Power Metallic Closes on Li-FT Power Land Acquisition

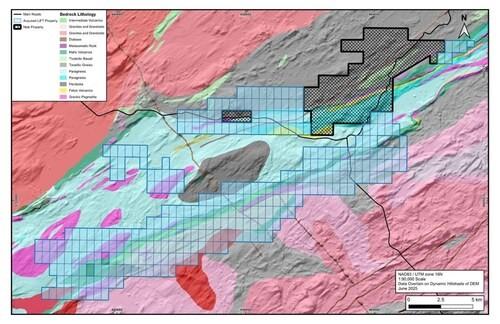

Power Metallic Mines Inc. (TSX-V: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV) is pleased to announce it has closed on the definitive agreement dated June 9, 2025 to acquire a 100% interest in 313 mineral claims totalling 167 km² from Li-FT Power Ltd. (TSX-V: LIFT) (OTCQX: LIFFF) (FRA: WS0). The claims adjoin the Company’s 45.86km² Nisk property, where exploration is expanding the high–grade Lion Cu–PGE discovery and the Nisk Cu–Ni-PGE-Co deposit. Power Metallic currently holds ~212.86 km² of land in the Nisk camp, securing approximately 20 km of strike on the northern basin margin and 30 km on the southern margin that envelope the Nisk, Lion, and Tiger discoveries (Figure 1 map of regional play with new property, showing relative size with original Nisk property).

Purchase Agreement Terms

With the closing conditions met, including final TSX Venture Exchange approval received, Power Metallic has advanced a $700,000 cash payment to Li-FT and issued 6,000,000 common shares of the Company. All the Shares have a statutory hold period of four months and a day from issuance in accordance with Canadian securities laws. 3,000,000 of the 6,000,000 Shares also bear a 12 month hold and restriction from transfer. Additionally, Li-FT retains a 0.5% NSR on all acquired claims under a royalty agreement between Li-FT and the Company effective the closing date. Certain of the claims also retain certain underlying royalties and in some cases buy back rights that were contained in previous agreements between Li-FT and prior property vendors.

Qualified Person

Joseph Campbell, P.Geo, VP Exploration at Power Metallic, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

Administrative Updates

The Company has appointed MNP LLP, Chartered Professional Accountants, as its new auditor. In alignment with its ongoing growth and strategic objectives, the Company elected to engage a PCAOB-registered mid-tier audit firm to support potential listings on senior stock exchanges.

For the Company’s recently completed Q2 ended June 30, 2025, for its interim financial statements (when filed), it will add a comparative figures note as it relates to investor relations expenses in prior periods: “Certain comparative figures have been reclassified to conform with the current year’s presentation. Amounts from Investor relations have been reclassified to Shareholder Communications, Listing fees, and Advisory and Business development. This reclassification should provide greater clarity to investors regarding the breakdown of the Company’s expenditures. The reclassification of comparative figures had no impact on the June 30, 2024, December 31, 2024 and 2023 statement of financial position or statement of changes in shareholders’ (deficit) equity.” For the FYE December 31, 2023, the total investor relations expense of $3,181,461 is reclassified as $497,134 to Shareholder Communications, $33,372 to Listing Fees, $1,784,661 to Advisory and Business Development, and $866,294 retained as Investor Relations to provide greater clarity on the nature of the expenses.

About Power Metallic Mines Inc.

Power Metallic is a Canadian exploration company focused on advancing the Nisk Project Area (Nisk–Lion–Tiger)—a high–grade Copper–PGE, Nickel, gold and silver system—toward Canada’s next polymetallic mine.

On 1 February 2021, Power Metallic (then Chilean Metals) secured an option to earn up to 80% of the Nisk project from Critical Elements Lithium Corp. (TSX–V: CRE). Following the June 2025 purchase of 313 adjoining claims (~167 km²) from Li–FT Power, the Company now controls ~212.86 km² and roughly 50 km of prospective basin margins.

Power Metallic is expanding mineralization at the Nisk and Lion discovery zones, evaluating the Tiger target, and exploring the enlarged land package through successive drill programs.

Beyond the Nisk Project Area, Power Metallic indirectly has an interest in significant land packages in British Columbia and Chile, by its 50% share ownership position in Chilean Metals Inc., which were spun out from Power Metallic via a plan of arrangement on February 3, 2025.

It also owns 100% of Power Metallic Arabia which owns 100% interest in the Jabul Baudan exploration license in The Kingdom of Saudi Arabia’s JabalSaid Belt. The property encompasses over 200 square kilometres in an area recognized for its high prospectivity for copper gold and zinc mineralization. The region is known for its massive volcanic sulfide (VMS) deposits, including the world-class Jabal Sayid mine and the promising Umm and Damad deposit.

Figure 1: New land package overlain on basin geology (CNW Group/Power Metallic Mines Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE