Marimaca Signs Binding Option to Acquire the Madrugador Project, Further Consolidating the SdM Exploration District

Marimaca Copper Corp. (TSX: MARI) is pleased to announce the signing of a binding option agreement to acquire the Madrugador project. Details of the transaction are found below in the “Transaction Summary” section of this press release.

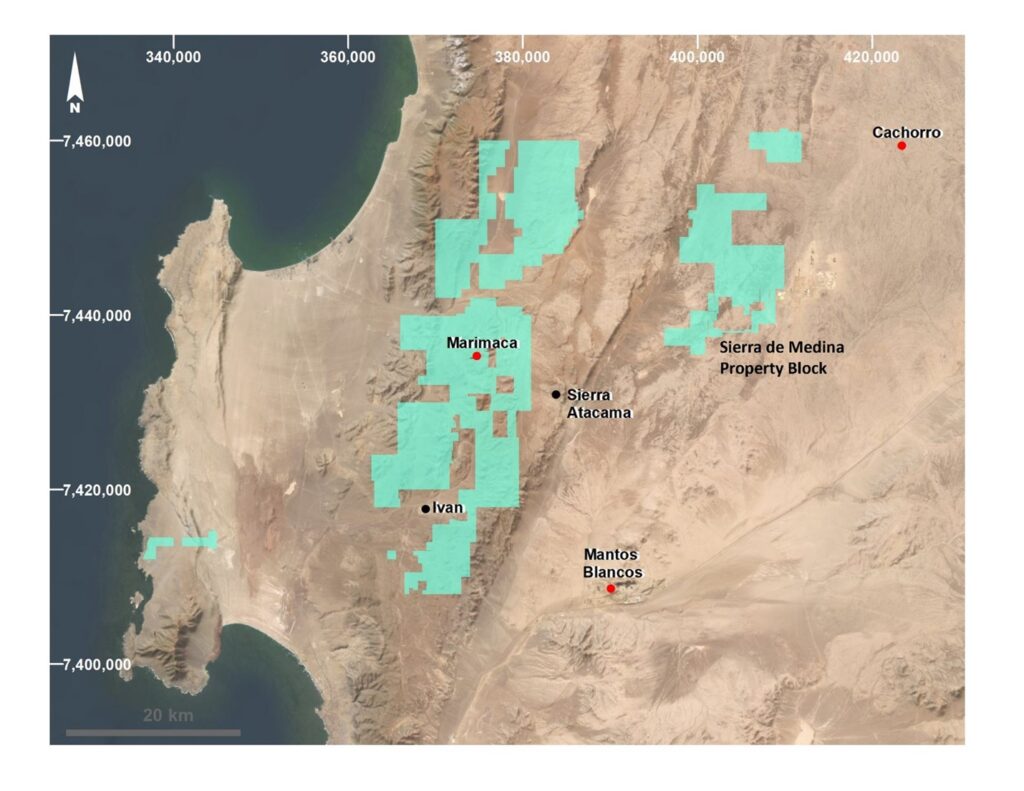

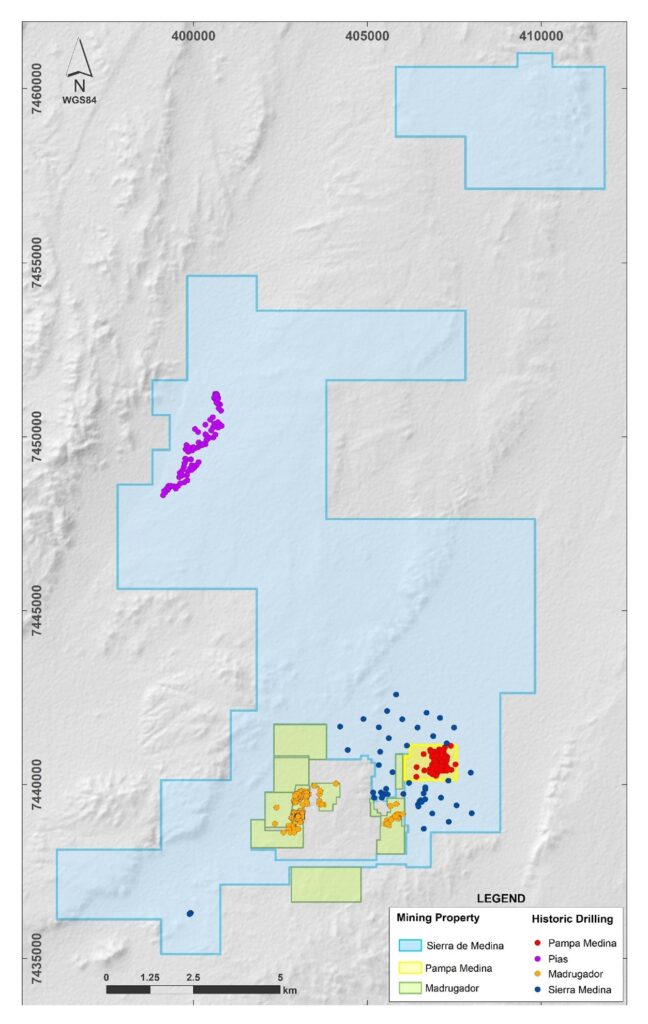

Madrugador consists of 10 mining concessions totaling 855 hectares and is located immediately adjacent to the Pampa Medina project (see press release dated October 8th, 2024). The acquisition of Madrugador and Pampa Medina consolidates the Company’s ownership of the southern extent of the broader 14,500ha Sierra de Medina property package (see Figures 1, 2 and 3). Madrugador is located approximately 26km in distance and ~200m higher elevation relative to the Company’s planned processing infrastructure as defined in the ongoing Marimaca Oxide Deposit Definitive Feasibility Study (see press release dated January 15th, 2024).

Madrugador hosts a historical National Instrument 43-101 – Standards of Disclosure for Mineral Projects non-compliant resource estimate of copper hosted in dominantly oxide mineralization, which is detailed below in Table 1 alongside relevant technical and regulatory disclosure. Marimaca is currently completing a review of available historical information to plan and execute a validation and upgrade program of the historical resource.

Hayden Locke, President & CEO, commented:

“The acquisition of Madrugador consolidates our ownership of what we now recognize as a highly prospective district for complementary leachable copper resources, underpinning our aspirations for growth in copper production in the future.”

”Similar to Pampa Medina, Madrugador hosts near or at surface, high grade, leachable copper mineralization. We believe these assets already have the potential to add meaningful, compliant, resources and we are completing confirmatory reviews to support eventual release of compliant Mineral Resource Estimates.”

”Both projects are also within areas where surface and geophysical exploration programs suggest good potential for extension with ongoing exploration. Our VP Exploration, Sergio Rivera, and his team are drilling several targets now and we expect to step up our exploration activities in the new year.”

”We are considering how the expanded project will fit in the broader development strategy of the MOD, as we expect the most logical development strategy for these assets will be to utilise the future MOD infrastructure. This is especially true with respect to our water management systems, potential pipeline routes, and the footprint of the SX-EW facility, to ensure an allowance for future, modular, capacity expansions at low incremental capital cost.”

Table 1. Historical Resource Estimate Taken From “Mineral Resources Technical Report on the Madrugador Property, Antofagasta, Chile, Apoquindo Minerals, 2009”

The historical estimate uses CIM categories. The Qualified Person (QP) has not done sufficient work to classify the historical estimate as a current resource at this stage. The Company is not treating the historical estimate as a current resource and intends to verify and upgrade the historical estimate via a planned work program outlined in the “Validation Program” section of this news release.

| Mineral Resource Category and Type | Quantity (tonnes) |

CuT (%) | CuS (%) |

| Total Measured | 6,639,000 | 0.73 | 0.53 |

| Total Indicated | 5,557,000 | 0.62 | 0.40 |

| Total Measured and Indicated | 12,196,000 | 0.68 | 0.47 |

| Total Inferred | 1,388,000 | 0.58 | 0.33 |

The Apoquindo Historical Estimate was conducted using a cut-off grade of 0.2% CuT.

Property Overview

- 855ha land package adjacent to Pampa Medina and Marimaca’s broader SdM exploration property package

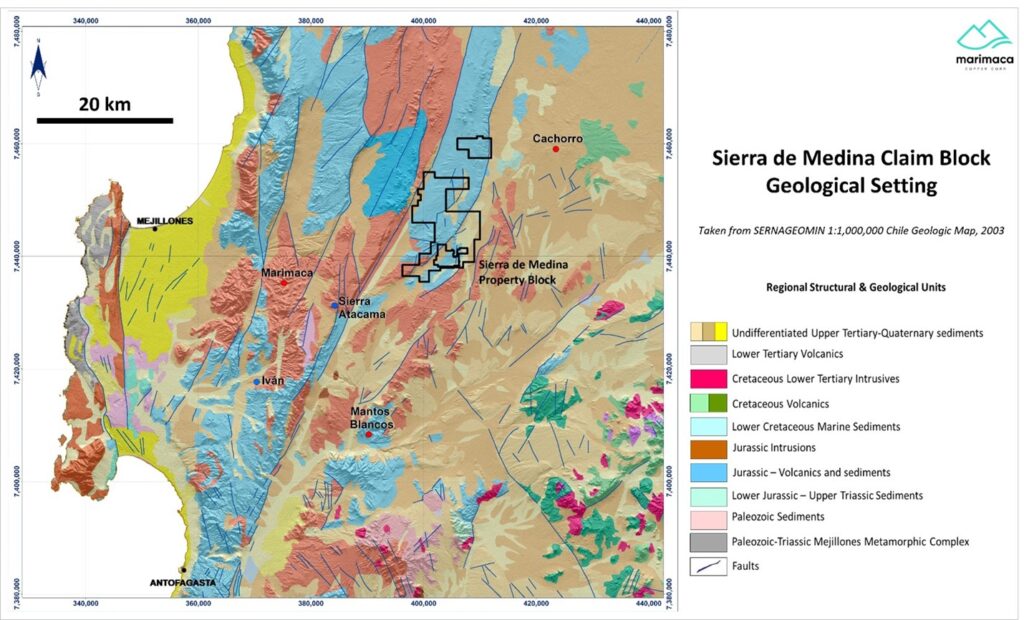

- Located in the eastern domain of the Antofagasta Region’s coastal copper belt, which hosts large, ‘Manto’-style copper deposits including Capstone Copper’s Mantos Blancos mine and Antofagasta Minerals’ Cachorro project (Figure 4)

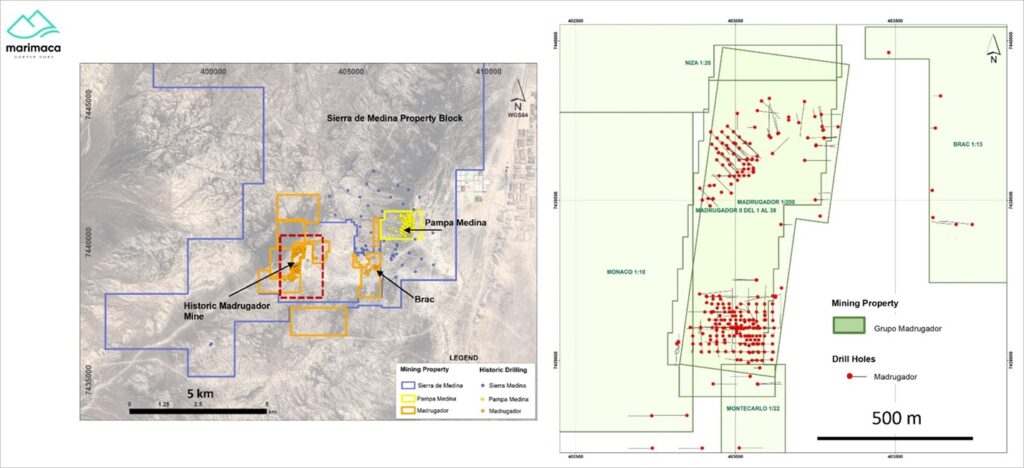

- Observable, shallow volcanic-hosted manto-style copper oxide mineralization near surface and in available drill core in the western historical Madrugador Mine concessions, with copper oxide and mixed oxide-sulphide mineralization described in historical reports and drilling observed in both volcanic and underlying sedimentary units in the east and southern concessions (Figure 2 and Figure 3)

- Historical resources reported are located in the historical Madrugador mine area. Over 6,000m of drilling was completed in the Brac area, however no historical resource was ever reported. Marimaca will review and consider the Brac drilling for future mineral resource updates

- 45,885m of historical drilling data available for review and validation

- Complements the Pampa Medina project currently undergoing step out drilling by adding further potential for the expansion of leachable copper resources

- Significant geological database to leverage for further exploration vectoring in the broader SdM land package

Validation Program (Underway)

- Geological relogging of available historical diamond drilling database

- Drill collar GPS validation, topography validation, survey validation

- Reinterpretation and rebuild of the geological model

- Strategy to upgrade historical resource to current resources will be further defined based on the results of the above

Transaction Summary

- Under the terms of the Agreement, Marimaca Copper will pay the following over an option term of 5-years to acquire 100% of Madrugador from Sociedad Legal Minera Juanita Uno del Mineral El Desesperado and Sociedad Legal Minera Madrugador Uno del Mineral de Sierra Valenzuela. Marimaca may withdraw from the Agreement at any time subject to forfeit of payments made up to the date of withdrawal.

- US$150,000 on signing

- US$250,000 on the first anniversary of signing

- US$400,000 24 months from of signing

- US$1,200,000 36 months from signing

- US$3,000,000 48 months from signing

- US$7,000,000 60 months from signing

- The sellers will retain a 1.5% royalty on Madrugador’s net gross sales. Marimaca will have the ability to buy back 1.0% of the NSR for US$1,500,000 at any time and a right of first refusal on any sale of the royalty to a third party.

Figure 1: Marimaca Land Position – Marimaca and Sierra de Medina

Figure 2: Madrugador, Pampa Medina and Pias Target (see press release dated February 27, 2024)

Figure 3: Madrugador – Historical Drilling and Western Historical Mine Area

Figure 4: Regional Geological Setting

Qualified Person

The technical information in this news release has been reviewed and approved by Sergio Rivera, VP of Exploration of Marimaca, a geologist with more than 35 years of experience and a registered member of the Comision Minera (Chilean Mining Commission), as well a member of the Colegio de Geólogos de Chile, Instituto de Ingenieros de Minas de Chile and of the Society of Economic Geologist USA, and who is a Qualified Person for the purposes of NI 43-101. As noted previously, the Qualified Person (QP) has not done sufficient work to classify the historical estimate presented in this news release as a current resource.

MORE or "UNCATEGORIZED"

Additional High Grade Antimony Results on the Bald Hill Property under Option from Globex

GLOBEX MINING ENTERPRISES INC. (TSX:GMX) (FRA: G1MN) (OTCQX:G... READ MORE

Cerro de Pasco Resources Provides Operational Review, Project Progress and Corporate Update

Cerro de Pasco Resources Inc. (TSX-V CDPR) (OTCQB GPPRF) (FRA N8H... READ MORE

Midland, in Partnership with Rio Tinto Exploration Canada, Intersects New Lithium and Cesium Bearing Pegmatites During the 2025 Drilling Program on the Galinée Project

Midland Exploration Inc. (TSX-V: MD), in partnership with Rio Tin... READ MORE

Brunswick Exploration Announces Inferred Mineral Resource of 52.2Mt at 1.08% Li2O at Mirage with Additional Exploration Target

Brunswick Exploration Inc. (TSX-V: BRW) (OTCQB: BRWXF) is very pl... READ MORE

Endeavour Silver Produces 6,486,661 Oz Silver and 37,164 Oz Gold, for a total of 11.2 Million Silver Equivalent Oz in 2025

Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) reports full year... READ MORE