SOMA GOLD REPORTS RECORD FIRST QUARTER FINANCIAL RESULTS

Highlights:

- Revenue for the first quarter of 2025 was $27.9 million – an increase of 44% from 2024-Q1.

- Net income for the quarter was $3.2 million, compared to a loss of $0.2 million in 2024-Q1

- Adjusted EBITDA(1) for the quarter was $13.5 million compared to $6.3 million for the same period in 2024, and unadjusted EBITDA(1) was $12.4 million, double the $6.0 million EBITDA(1) recorded in 2024-Q1.

- Soma sold 6,843 AuEq ounces in the current quarter, compared to 7,024 AuEq ounces in 2024-Q1.

- The average realized cash margin(1) was US$1,642 in the current quarter, compared to US$894 in 2024-Q1.

- EBITDA(1) per share was $0.14 in the current quarter, compared to $0.07 in 2024-Q1.

- The Company reduced Long Term Debt by $2.5 million in the quarter

Soma Gold Corp. (TSX-V: SOMA) (WKN: A2P4DU) (OTC: SMAGF) is pleased to announce that the Company’s Financial Statements and MD&A for the three months ended March 31, 2025 and 2024 have been filed on SEDAR+ and are also available on the Company’s website.

Operations Review – Quarter Ended March 31, 2025

- Soma produced 6,643 AuEq ounces in 2025-Q1 (2024-Q1 – 7,335 AuEq ounces).

- Income from mining operations was $9.8 million (2024-Q1 – $4.3).

- Net income for the year was $3.2 million (2024-Q1 – loss of $0.2 million)

- Net income per share was $0.03 (2024-Q1 – $0.00).

- Adjusted EBITDA(1) of $13.5 million (2024-Q1 – $6.3 million)

- Adjusted EBITDA(1) per share of $0.15 (2024-Q1 – $0.07).

- Cordero Operations reported attributable cash costs per ounce of gold sold(1) of US$1,261 (2024-Q1 – $1,192).

Geoff Hampson, Soma’s President and CEO, states, “The Company is pleased with the significant progress made in achieving record profitability. Our organic growth strategy remains on track, with the planned re-commissioning of the el Limon mill scheduled for June of this year. During the second half of 2025, el Limon is expected to increase overall throughput by approximately 20-30%, resulting in a corresponding increase in gold production. Feed for the mill will be sourced from the Aurora and Cordero mines, as well as several formalized small miners.

We are also working toward bringing the el Limon Mine back into production following the discovery of a parallel vein structure that appears to carry economic grades. Meanwhile, exploration in the Psyche 1 area is showing early signs of a potential new deposit, with additional drilling planned for the second half of the year to define the resource potential.

In parallel, the Company continues to advance the permitting process for the Nechi Mine, which is expected to begin production in 2027. We look forward to a strong second half of 2025 and continued production growth in 2026 and beyond.”

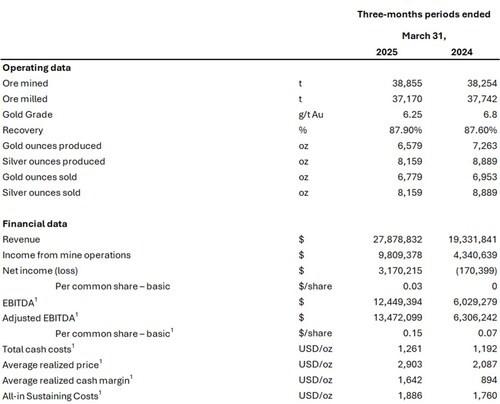

Financial and Operating Highlights Three Months Ended March 31, 2025 and 2024

Soma also announces that it has granted an aggregate of 200,000 stock options pursuant to its equity incentive plan to two Investor Relations consultants of the Company. The stock options are exercisable at a price of $1.07 per share and expire three years from the date of grant. In accordance with TSX Venture Exchange policies, the options granted to the IR consultants will vest in stages over a 12-month period, with no more than 25% vesting in any three-month period.

ABOUT SOMA GOLD

Soma Gold Corp. is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia, with a combined milling capacity of 675 TPD. (Permitted for 1,400 TPD). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

With a solid commitment to sustainability and community engagement, Soma Gold Corp. is dedicated to achieving excellence in all aspects of its operations.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

Q1 2025 Financial and Operating Highlights (CNW Group/Soma Gold Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE