ARIS MINING REPORTS Q2 2025 RESULTS

Higher Gold Sales, Record Adjusted EBITDA & Earnings, and Significant Growth in Cash

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its financial and operating results for the three and six months ended June 30, 2025. In addition, the Company announces the publication of its 2024 Sustainability Report, which is available for review on our website. All amounts are in U.S. dollars unless otherwise indicated.

Q2 2025 Financial Performance

- Record revenue of $200.2 million, up 30% from Q1 2025 and 75% from Q2 2024, driven by higher gold prices and increased sales volumes.

- Cash balance increased to $310 million as of June 30, 2025, up from $240 million at March 31, 2025 as a result of strong cash flow generation from operations and proceeds from ARIS.WT.A warrant exercises. After June 30, 2025, the Company received an additional $60.5 million from the exercise of these warrants, which expired on July 29. In total, 98.7% of the warrants were exercised, generating $114.8 million in proceeds.

- Adjusted EBITDA1 of $98.7 million, up 48% from Q1 2025 and nearly triple Q2 2024. On a trailing 12-month basis, Adjusted EBITDA1 has reached $264.0 million.

- Growth capital investment of $36.7 million, supporting long-term expansion, primarily at the Marmato Bulk Mining Zone ($23.6 million) and Segovia ($6.9 million).

- Record adjusted net earnings of $47.8 million or $0.27/share – the highest since Aris Mining’s formation in September 2022 – up from $0.16/share in Q1 2025 and $0.08/share in Q2 2024.

Neil Woodyer, CEO, commented “With record adjusted net earnings, over $310 million in cash, and the commissioning of the second mill at Segovia, we are well‑positioned for stronger production in the second half of 2025 while advancing construction of the Marmato Bulk Mining Zone and technical studies at Soto Norte and Toroparu, which underpin a compelling growth pipeline. The expiry of the ARIS.WT.A warrants on July 29 has simplified our capital structure and eliminated a source of non‑cash earnings volatility. We remain firmly on track to become a leading intermediate gold producer in Latin America with a highly attractive profile for investors.”

| Q2 2025 | Q1 2025 | Q2 2024 | |

| Gold production ounces (oz), total | 58,652 | 54,763 | 49,216 |

| Gold sold (oz), total | 61,024 | 54,281 | 49,469 |

| Segovia – AISC, Owner Mining ($/oz sold) | $1,520 | $1,482 | $1,616 |

| Segovia – CMP AISC Margin | 42 % | 41 % | 34 % |

| EBITDA | $31.6M | $39.7M | $30.8M |

| Adjusted EBITDA | $98.7M | $66.6M | $36.1M |

| Adjusted EBITDA, last 12 months | $264.0M | $201.3M | $144.6M |

| Net earnings (loss)2 | $(16.9)M3 or $(0.09)/share | $2.4M or $0.01/share | $5.7 or $0.04/share |

| Adjusted earnings | $47.8M or $0.27/share | $27.2M or $0.16/share | $12.7 or $0.08/share |

| Adjusted earnings, last 12 months | $112.7M or $0.65/share | $77.7M or $0.46/share | $42.9M or $0.31/share |

Q2 2025 Operational Performance

- Gold production totaled 58,652 oz, a 7% increase from 54,763 oz in Q1 2025. Production is expected to progressively increase in H2 2025 following the June 2025 commissioning of the second mill at Segovia.

- Marmato Narrow Vein Zone produced 7,125 oz, a 29% increase over Q2 2024 and consistent with Q1 2025 production levels.

- Segovia Operations produced 51,527 oz, supported by gold grades of 9.9 g/t and gold recoveries of 96.1%.

- AISC margin increased to $87.2 million, up 43% from Q1 2025. On a trailing 12-month basis, AISC margin has reached $250.4 million.

- Owner-operated Mining AISC was $1,520/oz (Q1 2025: $1,482/oz), bringing H1 2025 average to $1,503/oz, tracking toward the lower end of the full year 2025 guidance range of $1,450 to $1,600.

- Contract Mining Partner (CMP) sourced gold delivered an AISC sales margin of 42%, contributing to a 41% margin for H1 2025. This is above the full-year 2025 guidance range of 35% to 40%.

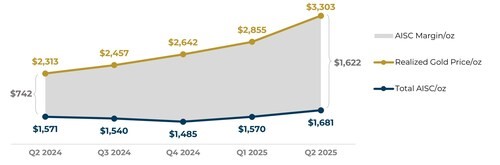

- Total AISC increased to $1,681/oz (Q1 2025: $1,570), primarily due to higher gold prices, which increased costs related to material purchased from CMPs, together with royalties and social contributions tied to gold sales.

| Total Segovia Operating Information | Q2 2025 | Q1 2025 | Q2 2024 | ||

| Average realized gold price ($/oz sold) | $3,303 | $2,855 | $2,313 | ||

| Tonnes milled (t) | 167,960 | 167,150 | 155,912 | ||

| Average tonnes milled per day (tpd) | 1,976 | 1,966 | 1,834 | ||

| Average gold grade processed (g/t) | 9.85 | 9.37 | 9.14 | ||

| Gold produced (oz) | 51,527 | 47,549 | 43,705 | ||

| Gold sold (oz) | 53,751 | 47,390 | 43,366 | ||

| AISC margin ($M) | 87.2 | 60.9 | 32.2 | ||

| Segovia Operating Information by Segment | Q2 2025 | Q1 2025 | Q2 2024 | ||

| Owner Mining | |||||

| Gold sold (oz) | 32,685 | 26,963 | 20,183 | ||

| Cash costs – ($/oz sold) | $1,047 | $1,123 | 1,222 | ||

| AISC – ($/oz sold) | $1,520 | $1,482 | 1,616 | ||

| AISC margin ($M) | 57.8 | 37.0 | 14.1 | ||

| CMPs | |||||

| Gold sold (oz | 21,066 | 20,427 | 23,183 | ||

| Cash costs – ($/oz sold) | $1,622 | $1,431 | 1,367 | ||

| AISC – ($/oz sold) | $1,931 | $1,687 | 1,532 | ||

| AISC sales margin (%) | 42 % | 41 % | 34 % | ||

| AISC margin ($M) | 29.4 | 23.9 | 18.1 | ||

| * Aris Mining operates its own mines and contracts with community-based mining partners, referred to as Contract Mining Partners (CMPs), to increase total gold production. Some partners work within Aris Mining’s infrastructure, while others manage their own mining operations on Aris Mining’s titles using their own infrastructure. In addition, Aris Mining purchases high grade mill feed from third-party contractors operating off-title, which further optimizes production and increases operating margins. | |||||

Growth and Expansion Updates

- Strong cash generation funding growth:

- Operations generated $74.6 million in cash flow after sustaining capital and income taxes in Q2 2025, fully funding all growth and expansion initiatives. After expansion capital, Aris Mining generated $37.9 million in net cash flow. See the Quarterly cash-flow summary in the following sections for additional cash flow analysis.

- Segovia expansion progressing well:

- Commissioning of the second ball mill in June 2025 marked a major milestone. The expanded plant capacity is expected to steadily increase gold production throughout H2 2025.

- As underground development advances and mill feed from contract mining partners increases, Segovia remains on track to achieve annual production of 210,000 to 250,000 ounces this year and targeting 300,000 ounces next year.

- $6.9 million was invested in Q2 2025 to support the plant expansion, underground development, and exploration activities.

- Marmato Bulk Mining Zone construction advancing:

- The Bulk Mining Zone is a large, porphyry-hosted gold-silver system with wide, continuous mineralized zones that support bulk underground mining methods. Extensive drilling has defined a large mineral resource, and the deposit remains open at depth and along strike.

- Decline development to access the Bulk Mining Zone is underway.

- Earthworks for the main substation are completed and earthworks for the carbon-in-pulp (CIP) plant platforms are nearing completion.

- Equipment deliveries continued through the quarter, including major components such as crushers, mills, and tailings filters.

- $23.6 million was invested in Q2 2025.

- The project remains on schedule, with first ore and production ramp up expected in H2 2026.

- Soto Norte Project:

- A new Pre-Feasibility Study (PFS) is underway, with completion expected in Q3 2025. The PFS incorporates a smaller-scale development plan and includes processing options designed to support local small-scale miners.

- Upon completion of the PFS, Aris Mining intends to finalize and submit the required studies to apply for an environmental license for the development of Soto Norte.

- Toroparu Project:

- A new Preliminary Economic Assessment (PEA) is underway to evaluate updated development options. Following the March 2023 mineral resource update, Aris Mining completed infrastructure optimization studies that strengthen the development plan. The PEA is expected to be completed in Q3 2025.

|

Endnotes |

| 1 All references to adjusted earnings, EBITDA, adjusted EBITDA, growth capital investment, cash flow after sustaining capital and income taxes, cash costs and AISC are non-GAAP financial measures in this document. These measures are intended to provide additional information to investors. They do not have any standardized meanings under IFRS, and therefore may not be comparable to other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Refer to the Non-GAAP Measures section in this document for a reconciliation of these measures to the most directly comparable financial measure disclosed in the Company’s financial statements. |

| 2 Net earnings represents net earnings attributable to owners of the company, as presented in the annual and interim financial statements for the relevant period. |

| 3 A $45.5 million non-cash loss was recognized in Q2 2025 from fair value adjustments to the Company’s warrant liability, valued at $40.8 million as of June 30, 2025. The fair value of the liability is directly correlated to the Company’s share price, which increased by 38% during Q2 2025 (year-to-date: 82% increase). In July 2025, the Company received an additional $60.5 million in cash proceeds from exercises of these warrants. With these exercises and the July 29, 2025 expiry of the remaining outstanding warrants, the liability has been fully extinguished, removing a source of non-cash earnings volatility from future results. |

About Aris Mining

Founded in September 2022, Aris Mining was established with a vision to build a leading Latin America-focused gold mining company. Our strategy blends current production and cashflow generation with transformational growth driven by expansions of our operating assets, exploration and development projects. Aris Mining intends to unlock value through scale and diversification. The Company is listed on the TSX (ARIS) and the NYSE-A (ARMN) and is led by an experienced team with a track record of value creation, operational excellence, financial discipline and good corporate governance in the gold mining industry.

Aris Mining operates two underground gold mines in Colombia: the Segovia Operations and the Marmato Complex, which together produced 210,955 ounces of gold in 2024. With expansions underway, Aris Mining is targeting an annual production rate of more than 500,000 ounces of gold, following the commissioning of the secondmill at Segovia, completed in June and ramping up during H2 2025, and the construction of the Bulk Mining Zone at the Marmato Complex, expected to start ramping up production in H2 2026. In addition, Aris Mining operates the 51% owned Soto Norte joint venture, where studies are underway on a new, smaller scale development plan, with results expected in Q3 2025. In Guyana, Aris Mining owns the Toroparu gold/copper project, where a new Preliminary Economic Assessment (PEA) is underway and its results are also expected in Q3 2025.

Colombia is rich in high-grade gold deposits and Aris Mining is actively pursuing partnerships with the Country’s dynamic small-scale mining sector. With these partnerships, we enable safe, legal, and environmentally responsible operations that benefit both local communities and the industry.

Figure 1: Strong AISC Margin Growth ($ million) – Segovia (CNW Group/Aris Mining Corporation)

Figure 2: Total AISC and Realized Gold Price Trends ($/oz) – Segovia (CNW Group/Aris Mining Corporation)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE