Discovery Reports 50,552 Ounces of Gold Production, $27.3 Million of Free Cash Flow¹ in Q2 2025

- TRANSFORMATIONAL QUARTER

- Acquired Porcupine Complex on April 15th, establishes Discovery as growing Canadian gold producer

- Finalized $575.0 million financing package, including $475.0M of royalty & equity financing, $100.0M senior debt facility

- Q2 2025 NET EARNINGS AND EPS

- Net earnings of $5.5M ($0.01/share) versus net loss of $5.1M ($0.01/share) in Q2 2024; Adjusted net earnings1 totaled $28.4 million or $0.04 per share

- INITIAL GOLD PRODUCTION IN Q2 2025

- 50,552 produced from April 16 – June 30; Production included 16,112 oz from Hoyle Pond, 27,286 oz from Borden and 7,154 oz from Pamour

- OPERATING CASH COSTS IN LINE WITH EXPECTATIONS

- Operating cash costs1,2 of $48.8M or $1,334/oz sold

- ATTRACTIVE MARGINS DRIVE PROFITABILITY AND CASH FLOW

- All-in sustaining costs (“AISC”)1,2 averaged $2,123/oz sold versus average realized gold price1 of $3,337/oz; Site-level AISC3 averaged $1,872/oz sold

- STRONG CASH FLOW FROM GOLD SALES

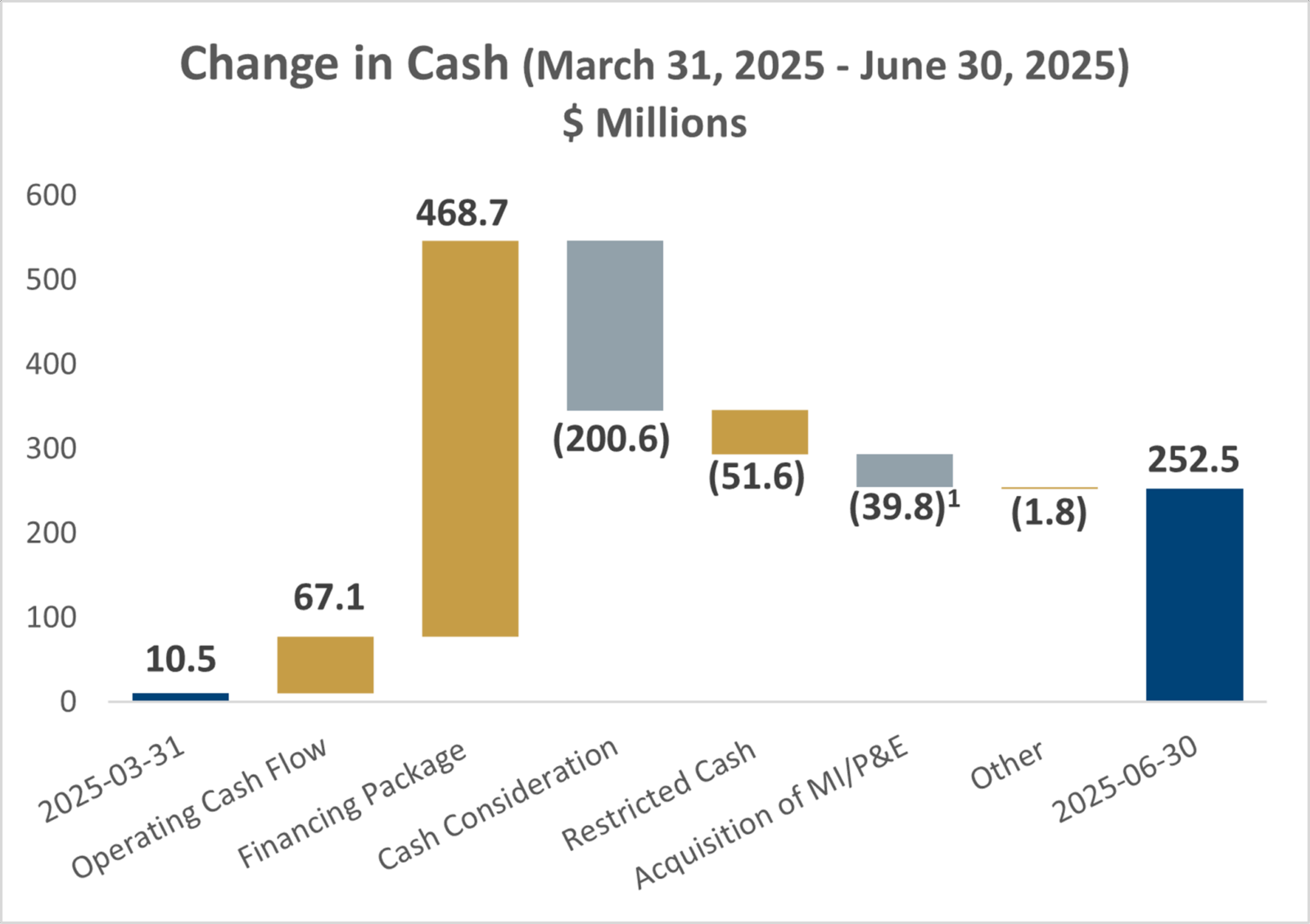

- Net cash from operating activities of $67.1M; Free cash flow1 of $27.3M

- SOLID CASH POSITION TO SUPPORT OPERATIONS AND GROWTH PLANS

- Cash at June 30, 2025, totaled $252.5M; with working capital of $225.9 million; Additional $100.0M of liquidity at June 30, 2025, through undrawn credit facility

- Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information.

2. Operating cash costs and AISC include results from the Hoyle Pond and Borden operating mines, as well as corporate expenditures where applicable. They do not include operating costs, capital expenditures, or gold ounces sold from Pamour, which is a capital project that continues to ramp up towards commercial levels of production.

3. Site-level AISC excludes corporate G&A expense, share-based compensation costs and corporate-level sustaining capital expenditures.

Discovery Silver Corp. (TSX: DSV, OTCQX: DSVSF) announced the Company’s financial and operating results for the second quarter and first six months of 2025. Q2 2025 represents the first quarter Discovery has reported the results of gold production and sales following the Company’s acquisition of the Porcupine Complex in and near Timmins, Ontario on April 15, 2025. The Company’s full financial statements and management discussion & analysis are available on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.discoverysilver.com. All dollar amounts are in US dollars, unless otherwise noted.

Tony Makuch, Discovery’s CEO, commented: “Q2 2025 was Discovery’s first quarter as a Canadian gold producer. During the quarter, we integrated systems, strengthened management structures and began implementing investment programs at Porcupine aimed at improving existing operations and pursuing growth opportunities. It was a significant challenge, and I want to thank our team for delivering a quarter of excellent progress. We also turned in a solid quarter of operating and financial performance, producing 50,552 ounces in the 76 days that we owned the assets. Gold sales of 42,550 ounces were below gold produced with the gold inventory at quarter end to be sold during Q3 2025. Net cash from operations totaled 67.1 million, while free cash flow was $27.3 million. Adjusted net earnings totaled $28.4 million or $0.04 per share.

“Key investment programs initiated during Q2 205 included investments at Dome Mill, mainly in the crushing, grinding and carbon handling circuits, advancing work at the Dome tailings management area continuing to ramp up Pamour, with pre-stripping and production levels meeting target levels, and commencing investments at Hoyle Pond and Borden to optimize and grow the operations. We also began deploying drills as part of an extensive exploration program targeting numerous near-mine and district targets at Hoyle Pond, Borden and Pamour, and supporting the evaluation of high-potential new sources of production, including the TVZ zone and the resumption of mining at Dome Mine.

“Looking ahead, we are targeting production levels to increase in the final two quarters of the year. We also plan to ramp up our capital investment and exploration programs as we move forward with our growth and value creation plans for Porcupine.”

SUMMARY OF Q2 2025 PERFORMANCE

| Three months ended | Six months ended | ||||||||||

| June 30, | June 30, | March 31 | June 30 | June 30, | |||||||

| 2025 | 2024 | 2025 | 2025 | 2025 | |||||||

| Revenue | $ | 142,010 | $ | – | $ | – | $ | 142,010 | $ | – | |

| Production costs | $ | 54,919 | – | – | 54,919 | – | |||||

| Earnings before income taxes | $ | 24,510 | (5,138) | (6,452) | $ | 18,058 | $ | (5,643) | |||

| Net earnings | $ | 5,534 | $ | (5,138) | $ | (6,452) | $ | (918) | $ | (5,643) | |

| Basic earnings per share | $ | 0.01 | $ | (0.01) | $ | (0.02) | $ | (0.00) | $ | (0.01) | |

| Diluted earnings per share | $ | 0.01 | $ | (0.01) | $ | (0.02) | $ | (0.00) | $ | (0.01) | |

| Cash flow from operating activities | $ | 67,081 | $ | (8,543) | $ | (6,075) | $ | 61,005 | $ | (11,014) | |

| Cash investment on mine development and PPE | $ | (39,766) | $ | (2,141) | $ | (3,767) | $ | (43,533) | $ | (5,448) | |

| Three months ended | Six months ended | ||||||||||

| June 30, | June 30, | March 31 | June 30 | June 30, | |||||||

| 2025 | 2024 | 2025 | 2025 | 2025 | |||||||

| Tonnes milled | 508,791 | – | – | 508,791 | – | ||||||

| Average Grade (g/t Au) | 3.39 | – | – | 3.39 | – | ||||||

| Recovery (%) | 91.3% | – | – | 91.3% | – | ||||||

| Gold produced (oz) | 50,552 | – | – | 50,552 | – | ||||||

| Gold sold (oz) | 42,550 | – | – | 42,550 | – | ||||||

| Average realized price ($/oz sold) | $ | 3,337 | $ | – | $ | – | $ | 3,337 | $ | – | |

| Operating cash costs per ounce sold ($/oz)(1)(2) | $ | 1,334 | $ | – | $ | – | $ | 1,334 | $ | – | |

| AISC per ounce sold ($/oz)(1)(2)(3) | $ | 2,123 | $ | – | $ | – | $ | 2,123 | $ | – | |

| Adjusted net earnings(1) | $ | 28,434 | $ | (2,107) | $ | (3,046) | $ | 25,338 | $ | (4,078) | |

| Adjusted net earnings per share(1) | $ | 0.04 | $ | (0.01) | $ | (0.01) | $ | 0.04 | $ | (0.01) | |

| Free cash flow(1) | $ | 27,314 | $ | (10,684) | $ | (9,842) | $ | 17,472 | $ | (16,462) | |

| (1) Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information. | |||||||||||

| (2) Consolidated operating cash costs per ounce sold and AISC per ounce sold include results from the Hoyle Pond and Borden operating mines, as well as corporate expenditures where applicable. They do not include operating costs, capital expenditures, or gold ounces sold from Pamour, which is a capital project that continues to ramp up towards commercial levels of production. | |||||||||||

| (3) YTD 2025 results exclude G&A expense, share-based compensation costs and sustaining capital expenditures and lease expense incurred prior to the April 15, 2025, the completion date of the Porcupine Acquisition. | |||||||||||

Q2 2025

- Revenue in Q2 2025 totaled $142.0 million that resulted from gold sales of 42,550 ounces at an average realized gold price¹ of $3,337 per ounce.

- EBITDA1,2 of $55.2 million compared to a loss before interest, taxes and depreciation and amortization of $5.1 million and $6.3 million in Q2 2024 and Q1 2025, respectively. The significant improvement in EBITDA performance resulted from revenue and earnings generated from gold sales following completion of the Porcupine Acquisition on April 15, 2025.

- Net earnings totaled $5.5 million ($0.01 per basic share) versus a loss of $5.1 million ($0.01 per basic share) in Q2 2024 and net loss of $6.5 million ($0.02 per basic share) in Q1 2025.

- Adjusted net earnings1 totaled $28.4 million ($0.04 per basic share) versus adjusted net loss of $3.0 million ($0.01 per basic share) in Q2 2024 and adjusted net loss of $3.0 million ($0.01 per basic share) the previous quarter; The difference between net earnings and adjusted net earnings reflected the after-tax impact of $16.6 million of acquisition-related costs, mainly for legal, consulting and advisory services, and other expenses, $6.8 million of foreign exchange losses and $2.4 million of transition-related costs involving the Porcupine Operations.

- Solid operating performance in initial quarter of production at Porcupine (April 16, 2025, to June 30, 2025):

- Production of 50,552 ounces, comprised of 16,112 ounces at Hoyle Pond, 27,286 ounces at Borden and 7,154 ounces at Pamour

- Gold poured totaling 46,608 ounces, with gold sales of 42,550 ounces

- Production costs of $54.9 million

- Operating cash costs1 averaging $1,334 per ounce sold

- All-in sustaining costs1 (“AISC”) averaging 2,123 per ounce sold; Site-level AISC averaging $1,872 per ounce sold (see the Operating Cash Costs and AISC tables in Non-GAAP Measures section near the end of this press release for more information).

- Cash flows included net cash provided by operating activities of $67.1 million, which compared to net used by operations activities of $8.5 million and $6.1 million in Q2 2024 and Q1 2025, respectively.

- Free cash flow1 totaled $27.3 million versus free cash flow of ($10.7) million in Q2 2024 and ($9.8) million in Q1 2025.

- Capital expenditures1 totaled $44.2 million, with sustaining capital expenditures1 accounting for $16.1 million and growth capital expenditures1 totaling $28.1 million; Sustaining capital expenditures largely focused on capital development at Hoyle Pond and Borden and construction work to raise and buttress the No. 6 tailings impoundment area, while the $28.1 million of growth capital expenditures related to pre-stripping at Pamour, with the remainder largely related to longer-term investments at the TMA.

| CAPITAL EXPENDITURES | |||||||||

| $ thousands unless otherwise states | Hoyle Pond | Borden | Pamour | Porcupine1 | Cordero | Corporate | Total | ||

| Sustaining | $5,743 | $9,032 | $- | $14,775 | $- | $1,347 | $16,122 | ||

| Growth | 1,854 | 2,665 | 22,338 | 26,857 | 1,196 | – | 28,053 | ||

| Total | $7,597 | $11,697 | $22,338 | $41,632 | $1,196 | $1,347 | $44,175 | ||

| 1. Capital expenditures incurred at Dome Mill and the TMA are allocated to Porcupine’s mining operations based on their proportion of mill fee provided to Dome Mill. | |||||||||

- Cash at June 30, 2025 totaled $252.5 million reflecting approximately $475.0 million of gross proceeds ($468.7 million of net proceeds after share issue costs) from a financing package (the “Financing Package”) arranged in conjunction with the Porcupine Acquisition, as well as $67.1 million of net cash from operating activities generated during Q2 2025, partially offset by $200.6 million of cash consideration paid for the Porcupine Operations at closing, the $44.2 million of capital expenditures during Q2 2025, as well as the impact of $51.6 million of restricted cash related to letters of credit and cash collateral for government required financial assurances in relation to closure plans involving the Porcupine assets.

- The difference between the $39.8 million of Acquisitions of mineral interests, property and equipment and total capital expenditures of $44.2 million relates to the timing of cash expenditures relative to the accrual of capital expenditures for accounting purposes.

- Working capital1 at June 30, 2025, totaled $225.9 million as compared to working capital of $17.0 million at December 31, 2024. The working capital balance at June 30, 2025, reflected the significant increase in cash during Q2 2025 as well as higher levels of short-term trade and other receivables and inventories, offset by higher current liabilities, mainly accounts payable and accrued liabilities, reclamation liabilities, deferred revenue, current income tax and employee-related benefits.

YTD 2025

Discovery did not generate revenue or earnings from mine operations in Q1 2025 or YTD 2024.

- Net loss for YTD 2025 totaled $0.9 million, or $0.00 per basic share, compared to net loss of $5.6 million, or $0.01 per basic share, in YTD 2024.

- Adjusted net earnings¹ and adjusted net earnings per basic share¹ were $25.4 million and $0.04, respectively, which compared to adjusted net loss and adjusted net loss per basic share of $4.5 million and $0.01, respectively, in YTD 2024. The difference between net earnings and adjusted net earnings¹ in YTD 2025 mainly reflected the exclusion from adjusted net earnings of the after-tax impact of $20.2 million of business development expenses related to the Porcupine Acquisition, $6.7 million of foreign exchange losses, as well as $2.4 of one-time transition-related costs.

- EBITDA¹,² for YTD 2025 totaled $48.9 million versus a loss before interest, taxes and depreciation and amortization of $5.6 million in YTD 2024. The difference between net earnings and EBITDA mainly reflected the exclusion from EBITDA of $16.4 million of depletion and depreciation expense, $14.4 million of net finance costs, largely due to accretion expense from reclamation and deferred consideration and interest expense related to royalty agreements entered into with Franco-Nevada Corp. concurrent with the completion of the Porcupine Acquisition, and $19.0 million of income tax expense.

- Net cash provided by operating activities in YTD 2025 totaled $61.0 million, while free cash flow¹ totaled $17.5 million.

- Total capital expenditures¹ for YTD 2025 totaled $48.1 million, including $16.2 million of sustaining capital expenditures¹, $31.1 million of growth capital expenditures¹ and $0.8 million related to financial leases. Sustaining capital expenditures were incurred during Q2 2025 following the completion of the Porcupine Acquisition. Of growth capital expenditures in YTD 2025, $26.9 million related to Porcupine, with $4.2 million related to Cordero, largely for land acquisition during Q1 2025.

(1) Example of Non-GAAP measure. See the section of this press release entitled, “NON-GAAP MEASURES” for more information.

(2) Refers to earnings before interest, taxes and depreciation and amortization.

|

INCOME STATEMENT SUMMARY |

|||||||||||

| $ thousands unless otherwise states | Three months ended | Six months ended | |||||||||

| June 30, | June 30, | March 31 | June 30 | ||||||||

| 2025 | 2024 | 2025 | 2025 | June 30, 2025 |

|||||||

| Revenue | $ | 142,010 | $ | – | $ | – | $ | 142,010 | $ | – | |

| Production costs | 54,919 | – | – | 54,919 | – | ||||||

| Depletion and amortization | 16,384 | – | – | 16,384 | – | ||||||

| Royalties | 1,916 | – | – | 1,916 | – | ||||||

| Earnings from mining operations | 68,791 | – | – | 68,791 | – | ||||||

| Expenses | |||||||||||

| General and administration | 22,877 | 1,827 | 5,474 | 28,351 | 3,641 | ||||||

| Exploration | 830 | 103 | 25 | 855 | 217 | ||||||

| Share-based compensation | 1,953 | 692 | 1,167 | 3,120 | 1,346 | ||||||

| Earnings (loss) from operations | 43,131 | (2,622) | (6,666) | 36,465 | (5,204) | ||||||

| Other | |||||||||||

| Other income (loss) | (6,879) | (3,012) | 189 | (6,690) | (1,451) | ||||||

| Finance items | |||||||||||

| Finance income (cost), net | (11,742) | 496 | 25 | (11,717) | 1,012 | ||||||

| Earnings (loss) before taxes | 24,510 | (5,138) | (6,452) | 18,058 | (5,643) | ||||||

| Income taxes expense (recovery) | 18,976 | – | – | 18,976 | – | ||||||

| Net earnings (loss) | $ | 5,534 | $ | (5,138) | $ | (6,452) | $ | (918) | $ | (5,643) | |

| Basic earnings per share | $ | 0.01 | $ | (0.01) | $ | (0.02) | $ | (0.00) | $ | (0.01) | |

| Diluted earnings per share | $ | 0.01 | $ | (0.01) | $ | (0.02) | $ | (0.00) | $ | (0.01) | |

| Weighted average number of common shares outstanding (in 000’s) | |||||||||||

| Basic | 735,616 | 397,570 | 401,122 | 569,293 | 396,771 | ||||||

| Diluted | 762,923 | 397,570 | 411,049 | 596,600 | 396,771 | ||||||

PORCUPINE OPERATIONS REVIEW

Discovery’s Porcupine Operations cover approximately 1,400 km2 in and near Timmins, Ontario. Porcupine consists of the Hoyle Pond, Pamour and Hollinger mine properties, the Dome mine property and milling facility, and numerous near-mine and regional exploration targets. The Complex also includes the Borden mine property and large land position near Chapleau, Ontario. Current operations include the Hoyle Pond and Borden underground mines, with the Pamour open-pit project currently ramping up towards commercial levels of production. All mineralization from the operating mines, and Pamour, is processed at Dome, including mineralization from Borden, which is trucked 190 km to the Dome Mill.

DOME MILL

The current Dome Mill was commissioned in 1988, with expansion projects being completed in 1995 and 2004. The mill consists of three-stage crushing, two parallel rod mill and ball mill circuits, a single leach and Carbon-in-Pulp circuit, followed by a carbon strip and electrowinning circuit. The Mill’s nameplate operating capacity is approximately 12,000 tonnes per day (approximately 4.3 million tonnes per annum). In recent years, the mill has operated at rates well below capacity levels, largely reflecting increased maintenance requirements which contributed to reduced availability and utilization rates, as well as production shortfalls from mining operations. Through investment programs launched following the closing of the Porcupine Acquisition, the Company is targeting a return to full capacity operations by 2028 or sooner.

| Three months ended | |||

| Dome Mill | June 30, 2025 | ||

| Total material milled (t) | 508,791 | ||

| Average Grade (g/t Au) | 3.39 | ||

| Recovery (%) | 91.3% | ||

| Gold produced (oz) | 50,552 | ||

| Gold poured (oz) | 46,608 | ||

| Gold sold (oz) | 42,550 | ||

| Milling operating costs ($ Millions) | $ | 12,861 | |

| Operating costs per tonne processed ($/tonne) | $ | 25.4 | |

For the period April 16, 2025, to June 30, 2025, a total of 508,791 tonnes were processed at Dome Mill at an average grade of 3.39 g/t, with recovery rates averaging 91.3%. A total of 50,552 ounces of gold were produced over this period, with total gold poured of 46,608 ounces. Availability rates at the Dome Mill during Q2 2025 were impacted by a two-week maintenance shutdown, previously scheduled by the prior owner, for the purpose of replacing equipment in the thickening tank. The Company used the occasion of the shutdown to advance multiple other projects, primarily in the crushing, grinding and carbon handling circuits. Based on operating days during Q2 2025, mill throughput averaged approximately 8,500 tonnes per day. Mill operating costs during Q2 2025 totaled $12.9 million for an average of $25.4 per tonne processed. These costs are allocated to the mine operations based on a proportion of total tonnes processed basis.

For the purpose of segment reporting, capital expenditures¹ for Dome Mill and the TMA are allocated to Hoyle Pond, Borden and Pamour based on a proportion of total tonnes processed basis. Capital expenditures allocated during Q2 2025 totaled $16.5 million. The majority of these capital expenditures related to the TMA, with work during the quarter largely focused on raising and buttressing the existing dam walls and constructing seepage collection systems.

HOYLE POND

Hoyle Pond Mine is an underground gold mining operation located within the Archean Abitibi Greenstone Belt approximately 20 km northeast of downtown Timmins, Ontario. Underground infrastructure includes two decline ramps, an 815-metre four-compartment shaft (“#1 Shaft”) and a 1,350 metre winze (the “#2 Winze”) with the deepest station being on the 1600-metre level. Underground production is trucked to the #2 Winze and is then hoisted to the 720 level, where it is sent by tram to the loading pocket of the #1 Shaft. Mineralization is then trucked approximately 17 km to Dome Mill. The mine began operations in 1985 and, since that time, has produced over 4.0 million ounces of gold.

| Three months ended | |||

| Hoyle Pond | June 30, 2025 | ||

| Total material milled (t) | 97,817 | ||

| Average Grade (g/t Au) | 5.50 | ||

| Gold Contained (oz) | 17,297 | ||

| Recovery (%) | 93.1% | ||

| Gold produced (oz) | 16,112 | ||

| Gold sold (oz) | 14,804 | ||

| Development metres – operating | 526 | ||

| Development metres – capital | 180 | ||

| Production costs | $ | 20,870 | |

| Operating cash costs per ounce sold1 | $ | 1,566 | |

| AISC per ounce sold1 | $ | 2,036 | |

| Total capital expenditures1 (in thousands) | $ | 7,597 | |

| (1) Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information. | |||

Gold production at Hoyle Pond from April 16, 2025, to June 30, 2025, totaled 16,112 ounces, which resulted from 97,817 tonnes being processed at an average grade of 5.50 g/t and average recoveries of 93.1%. Production during the quarter was primarily from the Lower S Zone on the 1965 and 1985 levels. A total of 45,160 tonnes were mined from April 16, 2025, to the end of Q2 2025, for an average mining rate of 594 tonnes per day. During Q2 2025, 52,657 tonnes of stockpiled material from Hoyle Pond were milled, which resulted in higher than planned tonnes milled for the quarter and a lower than expected average grade. The Company does not anticipate processing significant amounts of low-grade stockpiles from Hoyle Pond during the second half of 2025.

Operating development metres during Q2 2025 were mainly focused on the main production areas in the Lower S Zone, as well as in areas of the Upper Mine, where production from narrow, high-grade veins is expected to commence during the second half of 2025. Capital development activities during the quarter mainly involved continuing to extend the main ramp to depth in the Lower S Zone.

Production costs, including mining and processing costs, in Q2 2025 totaled $20.9 million, with operating cash costs averaging $1,566 per ounce sold¹. AISC¹ for the quarter averaged $2,036 per ounce sold, which included $5.7 million of sustaining capital expenditures¹, mainly related to capital development activities as well as Hoyle Pond’s allocation of capital expenditures¹ related to the TMA.

BORDEN

Borden Mine is a ramp access underground mine located on a 1,000 km2 land position approximately 20 km east of Chapleau, Ontario. The deposit mine is located within the lower limb of an antiform in the Borden Lake Greenstone Belt. Production at Borden commenced in 2019 and, to date, approximately 600,000 ounces have been produced. Mining is carried out at Borden using the longhole stoping method with unconsolidated as well as cemented rock fill. Material is trucked from underground to surface and then from the mine site approximately 190 km to the Dome Mill.

| Three months ended | |||

| Borden | June 30, 2025 | ||

| Total material milled (t) | 166,609 | ||

| Average Grade (g/t Au) | 5.62 | ||

| Gold Contained (oz) | 30,118 | ||

| Recovery (%) | 90.6% | ||

| Gold produced (oz) | 27,286 | ||

| Gold sold (oz) | 21,792 | ||

| Development metres – operating | 449 | ||

| Development metres – capital | 204 | ||

| Production costs | $ | 22,038 | |

| Operating cash costs per ounce sold1 | $ | 1,175 | |

| AISC per ounce sold1 | $ | 1,621 | |

| Total capital expenditures1 (in thousands) | $ | 11,697 | |

| (1) Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information. | |||

Gold production at Borden from April 16, 2025, to June 30, 2025, totaled 27,286 ounces, which resulted from 166,609 tonnes being processed at an average grade of 5.62 g/t and average recoveries of 90.6%. Production during Q2 2025 was mainly in the West and Central zones. A total of 123,743 tonnes of mineralization were mined from April 16, 2025, to the end of Q2 2025, for an average mining rate of 1,628 tonnes per day. Mining rates are expected to increase in the second half of 2025 as investments in new trucks and other equipment results in improved availability and utilization rates.

Operating development during the quarter was mainly focused on the West, Central and Upper East Zones, with capital development metres primarily related to the continued advancement of the main ramp and the exploration drift on the 575 level.

Production costs in Q2 2025 totaled $22.0 million, with operating cash costs per ounce¹ averaging $1,175 per ounce sold. AISC¹ averaged $1,621 per ounce sold for the quarter. Sustaining capital expenditures¹ totaled $9.0 million, with capital development accounting for $5.7 million and the remainder related to allocated TMA expenditures, as well as investments in infrastructure, including an upgrade of the slurry plant, and new equipment to optimize the mining fleet.

PAMOUR

Pamour mine, located approximately 20 km from downtown Timmins, first commenced underground mining in 1911 and was operated until 1996. Open-pit mining operations were initiated in 2006 and ceased in 2011. The project to re-develop and expand the Pamour open pit, and resume operations, commenced in 2023, with initial production achieved early in 2025 and project continuing to ramp up towards commercial production levels.

| Three months ended | |||

| Pamour | June 30, 2025 | ||

| Total material milled (t) | 244,366 | ||

| Average Grade (g/t Au) | 1.02 | ||

| Gold Contained (oz) | 7,976 | ||

| Recovery (%) | 89.7% | ||

| Gold produced (oz) | 7,154 | ||

| Gold sold (oz) | 6,051 | ||

| Production costs | $ | 12,011 | |

| Operating cash costs per ounce sold1 | $ | 2,051 | |

| AISC per ounce sold1 | $ | 2,194 | |

| Total capital expenditures1 (in thousands) | $ | 22,338 | |

| (1) Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information. | |||

Gold production at Pamour from April 16, 2025, to June 30, 2025, totaled 7,154 ounces, which resulted from 244,366 tonnes being processed at an average grade of 1.02 g/t and average recoveries of 89.7%. Significant pre-stripping continued during Q2 2025 as the mine continued development towards full production. A total of 104,000 tonnes of mineralization and 2.7 million tonnes of waste were mined from April 16, 2025, to June 30, 2025. Mill feed during Q2 2025 was mainly from Bench 19 of the Phase 1 Open Pit, with production from Bench 13 commencing late in the quarter. Mill feed from Pamour is expected to increase significantly in the second half of 2025, with the strip ratio expected to average below 10:1 during the final quarter of the year. In addition to mine production, 132,000 tonnes were processed from stockpiles in Q2 2025 at an average grade of 1.10 g/t for 4,650 ounces. The stockpiles processed included material from both Pamour as well as from the Hollinger open pit, where mining ceased late in 2024.

Production costs in Q2 2025 totaled $12.0 million. Operating cash costs¹ averaged $2,051 per ounce sold, while AISC¹ averaged $2,194 per ounce sold. All capital expenditures¹ at Pamour in Q2 2025 were growth capital expenditures¹ and related mainly to pre-stripping and allocated TMA capital expenditures.

(1) Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information.

CORDERO OVERVIEW

The Cordero Project was acquired by Discovery in 2019. Since that time, the Company has invested over a $100.0 million in Mexico, conducting significant exploration drilling and technical analysis, leading to the release of multiple studies, most recently the Feasibility Study (“FS”) dated February 16 2024 and filed on SEDAR+ (www.sedarplus.ca) on March 28, 2024. The results of the FS confirmed Cordero to be one of the world’s largest undeveloped silver deposits, with the potential for large-scale production at low unit costs and that is capable of generating substantial free cash flow and attractive economic returns.

Key highlights of the FS include:

- Average annual production of 37.0 million silver equivalent ounces (“AgEq”) over the first 12 years with a total project life of 19 years;

- All-in sustaining costs1 averaging below $12.50 per AgEq ounce in Years 1 – 8;

- Base-case after-tax net present value (“NPV”) of $1.2 billion (Base-case metal prices: Silver – $22.00 per ounce; Gold – $1,600 per ounce; Zinc – $1.20 per ounce; Lead – $1.00 per ounce);

- Initial capital expenditures1 of $606.0 million (resulting in a NPV to capital ratio of 2:1);

- Large-scale Mineral Reserve totaling 302.0 million ounces of silver, 840,000 ounces of gold, 5.2 billion pounds of zine and 3.0 billion pounds of lead;

- Important socio-economic contribution to Mexico, including an initial investment of over $600 million, the creation of 2,500 jobs during development, and over 1,000 jobs during operations, $4.0 billion in total procurement, all to remain within Mexico, and, assuming a fixed $35.00 per ounce silver price, total tax contributions within Mexico of $2.4 billion over the project life; and,

- High levels of environmental responsibility and a commitment to contributing to the management of key social issues such as carbon reduction and water quality and availability.

Second Quarter 2025 Highlights

During Q2 2025, Discovery continued work on key initiatives to further de-risk the project, including:

- Assessing the potential to use natural gas power sources versus the grid power supply;

- Advancing geotechnical and other work related to the planned upgrade of the local water treatment plant; and,

- Evaluating the potential to establish solar farms around the project site to contribute to the power supply required for mine development and operation.

(1) Example of Non-GAAP measure. See the section in this press release entitled, “NON-GAAP MEASURES” for more information.

OUTLOOK

With the closing of the Porcupine Acquisition on April 15, 2025, Discovery was transformed into a diversified North American-focused precious metals producer combining growing gold production in Northern Ontario, Canada, with one of the world’s largest silver development projects in Chihuahua State, Mexico. In Q2 2025, the Company commenced reporting gold production from the Hoyle Pond and Borden underground mines, as well as from the ramp up of gold production at the Pamour open-pit project.

Key priorities for the Porcupine Operations over the balance of 2025 include:

- Implementing investment plans aimed at growing mining rates, increasing production levels and lowering unit costs at Hoyle Pond and Borden;

- Ensuring the successful ramp up of production at Pamour;

- Advancing studies on the TVZ zone, Dome Mine project and Dome Mill expansion; and,

- Advancing numerous exploration opportunities at each of site, as well as at regional targets.

The Company is targeting a total of 140,000 metres of drilling in 2025. The goals for the drilling program include resource conversion at Hoyle Pond, Borden and Pamour, in support of establishing an initial reserve statement for the three mines during 2026. In addition, drilling will also target resource conversion at the Dome Mine as part of a study to update the Inferred Mineral Resource included in the technical report filed on SEDAR+ on January 28, 2025 entitled, “Porcupine Complex, Ontario, Canada, Technical Report on Preliminary Economic Assessment.” The Company is also planning a drill program at the TVZ Zone with a goal of releasing an initial mineral resource in the first half of 2026.

As of the date of this press release, the Company is well capitalized to fund growth and optimization plans for Porcupine and current expenditure plans at Cordero with total cash of approximately $279.0 million.

In Mexico, following release of the Cordero FS, the Company has conducted a limited work program aimed at further advancing and de-risking the Project, with key areas of focus being power, water availability and management, permitting, and continuation of ESG and community outreach programs.

Following the completion of the land acquisition program in March 2025, the next major milestone for the Cordero will be approval of the Company’s Environmental Impact Assessment or MIA by SEMARNAT, which was submitted in August 2023. The MIA passed SEMARNAT’s legal review soon after its submission and was advanced for technical review. As of the date of this, the Company had completed the technical review process and was awaiting approval of the MIA. The Company remains confident that Cordero will receive MIA approval.

ABOUT DISCOVERY

Discovery is a growing North American-focused precious metals company. The Company has exposure to silver through its first asset, the 100%-owned Cordero project, one of the world’s largest undeveloped silver deposits, which is located close to infrastructure in a prolific mining belt in Chihuahua State, Mexico. On April 15, 2025, Discovery completed the acquisition of the Porcupine Complex from Newmont Corporation, transforming the Company into a new Canadian gold producer with multiple operations in one of the world’s most renowned gold camps in and near Timmins, Ontario. Discovery owns a dominant land position within the camp, with a large base of Mineral Resources remaining and substantial growth and exploration upside.

MORE or "UNCATEGORIZED"

Aldebaran Announces Closing of $40 Million Bought Deal Offering

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

Erdene Announces Closing of $25 Million Bought Deal Private Placement

Erdene Resource Development Corp. (TSX:ERD) (MSE:ERDN) (OTCQX: ER... READ MORE

NOVAGOLD Announces Closing of Upsized Bought Deal for Gross Proceeds of US$310 Million

NOVAGOLD RESOURCES INC. (NYSE: NG) (TSX: NG) is pleased to report... READ MORE

Guanajuato Silver Sees Significant Growth in Resources at Valenciana

~ Inferred Mineral Resources Increased by 630% to 20.3M AgEq Ounc... READ MORE

Copper Quest Increases and Closes Unit Offering for Total Gross Proceeds of $2,099,890

Copper Quest Exploration Inc. (CSE: CQX) (OTCQB: IMIMF) (FRA: 3MX... READ MORE