Rick Mills – “Kodiak Copper Offers Significant Exposure to Copper and Gold in Low Cost Low Risk Environment”

The discovery of Copper Mountain in the 1880s led to a rush of miners to the Cascade Mountains near Princeton, south-central British Columbia.

The first two camps, Brown’s and E. Voight’s, merged to create the Grandby Company. Its Copper Mountain operation lasted for over a century but was closed in 1958 and later abandoned. Copper Mountain Mining restarted the mine in the early 2000s, with open-pit mining occurring in the Copper Mountain and Ingerbelle pits. Another 21 years of mine life was envisioned.

Copper Mountain Mining in 2023 was taken over by Hudbay Minerals. The combined entity became the third largest copper producer in Canada.

The merger highlighted demand for copper is heating up. The industrial metal is ubiquitous in construction wiring, plumbing, transportation and communications. It is also a crucial part of the transition to the green economy. Electrical vehicles use three times as much copper as gas-powered cars and trucks. The rust-colored mineral is also needed for charging stations, renewable power projects, 5G and to build transmission lines.

Yet copper supply is being challenged to keep up with demand, with several large copper mines becoming depleted, copper grades dropping, there being a lack of new discoveries, and resource nationalistic governments intent on exacting a greater percentage of mineral revenues for the state. All has led to a flurry of M&A in the copper space and bullish market sentiment. A shortage of copper is predicted as early as 2025.

Another high-profile copper deal was the attempted takeover of Teck Resources by Glencore Plc, one of the five biggest mining companies in the world. Teck allowed the sale of its steelmaking coal business but kept its copper mining unit intact.

Along with the Highland Valley copper mine, Teck owns or part-owns producing mines in Peru and Chile, along with Quebrada Blanca 2, a Chilean project that opened last year and is expected to double the company’s copper production.

Teck hasn’t forgotten its BC roots, in fact it is taking a second look at the minerals-rich region of south-central British Columbia as a potential source of new copper supply.

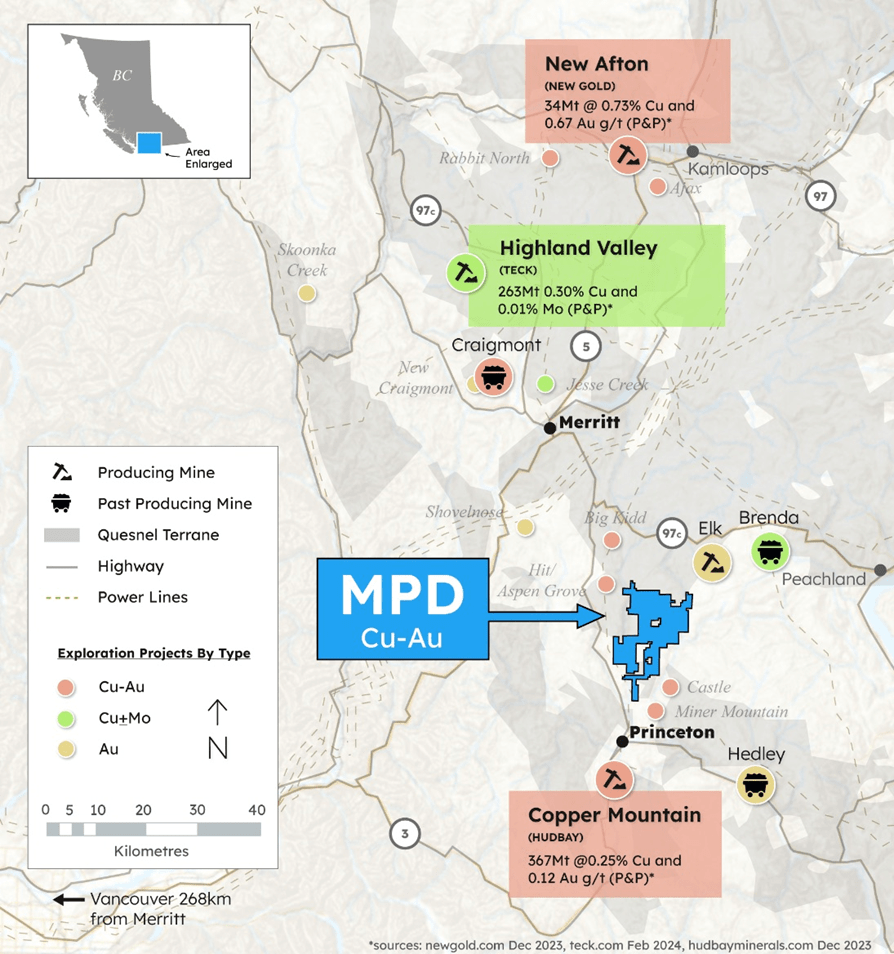

In 2020, Teck underwrote a $12.5 million financing in Kodiak Copper (TSX-V:KDK), becoming the largest (9.9%) shareholder in the junior, whose share price rallied on the discovery of a new zone at its MPD project, located 40 km south of Merritt and 25 km north of Princeton.

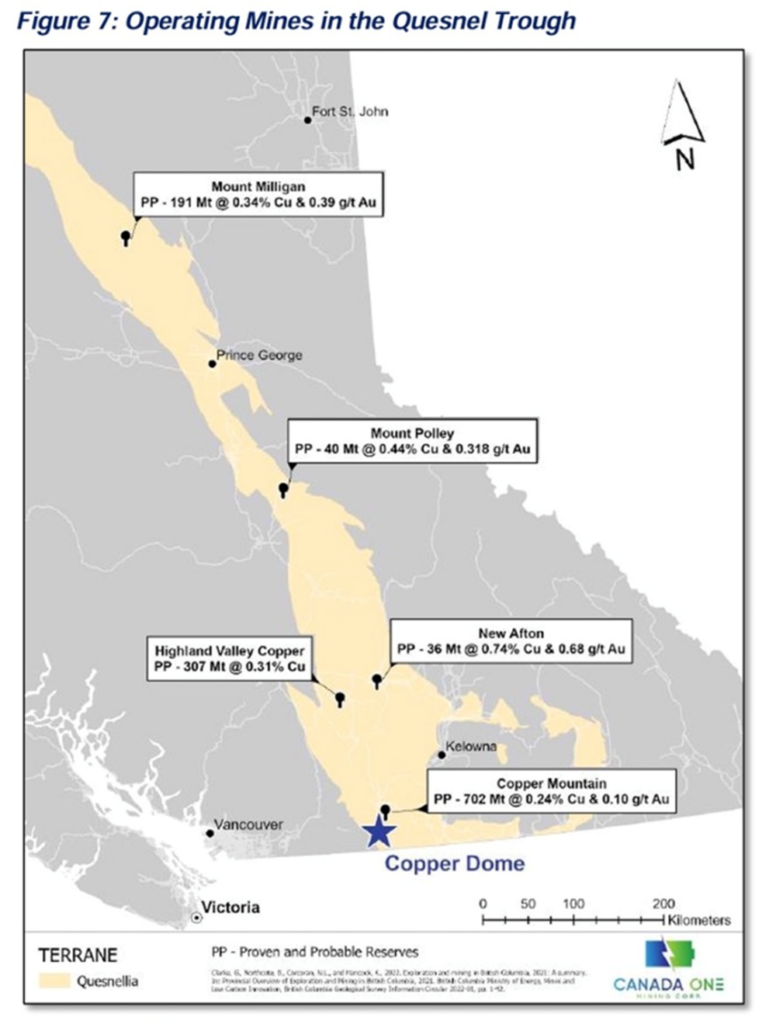

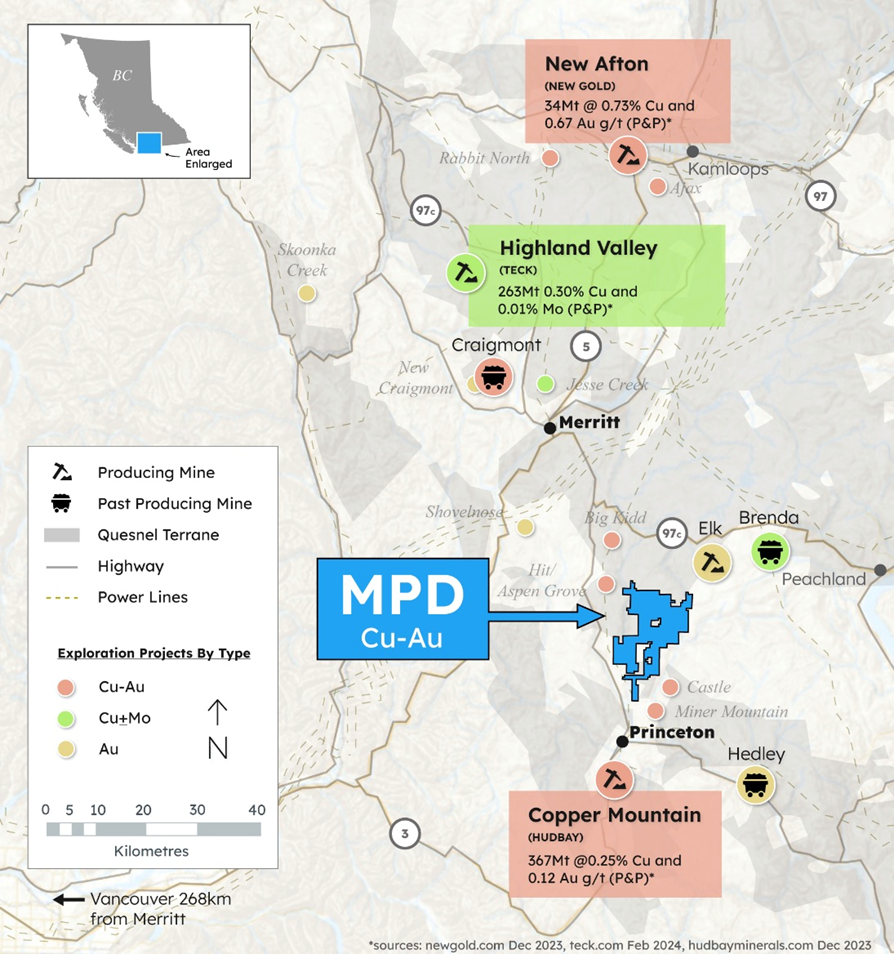

Kodiak Copper is situated within the southern part of the Quesnel Trough, an arc of volcananic-sedimentary rocks that hosts several copper-gold porphyry deposits. Operating mines include Mount Milligan, Mount Polley, New Afton, Highland Valley and Copper Mountain.

BC porphyries

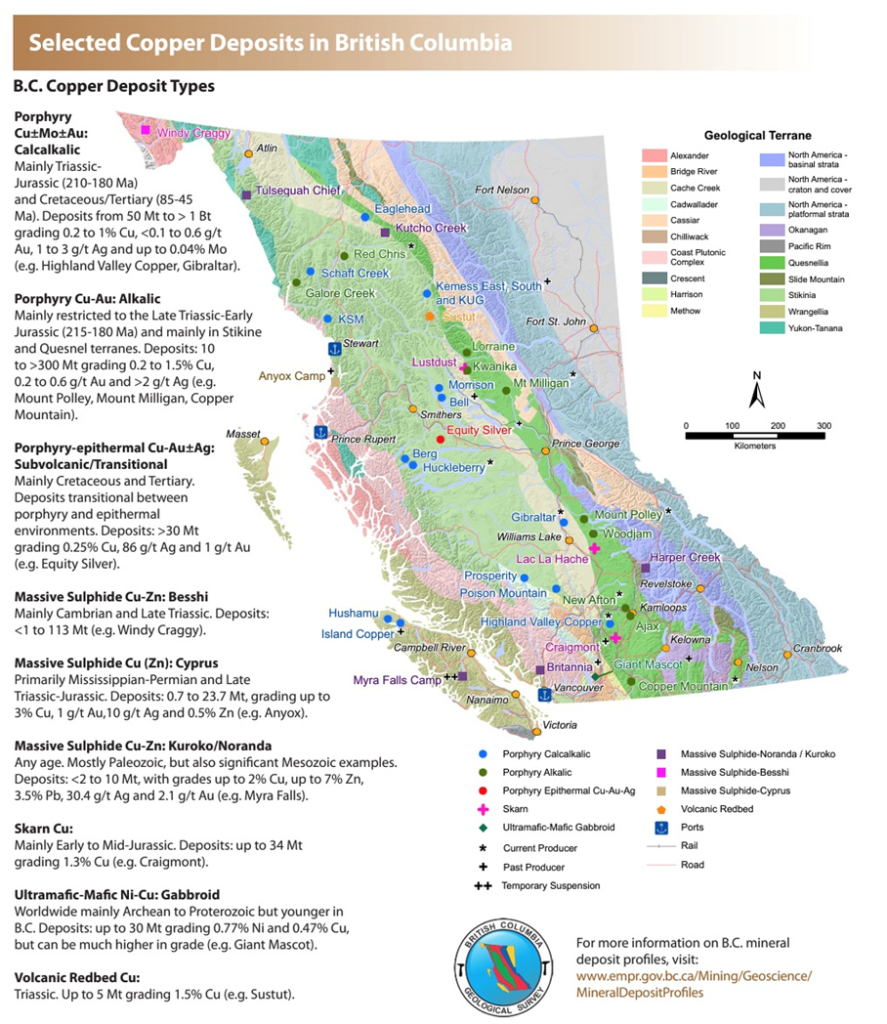

In Canada, British Columbia enjoys the lion’s share of porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

According to Singer and others (2008), via the US Geological Survey, British Columbia and the Yukon Territory contain 54 known porphyry copper deposits. By comparison, the rest of Canada contains only five.

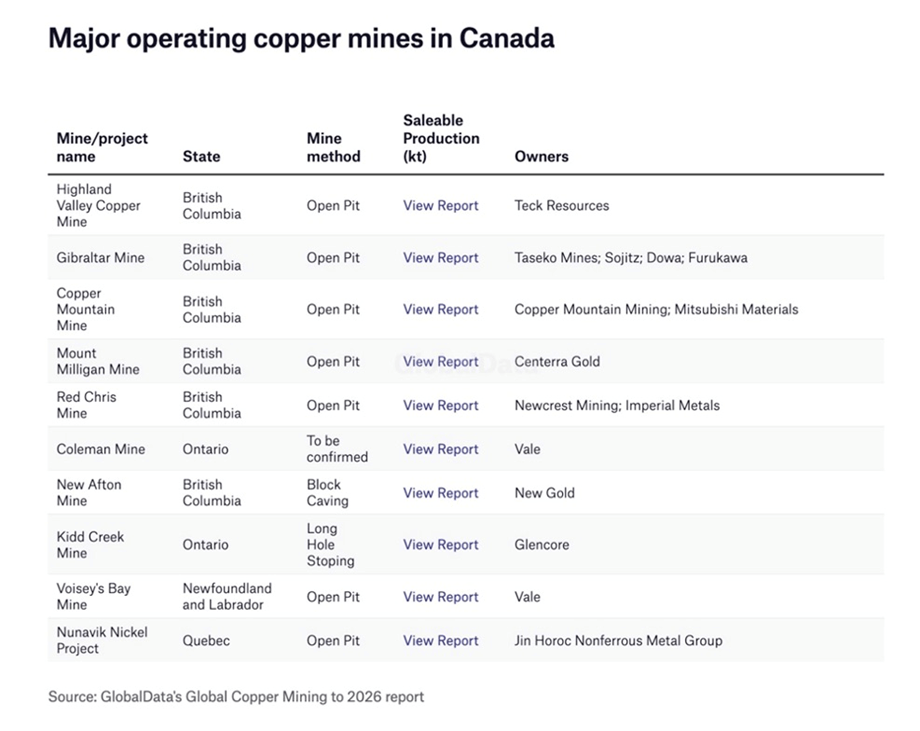

In the table below, of 10 major operating copper mines in Canada, six are in BC.

Source: British Columbia Geological Survey

Quesnel Trough

The Quesnel Trough, also called the Quesnel Terrane, is a Triassic‐Jurassic aged arc of volcanic sedimentary rocks that hosts several alkalic copper-gold porphyry deposits. Operating mines include Mount Milligan, Mount Polley, New Afton, Highland Valley and Copper Mountain.

Source: eResearch Industry Report

Source: eResearch Industry Report, Note New Afton is an underground operation hence the higher grade

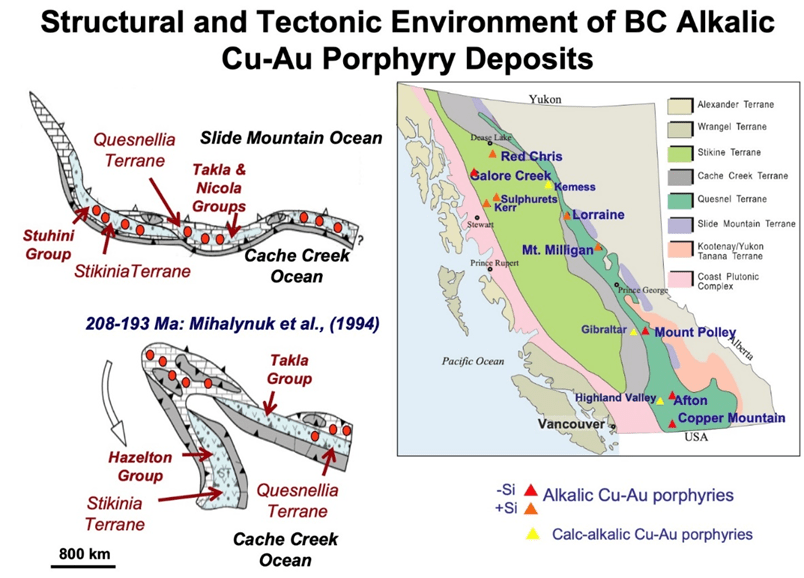

According to the Prospectors and Developers Association of Canada (PDAC), The Quesnel Terrane, along with the Stikine Terrane, are two Mesozoic-age volcanic arcs preserved in western Canada. These parallel arc terranes extend for 2,000 km along the axis of the Canadian Cordillera. They are joined at their northern ends, but are otherwise separated by relics of Tethyan ocean basin and oceanic arc rocks collectively referred to as the Cache Creek Terrane. Porphyry Cu ± Au‐Mo Ag deposits are concentrated within the Stikine‐Quesnel arc terranes.

More than 90% of the known copper endowment was emplaced within a 6 million-year pulse centered on 205 Ma. Distinct trends of Cu‐Au ± Ag Mo mineralization within both arc terranes coincide in time and space with events that are attributed to effects of slab subduction.

The Quesnel Trough extends over 1,000 kilometers from Washington State to the Yukon border. It is the longest mineral belt in Canada.

According to eResearch, there are currently 19 companies operating within the Quesnel Trough, including Hudbay Minerals, Imperial Metals, Newmont Mining, Taseko Mines and Teck Resources.

Six mines located within the Quesnel Trough contribute roughly 80% of Canada’s copper production: Gibraltar/Taseko, Mount Polley/Imperial, Copper Mountain/Hudbay, Highland Valley/Teck, Red Chris/Newmont, and New Afton/New Gold.

There are various deposit types along the Quesnel Trough.

There are copper-gold deposits, copper-molybdenum deposits, gold and some copper deposits, copper-molybdenum deposits, copper-moly-silver with a lower gold grade type of deposits and copper and gold skarn deposits.

The Quesnel Trough and its extensions are still prospective for discovering new mineral deposits. “Some of the deposits don’t have big footprints on surface, making them hard to find, but they offer tremendous depth potential which means that you can build some really significant tonnage,” David Moore, the former president of Serengeti Resources told Resource World magazine,. “You only have to look at the recent drilling success of Kodiak Copper with their spectacular deep drilled holes.”

(Moore was referencing Kodiak Copper’s drill programs in 2021 and 2022 totaling 48,000m that significantly extended the Gate Zone discovery to 1 km x 350m, 900m depth and still open. In 2022 a mineralized trend parallel to Gate was discovered at the Prime Zone, 400m x 200m, 750m depth to date, along with the high-grade gold-silver Beyer Zone on surface from trenching – Rick).

Alkalic and calc-alkalic porphyries

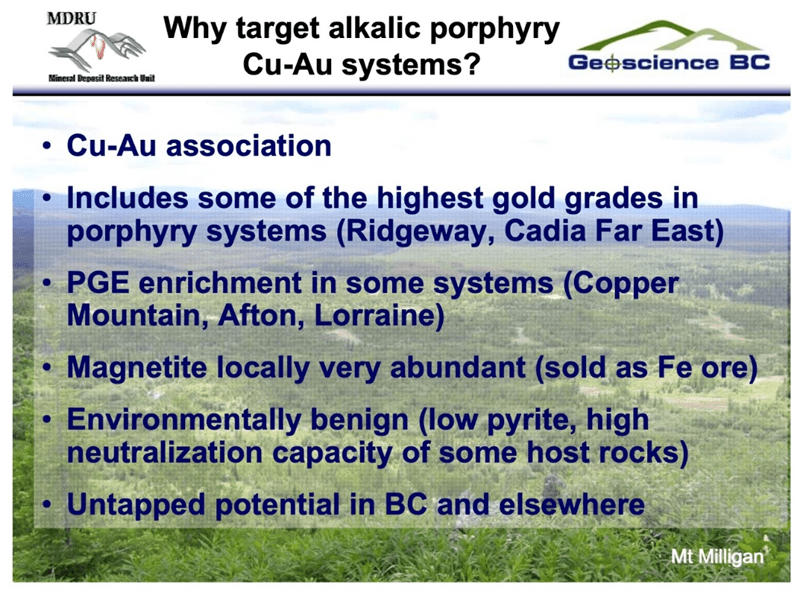

The Quesnel and Stikine terranes contain both alkalic and calc-alkalic porphyry systems, that extend for about 2,000 km along the axis of the Canadian Cordillera. According to a research paper, copper-gold porphyry deposits associated with alkalic igneous rocks are known in only a few mineral provinces worldwide. Some of the best-known examples are in British Columbia, including Galore Creek, Mount Polley, Afton and Copper Mountain.

Alkalic porphyry deposits are of economic significance and represent some of the world’s highest-grade porphyry gold resources.

The alkalic porphyries tend to be copper-gold, whereas the calc-alkalics contain copper, molybdenum and gold. According to Pantelevev (1995), The ore bodies are in, or adjoin, these intrusions and consist of large zones of mineralized quartz veins and veinlets, closely spaced fractures, stockworks, and breccia bodies that are economically bulk-mineable for their copper, molybdenum, and gold. Zones of disseminated sulfide mineralization are also present, but generally in subordinate amounts. Ore minerals consist of pyrite and chalcopyrite with lesser molybdenite, bornite, and magnetite.

Whereas for alkalic Cu-Au porphyries, the ore bodies consist of zones of fractured and mineralized rocks and mineralized breccias that are economically bulk-mineable for their contained copper and gold. Ore consists of stockworks of intersecting veinlets and disseminations of chalcopyrite, pyrite, magnetite, bornite and chalcocite±rare galena, sphalerite, tellurides, tetrahedrite, gold, and silver±traces of platinum group elements.

Kodiak Copper’s MPD project

Kodiak Copper acquired 32 mineral claims in late 2018 as a single land package, which consolidated three historical prospect areas for the first time — Man, Prime and Dillard. An adjoining 25 claims were added in 2021, known as MPD South or Axe. In February of 2023 Kodiak announced the addition of 11 contiguous claims totaling 7,800 hectares expanding Kodiak’s MPD project to a total of 22,642 hectares or 226 square kilometres.

One of the most interesting things about Kodiak Copper’s MPD project is its similarity to nearby alkalic and calc-alkalic porphyries. According to the company, MPD is “in an active mining region in the Quesnel terrane, British Columbia’s primary copper-producing belt.” It is also within “Nicola Belt geology with similar characteristics to the neighboring alkalic porphyry systems at Hudbay’s Copper Mountain Mine to the south and New Gold’s New Afton Mine to the north.”

Copper Mountain and New Afton are both alkalic porphyries, which means they are copper-gold deposits. Highland Valley, in green below, is copper-moly. One source notes that at New Afton (underground) and Copper Mountain (open pit), copper-gold porphyry mineralization is associated with 204 million-year-old alkalic intrusions.

Note some of the other mines on the map. Past-producing Craigmont is copper-gold, the Brenda mine is copper-moly, and the Hedley mine is gold only. So is the producing Elk mine, located between Peachland and Merritt along Highway 97C.

Brenda and Hedley are well-known historical mines. Other mineral exploration projects nearby include Westhaven’s Shovelnose and the New Craigmont property being worked by Nicola Mining.

There are two operating copper mines north of the MPD project, New Afton and Highland Valley, and one just south of it, Copper Mountain.

The Nicola Arc, a volcanic belt starting in the United States and running north towards Kamloops, is divided into three faults: Allison, Western and Summers Creek. Read more about the geology of the Nicola Group between Merritt and Princeton.

Kodiak’s claims are cut by a complex structural framework of steeply dipping faults, with jogs and splays that have facilitated pathways for porphyritic intrusions.

According to the company, MPD has all the hallmarks of a district-scale, multi-centered porphyry system, with several previously drilled targets with similar signatures to the Gate Zone yet to be tested, and multiple new targets being generated.

Three nearby mines

Copper Mountain

Last year Hudbay Minerals (TSX:HBM) paid US$439 million for a 75% stake in the Copper Mountain mine located near Princeton in south-western BC. The other 25% is owned by Mitsubishi Materials. The copper-gold-silver mine is expected to produce approximately 45,000 tonnes of copper and 49,500 ounces of gold annually over the next 10 years, with a 21-year mine life and total production of 783,000 tonnes of copper, 0.9 million gold ounces, and 5.6 million silver ounces.

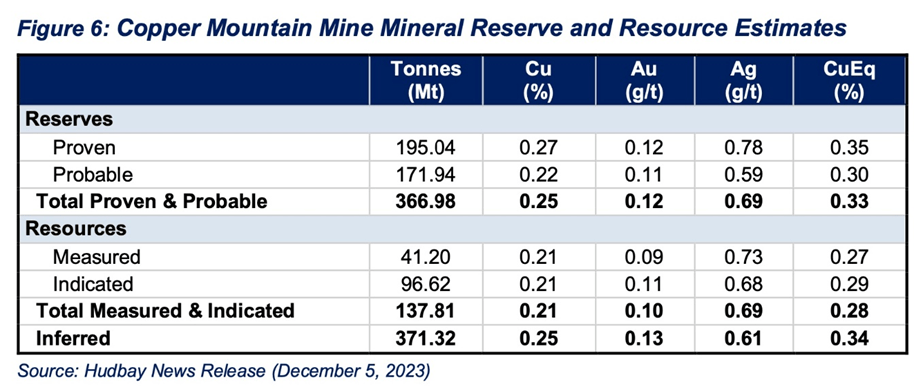

As of Dec. 1, 2023, proven and probable reserves were 367Mt at 0.25% Cu, 0.12 g/t Au, and 0.69 g/t Ag, with a copper-equivalent grade of 0.33%. (eResearch Industry Report, Feb. 29. 2024)

New Afton

New Gold (TSX:NGD) owns and operates New Afton, an underground copper-gold mine located near Kamloops in south-central BC.

It is the only operating block cave mine in Canada.

2023 production was 47.4 million pounds of copper and 67,433 ounces of gold.

As of Dec. 31, 2022, proven and probable reserves were 36.99Mt at 0.74% Cu (607Mlbs), 0.68 g/t Au (0.80Moz), and 1.7 g/t Ag (2.0Moz).

New Gold announced the completion of a new life of mine plan in March 2020 that incorporated the C-Zone development. It extends the mine life to at least 2030. (eResearch Industry Report, Feb. 29. 2024)

Highland Valley

The Highland Valley copper mine operated by Teck Resources (TSX:TECK-B) is the largest open-pit copper mine in Canada. Highland Valley is about 50 km southwest of Kamloops, in south-central BC.

It produces copper and molybdenum concentrates, and accounts for 1% of the world’s copper concentrate and 1.5% of its moly.

Highland Valley was expected to produce between 110,000 and 118,000 tonnes of copper in 2023 and 120,000-165,000t in 2024. The current mine life extends to 2028 with exploration plans to prolong the mine life to 2040.

As of Dec. 31, 2022, the copper-molybdenum deposit had proven and probable reserves of 307.4Mt grading 0.30% and 0.008% molybdenum, containing 790,000t of copper and 10,000t of moly. (eResearch Industry Report, Feb. 29. 2024)

Conclusion

Why Kodiak Copper

Kodiak Copper’s MPD project is located along the southern-most portion of the Quesnel Trough, an extremely prospective for discovery mineral belt extending over 1,000 kilometers from Washington State to the Yukon border. It is the longest mineral belt in Canada and British Columbia’s main copper-producing belt.

Copper-gold porphyries include Copper Mountain, New Afton, Mount Milligan, Woodjam, Kwanika and Kemess. Teck’s Highland Valley is the biggest open-pit mine in Canada.

The chances of successfully finding a deposit and building a mine are substantially higher when a skilled team is in charge. Kodiak’s management team, and the Discovery Group, have a successful, an envious, track record of shareholder return.

Juniors resource companies are sensitive to commodity prices, meaning their share prices rise, or fall, directly in line with the commodity with which they are associated. Historically junior resource companies have offered the best leverage to rising commodity prices.

Copper market fundamentals are currently strong with analysts predicting increasing demand facing the headwinds of structural supply deficits.

Most junior resource companies are struggling to attract funding despite a positive long-term outlook for mined commodities. KDK has a large, fully funded exploration/drilling program underway, and investors can expect news well into 2025.

Kodiak Copper, through a unique combination of advanced modern technology (AI) and old fashioned ‘boots on the ground’ exploration and prospecting offers significant exposure to copper and gold.

Exploration has already shown plenty of size potential as KDK has now drilled several kilometre-scale zones of mineralization over almost the entire length of the property of 20km. Drilling to date at Kodiak’s MPD deposit has proved extensive and high-grade mineralization at several porphyry centers, with multiple targets yet to be tested. The 2024 drill program is set to test multiple targets, building critical mass.

And we know that the project shares geological similarities to Copper Mountain and New Gold. All three are alkalic copper porphyries, meaning the mineralization is copper-gold.

“We are fully funded for a substantial drill program as we continue to systematically prove that our district-scale MPD project has the potential to become a world-class mine. For our 2024 program we have prioritized high-confidence targets near existing zones to expand mineralization, and new targets that present fresh discovery potential. We will continue to build critical mass and focus particularly on adding and expanding near-surface mineralization and higher-grade zones.” Claudia Tornquist, Kodiak President and CEO

Junior Resource Company valuations are low and Kodiak Copper MPD Project has all the hallmarks of a major copper/gold porphyry system with the potential to become a world class mine.

Kodiak’s MPD Project lies in a low cost, low risk area. Infrastructure includes supplies, roads, railway, highly trained skilled local workforce and cheap hydro power.

Strong capital structure and shareholders with Cdn$7m in treasury.

With a strong capital structure, cash in hand, a fully funded exploration/ drilling program underway, and Teck Resources as their largest shareholder (holding 9.1%), it seems Kodiak Copper is well-positioned for growth.

Kodiak Copper

TSXV:KDK

Cdn$0.45 2024.07.23

Shared Outstanding 63.9m

Market cap Cdn$33.5m

KDK website

Richard does not own shares of Kodiak Copper (TSX.V:KDK) KDK is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of KDK.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE