Equinox Gold Updates Mineral Resource Estimate for Hasaga Property in Red Lake, Ontario

Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) is pleased to announce an updated Mineral Resource Estimate for its 100% owned, exploration-stage Hasaga Property in Red Lake, Ontario.

Highlights

- Indicated Mineral Resource estimated at 1.470 million tonnes with an average grade of 8.64 grams per tonne gold for 408,000 ounces of contained gold

- Inferred Mineral Resource estimated at 2.059 Mt with an average grade of 7.31 g/t gold for 484,000 oz of contained gold

“Hasaga is located in the Red Lake Gold District of northwestern Ontario, which is renowned for its high gold grades and prolific historical gold production. This updated Mineral Resource Estimate focuses on the high-grade nature of the gold mineralization and is a departure from the previous bulk-tonnage approach,” stated Scott Heffernan, EVP Exploration of Equinox Gold. “As expected, the updated Mineral Resource Estimate contains fewer gold ounces but at significantly higher average gold grades.

“Further, the main zones of gold mineralization included in the updated Mineral Resource Estimate remain open, with numerous historical gold intersections defining drill-ready targets highlighting the potential for resource growth and new discoveries.”

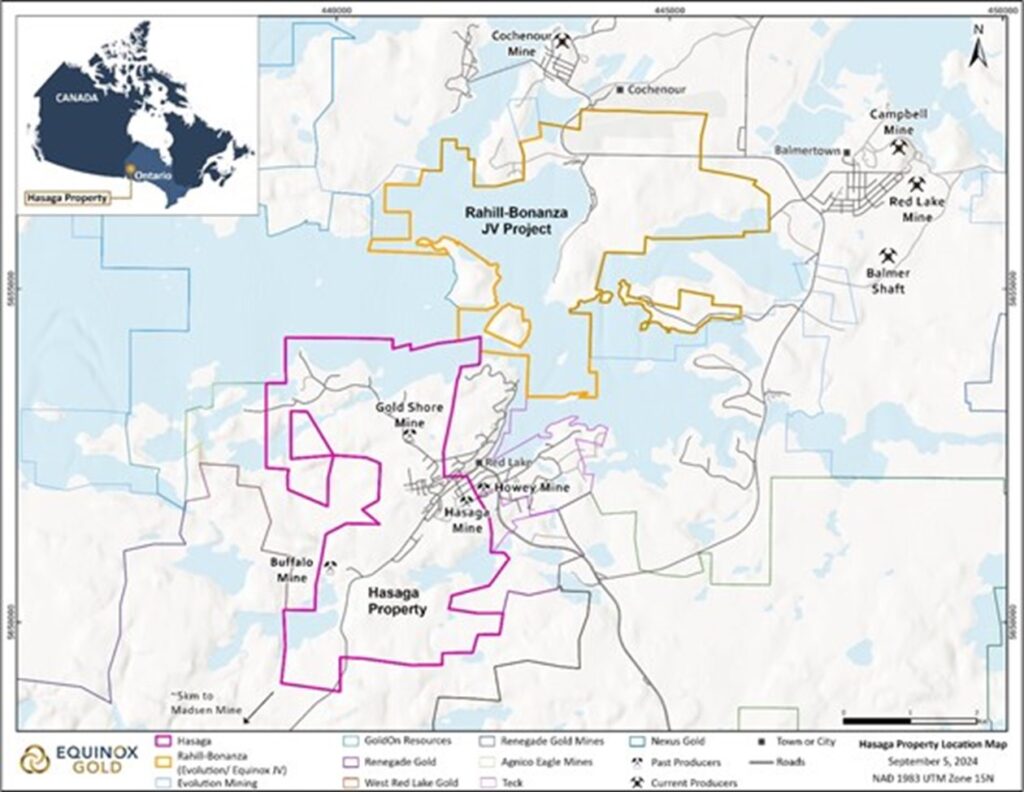

Hasaga is located on the western edge of the town of Red Lake, Ontario (Figure 1) within the Red Lake Greenstone Belt, which has produced over 30 million ounces of gold from active and past producing gold mines. Hasaga sits on the main northeast-southwest trend, approximately 5 km southwest of the Red Lake Mine Complex. Acquired by Equinox Gold in 2021 through the acquisition of Premier Gold Mines Limited, the Property is host to three past-producing gold mines (Hasaga, Buffalo and Red Lake Gold Shore) that combined produced 240,969 oz of gold. Most of the production came from underground mining in the Hasaga Mine, which produced 218,213 oz of gold at an average grade of 4.94 g/t gold between 1938 and 1952.

Hasaga Mineral Resource Update

The updated MRE is summarized in Table 1 and incorporates a new geological model that resulted from a core relogging campaign focused on drilling completed by the previous operator. No new drilling has been conducted by Equinox Gold to date. The revised MRE was optimized for underground mining with a 4 g/t gold cut-off grade and a minimum thickness of 1.0 m, which is appropriate for this style of deposit and typical of all significant gold mines in the Red Lake Gold District.

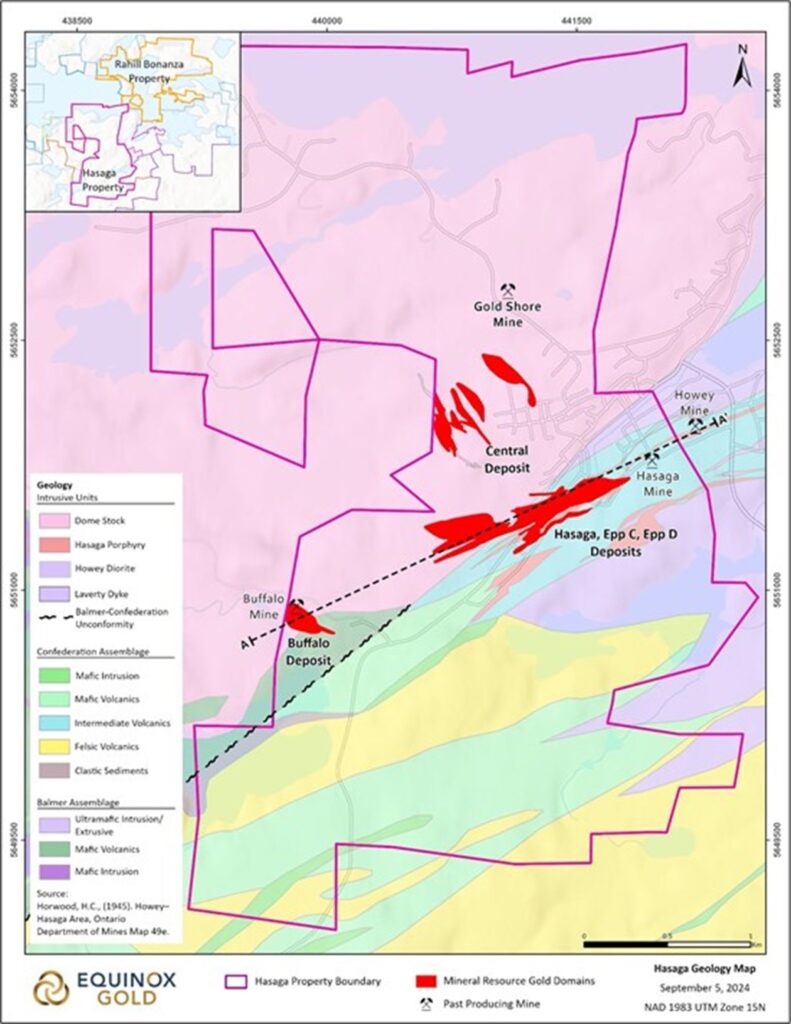

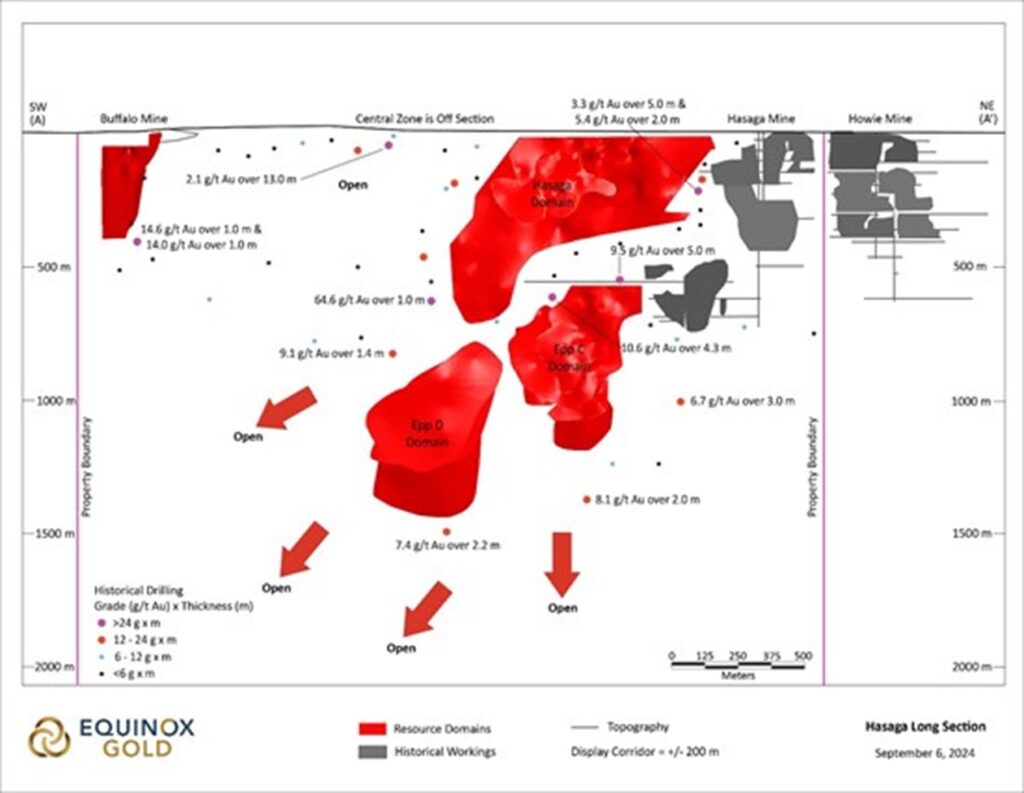

The main Hasaga, Epp C, and Epp D zones, which are hosted within the Hasaga Porphyry, account for most of the current mineral resource and are the most attractive targets for future exploration. All three zones occur along a common mineralized trend and represent the strike and down-dip extensions of the past producing Hasaga and Howie mines. The Buffalo Zone, located 1.5 km southwest of the Hasaga Deposit, and the Central Zone, located approximately 1 km north of the Hasaga Deposit, are both hosted within the Dome Stock. The zones are shown in Figures 2 and 3 and described in Hasaga Geology and Mineralization below.

Hasaga Exploration Potential

Historical drilling results along the main Hasaga trend underscore the exploration potential of the Property. Of the 46 drillholes outside of the resource areas, every hole returned at least one sample with > 1 g/t gold and 14 intersected potentially economic gold mineralization, providing drill-ready, high-potential targets for resource growth (Figure 3). Additionally, over 50% of the Property is underlain by the Dome Stock, which hosts the Buffalo and Central zones and has not been systematically explored, providing additional potential for new discoveries.

Exploration efforts contemplated for 2025 include:

- Geological mapping and surface geochemistry programs to cover the entire property

- Further relogging of historical drill core for continued geological model improvement

- Sampling of historical core intervals recognized as potentially gold bearing

- A limited infill and step-out diamond drilling program within the resource areas and within known mineralization away from the resource areas

Figure 1: Hasaga Property Location Map

Table 1: Hasaga Mineral Resource Estimate as of June 30, 2024

| Classification | Area | Tonnage (kt) |

Gold Grade (g/t) |

Contained Gold (koz) |

| Indicated | Epp C | 893 | 9.58 | 275 |

| Hasaga | 346 | 7.06 | 79 | |

| Buffalo | 158 | 8.17 | 41 | |

| Central | 73 | 5.66 | 13 | |

| Total | 1,470 | 8.64 | 408 | |

| Inferred | Epp C | 728 | 8.59 | 201 |

| Hasaga | 507 | 6.35 | 103 | |

| Epp D | 322 | 6.46 | 67 | |

| Buffalo | 259 | 7.09 | 59 | |

| Central | 243 | 6.81 | 53 | |

| Total | 2,059 | 7.31 | 484 |

- Mineral Resources are reported using a cut-off grade of 4.0 g/t gold based on the following costs and assumptions: US$1,700 per oz gold price, C$0.77 to US$1 exchange rate, US$4.62 per gold oz refining and transportation costs, 3% royalty, US$83.93/t mining costs, US$30.80/t process costs, US$23.10/t G&A costs, US$26.18/t sustaining capital, 90% process recovery and 1m minimum width.

- Mineral Resources are constrained using wireframes representing continuous blocks with estimated gold grades ≥4 g/t gold, continuous volumes representing >120 kt, and minimum thickness of 1.0 m.

- The Hasaga Property Mineral Resource statement has been prepared by Trevor Rabb, P.Geo. who is a qualified person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects.

- The Hasaga Property Mineral Resource statement has been prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects (May 2016) and the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014).

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Metric tonnes and gold ounces are rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

- Mineral Resources from the Hasaga Property presented herein have an effective date of June 30, 2024.

- See the Technical Report on the Hasaga Property, Red Lake, Ontario, Canada dated September 11, 2024, with an effective date of June 30, 2024 (“Hasaga Technical Report”) available on the Company’s profile on SEDAR+ www.sedarplus.ca and on the Company’s profile on EDGAR at www.sec.gov/edgar for details of the information required under sections 3.2, 3.3 and 3.4 of NI 43-101.

Hasaga Geology and Mineralization

Hasaga is located within the Red Lake Greenstone Belt in Ontario, Canada, with the northern half underlain by granodiorite of the Dome Stock and the southern portion by felsic, intermediate and mafic volcanics of the Confederation and Balmer Assemblages (Figure 2). The volcanic units are intruded by the intermediate Howie Diorite and the felsic Hasaga Porphyry. Gold mineralization is classified as an orogenic gold deposit and is primarily hosted in quartz-tourmaline-sulphide veins within the Dome Stock and Hasaga Porphyry. The Dome Stock is host to the Central and Buffalo zones, while the remainder of the zones (Hasaga, Epp C, and Epp D) are hosted in the Hasaga Porphyry. Despite having similar mineralogy, vein morphology differs between host rock types. Veins hosted in the Dome Stock are generally thinner, occurring as millimetre-scale to centimetre-scale veins, with little to no ductile deformation. Veins hosted in the Hasaga Porphyry are generally thicker, occurring as centimetre-scale to decimetre-scale with more abundant ductile deformation textures and well-developed alteration halos. Vein geometry and orientation also differs between zones, with the Hasaga Porphyry zones displaying an orientation slightly oblique to stratigraphy, striking northeast-southwest, with minor cross-cutting splays and folds. Dome Stock zones, in contrast, typically strike northwest-southeast. Both settings of mineralization are interpreted to be associated with a belt-scale mineralization event, postdating emplacement of all major geological units, and pre-dating the peak regional metamorphic and deformation event that modified mineralization.

Figure 2: Hasaga Property Geology Map

Figure 3: Schematic Long Section of the Hasaga Property

Rahill-Bonanza Property

Connecting Hasaga and the Red Lake Mine Complex (Figure 1), the Rahill-Bonanza Property is a joint venture between Equinox Gold and Evolution Mining Limited (“Evolution”). Rahill-Bonanza is situated on the main Red Lake mine trend and is the only remaining property on the mine trend that is not 100% owned by Evolution. Rahill-Bonanza boasts historical gold production from the past-producing Wilmar Mine, multiple deposits with historical resources and numerous exploration targets on key structures that remain open and warrant significant future exploration.

Qualified Persons

Scott Heffernan, M.Sc., P.Geo., Equinox Gold’s EVP Exploration, a qualified person (“QP”) under National Instrument 43-101, has reviewed and approved the scientific and technical information related to exploration and Mineral Resource matters contained in this news release.

About Equinox Gold

Equinox Gold is a growth-focused Canadian mining company operating entirely in the Americas, with eight producing gold mines and a clear path to achieve more than one million ounces of annual gold production from a pipeline of expansion projects.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE