Rick Mills – “Graphite One Releases Bankable Feasibility Study, Advancing US Graphite Supply Chain”

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

China also accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.

China has imposed restrictions on graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Up to now, the US has had no security of supply for graphite. The country has reached a point where much more graphite needs to be discovered and mined in the US.

Achieving security of US graphite supply

Graphite One (TSX-V:GPH) (OTCQX:GPHOF) could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio.

Consider: In 2024, the US imported 60,000 tonnes of natural graphite, of which 87.7% was flake and high-purity.

Graphite One’s Bankable Feasibility Study anticipates more than tripling the 53,000-tonne production rate in the Prefeasibility Study (PFS) to 175,000 tonnes. The Proven and Probable mineral reserve tonnage is 317% of the PFS reserve estimate. The Measured + Indicated resource tripled (322%) from the resource disclosed in the PFS.

This means Graphite One could have the capacity to not only meet the US’s annual graphite needs, but have extra to stockpile, around 100,000 tonnes each year. This additional graphite could be put to domestic usage or built up to accommodate future demand growth.

Graphite Creek has a current mine life of 20 years.

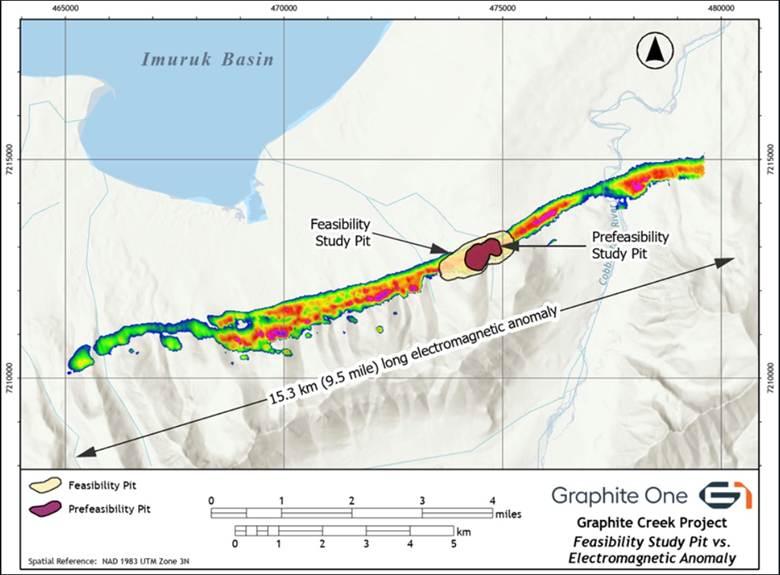

All of this is based on the results of just 1.9 km (~12%) of the 15.3-km-long geophysical anomaly. Graphite Creek is now triple the size when the US Geological Survey reported three years ago that it was the largest flake graphite deposit in the US. And it could get even bigger with further exploration. We are talking about a potential life of mine that provides all the graphite the US needs, spanning generations.

US achieves security of graphite supply with G1 Feasibility Study

Bankable Feasibility Study

Graphite One’s feasibility study is different, and more ambitious, than those typically released by junior resource companies. It is for both the Graphite Creek Mine in Alaska, and the anode active material (AAM) facility proposed for Ohio, known forthwith as the Secondary Treatment Plant (STP).

Thanks to Defense Production Act Title III Funding of $37.5 million, the feasibility study was completed 15 months ahead of schedule.

The FS envisions the first 48,000 tonnes per year (tpy) of commercial AAM production by 2028, start-up of the Graphite Creek Mine in 2030 and 169,000 tpy of AAM production by 2031.

The phased development strategy reduces upfront capital and aligns spending with project milestones, according to the company.

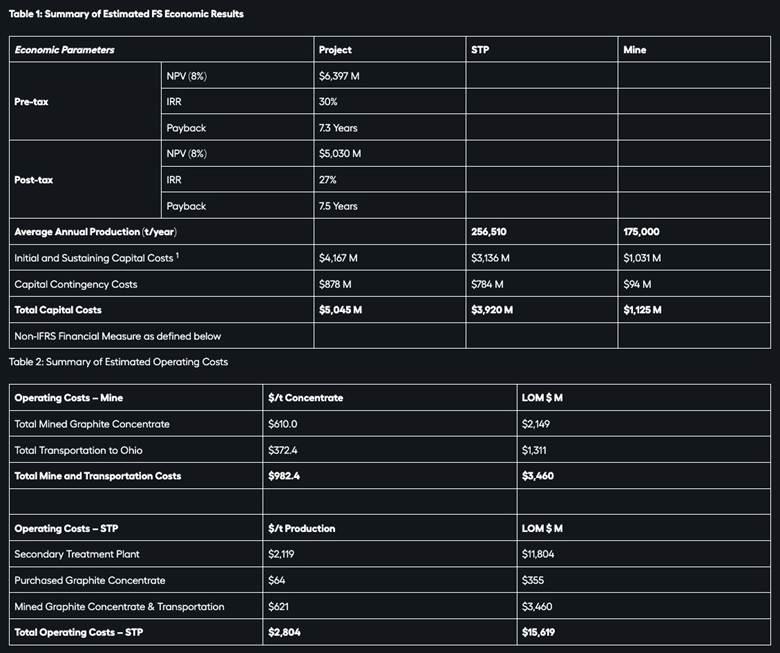

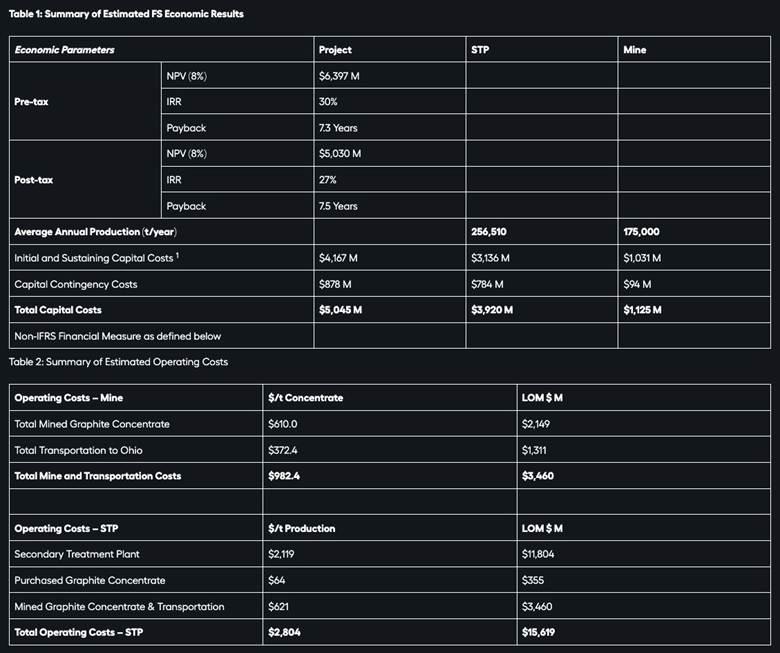

The FS has an estimated pre-tax internal rate of return (IRR) of 30%, with a pre-tax net present value (NPV) of $6.4 billion and a payback period of 7.3 years. The NPV was based on a 8% discount rate, which is very conservative given that many companies use a 5% discount rate for projects that are in the feasibility study stage.

“Our Feasibility Study represents a major milestone for G1 on our path to production and validates the efforts we’ve made with the Department of Defense’s DPA Title III support to complete our FS 15 months ahead of schedule, while tripling the size of our Graphite Creek resource,” said Graphite One’s CEO Anthony Huston in the April 23 news release. “With President Trump’s Critical Mineral and Alaska Executive Orders, Graphite One is positioned to be at the leading edge of a domestic Critical Mineral renaissance that will power transformational applications from energy and transportation to AI infrastructure and national defense.”

Graphite is used as the anode for all lithium-ion batteries. Its industrial application is indispensable in many sectors and for national defense it’s irreplaceable; graphite is used in aircraft, helicopters, ships, submarines, tanks, infantry fighter vehicles, artillery and missiles.

Graphite’s war-fighting capabilities — Richard Mills

The project is planned as an integrated business operation to produce lithium-ion battery anode materials and other graphite products for the US domestic market on a commercial scale using primarily natural graphite from Alaska. It combines the operation of the STP — an advanced graphite manufacturing facility to be located in Ohio — with the supply of synthetic graphite, then natural flake graphite from the company’s proposed Graphite Creek Mine in Alaska.

Phased development strategy

The project is planned to be implemented with a capital risk reduction strategy that develops the Ohio STP in seven 25,000 tpy modules while the mine completes permitting and construction. This modular approach allows for capital expenditures to be deployed progressively, in line with each phase of development, significantly reducing the upfront capital to $607 million, including $121 million of contingency for the first 25,000 tpy module.

Each subsequent module is estimated to cost $552 million, including contingency. As a result, the company expects to achieve 50,000 tpy of commercial natural graphite production by 2028 and 175,000 tpy by 2031, one year after the mine is expected to begin production.

The plant will use synthetic graphite until natural graphite anode active material becomes available from Graphite Creek, according to the March 20, 2024 news release. The company may purchase natural graphite as a backup.

“We will now enter the permitting process with a production rate triple what we projected just over two years ago. Our proven and probable reserve and contained graphite tripled from the reserve and contained graphite disclosed in the PFS. And all of this is based on FS-level resource drilling results from just 12% of the 15.3-km (9.5-mile)-long graphite mineralized zone as defined by geophysics and wide-spaced drilling (see Figure 1),” Huston noted.

Figure 1: FS pit versus PFS pit superimposed on electromagnetic survey anomaly

Graphite Creek Mine

Located on the Seward Peninsula, the Graphite Creek property comprises 9,600 hectares of Alaska mining claims. The claim block consists of 176 claims. G1’s deposit is entirely on state land.

The project isn’t near a salmon fishery and it has the backing of local communities. Nome, Alaska has a long history of resource extraction. Graphite Creek is about 60 km north of Nome.

The graphite mineral zone is exposed on the surface and strikes east/northeast along the north face of the Kigluaik Mountains.

The mine would produce an average 175,000 tpy of graphite concentrate for its projected 20-year mine life. The deposit would be mined with conventional open-pit mining methods including drilling, blasting, loading and hauling. The strip ratio in the FS is 3.2:1 with an ore variable cut-off grade of 2-3% graphitic carbon and an average head grade of 5.2% graphitic carbon. The pit would be mined in five phases over two decades. One year of pre-stripping would occur prior to the start-up of the process facility. Ore will be hauled to a process facility to be built adjacent to the pit. Run-of-mine waste would be comingled with dewatered process tails and placed in waste dumps.

The process facility would process an average of 10,000 tonnes per day (tpd) for 365 days per year. The flowsheet design is based on metallurgical test work conducted at SGS Canada Inc.’s facilities at Lakefield, Ontario. The flowsheet consists of a jaw crusher that feeds a semi autogenous grinding circuit. After grinding, the ore is subjected to a series of seven flotation and three regrind steps. The flotation/regrind steps are designed to recover the graphite at its largest possible flake size while still maintaining a concentrate with a graphitic carbon grade of greater than 95%. The graphite concentrate would be filtered and dried on site. The dried concentrate would be shipped by barge from Nome, Alaska to the STP in Ohio during the annual shipping season. The tails from the flotation circuit would be dewatered, comingled with the waste rock, and placed in a lined waste storage facility. Any drainage from the lined waste storage facility would be treated through a water treatment plant prior to discharge.

Mineral resources and reserves

Through 2022, 2023 and 2024, 90 holes were drilled in the resource area for a total of 13,482 meters. The resource database consists of 22,806 assays. The resource remains open down dip and along strike to the east and west.

The Mineral Resource estimate for Graphite Creek was updated with data from the 2024 drill program. The methodology used was the same as that described in the PFS. A lower cut-off grade of 2% was used for the 2022 and 2024 resource. The FS Mineral Resource estimate for Graphite Creek is presented in Table 4 and is as of March 25, 2025.

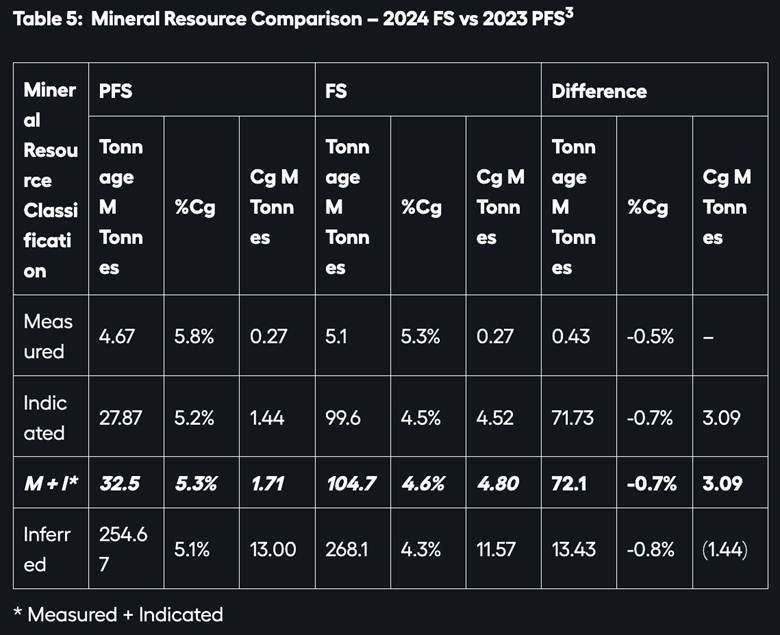

The 2023-24 drill program focused on converting Inferred resources into Measured and Indicated, to allow annual graphite production to be increased in the FS. A comparison of the PFS and FS mineral resources can be seen in Table 5.

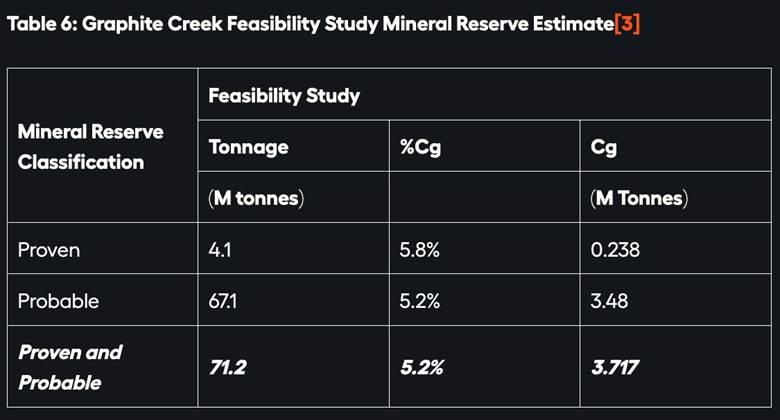

The 2024 Mineral Reserve estimate consists of 71.219Mt of Proven and Probable material at an average diluted grade of 5.22% graphite, yielding 3.7Mt of contained graphite. A variable cut-off grade between 2-3% was used in calculating the Proven and Probable reserve.

Table 6 shows the FS Mineral Reserve estimate for Graphite Creek as of March 25, 2025.

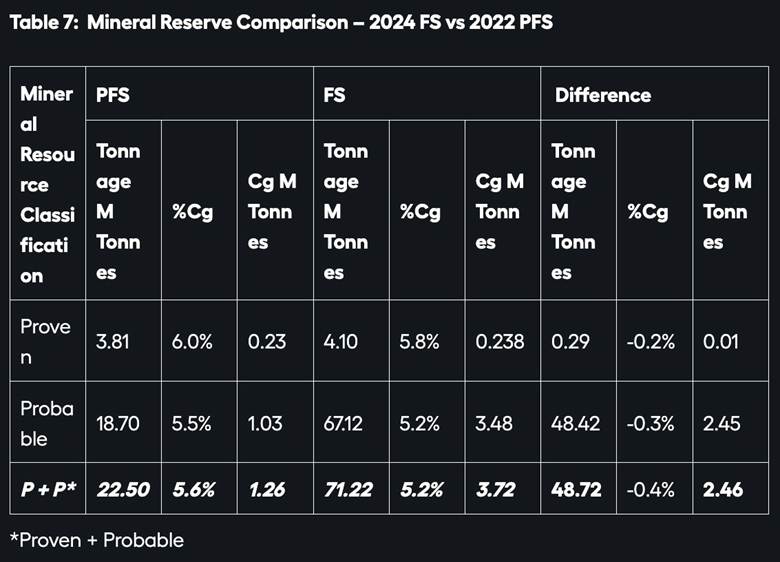

The FS Mineral Reserve estimate and contained graphite are 71.22Mt and 3.7Mt, respectively, an increase of 48.72Mt and 2.46Mt over the reserve and contained graphite disclosed in the PFS.

A comparison of the PFS versus FS Mineral Reserve estimate can be seen in Table 7.

Secondary Treatment Plant

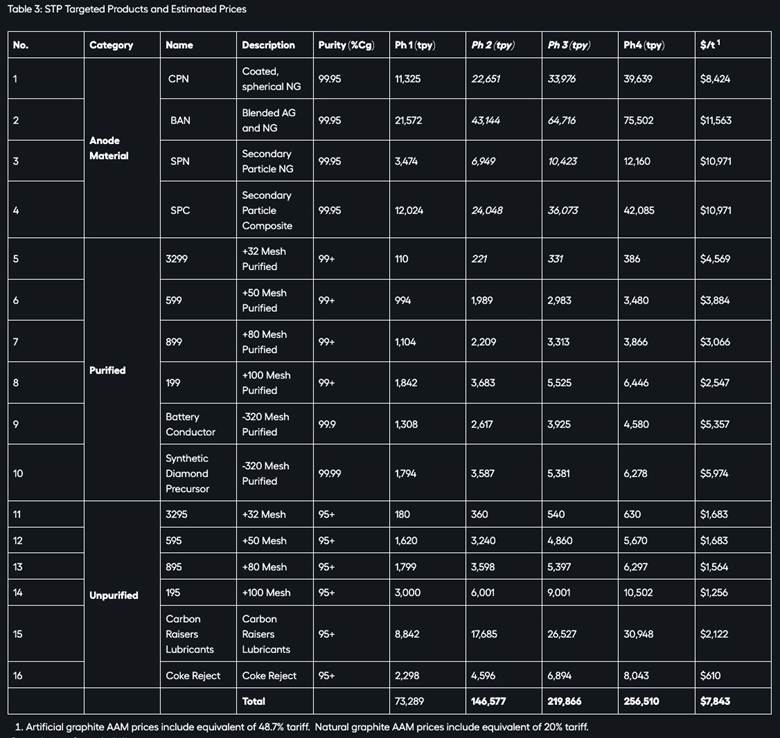

The STP would produce a targeted average of 256,500 tpy of graphite/carbon products. About 169,000 tpy would be AAM, 25,000 tpy purified graphite products, and 31,000 tpy of unpurified graphite and carbon products. The non-AAM products would serve industrial sectors and defense industry sectors.

The AAM products are:

- CPN: Coated, spherical natural graphite;

- BAN: Blended natural and artificial graphite;

- SPN: Secondary particle natural graphite; and

- SPC: Secondary particle composite.

The products would be manufactured from natural graphite concentrate, artificial/synthetic graphite, artificial graphite precursors, coke and pitch. Key components of the manufacturing process are the purification of natural graphite and graphitization of artificial graphite precursors in high-temperature, electrically heated furnaces. The STP’s planned location is in Ohio to access its relatively lower power rates, skilled workforce, and location relative to potential customers.

Permitting, final design, and construction of the first 50,000 tpy of STP natural graphite capacity is expected to take three years. Modular build-out of the total 175,000 tpy facility is expected to take about four more years depending on funding and customer demand.

What this effectively means is that in two and a half years, the manufacturing plant will be running with 25,000 tonnes of synthetic graphite to make graphite products. Annual revenue is expected to be approximately $200 million. (These numbers are not part of the Feasibility Study, as per National Instrument (NI) 43-101 rules. Forward-looking statement from a mine project’s manufacturing stage are not permitted in the NI 43-101 report.)

The important point is the forward multiple the $200 million gives investors. The mine may not be ready in 2.5 years but Graphite One will be on track to earn up to $200 million through plant revenue per 25,000 tpy module. Add another year, and revenue could rise to $400 million as the company adds an additional 25,000 tpy module. Very impressive for a junior that does not yet have an operating mine.

This brings up another important point: What does Graphite One focus on now, the manufacturing plant or the mine? The mine has to be developed in steps with a very set program that must be followed for it to be permitted and brought into production.

As Huston says, with the release of the Feasibility Study, G1 will now enter the permitting process. But this doesn’t preclude the company from making a strong push to get the Secondary Treatment Plant (STP) up and running. Obviously the quicker they can get the plant producing, the faster they can earn revenue to put towards mine development or other purposes.

Product pricing

Based on the FS assumptions, the average price of all products over the STP’s 22-year life is estimated at $7,843 per tonne. Product forecasts and prices have been developed based on numerous graphite market reports commissioned by or purchased by the company, combined with internal information. The long-term market forecast is based on Benchmark Mineral Intelligence’s various Q4 2024 price forecasts.

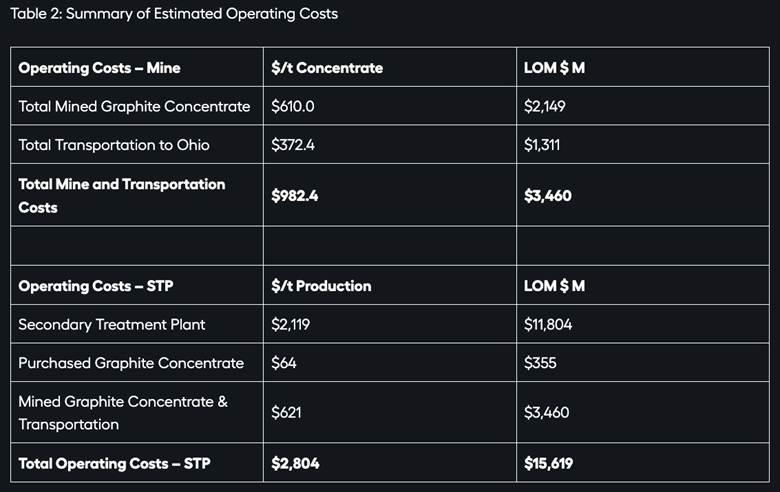

The estimated capital costs with their respective contingencies are summarized in Table 1.

Conclusion

Graphite One has presented a Bankable Feasibility Study with numbers that are both impressive and realistic, in my view.

Total capital costs are $5.045 billion. That includes $1.125 billion for the Graphite Creek Mine and $3.920B for the Secondary Treatment Plant (STP), including $878 million of contingency.

The project economics are attractive to investors. The FS has an estimated pre-tax internal rate of return (IRR) of 30%, with a pre-tax net present value (NPV) of $6.4 billion using an 8% discount rate, and a payback period of 7.3 years.

$5 billion is not a lot of money if you consider that it buys the United States security of graphite supply for at least two decades — eliminating import dependency on China for this critical mineral.

Graphite One ‘Graphite without geopolitics’

And there is a good possibility that the federal government will fund Graphite Creek to production and help construct the STP.

Two Department of Defense DPA fundings have already been awarded to Graphite One, one for $37.5 million, the other for $4.7 million — the latter to develop an alternative to the current firefighting foam used by the US military and civilian firefighting agencies, using graphite sourced from Graphite Creek.

G1’s Bankable Feasibility Study was 75% funded by the DoD.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

In October 2024 G1 received a Letter of Interest (LI) for up to $325 million in debt financing from the Export-Import Bank of the United States (EXIM), to go towards construction of its AAM manufacturing facility in Ohio. The funds would come from EXIM’s “Make More in America” and “China and Transformational Exports Program” (CTEP) initiatives.

EXIM’s funding commitment is conditional upon completing the application, due diligence and underwriting process and receiving all required approvals.

G1 expects to submit a formal application to EXIM in 2025.

Graphite One’s project is unique in that the mine and the manufacturing facility are wrapped up in one package.

Graphite One plans to develop a “circular economy” for graphite. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically — a US first.

The phased development approach is another strike of brilliance that makes the project more palatable to investors.

This capital risk reduction strategy develops the Ohio STP in seven 25,000 tpy modules while the mine completes permitting and construction. This modular approach allows for capital expenditures to be deployed progressively, in line with each phase of development, significantly reducing the upfront capital to $607 million, including $121 million of contingency for the first 25,000 tpy module.

In 2.5 years the plant is expected to be up and running using 25,000 tonnes of synthetic material to make graphite products. Revenue from the STP is pegged at $150-200 million annually, netting Graphite One a significant revenue source as it develops the mine to production, expected in 2030.

And let’s not forget that the Feasibility Study is based on drill results from just 12% of the 15.3-km (9.5-mile)-long graphite mineralized zone.

Graphite Creek is huge, the largest graphite deposit in the United States and one of the biggest in the world, according to the USGS. Arguably, much more graphite could be discovered, placed in reserve, and mined with minimal exploration expense and effort.

Graphite, whether synthetic or natural, plays a vital, irreplaceable part in the functioning of a modern economy.

Paramount is “security of supply.”

“The United States has zero commercialization of synthetic anode battery materials. Supplying proven products to the North American battery material supply chain will give G1 a competitive edge by allowing rapid entry into a market where technology is developing quickly.” — Graphite One’s CEO Anthony Huston

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2025.04.23 Share price: Cdn$0.98

Shares Outstanding: 146.2m

Market cap: Cdn$143.3m

GPH website

Subscribe to AOTH’s free newsletter

Richard owns shares of Graphite One Inc. (TSX-V:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE