AbraSilver Drilling at Diablillos Intercepts Wide Gold Intervals at Oculto East and Broad Silver Intercepts at JAC

Oculto East Returns 140 m at 0.57 g/t Gold & JAC Returns 32 m at 100 g/t Silver

AbraSilver Resource Corp. (TSX: ABRA) (OTCQX: ABBRF) is pleased to announce new assay results from six drill holes from the ongoing Phase V exploration program at its wholly-owned Diablillos project in Argentina. These drill holes continue to expand oxide-hosted gold mineralization to the east of the Oculto deposit and oxide silver mineralization within the JAC zone, highlighting the continued strong exploration upside potential across the Diablillos system.

Highlight Drill Results – Widths are reported as drilled lengths; true widths are not yet known.

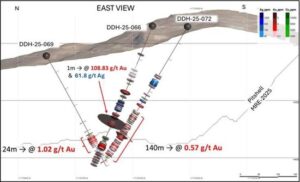

- Oculto East: Numerous broad zones of continuous gold mineralization intercepted, including:

- DDH 25-066: 1.0 metre with bonanza grades of 108.9 g/t gold from 288 m downhole, as well as 18.0 m at 0.97 g/t gold from 353 m

- DDH 25-069: 24.0 m grading 1.02 g/t gold from 243 m

- DDH 25-071: 33.0 m grading 0.42 g/t gold from 69 m

- DDH 25-072: 140.0 m grading 0.57 g/t gold from 262 m, including 8.0 m at 2.60 g/t gold from 338 m

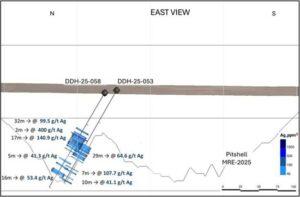

- JAC: Strong near-surface silver mineralization continues to expand the Mineral Resource potential, including:

- DDH 25-053: 29.0 m at 65 g/t silver from 85 m, including 7.0 m at 108 g/t silver

- DDH 25-058: 32.0 m at 100 g/t silver from 58 m, including 2.0 m at 400 g/t silver

John Miniotis, President and CEO, commented, “These latest drill results highlight the strong continuity of wide gold zones at Oculto East, together with additional near-surface silver mineralization at JAC. The potential to expand both gold and silver resources well beyond the current Mineral Resource conceptual open pit further demonstrates the scale of Diablillos and firmly positions us to continue delivering value through ongoing exploration and development.”

Dave O’Connor, Chief Geologist, commented, “Drilling at Oculto East continues to confirm broad intervals of gold mineralization to the east, while results at JAC reinforce the presence of thick, continuous silver mineralization to the west. Together, these results highlight the strength and continuity of the Diablillos system and its potential for significant additional Mineral Resource expansion.”

Table 1 – Summary of Key Drill Intercepts

Intercepts greater than 25 gram-metres gold or 2,000 gram-metres silver shown in bolded text:

| Drill Hole | Area | From (m) |

To (m) |

Type | Interval (m) | Ag g/t |

Au g/t |

| DDH-25-053 | JAC | 85.0 | 114.0 | Oxides | 29.0 | 64.6 | – |

| Including | 94.0 | 101.0 | Oxides | 7.0 | 107.7 | – | |

| 123.0 | 143.0 | Oxides | 20.0 | 41.1 | – | ||

| DDH-25-058 | JAC | 58.0 | 90.0 | Oxides | 32.0 | 99.5 | – |

| Including | 69.0 | 71.0 | Oxides | 2.0 | 400.0 | – | |

| 92.0 | 131.0 | Oxides | 39.0 | 35.3 | – | ||

| DDH-25-066 | Oculto East | 148.0 | 151.0 | Oxides | 3.0 | – | 0.75 |

| 161.0 | 163.5 | Oxides | 2.5 | – | 0.80 | ||

| 196.5 | 202.5 | Oxides | 6.0 | – | 2.23 | ||

| 228.0 | 230.0 | Oxides | 2.0 | 77.5 | – | ||

| 234.0 | 253.5 | Oxides | 19.5 | 49.6 | 0.41 | ||

| 265.0 | 270.0 | Oxides | 5.0 | 27.9 | 0.51 | ||

| 274.0 | 276.0 | Oxides | 2.0 | 37.6 | 0.87 | ||

| 288.0 | 289.0 | Oxides | 1.0 | 61.8 | 108.9 | ||

| 295.0 | 299.0 | Oxides | 4.0 | 18.4 | 0.90 | ||

| 353.0 | 371.0 | Oxides | 18.0 | 8.6 | 0.97 | ||

| 402.0 | 404.0 | Oxides | 2.0 | – | 0.77 | ||

| DDH-25-069 | Oculto East | 234.0 | 235.0 | Oxides | 1.0 | 6.8 | 1.32 |

| 242.0 | 266.0 | Oxides | 24.0 | 5.3 | 1.02 | ||

| 315.0 | 316.0 | Oxides | 1.0 | 4.6 | 1.08 | ||

| DDH-25-071 | Oculto East | 69.0 | 101.0 | Oxides | 33.0 | – | 0.42 |

| 115.0 | 116.0 | Oxides | 1.0 | 11.8 | 0.86 | ||

| 127.7 | 129.0 | Oxides | 1.3 | 10.7 | 1.02 | ||

| 167.0 | 168.0 | Oxides | 1.0 | – | 0.91 | ||

| DDH-25-072 | Oculto East | 166.0 | 183.0 | Oxides | 17.0 | 87.3 | 0.15 |

| 211.0 | 213.0 | Oxides | 2.0 | – | 0.57 | ||

| 230.0 | 234.0 | Oxides | 4.0 | 39.7 | 0.24 | ||

| 244.0 | 247.0 | Oxides | 3.0 | – | 1.15 | ||

| 262.0 | 402.0 | Oxides | 140.0 | 8.3 | 0.57 | ||

| Including | 338.0 | 346.0 | Oxides | 8.0 | 17.6 | 2.60 |

Note: All results in this news release are rounded. Assays are uncut & undiluted. Widths are drilled widths, not true widths. True widths are unknown.

Figure 1 – Plan View of Drill Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/268423_abrasilverimage1.jpg

Additional Details on Drill Results – Oculto East and JAC

At Oculto East, drilling continues to demonstrate broad, continuous intervals of oxide gold mineralization extending beyond the eastern margin of the current conceptual open pit. Hole DDH 25-072 returned 140.0 m grading 0.57 g/t Au and 8.3 g/t Ag, including a higher-grade interval of 8.0 m at 2.60 g/t Au, while hole DDH 25-066 intersected multiple zones of gold and silver mineralization including 1.0 m at 108.9 g/t Au and 61.8 g/t Ag. Other results, such as 24.0 m grading 1.02 g/t Au in hole DDH 25-069, further highlight the strong continuity and scale of gold mineralization in this area.

Mineralization depicted in Figures 2 and 3 below appears to be within the conceptual pit boundary but is actually situated on the margins. This highlights the strong potential for upgrading mineralization along the pit boundaries to the Measured category and enhancing overall project economics.

Figure 2 – Section Through Latest Drill Holes – at Oculto East Looking East

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/268423_abrasilverimage2.jpg

Note: Widths are drilled widths, not true widths. True widths are unknown.

At the JAC zone, drilling shows that shallow silver mineralization extends beyond the western margin of the conceptual open pit, likely following a structure perpendicular to the main trend. Hole DDH 25-053 intersected 29.0 m grading 65 g/t Ag, including 7.0 m at 108 g/t Ag, and hole DDH 25-058 intersected 32.0 m at 100 g/t Ag, including 2.0 m at 400 g/t Ag. Silver mineralization at JAC remains open to the south and west with potential to extend both the tank and heap leach Mineral Resources in these directions.

Figure 3 – Section Through Latest Drill Holes – at JAC Looking East

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/268423_abrasilverimage3.jpg

Table 2 – Collar Data

| Hole Number | UTM Coordinates | Elevation | Azimuth | Dip | Depth (m) | Area | |

| DDH 25-053 | 719282 | 7198746 | 4,138 | 0 | -60 | 146 | JAC |

| DDH 25-058 | 719210 | 7198763 | 4,135 | 0 | -60 | 150 | JAC |

| DDH 25-066 | 720810 | 7199498 | 4,395 | 315 | -60 | 419 | Oculto East |

| DDH 25-069 | 720777 | 7199776 | 4,317 | 180 | -60 | 329.5 | Oculto East |

| DDH 25-071 | 720923 | 7199790 | 4,345 | 180 | -60 | 251 | Oculto East |

| DDH 25-072 | 720757 | 7199406 | 4,394 | 340 | -60 | 419 | Oculto East |

About Diablillos

The Diablillos property is located within the Puna region of Argentina, in the southern part of Salta Province along the border with Catamarca Province, approximately 160 km southwest of the city of Salta and 375 km northwest of the city of Catamarca. AbraSilver acquired the property in 2016, which comprises 15 contiguous and overlapping mineral concessions with excellent year-round road access.

Exploration to date has outlined multiple occurrences of silver-gold oxide mineralization at Oculto, JAC, Laderas, and Fantasma, located within a 500 m to 1.5 km distance surrounding the Oculto/JAC epicentre. To date, over 150,000 metres have been drilled on the property, which continues to demonstrate the strong growth potential of shallow, oxide-hosted silver and gold resources. In addition, a large porphyry complex is centered approximately 4 km northeast of Oculto which includes outcropping porphyry intrusions within a major zone of alteration and associated gold rich epithermal mineralization.

Comparatively nearby examples of high sulphidation epithermal deposits include: La Coipa (Chile); Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina). The most recent Mineral Resource estimate for Diablillos is shown in Table 3:

Table 3 – Diablillos Mineral Resource Estimate – As of July 21, 2025

| Zone | Category | Tonnes (000 t) |

Ag (g/t) |

Au (g/t) |

AgEq (g/t) |

Contained Ag (000 Oz Ag) |

Contained Au (000 Oz Ag) |

Contained AgEq (000 Oz Ag) |

|

| Tank Leach | Oxides | Measured | 26,545 | 119 | 0.71 | 183 | 101,564 | 604 | 156,487 |

| Indicated | 46,584 | 56 | 0.63 | 114 | 84,430 | 948 | 170,592 | ||

| Measured & | 73,129 | 79 | 0.66 | 139 | 185,994 | 1,553 | 327,078 | ||

| Indicated | |||||||||

| Inferred | 9,693 | 34 | 0.57 | 86 | 10,616 | 176 | 26,647 | ||

| Heap Leach | Oxides | Measured | 6,673 | 16 | 0.14 | 25 | 3,486 | 30 | 5,342 |

| Indicated | 24,102 | 12 | 0.17 | 23 | 9,163 | 133 | 17,506 | ||

| Measured & | 30,774 | 13 | 0.16 | 23 | 12,649 | 162 | 22,848 | ||

| Indicated | |||||||||

| Inferred | 10,024 | 9 | 0.20 | 21 | 2,811 | 64 | 6,850 | ||

| Total | Oxides | Measured | 33,218 | 98 | 0.59 | 152 | 105,050 | 634 | 161,829 |

| Indicated | 70,686 | 41 | 0.48 | 83 | 93,593 | 1,081 | 188,098 | ||

| Measured & | 103,904 | 59 | 0.51 | 105 | 198,643 | 1,715 | 349,927 | ||

| Indicated | |||||||||

| Inferred | 19,628 | 21 | 0.38 | 53 | 13,427 | 241 | 33,496 |

Footnotes for Tank Leach Resource:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

- The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 83% process recovery for Ag, and 87% process recovery for Au.

- The constraining open pit optimization parameters used were US $1.94/t mining cost, US $22.96/t processing cost, US $3.32/t G&A cost, and average 51-degree open pit slopes.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the “Benefits = Income-Cost”, where, Income = [(Au Selling Price (US$/oz) – Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) – Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income]

- The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit and tank leach processing methods.

- In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- The Mineral Resource was estimated by Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101.

- Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

Footnotes for Heap Leach Resource:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

- The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 80% process recovery for Ag, and 58% process recovery for Au.

- The constraining open pit optimization parameters used and overall operational cost of US $11.31/t.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the “Benefits = Income-Cost”, where, Income = [(Au Selling Price (US$/oz) – Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) – Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income]

- In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- The Mineral Resource was estimated by Mr. Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101.

- Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company’s geologists in accordance with industry best practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals at site; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to assess sampling precision and reproducibility. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the ASA (Alex Stewart Argentina) preparation laboratory in Salta, where they are prepared, then the pulp sachet is directly dispatched to its facility in Mendoza, Argentina, where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four-acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are re-analyzed using four acid digestion with an ore grade AAS finish.

Qualified Persons

David O’Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical information in this news release.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos (tank leach-only) consists of 73.1 Mt grading 79 g/t Ag and 0.66 g/t Au, containing approximately 186Moz silver and 1.6Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders. In addition, the Company has an earn-in option and joint venture agreement with Teck on the La Coipita project, located in the San Juan province of Argentina. AbraSilver is listed on the Toronto Stock Exchange under the symbol “ABRA” and in the U.S. on the OTCQX under the symbol “ABBRF.”

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on X at www.x.com/abrasilver

Alternatively, please contact:

John Miniotis, President and CEO

info@abrasilver.com

Tel: +1 416-306-8334

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE