Kinross reports strong 2024 second-quarter results

Robust margins and significant free cash flow enable $200 million debt repayment

Positive progress at all growth projects including first gold produced from Manh Choh

High-grade exploration results at Great Bear, Round Mountain and Curlew

Kinross Gold Corporation (TSX: K) (NYSE: KGC) announced its results for the second quarter ended June 30, 2024.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on pages 30 and 31 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

2024 second-quarter highlights:

- Guidance reaffirmed: On an attributable basis, Kinross remains on track to meet its 2024 annual guidance for production, cost of sales, all-in sustaining cost and capital expenditures.

- Production of 535,338 gold equivalent ounces (Au eq. oz.).

- Production cost of sales of $1,029 per Au eq. oz. sold and all-in sustaining cost1 of $1,387 per Au eq. oz. sold.

- Margins2 increased to $1,313 per Au eq. oz. sold, outpacing the rise in the average realized gold price.

- Operating cash flow of $604.0 million and adjusted operating cash flow1 of $478.1 million. Attributable free cash flow1 of $345.9 million.

- Reported net earnings of $210.9 million, or $0.17 per share, with adjusted net earnings1 of $174.7 million, or $0.14 per share1.

- Balance sheet strength: Kinross has improved its debt metrics, with term loan repayments of $200.0 million. Total liquidity3 is approximately $2.1 billion, including cash and cash equivalents of $480.0 million.

- Kinross’ Board of Directors declared a quarterly dividend of $0.03 per common share payable on September 6, 2024, to shareholders of record at the close of business on August 22, 2024.

- Climate Report: Kinross released its 2023 Climate Report, providing a comprehensive summary of its progress in 2023.

Operations:

- Tasiast, Paracatu and La Coipa delivered 67% of total production, with production cost of sales of $848 per Au eq. oz. sold and margins2 of $1,494 per Au eq. oz. sold.

- Sustained strong performance at Tasiast as the mine continued to be the highest-margin operation in the portfolio, generating significant free cash flow.

- Fort Knox delivered a solid quarter, increasing production substantially at lower costs compared with Q1 2024.

Development Projects and Exploration:

- At Great Bear, Kinross remains on track to release a Preliminary Economic Assessment in September. During the quarter, Kinross drilled the deepest drill hole to date, which returned 3.8m at 9.52 g/t at a vertical depth of 1,575m, demonstrating robust mineralization at depth, well outside the current resource.

- Manh Choh achieved a significant milestone, on schedule, and poured its first gold bar on July 8, 2024. Full commissioning of the modifications at the Fort Knox mill is expected in the third quarter and the project remains on track to deliver its planned production this year.

- At Round Mountain Phase X, the exploration decline is progressing well with over 2,200 metres developed to date. Extension drilling has intersected mineralization with strong grades and widths outside of the primary exploration target.

CEO commentary:

- Paul Rollinson, CEO, made the following comments in relation to 2024 second-quarter results:

“Kinross had another strong quarter supporting an excellent first half of the year. Our portfolio of mines performed well, delivering high-margin production, and we remain on track to meet our annual production and cost guidance for 2024.

“Quarter-over-quarter, our margins2 grew by 21% to $1,313 per gold ounce sold, outpacing the rise in gold price, and attributable free cash flow1 more than doubled to $346 million, totalling $491 million year-to-date. We are continuing to prudently manage our business with a focus on maintaining our cost profile and capital discipline while continuing to advance projects and exploration targets to drive future value. We also continue to strengthen our investment grade balance sheet and reduce debt.

“Thanks to the hard work of our team and partners in Alaska, we achieved an important milestone, on schedule, and poured the first gold bar from Manh Choh in early July. The mine remains on plan, the Fort Knox mill is performing well, and the project is expected to be fully commissioned in Q3.

“At Great Bear, the drilling campaign continued to demonstrate positive results, including intersecting high-grade mineralization in the deepest drill hole to date, outside the current resource. Permitting and engineering for both the AEX and Main Project are continuing to advance, and we are looking forward to releasing a Preliminary Economic Assessment in September.

“We are also pleased to have released our 2023 Climate Report. We are on track to achieve our target of a 30% reduction in Scope 1 and Scope 2 GHG emissions intensity by 2030.”

Summary of financial and operating results

| Three months ended | Six months ended | |||||||

| June 30, | June 30, | |||||||

| (unaudited, in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2024 | 2023 | 2024 | 2023 | ||||

| Operating Highlights | ||||||||

| Total gold equivalent ounces(a) | ||||||||

| Produced | 535,338 | 555,036 | 1,062,737 | 1,021,058 | ||||

| Sold | 520,760 | 552,969 | 1,043,160 | 1,043,299 | ||||

| Financial Highlights | ||||||||

| Metal sales | $ | 1,219.5 | $ | 1,092.3 | $ | 2,301.0 | $ | 2,021.6 |

| Production cost of sales | $ | 536.1 | $ | 497.9 | $ | 1,049.0 | $ | 981.8 |

| Depreciation, depletion and amortization | $ | 295.8 | $ | 239.3 | $ | 566.5 | $ | 451.2 |

| Operating earnings | $ | 298.3 | $ | 237.8 | $ | 491.5 | $ | 381.7 |

| Net earnings attributable to common shareholders | $ | 210.9 | $ | 151.0 | $ | 317.9 | $ | 241.2 |

| Basic earnings per share attributable to common shareholders | $ | 0.17 | $ | 0.12 | $ | 0.26 | $ | 0.20 |

| Diluted earnings per share attributable to common shareholders | $ | 0.17 | $ | 0.12 | $ | 0.26 | $ | 0.20 |

| Adjusted net earnings attributable to common shareholders(b) | $ | 174.7 | $ | 167.6 | $ | 299.6 | $ | 255.2 |

| Adjusted net earnings per share(b) | $ | 0.14 | $ | 0.14 | $ | 0.24 | $ | 0.21 |

| Net cash flow provided from operating activities | $ | 604.0 | $ | 528.6 | $ | 978.4 | $ | 787.6 |

| Adjusted operating cash flow(b) | $ | 478.1 | $ | 459.1 | $ | 903.0 | $ | 791.9 |

| Capital expenditures(c) | $ | 274.2 | $ | 281.9 | $ | 516.1 | $ | 503.1 |

| Attributable(d) capital expenditures(b) | $ | 264.5 | $ | 272.3 | $ | 496.6 | $ | 484.9 |

| Attributable(d) free cash flow(b) | $ | 345.9 | $ | 258.3 | $ | 491.2 | $ | 305.3 |

| Average realized gold price per ounce(e) | $ | 2,342 | $ | 1,976 | $ | 2,206 | $ | 1,937 |

| Production cost of sales per equivalent ounce(a) sold(f)(g) | $ | 1,029 | $ | 900 | $ | 1,006 | $ | 941 |

| Production cost of sales per ounce sold on a by-product basis(b)(g) | $ | 989 | $ | 845 | $ | 965 | $ | 885 |

| All-in sustaining cost per ounce sold on a by-product basis(b)(g) | $ | 1,357 | $ | 1,262 | $ | 1,319 | $ | 1,272 |

| All-in sustaining cost per equivalent ounce(a) sold(b)(g) | $ | 1,387 | $ | 1,296 | $ | 1,348 | $ | 1,308 |

| Attributable(d) all-in cost per ounce sold on a by-product basis(b) | $ | 1,756 | $ | 1,596 | $ | 1,685 | $ | 1,606 |

| Attributable(d) all-in cost per equivalent ounce(a) sold(b) | $ | 1,774 | $ | 1,614 | $ | 1,702 | $ | 1,624 |

| (a) “Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the second quarter and first six months of 2024 was 81.06:1 and 84.51:1, respectively (second quarter and first six months of 2023 – 81.88:1 and 82.85:1, respectively). | ||||||||

| (b) The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages [x] to [x] of this report. Non-GAAP financial measures and ratios have no standardized meaning under International Financial Reporting Standards (“IFRS”) and therefore, may not be comparable to similar measures presented by other issuers. | ||||||||

| (c) “Capital expenditures” is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. | ||||||||

| (d) “Attributable” includes Kinross’ 70% share of Manh Choh costs, capital expenditures and cash flow, as appropriate. | ||||||||

| (e) “Average realized gold price per ounce” is defined as gold metal sales divided by total gold ounces sold. | ||||||||

| (f) “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | ||||||||

| (g) As production from Manh Choh commenced in July 2024, production cost of sales and attributable all-in sustaining cost figures and ratios for Manh Choh are nil for all periods presented. As a result, production cost of sales and all-in sustaining cost figures and ratios are equal to attributable production cost of sales and attributable all-in sustaining cost figures and ratios, as applicable. | ||||||||

The following operating and financial results are based on second-quarter gold equivalent production:

Production: Kinross produced 535,338 Au eq. oz. in Q2 2024, compared with 555,036 Au eq. oz. in Q2 2023. The 4% year-over-year decrease was primarily due to lower grades at Paracatu according to the planned mining sequence.

Average realized gold price4: The average realized gold price in Q2 2024 was $2,342 per ounce, compared with $1,976 per ounce in Q2 2023.

Revenue: During the second quarter, revenue increased to $1,219.5 million, compared with $1,092.3 million during Q2 2023.

Production cost of sales: Production cost of sales per Au eq. oz. sold increased to $1,029 for the quarter, compared with $900 in Q2 2023.

Production cost of sales per Au oz. sold on a by-product basis1 was $989 in Q2 2024, compared with $845 in Q2 2023, based on gold sales of 505,122 ounces and silver sales of 1,267,528 ounces.

Margins2: Kinross’ margin per Au eq. oz. sold increased by 22% to $1,313 for Q2 2024, compared with the Q2 2023 margin of $1,076, outpacing the 19% increase in average realized gold price4.

All-in sustaining cost1: All-in sustaining cost per Au eq. oz. sold was $1,387 in Q2 2024, compared with $1,296 in Q2 2023.

In Q2 2024, all-in sustaining cost per Au oz. sold on a by-product basis was $1,357, compared with $1,262 in Q2 2023.

Operating cash flow: Operating cash flow was $604.0 million for Q2 2024, compared with $528.6 million for Q2 2023.

Adjusted operating cash flow1 for Q2 2024 was $478.1 million, compared with $459.1 million for Q2 2023.

Attributable free cash flow1: Attributable free cash flow increased by 34% to $345.9 million in Q2 2024, compared with $258.3 million in Q2 2023.

Earnings: Reported net earnings increased by 40% to $210.9 million for Q2 2024, or $0.17 per share, compared with reported net earnings of $151.0 million, or $0.12 per share, for Q2 2023.

Adjusted net earnings1 increased to $174.7 million, or $0.14 per share1, for Q2 2024, compared with $167.6 million, or $0.14 per share1, for Q2 2023.

Attributable capital expenditures1: Attributable capital expenditures were $264.5 million for Q2 2024, compared with $272.3 million for Q2 2023, primarily due to a decrease in capital development at Bald Mountain and La Coipa, partially offset by capital development at Round Mountain Phase S.

Balance sheet

The Company maintained its investment grade ratings and strengthened its balance sheet during the second quarter, including repaying $200.0 million on its term loan.

Kinross had cash and cash equivalents of $480.0 million as of June 30, 2024, compared with $352.4 million at December 31, 2023.

The Company has additional available credit5 of $1.65 billion and total liquidity3 of approximately $2.1 billion.

Dividend

As part of its quarterly dividend program, the Board of Directors declared a dividend of $0.03 per common share payable on September 6, 2024, to shareholders of record as of August 22, 2024.

Operating results

Mine-by-mine summaries for 2024 second-quarter operating results may be found on pages 10 and 14 of this news release. Highlights include the following:

Tasiast continued its consistent and solid performance, with production increasing compared with Q1 2024 mainly due to higher grades and record mill throughput, while cost of sales per ounce sold remained largely in line. Production increased compared with Q2 2023 mainly as a result of the completion of the Tasiast 24k project in the second half of 2023, and cost of sales per ounce sold was in line.

At Paracatu, production increased quarter-over-quarter mainly due to higher grades and recoveries, while cost of sales per ounce sold decreased mainly due to the higher production. Production was lower compared with Q2 2023 mainly due to lower grades according to the planned mining sequence, and cost of sales per ounce sold was higher mainly due to the decrease in grade and production.

At La Coipa, production was lower quarter-over-quarter mainly due to a decrease in grades and recoveries, and cost of sales per ounce sold was higher mainly due to higher mill maintenance costs and timing of sales. Production was largely in line year-over-year, and cost of sales per ounce sold was higher primarily due to a lower proportion of mining activities related to capital development and higher mill maintenance costs.

In the second quarter, strong grades and recovery offset lower throughput. The operation continued to generate robust cash flow, and full-year production guidance remains on track. The Company is completing mill maintenance work aimed at increasing long-term plant reliability.

At Fort Knox, production increased significantly compared with the previous quarter mainly due to an increase in mill throughput, grades and recoveries, and was in line year-over-year. Cost of sales per ounce sold decreased compared with the previous quarter mainly due to the increase in production, and cost of sales per ounce sold increased year-over-year due to higher contractor and labour costs.

At Round Mountain, production decreased quarter-over-quarter mainly due to lower mill throughput and grades, and increased year-over-year mainly due to higher mill grades. Cost of sales per ounce sold was higher quarter-over-quarter mainly due to the decrease in production, and year-over-year as a result of higher cost ounces produced from the heap leach pads, partially offset by lower reagent and contractor costs.

At Bald Mountain, production was slightly lower compared with the previous quarter and increased year-over-year due to the timing of ounces recovered from the heap leach pads. Cost of sales per ounce sold was higher quarter-over-quarter primarily as a result of higher maintenance costs, and largely in line year-over-year.

Development Projects and Exploration

Great Bear

At the Great Bear project, the Company’s robust exploration program continues to make excellent progress, execution planning for the Advanced Exploration (AEX) program is well underway, permitting continues to advance, and the PEA is expected to be released in September 2024.

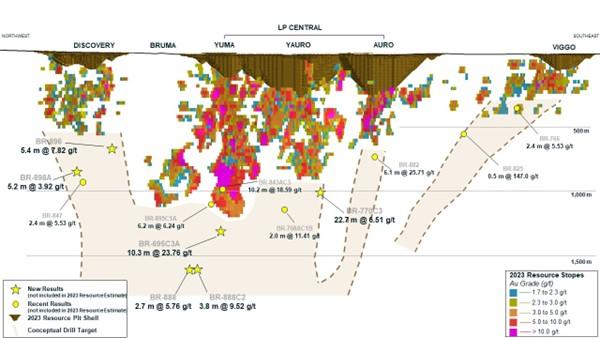

The drilling results described below (true width) continue to support the view of a high-grade, long-life mining complex at Great Bear, with recent results showing extension of mineralization at depth across multiple zones.

At Yuma, the deepest drill hole on the property to date, BR-888C2, has intersected 3.8m @ 9.52 g/t Au, along the predicted plunge of the zone at a vertical depth of 1,575m below surface. Also at Yuma, drill hole BR-695C3A intersected 10.3m @ 23.76 g/t at 1,285m vertical depth.

At Yauro, recent successful results received follow-up drill testing this quarter. Of note, drill hole BR-770C3 intersected 22.7m @ 6.51 g/t at a vertical depth of 1,000m below surface demonstrating continuity of mineralization at depth.

Mineralization at Discovery continues to expand with recent drill results, including BR-896 and BR-898A, which intersected 5.4m @ 7.82 g/t at 700m vertical depth and 5.2m @ 3.92 g/t at 780m vertical depth, respectively.

Drilling at Hinge and Limb this quarter has returned promising results for depth extension at both zones, providing optionality to supplement LP production in the future. At Hinge, drill holes DL-132C1 and DL-132C4 crossed quartz veins containing high-grade mineralization with DL-132C1 intersecting 3.1m @ 9.33 g/t at 850m vertical depth and DL-132C4 intersecting 3.1m @ 22.65 g/t at 865m vertical depth. At Limb, drill holes DL-132C1 and DL-132C3 intersected 5.0m @ 5.52 g/t at 720m vertical depth and 2.4m @ 4.54 g/t at 800m vertical depth, directly below the existing resource indicating mineralization remains open at depth.

The 2024 drill program will continue to target mineralization below the existing mineral resource, explore for additional deposits along strike, and expand the Red Lake style mineralization at Hinge and Limb.

Notable exploration results at Great Bear in the second quarter include:

- BR-695C3A (Yuma) 10.3m @ 23.76 g/t Au at a vertical depth of 1,285m

- including 3.6m @ 65.51 g/t Au

- BR-770C3 (Yauro) 22.7m @ 6.51 g/t Au at a vertical depth of 1,000m

- including 3.5m @ 37.83 g/t Au

- BR-888C2 (Yuma) 10.7m @ 3.88 g/t Au at a vertical depth of 1,575m

- including 3.8m @ 9.52 g/t Au

- BR-896 (Discovery) 5.4m @ 7.82 g/t Au at a vertical depth of 700m

- BR-898A (Discovery) 5.2m @ 3.92 g/t Au at a vertical depth of 780m

- DL-132C1 (Hinge) 3.1m @ 9.33 g/t Au at a vertical depth of 850m

- and (Limb) 5.0m @ 5.52 g/t Au at a vertical depth of 720m

- DL-132C3 (Limb) 2.4m @ 4.54 g/t Au at a vertical depth of 800m

- DL-132C4 (Hinge) 3.1m @ 22.65 g/t Au at a vertical depth of 865m

For the AEX program, permitting, detailed engineering, execution planning, and procurement continue to advance. Kinross is targeting the start of surface construction in the second half of 2024. Construction of the underground decline is planned to commence in mid-2025.

For the Main Project, Kinross continues to advance technical studies, including engineering and field test work campaigns. In the last quarter, metallurgical, geochemistry and backfill test work was advanced to continue building technical knowledge and provide input into engineering studies.

Kinross is on track to release its PEA in September 2024. The PEA will provide visibility into the potential production scale, construction capital, all-in sustaining cost and margins for both the open pit and the underground. The PEA will only include a subset of the ounces in the measured, indicated, and inferred resources drilled to date.

The Draft Tailored Impact Statement Guidelines for the Main Project were received from the Impact Assessment Agency of Canada in Q2 2024, as planned, and the Federal Impact Assessment is underway. Studies are ongoing and the Company expects to file its Impact Statement in the first half of 2025.

Selected Great Bear Drill Results

See Appendix A for full results.

| Hole ID | From (m) |

To (m) |

Width (m) |

True Width (m) |

Au (g/t) | Target | |

| BR-695C3A | 1,523.1 | 1,526.1 | 3.0 | 2.3 | 0.50 | Yuma | |

| BR-695C3A | 1,539.6 | 1,542.6 | 3.0 | 2.3 | 0.92 | ||

| BR-695C3A | 1,552.9 | 1,566.6 | 13.8 | 10.3 | 23.76 | ||

| BR-695C3A | Including | 1,553.9 | 1,558.8 | 4.8 | 3.6 | 65.51 | |

| BR-770C3 | 1,308.4 | 1,312.2 | 3.9 | 3.0 | 0.60 | Yauro | |

| BR-770C3 | 1,317.9 | 1,334.0 | 16.2 | 12.4 | 0.49 | ||

| BR-770C3 | 1,353.1 | 1,382.5 | 29.5 | 22.7 | 6.51 | ||

| BR-770C3 | Including | 1,357.6 | 1,362.1 | 4.5 | 3.5 | 37.83 | |

| BR-770C3 | 1,393.5 | 1,396.5 | 3.0 | 2.3 | 0.69 | ||

| BR-770C3 | 1,409.5 | 1,417.0 | 7.5 | 5.8 | 0.85 | ||

| BR-770C3 | 1,440.5 | 1,445.5 | 5.0 | 3.9 | 0.57 | ||

| BR-770C3 | 1,456.4 | 1,483.4 | 27.0 | 20.8 | 0.53 | ||

| BR-770C3 | 1,570.7 | 1,574.5 | 3.8 | 2.9 | 1.75 | ||

| BR-770C3 | 1,601.7 | 1,614.8 | 13.1 | 10.1 | 0.57 | ||

| BR-888C2 | 1,990.4 | 1,997.2 | 6.9 | 6.0 | 0.69 | Yuma | |

| BR-888C2 | 2,008.2 | 2,020.6 | 12.3 | 10.7 | 3.88 | ||

| BR-888C2 | Including | 2,009.3 | 2,013.6 | 4.3 | 3.8 | 9.52 | |

| BR-896 | 860.4 | 916.7 | 56.3 | 44.5 | 1.86 | Discovery | |

| BR-896 | Including | 881.6 | 888.4 | 6.8 | 5.4 | 7.82 | |

| BR-896 | 1,132.3 | 1,133.8 | 1.5 | 1.2 | 27.60 | ||

| BR-898A | 880.5 | 936.0 | 55.6 | 48.9 | 1.01 | Discovery | |

| BR-898A | Including | 928.6 | 934.5 | 5.9 | 5.2 | 3.92 | |

| BR-898A | 978.0 | 986.3 | 8.3 | 7.3 | 0.47 | ||

| BR-898A | 997.3 | 1,008.6 | 11.4 | 10.0 | 1.36 | ||

| BR-898A | 1,014.0 | 1,043.0 | 29.0 | 25.5 | 2.30 | ||

| BR-898A | Including | 1,032.0 | 1,034.3 | 2.3 | 2.0 | 3.13 | |

| BR-898A | And including | 1,039.5 | 1,041.5 | 2.0 | 1.8 | 15.56 | |

| BR-898A | 1,060.5 | 1,065.0 | 4.5 | 4.0 | 0.68 | ||

| DL-132C1 | 859.5 | 871.5 | 12.1 | 10.2 | 2.88 | Hinge/Limb | |

| DL-132C1 | Including | 859.5 | 865.4 | 5.9 | 5.0 | 5.52 | |

| DL-132C1 | 1,044.7 | 1,051.5 | 6.8 | 5.8 | 5.47 | ||

| DL-132C1 | Including | 1,044.7 | 1,048.3 | 3.6 | 3.1 | 9.33 | |

| DL-132C1 | 1,136.6 | 1,140.7 | 4.1 | 3.4 | 1.18 | ||

| DL-132C3 | 913.4 | 925.4 | 12.1 | 9.8 | 1.61 | Limb | |

| DL-132C3 | Including | 920.1 | 923.0 | 3.0 | 2.4 | 4.54 | |

| DL-132C4 | 885.3 | 888.7 | 3.5 | 2.9 | 0.55 | Hinge | |

| DL-132C4 | 1,043.1 | 1,059.0 | 15.9 | 13.4 | 6.08 | ||

| DL-132C4 | Including | 1,043.1 | 1,046.8 | 3.7 | 3.1 | 22.65 |

Results are preliminary in nature and are subject to on-going QA/QC. Lengths are subject to rounding.

See Appendix B for a LP long section.

Fort Knox – Manh Choh

At the Kinross-operated, 70%-owned Manh Choh project, processing of ore at the Fort Knox mill began in early July and the first gold bar was poured on July 8, 2024, during a ceremony with the Native Village of Tetlin and Lieutenant Governor of Alaska, Nancy Dahlstrom. Ore transportation has ramped up to planned volumes, full commissioning of the mill modifications is expected to be completed in Q3, and the project remains on track to deliver planned production this year.

Round Mountain

The extension work at Round Mountain is advancing well. At Phase S, mining remains on plan. For the heap leach pad expansion, earthworks and procurement are both complete while deployment of the geomembrane and overliner is advancing.

At Phase X, development of the exploration decline is progressing well, with over 2,200 metres developed to date. Infill drilling on the primary Phase X target began during the second quarter, as planned, alongside continued opportunity drilling outside of the primary Phase X exploration target to extend zones of mineralization. The Company expects to begin receiving the results from within the target mineralization in the third quarter.

The drilling in Q2 has shown exciting results, demonstrating strong grades and widths:

- DX-0052 (from 0m to 32.4m): 32.4m @ 29.6g/t Au Eq

- DX-0052 (from 40.5m to 63.4m): 22.9m @ 11.5 g/t Au Eq

- DX-0053: 18.9m @ 12.3g/t Au Eq

- DX-0040: 20.1m @ 6.5 g/t Au Eq

- DX-0054: 14.6m @ 5.3 g/t Au Eq

These results continue to indicate upside potential for expansion of the target area for mineralization and for the potential of future mining at Phase X. Watch a Round Mountain Phase X animation here.

Curlew Basin exploration

At Curlew, Kinross’ exploration program continued to show positive results at both the Stealth and Roadrunner zones.

Results at Stealth continued to show zones of wider mineralization with strong grades. Drilling is still underway and will continue through the second half of the year. Intercepts to date in 2024 include (true width):

- 1447: 18.7m @ 13.7 g/t Au, includes 4.7m @ 19.4 g/t Au, and 1.4m @ 22.2 g/t Au

- 1447: 6.1m @ 20.9 g/t Au, includes 1.5m @ 56.7 g/t Au

- 1448: 4.6m @ 14.3 g/t Au, includes 1.5m @ 20.7 g/t Au

Delineation drilling at the Roadrunner zone continues with drilling from both surface and underground platforms to document the geometry and continuity. The mineralization at Roadrunner was intercepted again in Q2, as highlighted below:

- 1442: 2.4m @ 12.5 g/t

Chile

Kinross’ activities in Chile are currently focused on La Coipa and potential opportunities to extend its mine life. The Lobo-Marte project continues to provide optionality as a potential large, low-cost mine upon the conclusion of mining at La Coipa. While the Company focuses its technical resources on La Coipa, it will continue to engage and build relationships with communities related to Lobo-Marte and government stakeholders.

Sustainability

Kinross published its 2023 Climate Report, providing comprehensive climate-related disclosures and the Company’s greenhouse gas (GHG) emissions data for 2023. The Climate Report can be accessed here: www.kinross.com/2023-Climate-Report

Kinross continued to advance its Climate Change Strategy during 2023 and is on track to achieve its goal of a 30% reduction in Scope 1 and Scope 2 GHG emissions intensity per ounce, over the 2021 baseline, by 2030. Efforts will continue to further reduce emissions intensity. The Climate Report details the Company’s progress towards the targets outlined in the United Nations Framework Convention on Climate Change (UNFCCC) Paris Agreement and our performance on Kinross’ Climate Change Strategy.

The Climate Report continues to adhere to reporting best practices and ensure that stakeholders have comprehensive information about Kinross’ global efforts to reduce emissions and address the impacts of climate change. Reporting has been in alignment with the Global Reporting Initiative (GRI) Standards since 2007, and in alignment with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) since 2020. The 2023 Climate Report begins the process of alignment with the International Sustainability Standards Board’s IFRS S2 Climate-Related Disclosures standard, which replaces the previous TCFD framework.

Across the Kinross portfolio, all sites and projects maintained a focus on managing climate risk, proactively developing solutions for energy efficiency and contributing to resiliency in host communities. An update of climate risk was completed for all sites and the Company’s renewable energy strategy progressed well, including the completion of a solar power plant at Tasiast. The Company contributed to community resiliency through continued development of solar energy solutions for Colla indigenous communities in Chile, provision of water for semi-nomadic communities near Tasiast, and ongoing engagement with communities and farmers in Paracatu, through the local watershed committee.

Climate-related opportunities are being considered in the planning for the Great Bear project, where the Company is focused on integrating best practices in energy efficiency and low-carbon emissions technologies, mining techniques and environmental stewardship. Energy considerations are being embedded in the proposed design with a focus on mine and mill process optimization, studying electrification of the underground, and energy efficient infrastructure. In the surface design, there is a strong focus on water management, water treatment and water stewardship. Additional design considerations for Great Bear will be reflected in its PEA.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange and the New York Stock Exchange.

Review of operations

| Three months ended June 30, (unaudited) | Gold equivalent ounces | ||||||||||

| Produced | Sold | Production cost of sales ($millions) |

Production cost of sales/equivalent ounce sold |

||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||

| Tasiast | 161,629 | 157,844 | 156,038 | 152,564 | 102.3 | 99.5 | 656 | 652 | |||

| Paracatu | 130,228 | 164,243 | 130,174 | 163,889 | 135.2 | 135.2 | 1,039 | 825 | |||

| La Coipa | 65,851 | 66,744 | 63,506 | 67,378 | 58.8 | 43.6 | 926 | 647 | |||

| Fort Knox | 69,914 | 69,438 | 70,477 | 69,206 | 94.8 | 79.3 | 1,345 | 1,146 | |||

| Round Mountain | 61,787 | 57,446 | 60,049 | 57,412 | 93.9 | 85.5 | 1,564 | 1,489 | |||

| Bald Mountain | 45,929 | 39,321 | 39,818 | 42,181 | 50.6 | 54.5 | 1,271 | 1,292 | |||

| United States Total | 177,630 | 166,205 | 170,344 | 168,799 | 239.3 | 219.3 | 1,405 | 1,299 | |||

| Maricunga | – | – | 698 | 339 | 0.5 | 0.3 | 716 | 885 | |||

| Operations Total | 535,338 | 555,036 | 520,760 | 552,969 | 536.1 | 497.9 | 1,029 | 900 | |||

| Six months ended June 30, (unaudited) | Gold equivalent ounces | ||||||||||

| Produced | Sold | Production cost of sales ($millions) |

Production cost of sales/equivalent ounce sold |

||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||

| Tasiast | 320,828 | 288,889 | 307,052 | 281,043 | 202.0 | 187.9 | 658 | 669 | |||

| Paracatu | 258,501 | 287,577 | 258,284 | 292,233 | 270.9 | 253.2 | 1,049 | 866 | |||

| La Coipa | 137,096 | 120,340 | 134,631 | 129,158 | 110.9 | 88.5 | 824 | 685 | |||

| Fort Knox | 123,264 | 134,825 | 126,769 | 134,610 | 177.3 | 156.9 | 1,399 | 1,166 | |||

| Round Mountain | 130,139 | 116,278 | 128,218 | 115,638 | 184.5 | 182.0 | 1,439 | 1,574 | |||

| Bald Mountain | 92,909 | 73,149 | 87,059 | 89,464 | 102.7 | 112.5 | 1,180 | 1,257 | |||

| United States Total | 346,312 | 324,252 | 342,046 | 339,712 | 464.5 | 451.4 | 1,358 | 1,329 | |||

| Maricunga | – | – | 1,147 | 1,153 | 0.7 | 0.8 | 610 | 694 | |||

| Operations Total | 1,062,737 | 1,021,058 | 1,043,160 | 1,043,299 | 1,049.0 | 981.8 | 1,006 | 941 | |||

Interim condensed consolidated balance sheets

| (unaudited, expressed in millions of U.S. dollars, except share amounts) | ||||||||

| As at | ||||||||

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 480.0 | $ | 352.4 | ||||

| Restricted cash | 9.5 | 9.8 | ||||||

| Accounts receivable and other assets | 276.9 | 268.7 | ||||||

| Current income tax recoverable | 1.5 | 3.4 | ||||||

| Inventories | 1,144.0 | 1,153.0 | ||||||

| Unrealized fair value of derivative assets | 16.5 | 15.0 | ||||||

| 1,928.4 | 1,802.3 | |||||||

| Non-current assets | ||||||||

| Property, plant and equipment | 7,922.6 | 7,963.2 | ||||||

| Long-term investments | 53.0 | 54.7 | ||||||

| Other long-term assets | 722.6 | 710.6 | ||||||

| Deferred tax assets | 12.6 | 12.5 | ||||||

| Total assets | $ | 10,639.2 | $ | 10,543.3 | ||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 546.9 | $ | 531.5 | ||||

| Current income tax payable | 110.1 | 92.9 | ||||||

| Current portion of long-term debt and credit facilities | 799.5 | – | ||||||

| Current portion of provisions | 49.9 | 48.8 | ||||||

| Other current liabilities | 10.6 | 12.3 | ||||||

| 1,517.0 | 685.5 | |||||||

| Non-current liabilities | ||||||||

| Long-term debt and credit facilities | 1,234.5 | 2,232.6 | ||||||

| Provisions | 900.4 | 889.9 | ||||||

| Long-term lease liabilities | 15.4 | 17.5 | ||||||

| Other long-term liabilities | 89.3 | 82.4 | ||||||

| Deferred tax liabilities | 435.2 | 449.7 | ||||||

| Total liabilities | $ | 4,191.8 | $ | 4,357.6 | ||||

| Equity | ||||||||

| Common shareholders’ equity | ||||||||

| Common share capital | $ | 4,486.7 | $ | 4,481.6 | ||||

| Contributed surplus | 10,640.4 | 10,646.0 | ||||||

| Accumulated deficit | (8,738.4 | ) | (8,982.6 | ) | ||||

| Accumulated other comprehensive loss | (68.6 | ) | (61.3 | ) | ||||

| Total common shareholders’ equity | 6,320.1 | 6,083.7 | ||||||

| Non-controlling interests | 127.3 | 102.0 | ||||||

| Total equity | $ | 6,447.4 | $ | 6,185.7 | ||||

| Total liabilities and equity | $ | 10,639.2 | $ | 10,543.3 | ||||

| Common shares | ||||||||

| Authorized | Unlimited | Unlimited | ||||||

| Issued and outstanding | 1,229,025,839 | 1,227,837,974 | ||||||

Interim condensed consolidated statements of operations

| (unaudited, expressed in millions of U.S. dollars, except per share amounts) | ||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | ||||||||||||||||

| Metal sales | $ | 1,219.5 | $ | 1,092.3 | $ | 2,301.0 | $ | 2,021.6 | ||||||||

| Cost of sales | ||||||||||||||||

| Production cost of sales | 536.1 | 497.9 | 1,049.0 | 981.8 | ||||||||||||

| Depreciation, depletion and amortization | 295.8 | 239.3 | 566.5 | 451.2 | ||||||||||||

| Total cost of sales | 831.9 | 737.2 | 1,615.5 | 1,433.0 | ||||||||||||

| Gross profit | 387.6 | 355.1 | 685.5 | 588.6 | ||||||||||||

| Other operating expense | 1.9 | 36.0 | 29.5 | 67.2 | ||||||||||||

| Exploration and business development | 55.7 | 49.3 | 97.4 | 83.3 | ||||||||||||

| General and administrative | 31.7 | 32.0 | 67.1 | 56.4 | ||||||||||||

| Operating earnings | 298.3 | 237.8 | 491.5 | 381.7 | ||||||||||||

| Other income (expense) – net | 5.7 | (10.4 | ) | 5.8 | (6.0 | ) | ||||||||||

| Finance income | 4.5 | 11.5 | 8.4 | 20.9 | ||||||||||||

| Finance expense | (21.8 | ) | (26.0 | ) | (43.3 | ) | (53.5 | ) | ||||||||

| Earnings before tax | 286.7 | 212.9 | 462.4 | 343.1 | ||||||||||||

| Income tax expense – net | (77.8 | ) | (62.0 | ) | (146.9 | ) | (101.8 | ) | ||||||||

| Net earnings | $ | 208.9 | $ | 150.9 | $ | 315.5 | $ | 241.3 | ||||||||

| Net earnings (loss) from continuing operations attributable to: | ||||||||||||||||

| Non-controlling interests | $ | (2.0 | ) | $ | (0.1 | ) | $ | (2.4 | ) | $ | 0.1 | |||||

| Common shareholders | $ | 210.9 | $ | 151.0 | $ | 317.9 | $ | 241.2 | ||||||||

| Earnings per share attributable to common shareholders | ||||||||||||||||

| Basic | $ | 0.17 | $ | 0.12 | $ | 0.26 | $ | 0.20 | ||||||||

| Diluted | $ | 0.17 | $ | 0.12 | $ | 0.26 | $ | 0.20 | ||||||||

Interim condensed consolidated statements of cash flows

| (unaudited, expressed in millions of U.S. dollars) | ||||||||||||||||

| Three months ended | Six months ended | |||||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net inflow (outflow) of cash related to the following activities: | ||||||||||||||||

| Operating: | ||||||||||||||||

| Net earnings | $ | 208.9 | $ | 150.9 | $ | 315.5 | $ | 241.3 | ||||||||

| Adjustments to reconcile net earnings to net cash provided from operating activities: | ||||||||||||||||

| Depreciation, depletion and amortization | 295.8 | 239.3 | 566.5 | 451.2 | ||||||||||||

| Share-based compensation expense | 2.8 | 2.0 | 5.3 | 1.4 | ||||||||||||

| Finance expense | 21.8 | 26.0 | 43.3 | 53.5 | ||||||||||||

| Deferred tax (recovery) expense | (21.2 | ) | 9.7 | (12.6 | ) | 18.7 | ||||||||||

| Foreign exchange losses (gains) and other | (7.1 | ) | 31.2 | 7.9 | 21.8 | |||||||||||

| Reclamation expense | – | – | – | 4.0 | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| Accounts receivable and other assets | 41.0 | 42.2 | 51.3 | 87.6 | ||||||||||||

| Inventories | 2.5 | (39.9 | ) | 8.4 | (83.1 | ) | ||||||||||

| Accounts payable and accrued liabilities | 112.2 | 91.2 | 124.3 | 85.4 | ||||||||||||

| Cash flow provided from operating activities | 656.7 | 552.6 | 1,109.9 | 881.8 | ||||||||||||

| Income taxes paid | (52.7 | ) | (24.0 | ) | (131.5 | ) | (94.2 | ) | ||||||||

| Net cash flow provided from operating activities | 604.0 | 528.6 | 978.4 | 787.6 | ||||||||||||

| Investing: | ||||||||||||||||

| Additions to property, plant and equipment | (274.2 | ) | (281.9 | ) | (516.1 | ) | (503.1 | ) | ||||||||

| Interest paid capitalized to property, plant and equipment | (17.0 | ) | (8.5 | ) | (51.9 | ) | (46.8 | ) | ||||||||

| Net (additions) disposals to long-term investments and other assets | (15.7 | ) | (10.4 | ) | (18.8 | ) | 4.9 | |||||||||

| Decrease in restricted cash – net | 0.8 | 2.2 | 0.3 | 1.4 | ||||||||||||

| Interest received and other – net | 3.8 | 4.2 | 7.7 | 6.9 | ||||||||||||

| Net cash flow of continuing operations used in investing activities | (302.3 | ) | (294.4 | ) | (578.8 | ) | (536.7 | ) | ||||||||

| Net cash flow of discontinued operations provided from investing activities | – | 40.0 | – | 45.0 | ||||||||||||

| Financing: | ||||||||||||||||

| Proceeds from drawdown of debt | – | – | – | 100.0 | ||||||||||||

| Repayment of debt | (200.0 | ) | (220.0 | ) | (200.0 | ) | (220.0 | ) | ||||||||

| Interest paid | – | (2.3 | ) | (18.5 | ) | (26.5 | ) | |||||||||

| Payment of lease liabilities | (3.4 | ) | (5.6 | ) | (6.8 | ) | (21.1 | ) | ||||||||

| Funding from non-controlling interest | 11.7 | 6.7 | 27.2 | 11.8 | ||||||||||||

| Dividends paid to common shareholders | (36.8 | ) | (36.9 | ) | (73.7 | ) | (73.7 | ) | ||||||||

| Other – net | – | (9.6 | ) | 0.3 | (7.5 | ) | ||||||||||

| Net cash flow used in financing activities | (228.5 | ) | (267.7 | ) | (271.5 | ) | (237.0 | ) | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | (0.1 | ) | 0.9 | (0.5 | ) | 1.4 | ||||||||||

| Increase in cash and cash equivalents | 73.1 | 7.4 | 127.6 | 60.3 | ||||||||||||

| Cash and cash equivalents, beginning of period | 406.9 | 471.0 | 352.4 | 418.1 | ||||||||||||

| Cash and cash equivalents, end of period | $ | 480.0 | $ | 478.4 | $ | 480.0 | $ | 478.4 | ||||||||

|

Operating Summary |

|||||||||||||||||||||||||

| Mine | Period | Tonnes Ore Mined | Tonnes Waste Mined | Ore Processed (Milled) | Ore Processed (Heap Leach) | Grade (Mill) | Grade (Heap Leach) | Recovery (a)(b) | Silver Grade | Silver Recovery | Gold Eq Production(c) | Gold Eq Sales(c) | Production cost of sales | Production cost of sales/oz(d) | Cap Ex – sustaining(e) | Total Cap Ex (e) | DD&A | ||||||||

| (‘000 tonnes) | (‘000 tonnes) | (‘000 tonnes) | (‘000 tonnes) | (g/t) | (g/t) | (%) | (g/t) | (%) | (ounces) | (ounces) | ($ millions) | ($/ounce) | ($ millions) | ($ millions) | ($ millions) | ||||||||||

| West Africa | Tasiast | Q2 2024 | 1,985 | 14,051 | 2,161 | – | 2.70 | – | 92 | % | 161,629 | 156,038 | $ | 102.3 | $ | 656 | $ | 7.0 | $ | 75.2 | $ | 84.0 | |||

| Q1 2024 | 2,044 | 15,145 | 2,073 | – | 2.46 | – | 91 | % | 159,199 | 151,014 | $ | 99.7 | $ | 660 | $ | 10.1 | $ | 79.5 | $ | 77.9 | |||||

| Q4 2023 | 2,937 | 14,062 | 2,056 | – | 3.04 | – | 93 | % | 160,764 | 171,199 | $ | 110.4 | $ | 645 | $ | 9.7 | $ | 85.2 | $ | 70.6 | |||||

| Q3 2023 | 3,486 | 12,231 | 1,796 | – | 3.10 | – | 92 | % | 171,140 | 162,823 | $ | 108.5 | $ | 666 | $ | 12.2 | $ | 77.3 | $ | 69.0 | |||||

| Q2 2023 | 1,688 | 12,996 | 1,663 | – | 3.25 | – | 93 | % | 157,844 | 152,564 | $ | 99.5 | $ | 652 | $ | 9.1 | $ | 81.9 | $ | 58.6 | |||||

| Americas | Paracatu | Q2 2024 | 14,094 | 12,108 | 15,053 | – | 0.35 | – | 80 | % | 130,228 | 130,174 | $ | 135.2 | $ | 1,039 | $ | 44.6 | $ | 44.6 | $ | 45.7 | |||

| Q1 2024 | 14,078 | 13,583 | 15,609 | – | 0.31 | – | 79 | % | 128,273 | 128,110 | $ | 135.7 | $ | 1,059 | $ | 19.6 | $ | 19.6 | $ | 46.7 | |||||

| Q4 2023 | 16,865 | 11,619 | 15,279 | – | 0.35 | – | 79 | % | 127,940 | 132,886 | $ | 144.2 | $ | 1,085 | $ | 41.6 | $ | 41.6 | $ | 43.3 | |||||

| Q3 2023 | 14,725 | 10,070 | 14,669 | – | 0.41 | – | 79 | % | 172,482 | 167,105 | $ | 141.2 | $ | 845 | $ | 58.4 | $ | 58.4 | $ | 53.1 | |||||

| Q2 2023 | 14,199 | 10,948 | 15,104 | – | 0.42 | – | 80 | % | 164,243 | 163,889 | $ | 135.2 | $ | 825 | $ | 39.7 | $ | 39.7 | $ | 49.8 | |||||

| La Coipa(f) | Q2 2024 | 690 | 3,773 | 882 | – | 1.97 | – | 84 | % | 65.02 | 51 | % | 65,851 | 63,506 | $ | 58.8 | $ | 926 | $ | 10.7 | $ | 10.7 | $ | 45.8 | |

| Q1 2024 | 1,035 | 2,696 | 827 | – | 2.09 | – | 87 | % | 87.20 | 58 | % | 71,245 | 71,125 | $ | 52.1 | $ | 733 | $ | 7.2 | $ | 7.2 | $ | 50.0 | ||

| Q4 2023 | 1,591 | 3,762 | 1,188 | – | 1.92 | – | 78 | % | 96.24 | 44 | % | 73,823 | 73,477 | $ | 52.9 | $ | 720 | $ | 7.0 | $ | 10.9 | $ | 54.8 | ||

| Q3 2023 | 1,137 | 5,597 | 1,017 | – | 1.69 | – | 81 | % | 106.70 | 63 | % | 65,975 | 65,856 | $ | 41.4 | $ | 629 | $ | 7.5 | $ | 15.2 | $ | 48.3 | ||

| Q2 2023 | 869 | 8,009 | 971 | – | 1.62 | – | 81 | % | 109.84 | 56 | % | 66,744 | 67,378 | $ | 43.6 | $ | 647 | $ | 19.9 | $ | 23.3 | $ | 48.3 | ||

| Fort Knox (100%)(g) | Q2 2024 | 8,331 | 13,667 | 2,003 | 6,385 | 0.85 | 0.22 | 81 | % | 69,914 | 70,477 | $ | 94.8 | $ | 1,345 | $ | 47.6 | $ | 89.2 | $ | 25.9 | ||||

| Q1 2024 | 10,037 | 12,211 | 1,850 | 8,778 | 0.67 | 0.24 | 76 | % | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 78.6 | $ | 20.5 | |||||

| Q4 2023 | 11,018 | 9,042 | 2,173 | 9,930 | 0.69 | 0.22 | 78 | % | 84,215 | 81,306 | $ | 104.3 | $ | 1,283 | $ | 50.6 | $ | 114.3 | $ | 31.5 | |||||

| Q3 2023 | 6,667 | 12,265 | 1,912 | 5,961 | 0.81 | 0.21 | 78 | % | 71,611 | 71,616 | $ | 82.3 | $ | 1,149 | $ | 52.1 | $ | 96.0 | $ | 24.6 | |||||

| Q2 2023 | 7,624 | 9,426 | 2,075 | 6,837 | 0.82 | 0.24 | 82 | % | 69,438 | 69,206 | $ | 79.3 | $ | 1,146 | $ | 52.1 | $ | 90.3 | $ | 22.1 | |||||

| Fort Knox (attributable)(g) | Q2 2024 | 8,249 | 12,627 | 2,003 | 6,385 | 0.85 | 0.22 | 81 | % | 69,914 | 70,477 | $ | 94.8 | $ | 1,345 | $ | 47.6 | $ | 79.5 | $ | 25.9 | ||||

| Q1 2024 | 10,009 | 11,271 | 1,850 | 8,778 | 0.67 | 0.24 | 76 | % | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 68.8 | $ | 20.5 | |||||

| Q4 2023 | 11,014 | 8,211 | 2,173 | 9,930 | 0.69 | 0.22 | 78 | % | 84,215 | 81,306 | $ | 104.3 | $ | 1,283 | $ | 50.6 | $ | 100.7 | $ | 31.5 | |||||

| Q3 2023 | 6,667 | 11,970 | 1,912 | 5,961 | 0.81 | 0.21 | 78 | % | 71,611 | 71,616 | $ | 82.3 | $ | 1,149 | $ | 52.1 | $ | 84.5 | $ | 24.6 | |||||

| Q2 2023 | 7,624 | 9,426 | 2,075 | 6,837 | 0.82 | 0.24 | 82 | % | 69,438 | 69,206 | $ | 79.3 | $ | 1,146 | $ | 52.1 | $ | 81.5 | $ | 22.1 | |||||

| Round Mountain | Q2 2024 | 2,956 | 12,069 | 806 | 1,541 | 1.11 | 0.35 | 73 | % | 61,787 | 60,049 | $ | 93.9 | $ | 1,564 | $ | 2.1 | $ | 37.2 | $ | 65.9 | ||||

| Q1 2024 | 4,246 | 7,849 | 960 | 3,257 | 1.32 | 0.37 | 73 | % | 68,352 | 68,169 | $ | 90.6 | $ | 1,329 | $ | 3.7 | $ | 19.3 | $ | 47.3 | |||||

| Q4 2023 | 4,666 | 4,640 | 884 | 2,729 | 0.91 | 0.48 | 68 | % | 55,764 | 56,495 | $ | 82.6 | $ | 1,462 | $ | 4.6 | $ | 4.8 | $ | 45.0 | |||||

| Q3 2023 | 8,474 | 3,618 | 911 | 7,644 | 0.75 | 0.38 | 75 | % | 63,648 | 61,931 | $ | 93.1 | $ | 1,503 | $ | 7.7 | $ | 7.8 | $ | 44.1 | |||||

| Q2 2023 | 10,496 | 6,119 | 1,021 | 10,028 | 0.67 | 0.35 | 76 | % | 57,446 | 57,412 | $ | 85.5 | $ | 1,489 | $ | 10.5 | $ | 10.5 | $ | 33.5 | |||||

| Bald Mountain | Q2 2024 | 2,906 | 16,020 | – | 2,906 | – | 0.47 | nm | 45,929 | 39,818 | $ | 50.6 | $ | 1,271 | $ | 4.4 | $ | 4.6 | $ | 27.0 | |||||

| Q1 2024 | 1,480 | 14,896 | – | 1,480 | – | 0.42 | nm | 46,980 | 47,241 | $ | 52.1 | $ | 1,103 | $ | 32.4 | $ | 32.4 | $ | 27.0 | ||||||

| Q4 2023 | 3,894 | 14,556 | – | 3,918 | – | 0.47 | nm | 44,007 | 49,375 | $ | 57.1 | $ | 1,156 | $ | 36.3 | $ | 38.8 | $ | 25.0 | ||||||

| Q3 2023 | 7,412 | 7,330 | – | 7,412 | – | 0.39 | nm | 40,593 | 41,300 | $ | 53.9 | $ | 1,305 | $ | 20.6 | $ | 24.9 | $ | 23.3 | ||||||

| Q2 2023 | 4,142 | 11,319 | – | 4,119 | – | 0.42 | nm | 39,321 | 42,181 | $ | 54.5 | $ | 1,292 | $ | 16.5 | $ | 31.4 | $ | 25.6 | ||||||

| (a) Due to the nature of heap leach operations, recovery rates at Bald Mountain cannot be accurately measured on a quarterly basis. Recovery rates at Fort Knox and Round Mountain represent mill recovery only. | |||||||||||||||||||||||||

| (b) “nm” means not meaningful. | |||||||||||||||||||||||||

| (c) Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the average spot market prices for the commodities for each period. The ratios for the quarters presented are as follows: Q2 2024: 81.06:1; Q1 2024: 88.70:1; Q4 2023: 85.00:1; Q3 2023: 81.82:1; Q2 2023: 81.88:1. | |||||||||||||||||||||||||

| (d) “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | |||||||||||||||||||||||||

| (e) “Total Cap Ex” is as reported as “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. “Cap Ex – sustaining” is a non-GAAP financial measure. The definition and reconciliation of this non-GAAP financial measure is included on pages 20 and 21 of this news release. | |||||||||||||||||||||||||

| (f) La Coipa silver grade and recovery were as follows: Q2 2024: 65.02 g/t, 51%; Q1 2024: 87.20 g/t, 58%; Q4 2023: 96.24 g/t, 44%; Q3 2023: 106.70 g/t, 63%; Q2 2023: 109.84 g/t, 56%. | |||||||||||||||||||||||||

| (g) The Fort Knox segment is composed of Fort Knox and Manh Choh, and comparative results shown are presented in accordance with the current year’s presentation. Manh Choh tonnes of ore processed and grade were nil for all periods presented as production commenced in July 2024. The attributable results for Fort Knox include 100% of Fort Knox and 70% of Manh Choh. | |||||||||||||||||||||||||

APPENDIX A

Recent LP zone assay results

| Hole ID | From (m) |

To (m) |

Width (m) |

True Width (m) |

Au (g/t) |

Target | |

| BR-695C3A | 1,523.1 | 1,526.1 | 3.0 | 2.3 | 0.50 | Yuma | |

| BR-695C3A | 1,539.6 | 1,542.6 | 3.0 | 2.3 | 0.92 | ||

| BR-695C3A | 1,552.9 | 1,566.6 | 13.8 | 10.3 | 23.76 | ||

| BR-695C3A | Including | 1,553.9 | 1,558.8 | 4.8 | 3.6 | 65.51 | |

| BR-695C4 | 1,339.6 | 1,345.0 | 5.4 | 4.5 | 2.08 | Yuma | |

| BR-695C4 | 1,512.9 | 1,516.4 | 3.5 | 2.9 | 0.56 | ||

| BR-695C4 | 1,522.8 | 1,559.3 | 36.6 | 30.7 | 0.73 | ||

| BR-695C4 | 1,572.0 | 1,577.1 | 5.1 | 4.3 | 0.53 | ||

| BR-699C1 | 697.7 | 710.0 | 12.3 | 9.2 | 1.28 | Yauro | |

| BR-699C1 | 717.3 | 721.3 | 4.0 | 3.0 | 0.67 | ||

| BR-699C1 | 1,168.5 | 1,173.0 | 4.5 | 3.4 | 1.19 | ||

| BR-699C1 | 1,179.0 | 1,182.0 | 3.0 | 2.3 | 29.90 | ||

| BR-699C1 | 1,198.5 | 1,201.5 | 3.0 | 2.3 | 2.27 | ||

| BR-708AC3 | 1,386.7 | 1,389.8 | 3.0 | 2.7 | 0.97 | Yauro | |

| BR-708AC4 | 1,404.8 | 1,435.7 | 30.9 | 22.9 | 1.43 | Yauro | |

| BR-708AC4 | Including | 1,418.0 | 1,419.0 | 1.0 | 0.7 | 26.40 | |

| BR-708AC5 | No Significant Intersections | Yauro | |||||

| BR-708AC6 | 1,229.9 | 1,233.6 | 3.7 | 3.2 | 0.86 | Yauro | |

| BR-708AC6 | 1,249.0 | 1,252.5 | 3.5 | 3.0 | 1.12 | ||

| BR-708AC6 | 1,321.8 | 1,325.0 | 3.2 | 2.8 | 11.22 | ||

| BR-708AC6 | Including | 1,321.8 | 1,324.0 | 2.2 | 1.9 | 16.04 | |

| BR-708AC6 | 1,376.0 | 1,379.0 | 3.0 | 2.6 | 2.68 | ||

| BR-770C2C | 1,250.7 | 1,257.0 | 6.3 | 5.1 | 0.40 | Yauro | |

| BR-770C2C | 1,312.8 | 1,324.2 | 11.4 | 9.2 | 3.83 | ||

| BR-770C2C | Including | 1,312.8 | 1,313.3 | 0.5 | 0.4 | 78.80 | |

| BR-770C2C | 1,476.0 | 1,497.1 | 21.1 | 17.1 | 0.61 | ||

| BR-770C3 | 1,308.4 | 1,312.2 | 3.9 | 3.0 | 0.60 | Yauro | |

| BR-770C3 | 1,317.9 | 1,334.0 | 16.2 | 12.4 | 0.49 | ||

| BR-770C3 | 1,353.1 | 1,382.5 | 29.5 | 22.7 | 6.51 | ||

| BR-770C3 | Including | 1,357.6 | 1,362.1 | 4.5 | 3.5 | 37.83 | |

| BR-770C3 | 1,393.5 | 1,396.5 | 3.0 | 2.3 | 0.69 | ||

| BR-770C3 | 1,409.5 | 1,417.0 | 7.5 | 5.8 | 0.85 | ||

| BR-770C3 | 1,440.5 | 1,445.5 | 5.0 | 3.9 | 0.57 | ||

| BR-770C3 | 1,456.4 | 1,483.4 | 27.0 | 20.8 | 0.53 | ||

| BR-770C3 | 1,570.7 | 1,574.5 | 3.8 | 2.9 | 1.75 | ||

| BR-770C3 | 1,601.7 | 1,614.8 | 13.1 | 10.1 | 0.57 | ||

| BR-770C4 | 1,307.5 | 1,310.5 | 3.0 | 2.1 | 1.22 | Yauro | |

| BR-770C5 | 1,280.5 | 1,283.5 | 3.0 | 2.3 | 0.66 | Yauro | |

| BR-770C5 | 1,293.5 | 1,299.0 | 5.5 | 4.2 | 2.51 | ||

| BR-770C5 | Including | 1,295.4 | 1,298.1 | 2.7 | 2.1 | 4.54 | |

| BR-770C5 | 1,356.0 | 1,359.0 | 3.0 | 2.3 | 0.58 | ||

| BR-770C5 | 1,365.3 | 1,403.8 | 38.5 | 29.2 | 1.05 | ||

| BR-770C5 | Including | 1,392.7 | 1,398.8 | 6.0 | 4.6 | 3.26 | |

| BR-770C5 | 1,410.2 | 1,418.0 | 7.8 | 6.0 | 0.83 | ||

| BR-770C5 | 1,458.5 | 1,463.1 | 4.5 | 3.5 | 0.70 | ||

| BR-770C5 | 1,519.2 | 1,528.1 | 8.8 | 6.7 | 3.80 | ||

| BR-770C5 | Including | 1,524.5 | 1,528.1 | 3.5 | 2.7 | 7.81 | |

| BR-843AC4 | 1,252.2 | 1,256.5 | 4.3 | 3.5 | 0.89 | Yuma | |

| BR-843AC4 | 1,353.2 | 1,356.2 | 3.0 | 2.4 | 0.39 | ||

| BR-843AC4 | 1,379.6 | 1,410.0 | 30.4 | 24.6 | 1.65 | ||

| BR-843AC4 | Including | 1,393.0 | 1,393.5 | 0.5 | 0.4 | 68.50 | |

| BR-843AC4 | 1,420.9 | 1,457.9 | 37.0 | 30.0 | 0.90 | ||

| BR-843AC4 | Including | 1,421.9 | 1,427.0 | 5.0 | 4.1 | 3.70 | |

| BR-843AC4 | 1,477.2 | 1,482.8 | 5.5 | 4.5 | 0.70 | ||

| BR-843AC4 | 1,503.2 | 1,506.7 | 3.5 | 2.8 | 0.53 | ||

| BR-843AC5 | 1,394.0 | 1,398.0 | 4.0 | 3.4 | 0.45 | Yuma | |

| BR-843AC5 | 1,412.4 | 1,432.4 | 20.1 | 16.8 | 1.36 | ||

| BR-843AC5 | Including | 1,429.0 | 1,431.4 | 2.3 | 2.0 | 8.53 | |

| BR-843AC5 | 1,446.0 | 1,451.0 | 5.0 | 4.2 | 0.44 | ||

| BR-843AC5 | 1,503.0 | 1,511.0 | 8.0 | 6.7 | 0.59 | ||

| BR-843AC6A | 1,288.5 | 1,302.0 | 13.5 | 11.2 | 1.73 | Yuma | |

| BR-843AC6A | 1,308.4 | 1,319.5 | 11.1 | 9.2 | 4.39 | ||

| BR-843AC6A | Including | 1,308.4 | 1,311.8 | 3.4 | 2.8 | 13.33 | |

| BR-843AC6A | 1,323.5 | 1,327.9 | 4.4 | 3.7 | 0.38 | ||

| BR-843AC6A | 1,334.2 | 1,408.5 | 74.3 | 61.7 | 0.53 | ||

| BR-843AC7 | 1,300.0 | 1,303.0 | 3.0 | 2.4 | 1.33 | Yuma | |

| BR-843AC7 | 1,308.7 | 1,314.2 | 5.5 | 4.5 | 0.60 | ||

| BR-843AC7 | 1,324.5 | 1,329.0 | 4.5 | 3.6 | 0.52 | ||

| BR-843AC7 | 1,334.9 | 1,341.0 | 6.2 | 5.0 | 0.67 | ||

| BR-843AC7 | 1,398.4 | 1,401.8 | 3.3 | 2.7 | 0.50 | ||

| BR-844C4 | 1,366.5 | 1,369.5 | 3.0 | 2.3 | 0.45 | Bruma | |

| BR-844C5 | 1,434.0 | 1,438.7 | 4.7 | 4.2 | 0.86 | Bruma | |

| BR-857 | 1,060.5 | 1,065.0 | 4.5 | 3.2 | 0.48 | Discovery | |

| BR-857 | 1,218.0 | 1,246.5 | 28.5 | 20.5 | 0.45 | ||

| BR-857 | 1,254.0 | 1,260.2 | 6.2 | 4.4 | 0.85 | ||

| BR-857 | 1,294.7 | 1,299.0 | 4.3 | 3.1 | 0.91 | ||

| BR-858 | 1,068.7 | 1,074.0 | 5.3 | 3.9 | 0.91 | Bruma | |

| BR-858 | 1,115.0 | 1,130.0 | 15.0 | 11.1 | 0.69 | ||

| BR-858 | 1,144.2 | 1,151.0 | 6.8 | 5.0 | 0.80 | ||

| BR-859 | 631.5 | 639.5 | 8.0 | 5.6 | 0.45 | Discovery | |

| BR-859 | 849.7 | 865.6 | 15.9 | 11.3 | 1.14 | ||

| BR-873 | 851.4 | 855.0 | 3.6 | 2.9 | 2.94 | Yuma | |

| BR-873 | 860.3 | 864.1 | 3.9 | 3.1 | 0.86 | ||

| BR-873 | 971.7 | 983.1 | 11.5 | 9.2 | 0.42 | ||

| BR-873 | 1,009.6 | 1,018.7 | 9.1 | 7.3 | 1.37 | ||

| BR-873 | 1,026.0 | 1,038.0 | 12.1 | 9.6 | 4.12 | ||

| BR-873 | Including | 1,032.5 | 1,033.7 | 1.3 | 1.0 | 31.18 | |

| BR-873 | 1,044.0 | 1,047.0 | 3.0 | 2.4 | 0.43 | ||

| BR-873 | 1,059.0 | 1,063.5 | 4.5 | 3.6 | 0.56 | ||

| BR-873 | 1,071.0 | 1,076.0 | 5.0 | 4.0 | 0.55 | ||

| BR-873 | 1,099.8 | 1,104.3 | 4.5 | 3.6 | 0.58 | ||

| BR-874 | 895.5 | 898.5 | 3.0 | 2.4 | 0.48 | Yuma | |

| BR-874 | 910.9 | 916.1 | 5.2 | 4.1 | 0.98 | ||

| BR-874 | 957.5 | 966.0 | 8.5 | 6.7 | 0.40 | ||

| BR-874 | 978.7 | 981.8 | 3.1 | 2.4 | 0.49 | ||

| BR-875 | 861.6 | 885.2 | 23.6 | 19.5 | 0.43 | Discovery | |

| BR-875 | 909.5 | 917.7 | 8.2 | 6.8 | 1.17 | ||

| BR-875 | 943.5 | 946.5 | 3.0 | 2.5 | 0.31 | ||

| BR-875 | 960.0 | 967.0 | 7.0 | 5.8 | 0.76 | ||

| BR-875 | 980.0 | 997.5 | 17.5 | 14.5 | 3.00 | ||

| BR-875 | Including | 981.0 | 984.6 | 3.6 | 3.0 | 11.48 | |

| BR-875 | 1,006.0 | 1,017.0 | 11.0 | 9.1 | 0.51 | ||

| BR-876 | 681.6 | 714.7 | 33.1 | 27.5 | 1.03 | Discovery | |

| BR-876 | Including | 683.5 | 685.9 | 2.4 | 2.0 | 4.15 | |

| BR-876 | 721.5 | 733.5 | 12.0 | 10.0 | 0.63 | ||

| BR-876 | 790.5 | 794.7 | 4.2 | 3.5 | 0.96 | ||

| BR-876 | 887.9 | 906.0 | 18.1 | 15.0 | 0.64 | ||

| BR-877 | 762.9 | 803.0 | 40.2 | 33.7 | 0.65 | Discovery | |

| BR-877 | 817.6 | 832.5 | 14.9 | 12.5 | 0.57 | ||

| BR-877 | 846.8 | 898.2 | 51.4 | 43.1 | 0.76 | ||

| BR-877 | Including | 881.5 | 882.0 | 0.5 | 0.4 | 42.50 | |

| BR-879 | 895.5 | 898.5 | 3.0 | 2.6 | 0.43 | Discovery | |

| BR-879 | 967.6 | 983.2 | 15.6 | 13.4 | 0.91 | ||

| BR-879 | 992.0 | 995.1 | 3.1 | 2.7 | 1.01 | ||

| BR-879 | 1,035.0 | 1,053.2 | 18.2 | 15.7 | 0.76 | ||

| BR-887 | 1,046.1 | 1,055.0 | 8.9 | 6.4 | 2.55 | Yuma | |

| BR-887 | 1,106.3 | 1,113.8 | 7.5 | 5.4 | 0.96 | ||

| BR-887 | 1,206.3 | 1,221.9 | 15.6 | 11.2 | 7.55 | ||

| BR-887 | Including | 1,208.1 | 1,216.9 | 8.8 | 6.3 | 12.92 | |

| BR-887 | 1,228.4 | 1,241.4 | 13.0 | 9.4 | 1.09 | ||

| BR-888 | 1,850.4 | 1,854.0 | 3.6 | 3.1 | 1.42 | Yuma | |

| BR-888 | 2,002.3 | 2,024.2 | 21.9 | 19.1 | 2.34 | ||

| BR-888 | Including | 2,008.6 | 2,015.0 | 6.4 | 5.6 | 3.14 | |

| BR-888 | And including | 2,021.1 | 2,024.2 | 3.1 | 2.7 | 5.76 | |

| BR-888C1 | 1,988.5 | 2,051.2 | 62.7 | 50.8 | 0.95 | Yuma | |

| BR-888C2 | 1,990.4 | 1,997.2 | 6.9 | 6.0 | 0.69 | Yuma | |

| BR-888C2 | 2,008.2 | 2,020.6 | 12.3 | 10.7 | 3.88 | ||

| BR-888C2 | Including | 2,009.3 | 2,013.6 | 4.3 | 3.8 | 9.52 | |

| BR-892 | 1,049.6 | 1,078.8 | 29.2 | 23.1 | 0.71 | Discovery | |

| BR-892 | 1,086.3 | 1,091.3 | 5.0 | 3.9 | 0.70 | ||

| BR-892 | 1,110.0 | 1,113.0 | 3.0 | 2.4 | 0.62 | ||

| BR-892 | 1,119.9 | 1,147.8 | 27.8 | 22.0 | 1.20 | ||

| BR-892 | Including | 1,143.8 | 1,147.8 | 4.0 | 3.2 | 4.60 | |

| BR-892 | 1,162.5 | 1,179.0 | 16.5 | 13.0 | 0.43 | ||

| BR-893 | 990.0 | 993.3 | 3.3 | 2.7 | 4.03 | Discovery | |

| BR-893 | Including | 990.0 | 992.5 | 2.5 | 2.1 | 5.14 | |

| BR-893 | 1,027.2 | 1,031.8 | 4.6 | 3.9 | 0.80 | ||

| BR-893 | 1,053.3 | 1,057.9 | 4.7 | 3.9 | 0.79 | ||

| BR-893 | 1,065.7 | 1,096.1 | 30.4 | 25.5 | 0.48 | ||

| BR-893 | 1,112.3 | 1,120.4 | 8.1 | 6.8 | 0.72 | ||

| BR-893 | 1,158.4 | 1,163.2 | 4.8 | 4.0 | 1.08 | ||

| BR-893 | 1,179.0 | 1,183.5 | 4.5 | 3.8 | 0.41 | ||

| BR-893 | 1,211.2 | 1,215.2 | 4.0 | 3.4 | 0.69 | ||

| BR-894 | 168.3 | 174.0 | 5.7 | 4.7 | 0.85 | Discovery | |

| BR-894 | 964.6 | 972.5 | 7.9 | 6.6 | 0.81 | ||

| BR-894 | 988.4 | 992.3 | 3.9 | 3.2 | 0.39 | ||

| BR-894 | 1,047.5 | 1,089.6 | 42.1 | 35.0 | 1.26 | ||

| BR-894 | Including | 1,056.7 | 1,059.0 | 2.3 | 1.9 | 3.64 | |

| BR-894 | 1,110.2 | 1,120.2 | 10.0 | 8.3 | 0.61 | ||

| BR-894 | 1,123.3 | 1,126.6 | 3.3 | 2.7 | 0.52 | ||

| BR-895 | 1,027.5 | 1,032.0 | 4.5 | 4.0 | 0.63 | Discovery | |

| BR-895 | 1,211.5 | 1,239.5 | 28.0 | 24.9 | 1.10 | ||

| BR-895 | Including | 1,216.3 | 1,219.6 | 3.3 | 3.0 | 3.86 | |

| BR-895 | 1,247.6 | 1,264.5 | 17.0 | 15.1 | 0.68 | ||

| BR-895 | 1,271.0 | 1,279.8 | 8.8 | 7.8 | 0.40 | ||

| BR-895 | 1,283.6 | 1,303.7 | 20.1 | 17.9 | 0.79 | ||

| BR-895 | 1,382.5 | 1,385.9 | 3.4 | 3.0 | 1.24 | ||

| BR-896 | 860.4 | 916.7 | 56.3 | 44.5 | 1.86 | Discovery | |

| BR-896 | Including | 881.6 | 888.4 | 6.8 | 5.4 | 7.82 | |

| BR-896 | 1,132.3 | 1,133.8 | 1.5 | 1.2 | 27.60 | ||

| BR-897A | 738.0 | 793.3 | 55.3 | 40.9 | 0.77 | Discovery | |

| BR-897A | 847.5 | 870.7 | 23.2 | 17.2 | 0.73 | ||

| BR-897A | 891.4 | 894.4 | 3.0 | 2.2 | 0.60 | ||

| BR-898A | 880.5 | 936.0 | 55.6 | 48.9 | 1.01 | Discovery | |

| BR-898A | Including | 928.6 | 934.5 | 5.9 | 5.2 | 3.92 | |

| BR-898A | 978.0 | 986.3 | 8.3 | 7.3 | 0.47 | ||

| BR-898A | 997.3 | 1,008.6 | 11.4 | 10.0 | 1.36 | ||

| BR-898A | 1,014.0 | 1,043.0 | 29.0 | 25.5 | 2.30 | ||

| BR-898A | Including | 1,032.0 | 1,034.3 | 2.3 | 2.0 | 3.13 | |

| BR-898A | And including | 1,039.5 | 1,041.5 | 2.0 | 1.8 | 15.56 | |

| BR-898A | 1,060.5 | 1,065.0 | 4.5 | 4.0 | 0.68 | ||

| BR-900BC1B | 1,059.0 | 1,065.5 | 6.5 | 5.7 | 0.46 | Yauro | |

| BR-900BC1B | 1,092.3 | 1,098.4 | 6.2 | 5.4 | 5.71 | ||

| BR-900BC1B | Including | 1,095.3 | 1,096.3 | 1.0 | 0.9 | 32.20 | |

| BR-900BC2A | 1,002.2 | 1,014.0 | 11.9 | 10.2 | 3.82 | Yauro | |

| BR-900BC2A | Including | 1,007.1 | 1,007.7 | 0.5 | 0.5 | 71.60 | |

| BR-900BC2A | 1,082.2 | 1,088.1 | 5.8 | 5.0 | 2.24 | ||

| BR-900BC2A | Including | 1,082.5 | 1,085.7 | 3.2 | 2.7 | 3.52 | |

| BR-901 | 718.8 | 724.0 | 5.2 | 4.4 | 1.80 | Bruma | |

| BR-901 | 859.9 | 875.8 | 15.9 | 13.3 | 0.60 | ||

| BR-901 | 892.3 | 912.4 | 20.1 | 16.9 | 1.29 | ||

| BR-901 | Including | 898.0 | 901.4 | 3.4 | 2.8 | 3.58 | |

| BR-902 | 984.6 | 1,020.2 | 35.6 | 32.0 | 0.86 | Discovery | |

| BR-902 | 1,049.5 | 1,062.3 | 12.8 | 11.5 | 1.42 | ||

| BR-902 | Including | 1,059.6 | 1,062.3 | 2.7 | 2.4 | 3.21 | |

| BR-902 | 1,090.0 | 1,095.4 | 5.3 | 4.8 | 0.63 | ||

| BR-902 | 1,113.0 | 1,120.3 | 7.3 | 6.6 | 0.42 | ||

| BR-902 | 1,138.0 | 1,151.3 | 13.3 | 12.0 | 0.65 | ||

| BR-903 | 526.1 | 531.0 | 4.9 | 4.2 | 1.50 | Discovery | |

| BR-903 | 798.0 | 801.7 | 3.6 | 3.1 | 0.33 | ||

| BR-903 | 806.3 | 833.1 | 26.8 | 22.8 | 0.48 | ||

| BR-903 | 847.0 | 851.7 | 4.7 | 4.0 | 0.48 | ||

| BR-903 | 858.0 | 863.0 | 5.0 | 4.3 | 1.13 | ||

| BR-903 | 872.8 | 884.8 | 12.1 | 10.2 | 0.92 | ||

| BR-903 | 907.0 | 910.5 | 3.5 | 3.0 | 1.10 | ||

| BR-903 | 930.2 | 933.8 | 3.6 | 3.1 | 1.04 | ||

| BR-904 | 590.3 | 598.6 | 8.3 | 5.9 | 1.11 | Discovery | |

| BR-904 | 661.0 | 664.0 | 3.0 | 2.2 | 3.32 | ||

| BR-911A | 988.3 | 992.8 | 4.5 | 3.2 | 0.79 | Auro | |

| BR-911A | 1,043.8 | 1,078.0 | 34.2 | 23.9 | 0.62 | ||

| BR-912 | 927.1 | 931.5 | 4.4 | 3.4 | 1.42 | Auro | |

| BR-912 | 937.3 | 956.8 | 19.5 | 15.4 | 1.11 | ||

| BR-913 | 1,431.8 | 1,435.3 | 3.5 | 3.0 | 0.50 | Auro | |

| BR-914 | 532.2 | 540.0 | 7.8 | 6.8 | 0.68 | Discovery | |

| BR-914 | 884.4 | 891.4 | 7.0 | 6.1 | 0.79 | ||

| BR-914 | 901.6 | 906.2 | 4.7 | 4.0 | 0.68 | ||

| BR-914 | 914.6 | 922.8 | 8.2 | 7.1 | 1.34 | ||

| BR-914 | 1,003.5 | 1,023.0 | 19.5 | 17.0 | 1.16 | ||

| DL-132C1 | 859.5 | 871.5 | 12.1 | 10.2 | 2.88 | Hinge | |

| DL-132C1 | Including | 859.5 | 865.4 | 5.9 | 5.0 | 5.52 | |

| DL-132C1 | 1,044.7 | 1,051.5 | 6.8 | 5.8 | 5.47 | ||

| DL-132C1 | Including | 1,044.7 | 1,048.3 | 3.6 | 3.1 | 9.33 | |

| DL-132C1 | 1,136.6 | 1,140.7 | 4.1 | 3.4 | 1.18 | ||

| DL-132C2 | 880.4 | 885.7 | 5.4 | 4.2 | 0.66 | Hinge | |

| DL-132C2 | 1,030.7 | 1,042.2 | 11.5 | 9.0 | 2.38 | ||

| DL-132C2 | Including | 1,037.8 | 1,041.4 | 3.6 | 2.8 | 5.18 | |

| DL-132C3 | 913.4 | 925.4 | 12.1 | 9.8 | 1.61 | Hinge | |

| DL-132C3 | Including | 920.1 | 923.0 | 3.0 | 2.4 | 4.54 | |

| DL-132C4 | 885.3 | 888.7 | 3.5 | 2.9 | 0.55 | Hinge | |

| DL-132C4 | 1,043.1 | 1,059.0 | 15.9 | 13.4 | 6.08 | ||

| DL-132C4 | Including | 1,043.1 | 1,046.8 | 3.7 | 3.1 | 22.65 | |

APPENDIX B

Great Bear: LP long section demonstrating potential for extension of a high-grade underground resource.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE