The Prospector News

Calibre Announces Q3 & Year to Date 2024 Gold Production; Revises 2024 Guidance With Q4 Expected to Be the Strongest Production of the Year; Valentine Remains Fully Funded and On Track for Q2, 2025 Gold Production

You have opened a direct link to the current edition PDF

Open PDF CloseCalibre Announces Q3 & Year to Date 2024 Gold Production; Revises 2024 Guidance With Q4 Expected to Be the Strongest Production of the Year; Valentine Remains Fully Funded and On Track for Q2, 2025 Gold Production

Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) announces operating results for the three months and nine months ended September 30, 2024, updated 2024 guidance and an update on the Valentine Gold Mine, located in Newfoundland & Labrador, Canada. All figures are expressed in U.S. dollars unless otherwise stated.

Q3 & YTD 2024 Production and Preliminary Cost Results

- Consolidated Q3 gold sales of 46,076 ounces; Nicaragua 36,427 ounces and Nevada 9,649 ounces:

- Consolidated Q3 Total Cash Cost1 of $1,580/oz: Nicaragua $1,615/oz and Nevada $1,451/oz; and

- Consolidated Q3 All-In Sustaining Cost1 of $1,946/oz: Nicaragua $1,880/oz and Nevada $1,813/oz.

- Consolidated YTD gold sales of 166,200 ounces; Nicaragua 140,646 ounces and Nevada 25,554 ounces:

- Consolidated YTD TCC1 of $1,379/oz: Nicaragua $1,364/oz and Nevada $1,463/oz;

- Consolidated YTD AISC1 of $1,656/oz: Nicaragua $1,554/oz and Nevada $1,734/oz; and

- In addition to the mine sequence changes at Limon Norte discussed in Q2, year-to-date Nicaragua production was impacted due to lower than budgeted ore deliveries from the new Volcan open pit. Full year production from Volcan is expected to be approximately 20,000 ounces below budget because of the higher-than-expected historical artisanal mining activity. However, ore tonnes and grade from Volcan now align with expectations, as the deposit model has been confirmed by infill drilling. In Nevada, lower tonnes stacked impact metal production by approximately 5,000 ounces for the full year.

Full Year 2024 Guidance Revision

- Consolidated 2024 production guidance revised to 230,000-240,000 ounces.

- Nicaragua’s Q4 mine plans deliver significantly higher ore tonnes mined, with production expected to be 60,000-70,000 ounces. Despite increasing ore haulage to Libertad by 30% to 3,000 tonnes per day in Q4, the Company forecasts an approximate 30,000 ounce increase in stockpiles by year end, available for processing in 2025.

- Consistent with YTD performance, full year spend is anticipated to be in line with budget, with lower ounces sold resulting in higher TCC1 and AISC1 for 2024:

- Consolidated TCC1 has been revised to $1,300-$1,350/oz; and

- Consolidated AISC1 has been revised to $1,550-$1,600/oz.

Valentine Construction & Capital Cost Update

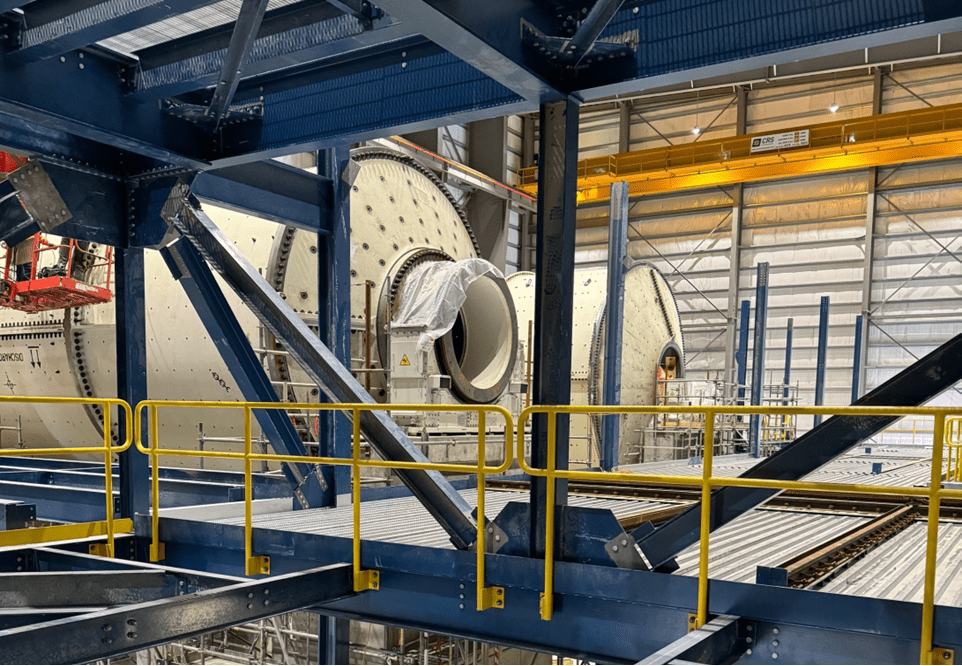

- Construction at Valentine surpasses 81% completion as of September 30, 2024:

- Tailings Management Facility is complete and ready to receive water;

- CIL leaching area tanks construction is nearing completion;

- Reclaim tunnel and coarse ore stockpile construction is progressing;

- Primary crusher installation is well advanced and overland conveyer construction has commenced; and

- Pre-commissioning is underway.

- Through September 30, 2024 Calibre has incurred costs of C$547 million. Estimated initial project capital has increased and is now forecast to be approximately C$744 million, resulting in a remaining cost to complete of C$197 million, inclusive of approximately C$20 million in contingency.

- With approximately C$300 million in cash (US$115.8 million) and restricted cash (US$100 million) at September 30 Valentine’s initial project capital remains fully funded and the project remains on track to deliver first gold in Q2 2025.

- The majority of the increase in capital is attributable to underperformance versus plan from certain contractors which has resulted in additional manpower, temporary camp accommodation, and extended time for certain contractor activities. Approximately 30% of the increase is a result of an underestimation in construction materials and scope of site infrastructure. Calibre had time contingencies, therefore remains confident that first gold will be delivered during Q2, 2025.

Darren Hall, President and Chief Executive Officer of Calibre, stated: “Q3 Production was lower than expected primarily due to higher-than-expected historical artisanal mining activity on the initial benches of the Volcan open pit and mine sequencing at Limon. Ore tonnes and grade from Volcan are now aligning with expectations and the deposit model has been confirmed by infill drilling.

Consolidated Q4 production is expected to be 70,000-80,000 ounces driven by Nicaragua’s Q4 mine plans which indicate significantly higher ore tonnes mined. It’s important to note that after increasing ore haulage to Libertad by 30% over Q3, to 3,000 tonnes per day, we forecast a stockpile build of approximately 30,000 ounces which will be processed in 2025.

We are guiding to finish 2024 approximately 18% below the midpoint of our original production guidance, the 30,000 ounce stockpile positions us well for a strong close to the year and a solid start to 2025. TCC and AISC guidance has been revised reflecting the revised production, with total spend for the year consistent with budget.

Construction of the multi-million-ounce Valentine Gold Mine is progressing well, reaching 81% completion at the end of September. Cost pressures have emerged primarily due to contractor performance versus plan, which have resulted in increased manpower and associated costs. The performance issues have been addressed, and we are confidently tracking towards mechanical and electrical completion in early Q1, 2025. With approximately C$300 million in cash and C$197 million cost to complete, the Valentine build remains fully funded and on track for first gold during Q2, 2025, representing a significant milestone in Calibre’s strategy to diversify and grow its production in Canada.”

Updated Full Year 2024 Guidance

| CONSOLIDATED | NICARAGUA | NEVADA | |

| Gold Production/Sales (ounces) | 230,000 – 240,000 | 200,000 – 210,000 | 34,000 – 36,000 |

| Total Cash Costs ($/ounce)1 | $1,300 – $1,350 | $1,300 – $1,350 | $1,450 – $1,500 |

| AISC ($/ounce)1 | $1,550 – $1,600 | $1,450 – $1,500 | $1,650 – $1,700 |

| Growth Capital ($ million)* | $60 – $70 | ||

| Exploration Capital ($ million) | $40 – $45 | ||

*Initial project capital at the Valentine Gold Mine not included

Original Full Year 2024 Guidance

| CONSOLIDATED | NICARAGUA | NEVADA | |

| Gold Production/Sales (ounces) | 275,000 – 300,000 | 235,000 – 255,000 | 40,000 – 45,000 |

| Total Cash Costs ($/ounce)1 | $1,075 – $1,175 | $1,000 – $1,100 | $1,400 – $1,500 |

| AISC ($/ounce)1 | $1,275 – $1,375 | $1,175 – $1,275 | $1,650 – $1,750 |

| Growth Capital ($ million) | $45 – $55 | ||

| Exploration Capital ($ million) | $25 – $30 | ||

Valentine Gold Mine Construction Progress

Primary Crusher

Tailings Management Facility

Marathon Pit

Plant Site

SAG and Ball Mill

The Company’s unrestricted cash position at September 30, 2024 was $115.8 million and $100 million in restricted cash remained in its debt proceeds account. Based on current forecasted production plans and the continuance of a strong gold price environment, the Company should have sufficient liquidity to implement its near-term operational plans and complete the development of Valentine. The Company will continue to monitor liquidity and commodity risks, capital markets, foreign exchange rates, ongoing operational and financial performance and progress of its capital projects including Valentine. The Company may take advantage of certain opportunities to manage its cost of capital, capital structure, liquidity, including cash flow variability during the remaining construction period and ramp up to design capacity, and flexibility considering capital markets and economic conditions. Accordingly, the Company may take additional measures to manage and/or increase liquidity and capital resources and/or make certain adjustments to its capital structure. Please see also Forward Looking Statements.

Qualified Person

The scientific and technical information contained in this news release was approved by David Schonfeldt P.GEO, Calibre Mining’s Corporate Chief Geologist and a “Qualified Person” under National Instrument 43-101.

About Calibre

Calibre is a Canadian-listed, Americas focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada and Washington in the USA, and Nicaragua. Calibre is focused on delivering sustainable value for shareholders, local communities and all stakeholders through responsible operations and a disciplined approach to growth. With a strong balance sheet, a proven management team, strong operating cash flow, accretive development projects and district-scale exploration opportunities Calibre will unlock significant value.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE