Battery Mineral Resources Drills High Grade Copper Intercepts from the Cinabrio Mine at Its Punitaqui Copper Complex in Chile

Battery Mineral Resources Corp. (TSX-V: BMR) (OTCQB: BTRMF) is pleased to announce encouraging drill core assay results from the new 2024 underground exploration and in-fill drill program at the Punitaqui mine complex in Chile.

Highlights

- Assay results from drillholes (see Table 1) have returned with encouraging results as follows:

- Drillhole CM-24-11: 18.3 meters grading 2.6 percent copper total and 11 grams per tonne silver including 14.9m at 3.1% CuT & 13g/t Ag drilled as an infill hole delineated the extent of the mineralization intercepted in historic drillholes CM-0-19-05 and CM-0-19-07

- CM-24-12: 6.4m grading 0.9% CuT and 5g/t Ag drilled as an extensional hole defined the northern strike extent of the planned extraction area

- CM-24-13: 23.1m at 2.0% CuT & 14g/t Ag drilled as an infill hole confirmed the extent of the mineralization intercepted in historic drillholes CM-0-19-05 and CM-0-19-07

- CM-24-14: 1.5m at 0.6% CuT & 1g/t Ag and 2.9m at 0.5% CuT & 14g/t Ag drilled as an extensional hole confirmed the southern strike extent of the planned extraction area

- The 2024 Cinabrio drill program is designed to confirm resources identified by previous drilling programs and expand these resources along strike and at depth. All holes reached target depth and have intersected the targeted shale-mudstone horizon that hosts the copper mineralization.

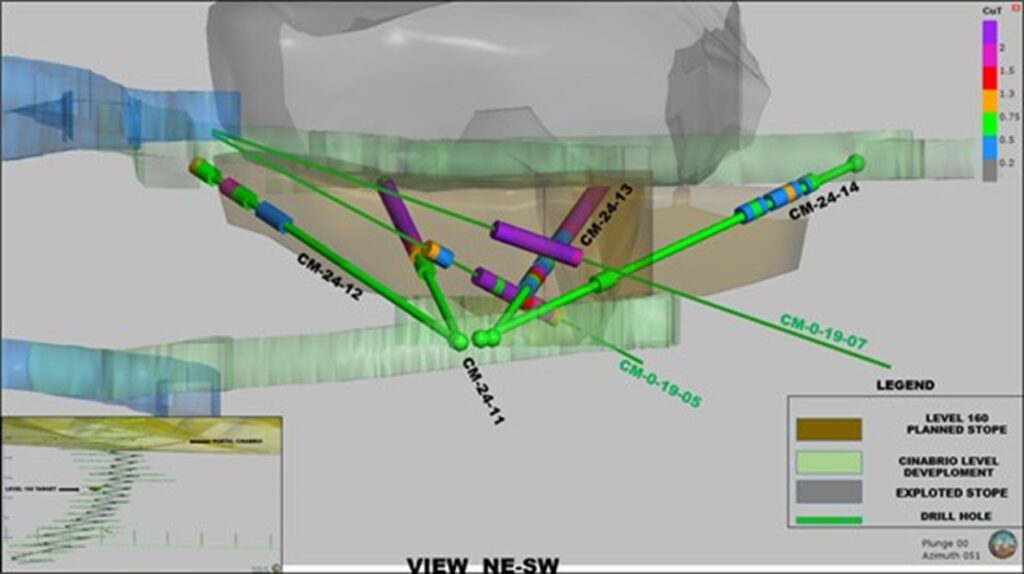

- This phase of Cinabrio underground drilling targeted the Level 160 scheduled production area where 4 drillholes totaling 173.6 meters of diamond core drilling were completed (see Table 2 and Figure 1).

- The four holes were designed to confirm the modelled geology, mineralization and probe the contact zone between the lower mineralized shale unit and the underlying andesites within and adjacent to the planned extraction area (CM-24-11, CM-24-12. CM-24-13 and CM-24-14).

- This drilling confirmed copper grades and better delineated the extent of the mineralization in the lower shale unit and footwall andesite within and adjacent to the planned extraction area.

- These drill results have been added to the three-dimensional geology and resource models which BMR’s mining engineers will use to update the current mine designs and optimize mining schedules.

- As of mid-August, the Cinabrio-San Andres underground drill program had resulted in the completion of 31 drillholes / 1,300.4m including 18 holes / 770.2m at Cinabrio.

- Drilling is ongoing and assay results for the remaining 11 Cinabrio drillholes are pending.

Battery Vice President of Exploration Peter Doyle stated, “These new, high-grade copper infill drill results not only confirm the copper grades predicted by our current geological model but also provide a more detailed understanding of the Level 160 target mineralization. The ongoing underground drilling continues to demonstrate encouraging results that highlight the potential of the Cinabrio mine.”

During the current operational ramp-up period, the underground drilling program is focused on accessible targets within existing Inferred Resource to upgrade the resources to a higher resource category as well as targeting areas adjacent to Inferred Resource to potentially add new resources.

The 2024 drill plan allows for some flexibility in terms of timing and sequencing of target areas which permits the drilling to be shifted between the Cinabrio mine and the adjacent San Andres underground.

Cinabrio Mine

Sample assay results, reported herein, are from the second target tested as part of the underground drilling at Cinabrio. These four BMR drillholes are infill holes designed to verify and better delineate mineralization for the Level 160 target. Historic drillholes CM-0-19-05 and CM-0-19-07 drilled by Xiana Mining Inc. were both collared from a working above and to the north of the Level 160 planned production area and drilled sub-parallel the stratigraphy. Hole CM-0-19-05 intersected 1.2m at 0.5% CuT and 2.3g/t Ag from 30m and 4.4m at 1.9% CuT and 4.9g/t Ag. Drillhole CM-0-19-07 is interpreted to have drilled from the footwall andesite into the lower part of the overlying sedimentary sequence and then back into the footwall andesites. This hole intersected a mineralized zone in the shales in the lower part of the sedimentary sequence that yielded an intercept of 3m at 6.6% CuT and 46.9g/t Ag.

All four of the BMR drillholes were drilled from the footwall andesite upward through the TSU sedimentary unit and terminated at the old mine workings above the target area.

Drillhole CM-24-11 was designed to test the north-central part of the Level 160 planned production area. The drillhole encountered weakly mineralized andesite near the contact of the TSU sedimentary unit and then a well mineralized sequence of shales and sandstones near the bottom of the hole which was stopped prior to encountering an old underground working. Assay results reported included 18.3m grading 2.6% CuT and 11g/t Ag from 15.0m including 14.9m at 3.1% CuT & 13g/t Ag from 18.6m. The drill hole confirmed the presence of a significant zone of copper mineralization in the planned extraction area.

Drillhole CM-24-12 was planned to test the northern end of the planned extraction area. The drillhole encountered footwall andesite from 0m to 30.9m which was weakly mineralized at the top adjacent to the overlying TSU sedimentary sequence. From 30.9m to the bottom of the hole (44.0m), this drillhole encountered variably mineralized sandstones and shales. Assay intervals reported include 6.4m grading 0.9% Cu and 5g/t Ag from 34.9m. The drillhole confirmed the northern limit of mineralization within the planned extraction area.

Drillhole CM-24-13 tested the south-central part of the planned extraction area. The drillhole encountered footwall andesite from 0m to 13.3m which is well mineralized. From 13.3m to 27.1m the section intersected consisted of a sequence of mixed shales and andesitic volcanoclastics with variable mineralization. From 27.1m to the bottom of the drillhole (42.5m), the interval intersected well mineralized shales cut by an andesite dyke from 38.6m to 42.4m. Assay results include 23.1m at 2% CuT & 14g/t Ag from 12m. The drill hole confirmed the presence of a significant high-grade zone of mineralization in the planned extraction area.

Drillhole CM-24-14 was designed to test the southern extent of the planned extraction area. This drillhole intersected footwall andesite from 0m to 30.3m followed by a section of sandstones, shales and volcanoclastics from 30.3m to the bottom of the drillhole at 54.8m. The hole yielded two weakly anomalous intercepts; 1.5m at 0.6% Cu & 1g/t Ag from 17m and 2.9m at 0.5% CuT & 14g/t Ag from 44.5m. Drill hole CM-24-14 confirmed the southern margin of mineralization in the planned extraction area.

Figure 1: Cinabrio Drilling Hole Location Plan- Level 160

Table 1: Cinabrio Level 160 Significant 2024 Drillhole Intercepts

| Drillhole Number |

Downhole Interval From (m) |

Downhole Interval To (m) |

Downhole Sample Interval (m) |

Sample Estimated True Interval Width (m) |

Total Copper CuT (%) |

Silver Ag (Grams per tonne) (g/t) |

| CM-24-11 Including |

15.00 | 34.30 | 19.3 | 18.30 | 2.57 | 10.50 |

| 18.60 | 34.30 | 15.70 | 14.90 | 3.06 | 12.6 | |

| CM-24-12 including |

30.90 | 44.00 | 13.10 | 9.30 | 0.69 | 4.00 |

| 34.90 | 44.00 | 9.10 | 6.40 | 0.87 | 4.90 | |

| CM-24-13 including |

12.00 | 39.00 | 27.00 | 23.10 | 1.97 | 14.00 |

| 13.25 | 16.20 | 2.95 | 2.50 | 1.89 | 9.00 | |

| CM-24-14 and |

16.96 | 19.25 | 2.29 | 1.50 | 0.58 | 0.80 |

| 44.45 | 49.00 | 4.55 | 2.90 | 0.45 | 13.90 |

Note: All Intercepts reported as estimated true widths intervals

Table 2: Cinabrio Level 160 – 2024 Drillhole Summary

| Hole Number | Collar UTM Easting (m) |

Collar UTM Northing (m) |

Collar Elevation (mASL) | Depth EoH (m) |

Hole Inclination (Dip) | Azimuth | Hole Type & Size |

| CM-24-11 | 288607.63 | 6599531.45 | 177.89 | 34.30 | 27.26o | N35.94oE | Diamond HQ Core |

| CM-24-12 | 288607.62 | 6599531.48 | 177.82 | 44.00 | 24.00 o | N007.94oE | Diamond HQ Core |

| CM-24-13 | 288610.55 | 6599529.60 | 178.11 | 42.5 | 24.01 o | N069.43oE | Diamond HQ Core |

| CM-24-14 | 288609.37 | 6599530.32 | 177.86 | 54.75 | 19.32 o | N098.96oE | Diamond HQ Core |

Background – Cinabrio Deposit

The Cinabrio copper deposit mined by Glencore and Xiana Mining was the main ore source for the Los Mantos processing plant for over 10 years. Cinabrio is the largest deposit mined to date and is part of the Punitaqui project which is situated within a 25km long mineralized district that is a classic IOCG and manto style copper belt that is comprised of manto and structural controlled copper-silver veins.

On October 3, 2022, BMR published an NI 43-101 resource for Cinabrio at a 0.70 Cu% cut-off.

- Indicated Sulphide Resource of 378,000 tonnes grading 1.55% CuT.

- Inferred Sulphide Resource of 90,000 tonnes at 0.98% CuT

In addition, Indicated resources for Cinabrio potentially recoverable pillars at a 0.70 Cu% cut-off.

- Undiluted Indicated resources of 1,027,000 tonnes at grading 1.51% CuT

- Diluted Indicated resources of 1,312,000 tonnes at 1.27% CuT

Note: Scientific and technical information pertaining to the San Andres Resource was extracted from the Company’s NI 43-101 “Technical report on Punitaqui Copper Complex Coquimbo, Chile” dated as of September 30,2022 with an effective date of August 16, 2022, prepared by Garth Kirkham (Kirkham Geosystems Ltd.) an Independent Qualified Person in accordance with NI 43-101.

The Cinabrio historic workings encompass about 700 vertical meters from the ridge-top oxide workings to the lowest level of underground development. Within the underground mine level development is spaced vertically at about a 30 meter interval.

The Cinabrio deposit is a tabular sedimentary horizon known as the “Targeted Stratigraphic Unit” within a volcanic sequence. This sedimentary horizon is variably mineralized and has a variable width ranging from 5m – 30m. It consists of an interlayered volcano-sedimentary sequence composed of dark colored laminated and unlaminated shales, volcanoclastic sandstone, conglomerates and breccias and tuff breccias. Most of the copper mineralization is hosted in the shale units within the TSU package. The horizon dips 40 to 50 degrees to the east.

Mineralization consists of veinlets and irregular disseminations in both the fine and coarse-grained clastic rocks and locally within the volcanic rocks above and below the host unit. The host horizon is also cut and offset by faults and dykes with a wide range of orientations.

Quality Control

Sample preparation, analysis and security procedures applied on the BMR exploration projects are aligned with industry best practice. BMR has implemented protocols and procedures to ensure high quality collection and management of samples resulting in reliable exploration assay data. BMR has implemented formal analytical quality control monitoring for all field sampling and drilling programs by inserting blanks and certified reference materials into every sample sequence dispatched.

Sample preparation is performed BMR Los Mantos Preparation Lab. Samples are dried then crushed to 70% < -2 millimeters and a riffle split of 250 grams is then pulverized to 85% of the material achieving a size of <75 microns. Sample pulps & rejects were then delivered to ALS Global – Geochemistry Analytical Lab in La Serana, Chile and sample analyses by ALS in Lima, Peru. ALS analytical facilities are commercial laboratories and are independent from BMR. All BMR samples are collected and packaged by BMR staff and delivered upon receipt at the ALS Laboratory. Samples are logged in a sophisticated laboratory information management system for sample tracking, scheduling, quality control, and electronic reporting. These prepared samples are then shipped to the ALS Laboratory in North Vancouver for analyses by the following methods:

- ME-MS61: A high precision, multi-acid digest including Hydrofluoric, Nitric, Perchloric and Hydrochloric acids. Analysed by inductively coupled plasma (“ICP”) mass spectrometry that produces results for 48 elements.

- ME-OG62: Aqua-Regia digest: Analysed by ICP-AES (Atomic Emission Spectrometry) or sometimes called optical emission spectrometry (ICP-OES) for high levels of Co, Cu, Ni and Ag.

Certified standards are inserted into sample batches by ALS. Blanks and duplicates are inserted within each analytical run. The blank is inserted at the beginning, certified standards are inserted at random intervals, and duplicates are analysed at the end of the batch.

Qualified Persons

Peter Doyle, Vice President of Exploration and Michael Schuler, Chile Exploration Manager for Battery Mineral Resources Corp., supervised the preparation of and approved the scientific and technical information in this press release pertaining to the Punitaqui exploration drill program. Mr. Doyle and Mr. Schuler are qualified persons as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Scientific and technical information pertaining to the Punitaqui Resource was extracted from the Company’s NI 43-101 “Technical Report on Punitaqui Copper Complex Coquimbo, Chile” dated as of September 30,2022 with an effective date of August 16, 2022, prepared by Garth Kirkham (Kirkham Geosystems Ltd.) an Independent Qualified Person in accordance with NI 43-101.

All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum definitions, as required under NI 43-101. Cut-off grades are based on a price of US$3.50/lb copper, US$20/oz silver and several operating costs, metallurgical recoveries, and recovery assumptions, including a reasonable contingency factor.

Further Disclosure

The press release of the Company dated September 9, 2024 disclosed a loan made by Weston Energy II LLC to the Company in the principal amount of US$750,000 (approximately C$1,019,925). The September 9 Press Release inadvertently referred to the date of issuance of a previous loan made by Weston II on June 26, 2024. The Company wishes to clarify that the Loan is separate from the June 26, 2024 loan and represents new funds to the Company. The Loan was advanced on September 6, 2024. As disclosed in the September 9 Press Release, the Loan matures on December 5, 2024 and accrues interest at a rate per annum equal to eight percent (8%). The Loan is unsecured and no bonus securities were issued for the Loan. The proceeds from the Loan will be applied towards the operations at the Company’s Punitaqui copper project in Chile.

The Loan is subject to acceptance by the TSX Venture Exchange.

Exchange Rates

All USD amounts for which CAD equivalent amounts are given in this news release were calculated at CAD/USD exchange rate of 1.3599, the exchange rate published by the Bank of Canada on September 10, 2024.

MI 61-101 Matters

Weston II is a “related party” to BMR pursuant to pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Prior to giving effect to the transactions disclosed in this news release, Weston II and its affiliates own or control (directly or indirectly) 107,578,740 BMR Common Shares on an undiluted basis and 193,011,575 BMR Common Shares on a diluted basis assuming conversion of all outstanding debentures (representing approximately 59.43% and 70.93%, respectively, of the outstanding BMR Common Shares).

The Loan constitutes a “related party transaction” for the purposes of MI 61-101. The Loan is exempt from the formal valuation requirements of MI 6-101 as BMR is not listed on a specified market that would require compliance with such formal valuation requirements (as set forth in Section 5.5(b) of MI 61-101). The Loan is further exempt from the minority shareholder approval requirements of MI 61-101 by virtue of the value of the Loan constituting less than 25% of the market capitalization of the Company, and being less than $2,500,000 in any case (as set forth in Sections 5.7(1)(a) and 5.7(1)(b) of MI 61-101).

About Battery Mineral Resources Corp.

Battery Mineral Resources’ mission is to build a mid-tier copper producer and it has recently initiated mine and mill operations at the Punitaqui Mining Complex, a historic copper-gold-silver producer, in the Coquimbo region of Chile. Battery Mineral Resources is unique because it leverages the inherent value from its 100% owned subsidiary, ESI Energy Services Inc., a renewable energy equipment rental and sales company. Battery Mineral Resources’ portfolio also consists of two cobalt assets and one graphite asset located in North America, South America and South Korea. The Company is focused on providing shareholders accretive exposure to copper and the global mega-trend of electrification while being focused on growth through cash-flow, exploration, and acquisitions in favorable mining jurisdictions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE