North Peak Intersects 2.9 g/t Au over 18.3m (60ft) and 2.0 g/t Au Over 13.7m (45ft) in Final Holes of Phase 1 at Prospect Mountain North; Second Phase of Drilling Commences

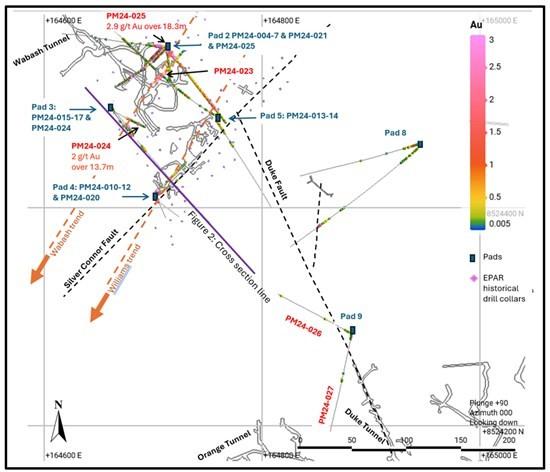

North Peak Resources Ltd. (TSX-V: NPR) announces assay results from final holes 23-27 of the recently completed 27-hole surface drilling program from the Prospect Mountain North area within its Prospect Mountain Property in Eureka, Nevada. Three of these holes targeted the historic Wabash mine area while two holes were on the east side of the Property ridge (see Figures 1 and 2 below). The Wabash holes strategically followed up on drilling results of the 94-hole program carried out in 1998/1999 by European American Resources (EPAR).

“These 3 holes at the Wabash mine area in Prospect Mountain North have extended mineralization to the SW, NE, and NW,” said Brian Hinchcliffe, Company CEO. “The consistent results from our phase 1 drilling both in terms of grade and virtually continuous wide mineralization has prompted a phase 2 drill program to start right away.”

Highlights

- PM24-025 extends Silver Connor shaft surface mineralization westwards and intersected 18.3m (60ft) @ 2.9 g/t Au from surface, including 1.5m (5ft) @ 7.0 g/t Au; this hole was drilled NW from the same set-up as hole PM24-004 which intersected from surface 126.49m (415ft) @ 1.06 g/t Au which included 12.19m (40ft) @ 4.20 g/t Au (see the Company’s August 14, 2024 press release).

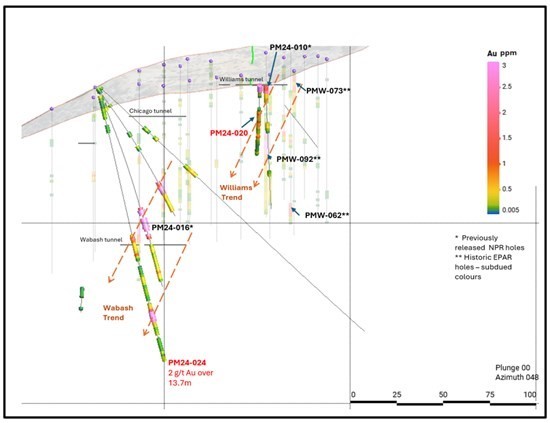

- PM24-024 intersects new zone parallel to the main zone at Wabash and intersected 13.7m (45ft) @ 2.0 g/t Au including 3.1m (10ft) @ 4.1 g/t Au, plus 13.7m (45ft) @ 0.7 g/t Au including 1.5m (5ft) @ 2.0 g/t Au; this hole was drilled 15.2m (50ft) down-dip from hole PM24-016 at the SW edge of drilling (hole PM24-016 intersected 18.3m (60ft) @ 3.92 g/t Au (which includes 10.7m (35ft) @ 5.01 g/t Au), from 71.6m (235ft), within 42.1m (135ft) @ 1.89 g/t Au, from 70.1m (230ft).

- PM24-023 confirms continuity of the Silver Connor shaft surface mineralization northwards and intersected 50.3m (165ft) @ 1.1 g/t Au (with a 1.5m void @ 0 g/t Au) from surface, including 3.1m (10ft) @ 4.0 g/t Au and 1.5m (5ft) @ 4.1 g/t Au and 1.5m (5ft) @ 2.7 g/t Au; this hole was drilled NE from the same set-up as hole PM24-022 which intersected 27.4m (90ft) @ 7.0 g/t Au (with a 1.5m void @ 0 g/t Au) from surface, including 6.1m (20ft) @ 23.1 g/t Au and 1.5m (5ft) @ 56.4 g/t Au and 161.0 g/t Ag.

Some of the initial observations from phase 1 drilling at the Wabash/Williams area are:

- Two zones of mineralization, Williams and Wabash, have both been confirmed and extended by our first phase of drilling and remains open along strike and to depth.

- High grade gold is present (up to 56.4 g/t Au and 161 g/t Ag over 1.5m (5ft), see hole PM24-022 in the September 4, 2024 press release) of a similar style to historic mining and is still present in the area.

- Mineralization is more Carlin like in this area, with high silver arsenic antimony and lower lead and zinc compared to classic CRD mineralization elsewhere on the Property.

- North Peak’s re-interpretation of the Wabash and Williams mineralization as steeply dipping, more continuous zones along structures, has been confirmed by the recent drilling.

- Historic vertical holes by EPAR are not ideal for steeply dipping structures and North Peak’s angled holes are helping to demonstrate better continuity within the mineralization envelope.

- Twin holes have confirmed zones encountered in the historic drilling are present though high grade gold correlation is poor (nuggety gold – the correlation is very good of best grades to best grades). Initial indications (e.g. Hole PM24-004) suggest the Wabash and Williams zones connect at depth and open up the size potential of the deposit.

- The Wabash/Williams areas are one small part of the Property with many other targets still to test. Geophysical targets, rock chip targets, and areas with previous good drilling still remain to be tested across the Property.

Wabash/Williams/Chicago Area – Three (3) holes are reported and discussed here from the 20 holes drilled to date in this west side area. Extreme topography has restricted the drilling to four pads on the west side of Prospect Mountain:

- PM24-024 intersected two zones with the deeper zone of 13.7m (45ft) @ 2.0 g/t Au opening up in width and grade below a second deeper zone in hole 16 and may line up with a zone in hole PM24-004 at 105ft – 125ft at 6.1m (20ft) @ 2.6 g/t Au that is 109m (358ft) to the NE.

- PM24-025 was drilled at -43 degrees to the NW almost in the opposite direction of hole PM24-004 which intersected from surface 126.49m (415ft) @ 1.06 g/t Au which included 12.19m (40ft) @ 4.20 g/t Au; the intersection adds to the width of the main Wabash zone. The hole was aimed at another known zone of mineralization noted in the old Wabash mine to the west that has not been drilled to date. The hole is not drilled from an ideal location due to the extreme topography and did not intersect the deeper target.

- PM24-023 which intersected 50.3m (165ft) @ 1.1 g/t Au (with a 1.5m void @ 0 g/t Au) from surface was drilled at -43 degrees to the NE; it is offset by 22m (72ft) from hole PM24-006 that was drilled parallel in the opposite direction. PM24-006 intersected the surface gossan zone, drilling 35.05m (115ft) of mineralization @ 1.38 g/t Au, 26.3 g/t Ag, before crossing a 4.57m (15ft) stope or cave

East Side of Property Ridge – Two holes are reported from the east side of the Property ridge and targeted the historic Duke mine and Duke fault and numerous associated surface workings:

- PM24-026 and PM24-027 intersected only low values along the Duke Fault in the vicinity of the Duke Mine.

See the Technical Report (defined below) for full details of the historic EPAR drill results referenced in this press release.

See Tables 1 and 2 below set out full results and information for these 5 holes of the 2024 Reverse Circulation drill program at Prospect Mountain North.

Figure 1: Plan of Prospect Mountain North drill area (West & East ridge)

Figure 2: Section View of Wabash Southwest area: looking North East

Table 1: Assay Results

| Hole ID | From | To | Intercept | From | To | Intercept | Au | Ag | Cu | Pb | Zn |

| (m) | (m) | (m) | (ft) | (ft) | (ft) | (g/t) | (g/t) | (%) | (%) | (%) | |

| PM24-023 | 0.0 | 50.3 | 50.3 | 0 | 165 | *165 | 1.09 | 13.3 | 0.3 | 0.7 | |

| 0.00 | 50.30 | 48.80 | 0 | 165 | **160 | 1.12 | 13.3 | 0.3 | 0.7 | ||

| incl. | v 0 | 18.3 | 18.3 | 0 | 60 | 60 | 2.22 | 23.6 | 0.3 | 0.1 | 0.6 |

| incl. | 3.0 | 6.1 | 3.0 | 10 | 20 | 10 | 4.03 | 9.4 | 0.1 | 0.5 | |

| incl. | 9.1 | 10.7 | 1.5 | 30 | 35 | 5 | 2.68 | 29.9 | 0.5 | 0.9 | |

| incl. | 15.2 | 16.8 | 1.5 | 50 | 55 | 5 | 4.10 | 63.3 | 1.1 | 0.2 | 1.3 |

| incl. | v 21.3 | 22.9 | 1.5 | 70 | 75 | 5 | 1.07 | 15.1 | 0.3 | 0.4 | |

| incl. | v 38.1 | 39.6 | 1.5 | 125 | 130 | 5 | 1.29 | 33.3 | 0.4 | 1.6 | |

| PM24-024 | 0.0 | 1.5 | 1.5 | 0 | 5 | 5 | 0.23 | 2.6 | |||

| 79.3 | 93.0 | 13.7 | 260 | 305 | 45 | 0.72 | 3.1 | 0.2 | |||

| incl. | 80.8 | 82.3 | 1.5 | 265 | 270 | 5 | 2.01 | 6.4 | 0.2 | 0.4 | |

| incl. | v 80.8 | 82.3 | 1.5 | 265 | 270 | 5 | 2.01 | 6.4 | 0.2 | 0.4 | |

| 103.6 | 108.2 | 4.6 | 340 | 355 | 15 | 0.27 | 2.4 | ||||

| 118.9 | 132.6 | 13.7 | 390 | 435 | 45 | 1.96 | 5.5 | 0.1 | 0.2 | 0.2 | |

| incl. | 125.0 | 128.0 | 3.0 | 410 | 420 | 10 | 4.11 | 11.4 | 0.2 | 0.4 | 0.4 |

| incl. | v 121.9 | 129.6 | 7.6 | 400 | 425 | 25 | 3.19 | 8.6 | 0.2 | 0.3 | 0.3 |

| 146.3 | 147.8 | 1.5 | 480 | 485 | 5 | 0.20 | 1.6 | ||||

| 149.4 | 152.4 | 3.0 | 490 | 500 | 10 | 0.21 | 1.3 | ||||

| PM24-025 | 0.0 | 18.3 | 18.3 | 0 | 60 | 60 | 2.88 | 60.6 | 0.1 | 0.1 | 0.2 |

| incl. | 12.2 | 13.7 | 1.5 | 40 | 45 | 5 | 7.00 | 167 | 0.2 | 0.2 | 0.3 |

| incl. | v 0 | 16.8 | 16.8 | 0 | 55 | 55 | 3.10 | 65.2 | 0.1 | 0.1 | 0.2 |

| PM24-026 | 4.6 | 7.6 | 3.0 | 15 | 25 | 10 | 0.22 | 10.5 | 0.3 | ||

| 38.1 | 39.6 | 1.5 | 125 | 130 | 5 | 0.40 | 29.8 | 0.2 | |||

| 112.8 | 114.3 | 1.5 | 370 | 375 | 5 | 0.45 | 25.7 | 0.1 | 0.1 | ||

| PM24-027 | 1.5 | 3.0 | 1.5 | 5 | 10 | 5 | 0.63 | 44.8 | 0.9 | 0.9 |

Notes: v = 1 g/t cut-off; * includes “0” grade for voids / ** leaves out voids; Composite intersections are calculated using a 0.2 g/t cutoff for gold with 10m internal dilution for the lower grade intervals. Higher grade intervals included within the lower grade intervals use a 1 g/t Au cutoff with 5m internal dilution; included are intervals >double 0.2 cut-off intersection. True widths are unknown due to uncertainty around orientations of mineralized zones.

Table 2: Drill Hole Coordinates

| Hole ID | Azimuth | Dip | Easting | Northing | Elevation | Total Depth (m) |

Total Depth (ft) |

| NAD83 m, Nevada East grid. EPSG: 32107 | |||||||

| PM24-023 | 43 | -45 | 164701 | 8524514 | 2526 | 60.96 | 200 |

| PM24-024 | 132 | -76 | 164660 | 8524492 | 2519 | 152.4 | 500 |

| PM24-025 | 276 | -44 | 164714 | 8524548 | 2520 | 137.16 | 450 |

| PM24-026 | 300 | -48 | 164881 | 8524285 | 2600 | 120.4 | 395 |

| PM24-027 | 191 | -50 | 164883 | 8524288 | 2593 | 152.4 | 500 |

Review by Qualified Person, Quality Control and Reports

Mr. Mike Sutton, P.Geo., a director of the Company, is the Qualified Person, as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, who reviewed and approved scientific and technical disclosure in this press release. The Qualified Person has not reviewed the mineral tenure, nor independently verified the legal status and ownership of the Property or any underlying property agreements.

Drilling and Sampling: Drilling was carried out using a Canadian built tracked MPD1500 RC drilling unit, the rig has jacks and a blade and is capable of working on small pads on steep ground to minimise ground prep. It is capable of drilling to 455m (1,500ft) using 4-inch pipe and a 51/4 inch bit. Holes were cased down to 25-80ft with 8-inch steel casing drifted in using a tricone bit. RC drilling uses a hammer, that is not face sampling but samples 4ft away from the hammer. A face sampling hammer was also trialed to compare efficiency.

Under Nevada law dry sampling is not allowed due to dust restrictions so RC drilling is done wet, with water actively pumped down the hole mixing with pulverised sample and coming through the cyclone to an 8-compartment rotary fan wet splitter. Each compartment can be shut off giving control of the amount of split material. Rotary splitter was setup with 1:4 split, with the quarter split going into two calico bags housed in buckets, for an assay sample and a field duplicate for permanent reference. The remainder of the sample falls to the ground and runs into the sump.

Each assay sample is for a 1.52m (5ft) interval. The splitter and cyclone are flushed every 4 samples or on noticing a change in colour. Chips were collected from the splitter reject and put into chip trays for reference.

Calico bags are pre-labelled with hole number and footage, with an FD for field duplicate added to the sample number for the field duplicate. The drilling team are responsible for changing the bags and the clearly labelled footage intervals on the bags avoids sample mix-ups. Filled sample bags are laid on the ground in order so a visual check can be easily performed when collecting samples. Samples are loaded into a plastic crate and dispatched daily to the ALS Global prep-lab in Elko Nevada. A standard, a blank and a field duplicate were inserted after every 20 samples, for a QA/QC rate of 15%. Six standards from CDN Resource Laboratories were rotated through the samples. The standards had gold values ranging from 0.433 to 7.34 ppm.

Samples are dried crushed and pulverised and assayed for gold with a 30g fire assay and a 44 element ICP MS suite. Overlimit samples for gold, silver, lead, zinc and copper are automatically re-assayed by suitable methods.

About Prospect Mountain

The Property lies in the Battle Mountain Eureka trend, in an area known as the Southern Eureka Gold Belt, where three styles of mineralization have been identified, gold, silver Carlin style mineralization, Carbonate Replacement gold, silver, lead, zinc mineralization (CRD) and carbonate hosted Porphyry Related Skarn lead, zinc and gold mineralization associated with cretaceous intrusions. At the Property, the CRD mineralization is heavily oxidized to depths of at least 610m (2,000ft) below the top of the ridge line.

A Plan of Operations is in place which covers part of the Property (totalling 81 acres) and entitles an operator to pursue surface exploration, underground mining of up to 365,000 tons per annum and certain infrastructural works. It includes a permit to extract water from a well and to build water containment facilities.

A more complete description of Prospect Mountain’s geology and mineralization, including at the Wabash area, can be found in the NI 43-101 Technical Report on the Prospect Mountain Property, Eureka County, Nevada, USA dated and with an effective date April 10, 2023, prepared by David Pym (Msc), CGeol. of LTI Advisory Ltd. and Dr Toby Strauss, CGeol, EurGeol., of Merlyn Consulting Ltd., which has been filed on SEDAR+ at www.sedarplus.ca under the profile of the Company and on the Company’s website.

About North Peak

The Company is a Canadian based gold exploration and development company that is listed on the TSX Venture Exchange under the symbol “NPR”. The Company is focused on acquiring historical sites, with low cost producing gold and other metals properties, with near term production potential and 8+ year mine life in the northern hemisphere.

The Company recently acquired an initial 80% interest in the Prospect Mountain Mine complex in Eureka, Nevada (see the Company’s May 4 and 23, 2023 and August 25, 2023 press releases).

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE