STLLR Gold Intersects 2.81 g/t Au over 18.50 m (Including 71.80 g/t Au over 0.50 m) at the Colomac Main Deposit

STLLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) (FSE: O9D) announces the final batch of assay results from the exploration drilling at the Colomac Gold Project in the Northwest Territories, Canada.

Table 1: 2024 Exploration Drilling Highlights – Colomac Main Deposit (See Figures 1-5):

| Zone | Hole ID | Assay Result |

| Colomac Main 2.5 | C24-14 | 2.81 g/t Au over 18.50 m (incl. 71.80 g/t Au over 0.50 m) & 1.33 g/t Au over 34.00 m (incl. 4.46 g/t Au over 3.55 m) & 0.74 g/t Au over 20.00 m (incl. 12.20 g/t Au over 0.50 m) |

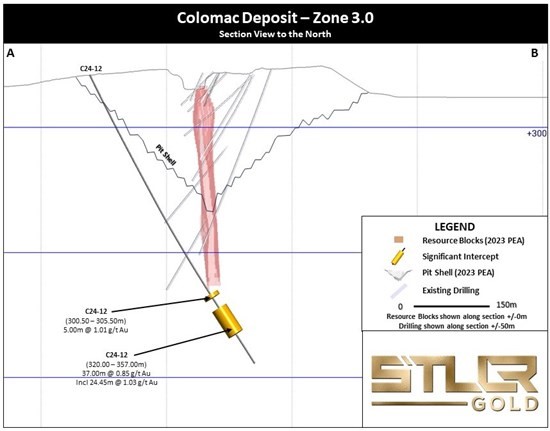

| Colomac Main 3.0 | C24-12 | 0.85 g/t Au over 37.00 m (incl. 1.03 g/t Au over 24.45 m) |

“g/t Au“: grams per tonne gold; “m“: metres

Keyvan Salehi, P.Eng., MBA, President, CEO, and Director of STLLR stated: “Our 2024 drilling campaign at Colomac concluded successfully, revealing mineralized zones beyond the known mineralization and below the 2023 Colomac PEA pit shell1. The results suggest the potential to expand the Project’s estimated mineral resources. With exploration drilling at both Colomac and the Tower Gold Project in Timmins now complete, we are focused on finalizing the updated Mineral Resource Estimate for the Tower Gold Project.”

Colomac Gold Project Drilling – Colomac Main Deposit (See Figures 1-5)

The Colomac Main Deposit, the primary deposit of the Colomac Gold Project, occurs in a north-south striking differentiated mafic sill, approximately 9 km long and up to 155 m wide, bounded by mafic volcanic rocks. Mineralization predominantly consists of free gold, associated with quartz-carbonate veining and minor sulphides. The Colomac Main Deposit is divided into six mineralized zones along its strike.

The 2024 drilling campaign focused on the southern end of Colomac Main (Zones 2.5, 3.0, and 3.5) in areas with limited data and potential for higher-grade gold mineralization. The latest drilling targeted Zones 2.5 and 3.0 below the 2023 Colomac PEA pit shell1. Significant mineralization was intersected near deep, cross-cutting geological fault structures. Holes C24-14 and C24-12 encountered intervals of mineralized quartz-diorite, the primary host rock for gold in the deposit, below the known mineralization.

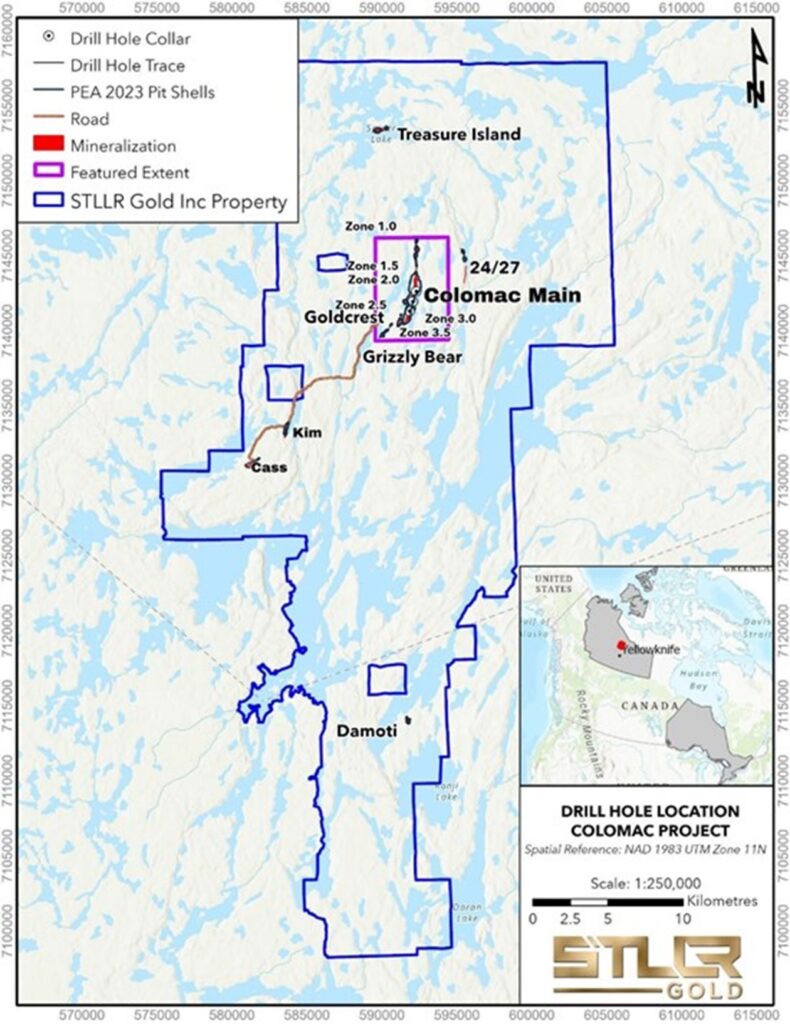

Figure 1: Colomac Gold Project – Regional Map

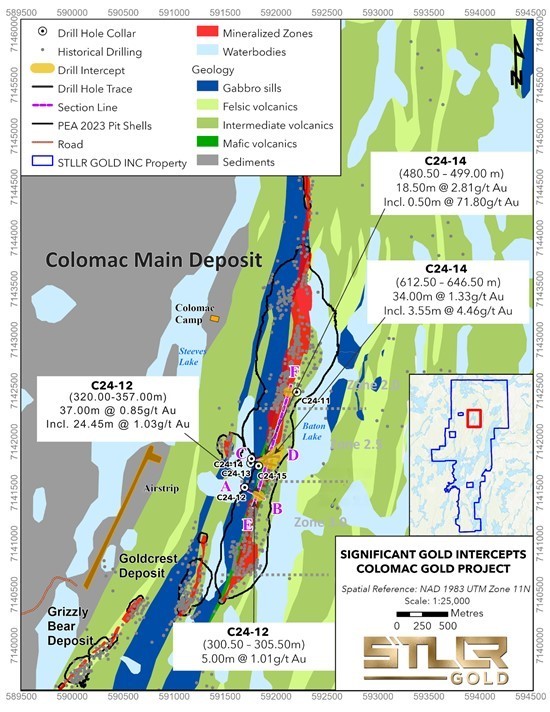

Figure 2: Colomac Main Deposit – Drill Location Map

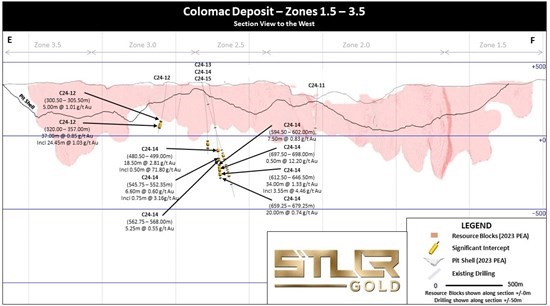

Figure 3: Colomac Main Deposit – Longitudinal Section Looking West

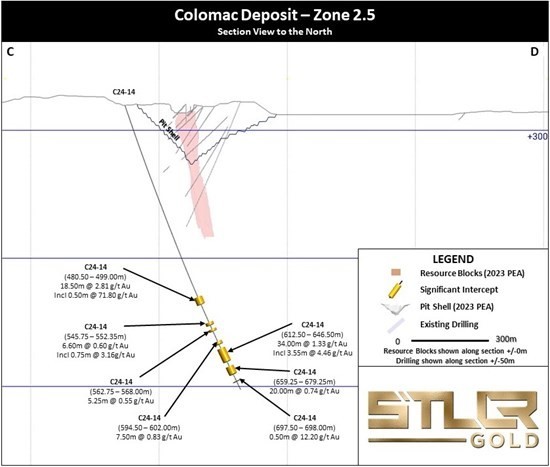

Figure 4: Colomac Main Deposit – Cross Section “C-D” Looking North

Figure 5: Colomac Main Deposit – Cross Section “A-B” Section Looking North

Table 2: Exploration Drilling Intercepts

| Target | Hole ID | From (m) |

To (m) |

Interval (m) |

Grade (g/t Au) |

Metal Factor (g/t Au x m) |

| Colomac Main 2.0 | C24-11 | 299.30 | 300.00 | 0.70 | 2.68 | 1.88 |

| Colomac Main 2.0 | and | 340.50 | 342.00 | 1.50 | 1.70 | 2.55 |

| Colomac Main 3.0 | C24-12 | 300.50 | 305.50 | 5.00 | 1.01 | 5.05 |

| Colomac Main 3.0 | and | 320.00 | 357.00 | 37.00 | 0.85 | 31.45 |

| Colomac Main 3.0 | including | 327.50 | 351.95 | 24.45 | 1.03 | 25.18 |

| Colomac Main 2.5 | C24-13 | 437.00 | 438.50 | 1.50 | 1.19 | 1.79 |

| Colomac Main 2.5 | and | 453.75 | 471.30 | 17.55 | 0.33 | 5.79 |

| Colomac Main 2.5 | and | 491.50 | 495.00 | 3.50 | 2.69 | 9.42 |

| Colomac Main 2.5 | C24-14 | 480.50 | 499.00 | 18.50 | 2.81 | 51.99 |

| Colomac Main 2.5 | including | 498.50 | 499.00 | 0.50 | 71.80 | 35.90 |

| Colomac Main 2.5 | and | 545.75 | 552.35 | 6.60 | 0.60 | 3.96 |

| Colomac Main 2.5 | including | 545.75 | 546.50 | 0.75 | 3.16 | 2.37 |

| Colomac Main 2.5 | and | 562.75 | 568.00 | 5.25 | 0.55 | 2.89 |

| Colomac Main 2.5 | and | 594.50 | 602.00 | 7.50 | 0.83 | 6.23 |

| Colomac Main 2.5 | and | 612.50 | 646.50 | 34.00 | 1.33 | 45.22 |

| Colomac Main 2.5 | including | 614.70 | 618.25 | 3.55 | 4.46 | 15.83 |

| Colomac Main 2.5 | and | 659.25 | 679.25 | 20.00 | 0.74 | 14.80 |

| Colomac Main 2.5 | and | 697.50 | 698.00 | 0.50 | 12.20 | 6.10 |

| Colomac Main 2.5 | C24-15 | 163.50 | 164.00 | 0.50 | 19.00 | 9.50 |

| Colomac Main 2.5 | and | 332.15 | 332.65 | 0.50 | 15.75 | 7.88 |

| Colomac Main 2.5 | and | 495.00 | 496.00 | 1.00 | 2.32 | 2.32 |

| Colomac Main 2.5 | and | 518.00 | 518.50 | 0.50 | 4.15 | 2.08 |

| Colomac Main 2.5 | and | 528.75 | 545.00 | 16.25 | 0.55 | 8.94 |

| Colomac Main 2.5 | and | 558.80 | 562.50 | 3.70 | 0.57 | 2.11 |

| Colomac Main 2.5 | and | 602.90 | 604.40 | 1.50 | 1.63 | 2.45 |

| Colomac Main 2.5 | and | 623.80 | 627.40 | 3.60 | 0.87 | 3.13 |

| Colomac Main 2.5 | and | 639.15 | 641.00 | 1.85 | 1.05 | 1.94 |

| Colomac Main 2.5 | and | 654.55 | 656.00 | 1.45 | 1.81 | 2.62 |

| Colomac Main 2.5 | and | 680.25 | 689.75 | 9.50 | 1.05 | 9.98 |

| Colomac Main 2.5 | and | 746.75 | 747.50 | 0.75 | 2.18 | 1.64 |

Note: All intercepts are calculated using a 0.30 g/t Au cut-off, a maximum of 5m internal dilution and no top cap applied. Drill intercepts are not true widths.

Table 3: Exploration Drill Hole Details

| Zone | Hole ID | Easting | Northing | Elevation | Azimuth | Inclination | End of Hole Depth (m) |

| Colomac 2.0 | C24-11 | 592203.00 | 7142486.99 | 343.46 | 265.00 | -78.00 | 477.00 |

| Colomac 3.0 | C24-12 | 591692.01 | 7141552.02 | 362.74 | 115.00 | -64.00 | 399.00 |

| Colomac 2.5 | C24-13 | 591751.00 | 7141789.00 | 357.00 | 85.00 | -68.00 | 543.00 |

| Colomac 2.5 | C24-14 | 591759.00 | 7141833.00 | 358.00 | 83.00 | -71.00 | 720.00 |

| Colomac 2.5 | C24-15 | 591828.02 | 7141762.01 | 368.00 | 44.00 | -71.00 | 840.00 |

Quality Control Procedures

NQ drill core is oriented and cut with half sent to ALS Laboratories Inc. (ALS) for drying and crushing to -2 mm, with a 1.00 kg split pulverized to -75 µm (200#). ALS is an ISO 17025 accredited laboratory. A 50 g charge is Fire Assayed and analyzed using an AAS finish for Gold. Samples above 10.00 g/t Au are analyzed by Fire Assay with a gravimetric finish and selected samples with visible gold or high-grade mineralization are assayed by Metallic Screen Fire Assay on a 1.00 kg sample. STLLR inserts independent certified reference material and blanks with the samples and assays routine pulp repeats and coarse reject sample duplicates, as well as completing routine third-party check assays at Bureau Veritas Commodities Canada Ltd.

Qualified Person

John McBride, MSc., P.Geo., Vice President of Exploration for STLLR, who is the “Qualified Person” as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About STLLR Gold

STLLR Gold Inc. is a Canadian gold development company actively advancing two cornerstone gold projects in Canada: The Tower Gold Project in the Timmins Mining Camp in Ontario and the Colomac Gold Project located north of Yellowknife, Northwest Territories. Each of these two projects has the potential for a long-life and large-scale operation and are surrounded by exploration land with favourable upside potential. STLLR’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards rapidly advancing these projects.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE