VIZSLA SILVER DRILLS MULTIPLE HIGH-GRADE INTERCEPTS, INCLUDING 1,017 G/T SILVER & 8.19 G/T GOLD OVER 13 METRES TRUE WIDTH AT COPALA

Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) (Frankfurt: 0G3) is pleased to report results from 12 new drill holes targeting the Copala resource area at its 100%-owned, flagship Panuco silver-gold project located in Mexico. The reported drilling, designed to infill near-surface mineralization, successfully confirmed high-grade continuity throughout Copala.

Highlights

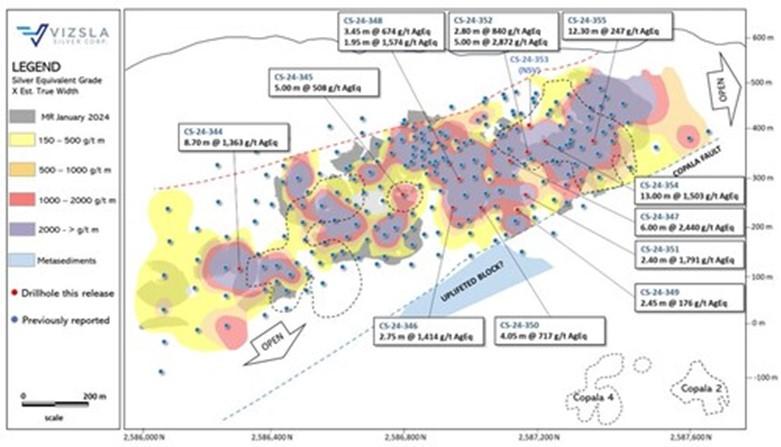

- CS-24-354 returned 1,503 grams per tonne silver equivalent over 13.00 metres true width (1,017 g/t silver and 8.19 g/t gold)

- Including 6,229 g/t AgEq over 1.40 mTW (4,124 g/t silver and 35.11 g/t gold)

- And 3,813 g/t AgEq over 1.31 mTW (2,540 g/t silver and 21.30 g/t gold)

- CS-24-344 returned 1,363 g/t AgEq over 8.70 mTW (1,096 g/t silver and 5.18 g/t gold)

- Including 10,516 g/t AgEq over 0.66 mTW (8,720 g/t silver and 36.60 g/t gold)

- CS-24-352 returned 2,872 g/t AgEq over 5.00 mTW (1,378 g/t silver and 22.95 g/t gold)

- Including 4,681 g/t AgEq over 2.75 mTW (2,115 g/t silver and 39.10 g/t gold)

- CS-24-347 returned 2,440 g/t AgEq over 6.00 mTW (1,882 g/t silver and 10.31 g/t gold)

- Including 4,957 g/t AgEq over 2.39 mTW (3,859 g/t silver and 20.51 g/t gold)

“New drill results from our ongoing Copala infill program continue to demonstrate excellent continuity of high-grade silver and gold mineralization,” commented Michael Konnert, President & CEO. “As we reduce the drill spacing at Copala, focused on converting mineralization to higher confidence resource categories, we continue to expand the high-grade precious metals core of the main structure, and in-turn the overall potential minable inventory. This is important as we progress through our 2024 de-risking initiatives including the delivery of a Preliminary Economic Assessment planned for early Q3.”

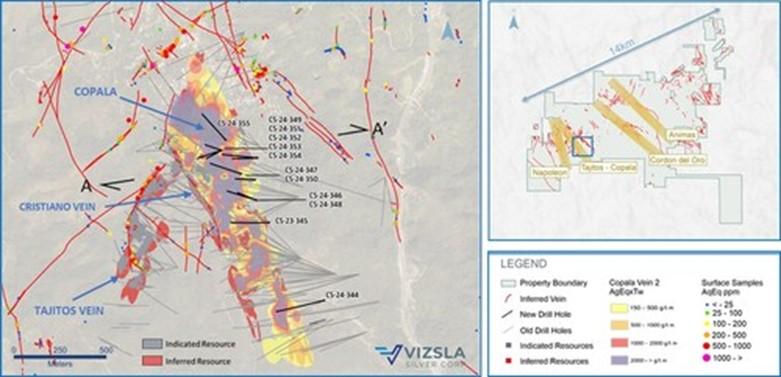

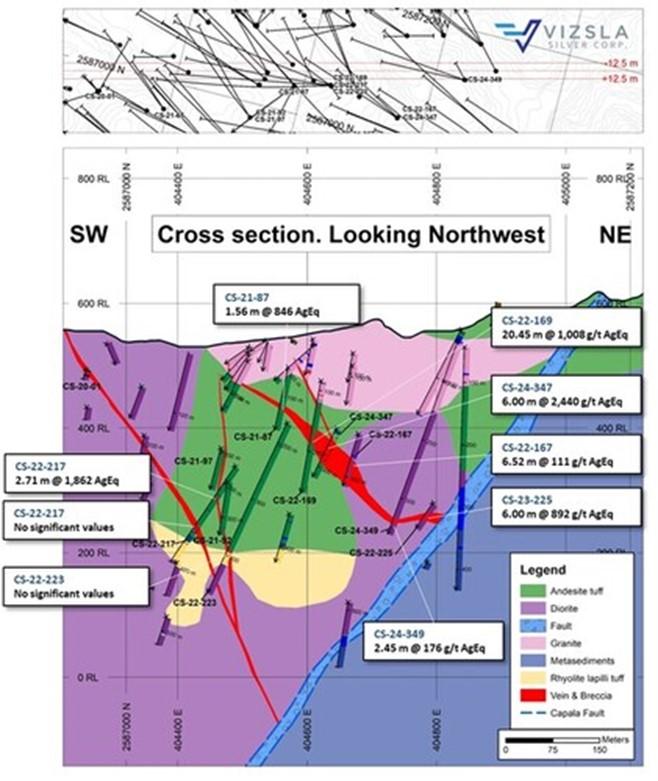

The precious metals dominant Copala Structure, located in the western portion of the Panuco district, is situated ~800 m to the east of the Napoleon vein. Copala currently hosts Indicated Resources of 83.3 Moz AgEq at 573 g/t AgEq and Inferred Resources of 48.3 Moz AgEq at 476 g/t AgEq within a broad envelope of vein-breccia interlayered with host rock, up to 82 metres thick (please refer to our Technical Report on Updated Mineral Resource Estimate for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico, by Allan Armitage, Ben Eggers and Peter Mehrfert, dated February 12, 2024 and to our Company´s press release dated January 8, 2024). Interpretations by Vizsla geologists indicate Copala has an average dip of ~46° to the east (~35° in its northern sector and steepening to ~65° in the southern sector).

Resource drilling at Copala has now traced mineralization along ~1,770 metres of strike length and ~400 metres down dip. The recently completed batch of infill drilling consisted of 11 holes drilled at ~50 m centres in the shallow high-grade zone of north-central Copala and one hole drilled in a previously identified deep high-grade zone in the southern extent. The infill holes drilled in the north-central zone targeted only the main Copala structure, but some holes intercepted Copala 3 and Copala 4 along the way. Additionally, holes CS-24-348 and CS-24-352 intercepted broad mineralized structures of 16.80 m and 17.50 m TW respectively, with high-grade zones internally diluted by lower-grade crackle breccia zones (see table 1). Broad intercepts consisting of mixed banded vein, stockwork and crackle breccia zones are common in north central Copala. Cymoid loops are also common in some vein sectors, as shown by the multiple vein intercepts on Copala 4 by CS-24-345 (see table 1).

Infill drilling completed to date in various parts of Copala have successfully confirmed high-grade mineral continuity. Extension drilling completed in the south has expanded mineralization by ~100m downdip to the east, marked by hole CS-23-330. Additionally, drilling along the southern extents of Copala has highlighted that the main structure gets steeper at depth (~65°) and develops narrower vein splays carrying significant silver and gold grades (Copala 3 and Copala 4). The recently reported Copala 4 splay vein sits between Cristiano and Copala, approximately 75m west of Copala, whereas Copala 3 sits less than 50m to the east of Copala main on the hanging wall side. Drilling to date has traced Copala 4 for approximately 300 m along strike and 400 m down dip. Copala 3 is more irregular in terms of grade and thickness along strike (locally forms sparse high-grade pockets), but overall, the structure has been traced over 400 m long by 400 m down dip.

| Drillhole | From | To | Downhole Length |

Estimated True width |

Ag | Au | AgEq | Vein | ||

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||

| CS-24-344 | 546.90 | 547.20 | 0.30 | 0.16 | 602 | 2.03 | 691 | Copala 3 | ||

| CS-24-344 | 561.95 | 573.90 | 11.95 | 8.70 | 1,096 | 5.18 | 1,363 | Copala | ||

| Includes | 563.10 | 564.00 | 0.90 | 0.66 | 8,720 | 36.60 | 10,516 | |||

| CS-24-345 | No significant values | Copala 3 | ||||||||

| CS-24-345 | 401.45 | 406.85 | 5.40 | 5.00 | 414 | 1.85 | 508 | Copala | ||

| Includes | 402.50 | 404.55 | 2.05 | 1.89 | 844 | 4.04 | 1,054 | |||

| CS-24-345 | 451.50 | 453.00 | 1.50 | 0.84 | 131 | 1.38 | 217 | Copala 4 | ||

| CS-24-345 | 456.00 | 457.50 | 1.50 | 0.84 | 153 | 1.25 | 227 | Copala 4 | ||

| CS-24-345 | 466.10 | 466.50 | 0.40 | 0.23 | 338 | 2.23 | 465 | Copala 4 | ||

| CS-24-346 | No significant values | Copala 3 | ||||||||

| CS-24-346 | 388.00 | 393.25 | 5.25 | 2.75 | 720 | 10.77 | 1,414 | Copala | ||

| CS-24-346 | 441.00 | 444.00 | 3.00 | 1.30 | 177 | 0.81 | 219 | Copala splay | ||

| CS-24-347 | 258.00 | 259.00 | 1.00 | 0.90 | 367 | 4.56 | 655 | Copala 3 | ||

| CS-24-347 | 287.85 | 294.00 | 6.15 | 6.00 | 1,882 | 10.31 | 2,440 | Copala | ||

| Includes | 289.00 | 291.45 | 2.45 | 2.39 | 3,859 | 20.51 | 4,957 | |||

| CS-24-347 | 299.75 | 300.30 | 0.55 | 0.40 | 186 | 0.60 | 212 | Copala splay | ||

| CS-23-348 | 333.85 | 337.50 | 3.65 | 3.45 | 439 | 3.89 | 674 | Copala | ||

| Includes | 335.25 | 336.00 | 0.75 | 0.71 | 946 | 10.80 | 1,622 | |||

| CS-23-348 | 349.50 | 351.50 | 2.00 | 1.95 | 1,312 | 5.39 | 1,574 | Copala | ||

| Includes | 350.50 | 351.50 | 1.00 | 0.95 | 2,390 | 9.60 | 2,852 | |||

| CS-23-349 | 338.15 | 340.75 | 2.60 | 2.45 | 130 | 0.82 | 176 | Copala | ||

| CS-23-349 | 375.45 | 376.80 | 1.35 | 1.35 | 214 | 0.82 | 253 | Copala splay | ||

| CS-23-350 | 328.50 | 334.55 | 6.05 | 4.05 | 636 | 1.97 | 717 | Copala | ||

| Includes | 333.05 | 334.55 | 2.50 | 1.67 | 1,265 | 3.50 | 1,398 | |||

| CS-24-351 | 336.35 | 338.8 | 2.45 | 2.40 | 1,541 | 5.52 | 1,791 | Copala | ||

| Includes | 336.85 | 337.55 | 0.70 | 0.69 | 4,710 | 16.75 | 5,467 | |||

| CS-24-351 | 343.05 | 343.75 | 0.70 | 0.65 | 208 | 0.885 | 252 | Copala splay | ||

| CS-24-352 | 140.00 | 144.25 | 4.25 | 3.25 | 137 | 1.09 | 201 | Copala 3 | ||

| CS-24-352 | 198.00 | 201.00 | 3.00 | 2.80 | 572 | 4.53 | 840 | Copala | ||

| Includes | 199.50 | 201.00 | 1.50 | 1.40 | 1,050 | 8.46 | 1,553 | |||

| CS-24-352 | 211.80 | 217.25 | 5.45 | 5.00 | 1,378 | 22.95 | 2,872 | Copala | ||

| Includes | 213.00 | 216.00 | 3.00 | 2.75 | 2,115 | 39.10 | 4,681 | |||

| CS-24-353 | No significant values | Copala | ||||||||

| CS-24-354 | 133.30 | 135.00 | 1.70 | 1.39 | 188 | 1.15 | 252 | Copala 3 | ||

| CS-24-354 | 153.50 | 168.30 | 14.80 | 13.00 | 1,017 | 8.19 | 1,503 | Copala | ||

| Includes | 153.50 | 155.10 | 1.60 | 1.40 | 4,124 | 35.11 | 6,229 | |||

| Includes | 157.55 | 159.05 | 1.50 | 1.31 | 2,540 | 21.30 | 3,813 | |||

| CS-24-355 | 174.30 | 189.00 | 14.70 | 12.30 | 150 | 1.57 | 247 | Copala | ||

| Includes | 176.55 | 177.10 | 0.55 | 0.46 | 323 | 6.52 | 754 | |||

| Includes | 184.50 | 185.70 | 1.20 | 1.00 | 554 | 3.78 | 771 | |||

| Table 1: Downhole drill intersections from the holes reported for Copala structure, Copala 3, FW Splay and Copala 4 veins. | ||||||||||

| Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 91% for silver and 94% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Copala vein (see press release dated August 16, 2023). |

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| CS-24-344 | 405,210 | 2,586,350 | 661 | 257.4 | -64.2 | 639.0 |

| CS-24-345 | 404,910 | 2,586,771 | 678 | 269.0 | -68.7 | 540.0 |

| CS-24-346 | 404,843 | 2,586,894 | 651 | 291.0 | -76.6 | 498.0 |

| CS-24-347 | 404,758 | 2,587,035 | 597 | 288.4 | -60.2 | 345.0 |

| CS-24-348 | 404,842 | 2,586,894 | 651 | 286.8 | -64.5 | 394.5 |

| CS-24-349 | 404,846 | 2,587,119 | 573 | 267.5 | -69.4 | 390.0 |

| CS-24-350 | 404,835 | 2,587,002 | 596 | 272.7 | -73.3 | 376.5 |

| CS-24-351 | 404,846 | 2,587,119 | 573 | 275.7 | -60.9 | 396.0 |

| CS-24-352 | 404,653 | 2,587,159 | 568 | 242.7 | -71.1 | 295.5 |

| CS-24-353 | 404,653 | 2,587,159 | 568 | 251.9 | -51.6 | 225.0 |

| CS-24-354 | 404,653 | 2,587,160 | 568 | 289.0 | -65.0 | 228.0 |

| CS-24-355 | 404,674 | 2,587,217 | 533 | 318.9 | -34.3 | 231.0 |

| Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13. | ||||||

Stock Option and Restricted Share Unit Grant

The Company announces that, pursuant to the Company’s Omnibus Equity Incentive Compensation Plan, it has granted 6,050,000 stock options at an exercise price of $2.26 and 775,000 restricted share units to directors, officers, employees and consultants of the Company. The Options are exercisable for a period of five years and will vest over the next two years and the RSUs will vest in three equal annual instalments commencing on the first anniversary of the grant date.

The Options are subject to the approval and policies of the TSX Venture Exchange and the NYSE American.

About the Panuco Project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 7,189.5-hectare, past producing district benefits from over 86 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

On January 8, 2024, the Company announced an updated mineral resource estimate for Panuco which includes an estimated in-situ indicated mineral resource of 155.8 Moz AgEq and an in-situ inferred resource of 169.6 Moz AgEq (please refer to our Technical Report on Updated Mineral Resource Estimate for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico, by Allan Armitage, Ben Eggers and Peter Mehrfert, dated February 12, 2024 and to our Company´s press release dated January 8, 2024).

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla Silver has completed over 350,000 metres of drilling at Panuco leading to the discovery of several new high-grade veins. For 2024, Vizsla Silver has budgeted +30,000 metres of resource/discovery-based drilling designed to upgrade and expand the mineral resource, as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver and rock samples were shipped to SGS Lab in Durango Mexico for sample preparation and analysis. The ALS Zacatecas, North Vancouver facilities and SGS lab are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Vice President of Exploration, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Figure 1: Plan map of recent drilling centered on the Copala structure. (CNW Group/Vizsla Silver Corp.)

Figure 2: Inclined longitudinal section for Copala structure with drillhole pierce points. The section is 1x along strike to 1.4x along the dip to compensate for the average 46-degree dip of Copala. The black dash outlines represent Copala 2 in the north and Copala 4 vein in the south. (CNW Group/Vizsla Silver Corp.)

Figure 3: Cross section showing Copala structure, Cristiano and Tajitos veins with completed drilling. (CNW Group/Vizsla Silver Corp.)

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE