Rick Mills – “Graphite One and EV Maker Lucid Sign Historic Supply Agreement”

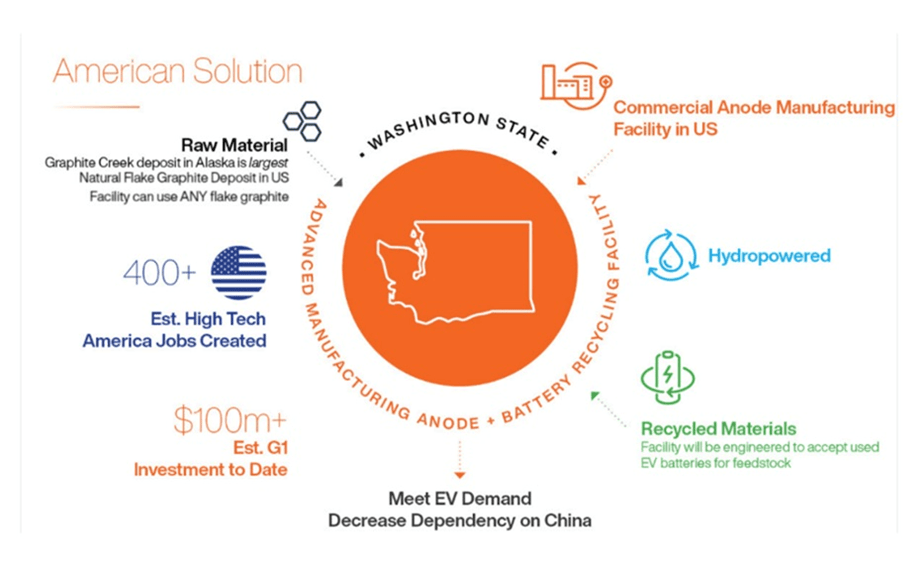

Graphite One (TSX-V:GPH) (OTCQX:GPHOF) has taken another step forward in its plan to become the first vertically integrated domestic graphite producer to serve the US electric vehicle battery market.

On Thursday, July 25, G1 announced it has entered into a non-binding Supply Agreement with Lucid Group, Inc. (NASDAQ: LCID), a California-based electric vehicle manufacturer, for anode active materials (AAM) used in EV batteries.

GPH shares rose 33% to $0.95/sh on the news.

“This is a historic moment for Graphite One, Lucid and North America: the first synthetic graphite Supply Agreement between a U.S. graphite developer and U.S. EV company,” said Anthony Huston, Graphite One’s President and CEO.

“G1 is excited to continue pushing forward developing our 100% U.S. domestic supply chain. We appreciate the support from our investors and the grant from the Department of Defense. Subject to project financing required to build the AAM facility, the Supply Agreement with Lucid puts G1 on the path to produce revenue in 2027,and that’s just the beginning for Graphite One as work to meet market demands and create a secure 100% U.S.-based supply chain for natural and synthetic graphite for U.S. industry and national security.”

Peter Rawlinson, CEO and CTO at Lucid, said “We are committed to accelerating the transition to sustainable vehicles and the development of a robust domestic supply chain ensures the United States, and Lucid will maintain technology leadership in this global race.

“Through work with partners like Graphite One, we will have access to American-sourced critical raw materials, helping power our award-winning vehicles made with pride in Arizona.”

Lucid’s flagship vehicle is the Lucid Air, which has been recognized with a number of awards, including MotorTrend 2022 Car of the Year, World Luxury Car of the Year, and Car and Driver 10 Best. Lucid is preparing a factory in Arizona to begin production of the Lucid Gravity SUV.

Supply Agreement

The Supply Agreement follows Graphite One’s selection in March 2024 of a site for the company’s proposed AAM facility in Warren, Ohio.

Through its wholly-owned subsidiary, Graphite One Alaska, the Vancouver-based company chose Ohio’s Voltage Valley, entering into a 50-year land-lease agreement on 85 acres. The deal also contains an option to purchase the property once known as the Warren Depot, part of the National Defense Stockpile infrastructure, until the brownfield site was processed through the Ohio EPA Voluntary Action program a decade ago, certifying that the land does not need further cleanup.

Construction is slated to start within the next three years. According to Graphite One, the Voltage Valley site is in the heart of the automobile industry, with ample low-cost electricity produced from renewable energy sources. It is accessible by road and rail, with nearby barging facilities. Existing power lines are sufficient for Graphite One’s Phase 1 production target of 25,000 tonnes per year of battery-ready anode material. Land is available for follow-on phases to ramp up to 100,000 tpy of production.

The five-year, non-binding Supply Agreement provides for 5,000 tpa of synthetic graphite. Sales are based on an agreed price formula linked to future market pricing, as well as satisfying base-case pricing agreeable to both parties.

Building a supply chain

The Ohio facility represents the second link in Graphite One’s graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, currently working toward completion of its Feasibility Study in Q4 2024, on an accelerated timetable, funded by a $37.5 million Defense Production Act grant from the Department of Defense in July 2023.

Subject to financing, the plant will manufacture synthetic graphite until a natural graphite anode active materials becomes available from the company’s Graphite Creek mine, located near Nome, Alaska, according to the March 20th news release.

The plan also includes a recycling facility to reclaim graphite and other battery materials, to be co-located at the Ohio site, which is the third link in Graphite One’s circular economy strategy.

Among the announced projects coming to Ohio, South Korean-based LG Energy Solution has partnered with General Motors in Ultium Cells LLC, which is building a $2.3 billion electric-vehicle manufacturing plant in Lordstown, Ohio; Honda and LG Energy Solution will construct a new EV battery plant in Fayette County; and Honda also announced $700 million to retool three of its existing factories in Union, Logan, and Shelby counties for EV production.

Synthetic vs natural graphite

Synthetic, or artificial graphite, and natural graphite are both used in battery anode applications, but synthetic dominates the market.

China is the number one graphite producer in the world, outputting 850,000 tonnes in 2022, and accounting for two-thirds of mine supply. Moreover, the Asian nation also controls 80% of synthetic graphite production.

Synthetic graphite’s primary application is in the graphite electrodes used for electric arc furnace steelmaking, which accounts for 70-80% of graphite electrode consumption. The market for this sector is estimated at 1.6 million tons in 2024, and is expected to reached 1.9Mt by 2029, according to Mordor Intelligence.

The boost is partly due to the Chinese government’s recent Work Plan for Steady Growth of the Iron and Steel Industry, which promotes the expansion of steel production with electric arc furnaces.

Total synthetic graphite consumption is pegged at 3.04Mt this year, compared to 1.68Mt for natural graphite.

Government/ community support

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek, the largest graphite deposit in the country and amongst the largest in the world. Two Department of Defense grants have already been awarded, one for $37.5 million, the other for $4.7 million.

G1’s feasibility study is now 75% funded by the DoD.

In addition, G1 qualifies for federal loan guarantees from the $72 billion federal loan fund to support innovative energy and supply chain initiatives.

Graphite One’s importance to the US government is exemplified through CEO Anthony Huston’s appearance at a recent White House event.

China, meanwhile, has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Graphite One is at the forefront of this trend. The company has significant financial backing from the Department of Defense, and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation, which has already made a $2 million investment with an option to invest a further $8.4 million.

The Graphite Creek mine isn’t near a salmon fishery and it has the backing of local communities, including as the city of Nome with its US$600 million port expansion. Nome has a long history of resource extraction.

Reducing US dependence

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce synthetic graphite and other graphite products from purchased graphite.

Graphite One could supply a significant portion of the graphite demanded by the United States.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles. Based on G1’s Prefeasibility Study (PFS), not the Feasibility Study which is expected this fall, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

Conclusion

The only way to alleviate import dependence is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s Graphite Creek deposit ticks all the boxes.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain. The United States currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Washington has finally begun to recognize this vulnerability. In 2022, President Biden issued a Presidential Determination under the 1950 Defense Production Act (DPA), declaring graphite and four other key battery minerals at risk of supply disruptions, as “essential to the national defense.”

Graphite is the largest ingredient in lithium-ion batteries by weight, making it a highly-sought-after raw material by battery-makers.

The U.S. Energy Department forecasts that global graphite demand could be more than eight times current production by 2035.

The PFS was based on the exploration of only one square kilometer of the 16-km deposit, meaning that G1 could potentially increase production by a factor several times the proposed run rate of 2,860 tonnes per day.

Only about 10% of the mineralized trend has been drilled so far.

“The continued expansion of our Graphite Creek resource will support our plan to quadruple the annual production from our PFS study,” said Graphite One Senior Vice President of Mining Mike Schaffner.

Last year, completed a 52 hole, 8,736-meter drill program focused on upgrading and expanding the deposit, and collecting data for the Feasibility Study. The company said the results demonstrated exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

Graphite One’s 2024 field program will gather the remaining data required to complete the Feasibility Study. The company says three drill rigs are currently operating to glean geotechnical information needed to engineer the pit walls and foundations for the process facility, tailings/waste rock facility and other infrastructure.

Twenty-two summer job positions have been filled by local residents from the communities of Teller, Brevig Mission and Nome.

Graphite One – Two-Pronged Production Localizing Graphite Supply

A recent report by Atrium Research highlights five attributes of Graphite One that support an investment in the company:

- Sizeable graphite development project with large upside;

- Tailwinds for the advanced anode manufacturing facility;

- Two-pronged approach reduces risks;

- Strong government and community support; and

- Significant discount to peers.

Upcoming catalysts include a Resource Update and Feasibility Study in Q4, and ongoing government grants, partnerships and investments.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.07.25 share price: Cdn$0.95

Shares Outstanding: 137.8m

Market cap: Cdn$130.9m

GPH website

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

LEGAL NOTICE / DISCLAIMER

AHEAD OF THE HERD NEWSLETTER, AHEADOFTHEHERD.COM, HEREAFTER KNOWN AS AOTH.

PLEASE READ THE ENTIRE DISCLAIMER CAREFULLY BEFORE YOU USE THIS WEBSITE OR READ THE NEWSLETTER. IF YOU DO NOT AGREE TO ALL THE AOTH/RICHARD MILLS DISCLAIMER, DO NOT ACCESS/READ THIS WEBSITE/NEWSLETTER/ARTICLE, OR ANY OF ITS PAGES. BY READING/USING THIS AOTH/RICHARD MILLS WEBSITE/NEWSLETTER/ARTICLE, AND WHETHER YOU ACTUALLY READ THIS DISCLAIMER, YOU ARE DEEMED TO HAVE ACCEPTED IT.

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE