Doubleview Gold Corp Increases the Dimensions of the Hat Polymetallic Deposit with High-Grade and Extensive Mineralization in Drill Holes H075 to H077

Doubleview Gold Corp. (TSX-V: DBG) (OTCQB: DBLVF) (FSE: 1D4) is pleased to announce further drill hole results from the 2024 drill campaign at its 100% owned Polymetallic Hat Porphyry Project, located in northwestern British Columbia. Long copper-gold-silver-cobalt intercepts in Drill holes H075, H076 and H077 expand the mineralization and potentially will increase the Hat Project’s resource in size and grade.

2024 Exploration:

The 2024 drilling program was designed to confirm the integrity of the resource estimate categories, particularly the indicated resource figures and potentially to allow elevating part or all to a measured resource. Holes were directed to intersect shallow mineralization and to further explore high grade zones. Drilling has confirmed the continuity of mineralization indicating that the deposit exhibits greater consistency than typically expected of a porphyry-style deposit.

Important Drill hole Intercepts:

| DDH | From (m) | To (m) | Length (m) | CuEq3 (%) excluding Sc2O3 | Au (g/t) | Cu (%) | Ag (g/t) | Co (g/t) | Sc (g/t) | |

| H075 | 90.0 | 525.0 | 435.0 | 0.35 | 0.15 | 0.21 | 0.40 | 64.8 | 27.2 | |

| Including | 90.0 | 406.7 | 316.7 | 0.42 | 0.17 | 0.25 | 0.48 | 74.2 | 26.7 | |

| Including | 148.0 | 389.0 | 241.0 | 0.50 | 0.21 | 0.30 | 0.54 | 74.4 | 26.0 | |

| Including | 196.7 | 253.3 | 56.6 | 1.00 | 0.44 | 0.62 | 1.18 | 95.7 | 23.8 | |

| Including | 218.5 | 240.0 | 21.5 | 2.06 | 0.79 | 1.41 | 2.62 | 110.2 | 23.5 | |

| H076 | 12.0 | 84.0 | 72.0 | 0.44 | 0.49 | 0.05 | 0.57 | 47.6 | 29.7 | |

| Including | 21.0 | 63.0 | 42.0 | 0.70 | 0.82 | 0.07 | 0.86 | 47.0 | 31.0 | |

| Including | 28.8 | 57.0 | 28.2 | 1.01 | 1.20 | 0.09 | 1.17 | 45.6 | 28.4 | |

| And | 247.8 | 367.0 | 119.2 | 0.40 | 0.20 | 0.22 | 0.17 | 64.2 | 29.1 | |

| H077 | 89.0 | 497.0 | 408.0 | 0.32 | 0.13 | 0.16 | 0.36 | 103.4 | 28.0 | |

| Including | 116.0 | 148.0 | 32.0 | 0.49 | 0.17 | 0.24 | 0.72 | 225.7 | 23.5 | |

| Including | 249.0 | 369.0 | 120.0 | 0.40 | 0.20 | 0.20 | 0.18 | 98.1 | 28.6 | |

| Including | 352.0 | 356.0 | 4.0 | 0.87 | 0.21 | 0.25 | 0.33 | 904 | 27.2 |

Detailed High-Grade Results:

- a) DDH H075:

The high-grade intercepts are tabulated below:

| DDH | From (m) | To (m) | Length (m) | CuEq3 (%) excluding Sc2O3 | Au (g/t) | Cu (%) | Ag (g/t) | Co (g/t) | Sc (g/t) | |

| H075 | 196.7 | 253.3 | 56.6 | 1.00 | 0.44 | 0.62 | 1.18 | 95.7 | 23.8 | |

| Including | 206.0 | 240.0 | 34.0 | 1.53 | 0.67 | 0.97 | 1.80 | 101.0 | 23.7 | |

| Including | 218.5 | 240.0 | 21.5 | 2.06 | 0.79 | 1.41 | 2.62 | 110.2 | 23.5 | |

| Including | 227.0 | 236.0 | 9.0 | 4.55 | 1.73 | 3.18 | 5.76 | 129.4 | 25.6 | |

| H075 | And | 329.0 | 351.0 | 22.0 | 0.99 | 0.39 | 0.67 | 0.94 | 68.4 | 19.5 |

Additionally, drill hole H075 has significant mineralization from 45 metres depth to 341 metres, with 0.40% CuEq. (including 0.23% Cu and 0.16 g/t Au).

- b) DDH H076:

Drill hole H076 was mineralized from near surface with stronger gold and silver values. As illustrated in the following table, gold values over long intervals are among the highest recorded on the property.

| DDH | From (m) | To (m) | Length (m) | CuEq3 (%) excluding Sc2O3 | Au (g/t) | Cu (%) | Ag (g/t) | Co (g/t) | Sc (g/t) | |

| H076 | 12.0 | 84.0 | 72.0 | 0.44 | 0.49 | 0.05 | 0.57 | 47.6 | 29.7 | |

| Including | 21.0 | 63.0 | 42.0 | 0.70 | 0.82 | 0.07 | 0.86 | 47.0 | 31.0 | |

| Including | 28.8 | 57.0 | 28.2 | 1.01 | 1.20 | 0.09 | 1.17 | 45.6 | 28.4 | |

| Including | 36.0 | 46.0 | 10.0 | 2.71 | 3.35 | 0.20 | 2.75 | 71.7 | 29.8 |

- c) DDH H077:

Drill hole H077 intercepted strong copper-silver-cobalt mineralization over more than 408 metres length. The 904 g/t cobalt over 4 meters from 352 meters depth demonstrates the wide array of elements which make the Hat Polymetallic Deposit unique.

| DDH | From (m) | To (m) | Length (m) | CuEq3 (%) excluding Sc2O3 | Au (g/t) | Cu (%) | Ag (g/t) | Co (g/t) | Sc (g/t) | |

| H077 | 89.0 | 497.0 | 408.0 | 0.32 | 0.13 | 0.16 | 0.36 | 103.4 | 28.0 | |

| H077 | Including | 352.0 | 356.0 | 4.0 | 0.87 | 0.21 | 0.25 | 0.33 | 904 | 27.2 |

Notes:

- Copper Equivalent (CuEq) currently does not include the Scandium

- Metal equivalents should not be relied upon for future evaluations. – Drill hole intercepts included in this news release are core lengths that may or may not be true widths of mineralization. It is not possible to determine true widths. –

- Parameters used to calculate Copper Equivalent: Au price (US$/oz): 1900; Ag price (US$/oz): 24; Cu price (US$/lb): 4; Co price (US$/lb): 22. Au recovery: 89.0%; Ag recovery: 68.0%; Cu recovery: 84.0%; Co recovery: 78.0%. * Copper Equivalent Calculation CuEq in % = ([Ag grade in ppm] *24*0.68/31.1035 + [Au grade in ppm] *1900*.89/31.1035 + 0.0001* [Co grade in ppm] *22*0.78*22.0462 + 0.0001* [Cu grade in ppm] *4*0.84*22.0462)/(4*22.0462*0.84).

Mr. Farshad Shirvani, president & CEO of Doubleview, states: “The 2024 drill campaign was successful in testing, confirming and improving our resource model. We are encouraged to see the occurrence of mineralization closer to the surface as well as strong mineralization drill holes which proves continuity and allows for more detailed structural interpretations. This will strongly reflect in the upcoming MRE.V 2.0 that will be part of Preliminary Economic Assessment (PEA) and add value to the Polymetallic Hat Deposit by increasing the metal content. We are continuously working on our exploration model as data becomes available to recognize details of the deposit and its critical and precious metals.”

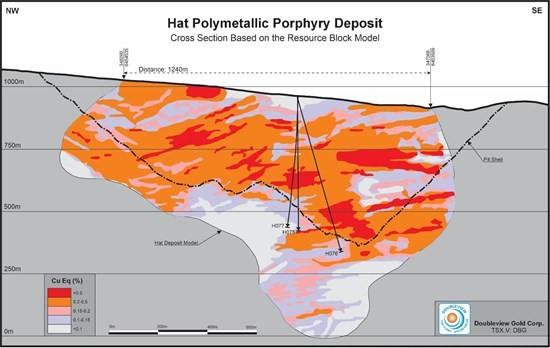

The following section illustrates drill holes H075 to H077 intersecting the Hat polymetallic deposit along the strike of major high-grade mineralization. (Section looking North East)

Cross Section Based on the Resource Block Model

Location and direction of reported drill hole table:

| DDH ID | UTM-East (m) | UTM-North (m) | Elevation (m) | Max-Depth (m) | Azimuth (°) | Dip (°) |

| H075 | 347,865 | 6,453,951 | 956.5 | 537 | 0 | 89 |

| H076 | 347,865 | 6,453,951 | 956.5 | 660 | 262 | 70 |

| H077 | 347,865 | 6,453,951 | 956.5 | 531 | 300 | 75 |

Quality Assurance and Quality Control:

Hat Project drill cores are processed at Doubleview’s camp where they are photographed, measured and logged by our technical staff and then divided using a diamond bladed saw. One half is placed in a stout bag to form the assay sample that is forwarded securely to the independent analytical lab. The remaining half core is stored on site where it is available for further examination and sampling. The assay cores are subject to a Chain of Custody routine as they are shipped from camp to a bonded carrier for delivery to the lab.

Core samples are analysed at the North Vancouver facility of ALS Canada Ltd. using their PREP-31, PGM-ICP24, ME-MS61, and ME-ICP06 packages. Each core sample is dried, then crushed to 70% passing a 2mm screen. All material is processed in an automatic Riffle splitter to yield a 250g homogenized, representative sample. This sub-sample is then pulverized to 85% passing a 75-micron screen. All samples are analyzed for Au, Pt, Pd by 50g fire-assay fusion/ICP-ES finish, using PGM-ICP24 package. A separate 0.25g pulp split is analyzed by Four Acid digestion/ICP-MS finish, reporting 48 elements. Over limit elements are analyzed by Ore Grade Four Acid digestion/ICP-ES finish using ME-OG62 assay package. All of Doubleview’s core samples are analyzed or assayed at independent ISO 17025 and ISO 9001- certified laboratories.

When initial assays are received and accepted by our staff, a certain fraction of the samples will be sent to a second ISO-certified lab for check assay and verification purposes. Assays will be reported in News Releases.

Doubleview maintains a website at www.doubleview.ca.

Qualified Persons:

Erik Ostensoe, P. Geo., a consulting geologist, and Doubleview’s Qualified Person with respect to the Hat Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, and approved the technical contents of this news release. He is not independent of Doubleview as he is a shareholder in the company.

About Doubleview Gold Corp

A mineral resource exploration and development company is headquartered in Vancouver, British Columbia, Canada. It is publicly traded on the TSX-Venture Exchange. Doubleview focuses on identifying, acquiring, and financing precious and base metal exploration projects across North America, with a strong emphasis on British Columbia. The company enhances shareholder value through the acquisition and exploration of high-quality gold, copper, cobalt, scandium, and silver projects-collectively critical minerals-utilizing cutting-edge exploration techniques.

Doubleview’s success is deeply rooted in the unwavering support of its long-term shareholders, supporters, and institutional investors. Their ongoing commitment has been instrumental in advancing the company’s strategic initiatives. Doubleview looks forward to further collaborative growth and development, and continues to welcome active participation from its valued stakeholders as the company expands its portfolio and strengthens its position in the critical minerals sector.

About the Hat Polymetallic Deposit

The Hat Deposit, located in northwestern British Columbia, is a polymetallic porphyry project with major resources of copper, gold, cobalt, and the potential for scandium. As one of the region’s significant sources of critical minerals, the Hat deposit has undergone targeted exploration and development. The 0.2% CuEq cut-off resource estimate, as of the recently completed Mineral Resource Estimate and the Company’s July 25, 2024, news release, is summarized below:

| Average Grade | Metal Content | |||||||||||

| Open Pit Model Hat | Resource Category | Tonnage | CuEq | Cu | Co | Au | Ag | CuEq | Cu | Co | Au | Ag |

| Mt | % | % | % | g/t | g/t | million lb | million lb | million lb | thousand oz | thousand oz | ||

| In Pit | Indicated | 150 | 0.408 | 0.221 | 0.008 | 0.19 | 0.42 | 1,353 | 733 | 28 | 929 | 2,045 |

| Inferred | 477 | 0.344 | 0.185 | 0.009 | 0.15 | 0.49 | 3,619 | 1,945 | 91 | 2,328 | 7,575 | |

Scandium potential for the Hat Deposit is estimated to be 300 to 500 million tonnes at an average grade of 40 ppm (0.004%) Sc2O3.

For further details of the MRE, please refer to the Company’s July 25, 2024 news release.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE