Eldorado Updates Lamaque Complex Technical Report; Demonstrating Significant Value and Potential to Extend Mine Life to 17 Years

Eldorado Gold Corporation (TSX: ELD) (NYSE: EGO) is pleased to announce the results of an updated Technical Report for the Lamaque Complex1 including an updated life-of-mine plan based on Mineral Reserves from Triangle, Ormaque and Parallel and a Preliminary Economic Assessment extended LOM plan primarily2 based on Inferred Mineral Resources from Triangle and Ormaque.

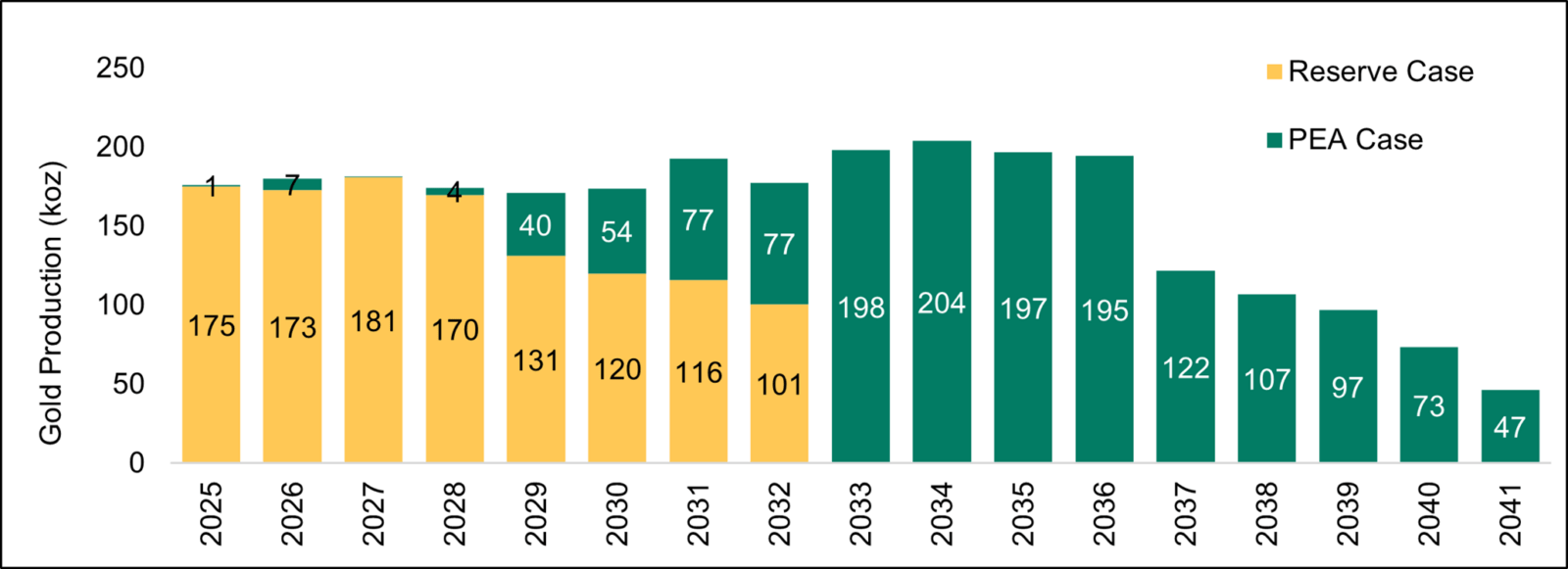

The Reserve Case outlines an 8-year mine life producing 1.2 million ounces of gold, while the PEA Case shows the potential to extend mine life incrementally by 9 years and incremental gold production of 1.5 million ounces. The Lamaque Complex Technical Report has been filed on SEDAR+.

Lamaque Complex Technical Report Highlights

Table 1 summarizes key metrics for the Reserve Case and PEA Case from the Lamaque Complex Technical Report which are based on the Mineral Reserve and Mineral Resource estimates that are shown in Appendix A.

Highlights of the Reserve Case

- Gold production of 1.2 million ounces over an 8-year mine life through 2032

- Average annual gold production above ~175,000 oz through 2028

- LOM All-In Sustaining Cost of $1,176/oz Au3

- Solid economics with an:

- after-tax NPV(5%) of $555 million at a gold price of $2,000/oz

- after-tax NPV(5%) of $1.1 billion at a gold price of $2,600/oz

Highlights of the PEA Case

- Incremental gold production of 1.5 million ounces, showing the potential to extend mine life to 17 years through 2041

- Maintains average annual gold production of ~185,000 oz through 2036, providing a long runway for the Lamaque Complex and the Company’s overall business in Québec

- Maintains LOM AISC of $1,149/oz Au3

- Significant incremental economics highlight the long-term potential of the Lamaque Complex:

- after-tax NPV(5%) of $623 million at a gold price of $2,000/oz

- (for a total after-tax NPV(5%) of $1.2 billion when combined with the Reserve Case)

- after-tax NPV(5%) of $1.1 billion at a gold price of $2,600/oz Au

- (for a total after-tax NPV(5%) of $2.1 billion when combined with the Reserve Case)

- incremental IRR of the PEA case is 43.5% at a gold price of $2,000/oz Au

- 68.2% at a gold price of $2,600/oz Au

- after-tax NPV(5%) of $623 million at a gold price of $2,000/oz

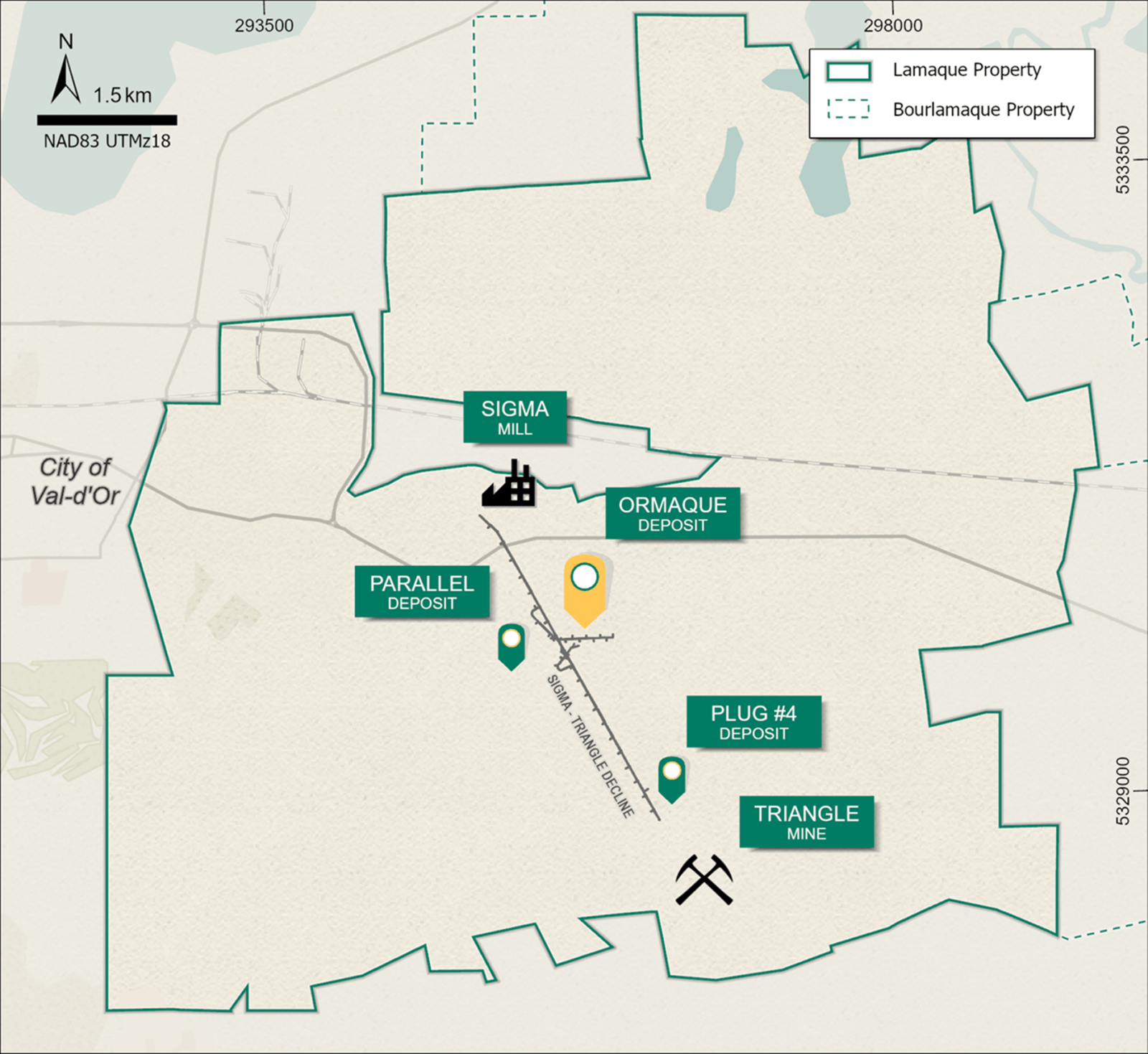

1 The Lamaque Complex includes the Triangle, Ormaque, Parallel and Plug No. 4 deposits, and the Sigma Mill (see Figure 2).

2 The PEA case includes a non-material amount of Measured and Indicated Mineral Resources (< 2%).

3 These are forward looking non-IFRS measures or ratios. Refer to the section “Forward-Looking Non-IFRS and Other Financial Measures and Ratios” for explanations and discussions of these non-IFRS financial measures or ratios.

The PEA Case is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves and there is no certainty that the forecast production amounts will be realized. The basis for the PEA and the qualifications and assumptions made by the qualified persons who undertook the PEA are set out in the advisories contained in this news release. The results of the PEA had no impact on the results of any prefeasibility or feasibility study in respect of the Lamaque Complex.

Maximizes installed capacity of plant and infrastructure with two mining centres. The installed capacity of the Sigma Mill, along with extensive infrastructure both on surface and underground, can be maximized with the addition of a paste plant and additional tailings capacity to bring the Ormaque deposit into production.

Strong collaboration and support from the Val-d’Or communities. We expect a transparent and predictable regulatory environment, reflective of Québec being a Tier 1 mining jurisdiction.

Significant exploration potential to grow Mineral Resources in existing deposits. The Ormaque deposit remains open at depth and laterally both in the upper and lower sections of the deposit. The Triangle deposit remains open at depth and we continue to drill Plug No. 4 and other advanced targets on the property.

Well-positioned with a large, under-explored land package in the Val d’Or area. The Company continues to assess exploration opportunities across the Lamaque Complex as well as its 100%-owned Bourlamaque property (contiguous to the Lamaque Complex) and in the wider Abitibi region.

“This marks another major milestone for the Lamaque Complex,” said George Burns, President and CEO. “After acquiring this asset in 2017, we successfully brought the Triangle deposit into commercial production in 2019, and it has since produced nearly one million ounces of gold. With the development of the Ormaque deposit, we will be adding a second underground mine to the Lamaque Complex, which provides operational flexibility and efficiency as we leverage the existing plant and infrastructure.

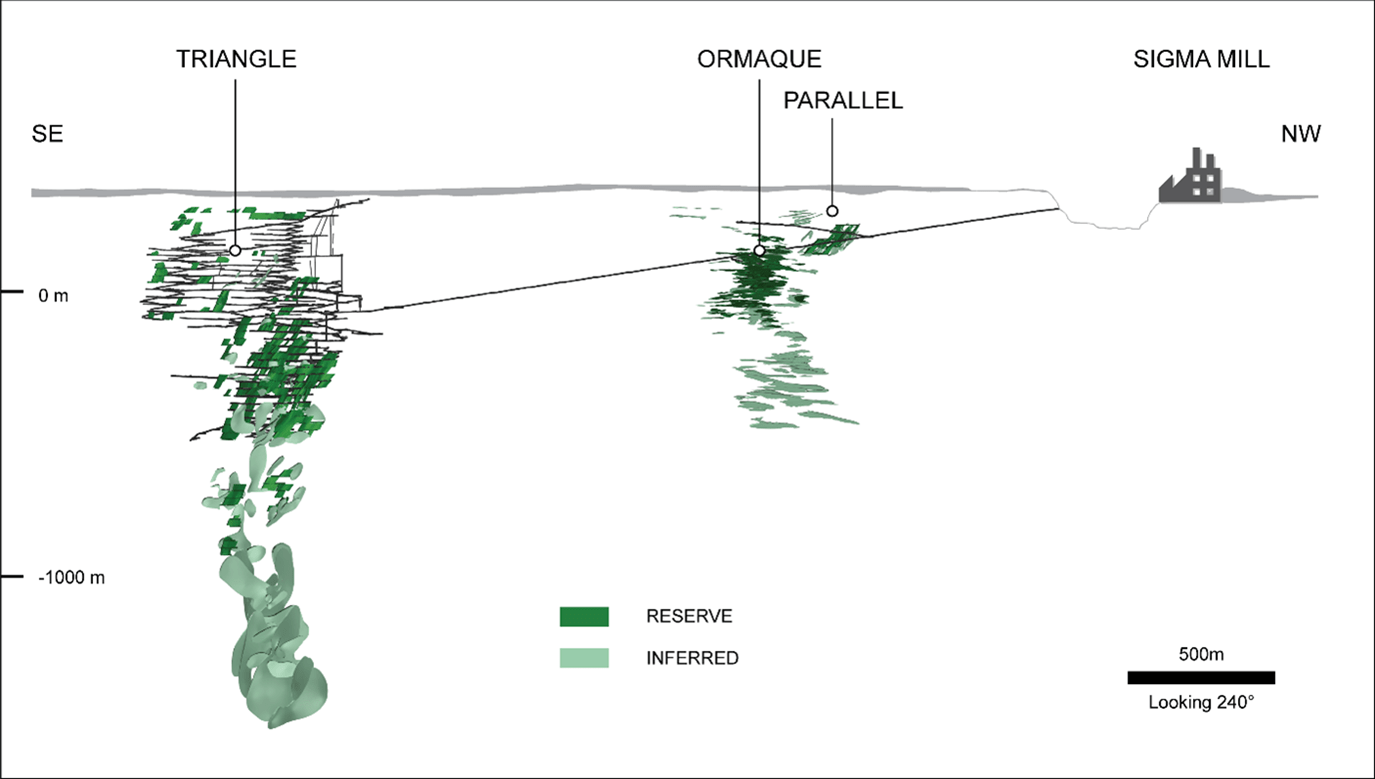

“Ormaque is located just off the existing Triangle–Sigma decline and was discovered through surface drilling in 2019 (see Figure 2 and Figure 3). An Inferred Mineral Resource was declared in February 2021 and an exploration drift was developed to allow underground conversion drilling of the upper sections of the deposit. A bulk sample of Ormaque material was processed at the Sigma Mill in December and preliminary results are in-line with expectations and support the current Ormaque Mineral Reserves and block model. The second phase of the bulk sample is expected for the second half of 2025, followed by an expected ramp-up phase beginning in 2026. We expect to reach full production in 2028.

“The Ormaque and Triangle deposits are located within the prolific Val-d’Or district of the Abitibi. This district hosts the historic Lamaque and Sigma Mines, which collectively produced nearly 10 million ounces of gold. Based on the existing resource base and favorable findings of the report, we maintain an optimistic view of the long-term potential at the Lamaque Complex.

“Our skilled and dedicated workforce, strategic position in the Abitibi region and collaborative relationships with First Nations and the local community, positions us to deliver sustainable, long-term benefits for the Val-d’Or region, while continuing to create value for our shareholders.”

Table 1: Key metrics based on the Lamaque Complex Technical Report

| Unit | Reserve Case (includes Mineral Reserves only) |

PEA Case (includes Inferred Mineral Resources2 and is incremental to Reserve Case) |

|

| Production | |||

| Mine Life | yrs | 8 | 9 |

| Total Material Processed | Mt | 5.7 | 7.1 |

| Average Gold Grade | g/t | 6.55 | 6.78 |

| Total Gold Produced | koz | 1,168 | 1,500 |

| Operating Costs | |||

| Direct Operating Cost | $/t | 188 | 180 |

| Total Cash Cost3 | $/oz | 944 | 873 |

| AISC3 | $/oz | 1,176 | 1,156 |

| Capital Costs | |||

| Growth Capital Costs3 | US$M | 227 | 33 |

| Sustaining Capital Costs3 | US$M | 270 | 424 |

| Total Capital Cost | US$M | 497 | 457 |

| Economics @ $2,000/oz Au | |||

| LOM After-tax Cash Flow | US$M | 669 | 1,085 |

| After-tax NPV(5%) | US$M | 555 | 623 |

| IRR | % | n/a | 43.5 |

| Economics @ $2,600/oz Au | |||

| LOM After-tax Cash Flow | US$M | 1,257 | 1,788 |

| After-tax NPV(5%) | US$M | 1,064 | 1,059 |

| IRR | % | n/a | 68.2 |

2 The PEA case includes a non-material amount of Measured and Indicated Mineral Resources (< 2%).

3 These are forward looking non-IFRS measures or ratios. Refer to the section “Forward-Looking Non-IFRS and Other Financial Measures and Ratios” for explanations and discussions of these non-IFRS financial measures or ratios.

Figure 1: Lamaque Complex Production Profile (Reserve Case + PEA Case)

Figure 2: Lamaque Complex property map showing location of gold deposits and key infrastructure

Figure 3: Lamaque Complex long-section showing location of gold deposits and key infrastructure

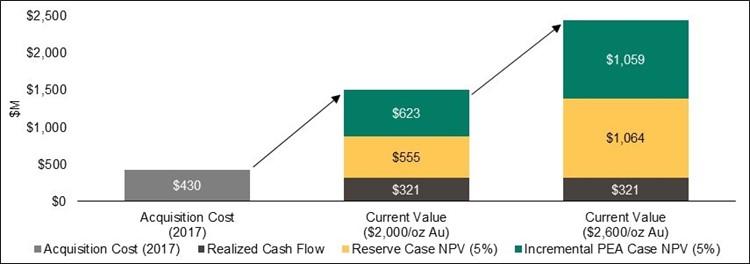

Significant Value Creation Since Acquisition

Eldorado acquired the Lamaque Complex in 2017 for total consideration of $430 million4. Since acquisition, it has generated over $3005 million of net cash flow and has been one of the Company’s most stable operations. Looking forward, we expect the Lamaque Complex to generate significant value and remain a cornerstone asset for the Company over the next decade and beyond. At a gold price of $2,000/oz, the Reserve Case generates an after-tax NPV5% of $555 million, while the PEA Case generates an incremental after-tax NPV5% of $623 million. At a gold price of $2,600/oz, the Reserve Case generates an after-tax NPV5% of $1.1 billion while the PEA Case generates an incremental after-tax NPV5% of $1.1 billion (see Figure 4).

Figure 4: Lamaque Complex track record of value creation since acquisition (US$ million)

4 Acquisition cost is based on headline transaction of C$590 million converted to USD at FX rate of 1.37.

5 Net cash flow generated from acquisition to December 31, 2024.

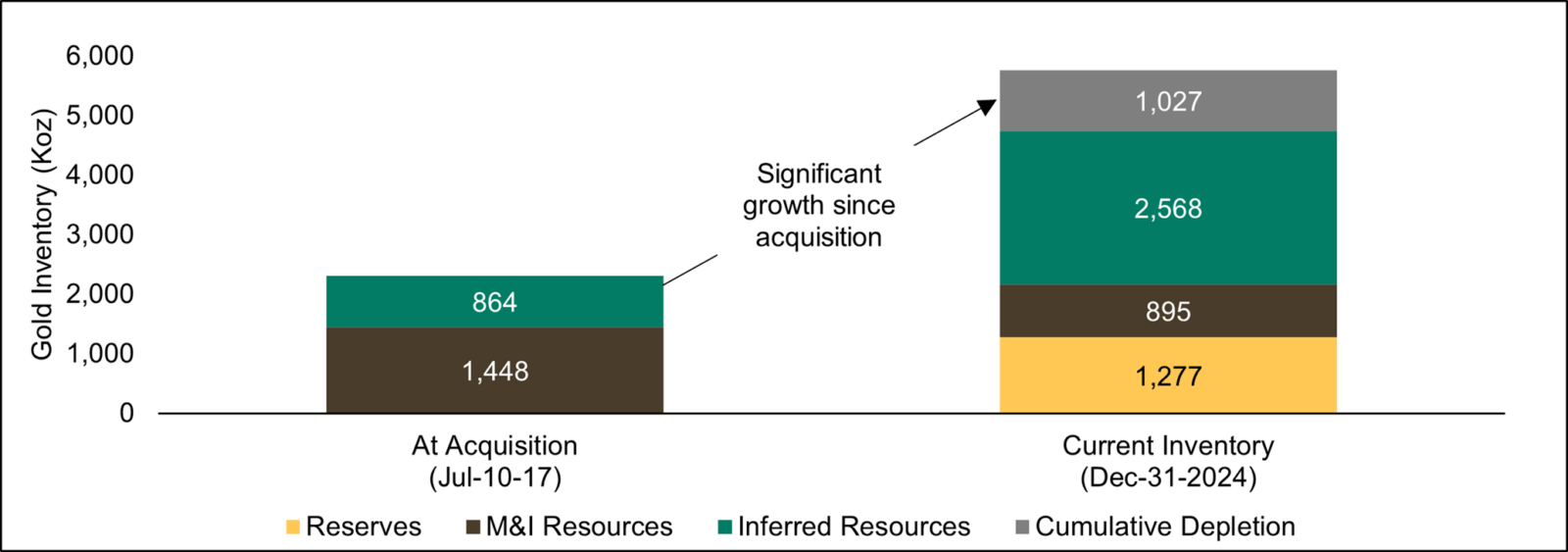

At the time of acquisition, the Lamaque Complex contained Measured and Indicated Mineral Resources (“M&I Resources”) of 1.4 million ounces of gold, Inferred Mineral Resources of 864,000 ounces of gold, and no Mineral Reserves. Since acquisition, the Lamaque Complex has produced nearly one million ounces of gold, while growing Mineral Reserves and Mineral Resources significantly (see Figure 5).

Figure 5: Lamaque Complex Mineral Reserve and Mineral Resource Growth since acquisition (koz Au)6,7

6 Depletion is based on contained gold processed as of December 31st, 2024.

7M&I Mineral Resources are exclusive of Mineral Reserves.

Lamaque Complex Planned Drilling and Regional Exploration

Exploration activities will continue at the Lamaque Complex, with a focus on resource conversion drilling at Lower Triangle, Ormaque and Plug No. 4, as well as testing for extensions at Ormaque and earlier stage targets close to Lamaque Complex infrastructure. Plans include:

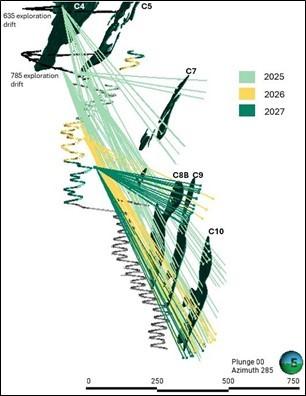

- Resource conversion drilling at Lower Triangle, where a multi-year plan has been developed to leverage access to drill platforms as underground infrastructure advances, while targeting deeper veins (C8 and below) with longer drill holes with the objective of reducing geological risk ahead of development (see Figure 6).

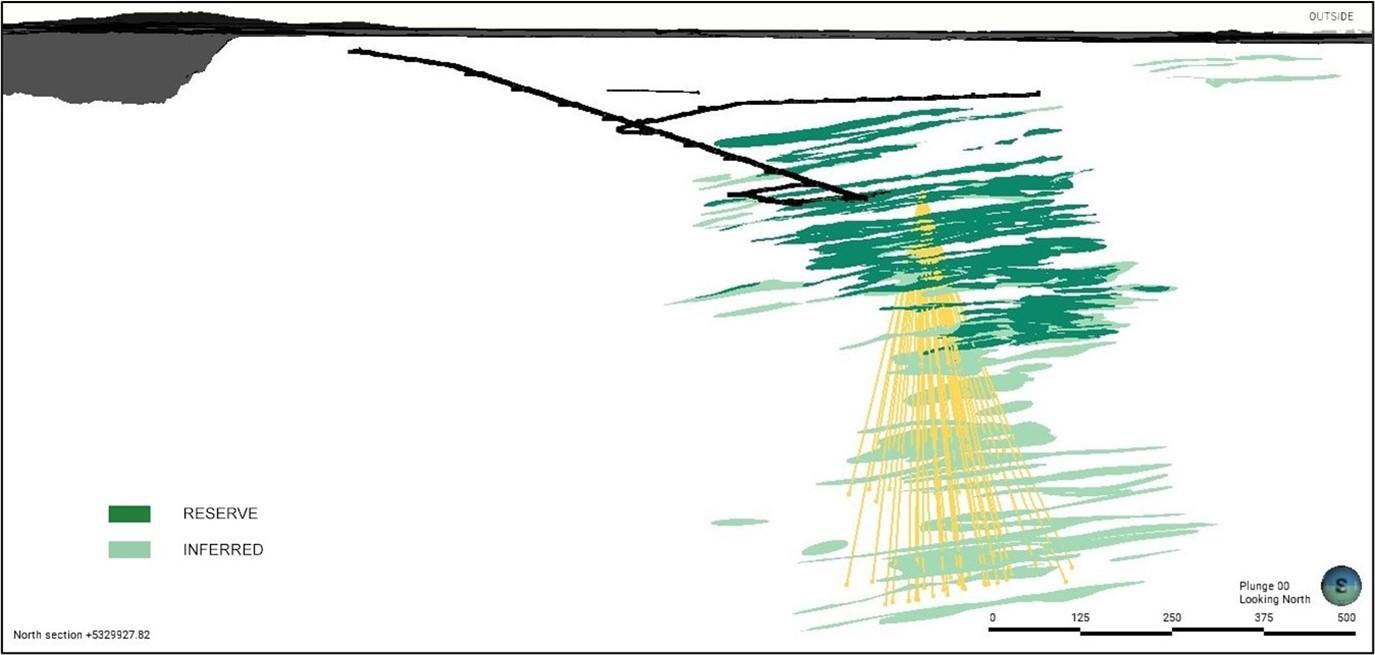

- Resource conversion drilling at Ormaque, where drilling during 2025 will focus on extending the core of the system at depth. Subsequent conversion drilling from 2026 onwards will be conditional upon ongoing exploration drilling that is testing lateral and depth extensions, and will prioritize domains of Inferred Mineral Resources that deliver maximum value for the operation (see Figure 7).

- Resource conversion drilling at Plug No. 4 will continue during 2025 from an exploration drift located off the Sigma-Triangle decline. Drilling will test the P30 to P50 veins, and conditional drilling is planned for 2026 and 2027 targeting shallower and deeper vein sets (see Figure 8).

- Surface drilling targeting additional Inferred Mineral Resources by testing lateral extensions of Ormaque, which remains open in all directions at various levels of the deposit, is planned through 2025.

- In addition, exploration drilling from surface and underground will also test earlier stage targets proximal to the Lamaque Complex infrastructure, including assessing the potential to extend known veins and testing new targets. In parallel, the Exploration team will continue to generate and drill test targets within the Eldorado land position in the wider district to assess future resource potential to feed the Sigma Mill.

Figure 6 – Lower Triangle Mineral Resource conversion drilling (2025-2027)

Figure 7 – Ormaque Mineral Resource conversion drilling (2025)

Figure 8 – Plug No. 4 Mineral Resource conversion drilling (2025, with conditional 2026-2027 conceptual plan)

Interactive VRIFY 3D Model

To view an interactive 3D model that includes updated views of the Mineral Reserve and Mineral Resource shells use the following link: https://vrify.com/decks/17646?auth=80334cc6-3e93-4722-ac41-9313e4c8591a or visit Eldorado Gold’s website: www.eldoradogold.com.

About Eldorado Gold

Eldorado is a gold and base metals producer with mining, development and exploration operations in Türkiye, Canada and Greece. The Company has a highly skilled and dedicated workforce, safe and responsible operations, a portfolio of high-quality assets, and long-term partnerships with local communities. Eldorado’s common shares trade on the Toronto Stock Exchange and the New York Stock Exchange.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE