Guanajuato Silver Posts Positive Mine Operating Income of US$4.8M in Q1, 2025

Guanajuato Silver Company Ltd. (TSX-V:GSVR) (OTCQX:GSVRF) is pleased to announce financial information and production results for the three months ended March 31, 2025. The Company’s condensed consolidated interim financial statements for the first quarter of 2025 and Management’s Discussion and Analysis thereon can be viewed under the Company’s profile at www.sedarplus.ca. All dollar amounts are in US dollars and prepared in accordance with IFRS Accounting Standards (IFRS) as issued by the International Accounting Standards Board. Production results are from the Company’s wholly owned El Cubo Mines Complex, Valenciana Mines Complex and the San Ignacio Mine located in Guanajuato, Mexico, and the Topia Mine located in Durango, Mexico.

Selected Q1 2025 Highlights:

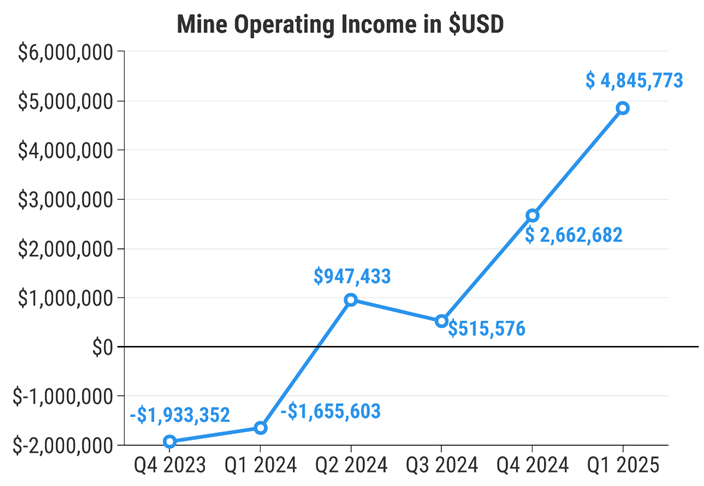

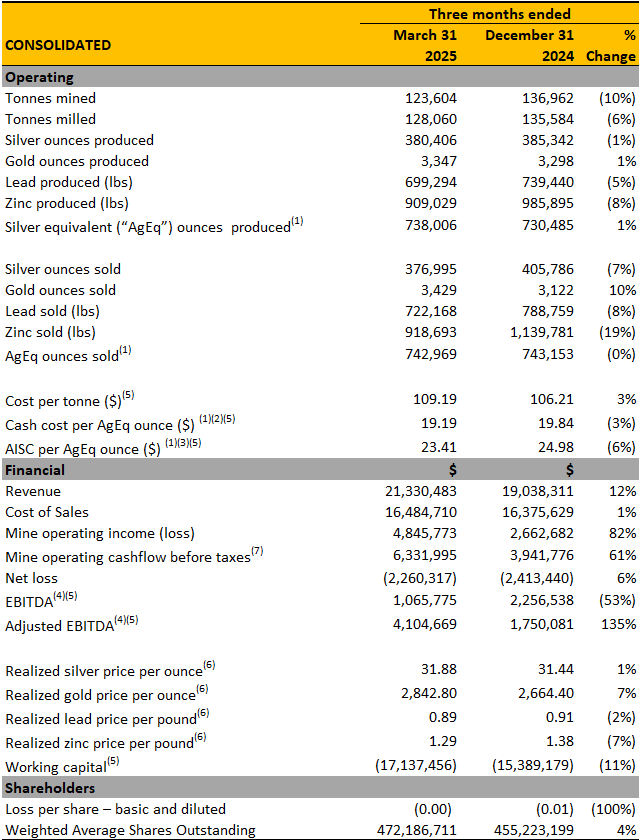

- Record mine operating income of $4,845,773 was up 82% over the previous quarter; the Company’s mining operations have now successfully generated four consecutive quarters of positive mine operating income.

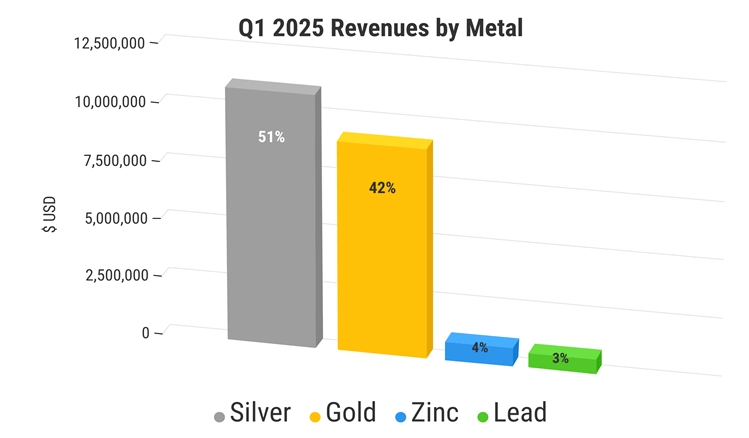

- Record revenue for the quarter of $21,330,483 was up 12% over the previous quarter. The average realized silver price for the quarter was $31.88 per ounce. The average realized gold price for the quarter was $2,842.80 per ounce. Guanajuato Silver is a primary precious metals producer with over 90% of the Company’s revenue derived from the production and sale of silver and gold.

- Operating costs continued to improve over the quarter; cash cost of $19.19 per AgEq ounce was 3% lower than the previous quarter; All-In Sustaining Cost was $23.41 per AgEq ounce – a 6% improvement over Q4, 2024.

- Production for the quarter was 738,006 silver equivalent ounces which was a 1% increase over the previous quarter. Production consisted of 380,406 ounces of silver, 3,347 ounces of gold, 699,294 pounds of lead, and 909,029 pounds of zinc. **

- Adjusted EBITDA* was up 135% over the previous quarter to $4,104,669.

James Anderson, CEO & Chairman, said, “Guanajuato Silver’s out-sized leverage to the price of precious metals returned record income from operations in the quarter as working efficiencies continue to show marked improvements at all four of our producing assets in Mexico. Additionally, production – especially in gold ounces from our three mines in Guanajuato – helped push quarterly revenue to the highest in Company history. With significant capacity remaining at our processing facilities, Guanajuato Silver is well positioned to take advantage of rising prices for both silver and gold.”

Corporate Update

In addition to its Q1 financial results, GSilver is pleased to announce the appointment of Mr. Dan Oliver, current director, as Lead Independent Director of the Board of Directors. In this role, Mr. Oliver will provide independent leadership to the Board, help coordinate the activities of non-executive directors, and serve as a key liaison between the Board and executive management to enhance governance and accountability.

James Anderson, Chairman & CEO, stated, “Dan’s appointment as Lead Independent Director underscores our commitment to strong corporate governance and effective oversight as we continue to grow our business and expand production across our Mexican operations.”

Mr. Oliver added, “It’s an honor to assume the role of Lead Independent Director at such a pivotal time for GSilver. I look forward to working closely with management and my fellow directors to ensure we maintain our strategic focus as we continue to build Mexico’s fastest growing silver producer.”

*EBITDA, (Earnings Before Interest, Taxes, Depreciation and Amortization) Adjusted EBITDA, AISC and working capital are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of Non-IFRS financial measures to the most directly comparable IFRS measures see “Non-IFRS Financial Measures” in this News Release.

Q1 2025 OPERATING AND FINANCIAL HIGHLIGHTS

The following table summarizes the Company’s consolidated operating and financial results for the three months ended March 31, 2025 as compared to the three months ended December 31, 2024.

Note: The net loss for the quarter was down 6% from Q4, 2024, and consists entirely of non-cash items including depreciation, amortization, and derivative adjustments.

- **Silver equivalents are calculated using an 89.68:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q1 2025; and an 84.86:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q4 2024, respectively. Cash cost per silver equivalent ounce includes mining, processing, and direct overhead. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

- AlSC per AgEq oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

- See Reconciliation of earnings before interest, taxes, depreciation, and amortization in the Non-IFRS Financial Measures section of this news release.

- Mine Operating Cashflow Before Taxes, Cash cost per silver equivalent, cost per tonne, AISC per AgEq ounce, EBITDA, Adjusted EBITDA and working capital are non-IFRS financial measures with no standardized meaning under IFRS, and therefore they may not be comparable to similar measures presented by other issuers. For further information and detailed reconciliations of non-IFRS financial measures to the most directly comparable IFRS measures see “Non-IFRS Financial Measures” in the Non-IFRS Financial Measures section of this news release.

- Based on provisional sales before final price adjustments, before payable metal deductions, treatment, and refining charges.

- Mine operating cash flow before taxes is calculated by adding back depreciation, depletion, and inventory write-downs to mine operating loss. See Reconciliation to IFRS in the Non-IFRS Financial Measures section of this news release.

NON-IFRS FINANCIAL MEASURES

The Company has disclosed certain non-IFRS financial measures and ratios in this news release, as discussed below. These non-IFRS financial measures and non-IFRS ratios are widely reported in the mining industry as benchmarks for performance and are used by Management to monitor and evaluate the Company’s operating performance and ability to generate cash. The Company believes that, in addition to financial measures and ratios prepared in accordance with IFRS, certain investors use these non-IFRS financial measures and ratios to evaluate the Company’s performance. However, the measures do not have a standardized meaning under IFRS and may not be comparable to similar financial measures disclosed by other companies. Accordingly, non-IFRS financial measures and non-IFRS ratios should not be considered in isolation or as a substitute for measures and ratios of the Company’s performance prepared in accordance with IFRS.

Non-IFRS financial measures are defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure as a financial measure disclosed that (a) depicts the historical or expected future financial performance, financial position or cash flow of an entity, (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most directly comparable financial measure disclosed in the primary financial statements of the entity, (c) is not disclosed in the financial statements of the entity, and (d) is not a ratio, fraction, percentage or similar representation.

A non-IFRS ratio is defined by NI 52-112 as a financial measure disclosed that (a) is in the form of a ratio, fraction, percentage, or similar representation, (b) has a non-IFRS financial measure as one or more of its components, and (c) is not disclosed in the financial statements.

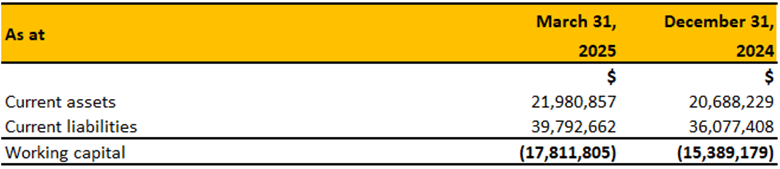

WORKING CAPITAL

Working capital is a non-IFRS measure that is a common measure of liquidity but does not have any standardized meaning. The most directly comparable measure prepared in accordance with IFRS is current assets net of current liabilities. Working capital is calculated by deducting current liabilities from current assets. Working capital should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. The measure is intended to assist readers in evaluating the Company’s liquidity.

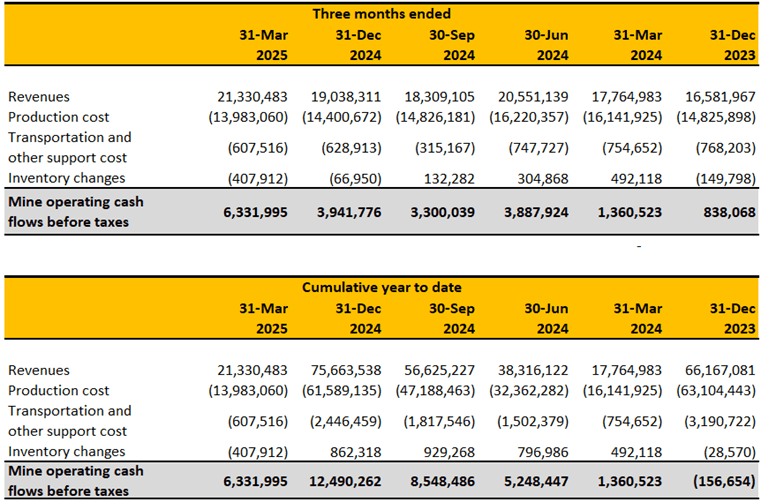

MINE OPERATING CASH FLOW BEFORE TAXES

Mine operating cash flow before taxes is a non-IFRS measure that does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. Mine operating cash flow is calculated as revenue minus production costs, transportation and selling costs and inventory changes. Mine operating cash flow is used by management to assess the performance of the mine operations, excluding corporate and exploration activities, and is provided to investors as a measure of the Company’s operating performance.

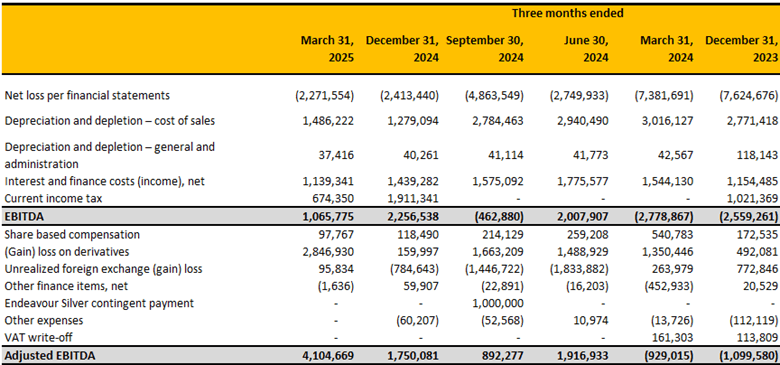

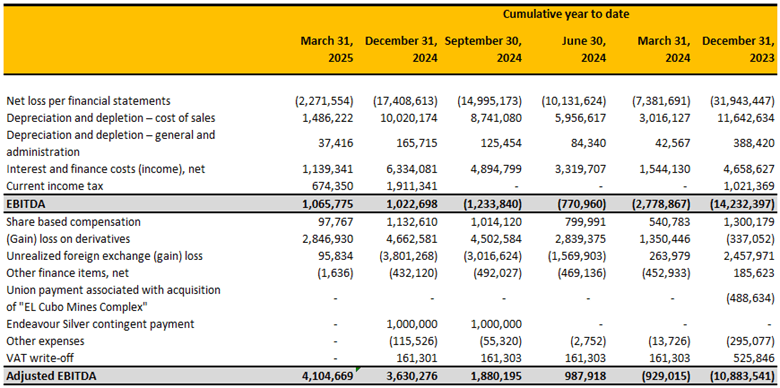

EBITDA is a non-IFRS financial measure, which excludes the following from net earnings:

- Income tax expense;

- Finance costs;

- Amortization and depletion.

Adjusted EBITDA excludes the following additional items from EBITDA:

- Share based compensation;

- Non-recurring impairments (reversals);

- Loss (gain) on derivative;

- Significant other non-routine finance items.

Adjusted EBITDA per share is calculated by dividing Adjusted EBITDA by the basic weighted average number of shares outstanding for the period.

Management believes EBITDA is a valuable indicator of the Company’s ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations, and fund capital expenditures. Management uses EBITDA for this purpose. EBITDA is also frequently used by investors and analysts for valuation purposes whereby EBITDA is multiplied by a factor or “EBITDA multiple” based on an observed or inferred relationship between EBITDA and market values to determine the approximate total enterprise value of a Company. Management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results because it is consistent with the indicators management uses internally to measure the Company’s performance and is an indicator of the performance of the Company’s mining operations.

EBITDA is intended to provide additional information to investors and analysts. It does not have any standardized definition under IFRS and should not be considered in isolation or as a substitute for measures of operating performance prepared in accordance with IFRS. EBITDA excludes the impact of cash costs of financing activities and taxes, and the effects of changes in operating working capital balances, and therefore is not necessarily indicative of operating profit or cash flow from operations as determined by IFRS. Other companies may calculate EBITDA and Adjusted EBITDA differently.

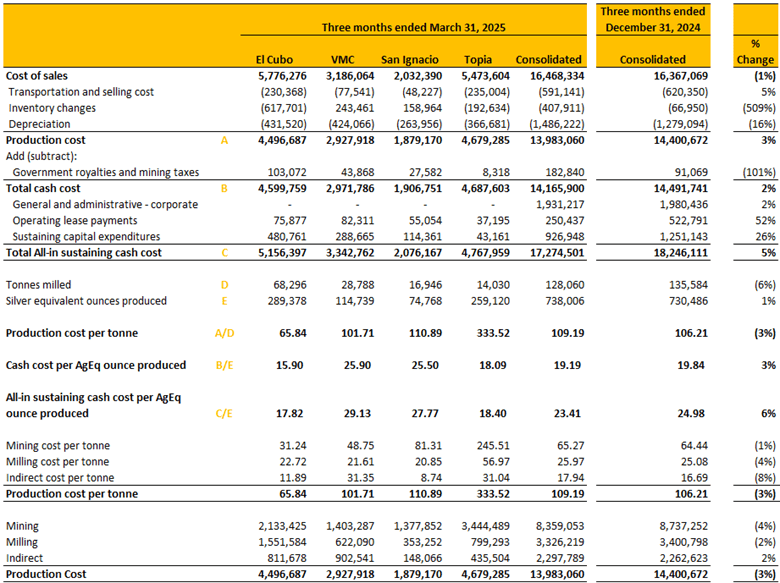

Cash Cost per AgEq Ounce, All-In Sustaining Cost per AgEq Ounce and Production Cost per Tonne are measures developed by precious metals companies in an effort to provide a comparable standard; however, there can be no assurance that the Company’s reporting of these non-IFRS measures and ratios are similar to those reported by other mining companies. Cash costs per silver equivalent ounce and total production cost per tonne are non-IFRS performance measures used by the Company to manage and evaluate operating performance at its operating mining unit, in conjunction with the related IFRS amounts. They are widely reported in the silver mining industry as a benchmark for performance, but do not have a standardized meaning and are disclosed in addition to IFRS measures.

Production costs include mining, milling, and direct overhead at the operation sites. Cash costs include all direct costs plus royalties and special mining duty. Total production costs include all cash costs plus amortization and depletion, changes in amortization and depletion in finished goods inventory and site share-based compensation. Cash costs per silver equivalent ounce is calculated by dividing cash costs and total production costs by the payable silver ounces produced. Production costs per tonne are calculated by dividing production costs by the number of processed tonnes. The following tables provide a detailed reconciliation of these measures to the Company’s direct production costs, as reported in its consolidated financial statements.

AISC is a non-IFRS performance measure and was calculated based on guidance provided by the World Gold Council. WGC is not a regulatory industry organization and does not have the authority to develop accounting standards for disclosure requirements. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles and policies applied, as well as differences in definitions of sustaining capital expenditures. AISC is a more comprehensive measure than cash cost per ounce and is useful for investors and management to assess the Company’s operating performance by providing greater visibility, comparability and representation of the total costs associated with producing silver from its current operations, in conjunction with related IFRS amounts. AISC helps investors to assess costs against peers in the industry and help management assess the performance of its mine.

AISC includes total production costs (IFRS measure) incurred at the Company’s mining operation, which forms the basis of the Company’s total cash costs. Additionally, the Company includes sustaining capital expenditures, corporate general and administrative expense, operating lease payments and reclamation cost accretion. The Company believes this measure represents the total sustainable costs of producing silver and gold concentrate from current operations and provides additional information of the Company’s operational performance and ability to generate cash flows. As the measure seeks to reflect the full cost of silver and gold concentrate production from current operations, new project capital at current operation is not included. Certain other cash expenditures, including share-based payments, tax payments, dividends and financing costs are also not included.

The following tables provide detailed reconciliations of these measures to cost of sales, as reported in notes to the Company’s consolidated financial statements.

- Silver equivalents are calculated using an 89.68:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q1 2025; and 84.86:1 (Ag/Au), 0.03:1 (Ag/Pb) and 0.04:1 (Ag/Zn) ratio for Q4 2024.

- Cash cost per silver equivalent ounce includes mining, processing, and direct overhead.

- AlSC per oz includes mining, processing, direct overhead, corporate general and administration expenses, on-site exploration, reclamation, and sustaining capital.

- Production costs include mining, milling, and direct overhead at the operation sites.

- Consolidated amount for the three months ended March 31, 2025, excludes $16,375 in relation to silver bullion transportation and selling cost from cost of sales.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Qualified Person

William Gehlen, a Director of Guanajuato Silver, is a Certified Professional Geologist with the American Institute of Professional Geologists (No. 10626), and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

Mr. Gehlen has reviewed and verified technical data disclosed in this news release and detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. The verification of data underlying the disclosed information includes reviewing production reports from each of the Company’s mining operations.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE