Energy Transition Momentum Slowing amid Rising Global Volatility, New Report Finds

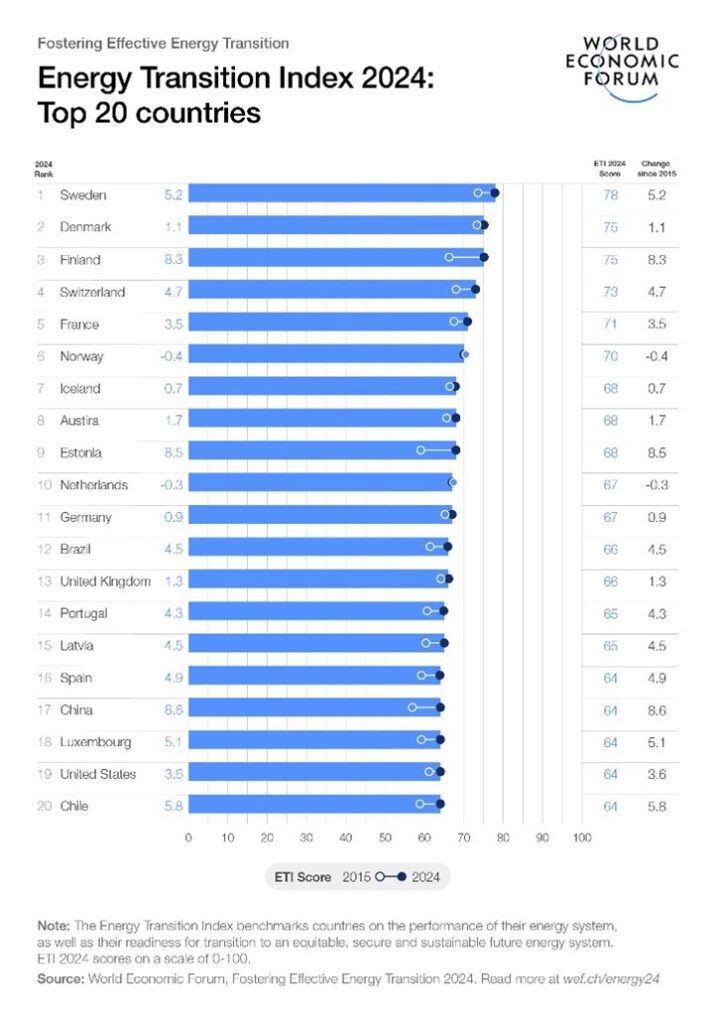

- European countries lead the World Economic Forum Energy Transition Index 2024 rankings; Sweden comes top, followed by Denmark, Finland, Switzerland and France.

- Emerging economies such as Brazil and China make notable progress, although 83% of countries move backwards from last year in at least one of the three energy system performance dimensions – security, equity and sustainability.

- The gap in energy transition performance between advanced and developing economies continues to narrow, although disparities in investments and regulation remain.

- Read the full report here.

The global energy transition to a more equitable, secure and sustainable energy system is still progressing but has lost momentum in the face of increasing uncertainty worldwide, according to a new World Economic Forum report, published today.

While 107 of the 120 countries benchmarked in the report demonstrated progress on their energy transition journeys in the past decade, the overall pace of the transition has slowed and balancing its different facets remains a key challenge. Economic volatility, heightened geopolitical tensions and technological shifts have all had an impact, complicating its speed and trajectory. There is, however, some reason for optimism, with increasing global investments in renewables and significant growth in energy transition performance in sub-Saharan Africa over the past decade.

The 14th annual edition of the Forum’s report, Fostering Effective Energy Transition 2024, published in collaboration with Accenture, uses the Energy Transition Index (ETI) to benchmark 120 countries on the performance of their current energy systems, with a focus on balancing equity, environmental sustainability and energy security, and on their transition-readiness. New this year to the report are “tailored pathways” for analysing country-specific characteristics, including income level and local energy resources, to provide region-specific recommendations.

“We must ensure that the energy transition is equitable, in and across emerging and developed economies,” said Roberto Bocca, Head of the Centre for Energy and Materials, World Economic Forum. “Transforming how we produce and consume energy is critical to success. We need to act on three key levers for the energy transition urgently: reforming the current energy system to reduce its emissions, deploying clean energy solutions at scale, and reducing energy intensity per unit of GDP.”

ETI 2024 Scores

Europe continues to lead the ETI rankings, with the top 10 list for 2024 fully composed of countries from that region. Sweden (1) and Denmark (2) top the rankings, having both placed in the top three countries each year for the past decade. They are followed by Finland (3), Switzerland (4) and France (5). These countries benefit from high political commitment, strong investments in research and development, expanded clean energy adoption – accelerated by the regional geopolitical situation, energy-efficiency policies and carbon pricing. France is a new entrant in the top five, with recent energy-efficiency measures reducing energy intensity in the past year.

Among G20 economies, Germany (11), Brazil (12), the United Kingdom (13), China (17) and the United States (19) join France in the ETI top 20, along with new entrants Latvia (15) and Chile (20), which were buoyed by increases in renewable energy capacity.

China and Brazil have progressed significantly in recent years, primarily driven by long-term efforts to increase the share of clean energy and enhance their grid reliability. Brazil’s ongoing commitment to hydropower and biofuels, recent strides in solar energy, along with initiatives tailored to create new opportunities have been key in attracting investments. In 2023, China also significantly scaled up its renewable energy capacity and continued to grow and invest in its manufacturing capability in clean technologies such as batteries for electric vehicles, solar panels, wind turbines and other critical technologies. China, together with the US and India, is also leading in developing new energy solutions and technologies.

The gap in overall ETI scores has narrowed between advanced and developing economies and the “centre of gravity” of the transition is moving to developing countries. However, clean energy investment continues to be concentrated in advanced economies and China. This underscores the need for financial support from advanced nations to facilitate an equitable energy transition in emerging and developing nations and forward-thinking policy-making in all nations to foster truly conducive investment conditions. As no universal solution exists, policies could be tailored to each country’s unique needs, based on factors such as income level, national energy resources and needs, as well as regional context.

“This year’s Energy Transition Index delivers a clear message: urgent action is needed. Global decision-makers must make bold moves to regain momentum in the transition towards an equitable, secure and sustainable energy future. This is critical for people, entire economies and the fight against climate change,” said Espen Mehlum, Head of Energy Transition Intelligence and Regional Acceleration, World Economic Forum.

Top 20 Countries in ETI 2024

ETI 2024 Results Analysis

Global average ETI scores reached a record high. However, the slowdown in the pace of the global energy transition, first identified in 2022, has intensified in the past year. The 2024 report shows that the three-year improvement in global ETI scores between 2021-2024 is almost four times less than the upswing over the 2018-2021 period. Furthermore, the report indicates that 83% of countries achieved lower scores than last year on at least one of the primary performance dimensions of the energy transition – sustainability, equity and security.

While the world remains off-track to meet net-zero ambitions by 2050 and keep global warming to no more than 1.5C, as called for in the Paris Agreement, there has been notable progress in energy efficiency and a marked increase in the adoption of clean energy sources. Energy transition momentum has been slowed by setbacks in energy equity, driven by rising energy prices in recent years. Energy security continues to be tested by geopolitical tensions.

Innovation is a key enabling factor for the energy transition and can reduce costs, scale key technologies, renew and reskill the workforce and attract investments. Despite a recent slowdown in innovation progress and a drop in global start-up investments in 2023, there are areas where innovation is accelerating, as per the new report.

Digital innovations, including generative AI, offer significant opportunities to fill this gap and reinvent the energy industry by enhancing productivity. Generative AI’s ability to analyse vast quantities of data can provide innovative forecasts and solutions, or streamline existing operations to increase efficiencies, among other benefits. However, to fully realize this potential, it will be crucial to responsibly and equitably address the risks and challenges posed by these technologies.

“C-suites consistently tell us a clear business case is a prerequisite for attracting investments in the energy transition, especially in the face of higher interest rates and the emerging talent shortage,” said Muqsit Ashraf, Group Chief Executive, Accenture Strategy. “We believe that a strong digital core, enabled by generative AI, can boost productivity, enhancing returns and talent availability and unlocking a new wave of investments.”

About the Energy Transition Index 2024

The Energy Transition Index provides a data-driven framework to foster understanding of the performance and readiness of global energy systems for the transition. The ETI covers 120 countries in terms of their current energy system performance and transition-readiness and countries are scored across 46 indicators. These countries are selected based on the availability of consistent indicator data at respective sources for more than a minimum number of indicators in each dimension of the index. System performance is equally weighted across equity, security and sustainability. Transition-readiness is split into two groups: core enablers and enabling factors. Core enablers include regulations and political commitment, and finance and investment. Enabling factors include innovation, infrastructure, and education and human capital. A country’s final ETI score is a composite of its scores on the two sub-indices of system performance and transition-readiness, weighted at 60% and 40% respectively.

Links to visuals and graphics

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE