Tectonic Metals Closes $12.7 Million Financing – More Than 80% Oversubscribed – to Launch Multi-Rig Drill Program at Flat Gold Project

Tectonic Metals Inc. (TSX-V: TECT; OTCQB: TETOF) today announced the successful closing of the Company’s oversubscribed, non-brokered private placement for gross proceeds of C$12,736,300. Initially targeted at C$7 million (see April 24, 2025 Tectonic news release), the Offering was oversubscribed by more than 80% – a clear signal of strong investor confidence in Tectonic’s leadership, exploration thesis and the tier-one potential of the Flat Gold Project in Alaska. The Offering was anchored by Crescat Capital, alongside a significant personal commitment by its principal, totalling C$3.5 million. Several other strategic, resource-focused funds and long-term shareholders also participated, further strengthening Tectonic’s aligned and value-driven shareholder base.

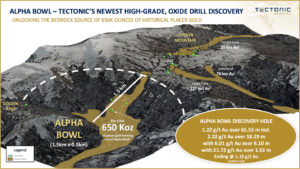

Proceeds from the Offering will include funding the fully financed 2025 Phase I Drill Program, which will see multiple drills turning to aggressively follow up on the 2024 Alpha Bowl drill discovery, see March 03, 2025 Tectonic news release, a new high-grade oxide gold discovery targeting the bedrock source of over 650,000 ounces of historic placer gold mined from Flat Creek1, one of Alaska’s most prolific placer gold-producing creeks.

Tony Reda, President and CEO of Tectonic Metals, stated:

“The market has spoken: raising C$12.7 million against a C$7 million target in mere weeks is a resounding vote of confidence in our Team, the Flat Gold Project and the Alpha Bowl discovery. Our shareholders—new and existing—see what we see: the potential to uncover a tier-one gold system in a jurisdiction that supports discovery and development. On behalf of the entire Tectonic team, I thank our shareholders for their confidence, commitment, and trust in our ability to deliver. Alpha Bowl’s scale, grade, and direct tie to 650,000 ounces of historic placer gold1 make it an extraordinary opportunity. With drills turning imminently, we’re just scratching the surface of what’s possible.”

Kevin Smith, Founder, CFA, Founder and CEOof Crescat Capital, commented:

“Tectonic has made a reduced-intrusive gold system discovery with tier-1 size potential. We see the metallurgical recoveries as to die for. The beauty is the location, just 40 kilometers from Novagold’s Donlin Gold Project, which appears to be one of the largest undeveloped gold resources on the planet that just received the green light from its billionaire owners, Tom Kaplan and John Paulson, to advance it toward production. Tectonic’s Flat will likely benefit from all the infrastructure soon coming to the region.

What is amazing is that every drill hole to date at Flat’s Chicken Mountain Intrusion has hit gold—an exceptional track record that speaks to the strength and consistency of the system. We believe that further aggressive drilling across this broad, gold-bearing intrusive complex will be highly productive in outlining what could become a significant, economically viable gold resource.

The funds from this private placement will ensure that a robust phase-1 drilling campaign starts early in the season. I expect this to be Tectonic and Flat’s biggest drill season yet. Crescat’s private funds are investing C$2.5 million, and I am personally investing C$1 million in this round. I am especially encouraged that the money from this oversubscribed financing comes from knowledgeable industry insiders and sophisticated resource funds who are likely to be long-term shareholders.”

Quinton Hennigh, Technical Director, Crescat Capital, stated:

“The Flat Gold Project exhibits hallmark features of a reduced intrusion-related gold system (RIRGS), comparable to Kinross’s Fort Knox, Snowline Gold’s Valley discovery, and Freegold Ventures’ Golden Summit project—all of which demonstrate the potential for large-tonnage, intrusion-hosted gold systems in favorable geological settings. Notably, geological evidence at Flat points to the presence of not just one, but potentially multiple intrusive centers—each with district-scale deposit potential.

Alpha Bowl has transitioned rapidly from a prioritized exploration target to a confirmed drill discovery, defined by near-surface, high-grade oxide gold mineralization from top to bottom of hole. We believe Alpha Bowl may represent the higher-grade core of the broader Chicken Mountain intrusive complex—situated directly above one of Alaska’s most historically productive placer corridors, which further validates the system’s fertility.

Having evaluated gold systems around the world—first as a Senior Research Geologist at Newmont and now with Crescat—it is rare to encounter a project at this stage with such a compelling convergence of geology, metallurgy, and scale. Situated near Donlin Gold, one of the largest undeveloped gold deposits globally with over 39 million ounces, Flat is exceptionally well-positioned. The imminent multi-rig drill program is a critical next step in what we believe could evolve into one of Alaska’s most significant new gold discoveries.”

Figure 1: Tectonic Alpha Bowl drilling discovers bedrock gold source underlying 650,000 Oz of historic placer gold production.1 Drill hole CMR24-026 returned 65.5 metres of 1.2 g/t Au, including 6.1 metres of 6.0 g/t Au with 1.5 metres of 21.7 g/t Au; drilled mineralized strike now 3kms and still open. Refer to the Tectonic March 3rd, 2025, news release for more information.

Share Consolidation

On May 20, 2025, the Company completed a Share Consolidation on a 10-for-1 basis of its common shares as previously announced on May 15, 2025. Immediately before the Share Consolidation, there were a total of 419,853,777 pre-Consolidation common shares issued and outstanding. Pursuant to the Consolidation, the 419,853,777 Pre-Consolidation Shares became 41,985,370 post-Consolidation common shares. No fractional Common Shares were issued as a result of the Consolidation, and any fractional share interest was rounded down to the nearest whole Common Share. No cash consideration was paid in respect of any fractional shares. There was no name or symbol change in conjunction with the Share Consolidation. The new CUSIP is 87877T608 and the new ISIN number is CA87877T6088 for the Common Shares.

The exercise or conversion price and the number of Common Shares issuable under any of the Company’s outstanding warrants and stock options was proportionately adjusted to reflect the Consolidation in accordance with their respective terms.

Effective May 20, 2025, a letter of transmittal is being mailed to registered shareholders, providing instructions with respect to surrendering share certificates representing Pre-Consolidation Shares in exchange for post-Consolidation Common Shares issued as a result of the Consolidation. Until surrendered, each certificate representing Pre-Consolidation Shares will be deemed to represent the number of post-Consolidation Common Shares the holder received as a result of the Consolidation. Shareholders who hold their Common Shares in brokerage accounts or in book-entry form are not required to take any action.

Close of the Offering

On May 20, 2025, concurrent with the Share Consolidation and pursuant to the close of the Offering (previously announced on April 24, 2025), Tectonic issued 25,472,600 post-Consolidation units, whereby each Unit consists of one Common Share of the Company and one post-Consolidation common share purchase warrant. As a result, the Company issued 25,472,600 Common Shares and 25,472,600 Warrants. Each Warrant entitles the holder to acquire one Common Share at an exercise price of C$0.75 per share, expiring on May 20, 2027. The Offering is subject to certain conditions, including, but not limited to, the receipt of all necessary approvals, including the final approval of the TSX Venture Exchange.

In connection with the Offering and in accordance with the policies of the TSXV, the Company incurred aggregate cash finders’ fees totaling C$335,700 to Canaccord Genuity Corp., Haywood Securities Inc., SCP Resource Finance LP, Red Cloud Securities Inc., Leede Financial Inc., 3L Capital Inc., Stephen Avenue Securities Inc., Golden Capital Consulting Ltd., Mezzo Consulting Services S.A., Research Capital Corporation, Black Oak Ventures Limited, and Roche Securities Ltd.. The Company also issued an aggregate of 671,400 non-transferable Warrants to the Finders. Each Finder’s Warrant entitles the holder to acquire one Common Share at an exercise price of C$0.75 per share, expiring on May 20, 2027.

Units issued pursuant to Offering will be issued pursuant to the “accredited investor” exemption from the prospectus requirements found in NI 45-106 and in the United States pursuant to exemptions from the registration requirements in Regulation D of the U.S. Securities Act of 1933, as amended. All securities issued will be subject to a four-month hold period from the date of closing.

The Offering and issuance of the Units referenced in this press release will involve one or more related parties (as such term is defined under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”)) and therefore constitutes a related party transaction under MI 61-101. This transaction will be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, as neither the fair market value of any securities issued to nor the consideration paid by such related parties will exceed 25% of the Company’s market capitalization.

About Crescat Capital

Crescat Capital is a global macro asset management firm headquartered in Denver, Colorado, which deploys tactical investment themes based on proprietary value-driven equity and macro models. Crescat’s investment goals are to provide industry-leading absolute and risk-adjusted returns over complete business cycles with low correlation to common benchmarks, and they apply their investment process across a mix of asset classes and strategies. Crescat is taking activist stakes in the precious metals exploration industry today as one of its key macro themes.

About Tectonic Metals Ltd.

Tectonic Metals Inc. is a gold exploration company founded by the same key executives who transformed Kaminak Gold from a $3 million venture into a $520 million success story. These leaders raised over $165 million to fund the acquisition, discovery, and advancement of the Coffee Gold Project in the Yukon Territory, including the completion of a bankable feasibility study, before selling the multi-million-ounce gold project to Goldcorp Inc. (now Newmont) for C$520 million.

Success with the Coffee Gold Project is only one example, as each member of the Tectonic team has a significant track record of success in all facets of exploration and mining, including over 30 Moz of gold discoveries, 18 feasibility studies, 20 projects permitted, over $3 billion in M&A transactions and over $2 billion in capital raising.

The former Kaminak Executives are back at it with the Flat Gold Project, which is located in Alaska, just 40 km from Novagold’s Donlin Gold Project, one the largest undeveloped gold deposits in the world. Spanning 99,800 acres of predominantly Native-owned land belonging to Doyon, Ltd. (Tectonic’s second-largest shareholder and one of Alaska’s largest for-profit Native Regional Corporations), Flat hosts a bulk-tonnage, Reduced Intrusion-Related Gold System (RIRGS) analogous to the Fort Knox gold mine.

Recognized as a prime example of the direct relationship between placer gold and bedrock sources, placer gold shed from Flat’s intrusions has contributed to 1.4 Moz of historical placer gold production.1Notably, the Project has achieved a 100% drill success rate, with gold intersected in all 86 drill holes, covering 3 km of drilled mineralized strike and reaching a vertical depth of 325 m at its primary intrusion target, Chicken Mountain, with mineralization remaining open in all directions.2

- Placer production figures from “Mineral Occurrence and Development Potential Report,Locatable and Salable Minerals, Bering Sea-Western Interior Resource Management Plan, BLM Alaska Technical Report 60”, prepared by the U.S. Department of the Interior, Bureau of Land Management, November 2010.

- Tectonic Metals Ltd. (2025, May). Tectonic Metals corporate presentation: The Flat Gold Project, Alaska’s next tier one gold mining opportunity [Slide 25].

Learn More About Tectonic Metals

Subscribe To Our Email List

View our 2025 Fact Sheet or Corporate Presentation

Tour The Flat Gold Project

Tectonic invites you to take a virtual tour of our Flat Gold Project with both the CEO of Tectonic and one of Alaska’s largest for-profit Native Regional Corporations, Doyon

To Be A Part Of “The Shift,” Follow Us On Social Media:

X

LinkedIn

Instagram

Facebook

YouTube

Qualified Person

Tectonic Metals’ disclosure of technical or scientific information in this press release has been reviewed, verified and approved by Peter Kleespies, M.Sc., P.Geo., Vice President of Exploration, who is a Qualified Person in accordance with Canadian regulatory requirements set out in National Instrument 43-101.

On behalf of Tectonic Metals Inc.,

Tony Reda

President and Chief Executive Officer

For further information about Tectonic Metals Inc. or this news release, please visit our website at www.tectonicmetals.com or contact Jesse Manna, Investor Relations, toll-free at 1.888.685.8558 or by email at jesse@tectonicmetals.com

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE