Asante Projects Transformative Growth in Updated Five-Year Outlook: 500,000+ oz Annual Gold Production by 2028, >$2 Billion in Free Cash Flow, Increased Mineral Reserves

Asante Gold Corporation (CSE:ASE) (GSE:ASG) (FRANKFURT:1A9) (U.S.OTC:ASGOF) is pleased to announce an updated five-year outlook (2025-2029) highlighting rapid production growth, declining costs, and robust free cash flow generation from its flagship mines in Ghana. The Chirano outlook also incorporates increased mineral reserves, marking the second consecutive year of mine life extension since acquisition by Asante. All dollar amounts are in U.S. dollars unless otherwise noted.

HIGHLIGHTS

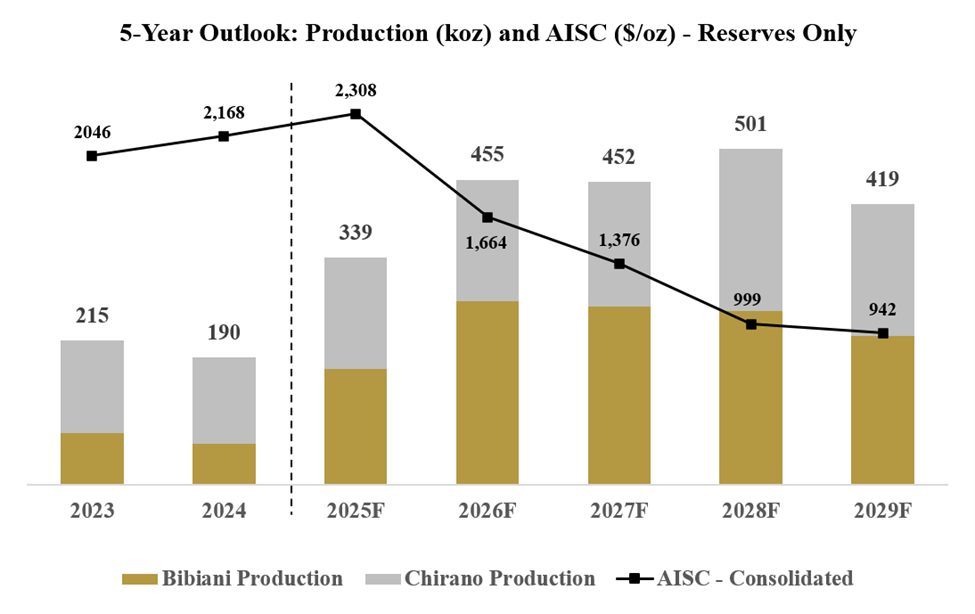

- Annual production from Bibiani and Chirano anticipated to grow by 34% to 455,000 ounces in 2026, increasing to more than 500,000 ounces in 2028

- Cumulative anticipated five-year production of 2.2 million ounces (2025 – 2029), based on reserves only, calculated at $1,700/ounce gold price

- Unlevered free cash flow of $2.1 billion anticipated over the same five-year period (assuming $3,000/ounce gold price)

- Supported by significantly lower all-in sustaining costs, reflecting increased scale, reduced stripping requirements, higher grades and increased gold recovery, with AISC1 expected to be $1,375/ounce by 2027, <$1,000/ounce by 2028

- Sulphide treatment plant construction is advanced, with start of operation scheduled for July 2025; gold recovery anticipated to be 92%

- Incorporates Bibiani underground feasibility study results announced January 15, 2025

- Increased reserves of 242,000 ounces at Chirano delineated since April 2024 Chirano Technical Report

- Excellent expansion and mine life extension opportunities at both mines underpinned by substantial resource base, track record of resource delineation and conversion, planned exploration investment

- Financing and liquidity update:

- Financing package announced October 30, 2024 has advanced significantly with closing targeted in Q2 2025; further announcement expected following final credit commitments

- Near-term liquidity strengthened with $100 million advance from Fujairah gold forward arrangement, scheduled for May 2025

- Increased Bibiani gold production relative to Q4 2024, and strong gold price environment

Dave Anthony, President and CEO stated:

“Our updated five-year outlook projects annual gold production exceeding 500,000 ounces by 2028 and more than $2 billion in unlevered free cash flow between 2025 and 2029. As a rapidly growing gold producer in the heart of one of Ghana’s most prolific mineral belts, Asante is well positioned to offer our shareholders exceptional leverage to rising gold prices at a time of significant global uncertainty. Notably, this outlook is based solely on current reserves, underscoring significant upside potential from ongoing resource conversion, expansion and mine life extension initiatives.”

References to years in this news release relate to the 12-month period commencing February of the applicable calendar year, consistent with the Company’s January 31 fiscal year-end. For example, “2025” refers to the 12-month period of February 2025 – January 2026.

Investors are invited to register for a live, interactive webinar to discuss the technical report results at 8:00 am Pacific Time / 11:00 am Eastern time / 3:00 pm Ghana time on Thursday, May 8, 2025 to be hosted by CEO Dave Anthony and CFO David Wiens at the following link: https://6ix.com/event/asante-gold-corporate-update.

Five-Year Outlook (Mineral Reserves Only) – Consolidated

Consolidated annual gold production and AISC from the Bibiani and Chirano mines are planned as follows:

Five-Year Outlook – Bibiani Mine (Mineral Reserves Only)

Key metrics at the Bibiani mine during the 2025-2029 period include:

| 2025 | 2026 | 2027 | 2028 | 2029 | 5-Year Total |

5-Year Average |

|||||||||||

| Operations | |||||||||||||||||

| Ore mined – open pit (kt) | 3,549 | 5,615 | 4,443 | – | – | 13,606 | 2,721 | ||||||||||

| Waste mined – open pit (kt) | 96,052 | 79,722 | 23,537 | – | – | 199,311 | 39,862 | ||||||||||

| Total mined – open pit (kt) | 99,601 | 85,337 | 27,980 | – | – | 212,917 | 53,229 | ||||||||||

| Strip ratio (waste:ore) | 27.1 | 14.2 | 5.3 | – | – | 14.6x | 14.6x | ||||||||||

| Grade mined – open pit (g/t) | 1.90 | 1.97 | 2.10 | – | – | 1.99 | 1.99 | ||||||||||

| Ore mined – underground (kt) | – | 148 | 1,253 | 2,301 | 2,641 | 6,344 | 1,269 | ||||||||||

| Grade mined – underground (g/t) | – | 1.74 | 1.81 | 2.23 | 2.45 | 2.23 | 2.23 | ||||||||||

| Ore milled (kt) | 3,276 | 4,062 | 4,055 | 4,092 | 3,989 | 19,474 | 3,895 | ||||||||||

| Grade milled (g/t) | 1.93 | 2.28 | 2.22 | 2.14 | 1.88 | 2.10 | 2.10 | ||||||||||

| Gold recovery (%) | 85 | % | 92 | % | 92 | % | 92 | % | 92 | % | 91 | % | 91 | % | |||

| Production (koz) | 172 | 273 | 266 | 259 | 222 | 1,193 | 239 | ||||||||||

| Cash Flow @ $3,000/oz | |||||||||||||||||

| Revenue | 517 | 820 | 799 | 778 | 666 | 3,580 | 716 | ||||||||||

| Net operating cashflow | 286 | 427 | 386 | 419 | 354 | 1,872 | 374 | ||||||||||

| Capex | (306 | ) | (260 | ) | (134 | ) | (59 | ) | (27 | ) | (786 | ) | (157 | ) | |||

| Net cash flow | (20 | ) | 167 | 251 | 360 | 326 | 1,085 | 217 | |||||||||

| AISC ($/oz) | 2,494 | 1,600 | 1,297 | 913 | 992 | 1,459 | 1,459 | ||||||||||

Consistent with the April 2024 Bibiani Technical Report, the Bibiani five-year outlook is based upon rapid production growth enabled by expansion of the Main Pit, increased fleet availability and completion of the sulphide treatment plant in 2025.

In 2025 thus far, mining activities at Russel and Main pits have increased significantly relative to Q4 2024 as a result of funding received in December 2024 from the Fujairah Gold Forward agreement. Gold production for the three-month period January to March 2025 increased 120%, relative to the period October – December 2024. Gold production of 172,000 ounces is planned for 2025, representing a 125% and 183% increase relative to 2024 and 2025 actual production respectively. Completion of the sulphide treatment plant and increased rate of mining operations are on track to deliver these results.

Delineation of underground reserves at Bibiani and development of a combined open pit / underground mining plan is motivated by the Company’s strategy to increase Life of Mine and optimize economic value. As a result, previously planned waste cuts in the open pit are eliminated and earlier access will be provided to higher-grade underground mineralized material.

The underground mine development will start in late 2025, with full production scheduled for 2028. This includes a robust underground design and mining strategy that includes establishment of an underground conveyor system in 2026 to feed the process plant area directly. Three access points into the main orebody will establish a robust mine infrastructure and commence stoping operations. This approach was initially articulated in the April 2024 Bibiani Technical Report and has been subsequently validated by the underground Definitive Feasibility Study (the “DFS”) as outlined in the Company’s news release of January 15, 2025. The results of the DFS are factored into the five-year outlook projections.

Capital expenditures at Bibiani are elevated in the 2025-2026 period as a result of capital projects to deliver: (i) completion of the sulphide treatment plant and other plant upgrades (pebble crusher, jaw crusher, CIL and elution circuit upgrades); (ii) stripping related to expansion of the Bibiani Main Pit; (iii) underground development activities; and (iv) community and social projects, including the planned resettlement of the neighboring Old Town and Zongo communities. These initiatives support an increase in gold recovery to 92% and plant throughput to 4 million tonnes per year, which contribute to a significant reduction in unit costs from 2026 onwards. When these capital projects are delivered, there will be a significant reduction of AISC.

Consistent with the April 2024 Bibiani Technical Report, the Company expects mining of existing reserves through early 2032. The Company’s strategy is to extend mine life well beyond this timeframe through resource conversion, extension of the underground mine, delineation and expansion of new satellite pits. This strategy is underpinned by the significant resource base at the Bibiani Mine (incremental to reserves), high prospectivity of regional geology and the Company’s track record of resource replacement and growth.

Five-Year Outlook – Chirano Mine (Mineral Reserves Only)

Key metrics at the Chirano mine during the 2025-2029 period include:

| 2025 | 2026 | 2027 | 2028 | 2029 | 5-Year Total |

5-Year Average |

||||||||

| Operations | ||||||||||||||

| Ore mined – open pit (kt) | 1,759 | 415 | 918 | 1,758 | – | 4,850 | 970 | |||||||

| Waste mined – open pit (kt) | 9,150 | 6,768 | 9,755 | 5,582 | – | 31,254 | 6,251 | |||||||

| Total mined – open pit (kt) | 10,908 | 7,182 | 10,673 | 7,340 | – | 36,104 | 9,026 | |||||||

| Strip ratio (waste:ore) | 5.2 | 16.3 | 10.6 | 3.2 | – | 6.4x | 6.4x | |||||||

| Grade mined – open pit (g/t) | 0.94 | 1.13 | 0.82 | 0.92 | – | 0.92 | 0.92 | |||||||

| Ore mined – underground (kt) | 1,949 | 2,779 | 2,656 | 3,155 | 2,682 | 13,221 | 2,644 | |||||||

| Grade mined – underground (g/t) | 2.03 | 1.95 | 2.14 | 2.19 | 2.31 | 2.13 | 2.13 | |||||||

| Ore milled (kt) | 3,987 | 3,715 | 3,369 | 4,114 | 3,685 | 18,870 | 3,774 | |||||||

| Grade milled (g/t) | 1.47 | 1.66 | 1.87 | 1.99 | 1.81 | 1.76 | 1.76 | |||||||

| Gold recovery (%) | 89 | % | 91 | % | 92 | % | 92 | % | 92 | % | 91 | % | 91 | % |

| Production (koz) | 167 | 182 | 186 | 242 | 197 | 973 | 195 | |||||||

| Cash Flow @ $3,000/oz | ||||||||||||||

| Revenue | 501 | 545 | 558 | 725 | 590 | 2,919 | 584 | |||||||

| Net operating cashflow | 161 | 230 | 227 | 338 | 295 | 1,250 | 250 | |||||||

| Capex | (78 | ) | (90 | ) | (32 | ) | (11 | ) | – | (210 | ) | (42 | ) | |

| Net cash flow | 84 | 140 | 195 | 327 | 295 | 1,040 | 208 | |||||||

| AISC ($/oz) | 2,115 | 1,760 | 1,490 | 1,091 | 887 | 1,469 | 1,469 | |||||||

The Chirano five-year outlook plans for continuation of open pit operations through 2028, to maintain a feed balance with the underground mines to optimize its production profile. This represents an extension of three years of open pit mining relative to the April 2024 Chirano Technical Report, resulting an overall increase in Chirano’s reserve life by one year relative to the technical report.

Underground production is supported by five mines within the Chirano footprint, with a particular focus on the Suraw and Obra mines in the 2026-2028 period. The Company’s strategy includes comprehensive rebuild and replacement programs of the underground equipment fleet, to increase development and productivity, while also reducing mining costs by increasing equipment size.

While the technical report envisages continuation of production at Chirano through 2029 based on mineral reserves, the Company’s strategy is to extend mine life well beyond 2029 through resource conversion, development of infrastructure needed to extend the underground mines to lower depths and delineation of new pits. The Chirano Mine has an excellent track record of resource to reserve extension since the commencement of operations in 2005. In addition, significant opportunities include the connection of Chirano’s northern mines, where lower costs will be achieved with development of a conveyer system to feed directly to the process plant. This would provide significant savings and extend mine life through reduced trucking costs.

Increased Mineral Reserves at Chirano Mine

Newly delineated reserves underpinning the Chirano mine life extension, as noted above, are supported by successful exploration efforts in 2024 at Obra Underground North Extension, Sariehu North, and Mamnao South Surface Extensions. A total of 34,363 metres of drilling were completed across 159 drill holes resulting in an additional 242,000 contained ounces of gold to the reserves and 155,000 ounces in resources following optimizations and engineering studies. We are excited to note the strike length for the Obra deposit has increased from 400 to 700m.

The 2024 drilling program results underscore the potential for discovery of significant resources in the area and support continuation of exploration efforts to unlock additional value. In 2025, exploration efforts will continue to focus on upgrading resources and extending the LoM at Chirano. Exploration in 2025 will target the deepening and lateral extension of mineralized structures, as well as evaluating new exploration opportunities to enhance our resource base.

Exploration efforts at Obra Underground in 2024 demonstrate a strong linkage with the Sariehu deposit at depth, returning encouraging intercepts and confirming the presence of a high-grade mineralized shoot (+2.5g/t Au) plunging to the north. These results indicate significant potential for further mineralization down dip. The deepest hole drilled in 2024 at Obra returned an impressive intersection of 39.09 metres at 2.63g/t Au (true width), including 5.71 metres at 5.18g/t Au.

A highlight of 2024 was the successful exploration at Obra Underground, which demonstrated a strong, positive linkage with the Sariehu deposit at depth. Drill results from this area returned encouraging intercepts, confirming the presence of a high-grade mineralized shoot (+2.5g/t Au) plunging to the north. These results indicate the potential for further mineralization down dip, with the deepest hole drilled in 2024 at Obra returning an impressive intersection of 39.09 metres at 2.63g/t Au (true width), including 5.71 metres at 5.18g/t Au. These results underscore the potential for high-grade resources in the area and support the continued exploration efforts to unlock additional value.

Looking ahead to 2025, exploration efforts will continue with a focus on upgrading resources and extending shoots, with the goal of further increasing the LoM at Chirano. Continued exploration will target the deepening and lateral extension of mineralized structures, as well as evaluating new exploration opportunities to enhance the resource base.

Incremental reserves are summarized as follows:

| DECEMBER 31, 2024 CHIRANO RESERVE ADDITIONS | ||||

| DEPOSIT | Classification | Tonnes | Grade | Ounces |

| (000’s) | (Au g/t) | (000’s) | ||

| OBRA UG | Proven | – | – | – |

| Probable | 2,327.0 | 2.27 | 169.7 | |

| Subtotal | 2,327.0 | 2.27 | 169.7 | |

| GSM | Proven | – | – | – |

| Probable | 2,241.1 | 1.00 | 72.4 | |

| Subtotal | 2,241.1 | 1.00 | 72.4 | |

| – | – | – | ||

| TOTAL | TOTAL | 4,568.1 | 1.65 | 242.1 |

Notes:

- The Mineral Reserve has been reported in accordance with the requirements and guidelines of NI 43-101.

- The Mineral Reserves are reported with appropriate modifying factors and Obra Underground reported using $1,700 metal price and GSM reported at $1,900 using a cut-off grade input parameter of 1.24g/t and 0.49g/t respectively.

- Apparent computational errors due to rounding and are not considered significant

- No Inferred Mineral Resources have been included in the Mineral Reserve estimate for the 2024 additions due to exploration efforts within the period.

- Mineral Reserve expressed on a 100% basis; Asante owns 90% of the Chirano Mine.

- The Mineral Reserve estimates contained herein may be subject to legal, political, environmental or other risks that could materially affect the potential exploitation of such Mineral Reserves.

Financing and Liquidity Update

The Company continues to advance its financing package and expects to provide an announcement in the coming weeks detailing the final anticipated capital structure, including the participants thereof. The financing package remains subject to receipt of credit commitments by certain financing counterparties and negotiating and execution of definitive agreements. Although there is no certainty that such financing initiatives will be completed, the Company is confident that it will be able to complete such initiatives in the second quarter of 2025.

As our financing initiatives advance, near-term liquidity is expected to be strengthened from (i) a $100 million advance from Fujairah scheduled for May 2025 for the future delivery of gold, (ii) increased Bibiani gold production relative to Q4 2024 and (iii) a strong gold price environment.

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed and approved by David Anthony, P.Eng., Mining and Mineral Processing, President and CEO of Asante, who is a “qualified person” under NI 43-101.

Non-IFRS Measures

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards including “all-in sustaining costs”. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS and should be read in conjunction with Asante’s consolidated financial statements. Readers should refer to Asante’s Management Discussion and Analysis under the heading “Non-IFRS Measures” for a more detailed discussion of how Asante calculates certain of such measures and a reconciliation of certain measures to IFRS terms.

About Asante Gold Corporation

Asante is a gold exploration, development and operating company with a high-quality portfolio of projects and mines in Ghana. Asante is currently operating the Bibiani and Chirano Gold Mines and continues with detailed technical studies at its Kubi Gold Project. All mines and exploration projects are located on the prolific Bibiani and Ashanti Gold Belts. Asante has an experienced and skilled team of mine finders, builders and operators, with extensive experience in Ghana. The Company is listed on the Canadian Securities Exchange, the Ghana Stock Exchange and the Frankfurt Stock Exchange. Asante is also exploring its Keyhole, Fahiakoba and Betenase projects for new discoveries, all adjoining or along strike of major gold mines near the centre of Ghana’s Golden Triangle.

About the Bibiani Gold Mine

Bibiani is an operating open pit gold mine situated in the Western North Region of Ghana, with previous gold production of more than 4.5 million ounces. It is fully permitted with available mining and processing infrastructure on-site consisting of a newly refurbished 3 million tonne per annum process plant and existing mining infrastructure. Asante commenced mining at Bibiani in late February 2022 with the first gold pour announced on July 7, 2022. Commercial production was announced November 10, 2022.

About the Chirano Gold Mine

Chirano is an operating open pit and underground mine located in the Western Region of Ghana, immediately south of the Company’s Bibiani Gold Mine. Chirano was first explored and developed in 1996 and began production in October 2005. The mine comprises the Akwaaba, Suraw, Akoti South, Akoti North, Akoti Extended, Paboase, Tano, Obra South, Obra, Sariehu and Mamnao open pits and the Akwaaba and Paboase underground mines.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE