AGNICO EAGLE RELEASES DETOUR LAKE PROPOSED UNDERGROUND MINING PLAN DEMONSTRATING STRONG RETURNS AND PATHWAY TO ANNUAL GOLD PRODUCTION OF ONE MILLION OUNCES

Agnico Eagle Mines Limited (NYSE: AEM) (TSX: AEM) is pleased to provide an update on the Detour Lake mine, located in Ontario.

The Company has recently completed an updated mineral reserve and mineral resource estimate and an updated life of mine plan for its Detour Lake mine as at March 31, 2024. The 2024 LOMP builds on the Company’s previously filed technical report on Detour Lake (2021) as well as the mine plan update released by the Company in July 2022 (see the Company’s news release dated July 27, 2022).

The 2024 LOMP updates the open pit mine production profile and incorporates updated costing. The Company has also completed a preliminary economic assessment which contemplates the concurrent operation of the open pit and a proposed underground mining project, combined with mill throughput optimization to 29 million tonnes per annum (“Mtpa”). The 2024 PEA demonstrates that the Underground Project and the mill optimization have the potential to increase the Detour Lake mine’s overall production to an average of approximately one million ounces of gold per year over a 14 year period, starting in 2030.

“At Detour Lake, the Company continues to build on the unique potential of this world class asset. With the development of an underground mine to complement the existing open pit mine, we see the opportunity to transform the asset into one of the top five gold mines in the world by output. We believe the Underground Project has relatively low execution risk, and has the potential to generate a strong risk-adjusted return on capital while maintaining exploration and production upside for decades in one of the best mining jurisdictions in the world,” said Ammar Al-Joundi, Agnico Eagle’s President and Chief Executive Officer. “We have adopted a phased and disciplined approach to develop this potential, with the approval of a $100 million investment over the next three years to further study and de-risk the Underground Project, including the development of an exploration ramp and the collection of a bulk sample. Concurrently, we are planning a conversion and expansion drill program to realize the upside exploration potential along the western plunge of the mineralization. The long mineral reserve life and significant production base at both Detour Lake and Canadian Malartic provide a solid foundation for Agnico Eagle’s production profile and strongly positions the Company for decades to come,” added Mr. Al-Joundi.

Highlights from the 2024 PEA include:

- Pathway to produce one million ounces per year at Detour Lake

- The PEA 2024 delivers on the Company’s objectives to increase returns and lengthen the mine life. The Underground Project provides earlier access to a high grade core of mineralization at depth below the reserve pit through underground development and displaces lower grade open pit production to the end of life. The project also sets the stage for future underground expansion along the western plunge of the mineralization

- The updated MRMR delineates a subset of the mineral resources with a gold cut-off grade of 1.22 grams per tonne (“g/t”), which is amenable to underground mining within, and proximal to, the open pit mineral resource. The mineral resource estimate from the high-grade mineralized corridors totals 1.2 million ounces of gold (19.0 million tonnes grading 1.93 g/t gold) of indicated mineral resource and 7.1 million ounces of gold (107.7 million tonnes grading 2.05 g/t gold) of inferred mineral resource

- In the 2024 PEA, the Underground Project incorporates in the mine plan approximately 55% of the in-situ high-grade mineral resources, including approximately 0.7 million ounces of gold in indicated mineral resources (9.0 million tonnes grading 2.36 g/t of gold) and 3.9 million ounces in gold of inferred mineral resources (48.5 million tonnes grading 2.50 g/t of gold)

- Relative to the 2022 LOMP, the life of mine payable gold production increases by 27% to 22 million ounces of gold in the 2024 PEA, including an increase of 0.7 million ounces of gold from the open pit and the addition of 4.0 million ounces of gold from the Underground Project

- The 2024 PEA assumes an underground mining rate of approximately 11,200 tonnes per day (equivalent to 4.0 Mtpa) starting in 2030, combined with a mill expansion to 79,450 tpd (equivalent to an annualized 29 Mtpa) starting in 2028. Annual production is expected to increase by approximately 43% or 300,000 ounces of gold per year, from 2030 to 2043 to approximately one million ounces per year when compared to average annual production in years 2024 to 2029

- The 2024 PEA extends Detour Lake’s mine life by two years to 2054. The Company believes that there is a good upside potential for additional exploration to add ounces to the mine plan in future years, which could result in an increase in production in the period between 2044 and 2054 or extend the life of the mine

- The large MRMR base provides a foundation for the Company’s production profile for decades to come

- The Underground Project and mill optimization bring value forward and improve valuation

- Overall, the inclusion of a portion of the large mineable mineral resource, increased mill throughput rate and current high gold price environment contribute significantly to increase the economic value of Detour Lake, more than offsetting inflationary cost increases since the 2022 LOMP

- The average total cash costs for the Underground Project, combined with the mill optimization to 29 Mtpa, are expected to be $690 per ounce

- Development capital expenditures for the Underground Project and mill optimization to 29 Mtpa are forecast to be approximately $731 million. Sustaining capital expenditures are forecast to be approximately $631 million over the life of the Underground Project, or between $40 million to $45 million per year from 2030 to 2043

- The Underground Project and mill throughput optimization to 29 Mtpa are expected to generate an after-tax internal rate of return (“IRR”) of approximately 18% using a gold price assumption of $1,900 per ounce and a C$/US$ foreign exchange rate of 1.34. At current gold prices of approximately $2,300 per ounce and a C$/US$ foreign exchange rate of 1.34, the Underground Project and mill throughput optimization to 29 Mtpa are expected to generate an after-tax IRR of approximately 25%

- The Detour Lake mine is forecast to generate strong free cash flow through the construction phase of the Underground Project

- Phased approach to further study and de-risk the project, with limited investment over next three years

- The Company has approved a $100 million investment from 2024 to 2026 to develop a 2.0 kilometre exploration ramp to a depth of approximately 270 metres to collect a bulk sample and to facilitate infill and expansion drilling of the current underground mineral resource. Another zone to the east will be tested through a high intensity drilling program in 2025. The analysis of the bulk sample and results from the high intensity drilling program will help validate the continuity of the mineralization and the accuracy of the geological model

- The exploration ramp will be sized to accommodate a potential production phase and is included in the initial capital expenditure estimate of approximately $731 million

- Significant exploration potential to grow underground mineral resources

- The 2024 PEA is based on a mineral resource estimate which relies on a drill database cut-off as at October 16, 2023. The Company has since drilled an additional 131,500 metres in 142 holes at Detour Lake to the end of May 2024 in an ongoing exploration program which has returned some of best intercepts to date at Detour Lake. The recent exploration results show potential to significantly expand the underground mineral resource at shallow depth, west of the pit

- As part of the Company’s exploration budget, over the next three years, an exploration program of $65 million will be carried out at Detour Lake to accelerate conversion and expansion drilling of the current underground mineral resource. Exploration in 2024 is continuing to test and extend the western plunge of the main deposit

- Continue to enhance value through optimization studies and exploration focus

- Concurrent with the enhanced exploration program and the development of the exploration ramp, the Company will continue to evaluate the optimization of the open pit, underground mining and mill processes to further improve project returns, including the potential to increase the mill throughput beyond the currently contemplated 29 Mtpa

- The Company will continue to advance regional exploration activities on satellite targets on the Company’s large land position around the Detour Lake and adjacent Detour East properties that could potentially extend the mine life

Operating and Financial Parameters Highlights – 2022 LOMP, 2024 LOMP and 2024 PEA

The life of mine totals, from the second quarter of 2024 to the end of life, for the operating and financial parameters of the 2022 LOMP, the 2024 LOMP and the 2024 PEA are set out in the table below.

The forecast parameters surrounding the 2024 PEA were based on a preliminary economic assessment, which is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty that the forecast production amounts will be realized. The basis for the preliminary economic assessment and the qualifications and assumptions made by the qualified persons who undertook the preliminary economic assessment are set out in this news release. The results of the preliminary economic assessment had no impact on the results of any pre-feasibility or feasibility study in respect of Detour Lake.

| LIFE OF MINE TOTALS

(All numbers are approximate) |

Unit | 2022 LOMP | 2024 LOMP | 2024 PEA |

| Open Pit

Mill at 28 Mtpa |

Open Pit

Mill at 28 Mtpa |

Open Pit

Underground Mill at 29 Mtpa |

||

| Economic Assumptions | ||||

| Gold Price | $/oz | $ 1,500 | $ 1,900 | $ 1,900 |

| Exchange Rate USD:CAD | 1.30 | 1.34 | 1.34 | |

| Effective Tax Rate (as % of free cash flow before tax) |

% | 26.7 % | 27.7 % | 28.7 % |

| Production | ||||

| Mine Life | 2052 | 2053 | 2054 | |

| Open Pit | ||||

| Tonnes Mined | Mt | 736.2 | 755.7 | 755.7 |

| Gold Grade | g/t | 0.77 | 0.77 | 0.77 |

| Strip Ratio | t:t | 1.71 | 1.76 | 1.76 |

| Underground | ||||

| Tonnes Mined | Mt | — | — | 52.8 |

| Gold Grade | g/t | — | — | 2.46 |

| Mill Metrics | ||||

| Mill Feed | kt | 781.2 | 818.6 | 871.5 |

| Gold Grade | g/t | 0.75 | 0.75 | 0.85 |

| Recovery | % | 91.6 % | 91.3 % | 92.2 % |

| Average Mill Throughput | Mtpa | 28.0 | 28.0 | 29.0 |

| Gold production | ||||

| Open Pit | Moz | 17.3 | 18.0 | 18.0 |

| Underground | Moz | — | — | 4.0 |

| Operating Costs | ||||

| Minesite costs per tonne1 | C$/t | $ 21.8 | $ 22.1 | $ 24.9 |

| Total Cash Cost*,1 | $/oz | $ 761 | $ 752 | $ 741 |

| Capital Expenditures | ||||

| Total Open Pit Development*,2 | ($ millions) | $ 1,550 | $ 2,252 | $ 2,252 |

| Total Open Pit Sustaining*,2 | ($ millions) | $ 2,973 | $ 3,601 | $ 3,601 |

| Total Underground Project Development2 | ($ millions) | $ — | $ — | $ 731 |

| Total Underground Project Sustaining2 | ($ millions) | $ — | $ — | $ 631 |

| Total Capital Expenditures2 | ($ millions) | $ 4,523 | $ 5,852 | $ 7,215 |

Note: * Capitalized deferred stripping at Detour Lake was adjusted for the life of mine estimates following the integration of Kirkland Lake Gold Ltd, which resulted in the reclassification of approximately $444 million from operating costs to capital expenditures in the 2024 LOMP when compared to the 2022 LOMP.

| ______________________ |

| 1 Minesite costs per tonne and total cash costs per ounce are non-GAAP measures that are not standardized financial measures under International Financial Reporting Standards (“IFRS”). For a discussion of the composition and usefulness of certain of these non-GAAP measures and a reconciliation of this historical measure to production costs, see “Reconciliation of Non-GAAP Financial Performance Measures” and “Note Regarding Certain

Measures of Performance” in the Company’s Management Discussion & Analysis for the periods ended December 31, 2023 and March 31, 2024. Unless otherwise indicated, but total cash costs per ounce are reported on (i) a per ounce of gold production basis, and (ii) a by-product basis. For the years ended December 31, 2023 and December 31, 2022, the Company reported minesite costs per tonne, total cash costs per ounce at the Detour Lake mine of C$26 and C$25, and $735 and $657, respectively. |

| 2 Sustaining capital expenditures and development capital expenditures are non-GAAP measures that are not standardized financial measures under IFRS. For a discussion of the composition and usefulness of these non-GAAP measures and a reconciliation of these historical measures to production costs, see “Reconciliation of Non-GAAP Financial Performance Measures” and “Note Regarding Certain Measures of Performance” in the Company’s Management Discussion & Analysis for the periods ended December 31, 2023 and March 31, 2024. For the years ended December 31, 2023 and December 31, 2022, the Company reported sustaining capital expenditures and development capital expenditures at the Detour Lake mine of $249,765 and $214,060 and $172,903 and $180,072, respectively. |

The major variances between the 2024 LOMP and 2022 LOMP include:

- Total gold production – Gold production increased by 4% or 0.7 million ounces of gold primarily due to the replacement and identification of further open pit mineral reserves in 2022 and 2023

- Total cash costs per ounce – Total cash costs per ounce decreased by 1%, or $9 per ounce, as a result of the reclassification of $444 million (approximately $26 per ounce) from operating costs to capital expenditures, the assumption of a weaker Canadian dollar assumption, strong cost control programs, partially offset by higher costs associated with three years of inflation

- Total Capital expenditures – Total capital expenditures increased by 25%, or $1,329 million, primarily due to the reclassification of $444 million in operating costs to capital expenditures, increased maintenance costs associated with higher wear and tear at the mill of approximately $162 million due to the higher throughput rate and the update in costs associated with three years of inflation, partially offset by the assumption of a weaker Canadian dollar assumption

The major variances between the 2024 PEA and 2024 LOMP include:

- Total gold production – Gold production increased by 22% or 4.0 million ounces of gold primarily due to the addition of production from the Underground Project

- Total cash costs – Total cash costs decreased by 1%, or $11 per ounce, as a result of higher gold grades from the Underground Project and lower processing cost per tonne due to the increased in mill throughput, partially offset by higher unit operating cost per tonne from the Underground Project

- Total Capital expenditures – The increase in total capital expenditures of approximately $1,364 million reflect the development capital of approximately $731 million and the sustaining capital expenditures of $631 million for the Underground Project and the mill optimization to 29 Mtpa

| __________________________ |

| Performance” in the Company’s Management Discussion & Analysis for the periods ended December 31, 2023 and March 31, 2024. For the years ended December 31, 2023 and December 31, 2022, the Company reported sustaining capital expenditures and development capital expenditures at the Detour Lake mine of $249,765 and $214,060 and $172,903 and $180,072, respectively. |

Overall, the inclusion of the large mineable mineral resource, increased mill throughput rate and higher gold price environment contribute significantly to the increased economic value of Detour Lake, more than offsetting inflationary cost increases since the 2022 LOMP.

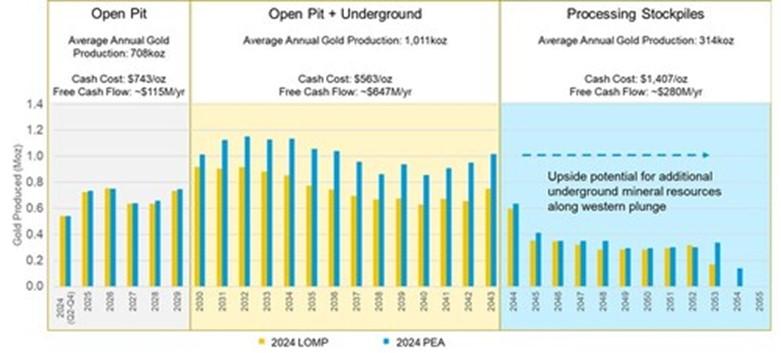

The Underground Project and mill optimization provide the Detour Lake mine with the potential to transform and grow annual gold production from approximately 700,000 ounces per year to approximately one million ounces per year starting in 2030. Over the pre-production period of the Underground project, annual average free cash flows3 would be of approximately $115 million at an assumed gold price of $1,900 per ounce and a USD:CAD exchange rate assumption of 1.34. The 2024 PEA provides that once the Underground Project is in production, annual free cash flow generation would be expected to increase significantly to an annual average of approximately $650 million. Once the open pit and underground mine would be forecast to end operating in 2044, the mill would be expected to run for another 10 years processing stockpiles. During that 10-year period, the site would be expected to remain a strong cash flow generator with annual average free cash flow of approximately $280 million.

The Company believes that there is a good upside potential for additional exploration to add ounces to the mine plan in future years, which could result in continued mine production and a resulting increase in annual gold production in the period 2044 to 2054 or an extension of the life of mine.

The graph below provides a breakdown of the annual gold production in the 2024 LOMP and 2024 PEA and shows the key operational and financial parameters over the main production phases of the 2024 PEA.

| ________________________ |

| 3 Free cash flow is a non-GAAP measure that is not a standardized financial measure under IFRS. For a discussion of the composition and usefulness of this non-GAAP measure, see “Note Regarding Certain Measures of Performance” in this news release. |

Updated MRMR Estimate at March 31, 2024

The MRMR estimate at Detour Lake has been updated to March 31, 2024, from the previously released MRMR estimate at December 31, 2023 (see the Company’s news release dated February 15, 2024). No additional drill results were incorporated into this latest update, which used the same drill database as the MRMR estimate at year-end, with a database closure date of October 16, 2023.

In contrast with the year-end 2023 MRMR estimate, the MRMR estimate at March 31, 2024 incorporates an improved mineral resource model and includes high grade and low grade mineralized corridors factoring an improved structural and geological understanding. The new mineral resource model provides more flexibility and reliability in ongoing project studies and optimization efforts.

The parameters of the updated MRMR estimate are in the notes of the table below and in the Appendix.

The updated MRMR estimate as at March 31, 2024 and the variances to the estimate as at December 31, 2023 are set out in the table below. The variance between estimates largely illustrates the replacement of lower grade ore that could be mined well into the future (primarily in the measured mineral resource and indicated mineral resource categories) with higher grade ore amenable to underground mining in the nearer term (primarily in the inferred mineral resource category).

| As at March 31, 2024 | As at December 31, 2023 | Variance | |||||

| Category | Tonnes (000s) |

Gold Grade

(g/t) |

Contained Gold

(000 oz) |

Tonnes (000s) |

Gold Grade

(g/t) |

Contained Gold

(000 oz) |

Contained Gold

(000 oz) |

| Mineral Reserves | |||||||

| Total Proven & Probable1 | 818,621 | 0.75 | 19,672 | 819,049 | 0.76 | 19,928 | -256 |

| Mineral Resources | |||||||

| Measured and Indicated Low Grade2 |

647,093 | 0.58 | 12,116 | 728,681 | 0.77 | 17,955 | |

| Measured and Indicated High Grade3 |

19,025 | 1.93 | 1,183 | — | — | — | |

| Total Measured & Indicated | 666,118 | 0.62 | 13,299 | 728,681 | 0.77 | 17,955 | -4,656 |

| Inferred Low Grade2 | 27,798 | 0.54 | 483 | 58,317 | 0.62 | 1,156 | |

| Inferred High Grade3 | 107,658 | 2.05 | 7,085 | 21,801 | 2.23 | 1,561 | |

| Total Inferred | 135,456 | 1.74 | 7,568 | 80,127 | 1.05 | 2,717 | 4,851 |

| Notes: | |||||||

| 1. Proven and Probable mineral reserves are reported at a cut-off grade of 0.30 g/t gold. | |||||||

| 2. March 31, 2024 low grade mineral resources are reported at a cut-off grade of 0.25 g/t gold. December 31, 2023 low grade mineral resources are reported at a cut-off grade of 0.30 g/t gold inferred mineral resources are undiluted | |||||||

| 3. High-grade mineral resources are reported at a cut-off grade of 1.22 g/t gold. | |||||||

The main variances in the MRMR estimate are set out below:

- Mineral Reserves – The slight decline of 0.26 million ounces of gold in the March 31, 2024 estimate, compared to the December 31, 2023 estimate, is primarily due to mining depletion totalling 171,000 ounces of in situ gold

- Measured and Indicated Mineral Resources – The decline of 4.7 million ounces of gold (or 26%) in the March 31, 2024 estimate compared to the December 31, 2023 estimate is primarily due to the updated open pit costs leading to a shallower mineral resource pit, offset partially by an optimized cut-off grade. The variance is also explained by a local reclassification of indicated mineral resources within the high-grade corridors to inferred mineral resources where tighter drill spacing is required to return these areas to indicated mineral resources that could be potentially mined by underground methods. The decline in measured and indicated mineral resources is partially offset by the initial declaration of an underground indicated mineral resource totalling 0.7 million ounces of gold (10 million tonnes grading 2.0 g/t gold) at March 31, 2024

- Inferred Mineral Resources – The increase of 4.9 million ounces of gold (or 179%) in the March 31, 2024 estimate, compared to the December 31, 2023 estimate is primarily due to the mineral resource reclassification within the pit resource and the addition of underground inferred mineral resource below the shallower resource pit

- The proportion of underground mineral resources has increased in the March 31, 2024 estimate, compared to the December 31, 2023 estimate, as they are now being reported below a shallower resources pit. Future exploration, conversion drilling, bulk sampling and geological and structural studies are expected to improve and add evidence of high-grade continuity in the next iterations of the Detour Lake model

Additional details on the Detour Lake mineral reserves and mineral resources at March 31, 2024 are set out in the Appendix of this news release. Additional details on the Detour Lake mineral reserves and mineral resources at December 31, 2023 are set out in the Company’s news release dated February 15, 2024.

Pathway to transform Detour Lake into a one million ounce per year producer

Underground Project Overview

The Underground Project is located on the west side of the open pit, within the Detour Lake mining permit, and it will benefit from the existing infrastructure at the Detour Lake site, including tailing storage facilities area, processing plant and maintenance facilities. The Underground Project will share the same operating philosophy as the Detour Lake mine as a low-grade, high-volume operation, with a focus on cost control and continuous improvement. The preliminary mine concept adopts many of the design criteria and parameters of the Company’s existing high-volume underground mines in the Abitibi region. Also, as a brownfield project, the Company believes the Underground Project inherently has lower execution risk given the reduced permitting timeline, existing relationships with Indigenous communities and an experienced workforce in place.

Mineable Resource

The Underground Project hosts several high-grade mineralized corridors, which extend within, below and to the west of the mineral resource pit. For the 2024 PEA, mineable stope shapes were generated using an assumed gold price of $1,400 per ounce and a USD:CAD exchange rate of 1.30. Approximately 4.6 million ounces of gold or 55% of the in-situ underground mineral resources are incorporated in the 2024 PEA. Within the underground mine plan, approximately 15% of the gold ounces are categorized as indicated mineral resources and 85% are categorized as inferred mineral resources. A breakdown of the March 31, 2024 MRMR estimate and the mineral resources amenable to underground mining included in the 2024 PEA is set out in the table below.

| Potential Underground Mineral Resource below the Mineral Reserve Pit1 | ||||||

| As at March 31, 20242 | Included in 2024 PEA Production Profile3 |

|||||

| Mt | g/t | Moz Au | Mt | g/t | Moz Au | |

| Indicated High Grade Mineral Resources | ||||||

| Inside March 2024 Resource Pit | 9.0 | 1.83 | 0.5 | 4.5 | 2.34 | 0.3 |

| Outside March 2024 Resource Pit | 10.0 | 2.02 | 0.7 | 4.5 | 2.37 | 0.3 |

| Total | 19.0 | 1.94 | 1.2 | 9.0 | 2.36 | 0.7 |

| Inferred High Grade Mineral Resources | ||||||

| Inside March 2024 Resource Pit | 50.8 | 2.06 | 3.4 | 24.3 | 2.46 | 1.9 |

| Outside March 2024 Resource Pit | 56.8 | 2.04 | 3.7 | 24.2 | 2.53 | 2.0 |

| Total | 107.7 | 2.05 | 7.1 | 48.5 | 2.50 | 3.9 |

| Note: | ||||||

| 1. Reported in-situ before mining recovery | ||||||

| 2. March 31, 2024 mineral resources are reported at a cut-off grade of 1.22 g/t gold, inferred resources are undiluted | ||||||

| 3. Subset of mineral resources included in the PEA are reported at a cut-off grade of not less than 1.5 g/t gold | ||||||

Mining

The preliminary mining concept for the Underground Project is based on transverse longhole open stoping, as this mining method is best suited for the sub-vertical mineral deposit. Sublevels will be 40 metres apart, with the stope size averaging approximately 30,000 tonnes. Primary stopes will be backfilled with cemented paste fill, while secondary stopes will be backfilled with either cemented paste fill or waste rock fill according to the sequence and waste material available. Approximately 130 stopes will be mined annually to sustain a mining rate of approximately 11,200 tpd (equivalent to an annualized production rate of 4.0 Mtpa).

The Underground Project is expected to use a combination of conventional and automated equipment, similar to the Company’s Odyssey mine at the Canadian Malartic complex in Quebec. Ore and waste handling will be conducted by scoops and trucks with a capacity of 21 tonnes and 60 tonnes, respectively. The ore handling system to surface will consist of ore passes, an underground jaw crusher located at level 760 and a conveyor system with a capacity of 15,000 tpd. The conveyor will be installed in a dedicated conveyor ramp, with the portal located near the primary crusher on surface, east of the open pit. A service ramp, with the portal located near the west end of the open pit, will be the main underground access for the workforce, equipment and materials.

Production could begin as early as 2030 and ramp up to the designed rate 11,200 tpd by 2033, which is expected to be sustained throughout the mine life until 2044.

Mill Optimization to Throughput of 79,450 tpd (or 29 Mtpa)

The processing facility consists of two independent milling circuits, including gravity separation, concentrate leach, agitated tank leaching, carbon-in-pulp, solvent extraction and electrowinning. Over the last four years, the processing plant has undergone significant modifications to de-bottleneck existing circuits and improve throughput while maintaining recovery and reliability. The 2024 PEA contemplates that underground ore will be blended with the open pit ore and processed through the existing plant.

Through investments in the crushing and grinding circuits and continuous improvement efforts, the mill throughput rate has increased from approximately 62,900 tpd in 2020 to approximately 69,700 tpd in 2023 and is expected to reach 76,700 tpd by the end of 2024. The Company believes that further process optimization can be achieved with minimal investment to reach a mill throughput rate of 79,450 tpd by 2028. The main initiatives to realize this potential include:

- The implementation of advanced process control systems to optimize circuit charge, mass flow balance and recovery

- Further improvements to the crushing and grinding circuits, including the implementation of variable frequency drives for the secondary crushers and pebble crushers and redesigned SAG discharge screens

- Further optimization to the maintenance practices and improved mill runtime

An investment of approximately $12 million is included in the 2024 PEA to execute these initiatives.

The tailing management facilities currently planned for the 2024 LOMP are expected to have the capacity to accommodate the additional tailings generated from the processing of the Underground Project ore.

2024 PEA Production Profile

The integrated mining sequence has been optimized to include production from the Underground Project starting in 2030 and a milling throughput capacity of 29 Mtpa. The optimized profile includes the concurrent operation of the underground and the open pit operations from 2030 to 2044, during which time lower grade material from the open pit will be stockpiled to be processed at the end of the mine life. During that period, Detour Lake is expected to produce approximately one million ounces of gold per year. This represents a 43% increase in gold production when compared to the average annual production in years 2024 to 2029, or incremental average annual production of 300,000 ounces of gold. From 2044 onwards, the open pit low grade stockpile provides enough ore to sustain throughput of 29 Mtpa until the end of the mine life in 2054.

The Underground Project adds approximately 4.0 million ounces of gold to the overall production profile and extends the mine life by two years to 2054 when compared to the 2022 LOMP. The Company believes that there is a good upside potential for additional exploration to add production to the mine plan in future years, which could result in an increase in production in the period 2044 to 2054 or extend the life of mine.

The 2024 PEA combined open pit and underground production profiles are set out in the table below.

| 2024 PEA Operating Metrics | |||||||||

| 2024 PEA | |||||||||

| O/P Production* | U/G Production* | Mill Production | |||||||

| Tonnes Mined |

Gold Grade |

Strip Ratio |

Tonnes Mined |

Gold Grade |

Throughput | Gold Grade |

Rec.** | Gold Production |

|

| Mt | g/t | t:t | Mt | g/t | Mt | g/t | % | koz | |

| 2024 Q2-Q4 | 31.4 | 0.69 | 1.71 | — | — | 21.0 | 0.88 | 91.6 | 540 |

| 2025 | 30.2 | 0.84 | 3.57 | — | — | 28.2 | 0.88 | 92.3 | 735 |

| 2026 | 30.8 | 0.83 | 3.41 | — | — | 28.5 | 0.89 | 92.1 | 751 |

| 2027 | 25.7 | 0.74 | 4.18 | — | — | 28.7 | 0.76 | 91.6 | 640 |

| 2028 | 38.3 | 0.67 | 2.50 | — | — | 29.0 | 0.77 | 91.5 | 658 |

| 2029 | 43.4 | 0.71 | 2.09 | — | — | 29.0 | 0.88 | 91.8 | 749 |

| 2030 | 54.2 | 0.80 | 1.42 | 0.8 | 3.68 | 29.0 | 1.17 | 92.9 | 1,015 |

| 2031 | 44.9 | 0.85 | 1.79 | 2.8 | 2.89 | 29.0 | 1.30 | 93.3 | 1,127 |

| Avg. 2032-2043 | 37.0 | 0.77 | 1.37 | 4.0 | 2.42 | 29.0 | 1.15 | 93.1 | 1,001 |

| 2044 | 12.3 | 0.88 | 0.20 | 0.7 | 2.17 | 29.0 | 0.74 | 91.5 | 635 |

| Avg. 2045-2053 | — | — | — | — | — | 29.0 | 0.40 | 89.0 | 332 |

| 2054 | — | — | — | — | — | 11.1 | 0.44 | 88.0 | 139 |

| Total LOM | 755.7 | 0.77 | 1.76 | 52.8 | 2.46 | 871.5 | 0.85 | 92.2 | 21,988 |

| * Open Pit (“O/P”), Underground (“U/G”) | |||||||||

| ** Represents metallurgical recovery percentage | |||||||||

Operating Costs

A breakdown of the unit operating costs for the open pit, underground, processing and site general and administrative expenses are set out in the table below.

| 2024 PEA Unit Operating Costs | Unit | Metric | Period |

| Royalty in-kind | % | 2.0 % | Life of Mine |

| Royalty | % | 0.8 % | Life of Mine |

| Open Pit Mine Costs | C$/t ex-pit | $ 3.89 | 2024 to 2044 |

| Underground Mine Costs | C$/t mined | $ 38.70 | 2030 to 2044 |

| Rehandling Costs | C$/t moved | $ 2.28 | 2045 to 2054 |

| Processing Costs | C$/t milled | $ 9.94 | 2024 to 2054 |

| Site General and Administrative Expenses | C$/t milled | $ 3.59 | 2024 to 2054 |

| Operating Costs (net of deferred stripping) | C$/t milled | $ 24.90 | 2024 to 2054 |

A breakdown of the operating costs, total cash costs by periods for the 2024 PEA is set out in the table below.

| 2024 PEA Operating Cost Metrics | ||

| Minesite costs (net of deferred stripping) |

Cash Costs (by-product basis) |

|

| C$/t milled | $/oz | |

| 2024 Q2-Q4 | $25.17 | $733 |

| Average of Years 2025-2029 | $24.45 | $745 |

| 2030 | $23.62 | $508 |

| 2031 | $27.76 | $538 |

| Average for Years 2032-2043 | $26.15 | $570 |

| Average for Years 2044-2054 | $22.95 | $1,407 |

| LOM | $24.90 | $741 |

The average total cash costs for the 2024 PEA, including open pit and underground production and the mill throughput at 29 Mtpa, are expected to be $741 per ounce over the life of the mine. The average total cash costs for the incremental Underground Project and mill optimization are expected to be $690 per ounce.

Capital Expenditures

Under the 2024 PEA, the Underground Project pre-production period is expected to be from 2024 to 2030, with initial production planned for 2030. During this pre-production period, development capital expenditures of $731 million are expected. Included in the development capital expenditures are approximately $12 million for the expansion of the mill throughput to 79,450 tpd by 2028. Commercial production for the underground mine is expected to be achieved in 2030 under the 2024 PEA. During production, sustaining capital expenditures are expected to average approximately $40 million to $45 million per year.

A breakdown of the development capital expenditures and sustaining capital expenditures for the open pit and for the underground by periods is set out in the table below.

| 2024 PEA Capital Expenditures | |||||

| Open Pit | Underground | Closure | |||

| Time Period | Development | Sustaining | Development | Sustaining | |

| (C$ millions) | (C$ millions) | (C$ millions) | (C$ millions) | (C$ millions) | |

| 2024 Q2-Q4 | $ 214.4 | $ 315.4 | $ 26.3 | $ — | $ 2.0 |

| 2025 | $ 421.9 | $ 285.4 | $ 41.2 | $ — | $ 5.0 |

| 2026 | $ 367.0 | $ 339.6 | $ 134.3 | $ — | $ 5.0 |

| 2027 | $ 469.9 | $ 250.6 | $ 168.7 | $ — | $ 3.1 |

| 2028 | $ 217.9 | $ 334.4 | $ 191.0 | $ — | $ 3.6 |

| 2029 | $ 105.6 | $ 348.9 | $ 241.7 | $ — | $ 4.7 |

| 2030 | $ 139.3 | $ 259.4 | $ 176.7 | $ 40.2 | $ 4.6 |

| 2031 | $ 171.2 | $ 206.4 | $ — | $ 80.7 | $ 3.5 |

| Avg. 2032-2043 | $ 75.8 | $ 184.5 | $ — | $ 59.0 | $ 3.8 |

| Avg. 2044-2055 | $ — | $ 26.2 | $ — | $ 1.5 | $ 13.9 |

| 2055+ (NPV (5%) of costs after 2055) | $ — | $ — | $ — | $ — | $ 110.8 |

| Total LOM | $ 3,017.0 | $ 4,825.0 | $ 979.8 | $ 846.0 | $ 339.7 |

Permitting and Indigenous Communities

The permitting of the Underground Project uses a phased approach. The first phase includes the scope planned between 2024 and 2026, associated with the development of the exploration ramp and related surface infrastructure. It includes an amendment to the Detour Lake closure plan (CPA3) and the permit to take water for this initial phase. The second permitting phase includes the submission of a revised closure plan (CPA4), a permit to take water and an amendment to the industrial sewage (discharge water) permit including the full scope of the proposed underground mine and surface infrastructure. The permits are expected to be received at the end of 2024 for the first phase and mid-year 2026 for the second phase.

Consultation with the Indigenous communities started in late 2022. The Company continues to engage with these communities on a regular basis to maintain their support and address their concerns associated with the expanded production.

Incremental Valuation Impact of the Underground Project and Mill Optimization to 29 Mtpa

The incremental valuation impact of the Underground Project and mill optimization is estimated by subtracting the estimated free cash flows generated in the 2024 LOMP to the estimated free cash flows generated in the 2024 PEA.

Using a gold price assumption of $1,900 per ounce and a USD:CAD foreign exchange rate assumption of 1.34, the Underground Project and mill throughput optimization to 29 Mtpa have an after-tax IRR of approximately 18% and an after tax net present value (“NPV”) (at a 5% discount rate) of approximately $0.89 billion. At current spot gold prices of approximately $2,300 per ounce, the after-tax IRR and NPV are approximately 25% and $1.42 billion, respectively.

The economics of the Underground Project are most sensitive to the gold price, USD:CAD foreign exchange rate, capital expenditures and operating costs. The estimated sensitivity of IRR and NPV to these factors are set out in the tables below.

Sensitivity to Gold Price

| Gold Price | ||||

| $1,800 | $1,900 | $2,000 | $2,300 | |

| IRR | 16.5 % | 18.3 % | 20.0 % | 24.6 % |

| NPV (5% discount rate) (billions $) | $0.75 | $0.89 | $1.02 | $1.42 |

Sensitivity to C$/US$ Exchange Rate

| Exchange Rate | ||||

| 1.32 | 1.34 | 1.36 | 1.38 | |

| IRR | 17.8 % | 18.3 % | 18.8 % | 19.3 % |

| NPV (5% discount rate) (billions $) | $0.86 | $0.89 | $0.91 | $0.93 |

Sensitivity to Operating Cost and Capital Expenditures

| (20) % | (10) % | — % | 10 % | 20 % | |

| Underground Project Operating Costs | |||||

| IRR | 20.5 % | 19.5 % | 18.3 % | 17.2 % | 16.0 % |

| NPV (5% discount rate) (billions $) | $1.05 | $0.97 | $0.89 | $0.80 | $0.72 |

| Underground Project Capital Expenditures | |||||

| IRR | 22.6 % | 20.3 % | 18.3 % | 16.6 % | 15.1 % |

| NPV (5% discount rate) (billions $) | $1.02 | $0.95 | $0.89 | $0.82 | $0.75 |

Phased approach to further study and de-risk the project, with limited investment over next three years

The 2024 PEA demonstrates strong returns, combined with significant exploration upside and growth potential. On this basis, the Company has approved the next phase of work to further study and de-risk the Underground Project, including a $100 million investment from 2024 to 2026 to develop a 2.0 kilometres exploration ramp to a depth of approximately 270 metres and collect a bulk sample from the shallow mineralized zone west of the pit. A deeper zone will be tested through a high intensity drilling program in 2025. The analysis of the bulk sample and of the high intensity drilling program will help validate the continuity of the mineralization and the geological block model.

Of the $100 million, approximately $11 million are forecast to be spent in 2024 related to the construction of the surface facilities and site preparation. The excavation of the ramp is expected to start in early 2025 and extend to 2.0 kilometres in length by 2026. The exploration ramp will be sized to accommodate the potential production phase and is part of the initial capital expenditures estimate of approximately $731 million.

Over the next three years, an exploration program of $65 million will have the objective of converting inferred mineral resources down to a 600 metres depth and expanding the current underground mineral resource along the western plunge of the mineralization.

Exploration Highlights

Since the last significant update of mineral reserves and mineral resources as at December 31, 2021, that was the base to support the 2022 LOMP, the extensive exploration campaign has continued and totalled 505,515 metres of surface diamond drilling in 547 holes from early 2022 to March 31, 2024.

The aggressive exploration campaign at Detour Lake over the past two and a half years has resulted in several successes, including: continued intersection of mineralization west of the resource pit shells, further supporting the potential to extend the open pits; encountering significant zones of both higher and lower grade mineralization, extending the deposit more than 2.5 kilometres along strike west of the current pit outline; and the declaration of initial underground inferred mineral resource at year-end 2023.

Most recently, tighter-spaced drilling at underground depths has demonstrated good grade continuity and thickness consistency, further supporting the underground mining concept.

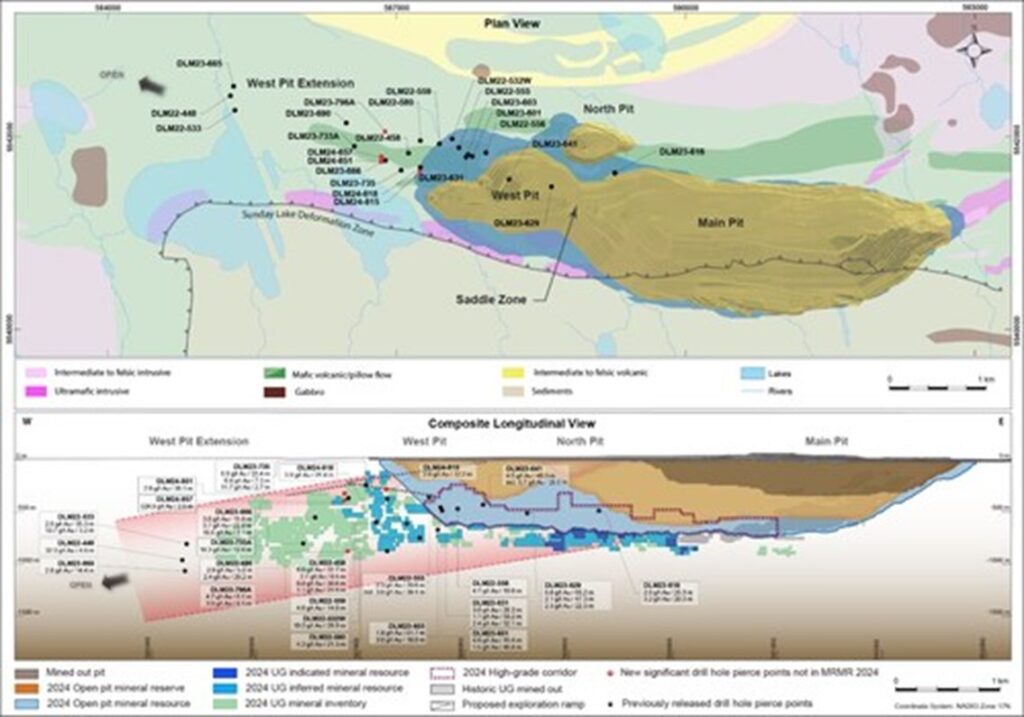

Selected recent and previously released holes from mid-2022 to 2024 are presented in the plan map and longitudinal section below and in the Appendix.

[Detour Lake Mine – Plan Map and Composite Longitudinal Section]

The recompositing of several previously released intersections within the mineral resources of the West Pit shell further demonstrates that several of the wide mineralized intersections that are amenable to bulk open-pit mining also contain wide higher grade intercepts in corridors that show potential for being mined earlier in the mine life from underground infrastructure. Highlights from these recomposited holes include: 6.8 g/t gold over 65.2 metres at 281 metres depth, 2.1 g/t gold over 47.3 metres at 397 metres depth and 2.3 g/t gold over 22.3 metres at 495 metres depth in hole DLM23-629; 3.0 g/t gold over 26.3 metres at 294 metres depth, 1.1 g/t gold over 59.2 metres at 378 metres depth and 2.4 g/t gold over 32.1 metres at 460 metres depth in hole DLM23-631; and 2.3 g/t gold over 70.6 metres at 335 metres depth in hole DLM22-555.

At greater depth and towards the west, ongoing exploration drilling also demonstrates the extension of these high-grade mineralized corridors. Interpretation work has resulted in improved modelling that is identifying higher grade mineral resources both inside and outside the mineral resources pit that can be used to optimize the project in further studies. Examples of intersections of the high-grade corridors at underground depths in the West Pit Extension Zone include the previously released hole DLM22-532W returning 10.2 g/t gold over 28.9 metres at 738 metres depth and previously released hole DLM22-458 returning 6.0 g/t gold over 32.7 metres at 481 metres depth.

Highlights from exploration drilling during the second quarter of 2024 in the West Pit Extension Zone approximately 200 metres below the planned exploration ramp include hole DLM24-851 returning 2.6 g/t gold over 36.1 metres at 322 metres depth and hole DLM24-857 returning 524.9 g/t gold over 2.6 metres at 391 metres depth, further demonstrating the potential to add mineral resources near the planned ramp infrastructure.

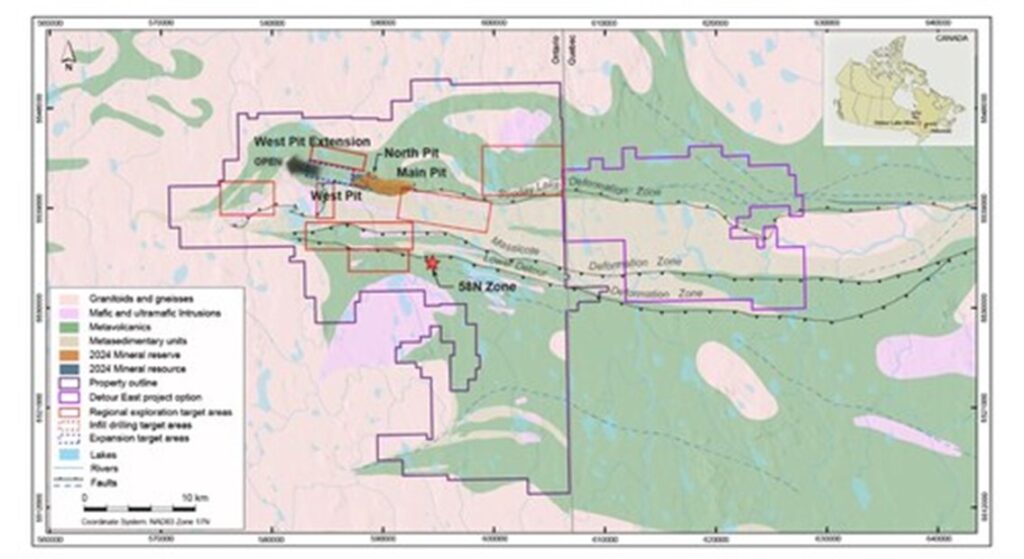

[Detour Lake Mine – Geology and Property Map Showing Exploration Target Areas]

The Company is on track to spend approximately $27.7 million for 160,000 metres of drilling at Detour Lake in 2024, including $20.3 million for 120,000 metres of capitalized drilling into the western plunge of the main deposit to increase confidence in the mineralization’s continuity, both in the inferred mineral resources for conversion purposes and to continue extending the mineralized trend to the west.

In addition, the Company expects to spend approximately $7.4 million for 40,000 metres of regional drilling in 2024, to explore satellite targets on the Company’s large 107,400 hectare land position around the Detour Lake and adjacent Detour East properties that could potentially provide mill feed to the Detour Lake operation.

Key regional targets include: northwest of the Detour Lake trend probing northwest-trending structures; the Detour mineralized trend north of the interpreted thrust fault intrusive to the east; geophysical features in the McAlpine and Central sediments; along the Lower Detour and Massicotte deformation trend areas; and the regional Sunday Lake and Massicotte deformation trends on the Detour East option.

With recent exploration success and results of the PEA study, the Company is contemplating to increase the drilling program and budget in the second half of 2024 to continue the infilling and extension of the mineral resources with the main objective of further conversion and derisking of the high grade corridors below and to the west of the Mineral Reserve open pit.

About Agnico Eagle

Agnico Eagle is a Canadian based and led senior gold mining company and the third largest gold producer in the world, producing precious metals from operations in Canada, Australia, Finland and Mexico. It has a pipeline of high-quality exploration and development projects in these countries as well as in the United States. Agnico Eagle is a partner of choice within the mining industry, recognized globally for its leading environmental, social and governance practices. The Company was founded in 1957 and has consistently created value for its shareholders, declaring a cash dividend every year since 1983.

APPENDIX A – Detour Lake Mineral Reserves and Mineral Resources (as at March 31, 2024)

| MINERAL RESERVES | |||||||||||

| As at March 31, 2024 | |||||||||||

| MINERALIZED ZONE | PROVEN | PROBABLE | PROVEN & PROBABLE | ||||||||

| GOLD | Mining Method1 |

000

Tonnes |

g/t | 000

oz Au |

000 Tonnes |

g/t | 000 oz Au |

000 Tonnes |

g/t | 000 oz Au |

Recovery

%2 |

| Detour Lake

(Above 0.5 g/t) |

O/P | 71,477 | 1.13 | 2,593 | 467,151 | 0.90 | 13,563 | 538,629 | 0.93 | 16,156 | 91.9 |

| Detour Lake

(Below 0.5 g/t) |

O/P | 50,174 | 0.42 | 684 | 229,819 | 0.38 | 2,832 | 279,993 | 0.39 | 3,516 | 90.0 |

| Detour Lake Total3 | 121,651 | 0.84 | 3,277 | 696,970 | 0.73 | 16,395 | 818,621 | 0.75 | 19,672 | ||

| MINERAL RESOURCES | |||||||||||||

| As at March 31, 2024 | |||||||||||||

| MINERALIZED ZONE | MEASURED | INDICATED | MEASURED & INDICATED | INFERRED | |||||||||

| GOLD | Mining Method1 |

000

Tonnes |

g/t | 000

oz Au |

000 Tonnes |

g/t | 000 oz Au |

000 Tonnes |

g/t | 000 oz Au |

000 Tonnes |

g/t | 000 oz Au |

| Detour Lake | O/P | 35,586 | 1.08 | 1,235 | 620,524 | 0.57 | 11,412 | 656,110 | 0.60 | 12,647 | 78,647 | 1.52 | 3,850 |

| Detour Lake | U/G | — | — | — | 10,008 | 2.02 | 652 | 10,008 | 2.02 | 652 | 56,809 | 2.04 | 3,718 |

| Detour Lake

Zone 58N |

U/G | — | — | — | 2,868 | 5.80 | 534 | 2,868 | 5.80 | 534 | 973 | 4.35 | 136 |

| Detour Lake Total | 35,586 | 1.08 | 1,235 | 633,400 | 0.62 | 12,598 | 668,985 | 0.64 | 13,833 | 136,430 | 1.76 | 7,704 | |

| 1 Open Pit (“O/P”), Underground (“U/G”) | |||||||||||||

| 2 Represents metallurgical recovery percentage | |||||||||||||

| 3 Gold cut-off grades: Detour Lake O/P Mineral Reserves is 0.30 g/t; Detour Lake O/P Mineral Resources is 0.25 g/t; U/G Mineral Resource is 1.22 g/t | |||||||||||||

CIM definitions (2014) were followed in the estimation of mineral reserves and mineral resources. Mineral reserves are reported exclusive of mineral resources. Tonnes and gold ounce information is rounded to the nearest thousand. Discrepancies in totals are due to rounding.

March 31, 2024 mineral reserves were estimated using a gold price of US$1,400/oz and a CAD/USD exchange rate of 1.30. The mineral reserves for Detour Lake are based on a high cut-off grade of 0.50 g/t gold and a low cut-off grade of 0.30 g/t gold (unchanged from the year-end 2023 mineral reserve estimate).

Cut-off grades were calculated including the costs of: mining, milling, general and administrative costs, royalties and capital expenditures and other modifying factors (e.g., dilution, mining extraction, mill recovery), and were also calculated using an optimized variable cut-off grade over time. Dilution is estimated at an average of 7%.

The open-pit mineral resources for Detour Lake are based on a cut-off grade of 0.25 g/t gold (versus 0.30 g/t gold for the year-end 2023 mineral resource estimate).

The underground mineral resources for Detour Lake are based on a cut-off grade of 1.22 g/t gold (unchanged versus the year-end 2023 mineral resource estimate) and reported in mineable shapes. Cut-off grades were calculated including the costs of mining, milling, general and administration, royalties and other modifying factors (e.g., dilution, mill recovery).

Mineral resources for Zone 58N are based on a cut-off grade of 2.2 g/t with an assumed mining dilution of 12%.

The mineral resources were estimated using a gold price of US$1,650/oz and a CAD/USD exchange rate of 1.30 for Detour Lake; and a gold price of US$1,300/oz and a CAD/USD exchange rate of 1.25 for Zone 58N deposit.

Assumptions used for the December 31, 2023 mineral reserve and mineral resource estimates at Detour Lake reported by the Company were US$1,300 per oz. gold for Mineral Reserve Estimation, US$1,500 per oz. gold for Mineral Resource Estimation, and US$1,300 per ounce of gold for Mineral Resource Estimation at Zone 58N. The Exchange rate was assumed to be C$1.30 per US$1.00.

The above gold price assumptions are below the three-year historic average (from January 1, 2021 to December 31, 2023) of approximately $1,853 per ounce of gold.

Detour Lake and 58N Mineral Reserves and Mineral Resources at March 31, 2024 and at December 31, 2023

| As at March 31, 2024 | As at December 31, 2023 | |||||

| Category | Tonnes

(000s) |

Gold

grade (g/t) |

Contained Gold (000 oz) |

Tonnes

(000s) |

Gold

grade (g/t) |

Contained Gold (000 oz) |

| Mineral Reserves | ||||||

| Proven | 121,651 | 0.84 | 3,277 | 118,703 | 0.85 | 3,230 |

| Probable | 696,970 | 0.73 | 16,395 | 700,346 | 0.74 | 16,698 |

| Total Proven & Probable | 818,621 | 0.75 | 19,672 | 819,049 | 0.76 | 19,928 |

| Mineral Resources | ||||||

| Measured | 35,586 | 1.08 | 1,235 | 30,861 | 1.45 | 1,434 |

| Indicated | 633,400 | 0.62 | 12,598 | 700,688 | 0.76 | 17,055 |

| Total Measured & Indicated | 668,985 | 0.64 | 13,833 | 731,549 | 0.79 | 18,489 |

| Inferred | 136,430 | 1.76 | 7,704 | 81,101 | 1.09 | 2,853 |

Note: Mineral reserves are not a subset of mineral resources. Tonnage amounts and contained metal amounts presented in this table have been rounded to the nearest thousand, so aggregate amounts may differ from column totals. Mineral reserves are in-situ, taking into account all mining recoveries, before mill or heap leach recoveries.

APPENDIX B – Exploration Details

Selected Recent and Previously Reported Exploration Drill Results at Detour Lake (2022 to 2024)

| Drill hole | Zone | From (metres) |

To (metres) |

Depth of midpoint below surface (metres) |

Estimated true width (metres) |

Gold grade (g/t) (uncapped)† |

| DLM22-448* | West Pit Extension | 1,099.8 | 1,105.4 | 955 | 4.8 | 32.3 |

| DLM22-458* | West Pit Extension | 526.0 | 565.0 | 481 | 32.7 | 6.0 |

| and | West Pit Extension | 583.0 | 593.0 | 517 | 8.5 | 2.7 |

| and | West Pit Extension | 621.0 | 657.0 | 560 | 30.6 | 0.8 |

| and | West Pit Extension | 670.0 | 707.0 | 602 | 31.5 | 1.1 |

| DLM22-532W* | West Pit | 903.0 | 934.0 | 738 | 28.9 | 10.2 |

| DLM22-533* | West Pit Extension | 838.2 | 880.7 | 744 | 35.3 | 2.6 |

| and | West Pit Extension | 923.2 | 927.0 | 800 | 3.2 | 13.7 |

| DLM22-555** | West Pit | 369.4 | 447.9 | 335 | 70.6 | 2.3 |

| including* | 392.0 | 436.0 | 340 | 39.4 | 3.8 | |

| DLM22-556* | West Pit | 572.8 | 594.3 | 463 | 19.8 | 4.7 |

| DLM22-559* | West Pit | 707.0 | 722.9 | 602 | 14.0 | 4.6 |

| DLM22-580* | West Pit Extension | 751.0 | 775.2 | 660 | 21.3 | 4.2 |

| DLM23-601* | West Pit | 370.6 | 387.8 | 311 | 15.4 | 4.6 |

| and** | West Pit | 442.3 | 494.0 | 380 | 46.8 | 1.5 |

| DLM23-603* | West Pit | 313.0 | 383.0 | 292 | 61.7 | 1.8 |

| and | West Pit | 488.0 | 508.0 | 410 | 18.0 | 3.0 |

| DLM23-616* | West Pit | 599.0 | 625.2 | 439 | 25.3 | 2.9 |

| and | West Pit | 656.0 | 677.0 | 474 | 20.3 | 3.2 |

| DLM23-629** | West Pit | 306.0 | 379.0 | 281 | 65.2 | 6.8 |

| and** | West Pit | 467.0 | 519.0 | 397 | 47.3 | 2.1 |

| and** | West Pit | 611.8 | 635.9 | 495 | 22.3 | 2.3 |

| DLM23-631* | West Pit | 345.2 | 374.7 | 294 | 26.3 | 3.0 |

| and** | West Pit | 434.6 | 500.0 | 378 | 59.2 | 1.1 |

| and** | West Pit | 558.0 | 593.1 | 460 | 32.1 | 2.4 |

| DLM23-641** | West Pit | 527.0 | 577.0 | 431 | 46.3 | 4.5 |

| including* | 527.0 | 559.0 | 424 | 29.6 | 6.7 | |

| DLM23-665* | West Pit Extension | 1,225.6 | 1,242.0 | 1,061 | 14.4 | 2.8 |

| DLM23-666* | West Pit Extension | 339.0 | 357.1 | 291 | 15.8 | 3.0 |

| and | West Pit Extension | 385.0 | 411.0 | 331 | 22.8 | 3.7 |

| and | West Pit Extension | 428.0 | 436.0 | 359 | 7.1 | 10.6 |

| DLM23-690* | West Pit Extension | 882.8 | 889.0 | 754 | 5.8 | 2.9 |

| and | West Pit Extension | 934.0 | 965.0 | 799 | 29.2 | 2.4 |

| DLM23-733A* | West Pit Extension | 602.0 | 617.1 | 545 | 12.6 | 18.3 |

| DLM23-735* | West Pit Extension | 260.7 | 287.0 | 236 | 22.4 | 6.0 |

| and | West Pit Extension | 305.5 | 314.0 | 265 | 7.3 | 6.4 |

| and | West Pit Extension | 331.0 | 334.0 | 284 | 2.7 | 11.7 |

| DLM23-796A*** | West Pit Extension | 815.2 | 822.1 | 708 | 6.1 | 4.7 |

| and | West Pit Extension | 1,038.5 | 1,047.5 | 883 | 8.1 | 3.9 |

| DLM24-815*** | West Pit Extension | 325.0 | 339.0 | 277 | 12.2 | 2.8 |

| DLM24-818* | West Pit Extension | 405.9 | 436.2 | 369 | 25.4 | 3.9 |

| DLM24-851*** | West Pit Extension | 350.0 | 392.3 | 322 | 36.1 | 2.6 |

| DLM24-857*** | West Pit Extension | 452.7 | 455.7 | 391 | 2.6 | 524.9 |

| † Results from Detour Lake are uncapped. | ||||||

| * Previously released in Agnico Eagle news releases dated July 28, 2022; February 16, 2023; April 27, 2023; July 26, 2023; February 15, 2024; and April 25, 2024. | ||||||

| ** Recompositing of previously released intersections in Agnico Eagle news releases dated February 16, 2023; April 27, 2023; and July 26, 2023. | ||||||

| *** Newly released results. | ||||||

Exploration Drill Collar Coordinates at Detour Lake

| Drill hole | UTM East* | UTM North* | Elevation (metres above sea level) |

Azimuth (degrees) |

Dip (degrees) | Length (metres) |

| DLM22-448 | 585276 | 5542425 | 292 | 185 | -60 | 1,260 |

| DLM22-458 | 587123 | 5541831 | 299 | 173 | -68 | 1,200 |

| DLM22-532W | 587560 | 5541980 | 288 | 179 | -63 | 1,302 |

| DLM22-533 | 585319 | 5542281 | 291 | 187 | -59 | 1,126 |

| DLM22-555 | 587643 | 5541890 | 287 | 175 | -57 | 591 |

| DLM22-556 | 587923 | 5541838 | 286 | 175 | -57 | 1,125 |

| DLM22-559 | 587441 | 5541927 | 288 | 175 | -62 | 1,200 |

| DLM22-580 | 587248 | 5541959 | 299 | 177 | -69 | 1,299 |

| DLM23-601 | 587784 | 5541797 | 286 | 181 | -60 | 625 |

| DLM23-603 | 587743 | 5541810 | 286 | 180 | -60 | 849 |

| DLM23-616 | 589267 | 5541626 | 283 | 180 | -52 | 695 |

| DLM23-628 | 589227 | 5541550 | 283 | 179 | -58 | 675 |

| DLM23-629 | 588609 | 5541481 | 285 | 178 | -58 | 687 |

| DLM23-631 | 587764 | 5541783 | 285 | 178 | -58 | 603 |

| DLM23-641 | 588168 | 5541559 | 288 | 178 | -56 | 657 |

| DLM23-665 | 585309 | 5542525 | 295 | 190 | -61 | 1,458 |

| DLM23-666 | 586885 | 5541753 | 297 | 175 | -59 | 801 |

| DLM23-690 | 586477 | 5542144 | 296 | 185 | -68 | 1,137 |

| DLM23-733A | 586562 | 5541903 | 292 | 181 | -68 | 1,002 |

| DLM23-735 | 587048 | 5541650 | 292 | 177 | -62 | 402 |

| DLM23-747 | 584911 | 5542490 | 294 | 186 | -65 | 1,281 |

| DLM23-796A | 586879 | 5542059 | 304 | 179 | -65 | 1,254 |

| DLM-815 | 587245 | 5541641 | 291 | 176 | -57 | 507 |

| DLM24-818 | 587246 | 5541689 | 291 | 176 | -64 | 600 |

| DLM24-851 | 586844 | 5541744 | 295 | 176 | -60 | 474 |

| DLM24-857 | 588927 | 5541584 | 283 | 176 | -61 | 675 |

| * Coordinate System: NAD 1983 UTM Zone 17N. | ||||||

Updated MRMR Estimate at March 31, 2024 (CNW Group/Agnico Eagle Mines Limited)

[Detour Lake Mine – Plan Map and Composite Longitudinal Section] (CNW Group/Agnico Eagle Mines Limited)

[Detour Lake Mine – Geology and Property Map Showing Exploration Target Areas] (CNW Group/Agnico Eagle Mines Limited)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE