Graphite – The Unsung Hero of the Energy Transition

By Jamie Hyland

As the global shift toward electric vehicles (EVs) and renewable energy accelerates, graphite has emerged as an indispensable mineral. Often overlooked compared to lithium, graphite is crucial for battery production, making it a prime target for investors and industry players alike.

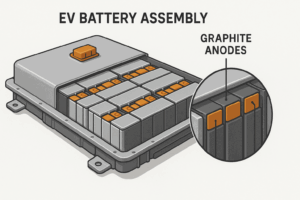

EV Demand Is Exploding – and Graphite Is Unavoidable

Every EV battery—regardless of its chemistry—relies heavily on graphite, using more graphite than lithium by weight. An average electric vehicle contains between 50–70 kg of graphite. With automotive giants like Tesla, BYD, and GM rapidly scaling their EV production, demand for battery-grade graphite is surging. Natural graphite remains the preferred choice, comprising over 60% of anode materials in most batteries, outcompeting synthetic graphite on both cost and sustainability fronts.

Supply Chain Shifts Are Already Underway

Currently, China dominates global graphite processing, controlling over 80% of the industry. Recent geopolitical tensions and export restrictions have pushed OEMs and battery manufacturers to seek alternative, reliable sources. North America and Africa have become strategic regions, witnessing significant capital inflow from governments and corporations aiming to establish vertically integrated graphite supply chains, starting at the mine.

The problem with China’s dominance has become increasingly evident, prompting a shift in consumer spending habits toward domestically produced goods. Many families, including our own, have created channels to recommend only Canadian-made products, from everyday goods to vehicles. Similar actions are needed in the United States, particularly within the military sector. Critical minerals like graphite, gallium, and others represent some of the most urgent needs.

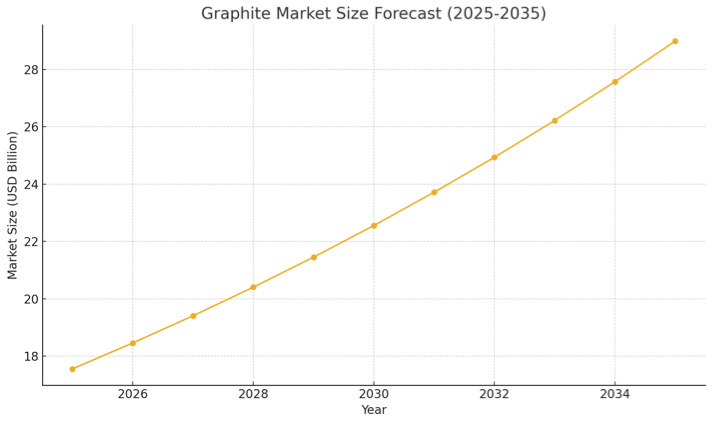

Prices & Projects: The Market Is Catching Up

Benchmark Mineral Intelligence forecasts graphite demand will surge 4–5 times by 2035, prompting steady price increases, especially as global stockpiles shrink. This bullish outlook has intensified investor interest in early-stage graphite mining projects, particularly those with strong flake distribution and robust ESG profiles.

Spotlight on Graphite Companies

Lomiko Metals (TSX.V: LMR)

Lomiko Metals has positioned itself prominently through its flagship La Loutre Project in Quebec. CEO and Interim Chair, Belinda Labatte, recently highlighted the company’s commitment: “The funding is at the heart of the research and scientific needs of Quebec and Canada’s critical minerals strategy, reflecting our dedication to harmonious development in the region. Lomiko has reconfirmed the suitability of La Loutre’s graphite as a battery anode material through multiple tests, and we are enthusiastic about continuing this collaboration with Quebec-based experts and consultants to strengthen the local battery industry.”

Lomiko’s active engagement with local communities underscores its ESG commitment, bolstering its attractiveness as a responsible investment.

E-Power Resources Inc. (CSE: EPR)

E-Power Resources Inc. is a Québec-based corporation headquartered in Montréal and focused on developing graphite assets within the province. Listed on the CSE under the symbol EPR, the company is dedicated to advancing critical mineral projects that align with Québec’s strategic vision for battery materials. E-Power’s portfolio emphasizes sustainable exploration practices and aims to support North America’s push for secure, local sources of battery-grade graphite.

The Bottom Line

Graphite is now more critical than ever, driving significant attention from investors and industry stakeholders. As the EV revolution accelerates and geopolitical shifts challenge traditional supply chains, companies like Lomiko Metals and E-Power Resources Inc. represent key opportunities. These Canadian-listed companies exemplify strategic positioning and operational excellence, making them attractive bets in the rapidly evolving graphite market.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE