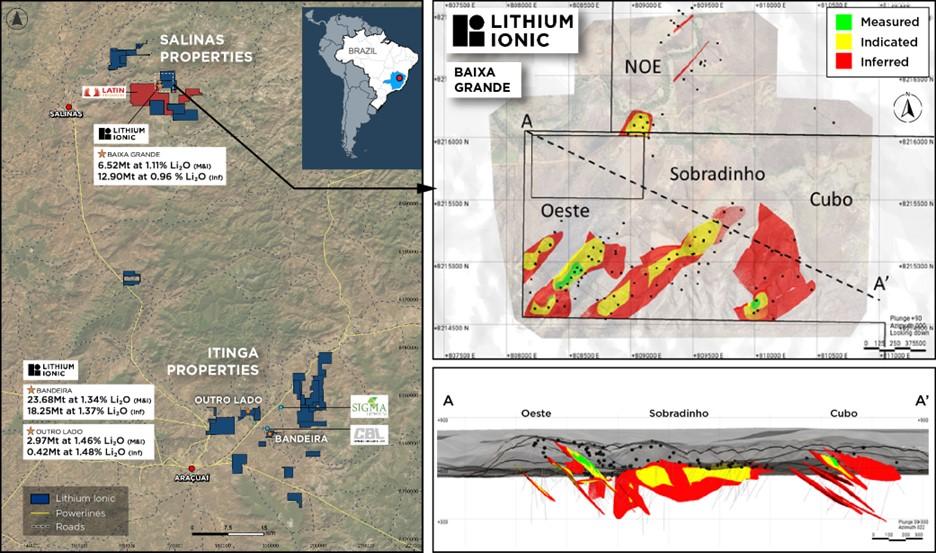

Lithium Ionic Reports 32% Growth in Updated Mineral Resource Estimate at Baixa Grande – Salinas, Minas Gerais, Brazil

Lithium Ionic Corp. (TSX-V: LTH) (OTCQB: LTHCF) (FSE: H3N) is pleased to announce an updated NI 43-101 Mineral Resource Estimate for the Baixa Grande Project the main deposit and growth target within its Salinas group of properties located in northern Minas Gerais State, Brazil (see Figure 1). This updated MRE highlights the significant expertise of Lithium Ionic’s exploration team in defining and growing resources efficiently, underscoring the quality and strategic potential of the Baixa Grande deposit and surrounding claims.

Baixa Grande Mineral Resource Estimate Highlights:

- 6.52 million tonnes in the Measured and Indicated category, and an additional 12.90Mt in the Inferred category (see Table 1).

- Since the maiden MRE at Baixa Grande announced in April 2024, M&I has increased 11.3%, while Inferred has increased 45%, showcasing the effectiveness of our exploration approach and the strong potential for further growth in the future.

- The MRE incorporates data from 35,734 metres of drilling (167 diamond drill holes). This additional drilling led to a 32% growth in the total MRE, showcasing the team’s strong geological understanding and exceptional success through targeted drilling efforts.

- In August 2024, Pilbara Minerals announced the acquisition of Latin Resources and their Colina deposit, located directly west of the Baixa Grande deposit in an all-share transaction valued at US$369.4 million (see Latin claims in Figure 1).

- The potential for significant additional lithium-bearing spodumene mineralization at Baixa Grande remains very high with the completion of additional drilling in the area.

Blake Hylands, P.Geo., CEO of Lithium Ionic, commented, “This updated mineral resource estimate for Baixa Grande is a testament to the remarkable work of our exploration team in successfully delineating and expanding the deposit with targeted and efficient drilling. Baixa Grande is proving to be a key contributor to our long-term growth and production strategy. I am confident in our team’s ability to further enhance and upgrade these resources and continue to reinforce the importance of the Salinas group of properties within our portfolio. While our near-term focus remains on advancing Bandeira toward production, we are excited by the continued growth potential at Baixa Grande and other regional targets, and their role in supporting our vision of becoming a leading lithium producer.”

Carlos Costa, P.Geo., Lithium Ionic’s VP of Exploration, commented, “This updated NI 43-101 mineral resource estimate highlights the outstanding achievements of our exploration team and the quality of our assets. The nearly 20Mt resource at Baixa Grande reflects not only the geological potential of the deposit but also the expertise of our technical team in unlocking value efficiently.”

Baixa Grande Project, Salinas Group of Properties

The Baixa Grande target, located within the Salinas group of properties acquired in March 2023, has quickly become one of the most promising growth assets in the Company’s portfolio. These properties are located approximately 100 kilometres north of the Company’s Bandeira development project, within the northern section of Brazil’s Eastern Pegmatite Province, a region that is highly prospective for spodumene-bearing pegmatites. The nearly 20Mt mineral resource at Baixa Grande is an important addition to the Company’s total resources, which further solidifies its position as a leading lithium company in the region.

In August 2024, Pilbara Minerals announced the acquisition of Latin Resources and their Colina deposit, located directly west of the Baixa Grande deposit. This acquisition marked Pilbara’s first diversification into the Americas, underscoring the quality, quantity and global competitiveness of Brazil’s lithium deposits in this region.

The Baixa Grande MRE is located on a 662-hectare property, a small portion of Lithium Ionic’s large 17,000-hectare land package (See Figure 1).

Baixa Grande Mineral Resource Estimate

The MRE was prepared by GE21 in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

This updated estimate builds upon the maiden MRE announced on April 4, 2024, incorporating expanded data from 167 diamond drill holes comprising 35,734 metres of drilling completed between May 2023 and September 2024.

This added drilling has increased the total mineral resource estimate at Baixa Grande by 32%, now totaling an estimated 6.52Mt grading 1.11% Li₂O, containing 179,580 tonnes of Lithium Carbonate Equivalent, in the M&I category, in addition to 11.67Mt grading 0.97% Li₂O, or 280,730 tonnes of LCE, in the Inferred category for open pit and 1.23Mt grading 0.83% Li₂O, or 25,190 tonnes of LCE, in the Inferred category for underground (see MRE results in Table 1).

Additional drilling at the Noé target, identified previously as having high potential for spodumene mineralization, yielded an initial Inferred resource estimate. Current interpretation suggests that the modelled pegmatites potentially increase at depth. Additional drilling is planned to confirm these observations.

Exploration efforts to date have laid a strong foundation for Baixa Grande’s future development. The deposit remains open at depth and along strike, providing significant potential for further resource growth.

The NI 43-101 technical report for the MRE, will be accessible on SEDAR+ (www.sedarplus.ca) under the Company’ issuer profile, and on the Company’s website, www.lithiumionic.com, within 45 days of this news release.

Table 1: Baixa Grande Mineral Resource Estimate Summary

| Deposit / | Category | Resource (Mt) | Grade | Contained LCE (kt) |

| Cut-Off Grade | (% Li2O) | |||

| Open-Pit (0.5% cut-off) |

Measured | 1.08 | 1.19 | 31.86 |

| Indicated | 5.44 | 1.10 | 147.72 | |

| Measured + Indicated | 6.52 | 1.11 | 179.58 | |

| Inferred | 11.67 | 0.97 | 280.73 | |

| Underground (0.5% cut-off) |

Measured + Indicated | – | – | – |

| Inferred | 1.23 | 0.83 | 25.19 | |

| TOTAL | Measured + Indicated | 6.52 | 1.11 | 179.58 |

| Inferred | 12.90 | 0.96 | 305.92 |

| 1. | The spodumene pegmatite domains were modeled using composites with Li₂O grades greater than 0.3%. |

| 2. | The Mineral Resource Estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit. |

| 3. | Mineral Resources are not Mineral Reserves and are not demonstrably economically recoverable. |

| 4. | Grades reported using Dry Density. |

| 5. | The effective date of the MRE is December 2, 2024. |

| 6. | The QP responsible for the MRE is geologist Leonardo Soares (MAIG #5180). |

| 7. | The MRE numbers provided have been rounded to the estimate relative precision. Values cannot be added due to rounding. |

| 8. | The MRE is delimited by Lithium Ionic Baixa Grande Target Claims (ANM). |

| 9. | The MRE was estimated using ordinary kriging in 16m x 16m x 4m blocks. |

| 10. | The MRE Report Table was produced in Leapfrog Geo software. |

| 11. | The reported MRE only contains Fresh Rock Domains. |

| 12. | The reported MRE was restricted by interpreting suitable-grade shells using a 0.5% Li₂O cut-off for both Open Pit and Underground resources. |

| 13. | The MRE was restricted by a pit shell using a selling price of 2,750 US$/t Conc., Mining cost of 2.50 US$/ton mined, processing cost of 12.50 US$/ton ROM and a selling cost of 112.56 US$/t Conc

|

Figure 1. Plan View of Lithium Ionic’s 17,000ha Land Package with Expanded View of Baixa Grande Mineral Resource Estimate

Details related to the calculation of the Baixa Grande MRE

The MRE was authored by Leonardo Soares, P.Geo., M.Sc., of GE21 with an effective date of December 2, 2024. This updated MRE follows the maiden MRE for Baixa Grande (previously referred to as “Salinas”) announced on April 4, 2024.

The MRE was estimated using the following geological and resource block modeling parameters which are based on geological interpretations, geostatistical studies, and best practices in mineral estimation.

The QP is not aware of any factors or issues that materially affect the MRE other than normal risks faced by mining projects in the province in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors, and additional risk factors regarding inferred resources.

- The Project geology comprises Neoproterozoic age sedimentary rocks of Araçuaí Orogen intruded by fertile Li-bearing pegmatites originated by fractionation of magmatic fluids from the peraluminous S-type post-tectonic granitoids of Araçuaí Orogen. Lithium mineralization is related to concordant and discordant swarms of spodumene-bearing tabular pegmatites hosted by cordierite-biotite-quartz schists.

- Drilling conducted by Lithium Ionic included diamond core drilling of NTW (64.2mm diameter).

- Diamond core has been sampled in intervals of ~ 1 m where possible, otherwise intervals less than 1 m have been selected based on geological boundaries. Geological boundaries have not been crossed by sample intervals. ½ core samples have been collected and submitted for analysis, with regular field duplicate samples collected and submitted for QA/QC analysis.

- Drill core samples were submitted to SGS Geosol laboratories in Brazil where they were analyzed for a 31-element suite via ICP90A (fusion by sodium peroxide and finish with ICP- MS/ICP-OES). Assay data were composited to 1 m.

- The MRE was estimated from the diamond drill holes completed by Lithium Ionic since May 2023. A total of 167 drill holes comprising 4,036 assays were used for the mineral resources model.

- The 3D modelling of lithium Mineral Resources was conducted using a minimum cut-off grade of 0.3% Li2O within a preliminary lithological model.

- The interpolation was conducted using Krigging methodology with three interpolation passes.

- The block model was defined by a block size of 16 m long by 16 m wide by 4 m thick and covers a strike length of approximately 1,200 m to a maximal vertical depth of 300 m below surface.

- The MRE was classified as Measured, Indicated and Inferred Mineral Resource based on data quality, sample spacing, and pegmatite continuity. The Measured MRE was defined using a search ellipsoid of 50 m by 50 m by 30 m, and where the continuity and predictability of the mineralized units was reasonable. The Indicated MRE was defined using a search ellipsoid 100 m by 100 m by 50 m. The Inferred MRE category was assigned to areas where drill hole spacing was greater than 100 m by 100 m by 50 m for all remaining blocks.

- Classification focused on spatial relation using a minimum of five composites in at least three different drill holes for the Measured and Indicated resources.

- Validation has proven that the block model fairly reflects the underlying data inputs. Variability over distance is relatively moderate to low for this deposit type therefore the maximum classification level is Indicated.

- Mineralization at the deposits extends to surface and is expected to be suitable for open cut mining; no minimum mining width was applied; internal mining dilution is limited to internal barren pegmatite and/or host rock intervals within the mineralized pegmatite intervals; based on these assumptions, it is considered that there are no mining factors which are likely to affect the assumption that the deposit has reasonable prospects for eventual economic extraction.

- It is the QP’s opinion that the current classification used is adequate and reliable for this type of mineralization and mineral resource estimate.

- Initial Metallurgical tests results are not available at this stage of project advancement. An assumed concentrate (DMS) recovery of 65% has been applied in determining reasonable prospects of eventual economic extraction.

- Mineral Resources were constrained within the boundaries of an optimized pit shell using the following constraints: Concentrate price: USD$2,750; mining costs: USD$2.5/t ROM; Processing costs: USD$12.5/t ROM, General/Admin: USD$3.0/t ROM, Lithium Recovery: 65%, Mining Recovery: 100% and Pit slope: 56° in fresh rock and 37° in saprolite.

- The MRE reported is a global estimate with reasonable prospects of eventual economic extraction.

*In addition to the MRE reported in this press release, please see NI 43-101 compliant technical report related to the Bandeira Bandeira MRE titled “NI 43-101 Technical Report – Mineral Resource Update on Bandeira Project, Araçuaí and Itinga, Minas Gerais State, Brazil” (effective date of March 5, 2024; QP: Leonardo Soares of GE21) and the NI 43-101 compliant technical reports related to the Outro Lado deposit titled “Mineral Resource Estimate for Lithium Ionic, Itinga Project” (effective date of June 24, 2023; authored by Maxime Dupéré, B. Sc., P.Geo. and Faisal Sayeed, B. Sc., P.Geo).

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its Itinga and Salinas group of properties cover ~17,000 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. Its Feasibility-stage Bandeira Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Qualified Persons

Leonardo Soares, P.Geo., M.Sc., of GE21 is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical information and data regarding the MRE included in this news release. Mr. Soares is independent of Lithium Ionic. All other scientific and technical information in this news release has been reviewed and approved by Carlos Costa, Vice President Exploration for Lithium Ionic, and a “Qualified Person” as defined in NI 43-101

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE