Arizona Metals Drills Discovery Hole in New Kay2 Lens at Kay Deposit: 50.0 m @ 6.7 g/t AuEq

Arizona Metals Corp. (TSX:AMC) (OTCQX:AZMCF) has drilled a discovery hole in a new lens of mineralization in the Kay deposit on the Kay Mine Project in Arizona. The drill hole, KM-24-166, returned 50.0 m grading 6.65 g/t AuEq, including 6.9 m @ 12.69 g/t AuEq, outside the north edge of previously known mineralization.

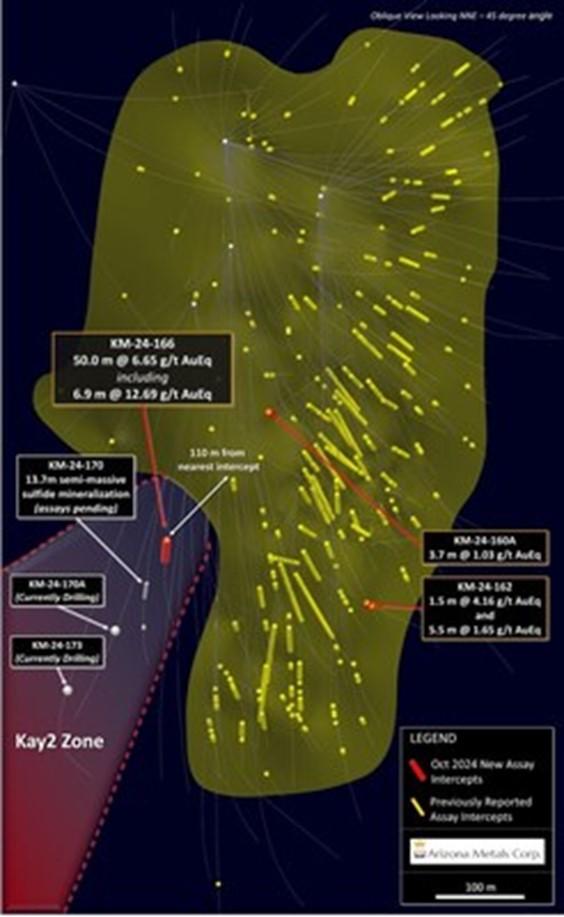

The new zone of mineralization, the Kay2 Zone, is located approximately 100 m north of previously drilled mineralization in the Kay deposit (Figure 1). Drill hole KM-24-166 stepped north 110 m from the nearest hole, KM-24-94B, moderately deep in the deposit. Mineralization consists of semi-massive to massive sulfide (Figure 2) similar to the extensive drilled intercepts throughout the Kay deposit. Additional drilling suggests that this is a new lens in the larger and expanding Kay deposit system: drill hole KM-24-170 intercepted 13.7 m of semi-massive sulfide approximately 50 m below hole 166 (assays pending). Additional holes are currently in progress to explore the horizontal and vertical dimensions of the Kay2 Zone.

Duncan Middlemiss, President and CEO of Arizona Metals, comments: “We have long anticipated the expansion potential of the Kay Project, and this drill hole shows that the upside at Kay is substantial. We currently have three drills on the Kay Project and have devoted two of them to the Kay2 Zone to test its extent. We expect the newly discovered Kay2 Zone to contribute to the upcoming mineral resource estimate for the Kay deposit.”

Two other drill holes in the Kay deposit returned notable intervals. Stepout hole KM-24-162 intersected 1.5 m @ 4.16 g/t AuEq and 5.5 m @ 1.65 g/t AuEq, which extended mineralization 30 m to the south (Figure 1). KM-24-160A cut 3.7 m @ 1.03 g/t AuEq in a 95-m gap near the center of the deposit.

Two holes in the North Central target intersected both the Kay horizon and Pad 10 horizon.

KM-24-161 intersected the Kay mineralization horizon over 3.2 m grading 0.43% CuEq. Both this and drill hole KM-24-163 displayed anomalous trace elements where expected in the Pad 10 horizon.

With the completion of recent drill holes, Arizona Metals has drilled a total of 122,000 meters on the Property. The Company is well funded, with $20.6 million in cash as of June 30, 2024.

The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (2) Assumptions used in USD for the copper and gold metal equivalent calculations were metal prices of $4.63/lb Copper, $1937/oz Gold, $25.20/oz Silver, $1.78/lb Zinc, and $1.02/lb Pb. Assumed metal recoveries (rec.), based on a preliminary review of historic data by SRK and ProcessIQ1, were 93% for copper, 92% for zinc, 90% for lead, 72% silver, and 70% for gold. The following equation was used to calculate copper equivalence: CuEq = Copper (%) (93% rec.) + (Gold (g/t) x 0.61)(70% rec.) + (Silver (g/t) x 0.0079)(72% rec.) + (Zinc (%) x 0.3844)(92% rec.) + (Lead (%) x 0.2203)(90% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(70% rec.) + (Copper (%) x 1.638)(93% rec.) + (Silver (g/t) x 0.01291)(72% rec.) + (Zinc (%) x 0.6299)(92% rec.) +(Lead (%) x 0.3609)(90% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

| __________ |

| 1 SRK Consulting (Canada) Inc., March 2022, Updated Metallurgical Review, Kay Mine, Arizona. Report 3CA061.004

|

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Project in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Deposit was reported by Exxon Minerals in 1982. (Fellows, M.L., 1982, Kay Mine massive sulphide deposit: Internal report prepared for Exxon Minerals Company)

The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Qualified Person and Quality Assurance/Quality Control

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Phoenix and Black Canyon City, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method

Au-AA23). Silver and 32 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-ICP61a). Over-limit samples for Au, Ag, Cu, and Zn were determined by ore-grade analyses Au-GRA21, Ag-OG62, Cu-OG62, and Zn-OG62, respectively.

ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver facility is ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The qualified person who reviewed and approved the technical disclosure in this release is David Smith, CPG, a qualified person as defined in National Instrument43-101–Standards of Disclosure for Mineral Projects. Mr. Smith supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the disclosure herein. Mr. Smith is the Vice-President, Exploration of the Company. Mr. Smith supervised the drill program and verified the data disclosed, including sampling, analytical and QA/QC data, underlying the technical information in this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE