ORVANA REPORTS Q3 FY2025 PRODUCTION AND EXPLORATION RESULTS FROM OROVALLE, SPAIN

Orvana Minerals Corp. (TSX: ORV) is pleased to report production and exploration updates for the third quarter of fiscal year 2025 ending June 30, 2025 from Orovalle (Spain).

Juan Gavidia, CEO of Orvana, commented, “We are pleased with the increased gold production levels during the third quarter. In addition, and in line with our plan, we have initiated preparatory and development activities at the Carlés mine, where skarn extraction is scheduled to begin in August. This will mark the start of a planned production ramp-up, with increasing tonnage from Carlés expected over the coming months”.

“Encouraging results have been obtained from the greenfield drilling program at Ortosa-Godán. Work continues with the aim of confirming a potential connection between the Godán mineralization and our Carlés deposit“, he added.

Orovalle – Q3 FY2025 Production Results

- The mill processed approximately 116,626 tonnes, 5% higher than the prior quarter.

- 8,536 gold ounces produced in Q3 FY2025, 26% higher than the previous quarter. Current production estimates are tracking moderately below the lower end of the guidance range of 37,000 to 41,000 ounces. The final production level will depend on the ramp-up pace of production at Carlés starting in August. Updated estimates will be released with the third quarter financials, expected mid-August 2025.

- 0.9 million copper pounds produced in Q3 FY2025, in line with the previous quarter. As of the end of the third quarter, copper production has already exceeded the higher end of the 2025 production guidance of 2,400 to 2,700 K lbs.

| Q3 FY2025 | Q2 FY2025 | Q3 FY2024 | YTD Q3 FY2025 |

FY 2025

Guidance |

||

| Ore milled (tonnes) | 116,626 | 111,272 | 150,843 | 346,547 | ||

| Gold equivalent (oz)(1) | 10,008 | 8,416 | 13,078 | 28,118 | ||

| Gold | ||||||

| Grade (g/t) | 2.43 | 2.06 | 2.37 | 2.22 | ||

| Recovery (%) | 93.6 | 92.0 | 94.1 | 92.8 | ||

| Production (oz) | 8,536 | 6,792 | 10,832 | 22,960 | 37,000 – 41,000 | |

| Copper | ||||||

| Grade (%) | 0.42 | 0.43 | 0.39 | 0.44 | ||

| Recovery (%) | 82.0 | 84.0 | 76.3 | 83.9 | ||

| Production (K lbs) | 886 | 885 | 986 | 2,839 | 2,400 – 2,700 | |

| Silver | ||||||

| Grade (g/t) | 9.86 | 9.81 | 8.30 | 10.16 | ||

| Recovery (%) | 80.4 | 80.1 | 76.7 | 80.5 | ||

| Production (oz) | 29,752 | 28,129 | 30,872 | 91,187 |

(1) Gold Equivalent Ounces is a Non-GAAP Financial Performance Measure. For further information and detailed reconciliations, please see the “Non-GAAP Financial Performance Measures” section of the Company’s latest MD&A. GEO were calculated using the following average market prices:

Q3 FY2025: $3,279.16/oz Au, $33.64/oz Ag, $4.32/lb Cu

Q2 FY2025: $2,862.56/oz Au, $31.91/oz Ag, $4.24/lb Cu

Q3 FY2024: $2,337.99/oz Au, $28.86/oz Ag, $4.42/lb Cu

Orovalle – Q3 FY2025 Drilling Update

| Drilled Meters | Infill | Brownfield | Greenfield | TOTAL |

| El Valle Boinás | ||||

| Boinás East (BE) | 1,561 | – | – | 1,561 |

| Boinás South (SB) | 1,192 | – | – | 1,192 |

| Area 208 (A2) | 103 | 123 | – | 226 |

| Ortosa-Godán | – | – | 575 | 575 |

| TOTAL | 2,856 | 123 | 575 | 3,554 |

El Valle Boinás

The Q3 FY2025 drilling program focused on skarn areas, aiming to convert inferred resources into measured and indicated resources. In Boinás East, 1,561 meters of drilling defined narrow skarn mineralization in the western part of the orebody, between levels 100 and 200, which will be incorporated into the mine plan. In Boinás South, 1,192 meters were drilled to complete mineral definition around stope designs and confirm orebody geometry. A minor drilling program was also carried out in Area 208 and will continue during the fourth quarter.

The drilling program in the fourth quarter of fiscal 2025 is focused on defining new resources in oxides areas and converting inferred resources in the same areas (mainly Area 208 and E2).

Ortosa-Godán

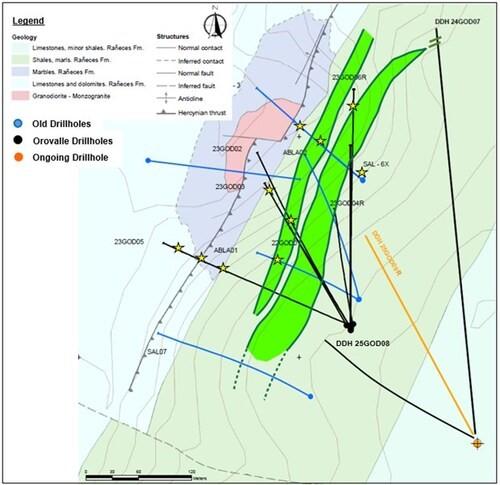

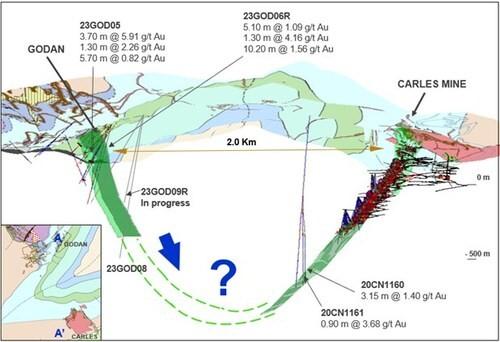

The Ortosa-Godan Project is located three kilometers northwest of our Carlés mine, within the same gold belt. The exploration program is currently focused on the Godán area, where FY2024 drilling proved mineralization at the contact between the intrusive and sedimentary rocks, with calcic skarn bands dipping 60-70º ESE over 200 meters of strike potential.

The FY2025 drilling program is currently underway, aiming to extend the definition of skarn mineralization at depth. Based on the interpreted dip of the formation, there is potential for the Godán mineralization to connect with the Carlés skarn system, and ongoing exploration is focused on testing this possibility.

| Drill Hole | Comments |

| 24GOD07 | Drill hole targeted skarn mineralization at the intrusive–limestone contact. While the intrusive was intersected, no skarn was encountered. |

| 25GOD08 | Continuing with the objective of drill hole 24GOD07, this hole targeted skarn mineralization 200 meters deeper. A 10.8 m interval of calcic skarn was intersected, proving the skarn continuity down to level -400. No gold grades were detected. |

| 25GO09 | A fault was intersected at 375 m depth, preventing further drilling. |

| 25GOD09R | The target of this drill hole is to evaluate the potential extension of the skarn 150 meters to the north. Drilling reached 575 meters by the end of June and is expected to be completed by the end of July. |

Quality Control

Greenfield drill hole samples were sent to an external laboratory (ALS Laboratory) for analyses. Infill and brownfield drill holes samples were analyzed in Orovalle’s Laboratory.

Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 70%

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and one-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

For A208 core samples is used a 1000 g sub-sample of each split and 250 g sub-samples are split. 50 g samples are twice analyzed. In case of the twice analysis don´t match, a metalling screening method is used to confirm the grade.

In case of the samples sent to an external laboratory, 30 g samples are analyzed for Au by fire assay with an atomic absorption (Au AA-25) and 35 elements by ICP (ME-ICP41) after an aqua regia digestion. When Au and Ag values are >100 ppm and Cu and As values are >10,000 ppm, specific analysis methods are used to determinate the final grade.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

Consolidated Operational and Financial Performance:

Project updates for Bolivia and Argentina, and Q3 FY2025 consolidated operational and financial highlights will be released with the third quarter financials, expected mid-Aug, 2025.

ABOUT ORVANA

Orvana is a multi-mine gold-copper-silver company. Orvana’s assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, and the Taguas property located in Argentina.

Figure 1. Geological map and drill holes (CNW Group/Orvana Minerals Corp.)

Figure 2. Longitudinal section A – A’ (CNW Group/Orvana Minerals Corp.)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE