Amex Announces Mineral Resource Estimate on Perron Project

Amex Exploration Inc. (TSX-V: AMX) (FSE: MX0) (OTCQX: AMXEF) is pleased to announce that it has completed a Mineral Resource Estimate on the company’s flagship Perron Project in the northwestern Abitibi region of Quebec. The majority of ounces come from the Company’s High-Grade Zone, with important contributions from the Denise Zone, the Gratien Zone, the Grey Cat Zone and the Team Zone. The drillhole database for the resource was closed on June 30, 2024, meaning recent drilling has not been included in this resource iteration at Perron. All zones on the property remain open in multiple directions for further expansion and Amex’s current continuing drill program is fully funded until the conclusion of 2025.

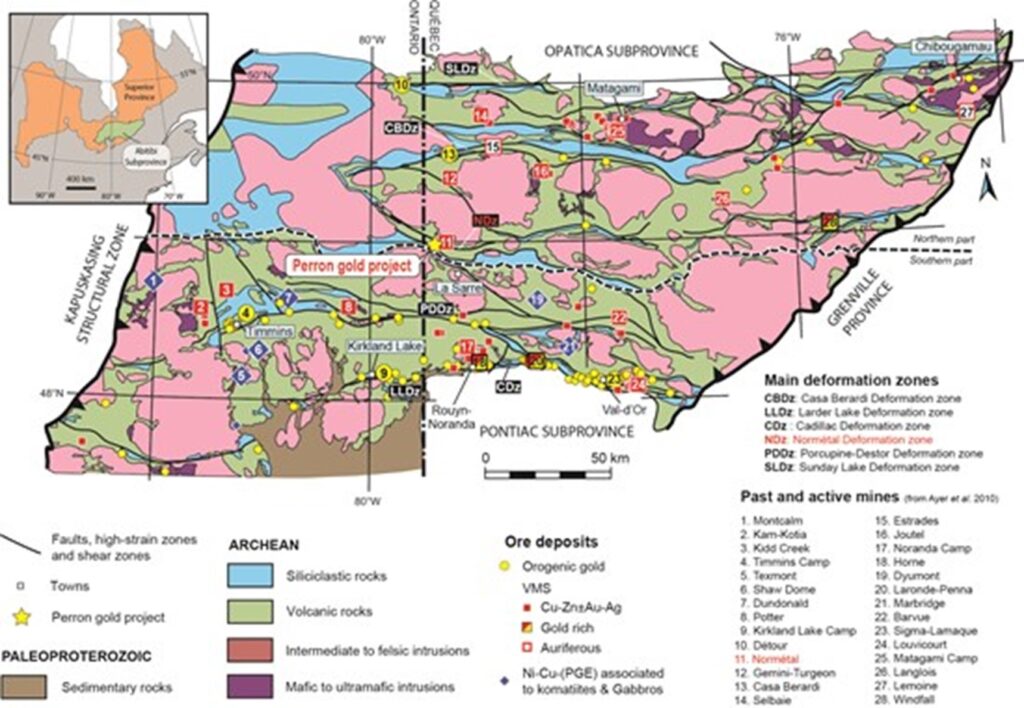

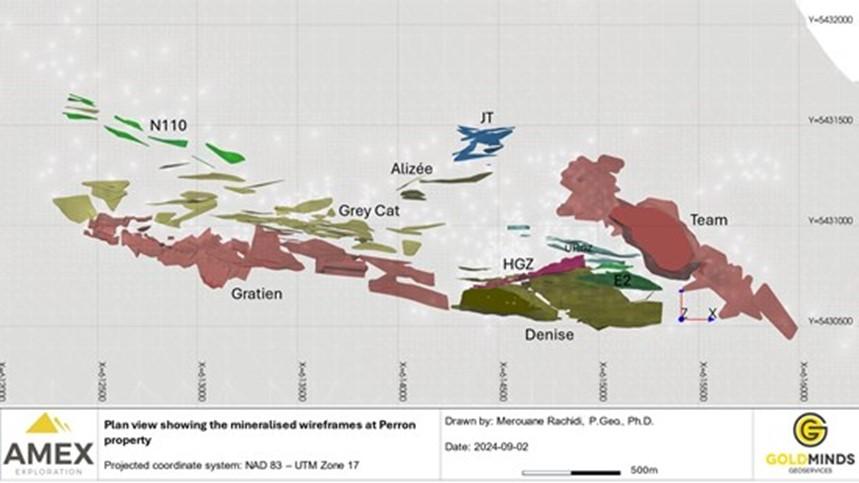

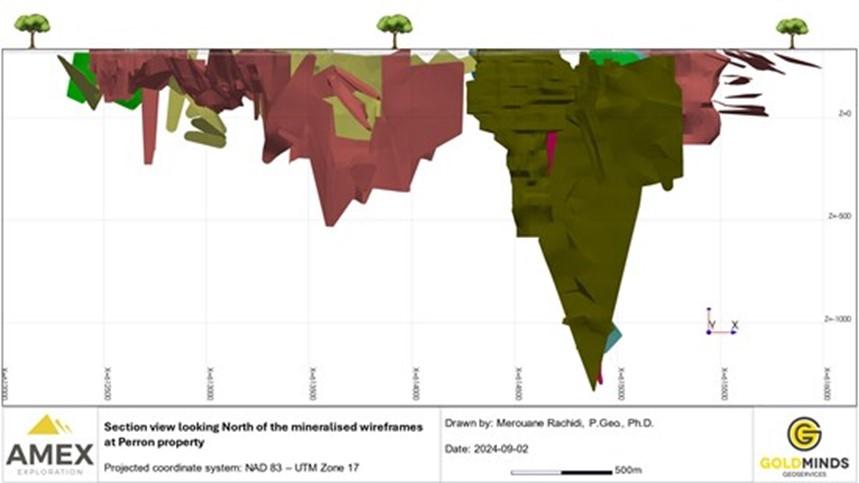

See Figure 1 for the location of the Perron Project, Figure 2 for a plan view of mineral resources at the Perron Project, Figure 3 for a sectional view of mineral resources of the Perron Project, and Table 1 for a summary of total mineral resources, Table 2 for summary of total mineral resources by zone and Table 3 for parameters used to constrain resources at Perron.

MRE Highlights:

- Open pit and underground stope constrained 594,100 of measured and indicated ounces at 4.28 g/t Au and 1,049,650 of inferred ounces at 3.80 g/t Au.

- The MRE shows excellent continuity throughout the project with exceptional high grade throughout, specifically in the High-Grade Zone (HGZ) which alone hosts 336,170 of measured and indicated ounces at 12.05 g/t Au and 415,470 of inferred ounces at 10.49 g/t Au.

- Of important significance within the HGZ is with improved confidence, comes increased grade. With regard to the HGZ under Table 2, as drill spacing is tightened to upgrade resources from inferred to indicated to measured, the grade improves. This is rare in the gold industry and speaks to exceptional continuity of the zone.

- The MRE is a base case for the gold at Perron and includes drilling up to June 30, 2024. Approximately 600,000 m of accumulative fully funded drilling is expected to be completed by the end of 2025.

- All zones remain open at Perron, providing excellent future mineral resource expansion potential.

- Metallurgical test work by SGS Canada achieved an overall gold recovery of up to 99% in the HGZ and up to 95% in the Denise, Team, Gratien and Grey Cat Zones.

- Near by housing, roads, electricity and labour are expected to favourably impact the economics of the Perron project in the upcoming PEA expected later this year.

- The Perron project also hosts VMS (copper-zinc) mineralization which has not been included in today’s MRE nor any of the silver credits that exist in some zones of the property. The Company plans to complete the modelling requirements surrounding these additional metals in the future, which is expected to enhance the economics of the project.

Jacques Trottier, PhD, Executive Chairman of Amex Exploration, commented, “I am very proud of our progress to date. Throughout my time at Perron, I was convinced that the project hosted a significant high-grade gold resource, so it is fantastic to have realised this. In my opinion, the high-grade nature of Perron is what truly sets its apart from its peers and we have just begun to scratch the surface of the potential. The grade at Perron compares very favourably to many of the recent world class projects in Canada and elsewhere. There is significant room for this resource to grow, as much of the property is yet to be explored. New machine learning and AI techniques have generated new high priority targets for us, some of which we have begun to test with success. Given the projects quality high-grade ounces, proximity to infrastructure and workforce, we look forward to releasing our project economics in the PEA, which remains on track for Q4 of this year. It should also be noted that this resource is purely gold focused. None of the silver credits that may exist across our zones have been modelled, neither have any of our copper-zinc mineralization of the QF Zone, Central Polymetallic Zone and Donna Copper Zone. We do plan on looking at these additional metals in future work, which should be accretive to the project.”

Aaron Stone, P.Geo, Vice President Exploration of Amex Exploration, continued, “This resource is an excellent starting point for Amex. Drilling never stops at Perron and we continue to work diligently on expanding and defining our known zones as well as exploring for further discoveries. Work has begun at site to better understand the mineralization and structure of the Team and Denise Zones to better guide infill drilling to increase their ounce count. Recent work in western zones such as Gratien, Grey Cat and Alizée have also yielded some very interesting high-grade results which need to be followed up on with further drilling. Since discovery of the JT Zone only a few months ago, our understanding of gold emplacement at Perron has been rapidly evolving and we are starting to see some geological similarities with the Windfall project. The mineralized felsic to intermediate dike that was found has given us a lot to think about for the genesis of all gold-bearing zones within the Beaupré Block. Studies have begun to validify this new theory, but if gold enrichment at Perron does turn out to be intrusion related, this will change our approach on how we search for another High-Grade Zone on the property. I am personally very excited by this as we continue to work closely with our strategic partners to unlock the full value that we believe is still to be discovered at Perron.”

Victor Cantore, President and CEO, Director of Amex Exploration, added, “There are limited projects around the world that are this high-grade in nature, and the grade of the HGZ puts the Perron Project in line with these world class assets. As we move forward our goal is to build ounces while simultaneously advancing the project towards production through advancing economic studies and permitting.”

Figure 1: Location of Perron Project, central Abitibi, 4km to the east of the Quebec-Ontario border. Perron is marked by a gold star and is directly adjacent to number 11, the historical producing Normétal VMS mine. Note the location of the Windfall Project, number 28, to the east along the same deformation corridor as the Perron Project.

Figure 2: Plan view of constrained mineral resources at Perron.

Figure 3: View looking to the north of mineral resources delineated at Perron. Note the HGZ has been defined to 1.3km vertically and remains open at depth.

Table 1: Summary of total Mineral Resources at the Perron Project

| All Zones | Open Pit Constrained | UG stopes | Total | ||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | |

| Measured | 131,250 | 1.39 | 5,880 | 445,250 | 6.60 | 94,530 | 576,500 | 5.42 | 100,400 |

| Indicated | 706,600 | 1.80 | 40,780 | 3,030,580 | 4.65 | 452,920 | 3,737,200 | 4.11 | 493,700 |

| Indicated+Measured | 837,850 | 1.73 | 46,660 | 3,475,830 | 4.90 | 547,450 | 4,313,700 | 4.28 | 594,100 |

| Inferred | 996,500 | 2.01 | 64,420 | 7,597,300 | 4.03 | 985,220 | 8,593,800 | 3.80 | 1,049,650 |

Table 2: Summary of Mineral Resources at the Perron Project by zone

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| HG Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | 400 | 1.38 | 20 | 136,000 | 15.95 | 69,740 | 136,400 | 15.90 | 69,750 |

| Indicated | 13,590 | 1.18 | 515 | 717,800 | 11.52 | 265,900 | 731,400 | 11.33 | 266,410 |

| Indicated+Measured | 14,000 | 1.18 | 530 | 853,800 | 12.23 | 335,630 | 867,800 | 12.05 | 336,170 |

| Inferred | 3,330 | 0.56 | 60 | 1,228,060 | 10.52 | 415,410 | 1,231,400 | 10.49 | 415,470 |

Note: As ounces in the High-Grade Zone increase in confidence from inferred to indicated to measured, so does the grade. This is rare in gold deposits and displays the exceptional continuity of high-grade mineralization within this zone.

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| Denise Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | 92,800 | 1.11 | 3,310 | 208,550 | 2.46 | 16,520 | 3,013,410 | 2.05 | 19,820 |

| Indicated | 324,760 | 1.36 | 14,230 | 1,304,960 | 2.45 | 102,730 | 1,629,720 | 2.23 | 116,960 |

| Indicated+Measured | 417,560 | 1.31 | 17,540 | 1,513,500 | 2.45 | 119,250 | 1,931,060 | 2.20 | 136,780 |

| Inferred | 3,400 | 0.60 | 70 | 2,239,690 | 2.94 | 211,600 | 2,243,100 | 2.93 | 211,660 |

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| Team Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | 38,040 | 2.09 | 2,560 | 93,640 | 2.60 | 7,810 | 131,680 | 2.45 | 10,370 |

| Indicated | 205,450 | 2.34 | 15,470 | 629,150 | 2.44 | 49,420 | 834,600 | 2.42 | 64,880 |

| Indicated+Measured | 243,490 | 2.30 | 18,030 | 722,790 | 2.46 | 57,230 | 966,280 | 2.42 | 75,250 |

| Inferred | 273,450 | 2.16 | 18,980 | 1,039,890 | 2.73 | 91,320 | 1,313,340 | 2.61 | 110,300 |

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| AZ Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | |||||||||

| Indicated | |||||||||

| Indicated+Measured | |||||||||

| Inferred | 19,310 | 1.87 | 1,160 | 19,310 | 1.87 | 1,160 | |||

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| N110 Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | 5,720 | 1.83 | 340 | 5,720 | 1.83 | 340 | |||

| Indicated | 7,500 | 2.40 | 580 | 7,500 | 2.40 | 580 | |||

| Indicated+Measured | 13,220 | 2.16 | 920 | 13,220 | 2.16 | 920 | |||

| Inferred | 240 | 2.48 | 20 | 87,300 | 2.20 | 6,200 | 87,540 | 2.20 | 6,220 |

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| CPZ Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | 1,340 | 2.81 | 120 | 1,340 | 2.81 | 120 | |||

| Indicated | 63,980 | 2.02 | 4,150 | 63,980 | 2.02 | 4,150 | |||

| Indicated+Measured | 65,320 | 2.03 | 4,270 | 65,320 | 2.03 | 4,270 | |||

| Inferred | 148,210 | 1.50 | 7,140 | 148,210 | 1.50 | 7,140 | |||

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| Gratien Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | |||||||||

| Indicated | 22,530 | 2.19 | 1,580 | 127,350 | 3.96 | 16,220 | 149,880 | 3.70 | 17,800 |

| Indicated+Measured | 22,530 | 2.19 | 1,580 | 127,350 | 3.96 | 16,220 | 149,880 | 3.70 | 17,800 |

| Inferred | 147,330 | 3.59 | 16,990 | 1,361,620 | 3.39 | 148,500 | 1,508,950 | 3.41 | 165,500 |

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| Grey Cat Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | |||||||||

| Indicated | 135,390 | 2.02 | 8,790 | 111,750 | 2.46 | 8,860 | 247,140 | 2.22 | 17,650 |

| Indicated+Measured | 135,390 | 2.02 | 8,790 | 111,750 | 2.46 | 8,860 | 247,140 | 2.22 | 17,650 |

| Inferred | 291,020 | 1.97 | 18,400 | 996,130 | 2.29 | 73,210 | 1,287,150 | 2.21 | 91,610 |

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| UHGZ Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | |||||||||

| Indicated | 38,780 | 2.08 | 2,590 | 38,780 | 2.08 | 2,590 | |||

| Indicated+Measured | 38,780 | 2.08 | 2,590 | 38,780 | 2.08 | 2,590 | |||

| Inferred | 118,800 | 1.86 | 7,110 | 118,800 | 1.86 | 7,110 | |||

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| E2 Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | |||||||||

| Indicated | 28,850 | 2.64 | 2,450 | 28,850 | 2.64 | 2,450 | |||

| Indicated+Measured | 28,850 | 2.64 | 2,450 | 28,850 | 2.64 | 2,450 | |||

| Inferred | 303,900 | 2.13 | 20,850 | 303,900 | 2.13 | 20,850 | |||

| Open Pit Constrained | UG stopes | Total | |||||||

| COG 0.42 Au g/t | COG 1.29 Au g/t | ||||||||

| JT Zone | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. | Tonnes | Au gpt | Au oz. |

| Measured | – | – | |||||||

| Indicated | 4,880 | 1.23 | 190 | 480 | 1.75 | 30 | 5,360 | 1.28 | 220 |

| Indicated+Measured | 4,880 | 1.23 | 190 | 480 | 1.75 | 30 | 5,360 | 1.28 | 220 |

| Inferred | 277,700 | 1.11 | 9,900 | 54,370 | 1.57 | 2,740 | 332,080 | 1.18 | 12,640 |

Note: Drilling on the JT Zone has tripled in amount since the drill database was cut off for the resource calculation. The Company is confident that the JT Zone will significantly grow in size and is especially buoyed by its potential geological implications for mineralization contained throughout the entirety of the Beaupré Block at Perron.

Cautionary statement: These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred resources as Indicated or Measured, and it is uncertain if further exploration will result in upgrading them to these categories. Totals may not add up due to rounding of numbers.

Please note that the Company states this is not a Maiden Resource Estimate due to a previous resource estimate completed on the Gratien Zone in 2009 for 69,907 inferred ounces of gold (please refer to SEDAR filing submitted June 2, 2009. Report is titled Resource Estimate, Form 43-101F1 Technical Report, Project Perron, is dated May 10, 2009 and was authored by Qualified Person Jacques Marchand P. Eng).

Resource Estimation Methodology and Parameters

As part of the resource estimation process, the Company and GoldMinds compiled, verified and modelled all technical information available from the Project

Parameters used in the definition of cut-of grades, modifying factors to enable reasonable prospect of economic extraction, pit constrained and mineable shapes as per CIM 2019 Guidelines.

Table 3: Parameters used for constraining resources at Perron

| Pit parameters | Stope parameters | |

| Open Pit | Underground | |

| Total processing costs ($) | 28.00 | 28.00 |

| Mining cost (rock) ($) | 5.00 | 75.00 |

| Specific gravity (rock) | 2.7 | 2.7 |

| Pit slopes (overburden) | 20 | |

| Pit slopes (rock) | 45 | |

| Mining cost (overburden) | 5 | |

| Specific gravity (overburden) | 1.9 | |

| Au price ($USD) | 1900 | 1900 |

| Exchange rate ($CAD/$USD) | 1.35 | 1.35 |

| Au price (CAD$/g) | 82.47 | 82.47 |

| Recovery | 95% | 97% |

| COG (g/t Au) | 0.42 | 1.29 |

Perron Gold project Mineral Estimate notes:

- The mineral resource estimate is compliant with CIM 2019 standards and guidelines for reporting mineral resources and reserves.

- Resources are presented undiluted and in situ and are considered to have reasonable prospects for economic extraction. The resources at surface are constrained by pit optimization surfaces and the underground resources are constrained by mineable shapes.

- The database comprised a total of 1,533 drill holes for 617,836.50 metres of drilling (which includes historical drilling completed by previous operators) in the extent of the mineral resource, of which (312,051.20 metres) 264,462 samples were assayed as of June 30th, 2024, grid spacing are variable (The Genesis file is Amex_24 Aout 2024_MR.gnft and where the database file is BD_AMEX_08 Jul 2024_MR.accdb).

- All NQ core assays reported by AMEX were obtained by analytical methods described below under “QA&QC”.

- Geological interpretation of the deposits was based on lithologies, mineralized zones orientation and the mineral observations. Each zone has its own characteristic of mineral occurrence and amount of free gold.

- Interpretation was initially made from cross-sections at intervals, and then completed in GENESIS, a modelling software, where selections of mineralization intervals were combined to generate mineralization wireframes. Envelopes are generally subvertical with various plunges.

- The mineral resource estimate encompasses a total of 189 envelopes, sub-vertical gold-bearing envelopes/domains each defined by individual wireframes with a minimum true thickness of 2.0 metres.

- Samples were composited within the mineralization envelopes into 1.0 metre length composites. A value of zero grade was applied in cases of core not assayed.

- High grade capping was done on composite data and established using a statistical analysis on a per-zone basis for gold. Capping varied from 5 g/t Au to 200 g/t Au and was applied on composites within each specific envelope.

- Density values were applied on the different mineralized zones (t/m3) varied from 2.67 to 2.83 from core measurement.

- Inverse distance squared grade estimation is used. The trial of Ordinary Kriging (OK) was rejected due to smearing and non-effective representation of high-grade areas.

- Most of the estimates are based on a block dimension of 2m North, 2m East and 2m height and estimation parameters determined by variography. The High-Grade zone has blocks of 2.5m East x 5m Z (Elevation) x 0.5m North.

- The Perron mineral resource estimate is categorized as Measured, Indicated and Inferred mineral resource as follows:

- The Measured mineral resource category is automatic & manually defined and encloses areas where drill spacing is generally less than 30m (search radius of 15m), blocks are informed by a minimum of three drill holes, and reasonable geological and grade continuity is shown.

- The Indicated mineral resource category is manually defined and encloses areas where drill spacing is generally less than 60m (search radius of 30m), blocks are informed by a minimum of three drill holes, and reasonable geological and grade continuity is shown.

- The Inferred mineral resource category is manually defined and encloses areas where drill spacing is less than 130m (search radius of 65m), blocks are informed by a minimum of two drill holes, and reasonable, but not verified, geological and grade continuity is observed.

- Estimates use metric units (metres, tonnes and g/t). Metal contents are presented in troy ounces (metric tonne x grade / 31.10348).

- GoldMinds is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues, or any other relevant issue not reported in the technical report, that could materially affect the mineral resource estimate.

Further details regarding the 2024 mineral resource estimate, key assumptions, parameters and methods used to estimate the mineral resources of the Perron Gold Project will be available on SEDAR Plus (www.sedarplus.ca) under the Corporation’s issuer profile within 45 days in accordance with NI 43-101. The resource estimate will be the basis for the ongoing PEA to be released in Q4, 2024.

Independent Qualified Persons

The Mineral Resource Estimate was prepared for Amex Exploration Inc. under the supervision of GoldMinds Geoservices Inc. The Qualified Persons have reviewed and approved the content of this news release. Independent QP’s from GMG who have prepared and supervised the preparation of the technical information relating to this Mineral Resource Estimate are:

– Merouane Rachidi, Ph.D. P.Geo.

– Claude Duplessis, Eng.

Perron Project Qualified Person and QA&QC

Jérôme Augustin P.Geo. Ph.D., (OGQ 2134), an independent “qualified person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the geological information reported in this news release. The drilling campaign and the quality control program have been planned and supervised by Jérôme Augustin. Core logging and sampling were completed by Laurentia Exploration. The quality assurance and quality control protocols include insertion of blank or standard samples every 10 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples accredited by Laboratoire Expert during the analytical process.

For all analyses targeting gold mineralization, gold values are estimated by fire assay with finish by atomic absorption. Values over 3 ppm Au are reanalyzed by fire assay with finish by gravimetry by Laboratoire Expert Inc, Rouyn-Noranda. Samples containing visible gold mineralization are analyzed by metallic sieve. For additional quality assurance and quality control, all samples were crushed to 90% less than 2 mm prior to pulverization, in order to homogenize samples which may contain coarse gold.

Furthermore, gold mineralization associated with base metals were sent to ALS Canada Ltd., Rouyn-Noranda with the same quality assurance and quality control protocol to LabExpert. Gold values are estimated by fire assay with finish by atomic absorption. Zinc, Copper and Silver values are estimated by four acid digestion multi elements Inductively Coupled Plasma – Atomic Emission Spectroscopy (ICP-AES), ME-ICP61. Zinc values over 1%, copper values over 1% and silver values over 100 g/t are estimated by four acid digestion ICP-AES, OG62.

About Amex

Amex Exploration Inc. has made significant gold discoveries on its 100% owned high-grade Perron Gold Project located ~110 kilometres north of Rouyn-Noranda, Quebec, consisting of 117 contiguous claims covering 4,518 hectares. The project is well-serviced by existing infrastructure, on a year-round road, 10 minutes from an airport and just outside the town of Normétal (~8 km). In addition, the project is in close proximity to a number of major gold producers’ milling operations. The project host both bulk tonnage and a high-grade gold style mineralization. Since January 2019, Amex has intersected significant gold mineralization in multiple gold zones and discovered copper-rich VMS zones.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE