a more resilient investment portfolio.

We are definitely in a race for AI dominance, “but that S curve of tech adoption meets a J curve of resource realities.”

Philbrick is talking about resource scarcity, in particular, a paucity of copper when it comes to the amount of new technology demanded.

“We have an AI build-out that’s creating a real demand-side shock,” he says.

“If you’ve got data center backlogs, multi-year capex that’s going on, you’ve got acute bottlenecks in power, you’ve got turbines, transformers, generators, memory, drive, all of that is in short supply. And all of that needs to be built out. That means more energy, more grids.

“What’s required for that? Metals, industrial gear, all of those types of things, copper, nickel, silver, all of these core atoms that are going to create the infrastructure for the AI now needs to be produced. And that’s a J-curve. That’s a dip before you get the rip…

“Copper is going to be the new oil. All of the energy or the power that has to run to these data centers is run on copper cables.”

Majors want copper

The looming copper shortfall has encouraged copper mergers and acquisitions (M&A), such as Glencore’s 2023 attempted hostile takeover of Teck Resources, BHP’s (ASX:BHP) acquisition of copper producer Oz Minerals, and Newmont’s (NYSE:NEM) $19.5 billion takeover of Australia’s Newcrest. The latter acquisition established Newmont as the world’s leading gold producer, while expanding its assets to include gold and copper mines across North and South America, Africa, Australia, and Papua New Guinea.

2023 also saw China’s MMG agreeing to pay $1.9 billion for Cuprous Capital, a private company that owns the Khoemacau operation in Botswana.

In 2024 Anglo fended off a $49-billion bid from BHP.

In May of this year, Barrick Gold changed its name to Barrick Mining (TSX:ABX) Corporation to position itself for a future shaped increasingly by copper.

Mining.com notes The company has two key projects that are on track for first production in 2028. The Reko Diq copper-gold project in Pakistan, designed to produce 400,000 tonnes of copper and 500,000 ounces of gold per year in the second phase of its development. The other project, the Lumwana Super Pit in Zambia, will double the mine’s copper production over a mine life estimated at more that 30 years.

The latest high-profile M&A involving copper is Anglo American’s takeover of Canada’s Teck Resources. The $53 billion, shareholder-approved merger, considered to be the decade’s top mining deal, creates the world’s fifth-largest copper producer.

Significantly, the company’s headquarters will move to Vancouver, a nexus for the world’s junior mining companies, and located in a province known for its gigantic copper-gold deposits.

BHP in 2021 shifted its exploration headquarters to Toronto.

Central to Anglo’s strategy to take over Teck’s prized copper assets is Teck’s Quebrada Blanca mine in Chile, “an operation plagued by cost overruns and operations challenges,” Mining.com said.

Both companies have been shifting their portfolios to focus more on critical minerals, with Teck selling most of its coal unit to Glencore, and Anglo shedding coal, platinum and diamonds.

The new company will have six producing copper mines along with iron ore and zinc operations.

The deal has been deemed a win for British Columbia. According to the Mining Association of BC, via BIV, The merger would provide the new company with a significantly larger balance sheet, enabling it to invest in existing B.C. development projects that were already under Teck’s ownership, [President and CEO Michael Goehring] added.

The companies have committed to investing nearly $4.5 billion over the next five years, including up to $750 million at the Trail Operations in southeast B.C., and $750 million in advancing the Galore Creek and Schaft Creek mine copper development projects in northwest B.C.

Nation-building projects

Of the Canadian government’s fast-tracked “nation-building” projects, two are copper mines: an expansion of the Red Chris copper-gold mine in northwestern BC, which is switching from an open-pit to an underground block-cave operation (in 2024 the mine produced 85,320,618 pounds of copper and 59,811 ounces of gold); and the McIlvenna Bay Foran Mining (TSX:FOM) copper mine project in Saskatchewan. Foran says McIlvenna Bay is the largest VMS deposit along the prolific Flin Flon Greenstone Belt. It hosts probable reserves of 29.7 million tonnes containing 793 million pounds of copper and 1.4 billion pounds of zinc.

The United State has fast-tracked Rio Tinto (ASX:RIO) and BHP’s Resolution copper project in Arizona, and Hecla Mining’s (NYSE:HL) Libby silver-copper project in Montana by granting them FAST-41 status, which accelerates permitting reviews. (AI Overview)

BC porphyries

Anglo American’s interest in Teck makes sense once you realize that the mining industry is on the hunt for large copper-gold deposits that have favorable grades, and that are in locations amendable to development.

Over 80% of the world’s copper production comes from large-scale open-pit porphyry copper mines.

In Canada, British Columbia enjoys the lion’s share of porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

Teck’s Highland Valley copper mine is Canada’s largest copper mine. Of the 39 copper mines in Canada, four of the top five are in BC. The following are the four largest copper mines by production in Canada in 2023, according to GlobalData’s mining database:

#1 Highland Valley BC

#2 Gibraltar Mine BC

#3 Copper Mountain Mine BC

#4 Mount Milligan BC

Copper-gold porphyries make attractive targets for both copper and gold companies because of the gold kicker.

Indeed, BC’s alkalic copper-gold porphyries are as much a gold deposit as they are a copper deposit. New Afton for example has 2 billion pounds of copper and 2 million ounces of gold. The Ajax deposit has 3 billion pounds of copper and 3 million ounces of gold.

If an exploration company were to find a 3-4Moz gold deposit these days, they would get plenty of market excitement and major miner interest, but to be able to add in a couple billion pounds of copper really turns the tables on the prospectivity and the attractiveness of these types of systems.

Ten years ago, that wasn’t the case, but with the paradigm shift in gold market psychology, with private capital flows amplifying moves once driven primarily by central banks and macro funds, gold is no longer being seen as a byproduct but as a coproduct.

Meaning traditional gold-only companies are looking at copper-gold opportunities, especially in safe jurisdictions such as the Quesnel Terrane of central and southern British Columbia.

At AOTH we believe a massive bull market is building for precious metals and copper. As an astute investor my job is one, find the cheapest metal still in the ground, two that metal is in safe to operate jurisdictions that still believes rule of law protects private property and three to earn maximum returns on investments. Ahead of the Herd has in its stable of companies three who are working on copper/ gold projects in central and southern British Columbia: Kodiak Copper (TSX.V:KDK), Torr Metals (TSX.V:TMET) and Orestone Mining (TSX.V:ORS).

Also known as the Quesnel Trough, the Quesnel Terrane is British Columbia’s primary copper-gold producing belt. Operating mines include Mount Milligan, Mount Polley, New Afton, Highland Valley and Copper Mountain.

According to Singer and others, via the US Geological Survey, British Columbia and the Yukon Territory contain 54 known porphyry copper deposits. By comparison, the rest of Canada contains only five.

Conclusion

Copper analysts always have a percentage of supply that they pencil in as going to be lost, for various reasons. The mudslide at Grasberg in Indonesia completely blew that away. The cumulative loss between Sept. 8, when the slide occurred, and the end of 2026 will be almost 600,000 tons of contained copper. Grasberg output is not expected to return to pre-incident levels until 2027.

Add in temporary mine closures in Peru and Chile, earthquake-caused flooding at the Kakula mine in the DRC, and a massive tailings dam collapse at a mine in Zambia, and you have a serious situation where forecast surplus for 2025 is wiped out; the small global deficit forecast for 2026 becomes a hell of a lot more with no cushion left.

Benchmark Mineral Intelligence, a reliable source for global supply, has widened its expected 2026 market supply shortfall from 72,000 tons to 400,000 tons. That a 5.5X increase.

Citi has also revised its global market balance estimates and projects a similar-sized deficit in 2026 and a potential further 350,000-ton shortfall in 2027 unless prices rise significantly to incentivize more supply.

We need about a million tons of new supply every year until 2030 — the equivalent of one Escondida mine — to offset an expected 6Mt deficit by 2030.

But new copper supply is concentrated in just five mines, and most of it is spoken for; the West has almost no off-take agreements in place for 80% of the world’s future copper supply. With most of the newly offline copper supply destined for Asia how is that going to effect western copper supply? Competition for the few concentrates the west actually mines and can refine is going to be fierce, imports might become non-existant.

The mining industry is therefore under tremendous pressure to find new copper and copper-gold deposits.

The Quesnel Terrane running through central and southern BC is a highly prospective region where several majors are operating and a number of juniors are doing their best to make discoveries that could develop into the next major copper mine.

Meanwhile, demand for copper continues to increase. Its excellent conductivity makes it the ideal metal for electric vehicles, renewable energy projects and AI data centers.

Analysts predict global demand for copper will double to 50 million tons a year by 2035, but also feel miners will struggle to deliver, states The Register.

Copper has been declared a critical mineral in Canada and the United States, which will only increase demand for it in a world of depleting existing copper reserves, declining ore grades, mines having to go underground at greater expense and risk, climate change (droughts, floods), supply interruptions and a lack of new discoveries.

People are finally realizing that copper supply is in trouble because demand keeps growing and mines can’t keep up.

Subscribe to AOTH’s free newsletter

Richard owns shares of Torr Metals (TSX.V:TMET) and Orestone Mining (TSX.V:ORS). Richard does not own shares of Kodiak Copper (TSX.V:KDK).

KDK, ORS & TMET are paid advertisers on his site aheadoftheherd.com. This article is issued on behalf of TMET, ORS & KDK.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE