Rick Mills – “Torr Metals is Chasing High-Quality Porphyry Targets With Strong Similarities to New Afton in Southern BC”

New Gold’s (TSX:NGD) New Afton mine is Canada’s only underground block caving operation, located about 10 kilometers outside of Kamloops, in south-central British Columbia.

New Gold began construction of the New Afton mine in 2007 and reached commercial production in 2012. The operation is on the site of the historic Afton open pit mine, which operated from 1977 until 1997.

In March 2020 New Gold incorporated the C-Zone development that extended the mine life to 2030.

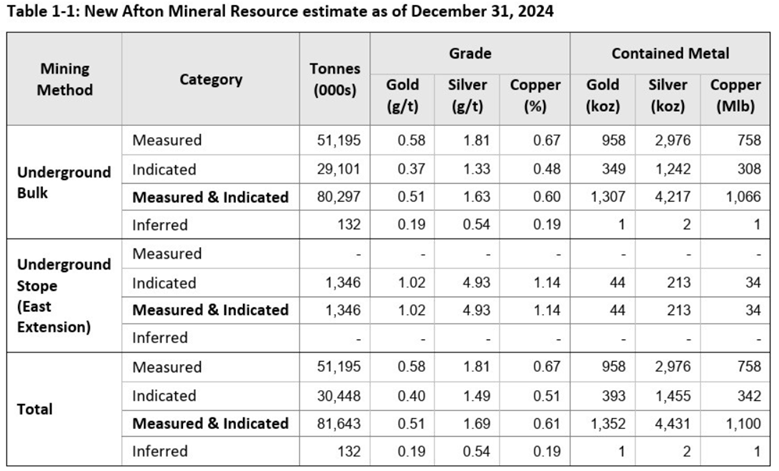

The mineral resource estimate as of Dec. 31, 2024, consists of 81,643,000 tonnes of ore in the measured and indicated categories. At grades of 0.51 grams per tonne gold, 1.69 g/t silver and 0.61% copper, the New Afton deposit contains 1,352,000 ounces of gold, 4,431,000 ounces of silver and 1.1 billion pounds of copper.

Source: New Gold Inc.

In 2024 New Afton produced 72,609 gold ounces and 54 million pounds of copper, beating gold guidance and meeting copper guidance for the year.

According to a Feb. 10 2025, technical report,

The New Afton deposit is classified as a silica-saturated alkalic copper-gold porphyry deposit. Copper-gold alkalic porphyry mineralization results from late-stage hydrothermal activity driven by remnant heat from the porphyry intrusion. Thermal gradients within these systems give rise to broadly concentric, although often complexly intermingled, zones of alteration and mineralization. At New Afton, copper-gold mineralization typically occurs as east-west subvertical tabular zones of disseminations, stringers, and fracture-filling sulphides within rocks of the volcanic Nicola Group and the diorite. The deposit consists of three principal zones:

- The Main zone, located on the western edge of the Pothook diorite is subdivided into Lift 1 East, Lift 1 West (both mined out), B3, C-Zone, and D-Zone mining zones; mining is currently focused on the B3 and C-Zone.

- The Hangingwall (HW) zones are smaller satellite zones located along the southern margin of the Pothook diorite.

- The Eastern zones include two separate areas located on the northern margin of the Pothook diorite: East Extension and K-Zone. East Extension is currently in the mine planning phase and KZone is currently being explored.

Mineralization is subdivided into three types: hypogene (either chalcopyrite- or bornite-dominant), secondary hypogene (sometimes referred to as mesogene) (overprint of tennantite-enargite + tetrahedrite and bornite + chalcocite rims), and supergene (native copper and chalcocite).

I have been evaluating copper-gold deposits in the southern and northern Quesnel Trough for over 20 years. While no one has yet discovered another deposit like New Afton, Torr’s ongoing exploration efforts may yield promising results, though there are no guarantees.

The Quesnel Trough, or Quesnel Terrane, is a Cordilleran volcanic and magmatic island-arc assemblage that was accreted onto the continental margin of North America during the Late Triassic to Early Jurassic periods; it is British Columbia’s primary copper-producing belt.

Torr Metals

Torr Metals started out exploring the Latham copper-gold project in the Golden Triangle of northwestern BC but pivoted to the Kolos copper-gold project after CEO Malcolm Dorsey and his brother, Cameron Dorsey, both structural geologists (Cameron is an advisor to the company) staked the claims based on an exploration model they have developed over the past several years of working in the region.

Torr’s third property is the Filion gold project in Ontario.

Kolos Copper-Gold Project

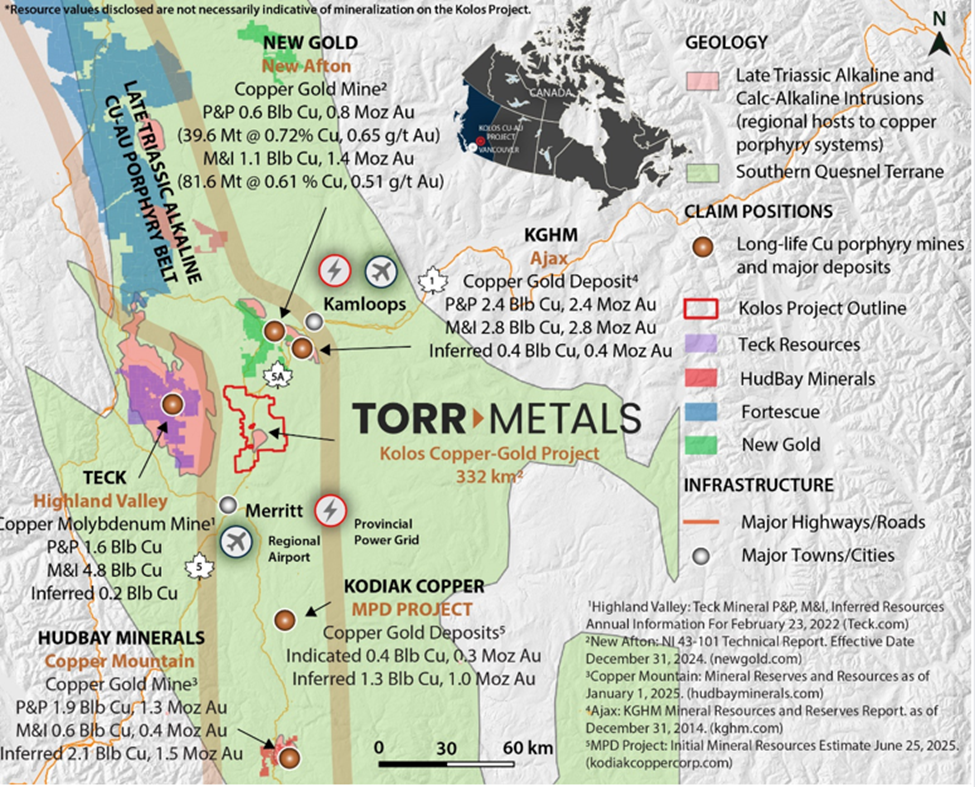

The 332-square-kilometer Kolos copper-gold project (including the 57-square-kilometer Bertha Property strategically optioned in March 2025 for full ownership) contains Nicola Belt geology along trend and with similar attributes to alkaline and calc-alkaline copper ± gold ± molybdenum porphyry mines at Copper Mountain, Highland Valley, and New Afton.

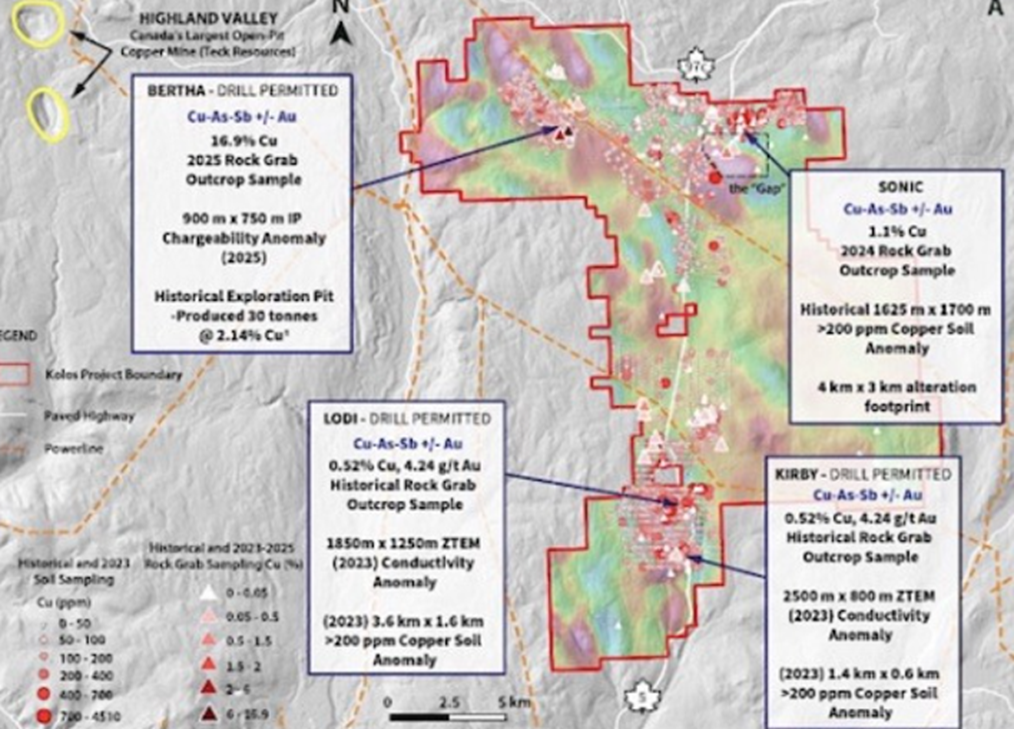

The project is adjacent to Highway 5, the Coquihalla Highway, with year-round access and operation potential via forestry service roads and substantial infrastructure provided by the city of Merritt located 23 km to the south. The project contains sixteen historical copper and gold occurrences, majority never drill tested including the main target areas. Through its own exploration, Torr has vectored four main copper-gold porphyry targets covering 11.8-square-kilometers of surface geochemical anomalism, three of those are permitted for drilling.

Geology

The project lies within the Quesnel Terrane, a prolific porphyry belt in British Columbia that is host to major deposits and long-lived mines that within the region largely consist of Late Triassic calc-alkaline and alkaline intrusions, including Highland Valley (30 km to the northwest), New Afton (30 km to the north), and Copper Mountain (106 km to the south) deposits.

Map of the Kolos project location relative to major porphyry mines at Highland Valley, New Afton and Copper Mountain.

The Coquihalla Highway separates the two main lithologies encountered on the Kolos project. West of the highway and in the northeast section of the property andesitic rocks of the Late Triassic Nicola Group predominate, consisting of andesite hornblende porphyry as well as andesitic tuff, lapilli tuff, agglomerate and volcanic breccias. Within the northern portion of the property Nicola Group volcanics are intruded by a fine-grained diorite that is apparently a subvolcanic equivalent of the andesite.

A major north-trending structural corridor, the Fanta Fault, is exposed along the Coquihalla Highway and for the most part separates Nicola Group volcanic and sedimentary rocks to the west from the batholith to the east. The fault is characterized by brecciation, pyritization, carbonate and epidote alteration, local clay alteration and variable silicification.

Highly prospective mineralization consists of locally abundant pyrite that is disseminated within host volcanics as well as concentrated within north-trending fault structures that separate the underlying Late Triassic Nicola Group rocks from Late Triassic granodiorite to quartz monzonite intrusions.

Elsewhere throughout the project area, localized occurrences of malachite with rare chalcopyrite also occur within host Nicola Group volcanics, associated with increased fracturing together with carbonate alteration and quartz-carbonate veinlets. These veinlets carry malachite, pyrite ± chalcocite that together with observed alterations styles is suggestive of the upper level of a large-scale copper porphyry system with near-surface exposure.

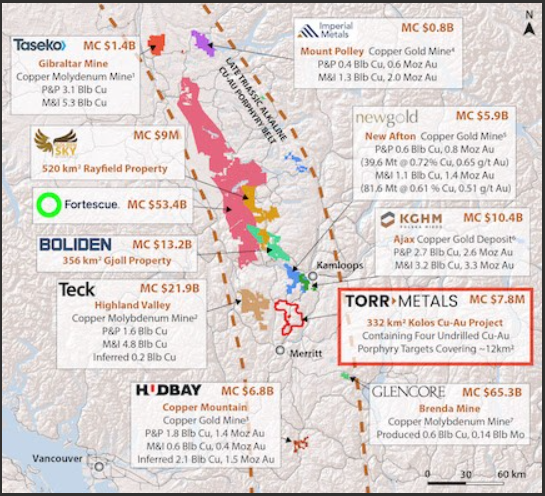

As shown on the map below, there are at least nine major or mid-tier mining companies operating within the Late Triassic-Alkaline Cu-Au Porphyry Belt, including Taseko (Gibraltar mine), Boliden (Gjoll project), Teck (Highland Valley mine), Hudbay Minerals (Copper Mountain mine), Imperial Metals (Mount Polley mine), New Gold (New Afton mine), KGHM (Ajax project), and Glencore’s shuttered Brenda mine.

Regional exploration

Regional exploration occurred in the area starting in the 1960’s through to the late 1980’s as a result of the porphyry copper-molybdenum discoveries at Highland Valley. There have been at least 10 operators within the Kolos project area since the 1960’s that defined six significant copper and gold occurrences: Ace, Kirby, Lodi, Rea, Helmer and Clapperton. Intermittent historical work at these occurrences includes rock and soil geochemical sampling, trenching and electromagnetic (EM) geophysical surveys.

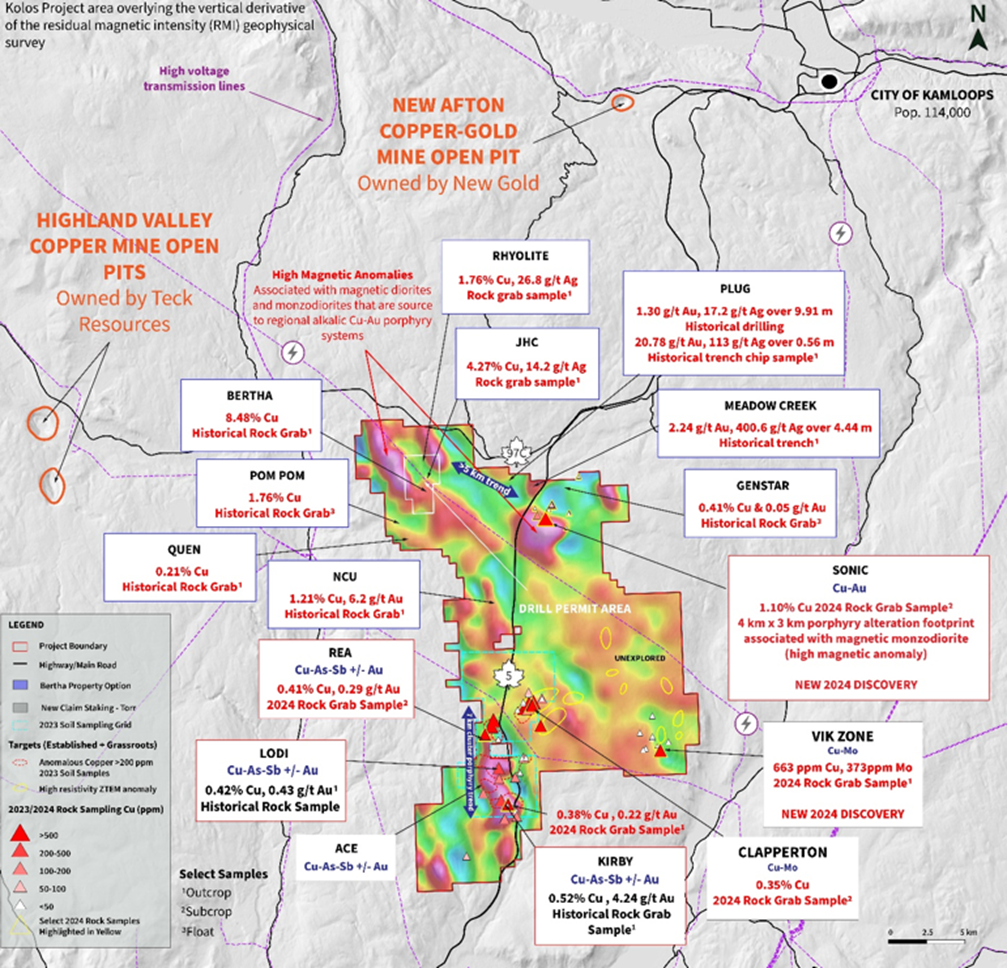

Kolos project boundary with known copper and gold mineral occurrences annotated with select historical rock grab samples.

Kolos copper and gold occurrences. What Torr started with

Ace

Historical geological mapping from 1988 identified older trenches with exposures of andesite tuff, andesite feldspar porphyry, quartz-sericite schists, phyllites and a quartz monzonite hosting quartz-carbonate veins and variable amounts of malachite, chalcocite and chalcopyrite.

Kirby

A rock sample taken from the discovery of the Kirby occurrence in 2014 assayed 4.24 grams per tonne gold, 11.3 g/t silver and 0.516% copper.

Another zone of historical mineralization is noted ~500 meters east-southeast of the Kirby occurrence near the Coquihalla Highway, with exposures of andesite tuff and diorite hosting quartz-carbonate veins with pyrite, chalcopyrite and malachite. In 1988, four rock samples taken from this outcrop exposure yielded 0.14, 0.60, 0.89, 0.22 grams per tonne gold across a 400-meter north-south trend.

Lodi

The Lodi occurrence contains andesite hosting crosscutting fracture zones along the north-trending Fanta fault with narrow quartz carbonate veins, up to a quarter-meter wide, and weak to trace malachite ± chalcocite, chalcopyrite and pyrite mineralization. Magnetite is also reported in the area with a rock sample collected in 1988 yielding 0.60 grams per tonne gold, 4.8 g/t silver and 0.233% copper. Another zone of mineralization is located ~1 kilometer east of the main occurrence, near the Coquihalla Highway, where another outcrop rock grab sample from 1988 yielded 0.425 g/t gold, 1.8 g/t silver and 0.415% copper.

Rea

The only known historical work consists of a rock grab sampling program in 1988 with one sample taken from a rare outcrop that yielded 4.75 g/t gold, 144.0 g/t silver, 0.52% zinc and greater than 1% lead and copper, whereas another sample taken approximately 900 meters west of the previous sample yielded 0.63 g/t gold.

In 2004, a rusty diorite boulder (float) sample, located approximately 1.1 kilometers west-southwest of the occurrence, yielded 4.84 g/t gold, 14.3 g/t silver, 0.202% copper and 0.126% lead.

Helmer

Historical trenching has exposed narrow, up to 1-meter-wide silicified zones and/or quartz calcite veins in altered and sheared andesitic and tuffs hosting pyrite, minor galena, chalcopyrite, and sphalerite mineralization together with limonite and malachite oxidation. The veins trend northwest with a steep dip. Historical rock grab sampling from a trench-exposed outcrop yielded up to 1.425 g/t gold and 11.4 g/t silver. In 2007, a chip sample of mineralized outcrop yielded 1.26 g/t gold, 7.0 g/t silver, 0.178% copper, 0.410% lead and 1.450% zinc over 0.4 meters, whereas a grab sample from another historical trench assayed 0.37 g/t gold, 163.0 g/t silver, 1.860% lead and 6.50% zinc.

Clapperton

Scattered quartz veins up to 15 centimeters wide contain minor calcite, epidote, chlorite and hornblende hosted within a chloritized and kaolinized biotite-hornblende diorite. The veins parallel the shear direction, trending approximately 20 and 120 degrees, and contain minor amounts of chalcocite, chalcopyrite, bornite, malachite and rare molybdenite as disseminated blebs.

In 1975, other zones of chalcopyrite and malachite mineralization were reported several hundred meters north-northwest, 600 meters northeast, 400 meters south, and 1 km east-southeast of the main zone. This indicates a multi-kilometer scale to copper porphyry-style mineralization.

Recent exploration

In September 2023 Torr Metals announced the staking of the Kolos copper-gold project totaling 13,957 hectares. The news release mentions the six copper and gold occurrences with the highlighted grades, and the initiation of a 2023 field program composed of up to 2,300 soil samples as well as rock sampling, with a focus on testing potential extensions to historical geochemical anomalies.

The field program was completed that November, and Torr announced that it collected 47 rock and 3,348 soil samples, within about a 48 km² area. The program included the first-ever surface geochemical and ZTEM airborne geophysical surveys conducted over known historical copper-gold occurrences that have never been drill-tested.

President and CEO Malcolm Dorsey compared what was found at Kolos to Kodiak Copper’s (TSX-V:KDK) proximal MPD project:

“These highly pronounced geophysical and geological features in addition to the coincident historical occurrences are what first attracted our attention to the area, as we know that similar geophysical patterns have proven to be highly prospective within the region, such as at Kodiak Copper Corp’s West and Gate Zones ~60 km to our south.”

The following May, 2024, Torr Metals expanded the project by 75% through staking, upsizing it from 140 km² to 240 km². The northerly expansion followed an extension of the Fanta Fault, an orientation identified by the company as a major structural control on copper and gold mineralization in the area.

Torr was also the first to identify and sample a new mineralized outcrop exposure it named the Vik Zone. New exploration targets were identified in the northern and eastern portions of the expanded project, including two large-scale low magnetic geophysical anomalies that exhibit the same signature as the nearby Ram soil anomaly, which is defined by a footprint of >200 ppm Cu measuring 900m by 500m.

“While our main focus remains on the more advanced drill-ready Lodi, Kirby, Ace, Rea, and Clapperton Zones, the new discovery of the Vik Zone demonstrates the effectiveness of our exploration model in finding highly anomalous mineralization in unexplored areas,” Dorsey said.

The next month, Torr announced the final assay results from the 2023 rock sampling program and delineation of a robust ZTEM geophysical anomaly at the Vik Zone, which it described as “a new discovery of copper (Cu) and molybdenum (Mo) mineralization in outcrop, on the margins of one of three highly prospective and untested moderate to high resistivity anomalies identified across a >2.5 kilometer (km) trend.”

Of the 47 rock grab samples taken, 22 yielded >100 ppm Cu, with five samples exceeding 500 ppm. The highest value returned 4,240 ppm (4.24%) Cu within the Clapperton Zone.

A total of 10 grassroots targets were identified in the southern and central portions of the project, with comparable prospective geology and ZTEM geophysical signatures to the six significant mineralized zones, which now comprised Vik, Lodi, Kirby, Ace, Rea and Clapperton.

Sonic Zone discovery

In August 2024 Torr Metals made a discovery that both confirmed the exploration methodology, and introduced a fascinating analog.

Final assay results from a total of 33 rock grab samples collected during 2024 reconnaissance programs revealed additional high-grade rock grab assays within the Kirby, Rea and Clapperton zones, as well as a new copper-gold discovery in the northern portion of the project that Torr termed the Sonic Zone.

Initial rock grab samples from the Sonic Zone revealed anomalous copper and gold values in outcrop within a 1,000- by 2,000-meter footprint of strong magmatic-hydrothermal alteration that aligns with the margins of a high magnetic geophysical signature, identified as a potential source for a monzodiorite intrusion.

The discovery reinforced Torr’s exploration model and suggested the potential for another large-scale cluster of anomalies comparable in scale to the already established Kirby, Lodi, Ace and Rea targets to the south.

New Afton comparison

CEO Malcolm Dorsey for the first time referenced New Afton as a potential comparable to the Kolos copper-gold project:

“The discovery of the Sonic Zone is particularly promising, as it opens up a new area of mineralization that bears geological similarities to the high-grade New Afton copper-gold porphyry deposit, located just 27 km to the north,” he said.

More details on the proposed analog were provided in the next paragraph:

“Key surface indicators within the Sonic Zone suggest significant potential for a silica-saturated porphyry system with similar geological characteristics to the nearby high-grade New Afton copper-gold deposit. New Afton is characterized by monzonite to monzodiorite intrusions and alteration patterns that include potassic alteration (dominated by biotite, with K-feldspar and magnetite) and propylitic alteration (chlorite, epidote, and calcite).

Surface features such as these, along with narrow quartz veins, silicification (increased silica content in the rock), and location along the margins of a high magnetic geophysical anomaly are strong indicators of underlying mineral potential. Similar parallels have been observed at the Sonic Zone, underscoring the high degree of prospectivity for this area to host a substantial mineralizing system.”

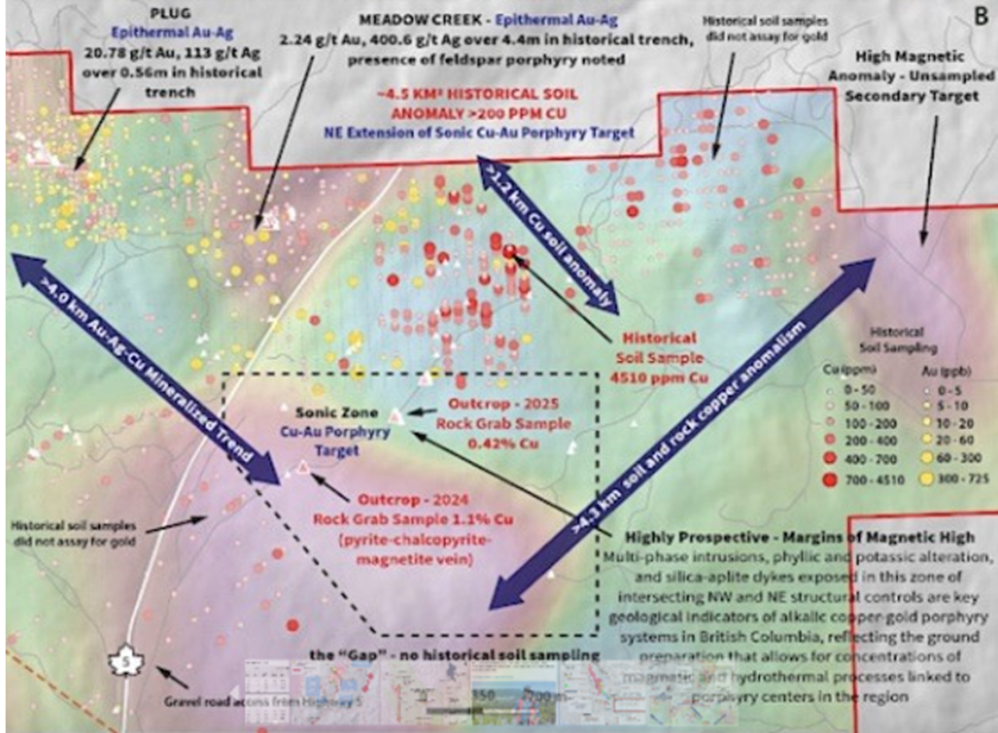

Fast forward to January 2025, when Torr announced a high-grade rock grab sample of 1.10% Cu from the Sonic Zone, as well as new mapping that significantly expanded Sonic’s footprint from 2 km² to 12 km². The zone now spans approximately 3 km by 4 km, “characterized by pervasive alteration and mineralization in surrounding Nicola Group volcanics and altered monzonite-monzodiorite intrusive bodies comparable to regional alkalic copper-gold porphyry systems such as New Afton and Copper Mountain.”

“The geological and geophysical similarities to the nearby high-grade New Afton deposit underscore the immense potential for substantial discoveries in this area,” said Dorsey.

Bertha discovery

In March 2025 Torr Metals made another move to expand the Kolos property, this time by signing an option agreement for the Bertha property, which is contiguous to Kolos on its northern portion. Along with gaining the 57-square-km Bertha, the company also staked an additional 35 km² of highly prospective ground surrounding the new target.

According to Torr, unexplored Bertha hosts nine significant copper and gold occurrences along an epithermal and porphyry trend extending northwest from the Sonic Zone. Through this acquisition and claim staking, the Kolos project now covers 332 km².

Supergene enrichment

“At Bertha, fieldwork confirmed structurally controlled supergene copper mineralization composed primarily of chalcocite, where historical rock grab samples have returned up to 8.48% Cu in outcrop. The upcoming IP survey will be the first to test for subsurface extensions of this undrilled zone, which shares key structural and mineralogical features with the upper supergene zone of the high-grade New Afton copper-gold deposit, located just 28 kilometres to the north-northeast.”

“We’re excited to launch this next phase of exploration across our 332 km² land package, where recent work at the Bertha target has revealed compelling geological similarities to the nearby high-grade New Afton deposit,” Dorsey stated on June 26. “A new copper-gold porphyry discovery at Kirby, Bertha, or Sonic would be highly meaningful.”

The following three paragraphs are from the July 8, 2025 news release:

“The Bertha Zone represents a highly prospective, underexplored high-grade copper target where recent fieldwork has confirmed supergene-style copper mineralization, primarily sooty chalcocite, native copper, and malachite nodules hosted within brecciated volcanic rocks. This style and setting are geologically significant and comparable to the supergene enrichment zone at New Afton, located just 28 km to the north.”

“Supergene mineralization happens when copper-rich fluids from deeper underground move up through cracks in the rock, usually helped by rainwater or groundwater. As these fluids rise closer to surface, they interact with oxygen and other elements. This chemical reaction causes high-grade copper minerals, like chalcocite, native copper, and malachite, to form near surface.”

“At New Afton, the presence of a well-developed supergene blanket, characterized by abundant native copper and sooty chalcocite, was critical to the early economic success of the mine. This zone accounted for approximately 80% of the initial orebody, enabling low strip ratios, enhanced metal recoveries, and early cash flow. It overlies a deeper primary hypogene copper-gold porphyry system hosted within the Cherry Creek intrusion of the Iron Mask batholith, where brecciation and hydrothermal fluid pulses played a key role in both metal deposition and alteration zoning.”

On Aug. 13, 2025, Torr Metals announced results from the induced polarization (IP) survey and rock grab sampling program at Bertha.

Selected rock grab sampling returned up to 16.9% copper and 8.48 grams per tonne silver from a series of parallel quartz-carbonate veins along a 30-meter strike length. According to TMET, these results validate the high-grade nature of the historical exploration pit, which reported past production of 30 tonnes averaging 2.14% Cu and 27.43 g/t Ag. Additionally, mineralization continues along a >450m west-southwest strike between the Bertha and Bertha South showings.

Importantly, the high-grade copper mineralization is situated along the margins of a newly defined IP chargeability anomaly exceeding 900 meters in strike length and over 500 meters in width, which remains open at depth, down-plunge, and to the east.

“The confirmation of high-grade copper at-surface and identification of a large 0.7 km2 IP geophysical anomaly at Bertha represent a major step forward in defining the untested potential of this area,” Dorsey said. “The signature strength and dimensions are highly promising for targeting a midsize high-grade porphyry system perhaps similar to the New Afton system, with a broad moderate chargeability overlapping resistivity along the margins of a magnetic anomaly, together with nearby evidence of high-grade supergene copper mineralization. We now have the geochemical and geophysical data needed to plan drill targets in preparation for an inaugural drilling program at Bertha, the first to test this previously untouched target.”

Torr’s latest news release on Sept. 3 announced results from the compilation of historical soil and rock grab sampling covering the adjoining 57-square-km Bertha property.

The data set highlights a 4.5-square-km copper-gold soil anomaly north of the Sonic Zone, reporting up to 4,510 ppm (4.51%) copper and 590 parts per billion gold (0.590 g/t). The anomaly has a strike length of 3.7 km with a width of 1.2 km.

Meanwhile, 2025 field reconnaissance at the Sonic Zone copper-gold porphyry target area identified a new mineralized outcrop approximately 1 km northeast of Torr’s 2024 discovery, which returned 1.1% Cu in a magnetite-rich grab sample along the margins of a highly prospective high magnetic anomaly. The newly identified outcrop yielded 0.42% Cu from a strongly sheared quartz-carbonate vein hosted in Nicola Group volcanics, proximal to a pyritized monzonite intrusion and silica-apatite dyke: further supporting vectors toward a potential alkalic Cu-Au porphyry center.

The historical data set also defined a more than 4-km gold-silver epithermal corridor, extending northwest from the Sonic Zone porphyry target through the Plug and Meadow Creek occurrences (March 11, 2025 news release) with up to 700 ppb Au in soil and 2.24 g/t Au over 4.4 meters, 20.78 g/t Au over 0.56m, and 6.24 g/t Au with 1,715 g/t Ag over 0.36m in trenching.

Four porphyry targets

In total, Torr has identified four undrilled copper-gold porphyry targets at Kolos — Sonic, Bertha, Kirby and Lodi — with surface geochemical anomalies covering a combined 11.8 km². Bertha, Kirby, and Lodi are fully drill-permitted, while Sonic is in the permitting phase.

“The combination of historical data and our recent fieldwork continue to highlight the significant discovery potential at the highway-accessible Kolos Project,” Dorsey stated. “We are advancing the drill permit for the Sonic Zone and plan to fully evaluate the highly prospective 4 km² “Gap” area this year.

Our inaugural Phase 1 drill program will begin at the Bertha target, where surface outcrop rock samples returned up to 16.9% copper, supported by a strong chargeability anomaly suggesting mineralization may extend beyond 500 vertical metres. These efforts mark the beginning of a broader strategy to unlock four high-impact opportunities within Canada’s most productive copper belt.”

Top figure (A): Kolos Project with historical soil and rock grab samples outlining key porphyry targets overlying first vertical derivative residual magnetic intensity (RMI) geophysics with select 2023-25 annotated rock grab samples. Bottom figure (B): Sonic Zone area with historical soil and rock grab samples overlying first vertical derivative residual magnetic intensity (RMI) geophysics with select 2023-2025 annotated rock grab samples.

Conclusion

The average copper grade in BC is .40% CuEq. If a large part of Kolos exhibits higher-grade mineralization it could potentially support a starter pit and the tonnage required for an economic mine would be smaller. Also, it will attract more investor attention which makes financing easier.

And it might be something TMET could handle by itself without blowing out the share structure, which is mostly what happens with juniors with porphyries (Because it takes so many drill holes to come up with a resource). On the other hand, it could attract deep-pocketed majors to fund exploration/development.

I have been looking at these types of deposits in the southern Quesnel Trough for over 20 years. But no one has ever found another Afton. A well-developed supergene enrichment blanket superimposed on the hypogene mineralization is a target well worth chasing; Kolos appears to have it (although it is very early stage and needs to have more work), strengthening the potential comparison to New Afton. And let’s not forget at least three other large already identified targets.

Torr Metals

TSX-V:TMET

2025.09.12 Share Price: Cdn$0.16

Shares Outstanding: 31.8m

Market Cap: Cdn$6.7m

TMET website

Subscribe to AOTH’s free newsletter

Richard does not yet own shares of Torr Metals (TSX-V:TMET). TMET is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of TMET

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eldorado Announces Strong Exploration Results of Multiple New High-Grade Zones in Canada and Greece and Increases 2026 Exploration Investment, Reinforcing Confidence in Discovery Strategy

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) is pleased to announce the discovery of four new hi... READ MORE

First Atlantic Nickel Increases RPM Zone Strike Length 50% to Over 1.2 km and Width to Over 800 m from Phase 2x Drilling at Pipestone XL Magnetic Nickel-Cobalt Alloy Project

First Atlantic Nickel Corp. (TSX-V: FAN) (OTCQB: FANCF) (FSE: P21) is pleased to announce pos... READ MORE

McEwen Drilling Returns Significant Intersection at Gold Bar Mine Complex in Nevada: 5.55 gpt Gold over 44.2 Meters; Transformation into a Long-Life Mine Continues

McEwen Inc. (NYSE: MUX) (TSX: MUX) announces new drill results from the Gold Bar Mine Complex in th... READ MORE

Aya Gold & Silver Provides 2026 Outlook and Strategic Priorities

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased to provide its 2026 outlook and pres... READ MORE

Highlander Silver Announces US$40 Million Strategic Investment by Eric Sprott to Accelerate Growth

Highlander Silver Corp. (TSX: HSLV) is pleased to announce that Mr. Eric Sprott, an arm’s l... READ MORE