Cornish Metals Completes an Updated PEA of the South Crofty Critical Mineral Project with an NPV of £180 Million and 20% IRR

Cornish Metals Inc. (AIM: CUSN) (TSX-V: CUSN) is pleased to report the results of a detailed review and updated Preliminary Economic Assessment study for its wholly owned and permitted South Crofty critical mineral project in Cornwall, United Kingdom, the highest grade known tin resource not in production and potentially the first primary producer of tin in Europe or North America.

Since the highly successful £57 million fundraise earlier this year, bringing in the UK’s National Wealth Fund and further investment from Vision Blue Resources, the pace of development has quickened and the project review has advanced. The review was led by Cornish Metals’ newly reinforced leadership team of highly experienced mine builders and operators and supported by top tier consultants, Technical Management Group and Worley, and other subject matter experts to align with current leading industry standards. A detailed capex review was completed incorporating process design and plant layout reviews, quotations and bill of quantities.

While on-site construction is already underway, the team rigorously validated key assumptions, optimised project parameters, and further refined cost estimates, significantly advancing and de-risking multiple elements of the project design and execution plan.

This updated PEA, constrained by the current Mineral Resource, which was reported in accordance with National Instrument 43-101 with an effective date of 6 September 2023, confirms South Crofty’s compelling economics: an after-tax Net Present Value of £180 million (US$235 million) and Internal Rate of Return of 20%, underpinned by a low-cost operating profile. All-In Sustaining Cost is estimated at approximately US$14,500 /tonne over the Life of Mine, compared to a tin price recently trading at approximately US$35,000 /tonne – positioning South Crofty in the lowest quartile of the industry cost curve and among the lowest cost producers. Pre-production capital is estimated at £198 million, with pay back in 3.3 year and annual average earnings before interest, taxes, depreciation and amortisation of approximately £70 million in the first five years of full production.

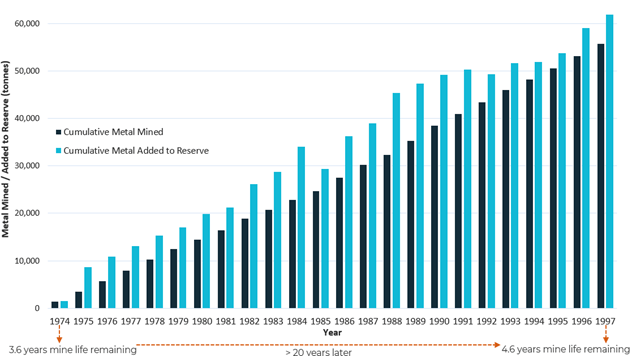

This Study is constrained by the current NI 43-101 Mineral Resource, supporting a 14-year LOM. Importantly, the South Crofty Mineral Resource remains open at depth, along strike and within the current mine envelope. On final investment decision, subject to funding, the Company will re-commence underground resource conversion and expansion drilling in parallel with mine construction and development – simultaneously driving growth and delivery. Over the last 25 years in operation, South Crofty has consistently replaced mined tonnes to extend its life of mine and the Company is targeting a continuation of this trend.

Don Turvey, CEO and Director of Cornish Metals, stated: “Completion of the project review and updated Study marks another important step for South Crofty as we advance towards first tin production by mid-2028. We are delighted with the attractive economics that the project offers and, once in operation, we expect South Crofty to be a long life, lowest quartile cost producer and highly cash generative with EBITDA margins in excess of 60%.

“The project continues to be supported by robust economics with an increased NPV and a short payback period of only 3.3 years.

“Additionally, the upside potential through further Mineral Resource expansion is material, as evidenced by the mine’s historical record of consistently replacing mined tonnes and adding to the resource base, a trend that we expect will be replicated once we are in a position to start an underground near-mine drilling programme on commencement of underground development. The programme is structured to build on historical resource replacement and de-risk the mine plan aiming at accelerated resource growth targeting defined in-mine exploration zones to expand inventory and extend mine life. We believe that the current South Crofty Mineral Resource, which constrains the current study’s 14-year mine life, is only a small deposit within a much broader tin system in the South Crofty mining permission area that will support a multigenerational asset, as it was once before.

“South Crofty was the last mine in the region to close, and we are proud to be on the cusp of making it the first to re-open, producing tin, a critical mineral that is essential to the green economy. The project is effectively already in construction with major works underway including the shaft and pump station refurbishment, construction of the workshop and stores building, process plant site excavation and critical site utilities. Key long-lead equipment has been ordered and locked in, including the production and service winders and other important systems. We are deploying best practice initiatives including real-time monitoring for safer operations, productivity enhancement, equipment availability, and continuous optimisation, and we are also designing operational buffers to maximise flexibility and uptime. We have a comprehensive development plan for South Crofty and the backing of the community and government.

“South Crofty remains a flagship project within the UK Government’s Critical Minerals Strategy. The Company benefits from direct investment and strong strategic support from the UK Government, alongside backing from leading industry partners in the critical minerals space.”

“We look forward to restarting production and bringing significant value to Cornwall, including the creation of more than 300 direct jobs, and a further 1,000 indirect jobs. The detailed project human resources plan envisages the establishment of an on-site training centre to harness and upskill local talent in preparation for developing and operating the mine.”

Highlights

- Reinforced leadership team delivering global best practice

- Newly appointed General Manager and Project Director have aligned the project with global best practice across current works, project delivery and eventual operations

- Top-tier third party consultants have independently verified all project parameters—from technical design to real time cost estimation—ensuring rigour, transparency, and execution confidence

- Solid project economics and cash generation

- £180 million after-tax NPV6% Real and 20% IRR at a tin price of US$33,900 /tonne

- £237 million pre-tax NPV6% Real and 23% IRR

- Capital payback period of 3.3 years after-tax

- Cumulative after-tax cash flow of approximately £558 million from start of production

- Average annual after-tax cash flow of approximately £57 million in years two through six

- Average annual EBITDA of £70 million and 62% EBITDA margin in years two through six which is expected to be sustained when additional Mineral Resources are added from planned underground drilling of known orebody extensions

- A low-cost, high-grade, responsible tin operation with strong ESG credentials

- Lowest quartile producer – Average AISC of approximately US$13,400 /tonne of payable tin for years two through six, US$14,500 /tonne over LOM, positioning South Crofty in the lowest quartile of the cost curve

- Average annual tin production of approximately 4,700 tonnes for years two through six (equivalent to approximately 1.6% of global mined tin production)

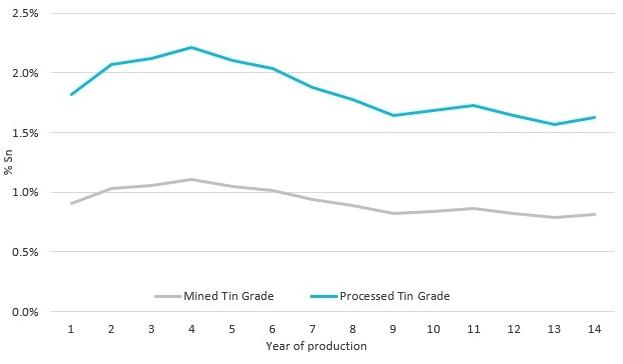

- Average pre-concentrated head grade of 2.11% tin in years two through six, upgraded from an average mined grade of 1.05% tin

- Low impact underground operation with no surface tailings disposal

- Use of 100% renewable electricity supply with renewable power generation optionality

- Potential to directly employ over 300 people and create up to 1,000 indirect jobs

- Sizeable Exploration Target potential

- Near mine Exploration Target points to potential additional mineralisation of 6 to 13 million tonnes (“Mt”), at a tin grade of 0.5% to 1.8%

- South Crofty has a record of consistently replacing mined tonnes to extend its life of mine and the Company is targeting a continuation of this trend

- The Company has good visibility on higher grade extensions that can allow a further optimised mine plan in due course subject to exploration drilling success

- The Company has developed a resource drilling programme that is planned to commence with the start of underground development and continue alongside production

- Further growth opportunities from longer term exploration within the South Crofty mining permission area and within Cornish Metals’ extensive mineral rights holdings in Cornwall

- Well supported project

- Support from local communities and government, and UK government

- Permitted project with existing mine infrastructure, mining permission through to 2071 and full planning permission to construct the processing plant to recover tin concentrate

Cornish Metals will host a presentation on 30 September 2025 at 3:00pm London time. Please access the webinar here using the following passcode: 363356.

A Technical Report prepared in accordance with NI 43-101 will be filed on SEDAR+ within 45 days of this announcement.

| Summary Operating & Financial Metrics | ||

| Operations | Mine throughput | 500 ktpa |

| Processed throughput (post pre-concentration) | 250 ktpa | |

| LOM | 14 years | |

| Total LOM tonnes mined | 5,938 kt | |

| Average mined tin grade | 0.94% | |

| Contained tin | 55,982 t | |

| Total LOM concentrator tonnes processed | 2,874 kt | |

| Average processed tin grade | 1.89% | |

| Average tin recovery | 87.8% | |

| Total LOM tin produced | 49,168t | |

| Total LOM copper produced | 3,842 t | |

| Total LOM zinc produced | 3,223 t | |

| Years 2–6 average annual tin production | 4,695 t | |

| Capital costs | Pre-production | £198 million |

| Post-production sustaining | £43 million | |

| Operating costs | Average net cash cost in years 2–6 | US$12,302 /tonne tin payable |

| Average LOM net cash cost | US$13,494 /tonne tin payable | |

| Average AISC in years 2–6 | US$13,419 /tonne tin payable | |

| Average LOM AISC | US$14,461 /tonne tin payable | |

| Economic assumptions | Tin price | US$33,900 /tonne |

| GB£:US$ | 1.30 | |

| UK corporate tax rate | 25% | |

| Financials | NPV (6% Real) – Pre-tax / After-tax | £237 million / £180 million |

| IRR – Pre-tax / After-tax | 23% / 20% | |

| Capital payback period after-tax | 3.3 years | |

| Total LOM net Revenue | £1.2 billion | |

| Total LOM EBITDA | £693 million | |

| After-tax Free Cash Flow (from start of production) | £558 million | |

| Years 2–6 average annual after-tax Free Cash Flow | £57 million | |

| Years 2–6 average annual EBITDA / EBITDA margin | £70 million / 62% | |

Table 1: South Crofty operating and economic summary

Notes:

- NPV effective as at 1 April 2026;

- Mine plan and financial modelling include Inferred Mineral Resources.

The evaluation at this level of study includes Indicated and Inferred blocks and consequently it is not possible to define a Mineral Reserve. This study is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied that would enable them to be categorised as Mineral Reserves. There is no certainty that this study will be realised.

Capital and Operating Costs

The pre-production capital cost of the South Crofty project commencing from 1 April 2026 is estimated to be £198 million. The LOM sustaining capital is estimated to be a further £43 million, comprising mainly underground development and a process plant upgrade to treat polymetallic material.

| (£ million) | % | |

| Mine development and pre-production | 48.8 | 25% |

| Process plant | 51.7 | 26% |

| Site development and ancillary facilities | 4.0 | 2% |

| Other surface infrastructure | 7.4 | 4% |

| Tailings management | 10.0 | 5% |

| Owners cost | 39.2 | 20% |

| Indirects | 19.9 | 10% |

| Contingency | 17.3 | 9% |

| Total pre-production capital | 198.3 | 100% |

Table 2: South Crofty pre-production capital costs (1 April 2026)

The pre-production capital estimate increased from the 2024 PEA estimate of £142 million reflecting, among other things, changes to scope, labour costs, longer mine dewatering and shaft refurbishment costs, extended timeline and general cost escalation.

The South Crofty underground mining operation is estimated to have a low total unit operating cost, averaging approximately £85 per tonne of mineralised material, totalling approximately £520 million over the 14-year LOM.

| Unit Cost (£/t) |

Total LOM Cost (£ million) |

% | |

| Mining & hoisting | 52.6 | 313.4 | 60% |

| Processing | 16.0 | 95.5 | 18% |

| Pumping and water treatment | 6.4 | 38.2 | 7% |

| G&A, including closure cost | 12.5 | 74.2 | 14% |

| Total | 87.5 | 521.3 | 100% |

Table 3: South Crofty operating costs

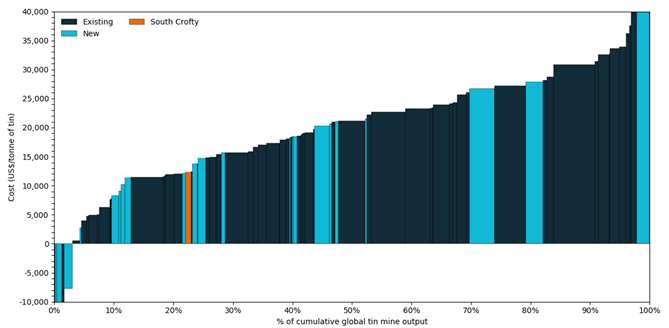

Average LOM net unit cash costs, inclusive of treatment charges and by-product credits from copper and zinc are estimated to be US$13,494 per tonne of payable tin sold. The LOM AISC is estimated at US$14,461 per tonne. Over the first full five years of production the net cash cost and AISC are estimated at US$12,302 per tonne and US$13,419 per tonne, respectively, potentially positioning South Crofty within the first quartile of the global tin industry cost curve.

Figure 1: South Crofty expected to be a lowest quartile cost tin producer (2030 net cash cost of production). Source: International Tin Association

Cash Flow Generation

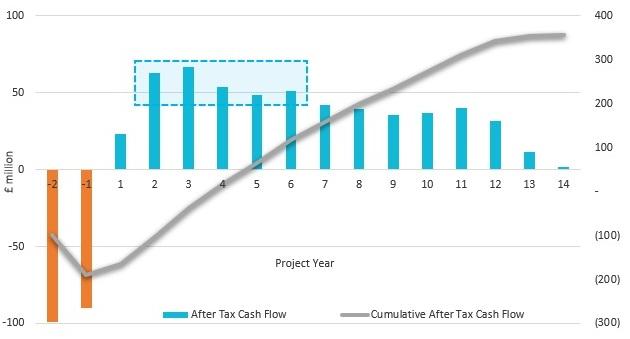

South Crofty’s estimated low operating costs and a well-supported tin price environment are expected to translate to high margin tin sales and strong cash generation. After-tax free cash flow is estimated to total approximately £357 million across the Project (£558 million from start of production), averaging approximately £57 million in years two through six and peaking at £67 million in the third year of production. The Company hopes to replicate this in later years through planned exploration programmes and extended mine production plans.

Figure 2: South Crofty after-tax free cash flow profile

Sensitivity Analysis

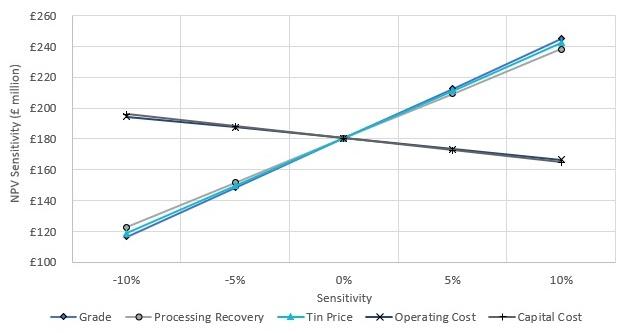

South Crofty project economics are well supported at a range of tin price assumptions and discount rates.

| After-tax NPV (£ million) |

Commodity Price | ||||||

| -20% | -10% | 0% | +10% | +20% | |||

| Discount Rate (Real) | 5% | 71 | 138 | 204 | 269 | 335 | |

| 6% | 57 | 119 | 180 | 242 | 304 | ||

| 7% | 43 | 101 | 160 | 218 | 276 | ||

| 8% | 31 | 86 | 140 | 195 | 250 | ||

| 9% | 19 | 71 | 123 | 174 | 226 | ||

Table 4: Metal price and discount rate sensitivity analysis

The base-case tin price of US$33,900 /tonne, based on Project Blue’s latest price forecast from the Q3 2025 Medium-Term Outlook analysis published in July 2025, reflects a tin market environment of supply falling short of demand in the medium-term that will drive the market into a deficit. The spot tin price, recently trading at approximately US$35,000 /tonne, above our assumption, at which level the estimated NPV6% would increase by approximately £20 million to approximately £200 million. A sensitivity analysis was performed on the study’s pre-tax NPV to examine project sensitivity to metal prices, capital and operating costs, grades and process recoveries.

Figure 3: Pre-tax NPV6% sensitivity analysis to various project parameters

Production Profile

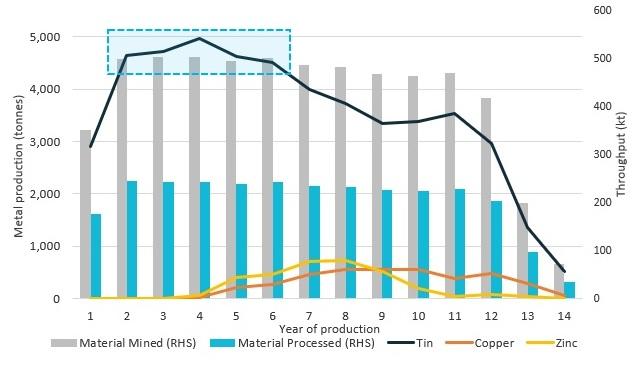

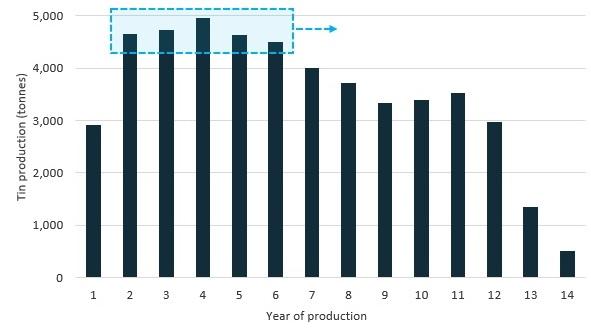

South Crofty’s production profile is based on an annual mined throughput of approximately 500,000 tonnes and annual processing of approximately 250,000 tonnes following pre-concentration at an average tin grade of 1.89%. Tin in concentrate production over a 14-year LOM is expected to total slightly more than 49,000 tonnes, averaging approximately 4,700 tonnes of tin in concentrate per year in the first five years post ramp-up (years two through six) (see blue box in Figure 4).

Figure 4: South Crofty indicative production profile

The use of pre-concentration employing the latest X-Ray Transmission (“XRT”) ore sorting technologies reduces the volume of material processed and required for backfilling to approximately half of the material mined. The impact to concentrator feed grades is also significant, with LOM processed tin grades averaging 1.89%, approximately double the average mined grade of 0.94% tin. Estimated processed tin grades in years two through six average approximately 2.1%.

Figure 5: South Crofty mined and processed tin grades

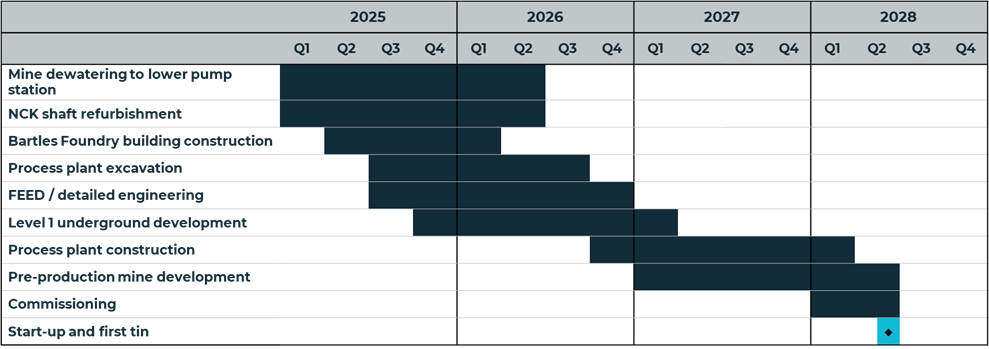

Indicative timeline

The pace of activities at South Crofty continues to rise as the newly reinforced leadership team works towards first tin production by mid-2028. Key areas of focus and deliverables are outlined in the indicative timeline below:

Figure 6: Indicative timeline to first tin production

Opportunities

This study is constrained by the current South Crofty Mineral Resource Estimate updated in September 2023 that produced a significant increase in contained tin in the Indicated category of the lower mine. Additional in-mine exploration provides the opportunity to extend South Crofty’s mine life well beyond the current constrained 14-year LOM. Near-mine exploration targets, such as the Wide Formation, provide further potential to add to the existing Mineral Resource base.

Historic production at South Crofty demonstrates consistent discovery of new material and subsequent conversion to Reserves (Figure 7).

Figure 7: South Crofty cumulative metal mined and metal added to Reserve – 1974 to 1997.

In November 2024, Cornish Metals produced a near mine Exploration Target1 that points to potential additional mineralisation of 6Mt to 13Mt, at a tin grade of 0.5% to 1.8%. The Company plans to test the Exploration Target systematically alongside underground development and production at South Crofty, with the purpose of definition of additional supplementary mineralisation. This is expected to be carried out through targeted drilling programmes aimed at extending the existing Mineral Resource both along strike and down dip, particularly during the early years of operation.

The Company has developed a resource drilling programme that, subject to funding, is planned to commence with the start of underground development and continue alongside production. The South Crofty mine benefits from being a brownfield operation through access to over 25 years of digitalised exploration, development and production data. The programme will be focused on resource definition and expansion with the aim of replacing mined resources, continuing the resource replacement trend demonstrated through the mine’s production history.

The near mine exploration target demonstrates the potential to maintain a stable and higher rate of production beyond the sixth year of production, as well as an extended mine life well in excess of the study’s constrained 14 years. The Company is also assessing the potential for increased throughput, with further growth opportunities from longer term exploration activities within Cornish Metals’ wider mineral rights holdings in Cornwall.

The Study’s production profile for South Crofty indicates total tin production of slightly above 49,000 tonnes over a 14-year mine life, averaging approximately 4,700 tonnes of tin per year in the first five years post ramp-up (years two to six) with a declining trend in later years. The production profile is constrained by the current South Crofty Mineral Resource as last updated in September 2023.

The near mine Exploration Target points to potential additional mineralisation at South Crofty and it is management’s belief that the production profile in years two through six might be prolonged if the Company replicates its historical record of consistently replacing mined tonnes to extend its life of mine. The Company is also assessing the potential for increased throughput, with further growth opportunities from longer term exploration activities within Cornish Metals’ wider mineral rights holdings in Cornwall.

Figure 8: South Crofty tin production profile.

Qualified Persons

The Qualified Persons for the updated PEA are Mr Dominic Claridge, FAusIMM, Principal Mining Engineer (AMC); Mr Nick Szebor, MCSM, CGeol, EurGeol, FGS, Director/Global Lead – Geosciences and Principal Geologist (AMC); Mr Mike Hallewell, FIMMM, FSAIMM, FMES, CEng (Independent Consultant); Mr Barry Balding, PGeo, EurGeol, Technical Director – Mining Advisory Europe (SLR); Mr Steve Wilson, ACSM, CEng, FIMMM, Managing Director: Europe (P&C). Qualified Persons under National Instrument 43-101 (NI 43-101) and Competent Persons as defined under the JORC Code (2012).

All QPs have reviewed the technical content of this news release for the South Crofty deposit and have approved its dissemination.

A Technical Report disclosing the updated PEA in accordance with the requirements of NI 43-101 will be prepared by AMC on behalf of Cornish Metals and filed on SEDAR within 45 days of this news release. Messrs Claridge, Szebor, Hallewell, Balding, Wilson and O’Connell, and Ms Collins consent to the inclusion in this announcement of the matters based on their information in the form and context in which it appears.

This news release has been reviewed and approved by Mr Stephen Holley, (BSc (Hons), ACSM, MSc, MSCM, CEng FIMMM), Technical Services Manager for Cornish Metals Inc, who is the designated QP for the Company.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral exploration and development company (AIM and TSX-V: CUSN) that is advancing the South Crofty tin project towards production. South Crofty:

- is a historical, high-grade, underground tin mine located in Cornwall, United Kingdom and benefits from existing mine infrastructure including multiple shafts that can be used for future operations;

- is permitted to commence underground mining (valid to 2071), construct a new processing facility and for all necessary site infrastructure;

- would be the only primary producer of tin in Europe or North America. Tin is a Critical Mineral as defined by the UK, American, and Canadian governments as it is used in almost all electronic devices and electrical infrastructure. Approximately two-thirds of the tin mined today comes from China, Myanmar and Indonesia;

- benefits from strong local community, regional and national government support with a growing team of skilled people, local to Cornwall, and could generate over 300 direct jobs.

ON BEHALF OF THE BOARD OF DIRECTORS

“Don Turvey”

Don Turvey

CEO and Director

Engage with us directly at our investor hub. Sign up at: https://investors.cornishmetals.com/link/Pm59nP

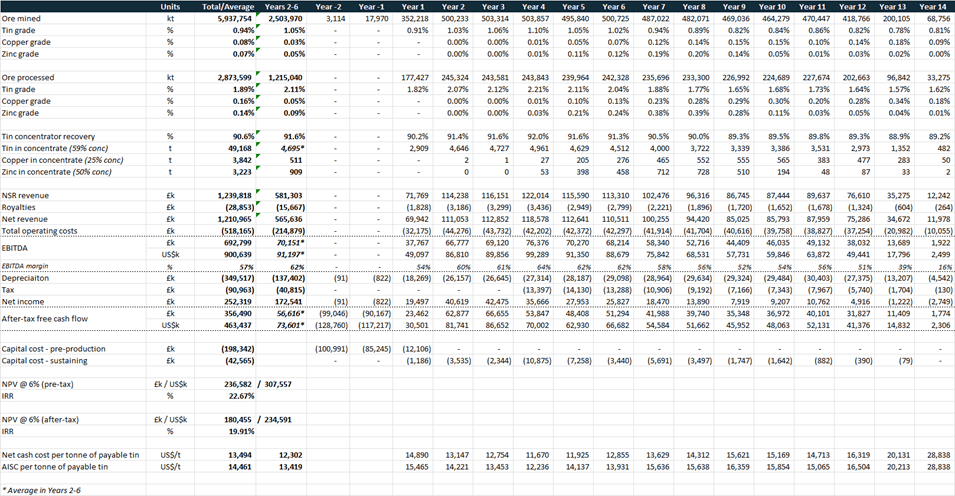

Appendix 1 – South Crofty summary LOM operating and financial model

1 The potential quantity and average grade of the near mine Exploration Target is conceptual in nature and is an approximation. There is insufficient data to estimate a Mineral Resource in the area considered and it is uncertain if further exploration will result in the definition of a Mineral Resource.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE