Alphamin Announces Record FY2024 and Q4 2024 Tin Production FY2025 Production Guidance Exploration Success

Alphamin Resources Corp. (TSX-V:AFM) (JSE AltX:APH) is pleased to provide the following update for the year and quarter ended 31 December 2024:

- FY2024 tin production of 17,324 tonnes, up 38% from the prior year

- Q4 tin production of 5,237 tonnes (Q3: 4,917 tonnes)

- FY2024 EBITDA2,3 guidance of US$274m, an estimated increase of 102% from actual FY2023

- Positive exploration results at Mpama North and South

- FY2025 contained tin production guidance of approximately 20,000 tonnes

Operational and Financial Summary for the Year and Quarter ended December 20241

| Description | Units | Year ended December 2024 | Year ended December 2023 | Change | Quarter ended December 2024 | Quarter ended September 2024 | Change |

| Ore Processed | Tonnes | 738 067 | 400 691 | 84% | 232 860 | 229 107 | 2% |

| Tin Grade Processed | % Sn | 3,1 | 4,2 | -25% | 3,0 | 2,9 | 3% |

| Overall Plant Recovery | % | 74,7 | 75,5 | -1% | 75,1 | 73,5 | 2% |

| Contained Tin Produced | Tonnes | 17 324 | 12 568 | 38% | 5 237 | 4 917 | 7% |

| Contained Tin Sold | Tonnes | 17 865 | 11 385 | 57% | 4 942 | 5 552 | -11% |

| EBITDA2,3(FY2024 and Q4 2024 guidance) | US$’000 | 274 100 | 135 537 | 102% | 76 200 | 91 567 | -17% |

| AISC2, 3 (FY2024 and Q4 2024 guidance) | US$/t sold | 15 323 | 14 205 | 8% | 15 106 | 15 728 | -4% |

| Dividends paid (cents per share) | C$ cps | 9 | 6 | 50% | 6 | 0 | n/a |

| Average Tin Price Achieved | US$/t | 30 345 | 26 009 | 17% | 30 371 | 31 757 | -4% |

1Information is disclosed on a 100% basis. Alphamin indirectly owns 84.14% of its operating subsidiary to which the information relates. 2FY2024 and Q4 2024 EBITDA and AISC represent management’s guidance.3This is not a standardized financial measure and may not be comparable to similar financial measures of other issuers.See “Use of Non-IFRS Financial Measures” below for the composition and calculation of this financial measure.

Operational and Financial Performance

Contained tin production of 5,237 tonnes for the quarter ended December 2024 was 7% above the prior period. The volumes and tin grade of ore processed were slightly above that of the previous quarter and in line with the annualised target of 900,000 tonnes at a grade of 3%. The processing facilities performed exceptionally well – overall plant recoveries averaged 75% during the quarter, above the target of 73%. For the year ended 31 December 2024, the Company produced 17,324 tonnes of contained tin, 38% above that of the previous year and within the guidance range of 17,000 to 18,000 tonnes. This increase is a result of production from the Mpama South expansion which was completed during Q2 2024.

Tin sales volumes for the quarter decreased by 11% to 4,942 tonnes – the previous quarter’s sales of 5,552 tonnes included the clearing of a ~600 tonnes sales backlog. As has historically been the case, Q4 experienced high rainfall which impacted the outbound road conditions and transit times and as a result sales volumes for Q4 were 295 tonnes below tin volumes produced with the backlog expected to clear during January 2025.

Q4 guidance for AISC per tonne of tin sold is US$15,106 at 4% below the prior quarter’s actual AISC of US$15,728, primarily due to a ~60% reduction in marketing fees as a condition to the previously announced extension of the tin concentrate off-take agreement with Gerald Metals.

EBITDA for the year ended 31 December 2024 is estimated to increase by 102% to US$274m (FY2023 actual: US$136m) due to higher tin production and sales volumes following the Mpama South expansion as well as the benefit of a 17% increase in the average tin price to US$30,345/t. The Q4 EBITDA guidance of US$76m is 17% below the actual of the previous quarter due to lower sales volumes for the reasons outlined above as well as a 4% lower tin price.

Alphamin’s audited consolidated financial statements and accompanying Management’s Discussion and Analysis for the year and quarter ended 31 December 2024 are expected to be released on or about March 14, 2025.

Production guidance for the year ending December 2025

Production guidance for the year ending December 2025 is approximately 20,000 tonnes of contained tin (FY2024: 17,324 tonnes) with the full year expected to benefit from the Mpama South expansion.

Exploration update

Alphamin’s exploration strategy focuses on three key objectives:

1.Increase the Mpama North and Mpama South Resource base and life of mine

2.Discover the next tin deposit in close proximity to the Bisie mine

3.Ongoing grassroots exploration in search of remote tin deposits on the large prospective land package

Exploration drilling at Mpama North and Mpama South re-commenced during Q4 2024.

Mpama South

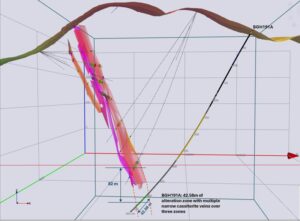

A surface drilling campaign at Mpama South targeting both down-dip, up-dip and strike extensions is underway with three holes completed to date. The first two holes to the far south of the current mineralised zone designed to test the lower grade southern extents did not intersect visual tin mineralisation. The subsequent holes were planned 50-80m below the current resource boundary and at depth. The first of these holes (BGH191A) intercepted multiple narrow cassiterite veins 82m below the current Resource boundary over three zones of 9.04 m, 0.86m and 1.04m that potentially extends the mineralised system.

Figure 01: Mpama South down-dip extension hole BGH191A viewed from the South

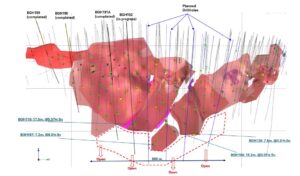

Figure 02: Mpama South (viewing from the East) current exploration drilling program targeting extensions of tin mineralisation at depth which is still open with a strike length of ~500m

Mpama North

A short campaign of geological fan drilling from underground at Mpama North on the northern open extensions of the mineralised zone started in Q4 2024. This campaign was aimed at better understanding the geological structure in this area. These eight holes totalling 1,525m, intersected a number of chlorite alteration zones associated with tin mineralisation as well as minor cassiterite veins. One hole in particular intersected wide zones of massive sulphides which are frequently used as a hanging wall marker horizon potentially indicating further cassiterite mineralisation at depth.

The next drill holes at Mpama North are targeting an extension to mineralisation at depth along strike to the north. The first of these drillholes (MNUD008A) was completed in early January 2025 and intersected a thick chlorite altered zone of visual tin cassiterite approximately 20m north of the previously most northerly Resource drillhole and some 200m below the bottom of the current mining echelon. Two more step-out holes are planned from underground targeting these strike and dip extensions, after which surface drilling targeting further dip and strike extension is planned.

Figure 03: Core photographs from Mpama North drillhole MNUD008A of highly mineralized tin cassiterite intercepts

No external laboratory assays have been received to date.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE