VIZSLA SILVER REPORTS MORE HIGH-GRADE RESULTS AT COPALA AND COPALA 3, DEMONSTRATING STRONG MINERAL CONTINUITY

Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) (Frankfurt: 0G3) is pleased to report results from six new drill holes targeting the Copala resource area at its 100%-owned, flagship Panuco silver-gold project located in Mexico. The reported drilling, designed to infill near-surface Indicated Mineral Resources, continues to confirm high-grade continuity throughout Copala including new high-grade intercepts on the Copala 3 hanging-wall vein splay.

Highlights

- CS-24-366 returned 2,398 grams per tonne silver equivalent over 7.00 metres true width (1,898 g/t silver and 9.51 g/t gold)

- Including 5,385 g/t AgEq over 0.56 mTW (3,950 g/t silver and 25.40 g/t gold)

- And, 4,457 g/t AgEq over 1.29 mTW (3,430 g/t silver and 18.95 g/t gold)

- CS-24-359 returned 1,027 g/t AgEq over 7.80 mTW (788 g/t silver and 4.40 g/t gold)

- Including 6,343 g/t AgEq over 0.86 mTW (5,010 g/t silver and 25.30 g/t gold)

- And, 1,749 g/t AgEq over 0.53 m TW (1,360 g/t silver and 7.26 g/t gold)

- CS-24-361 returned 2,023 g/t AgEq over 3.50 mTW (1,617 g/t silver and 7.83 g/t gold)

- Including 6,331 g/t AgEq over 0.39 mTW (5,230 g/t silver and 22.30 g/t gold)

- CS-24-363 returned 2,193 g/t AgEq over 2.68 mTW (1,831 g/t silver and 7.47 g/t gold)

- Including 4,787 g/t AgEq over 0.78 mTW (4,040 g/t silver and 15.75 g/t gold)

“Ongoing infill drilling at Copala, where initial mining will likely take place, continues to demonstrate exceptional mineral continuity,” commented Michael Konnert, President & CEO. “Tight-spaced drilling along Copala Main and its hanging-wall splay structures has now expanded the high-grade footprint closer to surface, potentially reducing the overall development required to access the minerlization. The more we drill on the property, the more confidence we have that Panuco will be a high-margin, low capex project. Moving forward, we will continue our conversion drilling at Copala as we de-risk the Project ahead of the maiden PEA, slated for early Q3 2024.”

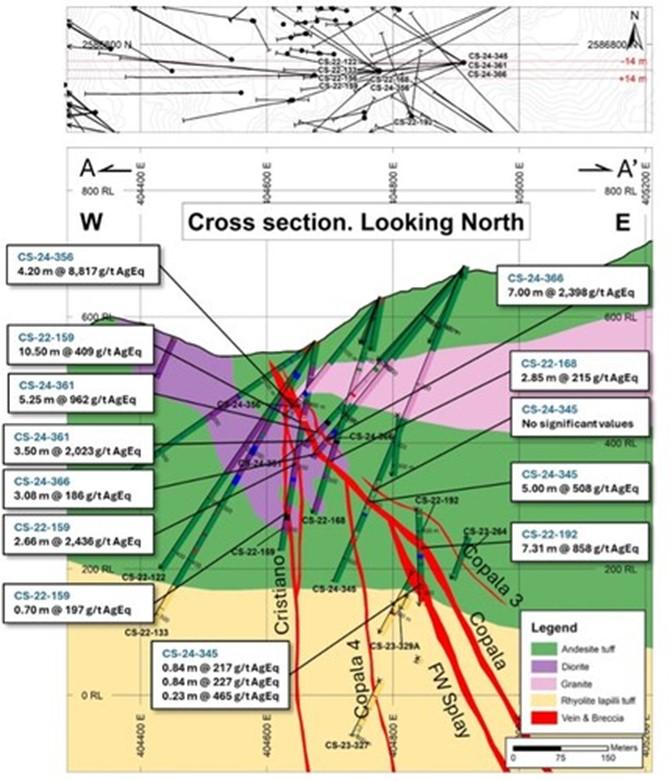

The precious metals dominant Copala structure, located in the western portion of the Panuco district, is situated ~800 m to the east of the Napoleon Vein. Copala currently hosts Indicated Resources of 83.3 Moz AgEq at 573 g/t AgEq and Inferred Resources of 48.3 Moz AgEq at 476 g/t AgEq within a broad envelope of vein-breccia interlayered with host rock, up to 82 metres thick (please refer to our Technical Report on Updated Mineral Resource Estimate for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico, by Allan Armitage, Ben Eggers and Peter Mehrfert, dated February 12, 2024 and to Vizsla’s press release dated January 8, 2024). Interpretations by Vizsla geologists indicate Copala has an average dip of ~46° to the east (~35° in its northern sector and steepening to ~65° in the southern sector).

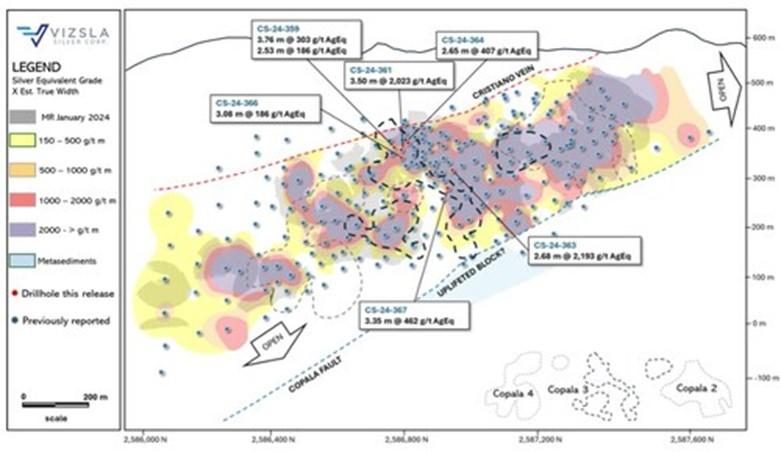

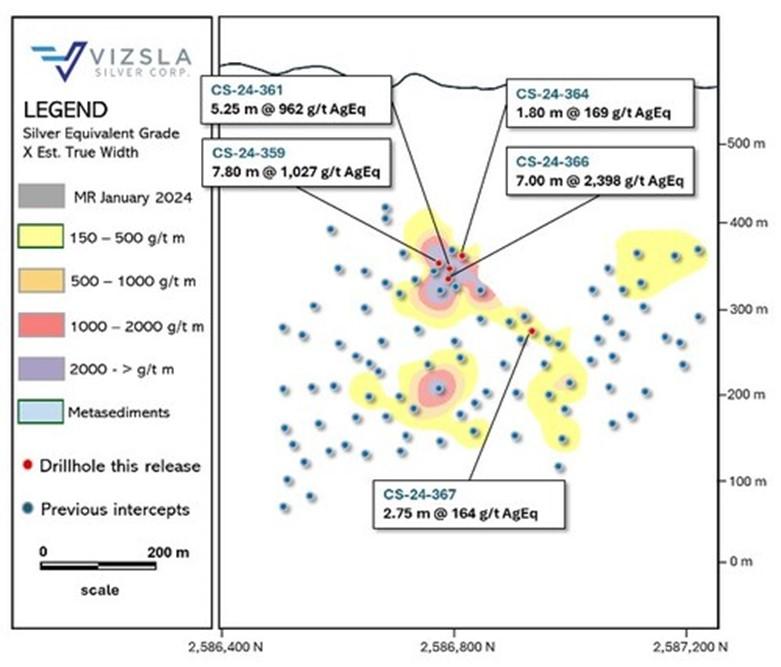

Exploration and Resource drilling at Copala has traced mineralization along ~1,770 metres of strike length and ~400 metres down dip. The infill holes reported herein are part of an ongoing ~10,000 program (~35 holes), planned to convert near surface Indicated Mineral Resources in the central portion of main Copala into the Measured Resource category. The six infill holes reported were drilled at approximately 25 metre centers from pre-existing holes and continue to successfully confirm grade continuity along the main Copala structure. Additionally, some of these holes also intercepted high-grades on Copala 3, which sits between 10-45 metres to the east of Copala main, on the hanging-wall side of the structure. The Copala 3 vein is demonstrating good continuity with many holes having previously intercepted the structure, as shown by the blue pierce points in Figure 3. The high grades seen in Copala 3, may contribute to a further improved, overall grade profile as more resources are converted to higher confidence categories in the central portion of Copala. Vizsla plans to complete its ongoing ~10,000 infill program by mid to late July. Based on the results received, Vizsla is analysing additional drilling metres to continue upgrading and expanding mineral resources in high priority areas at Copala.

| Drillhole | From | To | Downhole Length |

Estimated True width |

Ag | Au | AgEq | Vein | ||

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||

| CS-24-359 | 332.15 | 341.65 | 9.50 | 7.80 | 788 | 4.40 | 1,027 | Copala 3 | ||

| Includes | 336.25 | 337.30 | 1.05 | 0.86 | 5,010 | 25.30 | 6,343 | |||

| Includes | 341.00 | 341.65 | 0.65 | 0.53 | 1,360 | 7.26 | 1,749 | |||

| CS-24-359 | 369.30 | 373.75 | 4.45 | 3.76 | 242 | 1.18 | 303 | Copala | ||

| Includes | 371.00 | 371.60 | 0.60 | 0.51 | 1,015 | 3.60 | 1,177 | |||

| CS-24-359 | 378.00 | 381.00 | 3.00 | 2.53 | 170 | 0.44 | 186 | Copala | ||

| CS-24-361 | 346.05 | 351.60 | 5.55 | 5.25 | 547 | 6.58 | 962 | Copala 3 | ||

| Includes | 346.05 | 346.50 | 0.45 | 0.43 | 2,370 | 59.70 | 6,366 | |||

| Includes | 347.25 | 348.20 | 0.95 | 0.90 | 1,110 | 5.03 | 1,365 | |||

| CS-24-361 | 366.00 | 369.60 | 3.60 | 3.50 | 1,617 | 7.83 | 2,023 | Copala | ||

| Includes | 368.20 | 368.60 | 0.40 | 0.39 | 5,230 | 22.30 | 6,331 | |||

| CS-24-363 | 325.40 | 328.15 | 2.75 | 2.68 | 1,831 | 7.47 | 2,193 | Copala | ||

| includes | 326.55 | 327.35 | 0.80 | 0.78 | 4,040 | 15.75 | 4,787 | |||

| CS-24-364 | 344.55 | 346.40 | 1.85 | 1.80 | 131 | 0.71 | 169 | Copala 3 | ||

| CS-24-364 | 358.10 | 360.75 | 2.65 | 2.65 | 277 | 2.20 | 407 | Copala | ||

| CS-24-366 | 348.85 | 357.00 | 8.15 | 7.00 | 1,898 | 9.51 | 2,398 | Copala 3 | ||

| Includes | 348.85 | 349.50 | 0.65 | 0.56 | 3,950 | 25.40 | 5,385 | |||

| Includes | 351.00 | 352.50 | 1.50 | 1.29 | 3,430 | 18.95 | 4,457 | |||

| Includes | 352.80 | 354.00 | 1.20 | 1.03 | 3,200 | 13.00 | 3,829 | |||

| CS-24-366 | 376.50 | 379.70 | 3.20 | 3.08 | 147 | 0.74 | 186 | Copala | ||

| CS-24-367 | 352.30 | 355.50 | 3.20 | 2.75 | 124 | 0.72 | 164 | Copala 3 | ||

| CS-24-367 | 374.50 | 378.95 | 4.45 | 3.35 | 383 | 1.62 | 462 | Copala | ||

| Includes | 374.50 | 375.50 | 1.00 | 0.75 | 1,280 | 5.54 | 1,555 | |||

| Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 91% for silver and 94% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Copala vein (see press release dated August 16, 2023). | ||||||||||

| Table 1: Downhole drill intersections from the holes reported for Copala and Copala 3 veins. The two intercepts on main Copala for CS-24-359 occur within a broad (9.90 m) lower grade vein-breccia structure. |

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| CS-24-359 | 404,912 | 2,586,771 | 680 | 261.7 | -45.8 | 382.5 |

| CS-24-361 | 404,912 | 2,586,771 | 680 | 265.5 | -47.9 | 381.0 |

| CS-24-363 | 404,844 | 2,586,892 | 653 | 277.7 | -61.7 | 343.5 |

| CS-24-364 | 404,912 | 2,586,771 | 680 | 270.4 | -43.2 | 376.5 |

| CS-24-366 | 409,912 | 2,586,771 | 680 | 266.2 | -51.5 | 387.0 |

| CS-24-367 | 404,844 | 2,586,892 | 653 | 274.7 | -69.4 | 394.5 |

| Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13. | ||||||

About the Panuco Project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 17,856.5-hectare, past producing district benefits from over 86 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

On January 8, 2024, the Company announced an updated mineral resource estimate for Panuco which includes an estimated in-situ indicated mineral resource of 155.8 Moz AgEq and an in-situ inferred resource of 169.6 Moz AgEq (please refer to our Technical Report on Updated Mineral Resource Estimate for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico, by Allan Armitage, Ben Eggers and Peter Mehrfert, dated February 12, 2024 and to our Company´s press release dated January 8, 2024).

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla Silver has completed over 368,000 metres of drilling at Panuco leading to the discovery of several new high-grade veins. For 2024, Vizsla Silver has budgeted +30,000 metres of resource/discovery-based drilling designed to upgrade and expand the mineral resource, as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver and rock samples were shipped to SGS Lab in Durango Mexico for sample preparation and analysis. The ALS Zacatecas, North Vancouver facilities and SGS lab are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Vice President of Exploration, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

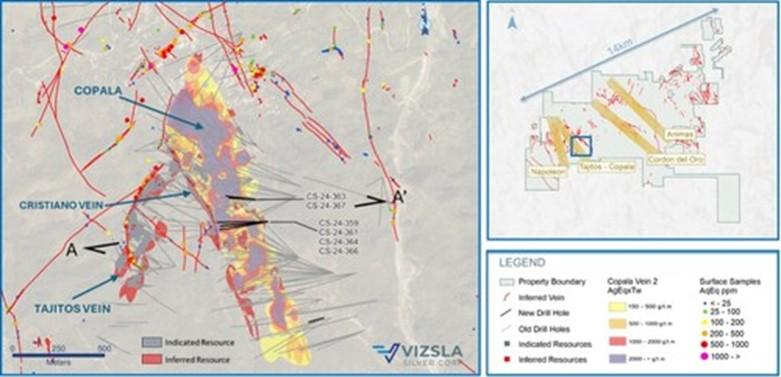

Figure 1: Plan map of recent drilling centered on the Copala structure. (CNW Group/Vizsla Silver Corp.)

Figure 2: Inclined longitudinal section for Copala structure with drillhole pierce points. The section is 1x along strike to 1.4x along the dip to compensate for the average 46-degree dip of Copala. The gray and black dash outlines represent Copala 2, Copala 3 and Copala 4 vein splays. (CNW Group/Vizsla Silver Corp.)

Figure 3: Inclined longitudinal section for Copala 3 vein splay with drillhole pierce points. The section is 1x along strike to 1.4x along the dip to compensate for the average 46-degree dip of Copala. (CNW Group/Vizsla Silver Corp.)

Figure 4: Cross section showing Copala structure, Cristiano, Copala 3, Copala 4 and FW Splay veins with completed drilling. (CNW Group/Vizsla Silver Corp.)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE