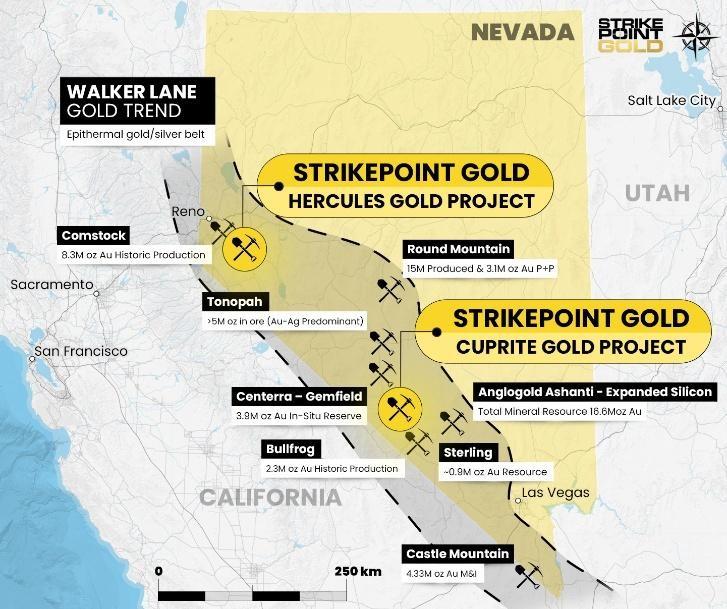

Strikepoint Gold – Nevada’s Walker Lane Trend

Starting in the early 2020’s, there has been a renaissance in Nevada’s Walker Lane gold trend, an area that wasn’t historically considered for “big” discoveries in Nevada. However mining giant AngloGold Ashanti proved this perception wrong with the discovery and development of the Extended Silicon discovery near Goldfield.

This richly endowed ground had sat idle for decades as it was the original railway access line to what was to become the largest nuclear waste depository in the USA, at Yucca Mountain, however this plan was scrapped and so the ground was aggressively staked and claimed by AngloGold who have now defined 16.6 million ounces at Silicon.

Another group that staked claims adjacent to Silicon on the Yucca Mountain access ground was Orogen Royalties, who ultimately sold that ground to Strikepoint Gold…more on that story in future emails.

Significant Corporate Activity in Walker Lane:

- AngloGold Ashanti acquires Corvus Gold $370m

- AngloGold Ashanti announces initial resource at Silicon Project (4.22Moz Au)*

- Centerra Acquires Gemfield Project for $206.5m

- AngloGold Ashanti acquires Sterling Project from Couer Mining for up to $200m, this asset was originally acquired by Strikepoint CEO Mike Allen with Northern Empire for US $10 M and sold 16 months later to Coeur Mining for C$120 million, at the peak share price for Northern Empire shareholders.

- AngloGold Ashanti announces 9Moz Au “Merlin” Discovery, bringing the Expanded Silicon/Merlin deposits to 16.6 million ounces.

- Orogen Royalties divests its 1% royalty on AngloGold Ashanti’s Expanded Silicon deposit for C$421m

Augusta Gold Acquired by AngloGold Ashanti C$197m for Bullfrog deposit (1.2 m oz Au and 2.8m oz Ag) and permitted Reward deposit

The one common element of these low suphidation epithermal deposits is that mineralization occurs along the margins of a volcanic caldera. StrikePoint assets are of no exception in the region, and almost mirrors that of Silicon. Note that the Walker Lane also hosts Tier 1 gold mines including Kinross’s Round Mountain Mine located approximately 130km north of Cuprite.

StrikePoint CEO Mike Allen “steals” back the Hercules deposit…

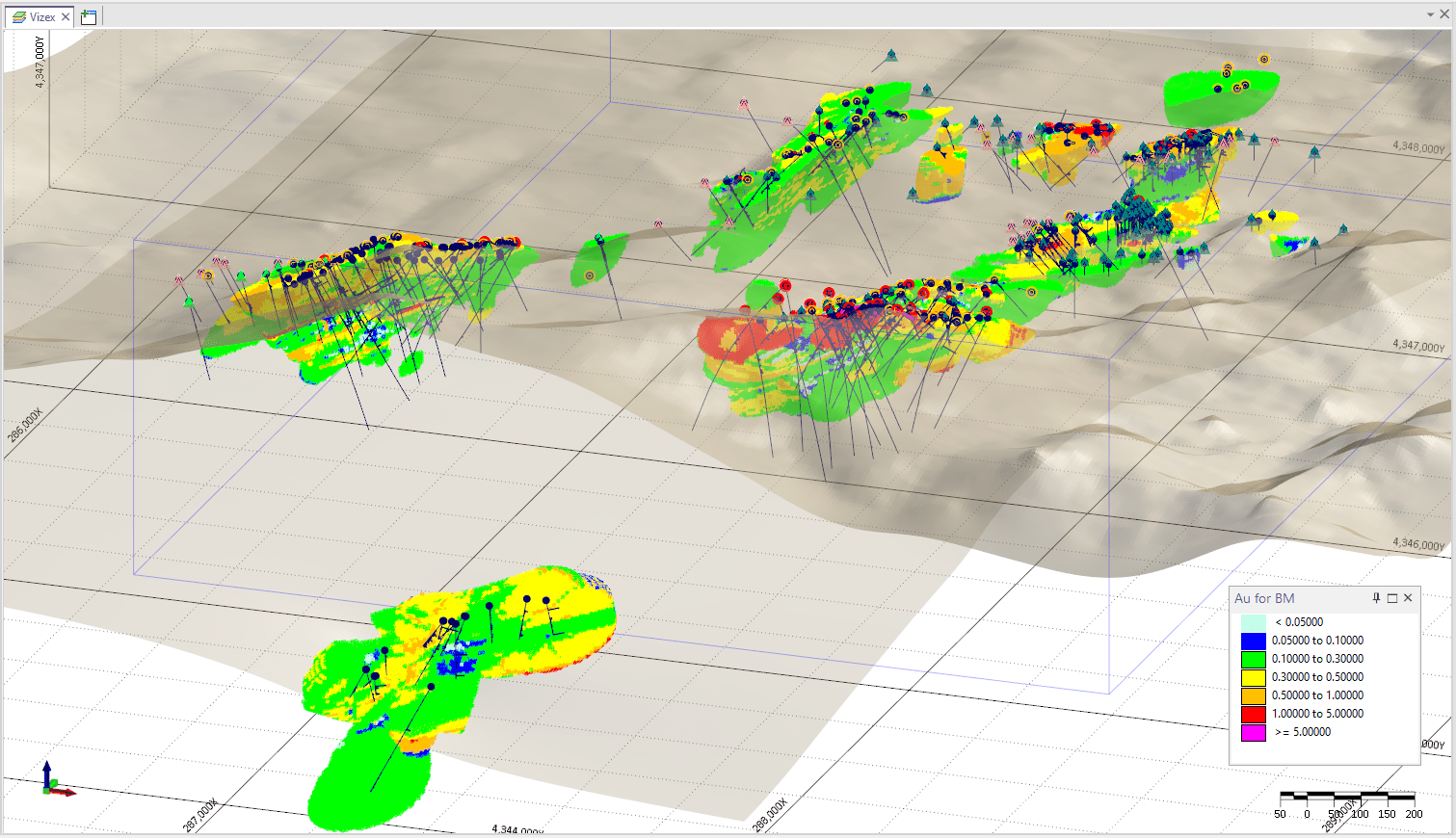

After the sale of Northern Empire’s Sterling deposit, Mike Allen launched Eclipse Mining which acquired the Hercules gold deposit, one hour southwest of Reno. The asset had been historically drilled with 260 holes on the 100km2 property. Allen and long time Nevada geological consultant Ron Kieckbusch unwound its geological mystery: essentially turning the rig from drilling parallel to the mineralizing structures to drilling across the structures for more ‘predictability’. In 2020-21, they drilled 40 successful drill holes all returning what is comparable to the economic intercepts of existing shallow oxide gold mines in Nevada. Intercepts included: 89.92m of 0.65 /g/t Au with 12.51 g/t Ag.

Even before these drill result were returned, Allen had sold Hercules for a valuation of US $25 million to a company which also had an operating mine in Arizona .

Flash forward 3 years and Allen had the opportunity to buy-back Hercules with StrikePoint from the struggling company that went into receivership for its failed Arizona mine…they never had an opportunity to drill Hercules, and now they had to sell it out receivership for $250.000, one penny on the dollar. Subsequently, StrikePoint disclosed an NI-43-101 Exploration Target on Hercules, it ranged between 819,000 to 1,018,000 oz Au at a grade between 0.48 and 0.63 g/t Au, all open for expansion and conversion to resources.

The company’s follow-up 1,400 metre drill campaign did well to prove the target ranges with gold/silver intervals including:

- 12.19m of 2.17 g/t Au and 9.55 g/t Ag, within 117.35m of 0.45 g/t Au and 3.55 g/t Ag

- 10.67m of 1.17 g/t Au and 18.13 g/t Ag starting at surface

- 44.20m of 0.35 Au and 4.34 g/t

According to CEO Mike Allen, “This drill program successfully demonstrated that the Hercules Gold Project has a predictable, large, epithermal footprint hosting abundant near surface oxide gold. Our geological model for the project has been confirmed and we believe that the mineralization at Hercules shows the grade and consistency to move forward with the project. Holes 5 and 6 were particularly interesting as they delivered strong mineralization at the southern extremes of the target areas, indicating that the mineralizing systems remain robustly open.”

This sets the stage for further drilling at Hercules, particularly targeting the southern extensions of the Hercules and Cliff Zones.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE