Silver Storm Extends San Marcos Mine 100 M at Depth With High-grade Drill Results

Silver Storm Mining Ltd. (TSX-V: SVRS) (OTCQB: SVRSF) (FSE: SVR), is pleased to announce further drill results from its Phase 1 diamond drilling program at the Company’s 100% owned La Parrilla Silver Mine Complex, located in Durango Mexico. Results from the 16 holes (1,935 metres) contained within this release are from the San Marcos Mine.

An overview video on the La Parrilla Project is available at www.youtube.com/watch?v=dybgKXcGrYo

Key highlights include:

- In San Marcos South, hole SM-24-010 returned 504 g/t Ag.Eq1 over 5.14 m and 367 g/t Ag.Eq over 2.63 m within a broader interval of 249 g/t Ag.Eq over 19.03 m and 427 g/t Ag.Eq over 2.13 m

- SM-24-011 returned 569 g/t Ag.Eq over 2.00 m and 431 g/t Ag.Eq over 1.87 m within a broader interval of 319 g/t Ag.Eq over 11.75 m

– Both holes 010 & 011 are located approximately 35 m and 100 m, respectively, downdip below the 1790 EL stope where the composited weighted average grade of historical channel samples returned 597 g/t Ag.Eq over a strike length of 33 m and average width of 2.37 m. Results from these two holes indicate mineralization has become wider, below previous mined horizons.

- SM-24-014 returned 204 g/t Ag.Eq over 1.00 m, SM-24-012 returned 503 g/t Ag.Eq over 0.49 m and 141 g/t Ag.Eq over 1.21 m, and SM-24-008 returned 182 g/t Ag.Eq over 0.76 m

– Further extends the oxide mineralization approximately 77 m to the south-southeast from the last mine development in the area

- In San Marcos North, hole SM-24-017 returned 405 g/t Ag.Eq over 1.00 m, SM-24-016 returned 191 g/t Ag.Eq over 3.25 m, SM-24-005 returned 178 g/t Ag.Eq over 2.50 m and 371 g/t Ag.Eq over 1.00 m, SM-24-004 returned 148 g/t Ag.Eq over 0.72 m, and SM-24-003 returned 163 g/t Ag.Eq over 0.40 m

– Intercepts from holes SM-24-004 and SM-24-017 extend the oxide zone mineralization respectively 37 m and 100 m below the last mine development in this area

- A new mineralized zone was discovered approximately 10 m to the southwest of the San Marcos Zone with hole SM-24-004 returning 283 g/t Ag.Eq over 0.55 m, SM-24-005 returning 147 g/t Ag.Eq over 3.50 m.

Greg McKenzie, President and CEO, commented: “We are pleased with the strong drill results from the San Marcos Mine, where we have intersected high-grade mineralization in both the South & North Zones approximately 100 m below the last mined stopes. In particular, the South Zone appears to be getting wider at depth where hole SM-24-011 intersected 319 g/t Ag.Eq over 11.8 m (true width ~ 11 m) compared to 2.4 m within the last mined stope 100 m higher. We anticipate these results should have a positive impact on future Mineral Resources, both in terms of tonnage and grade. Follow up drilling will be performed in proximity to holes 010 and 011 allowing for the potential addition of indicated resources within this area of San Marcos.”

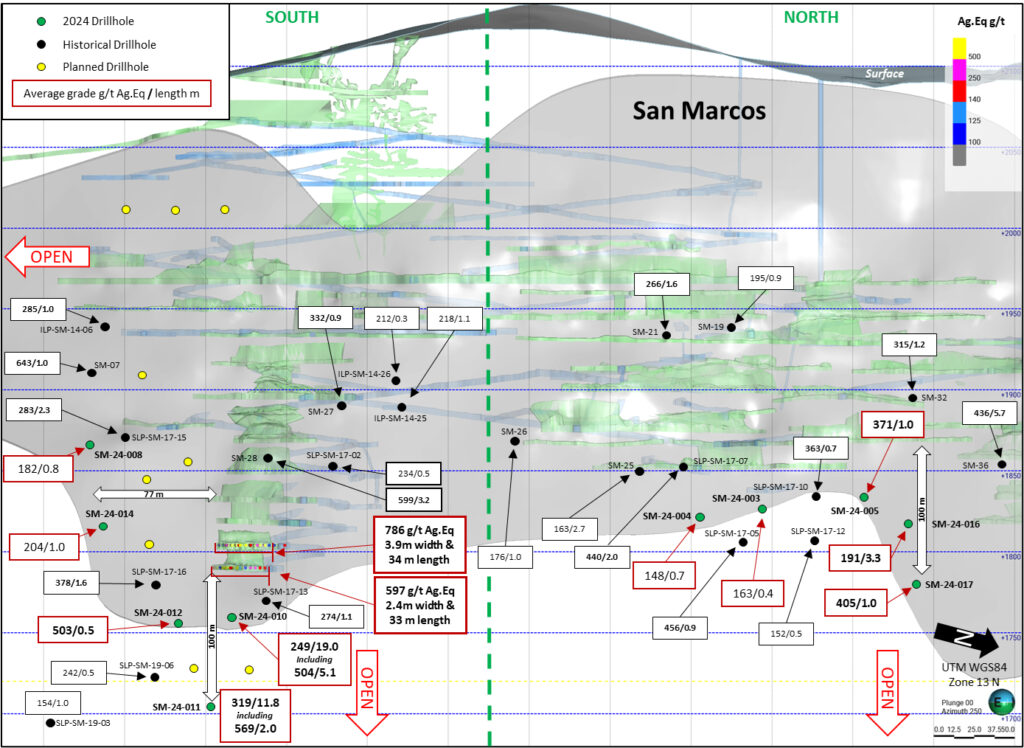

San Marcos Zone

The San Marcos Zone is comprised of quartz-carbonate vein mineralization, striking 340 degrees and dipping 60 degrees to the NE, hosted within a fault zone marking the eastern contact of the granodiorite stock. It has a known strike length of 650 m with mineralization extending vertically for 450, and a thickness of up to 17 m. The zone is mainly characterized by oxide mineralization consisting of hematite, goethite, native silver, and cerargyrite. However, the southern section of the zone beneath 1875 m EL is characterized by sulphide replacement mineralization contained within the bedding.

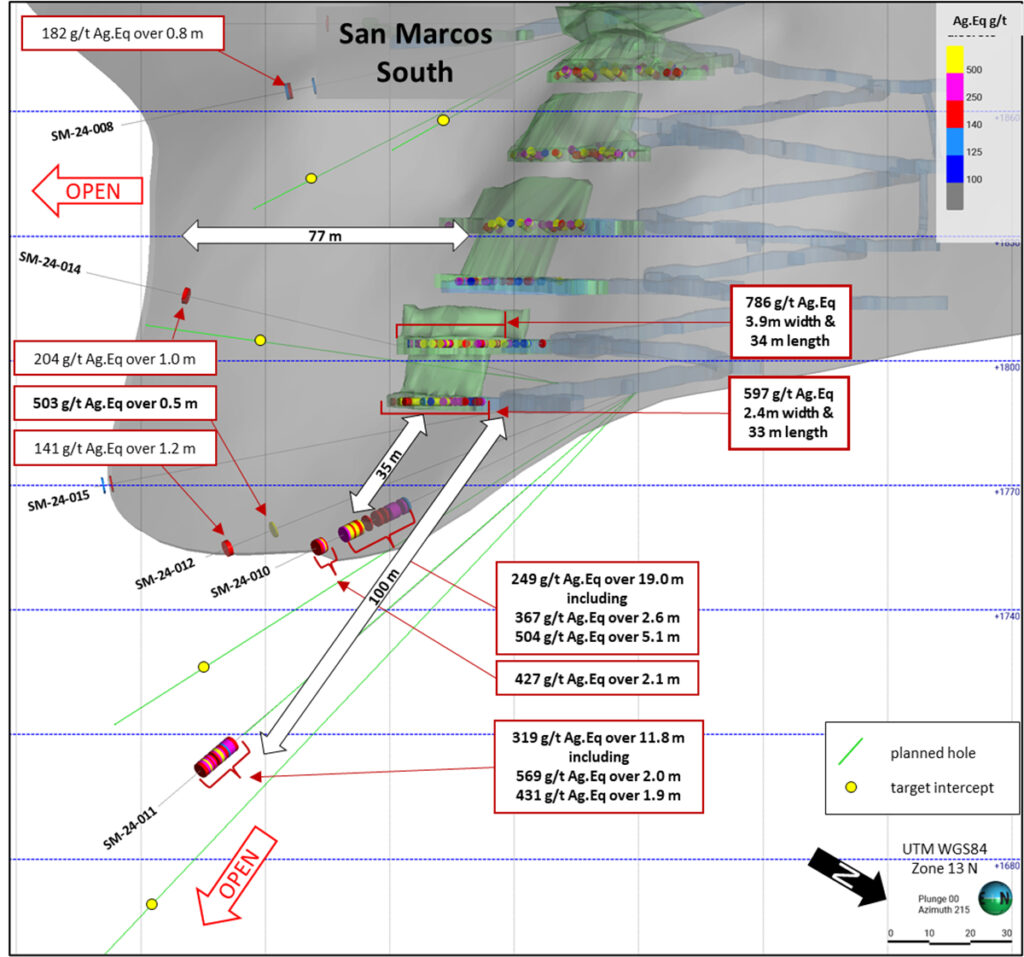

San Marcos South

Eight holes targeted the southern section of the San Marcos Zone (Figures 1 & 2; Tables 1 & 2). Hole SM-24-014 returned 204 g/t Ag.Eq over 1.00 m (94.00 to 95.00 m), SM-24-012 returned 503 g/t Ag.Eq over 0.49 m (95.04 to 95.53 m) and 141 g/t Ag.Eq over 1.21 m (107.34 to 108.55 m), and SM-24-008 returned 182 g/t Ag.Eq over 0.76 m (81.00 to 81.76 m), further extending the oxide mineralization approximately 77 m to the south-southeast from the last mine development in the area.

Hole SM-24-010 returned 367 g/t Ag.Eq over 2.63 m and 504 g/t Ag.Eq over 5.14 m within a broader interval of 249 g/t Ag.Eq over 19.03 m (75.72 to 94.75 m) and 427 g/t Ag.Eq over 2.13 m (101.52 to 103.65 m). Hole SM-24-011 returned 569 g/t Ag.Eq over 2.00 m and 431 g/t Ag.Eq over 1.87 m within a broader interval of 319 g/t Ag.Eq over 11.75 m (147.92 to 159.67 m). Holes SM-24-010 and 011 are respectively located approximately 35 m and 100 m downdip below the last mine development in this area, with similar high-grade sulphide replacement mineralization:

- The composited weighted average grade of historical channel samples from the 1790 EL stope returned 597 g/t Ag.Eq over a strike length of 33 m and average width of 2.37 m.

San Marcos North

Eight holes targeted the northern section of the San Marcos Zone. Hole SM-24-016 returned 191 g/t Ag.Eq over 3.25 m (120.50 to 123.75 m) including 514 g/t Ag.Eq over 0.50 m, SM-24-005 returned 178 g/t Ag.Eq over 2.50 m (92.50 to 95.00) and 371 g/t Ag.Eq over 1.00 m (101.00 to 102.00 m), SM-24-004 returned 148 g/t Ag.Eq over 0.72 m (80.53 to 81.25 m), and SM-24-003 returned 163 g/t Ag.Eq over 0.40 m (81.80 to 82.20 m) (Figure 1; Table 1). The intercepts from hole SM-24-004 and 017 extend the oxide zone mineralization 37 m and 100 m, respectively, below the last mine development in this area.

A new parallel mineralized zone was discovered approximately 10 m to the southwest of the San Marcos Zone: hole SM-24-004 returned 283 g/t Ag.Eq over 0.55 m (44.45 to 45.00 m), SM-24-005 returned 147 g/t Ag.Eq over 3.50 m (53.50 to 57.00 m).

Table 1 – Select Assay Intervals from Holes SM-24-001 to 017 and Historical Results

| Zone | Hole | From | To | Length (m) |

Type(2) | Ag.Eq(1) g/t |

Ag g/t |

Au g/t |

Pb % |

Zn % |

Cu % |

| SM | SM-24-003 | 81.80 | 82.20 | 0.40 | OX | 163 | 117 | 0.52 | 0.16 | 0.19 | 0.01 |

| NEW | SM-24-004 | 44.45 | 45.00 | 0.55 | OX | 283 | 266 | 0.19 | 0.56 | 0.08 | 0.01 |

| SM | SM-24-004 | 80.53 | 81.25 | 0.72 | OX | 148 | 17 | 1.46 | 0.04 | 0.01 | 0.00 |

| NEW | SM-24-005 | 53.50 | 57.00 | 3.50 | OX | 147 | 141 | 0.07 | 0.38 | 0.34 | 0.01 |

| SM | SM-24-005 | 92.50 | 95.00 | 2.50 | OX | 178 | 166 | 0.13 | 0.16 | 0.08 | 0.01 |

| SM | SM-24-005 | 97.50 | 98.00 | 0.50 | OX | 187 | 181 | 0.07 | 0.18 | 0.11 | 0.02 |

| SM | SM-24-005 | 101.00 | 102.00 | 1.00 | OX | 371 | 369 | 0.02 | 0.13 | 0.43 | 0.04 |

| SM | SM-24-008 | 81.00 | 81.76 | 0.76 | OX | 182 | 165 | 0.19 | 0.09 | 0.09 | 0.00 |

| SM | SM-24-010 | 75.72 | 94.75 | 19.03 | SUL | 249 | 183 | 0.60 | 0.44 | 0.18 | 0.02 |

| including | 77.85 | 80.48 | 2.63 | SUL | 367 | 142 | 2.45 | 0.53 | 0.52 | 0.01 | |

| and | 89.61 | 94.75 | 5.14 | SUL | 504 | 449 | 0.37 | 0.75 | 0.20 | 0.04 | |

| SM-24-010 | 101.52 | 103.65 | 2.13 | SUL | 427 | 370 | 0.24 | 1.15 | 0.23 | 0.03 | |

| SM | SM-24-011 | 147.92 | 159.67 | 11.75 | SUL | 319 | 210 | 0.65 | 1.67 | 0.43 | 0.05 |

| including | 152.30 | 154.30 | 2.00 | SUL | 569 | 374 | 0.83 | 4.28 | 0.48 | 0.08 | |

| and | 156.80 | 158.67 | 1.87 | SUL | 431 | 340 | 0.53 | 1.47 | 0.31 | 0.07 | |

| SM | SM-24-012 | 95.04 | 95.53 | 0.49 | OX | 503 | 489 | 0.16 | 1.39 | 3.76 | 0.04 |

| SM | SM-24-012 | 107.34 | 108.55 | 1.21 | OX | 141 | 126 | 0.16 | 0.37 | 0.17 | 0.02 |

| SM | SM-24-014 | 94.00 | 95.00 | 1.00 | OX | 204 | 204 | 0.00 | 0.03 | 0.10 | 0.00 |

| SM | SM-24-016 | 120.50 | 123.75 | 3.25 | SUL | 191 | 125 | 0.38 | 0.93 | 0.42 | 0.03 |

| SM | including | 122.50 | 123.00 | 0.50 | SUL | 514 | 485 | 0.07 | 0.74 | 0.13 | 0.05 |

| NEW | SM-24-017 | 134.40 | 134.80 | 0.40 | OX | 178 | 152 | 0.29 | 3.66 | 0.93 | 0.08 |

| SM | SM-24-017 | 173.00 | 174.00 | 1.00 | OX | 405 | 392 | 0.14 | 1.13 | 0.17 | 0.05 |

| HISTORICAL RESULTS | |||||||||||

| SM | SLP-SM-19-03 | 404.05 | 405.00 | 0.95 | OX | 154 | 141 | 0.14 | 0.29 | 0.38 | 0.00 |

| SM | SLP-SM-19-06 | 386.85 | 387.30 | 0.45 | OX | 242 | 32 | 2.33 | 0.01 | 0.02 | 0.00 |

| SM | SLP-SM-17-02 | 262.35 | 262.85 | 0.50 | OX | 234 | 2 | 2.58 | 0.00 | 0.05 | 0.03 |

| SM | SLP-SM-17-05 | 308.35 | 309.20 | 0.85 | OX | 456 | 444 | 0.13 | 0.38 | 0.12 | 0.09 |

| SM | SLP-SM-17-07 | 239.15 | 241.15 | 2.00 | OX | 440 | 439 | 0.01 | 0.44 | 0.15 | 0.01 |

| SM | SLP-SM-17-10 | 258.55 | 259.25 | 0.70 | OX | 363 | 358 | 0.06 | 0.80 | 1.39 | 0.01 |

| SM | SLP-SM-17-12 | 280.25 | 280.75 | 0.50 | OX | 152 | 124 | 0.31 | 0.21 | 0.04 | 0.03 |

| SM | SLP-SM-17-13 | 314.75 | 315.80 | 1.05 | SUL | 274 | 122 | 1.19 | 0.83 | 1.25 | 0.01 |

| SM | SLP-SM-17-15 | 268.80 | 271.10 | 2.30 | OX | 283 | 283 | 0.01 | 0.03 | 0.06 | 0.00 |

| SM | SLP-SM-17-16 | 312.30 | 313.85 | 1.55 | OX | 378 | 344 | 0.38 | 2.99 | 3.42 | 0.05 |

| SM | ILP-SM-14-06 | 17.00 | 17.95 | 0.95 | OX | 285 | 285 | 0.01 | 0.04 | 0.09 | 0.00 |

| SM | ILP-SM-14-25 | 27.35 | 28.40 | 1.05 | OX | 218 | 218 | 0.01 | 0.10 | 0.13 | 0.00 |

| SM | ILP-SM-14-26 | 26.30 | 26.60 | 0.30 | OX | 212 | 199 | 0.14 | 0.10 | 0.17 | 0.01 |

| SM | SM-07 | 189.70 | 190.70 | 1.00 | OX | 643 | 633 | 0.11 | 0.11 | 0.04 | 0.33 |

| SM | SM-19 | 127.80 | 128.70 | 0.90 | OX | 195 | 185 | 0.11 | 0.09 | 0.20 | 0.01 |

| SM | SM-21 | 184.10 | 185.70 | 1.60 | OX | 266 | 136 | 1.44 | 0.08 | 0.07 | 0.01 |

| SM | SM-25 | 258.45 | 261.10 | 2.65 | OX | 163 | 161 | 0.02 | 1.43 | 2.41 | 0.01 |

| SM | SM-26 | 266.55 | 267.50 | 0.95 | OX | 176 | 158 | 0.20 | 0.12 | 0.24 | 0.01 |

| SM | SM-27 | 222.85 | 223.75 | 0.90 | OX | 332 | 328 | 0.05 | 0.11 | 0.07 | 0.06 |

| SM | SM-28 | 243.45 | 246.60 | 3.15 | SUL | 599 | 539 | 0.55 | 0.57 | 0.01 | 0.05 |

| SM | SM-32 | 197.90 | 199.05 | 1.15 | OX | 315 | 313 | 0.02 | 0.11 | 0.08 | 0.01 |

| SM | SM-36 | 232.35 | 238.05 | 5.70 | OX | 436 | 416 | 0.22 | 2.05 | 1.47 | 0.03 |

Table 2 – Historical Channel Sample Results (3) – San Marcos Zone

| Elevation | Zone | Channel | Width | Type(2) | Ag.Eq(1) g/t |

Ag g/t |

Pb % |

Zn % |

| 1790 | SM | VSM-1790-2188 | 0.60 | SUL | 755 | 702 | 1.51 | 0.46 |

| 1790 | SM | VSM-1790-2190 | 0.80 | SUL | 102 | 45 | 1.17 | 0.92 |

| 1790 | SM | VSM-1790-2193 | 2.60 | SUL | 1,344 | 1,255 | 2.88 | 0.44 |

| 1790 | SM | VSM-1790-2195 | 3.40 | SUL | 1,045 | 942 | 3.65 | 0.21 |

| 1790 | SM | VSM-1790-2198 | 4.50 | SUL | 628 | 598 | 0.93 | 0.18 |

| 1790 | SM | VSM-1790-2201 | 2.30 | SUL | 759 | 685 | 2.58 | 0.17 |

| 1790 | SM | VSM-1790-2203 | 2.40 | SUL | 442 | 404 | 1.32 | 0.09 |

| 1790 | SM | VSM-1790-2205 | 4.10 | SUL | 836 | 777 | 2.11 | 0.10 |

| 1790 | SM | VSM-1790-2208 | 3.50 | SUL | 514 | 484 | 1.10 | 0.00 |

| 1790 | SM | VSM-1790-2211 | 3.40 | SUL | 198 | 183 | 0.52 | 0.04 |

| 1790 | SM | VSM-1790-2214 | 0.30 | SUL | 277 | 265 | 0.43 | 0.01 |

| 1790 | SM | VSM-1790-2217 | 0.50 | SUL | 267 | 251 | 0.54 | 0.05 |

| 1804 | SM | VSM-1804-2191 | 2.35 | SUL | 243 | 220 | 0.52 | 0.30 |

| 1804 | SM | VSM-1804-2194 | 0.40 | SUL | 486 | 434 | 1.80 | 0.16 |

| 1804 | SM | VSM-1804-2195 | 2.70 | SUL | 766 | 616 | 4.01 | 1.54 |

| 1804 | SM | VSM-1804-2197 | 3.55 | SUL | 972 | 835 | 4.99 | 0.10 |

| 1804 | SM | VSM-1804-2199-2200 | 6.90 | SUL | 1,739 | 1,552 | 6.00 | 0.92 |

| 1804 | SM | VSM-1804-2202-2204 | 8.90 | SUL | 1,072 | 976 | 3.45 | 0.11 |

| 1804 | SM | VSM-1804-2206-2207 | 7.50 | SUL | 828 | 754 | 2.67 | 0.08 |

| 1804 | SM | VSM-1804-2208-2209 | 5.25 | SUL | 824 | 747 | 2.80 | 0.07 |

| 1804 | SM | VSM-1804-2211-2213 | 4.95 | SUL | 757 | 97 | 0.13 | 0.01 |

| 1804 | SM | VSM-1804-2214 | 3.50 | SUL | 506 | 464 | 1.57 | 0.00 |

| 1804 | SM | VSM-1804-2217 | 3.70 | SUL | 304 | 293 | 0.36 | 0.05 |

| 1804 | SM | VSM-1804-2220 | 0.55 | SUL | 1,078 | 1,066 | 0.42 | 0.00 |

| 1804 | SM | VSM-1804-2223 | 0.50 | SUL | 643 | 638 | 0.15 | 0.03 |

| (1) | All results in this release are rounded. Assays are uncut and undiluted. Widths are core-lengths, not true widths. Silver equivalent: Ag.Eq g/t was calculated using commodity prices of US$22.50 /oz Ag, US$1,800 /oz Au, US$0.94 /lb Pb, and US$1.35 /lb Zn applying metallurgical recoveries of 70.1% for silver and 82.8% for gold in oxides and 79.6% for silver, 80.1% for gold, 74.7% for lead and 58.8% for zinc in sulphides. Metal payable used was 99.6% for silver and 95% for gold in doré produced from oxides, and 95% for silver, gold, and lead and 85% for zinc in concentrates produced from sulphides. Cut-off grades considered for oxide and sulphide were, respectively 140 g/t Ag.Eq and 125 g/t Ag.Eq and are based on 2017 costs adjusted by the inflation rate and include sustaining costs. | |||||||

| (2) | Each mineralization type, Oxide (OX) or sulphide (SUL), has different assumptions, outlined in Note (1) above, which are used to arrive at a calculated Ag.Eq g/t. | |||||||

| (3) | Weighted average grades were calculated over the mineralized widths of each channel (Figures 1 & 2). | |||||||

Sample Analysis and QA/QC Program

Silver Storm uses a quality assurance/quality control program that monitors the chain of custody of samples and includes the insertion of blanks, duplicates, and reference standards in each batch of samples sent for analysis. The drill core is photographed, logged, and cut in half, with one half retained in a secured location for verification purposes and one half shipped for analysis. Sample preparation (crushing and pulverizing) is performed at ALS Geochemistry, an independent ISO 9001:2001 certified laboratory, in Zacatecas, Mexico and pulps are sent to ALS Geochemistry in Vancouver, Canada for analysis. The entire sample is crushed to 70% passing -2 mm, and a riffle split of 250 grams is taken and pulverized to better than 85% passing 75 microns. Samples are analyzed for gold using a standard fire assay with Atomic Absorption Spectrometry (AAS) (Au-AA23) from a 30-gram pulp. Gold assays greater than 10 g/t are re-analyzed on a 30-gram pulp by fire assay with a gravimetric finish (Au-GRA21). Samples are also analyzed using a 34 element inductively coupled plasma (ICP) method with atomic emission spectroscopy (AES) on a pulp digested by four acids (ME-ICP61). Overlimit sample values for silver (>100 g/t), lead (>1%), zinc (>1%), and copper (>1%) are re-assayed using a four-acid digestion overlimit method with ICP-AES (ME-OG62). For silver values greater than 1,500 g/t, samples are re-assayed using a fire assay with gravimetric finish on a 30-gram pulp (Ag-GRA21). Samples with lead values over 20% are re-assayed using volumetric titration with EDTA on a 1-gram pulp (Pb-VOL70). No QA/QC issues were noted with the results reported herein.

Review by Qualified Person and QA/QC

The scientific and technical information in this document has been reviewed and approved by Bruce Robbins, P.Geo., a Qualified Person as defined by National Instrument 43-101.

About Silver Storm Mining Ltd. (formerly Golden Tag Resources Ltd.)

Silver Storm Mining Ltd. holds advanced-stage silver projects located in Durango, Mexico. Silver Storm recently completed the acquisition of 100% of the La Parrilla Silver Mine Complex, a prolific operation which is comprised of a 2,000 tpd mill as well as five underground mines and an open pit that collectively produced 34.3 million silver-equivalent ounces between 2005 and 2019. The Company also holds a 100% interest in the San Diego Project, which is among the largest undeveloped silver assets in Mexico.

Figure 1: San Marcos Zone Cross Section View to WSW of Key Results Current & Historical Holes (Photo: Business Wire)

Figure 2: San Marcos Zone South Oblique View to SW of Key Results Holes SM-24-008 to 015 (Photo: Business Wire)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE