Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from project drilling at Ikkari (Figure 1). The drilling, principally for metallurgical sampling produced some of the best intercepts achieved to date at Ikkari (Tables 1 & 2).

Highlights

Ikkari

- #124043 intersected 120m at 6.2g/t Au from 45m downhole (36m vertical), the third-best intercept achieved to date at Ikkari with 748 gram x meters (see Table 1 for details). Additional intercepts of 22m at 2.9g/t Au from 16m downhole (13m vertical), 5m at 4.5g/t Au and 56m at 3.5g/t Au (Figure 2) combine to make this the second highest yielding drillhole of all time at Ikkari with 1028 gram x meters (see Table 2 for details).

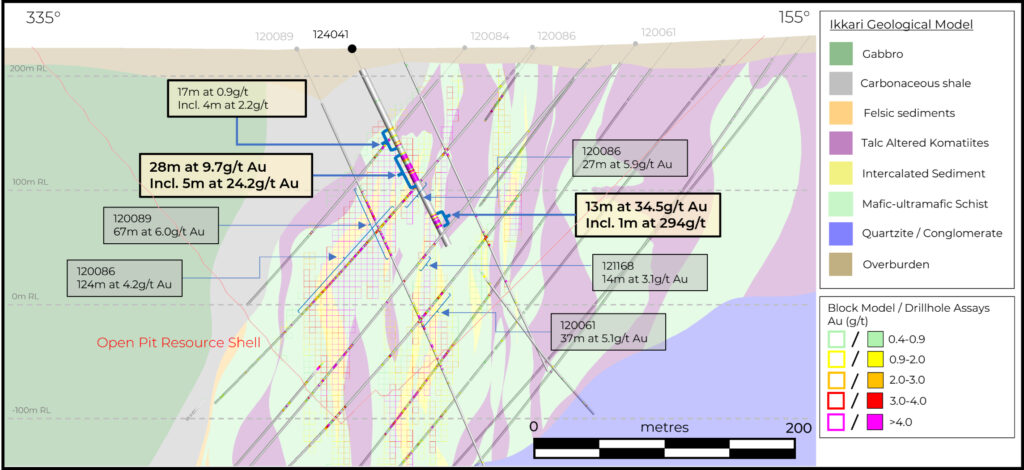

- #124041 intersected 28m at 9.7g/t Au from 101m and 13m at 34.5g/t Au from 161m including 1m at 294g/t Au (Figure 3). Combined intercepts in #124041 yield 737gram x meters also in the top 10 yielding drillholes of all time at Ikkari.

- #124040 and #124047 also delivered broad, continuously mineralised intersections typical of the Ikkari deposit. #124040 intersected 121.2m at 2.5g/t Au from 52m downhole and #124047 intersected 167.8m at 2.6g/t Au from 17.2m (the base of the overburden).

James Withall, CEO of Rupert Resources commented “The project drilling results reported from Ikkari today confirm the robustness of the Ikkari mineral resource with exceptionally continuous high-grade mineralisation near surface that will conceptually be captured in a low strip ratio, open pit in the early years of operations. The PFS engineering is progressing well on the existing resource and is building on the scope outlined in the November 2022 PEA. We continue to evaluate other opportunities which will only be pursued if they meet our long standing corporate objectives and build meaningful shareholder value.”

Table 1. Top 10 intercepts from Ikkari

| Hole ID | From (m) | To (m) | Length (m) | Grade

(g/t Au) |

Gram x Meters | Release Date |

| 121026 | 58.00 | 258.00 | 200.00 | 4.2 | 840 | April 20, 2021 |

| 121160 | 153.00 | 258.00 | 105.00 | 7.9 | 824 | February 1, 2022 |

| 124043 | 45.00 | 165.00 | 120.00 | 6.2 | 748 | *New |

| 121010 | 254.00 | 412.00 | 158.00 | 3.8 | 593 | March 17, 2021 |

| 121019 | 202.00 | 294.00 | 92.00 | 6.3 | 579 | April 6, 2021 |

| 120075 | 11.80 | 169.00 | 157.20 | 3.7 | 574 | October 21, 2020 |

| 121169 | 185.00 | 300.00 | 115.00 | 4.9 | 567 | March 16, 2022 |

| 121171 | 32.00 | 193.00 | 161.00 | 3.4 | 541 | March 16, 2022 |

| 120086 | 186.00 | 310.00 | 124.00 | 4.2 | 521 | November 12, 2020 |

| 120069 | 19.80 | 191.00 | 171.20 | 3.0 | 514 | September 15, 2020 |

Top 10 intercepts from Ikkari are ranked by gram-meters (average grade [Au g/t] x length [m]). Intercepts are calculated with a 0.4g/t Au cut-off with a maximum 5m continuous internal dilution accepted. See relevant press releases for further information.

Table 2. Top 10 yielding holes from Ikkari

| Hole ID | Length (m) | Grade

(g/t Au) |

Gram x Meters | Release Date |

| 121160 | 213.00 | 5.0 | 1058 | February 1, 2022 |

| 124043 | 197.00 | 5.2 | 1028 | *New |

| 121026 | 307.00 | 3.2 | 990 | April 20, 2021 |

| 121070 | 176.70 | 4.8 | 841 | September 13, 2021 |

| 120086 | 180.00 | 4.6 | 822 | November 12, 2020 |

| 120075 | 290.20 | 2.7 | 775 | October 21, 2020 |

| 124041 | 66.00 | 11.2 | 737 | *New |

| 121019 | 156.00 | 4.7 | 734 | April 6, 2021 |

| 120071 | 196.00 | 3.7 | 721 | October 1, 2020 |

| 121025 | 288.00 | 2.5 | 713 | June 16, 2021 |

Top-10 all time yielding holes from Ikkari are ranked by gram-meters (average grade [Au g/t] x length [m]). Individual intercepts are calculated with a 0.4g/t Au cut-off with a maximum 5m continuous internal dilution accepted, minimum yield per intercept is 1 gram-meter. The “yield” is the sum of all intercepts within each drillhole. See relevant press releases for further information.

Ikkari

A project drilling program was initiated at Ikkari during spring 2024 serving multiple purposes: increasing confidence in the ~4Moz Indicated Mineral Resource Estimate (see press release 28th November 2023); providing additional material for metallurgical test work feeding into future, more advanced engineering studies and providing further geotechnical data for the optimisation of mine planning. Results from the second tranche of holes within this program are presented here and include some of the best intercepts achieved to date in Ikkari with broad high-grade zones achieved in all drill holes. Table 5 details the main interval in hole #124043. Project engineering and permitting continues with a prefeasibility study now targeted for delivery in the second half of calendar 2024.

Geological interpretation of Ikkari

Ikkari was discovered using systematic regional exploration that initially focused on geochemical sampling of the bedrock/till interface through glacial till deposits of 5m to 40m thickness. No outcrop is present, and topography is dominated by low-lying swamp areas.

The Ikkari deposit occurs within rocks that have been regionally mapped as 2.05-2.15 billion years old Savukoski group greenschist-metamorphosed mafic-ultramafic volcanic rocks, part of the Central Lapland Greenstone Belt. Gold mineralisation is largely confined to the structurally modified unconformity at a significant domain boundary. Younger sedimentary lithologies are complexly interleaved, with intensely altered ultramafic rocks, and the mineralized zone is bounded to the north by a steeply N-dipping cataclastic zone. Within the mineralised zone lithologies, alteration and structure appear to be sub-vertical in contrast to wider Area 1 where lithologies generally dipping at a moderated angle to the north.

The main mineralized zone is strongly altered and characterised by intense veining and foliation that pervasively overprints original textures. An early phase of finely laminated grey ankerite/dolomite veins is overprinted by stockwork-like irregular siderite ± quartz ± chlorite ± sulphide veins. These vein arrays are often deformed with shear-related boudinage and in situ brecciation. Magnetite and/or haematite are common, in association with pyrite. Hydrothermal alteration commonly comprises quartz-dolomite-chlorite-magnetite (±haematite). Gold is hosted by disseminated and vein-related pyrite. Multi-phase breccias are well developed within the mineralised zone, with early silicified cataclastic phases overprinted by late, carbonate- iron-oxide- rich, hydrothermal breccias which display a subvertical control. All breccias frequently host disseminated pyrite, and are often associated with higher gold grades, particularly where magnetite or haematite is prevalent. In the sedimentary lithologies, albite alteration is intense and pervasive, with pyrite-magnetite (± gold) hosted in veinlets in brittle fracture zones.

Figures & tables

Figures and tables featured in the Appendix at end of release include:

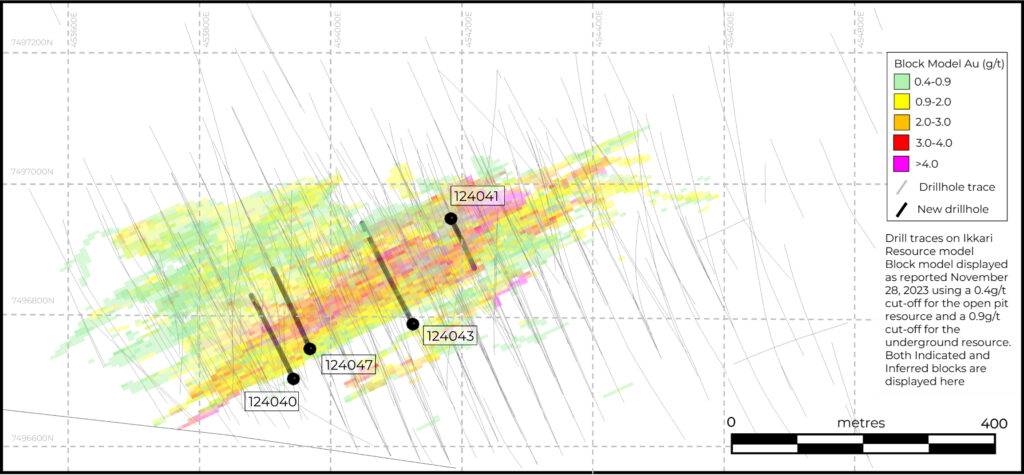

- Figure 1. Plan map showing the location of new drilling at Ikkari.

- Figure 2. Cross section showing the results of hole 124043 in relation to the mineral resource block model and the geological interpretation at Ikkari.

- Figure 3. Cross section showing the results of hole 124041 in relation to the mineral resource block model and the geological interpretation at Ikkari.

- Table 3. Collar locations of the new drill holes, Ikkari

- Table 4. New Intercepts from Infill Drill Holes, Ikkari

- Table 5. Individual assays from uncut mineralised intercept of 6.0g/t Au over 120m in drill hole 124043

Review by Qualified Person, Quality Control and Reports

Craig Hartshorne, a Chartered Geologist and a Fellow of the Geological Society of London, is the Qualified Person, as defined by National Instrument 43-101, responsible for the accuracy of scientific and technical information in this news release.

The majority of samples are prepared by ALS Finland in either Sodankylä or Outokumpu. Fire assays are subsequently completed at ALS Romania whilst multielement analysis is completed in ALS Ireland or Sweden. A minority of samples are prepared by Eurofins Laboratory in Sodankylä and Fire Assay is carried out on site. A pulverised sub-sample is then sent to ALS Ireland for multi-element analysis. All samples are under watch from the drill site to the storage facility. Samples at both laboratories are assayed using 50g fire assay method with aqua regia digest and analysis by AAS for gold. Over limit analysis (>100 ppm Au) are conducted using fire assay and gravimetric finish. For multi-element assays, Ultra Trace Level Method by 4-Acid digest (HF-HNO3-HClO4 acid digestion, HCl leach) and a combination of ICP-MS and ICP-AES are used. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at appropriate intervals. Approximately five percent (5%) of samples have the pulp reject resubmitted for check assaying at a second laboratory.

Base of till samples are prepared in ALS Sodankylä by dry-sieving method prep-41 and assayed for gold by fire assay with ICP-AES finish. Multi-elements are assayed in ALS laboratories in either of Ireland, Romania or Sweden by aqua regia with ICP-MS finish. Rupert maintains a strict chain of custody procedure to manage the handling of all samples. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication and external check assays.

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the TSX Exchange under the symbol “RUP.” The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari1, a new high quality gold discovery in Northern Finland. Ikkari is part of the Company’s “Rupert Lapland Project,” which also includes the Pahtavaara gold mine, mill, and exploration permits.

Figure 1. Plan Map Showing the Location of New Drillholes in Ikkari in the Context of November 2023 Mineral Resource Estimate Block Model

Figure 2. Cross Section through the Ikkari deposit along drillhole 124043 showing the intercepts achieved in relation to the resource block model and geological model, looking towards 065°

Figure 3. Cross Section through the Ikkari deposit along drillhole 124041 showing the intercept achieved in relation to the resource block model and geological model, looking towards 065°

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE