Centerra Gold Announces Attractive Economics on the Goldfield Project; Proceeding with Project Development and Construction Activities

The Goldfield Project is expected to have after-tax NPV5% of $245M and IRR of 30%

Centerra Gold Inc. (TSX: CG) (NYSE: CGAU) is pleased to announce that it has completed a technical study of its Goldfield project in Nevada, which confirms attractive economics for the Project, including an after-tax net present value (5%) of $245 million and an after-tax internal rate of return of 30%, using a long-term gold price of $2,500 per ounce and includes the impact of gold hedges on a portion of production in 2029 and 2030. Centerra is proceeding with the project and will immediately commence detailed engineering and early procurement activities for construction.

President and CEO, Paul Tomory, commented, “We are pleased to be advancing with development and construction at the Goldfield project. Over the last several months, Centerra has undertaken additional technical work and project optimizations that have significantly enhanced Goldfield’s value proposition and have de-risked the project. Favourable gold prices combined with these recent developments have improved the Project’s economics, enabling us to move forward with execution. We believe Goldfield is well positioned to deliver strong returns. The project is expected to be funded from Centerra’s existing liquidity and is located in a top tier mining jurisdiction, with an approximate 7-year mine life, average annual gold production of around 100,000 ounces in peak production years at an all-in sustaining costNG (“AISC”) of approximately $1,392 per ounce, and a competitive initial capital cost of about $250 million. First production from Goldfield is expected by the end of 2028, which would grow Centerra’s near-term gold production profile, generate robust cash flow and deliver significant value to shareholders. We believe Goldfield to be ideally positioned in our project development pipeline, bringing gold production online as we continue to advance development of the longer-life Mount Milligan and Kemess gold-copper assets in British Columbia.”

Goldfield Highlights

- Attractive economics with low execution risk in a top tier mining jurisdiction. Goldfield is expected to yield an after-tax NPV5% of $245 million and after-tax IRR of 30%, using a long-term gold price of $2,500 per ounce, which includes the impact of gold hedges on a portion of production in 2029 and 2030 to lock in strong margins, safeguard project economics in the early years of the project, and expedite the capital payback period. The initial capital investment at Goldfield is $252 million, including approximately $40 million in pre-production stripping and other costs, and the Project is expected to benefit from a short timeline to first production by the end of 2028 and low execution risk given its relatively simple process flowsheet. The Project is located in a historic mining district of Nevada, one of the most reliable mining jurisdictions, offering a stable regulatory environment, skilled workforce, and strong support for resource development.

- Supportive gold price environment has enhanced project returns. Since the start of 2025, the gold price has increased by 30%. As a result, long-term gold price estimates have increased to $2,500 per ounce, which is the gold price assumption for Goldfield’s economics. In addition, Centerra has implemented a targeted gold hedging strategy on 50% of production in 2029 and 2030, with a gold price floor of $3,200 per ounce and an average gold price cap of $4,435 per ounce in 2029 and $4,705 per ounce in 2030, at no cost to the Company. This hedging strategy is expected to allow Centerra to lock in strong margins to safeguard project economics and support predictable cash flow during the ramp-up period, while maintaining exposure to rising gold prices for the life of mine (“LOM”). For the LOM, almost 80% of the planned production remains unhedged and fully exposed to market gold prices.

- Additional technical work on crushing strategy optimization resulted in a positive impact on project economics. Over the last several months, Centerra advanced technical work to evaluate hybrid processing alternatives which led to an optimized process flowsheet. High-grade material is expected to be processed through a three-stage semi-portable crushing circuit to maximize recovery, and lower-grade material is expected to be processed as run-of-mine to maintain low capital intensity. The selective routing of mineralized material to the most economically appropriate path substantially improved average recoveries, from mid-60% to approximately 76%, and resulted in a positive impact to the overall project returns.

- Goldfield is expected to grow Centerra’s near-term gold production profile, making it a strategic asset as the Company continues to advance its longer-life gold-copper growth pipeline. The Project is expected to provide an increase in gold production, which will help offset natural declines at Öksüt, and ensure continuity as Centerra advances its next phase of long-life, gold-copper, cornerstone organic growth projects in British Columbia at Mount Milligan and Kemess.

Goldfield Project Summary

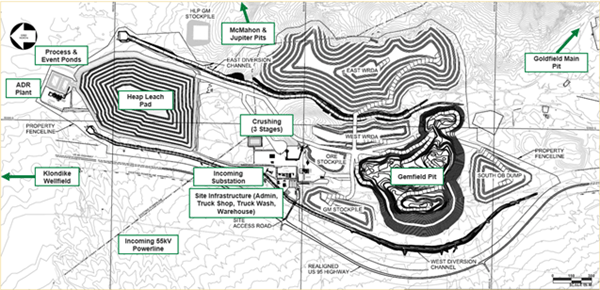

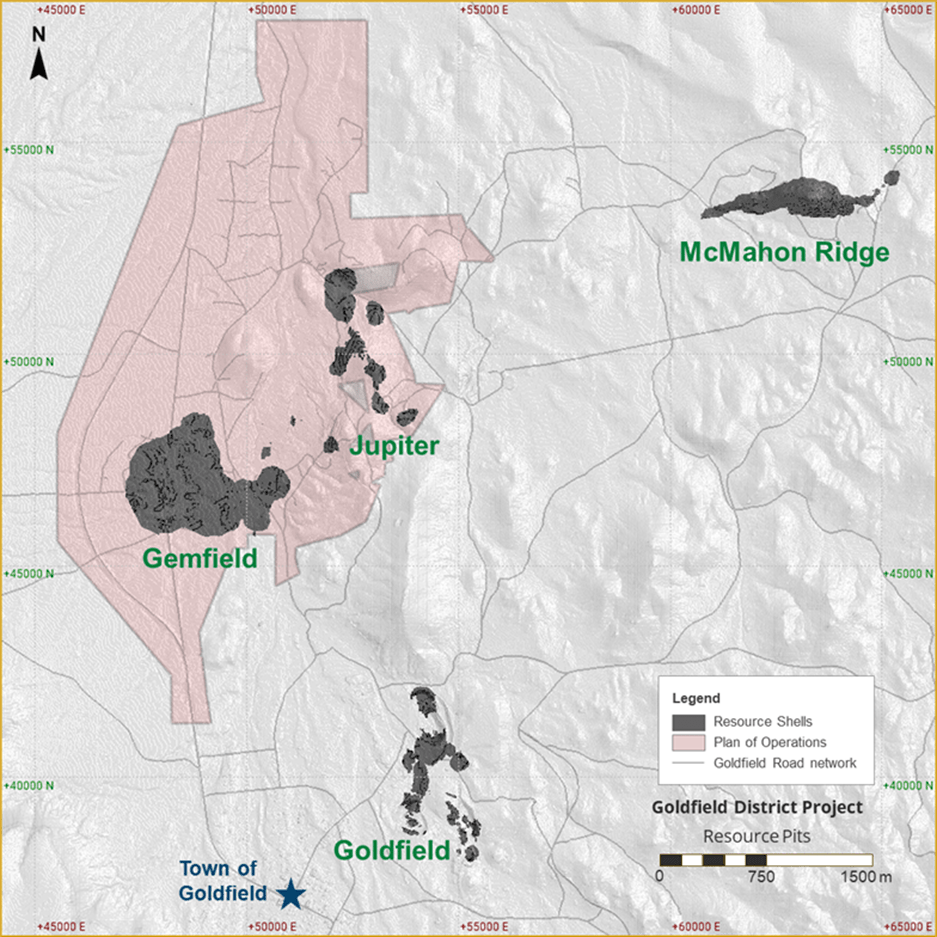

Goldfield is a conventional open-pit, heap leach project located in Nevada, a top tier mining jurisdiction. Centerra has completed a technical study which demonstrated a NPV5% of $245 million and IRR of 30%, using an assumed long-term gold price of $2,500 per ounce as well as gold hedges on a portion of production in 2029 and 2030. The technical study includes a mine life of approximately seven years, average annual gold production of 100,000 ounces for the peak production years between 2029 and 2032, at an AISCNG of $1,392 per ounce, and an initial capital cost of $252 million, which can be funded from Centerra’s existing liquidity. First production is expected by the end of 2028, and will come from four open pits on the property, of which the Gemfield pit is approximately 80% of total LOM production. A summary of the production and cost profile is included in the table below.

Goldfield Production and Cost Profile

| Total Mined(3) (kt) |

Grade (g/t) |

Gold Production (koz) |

Production Cost ($/oz) |

AISCNG ($/oz) |

|

| 2028(1) | 18,633 | 0.70 | 22 | – | – |

| 2029 | 20,592 | 0.87 | 114 | 1,003 | 1,419 |

| 2030 | 19,958 | 0.77 | 120 | 965 | 1,194 |

| 2031 | 18,717 | 0.76 | 106 | 1,040 | 1,269 |

| 2032 | 14,697 | 0.48 | 90 | 1,023 | 1,306 |

| 2033 | 5,488 | 0.38 | 47 | 1,169 | 1,325 |

| 2034 | 996 | 0.30 | 29 | 1,000 | 1,144 |

| 2035(2) | – | – | 6 | 1,596 | 1,833 |

| Total LOM | 99,079 | 0.66 | 533 | 1,077 | 1,392 |

(1) 2028 is a partial year of operation with first production expected by the end of the year. (2) 2035 is a partial year of operation with residual leaching. (3) Total tonnes mined includes both ore and waste. The strip ratio is 1.97.

Goldfield Gold Hedging Strategy

Centerra has implemented a targeted gold hedging strategy on 50% of gold production in 2029 and 2030, at no cost to the Company. This hedging strategy is expected to allow Centerra to lock in strong margins to safeguard project economics and support predictable cash flow during the ramp-up period, while maintaining exposure to rising gold prices for the LOM. For the LOM, almost 80% of the planned production remains unhedged and fully exposed to market gold prices. The table below outlines the hedging strategy.

| Hedged Production (kozs) |

Unhedged Production (kozs) |

Hedge Floor Price ($/oz) |

Average Hedge Ceiling Price ($/oz) |

|

| 2029 | 57 | 57 | 3,200 | 4,435 |

| 2030 | 60 | 60 | 3,200 | 4,705 |

Capital ExpendituresNG

Goldfield is expected to require an investment of approximately $252 million in total initial non-sustaining capital expendituresNG. A breakdown of the initial capital is included in the table below.

| Goldfield Initial Non-Sustaining CapitalNG Breakdown | Total ($M) |

| Mine | 10 |

| Crushing | 22 |

| Processing | 34 |

| Power Supply and Electrical | 26 |

| Heap Leach | 17 |

| Site General | 27 |

| Subtotal Infrastructure Directs | 136 |

| Indirects | 40 |

| Contingency | 35 |

| Subtotal Infrastructure | 211 |

| Pre-production Stripping and Other Costs | 41 |

| Total Initial Non-Sustaining CapitalNG | 252 |

In 2025, following approval of the Project, Centerra expects to spend between $2 to $5 million on study costs and field campaigns to advance upcoming detailed engineering, which is not included in initial non-sustaining capitalNG. In 2026, the focus for initial non-sustaining capital expendituresNG is expected to be on finalizing engineering studies, launching long-lead procurement and initiating site establishment works. Major construction will advance in 2027, including the heap leach pad, crushing and processing circuits. Construction and pre-commissioning will be finalized in 2028, before commissioning works are initiated to meet first production by the end of 2028. With major construction advancing in 2027, approximately 85% of the initial non-sustaining capitalNG is expected to be evenly weighted across 2027 and 2028.

Sustaining capital expendituresNG following first production are expected to be approximately $136 million, of which approximately $100 million is related to capitalized deferred stripping and the remainder is primarily related to the heap leach pad expansion, haul road development and processing maintenance. Sustaining capital expendituresNG are included in the AISCNG figures throughout the mine’s operating period.

Centerra is expected to use contract mining at Goldfield to benefit from several strategic and economic advantages that align with the Project’s scale and development timeline. By leveraging third-party mining contractors, Centerra’s plan has optimized initial capital requirements and mobilization timelines, and is expected to mitigate the execution risks during the early phases of operation.

Figure 1: Main Site Infrastructure and Gemfield Overview

Mineral Reserve and Mineral Resource Estimate

Four mineralized zones have been outlined as part of the mine plan: Goldfield Main, Gemfield, Jupiter, and McMahon Ridge, from which the Company is targeting oxide and transition material. In February 2025, Centerra published an initial measured and indicated gold mineral resource of 706,000 ounces as of December 31, 2024. Mineral resources, inclusive of reserves at the Project have increased due to changes in metal price, recoveries and processing assumptions. The table below outlines the mineral reserve and resource at Goldfield as of June 30, 2025.

Goldfield Gold Mineral Reserve and Resource Estimate (June 30, 2025)

| Tonnes (kt) |

Gold Grade (g/t) |

Contained Gold (koz) |

|

| Mineral Reserves | |||

| Proven | 9,944 | 1.04 | 334 |

| Probable | 23,404 | 0.49 | 372 |

| Total Proven and Probable Reserves | 33,348 | 0.66 | 706 |

| Mineral Resources (inclusive of Mineral Reserves) | |||

| Measured | 10,418 | 1.08 | 363 |

| Indicated | 26,616 | 0.50 | 432 |

| Measured and Indicated Resources | 37,034 | 0.67 | 794 |

| Inferred Resources | 2,121 | 0.33 | 23 |

NOTE: Refer to “Reserve and Resource Additional Footnotes” at the end of this news release. Totals may not sum due to rounding.

Figure 2: Plan view of the four mineralized zones – Goldfield Main, Gemfield, Jupiter, McMahon Ridge

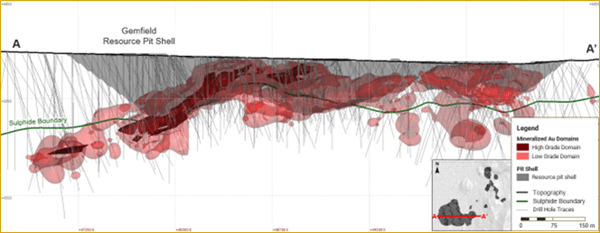

Figure 3: Cross section view of the Gemfield deposit, looking north

Permitting and Community Relations

Centerra continues to advance permitting activities for Goldfield in alignment with its staged development approach. The Project has existing permits for the Gemfield deposit, which will require minor amendments. The Modified Plan of Operations for the Gemfield deposit was submitted in early August 2025, with associated air and water pollution and control permits to follow shortly. Permit applications for Goldfield and McMahon Ridge are expected to be submitted in accordance with the approved mine plan sequence and align with projected development timelines.

The Goldfield project benefits from strong support from local communities, underpinned by an executed Development Agreement with Esmeralda County that reinforces Centerra’s commitments to community partnership and responsible development.

The Project is expected to deliver substantial long-term benefits to the local communities and the broader region over the life of the mine. Centerra expects to invest over $300 million on labour, supplies and services over the life of the mine. The construction and operations will support a range of local employment opportunities, with a target to prioritize Nevada-based hiring and procurement where feasible. The company expects to create approximately 300 to 400 jobs during construction, and 250 to 300 jobs during operations. In addition, the Project will contribute approximately $100 million in direct taxes over its life. This includes state mining-specific taxes, federal income taxes, local property tax, sales tax on equipment and materials, and other operational levies. Strategic investments in community initiatives will also further enhance regional development, ensuring that the benefits of the project are shared broadly and sustainably through the life of the mine.

Sensitivity Analysis

Goldfield demonstrates attractive economics at an assumed long-term gold price of $2,500 per ounce. The sensitivity to changes in gold prices is illustrated in the table below.

| Project Economics |

Gold Price ($/oz) | ||||

| $2,000 (unhedged / hedged) |

$2,500 (unhedged / hedged) |

$3,000 (unhedged / hedged) |

$3,400 | $3,800 | |

| NPV5% | $5M / $111M | $184M / $245M | $362M / $380M | $486M | $605M |

| IRR | 5% / 18% | 24% / 30% | 37% / 39% | 47% | 55% |

Project Assumptions

The economic analysis of the Project was performed using the following assumptions and basis:

- Economic assessment of the project uses a discounted cash flow approach. Cash flows are taken to occur at the mid-year of each period. NPV is calculated by discounting LOM cash flows from 2026 to the end of mine life to December 31, 2035, using 5% discount rate, and includes the impact of gold hedges on a portion of production in 2029 and 2030. Refer to the “Goldfield Gold Hedging Strategy” section above for details.

- Project economics are based on a valuation date of January 1, 2026.

- A flat price of $2,500/oz of gold is assumed throughout the LOM.

- All costs presented are in constant US dollars as of June 30, 2025 with no price inflation or escalation factors applied.

- No salvage values are assumed for the capital equipment at the end of mine life.

- Reclamation and closure costs for the site were estimated at a total of $31 million.

Reserve and Resource Additional Footnotes

General

- A conversion factor of 31.1035 grams per troy ounce of gold and 0.9072 metric tonnes per short ton are used in the mineral reserve and resource estimates.

- Samples were prepared and analyzed by independent, ISO-accredited laboratories. Quality control programs include the insertion of blanks, certified reference materials, duplicate samples, internal and external reviews and checks by umpire laboratories.

- Development of geological and mineralized domains, geostatistical analysis, block model construction and grade estimates were done using industry standard methods and commercially available software packages. Assays were composited and capped; block grades were estimated using ordinary kriging.

- The following formula was used to calculate cut-off grade for each mineralized zone: [Processing cost + G&A cost] / [Recovery * (Gold Price * Payability Factor * (1- Royalty%) – Selling Cost)] where G&A cost is $0.55/t, payability factor is 99.9% and selling cost is $5/oz.

Reserves

- Mineral reserves are reported in metric tonnes based on a gold price of $2,000/oz.

- Mineral reserve estimates are supported by mineable pit designs, detailed LOM plan, equipment simulations, capital and operating cost estimates, and financial analysis.

- The Gemfield pit includes a volume of “must take” mineralized material (662,157 tonnes and 6,469 contained ounces) for permitting and closure purposes which lies outside the optimized pit shell. This material is included in the Gemfield reserve pit and economic analysis.

- Lersch-Grossman (LG) pit shells were generated for each mineralized zone that guided pit design. Pit shell inputs include average mining cost, incremental haulage cost, overall pit slope angles, metallurgical recoveries, processing costs and costs of sales. Metallurgical testing for each mineralized zone was used to determine recoveries and processing costs. Pit shell optimization inputs are shown below.

- Mining Cost: A base mining cost of $3.47/t was applied with an incremental haulage costs of $0.31/t and $0.35/t applied to Goldfield Main and McMahon Ridge respectively. A general and administrative (“G&A”) cost of $0.55/t was applied for constraining the pit shell.

- Pit Slope Angles: Overall slope angles were assumed to be 35 degrees for all mineralized zones, except Goldfield Main which varied between 25 and 35 degrees depending on slope orientation. Inter-ramp pit slope used in designs are variable by rock type and were determined by drilling, laboratory testing, and geotechnical evaluations of the different zones.

- Processing Costs: Processing costs were estimated based on crushing and metallurgical testing to determine sizing of equipment, reagent consumption, placement of material, and leaching operations. Gemfield: run-of-mine (“ROM”) $3.95/t, crushed $5.97/t; Goldfield Main: ROM $4.87/t, crushed $6.90/t; Jupiter: ROM $3.03/t, crushed $5.06/t; McMahon Ridge: ROM $3.43/t for oxide and $4.99/t for transition, crushed $5.46/t for oxide and $7.02/t for transition material.

- Recovery: Recoveries were estimated by laboratory testing of representative samples including bottle roll and column leach tests. Gemfield (0.1-0.8 g/t Au): ROM 69%, crushed 87%; Gemfield (>0.8 g/t Au): ROM 54%, crushed 78%; Goldfield Main: ROM 61%, crushed 51% for transition or 82% for oxide material; Jupiter: ROM 56%, crushed 77%; McMahon Ridge: ROM 56%, crushed 61% for transition or 77% for oxide material.

- Cut-off Grades: Gemfield: ROM 0.11 g/t, crushed 0.12 g/t; Goldfield Main: ROM 0.16 g/t, crushed 0.15 g/t for oxide or 0.24 g/t for transition material; Jupiter: ROM 0.10 g/t, crushed 0.12 g/t; McMahon Ridge: ROM 0.10 g/t, crushed 0.12 g/t for oxide or 0.20 g/t for transition material.

- No dilution factor was applied as the selective mining unit (“SMU”) is expected to account for operational dilution and reflects the equipment sizing and capabilities.

- Royalties applied: Gemfield 5%, Goldfield Main 4%, Jupiter 2.9%, McMahon Ridge 3%

Resources

- Mineral resources are reported in metric tonnes based on a gold price of $2,400/oz.

- The open pit mineral resources are constrained by a pit shell and are reported based on cut-off grades reported below that take into consideration metallurgical recoveries and selling costs.

- Mineral resources are reported inclusive of reserves.

- Mining Cost: A base mining cost of $3.43/t was used with an incremental haulage costs of $0.31/t and $0.35/t applied to Goldfield Main and McMahon Ridge respectively. A G&A cost of $0.55/t was applied for constraining the pit shell.

- Processing Costs: Processing costs were estimated based on crushing and metallurgical testing to determine sizing of equipment, reagent consumption, placement of material, and leaching operations. Goldfield Main: ROM $3.95/t, crushed $6.27/t; Goldfield: ROM $4.87/t, crushed $7.20/t; Jupiter: ROM $3.03/t, crushed $5.36/t; McMahon Ridge: ROM $3.43/t, crushed $5.75/t for oxide and $7.32/t for transition material.

- Cut-off Grades: Gemfield: ROM 0.08 g/t, crushed 0.10 g/t; Goldfield Main: ROM 0.12 g/t, crushed 0.12 g/t for oxide and 0.20 g/t for transition material; Jupiter: ROM 0.08 g/t, crushed 0.10 g/t; McMahon Ridge: ROM 0.09 g/t, crushed 0.11 g/t for oxide and 0.17 g/t for transition material.

- No royalty costs were applied to the resource estimate.

- Sulphide Resources: Laboratory testing has shown that material classified as sulphide can be recovered from the Goldfield and McMahon Ridge zones with crushing. Sulphide material contained in the constraining pit shell is included in the resource. Processing costs, recoveries and cut-off grades for sulphide materials as follows – Goldfield Main: Crushed processing cost $9.59/t, recovery 51%, cut-off grade 0.26 g/t; McMahon Ridge: Crushed processing cost $7.89/t, recovery 37%, cut-off grade 0.30 g/t.

Mineral reserve and mineral resource estimates are forward-looking information and are based on key assumptions and are subject to material risk factors. If any event arising from these risks occurs, the Company’s business, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares could be adversely affected. Additional risks and uncertainties not currently known to the Company, or that are currently deemed immaterial, may also materially and adversely affect the Company’s business operations, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares. See the section entitled “Risk That Can Affect Centerra’s Business” in the Company’s Management’s Discussion and Analysis (MD&A) for the three months ended June 30, 2025, available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and see also the discussion below under the heading “Cautionary Statement on Forward-Looking Information”.

Qualified Person – Mineral Reserves and Resources

Christopher Richings, Professional Engineer, member of the Engineers and Geoscientists British Columbia and Centerra’s Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Mr. Richings is a Qualified Person within the meaning of NI 43-101.

All mineral reserve and resources have been estimated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange under the symbol CG and on the New York Stock Exchange under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE