K92 Mining Announces Q4 Production Results – Record Quarterly Production Of 53,401 oz AuEq, Record Annual Production Significantly Exceeding Production Guidance

- Record quarterly production of 53,401 oz gold equivalent 1) or 51,371 oz gold, 958,312 lbs copper and 41,992 oz silver, representing a 37% increase from Q4 2023 and a 21% increase from the previous quarterly record set in Q3 2024. Record quarterly sales of 48,350 oz gold, 946,704 lbs copper and 41,720 oz silver.

- Record annual production of 149,515 oz AuEq or 139,123 oz gold, 4,926,738 lbs copper and 142,063 oz silver, increasing 27% from 2023 and significantly exceeding the production guidance range of 120,000 to 140,000 ounces AuEq. Record annual sales of 140,659 oz gold, 5,043,134 lbs copper and 145,060 oz silver.

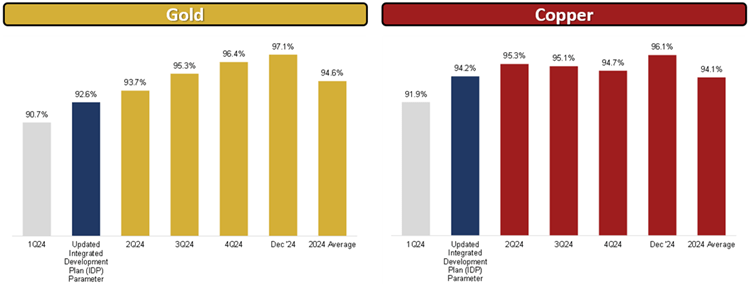

- Record metallurgical recoveries in Q4 of 96.4% for gold and near-record recoveries of 94.7% for copper, with December achieving record monthly gold recoveries of 97.1% and copper recoveries of 96.1%. Annual gold recoveries of 94.6% and copper recoveries of 94.1% compare favourably to the recovery parameters from the Updated Integrated Development Plan (IDP), of 92.6% and 94.2%, respectively (January 1, 2024 effective date).

- Quarterly ore processed of 96,614 tonnes with a head grade of 18.0 grams per tonne AuEq, or 17.3 g/t gold, 0.47% copper and 15.2 g/t silver. AuEq head grade in Q4 was the highest since Q2 2020 and was above budget, benefiting from a combination of higher grade stopes from Kora and Judd plus a notable positive gold grade reconciliation and moderate positive copper grade reconciliation versus the latest independent mineral resource (effective date of September 12, 2023 for Kora and Judd). Throughput was deliberately reduced to maximize recoveries at the higher feed grade.

- Ore mined of 97,016 tonnes and total material movements (ore plus waste) was the second highest on record, totalling 306,430 tonnes. Long hole open stoping performed to design, and mine development totaled of 2,571 metres, increasing by 381 metres or 17% from the prior quarter. Development rates are well positioned to continue to increase near-term to 1,000 metres per month required for the Stage 3 Expansion run-rate, and later this year to 1,200 metres per month required for the Stage 4 Expansion run-rate, driven by: i) the interim ventilation system upgrade (completed and operating since early January 2025), ii) the completion of multiple infrastructure upgrades over the first half of 2025, iii) a major increase to available headings from the opening of two new mining fronts, iv) the progressive introduction of additional equipment already on site as available headings increase, and, v) the execution of various identified productivity initiatives.

Note (1): Gold equivalent for Q4 2024 is calculated based on: gold $2,658 per ounce (“oz”); silver $31.52 per oz; and copper $4.25 per pound (“lb”).

John Lewins, K92 Chief Executive Officer and Director, stated, “We are delighted to announce a second consecutive quarterly production record, delivering 53,401 oz AuEq in Q4, an increase of 21% from the prior quarter. The strength of the operation in the second half of the year resulted in the Company achieving record annual production of 149,515 oz AuEq, significantly exceeding our annual production guidance, despite the impact of the temporary suspension of underground mining due to the non-industrial fatal incident from mid-March to mid-April, highlighting the strength of the Company, our people and the Kora and Judd ore bodies.

As we look ahead at 2025, there is tremendous enthusiasm within the Company and in Papua New Guinea for the upcoming delivery of the Stage 3 Expansion, which is designed to transform Kainantu into a Tier 1 Mid-Tier Producer. Construction is rapidly advancing, with approximately 70% of growth capital either spent or committed as at December 31, 2024. The drone footage, found at the following LINK, highlights the rapid pace of construction progress at the process plant, with commissioning of the Stage 3 Expansion process plant scheduled to commence near-term in late-Q2. Other construction projects are also rapidly progressing and with consecutive quarters of strong operating results in a record gold price environment, the Company continues to be in a strong financial position to deliver the expansions and exploration from multiple high-priority targets concurrently.”

K92 Mining Inc. (TSX: KNT) (OTCQX: KNTNF) is pleased to announce record quarterly production results for the fourth quarter of 2024 at its Kainantu Gold Mine in Papua New Guinea, of 53,401 oz AuEq or 51,371 oz gold, 958,312 lbs copper and 41,992 oz silver, which represents a 37% increase from Q4 2023 and a 21% increase from the previous quarterly record set in Q3 2024. Sales during the quarter were 48,350 oz gold, 946,704 lbs copper and 41,720 oz silver. Annual production achieved 149,515 oz AuEq or 139,123 oz gold, 4,926,738 lbs copper and 142,063 oz silver, significantly exceeding the production guidance range of 120,000 to 140,000 oz AuEq and representing a 27% increase from 2023. Annual sales were 140,659 oz gold, 5,043,134 lbs copper and 145,060 oz silver.

During Q4, the process plant processed 96,614 tonnes, with a head grade averaging 18.0 g/t AuEq or 17.3 g/t gold, 0.47% copper and 15.2 g/t silver. Gold equivalent head grade was the highest since Q2 2020. Gold grades were above budget, driven by higher grade stopes from Judd and Kora combined with a notable positive gold grade reconciliation and moderate positive copper grade reconciliation when compared with the independent mineral resource model. Throughput was deliberately reduced to maximize recoveries at the higher feed grade.

Strong metallurgical recoveries were also achieved, with record recoveries in the quarter for gold, averaging 96.4%, and near-record recoveries of 94.7% for copper, and record monthly gold recovery of 97.1% and copper recovery of 96.1% in December. Annual gold recoveries of 94.6% and copper recoveries of 94.1% compare favorably to the recovery parameters stated in the Updated IDP, of 92.6% and 94.2% for gold and copper, respectively (January 1, 2024 effective date).

In Q4, the mine delivered 97,016 tonnes of ore mined, with 12 levels mined, including the 1090, 1285, 1305, 1345, and 1365 levels at Kora, and the 1170, 1185, 1205, 1265, 1305, 1325 and 1365 levels at Judd. Total material movements (ore plus waste) were the second highest on record, totalling 306,430 tonnes. Long hole open stoping performed to design. Overall mine development achieved a total of 2,571 metres, increasing by 381 metres, or 17% from the prior quarter. Development rates are well positioned to continue to increase near-term to 1,000 metres per month required for the Stage 3 Expansion and later this year to the 1,200 metres per month required to ramp-up to the Stage 4 Expansion run-rate, driven by: the interim ventilation upgrade recently completed and online in early January 2025; stage 2 interim clean water supply upgrade planned for completion in second half of January 2025; the sequential completion of multiple infrastructure projects over the next 2 quarters (Puma ventilation drive for life of mine ventilation upgrade with two x 2 MW fans operational – Q2 2025, first ore pass/waste pass – raise bore completion early Q1 2025, fully operational late Q2 2025); significant increase to available headings and advance productivities as two mining fronts are opened up (twin incline and front below the main mine); progressive introduction of multiple jumbos and equipment that are already on site as available headings increase, and; the execution of various identified productivity initiatives.

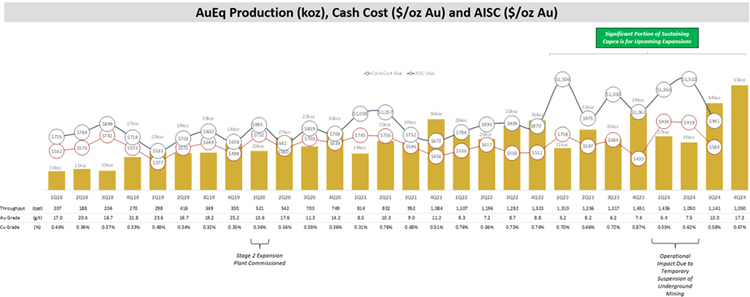

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

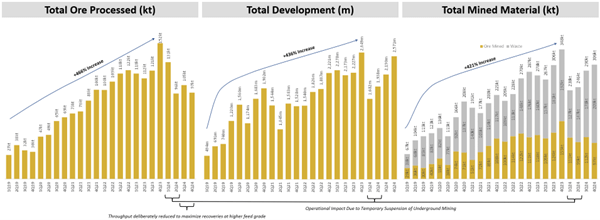

See Figure 2: Quarterly Ore Processed, Development, and Mined Material Chart

See Figure 3: Gold and Copper Recoveries Chart

Table 1 – 2024 & 2023 Annual Production Data

| 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | 2024 | ||

| Tonnes Processed | T | 503,484 | 130,632 | 95,582 | 104,992 | 96,614 | 427,821 |

| Feed Grade Au | g/t | 6.8 | 6.4 | 7.5 | 13.0 | 17.3 | 10.7 |

| Feed Grade Cu | % | 0.75% | 0.55% | 0.62% | 0.58% | 0.47% | 0.55% |

| Recovery (%) Au | % | 91.5% | 90.7% | 93.7% | 95.3% | 96.4% | 94.6% |

| Recovery (%) Cu | % | 92.8% | 91.9% | 95.3% | 95.1% | 94.7% | 94.1% |

| Metal in Conc & Doré Prod Au | oz | 100,533 | 24,389 | 21,661 | 41,702 | 51,371 | 139,123 |

| Metal in Conc Prod Cu | T | 3,488 | 655 | 565 | 580 | 435 | 2,235 |

| Metal in Conc & Doré Prod Ag | oz | 160,628 | 35,650 | 26,754 | 37,613 | 41,992 | 142,063 |

| Gold Equivalent Production | oz | 117,607 | 27,462 | 24,347 | 44,304 | 53,401 | 149,515 |

Notes – Gold equivalent for Q4 2024 is calculated based on:

gold $2,658 per ounce; silver $31.52 per ounce; and copper $4.25 per pound.

Gold equivalent for Q3 2024 is calculated based on:

gold $2,474 per ounce; silver $29.43 per ounce; and copper $4.17 per pound.

Gold equivalent for Q2 2024 is calculated based on:

gold $2,338 per ounce; silver $28.84 per ounce; and copper $4.42 per pound.

Gold equivalent for Q1 2024 is calculated based on:

gold $2,070 per ounce; silver $23.34 per ounce; and copper $3.83 per pound.

Gold equivalent for 2023 is calculated based on:

Q4 2023: gold $1,974 per ounce; silver $23.20 per ounce; and copper $3.71 per pound. Q3 2023: gold $1,928 per ounce; silver $23.57 per ounce; and copper $3.79 per pound. Q2 2023: gold $1,976 per ounce; silver $24.13 per ounce; and copper $3.85 per pound. Q1 2023: gold $1,890 per ounce; silver $22.55 per ounce; and copper $4.05 per pound.

Qualified Person

K92 Mine Geology Manager and Mine Exploration Manager, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings, and discussing work programs and results with geology and mining personnel.

Technical Report

The Updated Integrated Development Plan for the Kainantu Gold Mine Project in Papua New Guinea that contains information on the Mineral Resource Estimate, Definitive Feasibility Study and Preliminary Economic Assessment is included in a technical report, titled, “Independent Technical Report, Kainantu Gold Mine Updated Integrated Development Plan, Kainantu Project, Papua New Guinea” dated November 28, 2024, with an effective date of January 1, 2024.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018, is in a strong financial position, and is working to become a Tier 1 mid-tier producer through ongoing plant expansions. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE